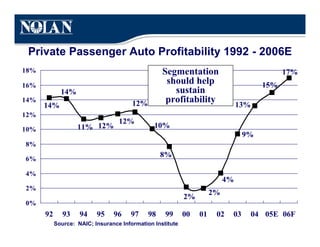

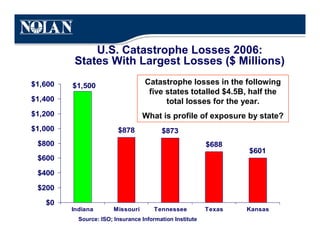

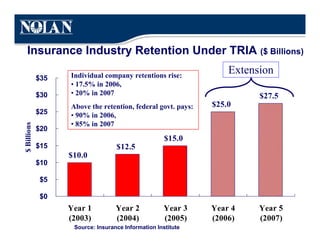

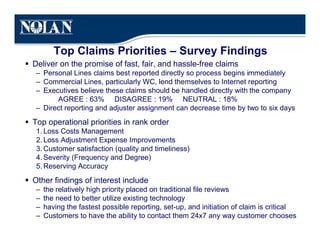

The document presents an overview of the 2007 insurance trends, financial performance, and challenges facing the property and casualty (P&C) insurance industry, focusing on issues such as underwriting gains, profitability, and product line dynamics. It highlights the cyclical nature of the industry, with varying market conditions influencing premium growth and profitability, alongside operational strategies for improving effectiveness. Additionally, it addresses emerging risks related to product liability and the impact of catastrophes on insured losses and overall market stability.