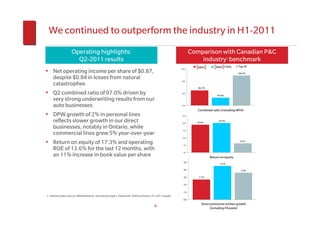

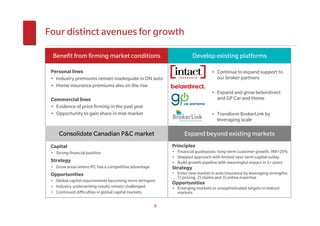

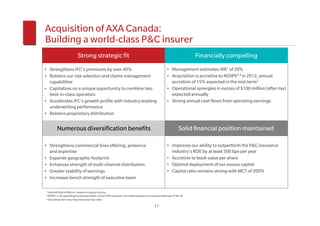

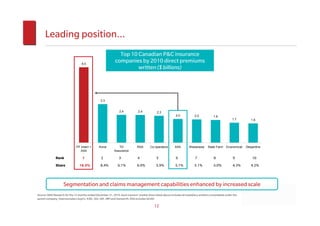

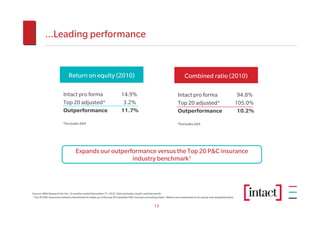

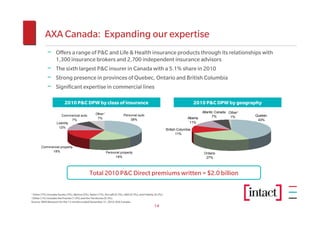

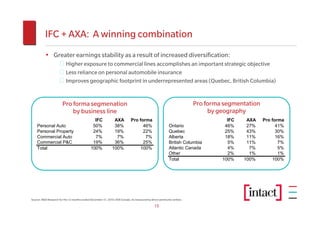

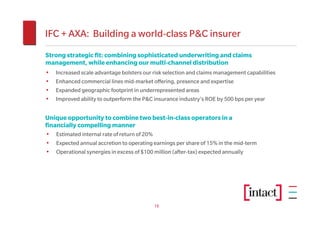

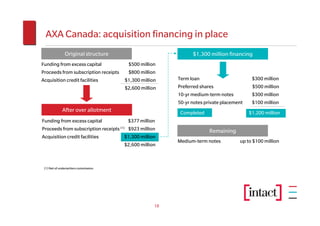

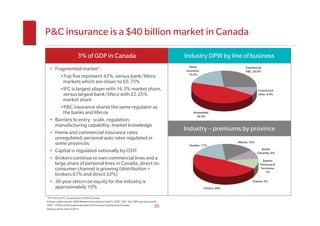

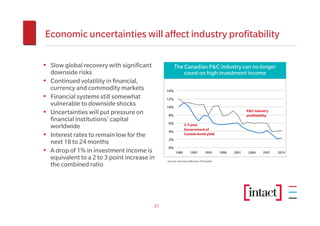

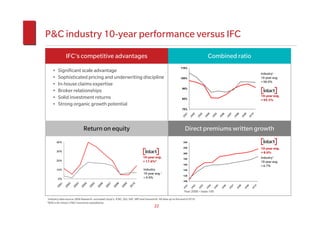

Intact Financial Corporation is Canada's largest personal and commercial property and casualty insurer. The document summarizes Intact's acquisition of AXA Canada, which will make Intact significantly larger. The acquisition is a strong strategic fit that will boost Intact's premiums by over 40% and bolster its risk selection, claims management, and distribution capabilities. It is financially compelling with an expected internal rate of return of 20% and accretion to earnings. The combined company will have a leading market position and outperform industry benchmarks for return on equity and combined ratio, maintaining a strong financial position.