Embed presentation

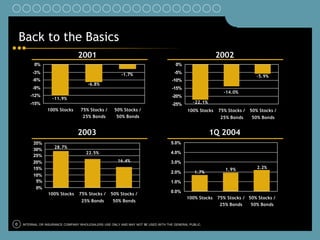

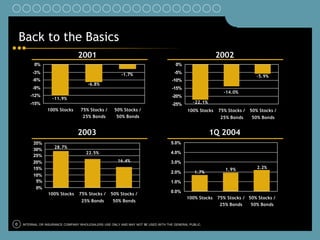

The document compares the performance of different portfolio allocations from 2001-2004 and 1Q 2004. It shows that portfolios with a mix of stocks and bonds significantly outperformed those with 100% stock allocations during periods of market decline from 2001-2003. The key finding is that asset allocation, or how assets are divided among asset classes like stocks and bonds, has the biggest impact on portfolio performance rather than choices about specific securities or market timing.