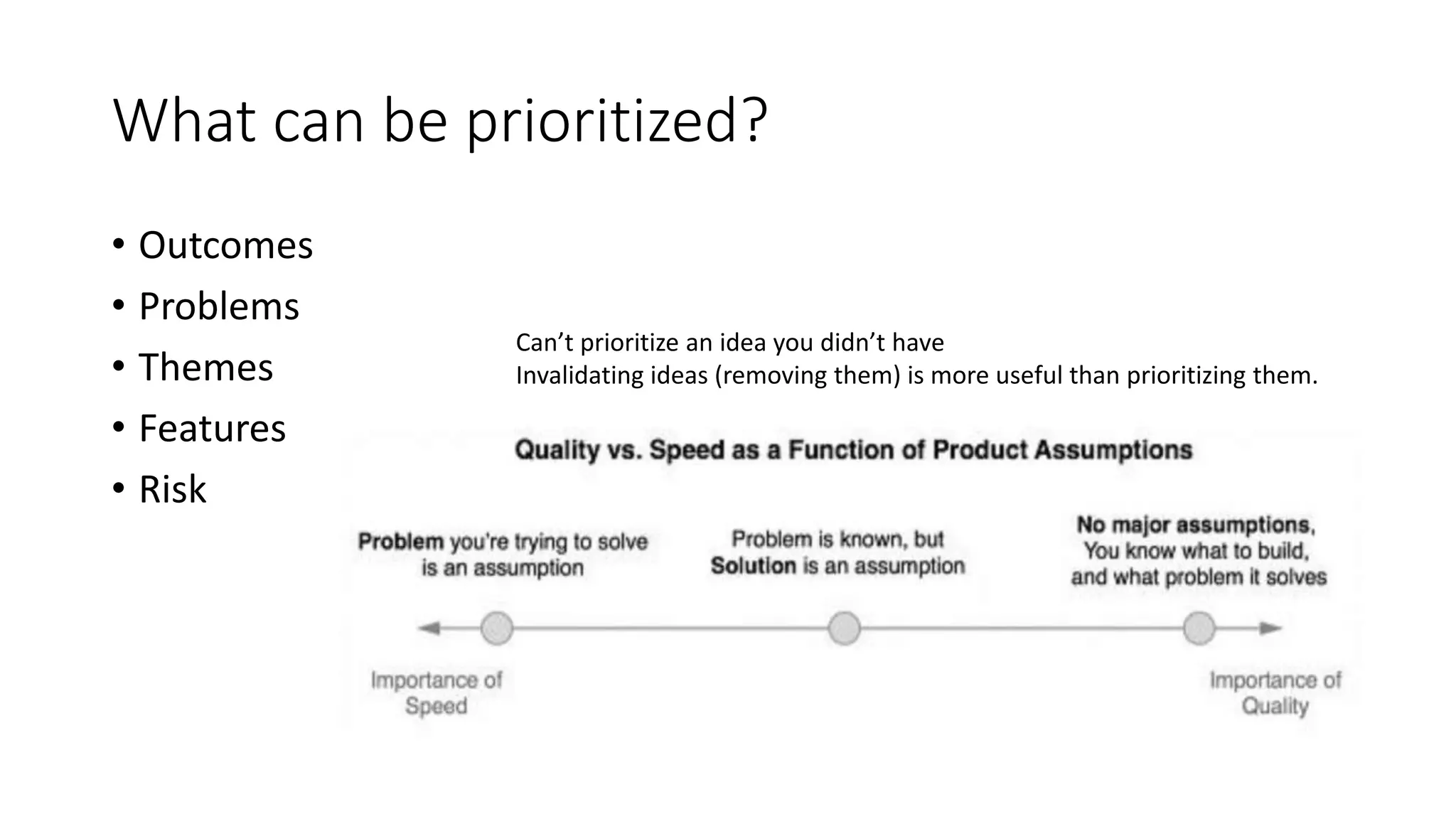

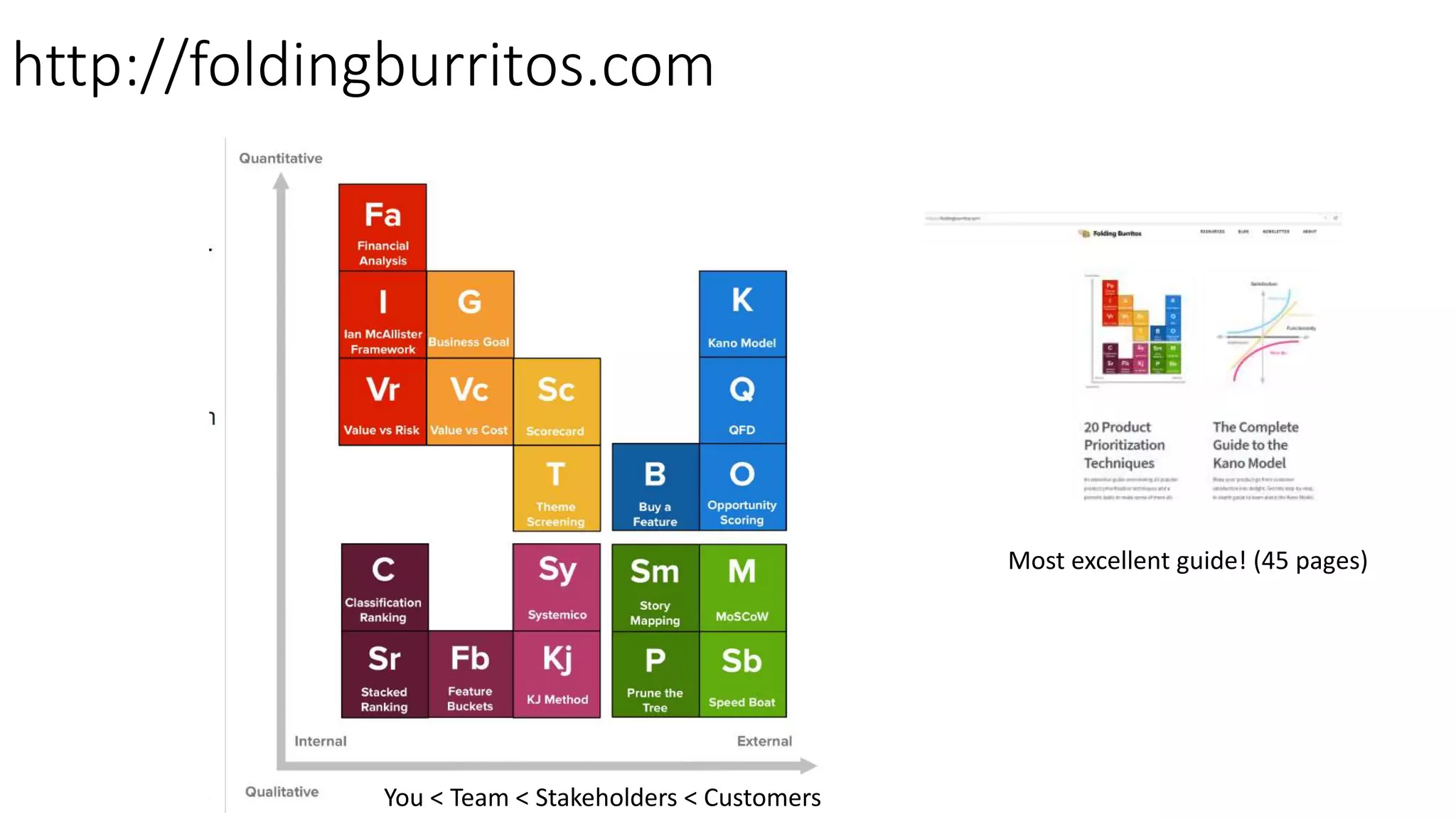

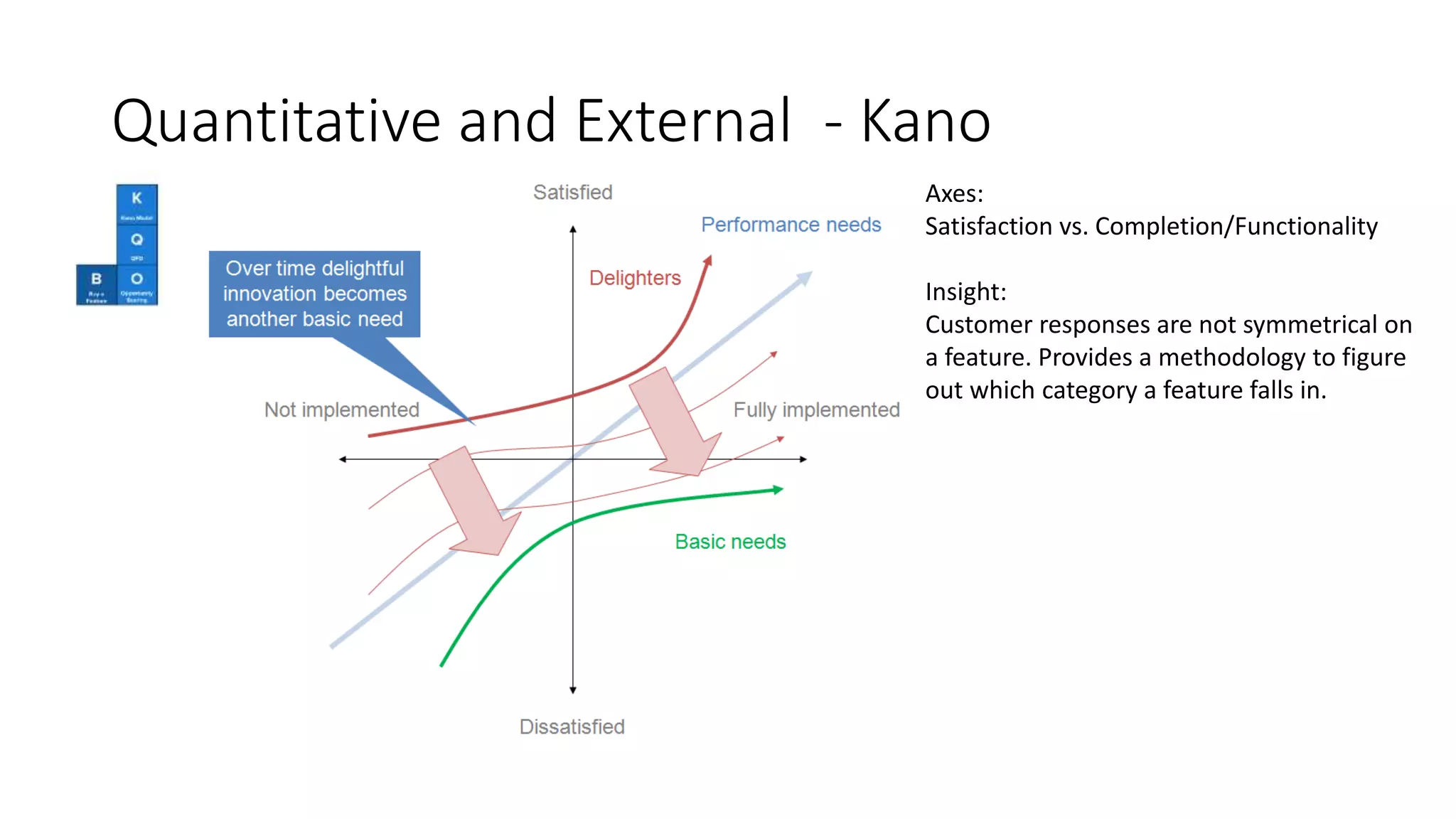

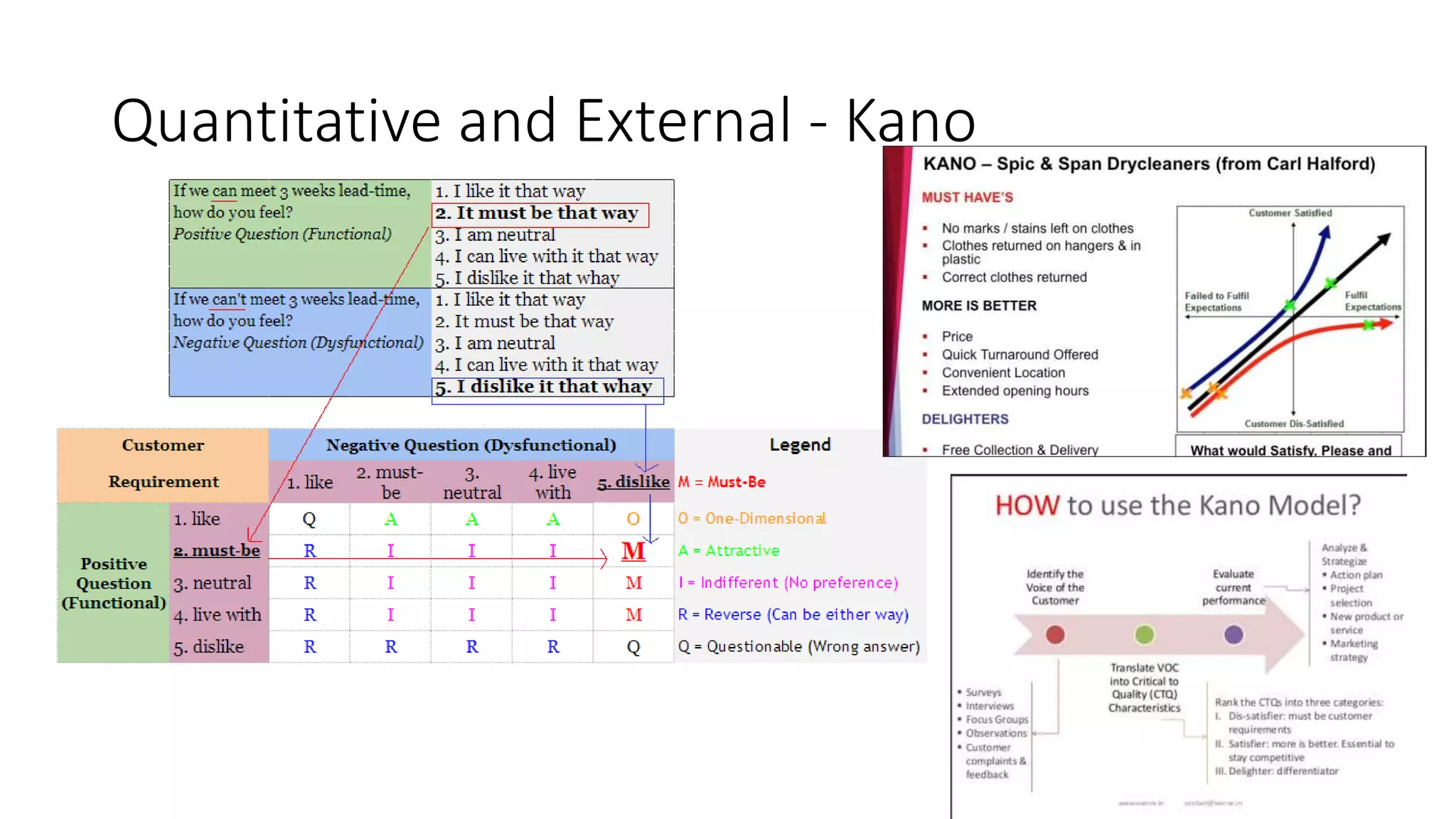

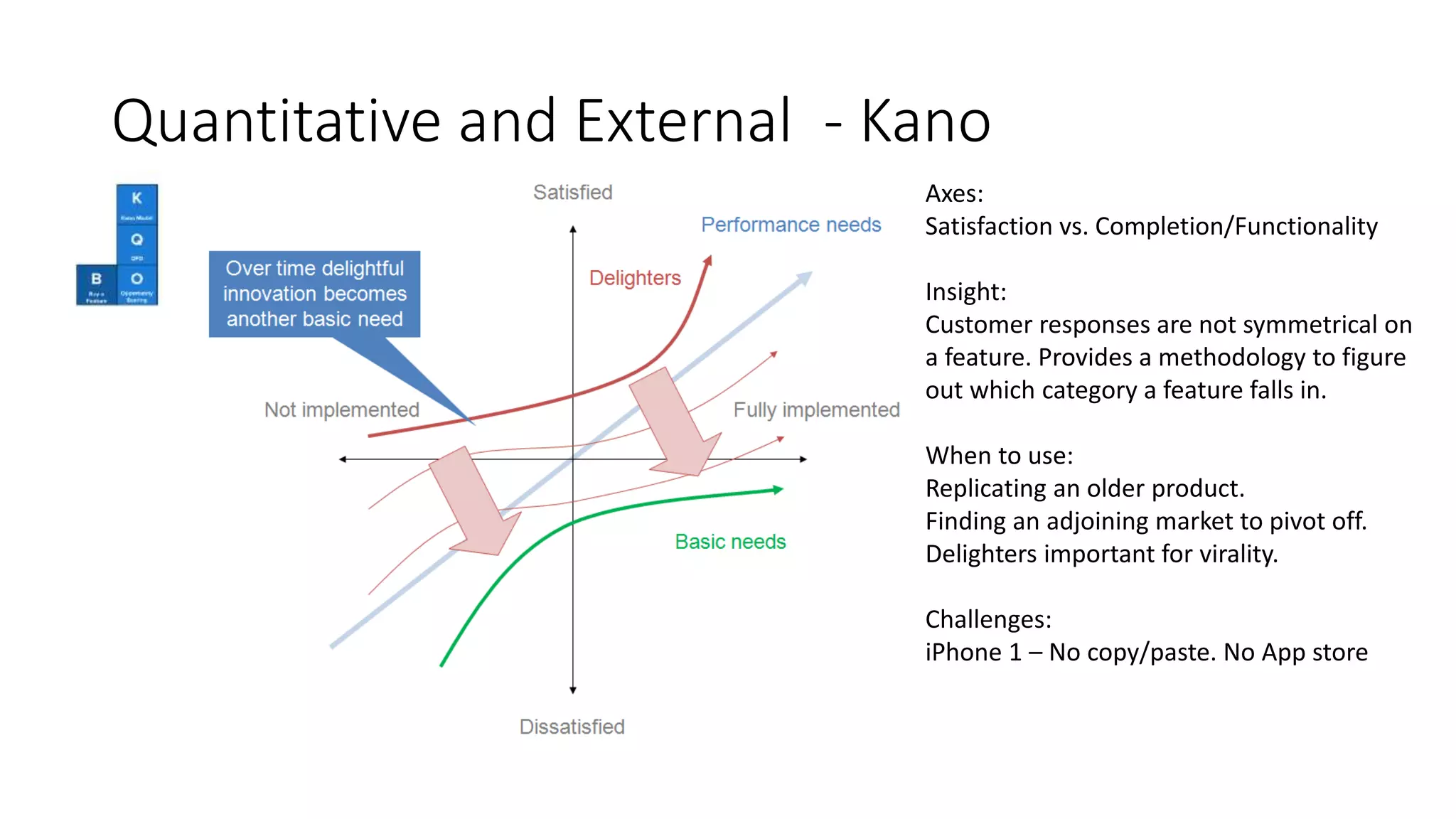

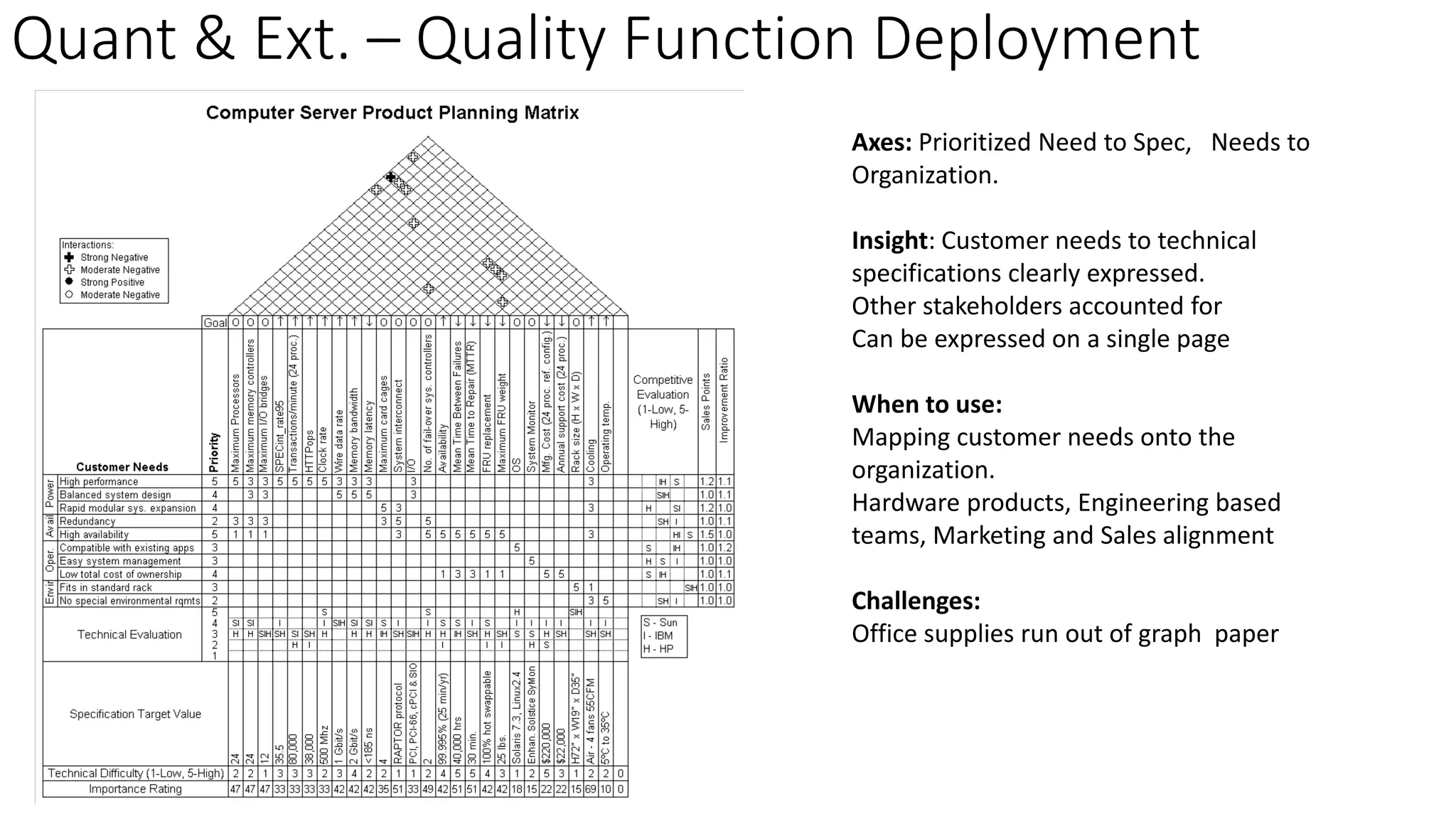

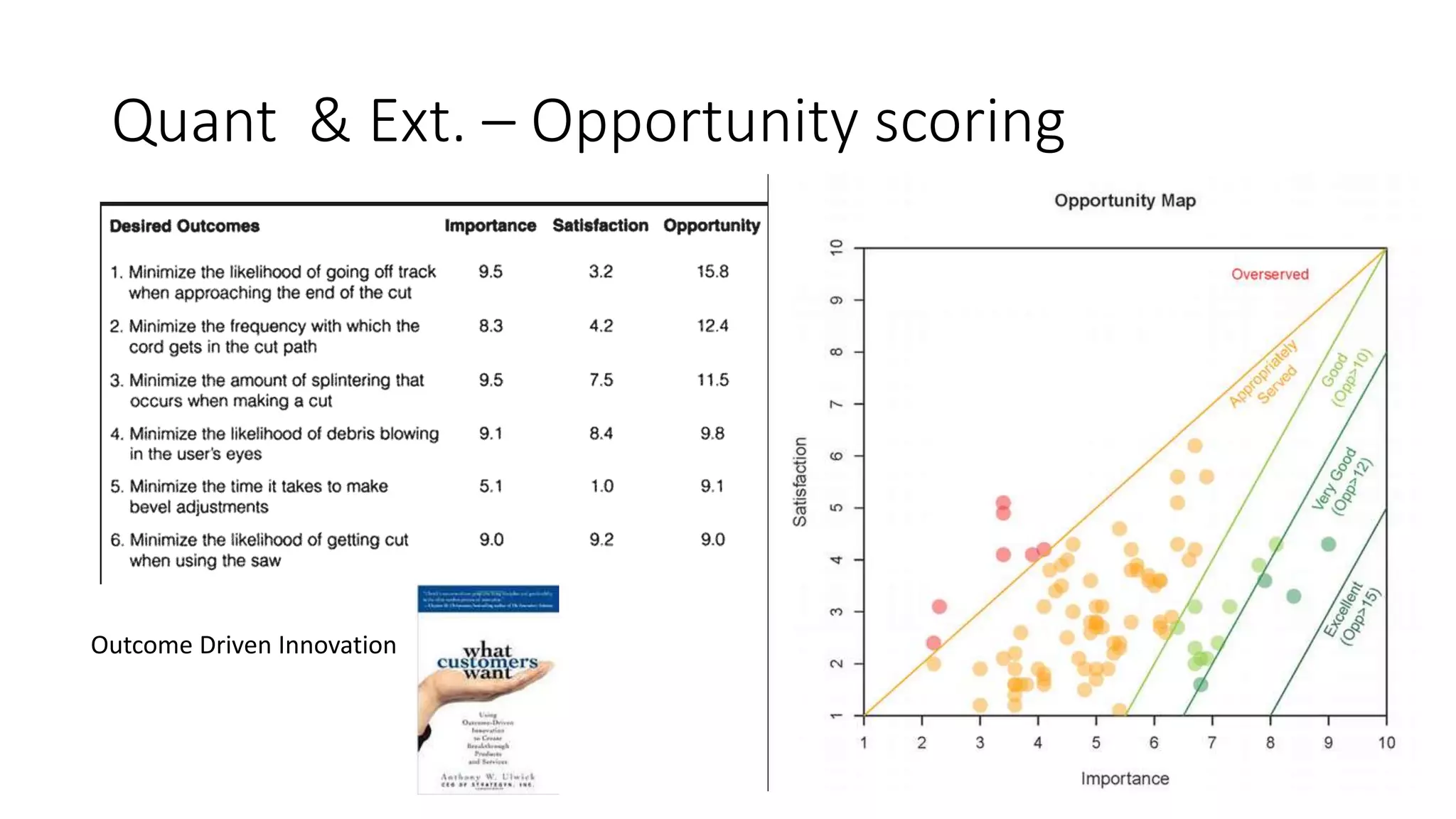

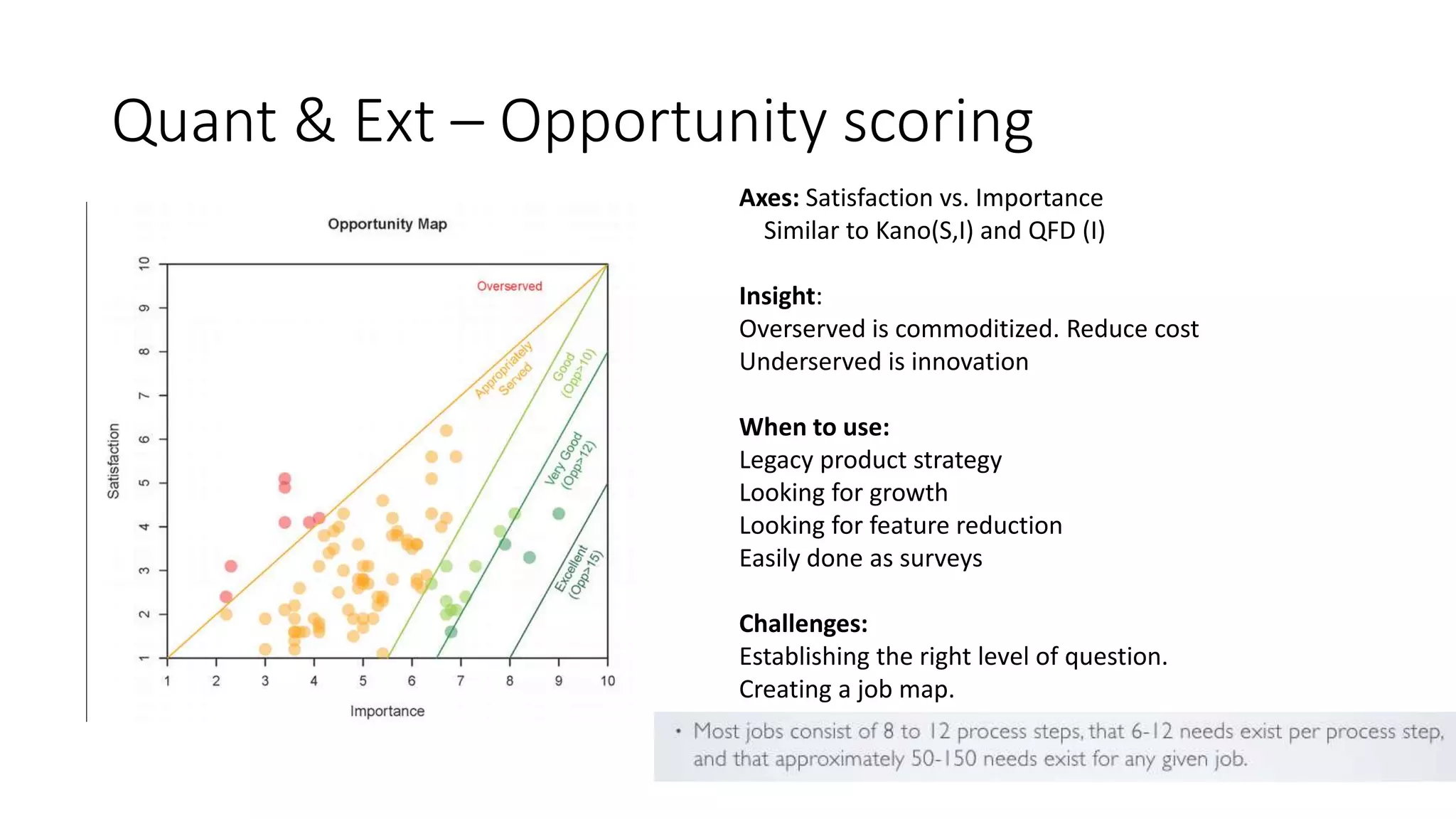

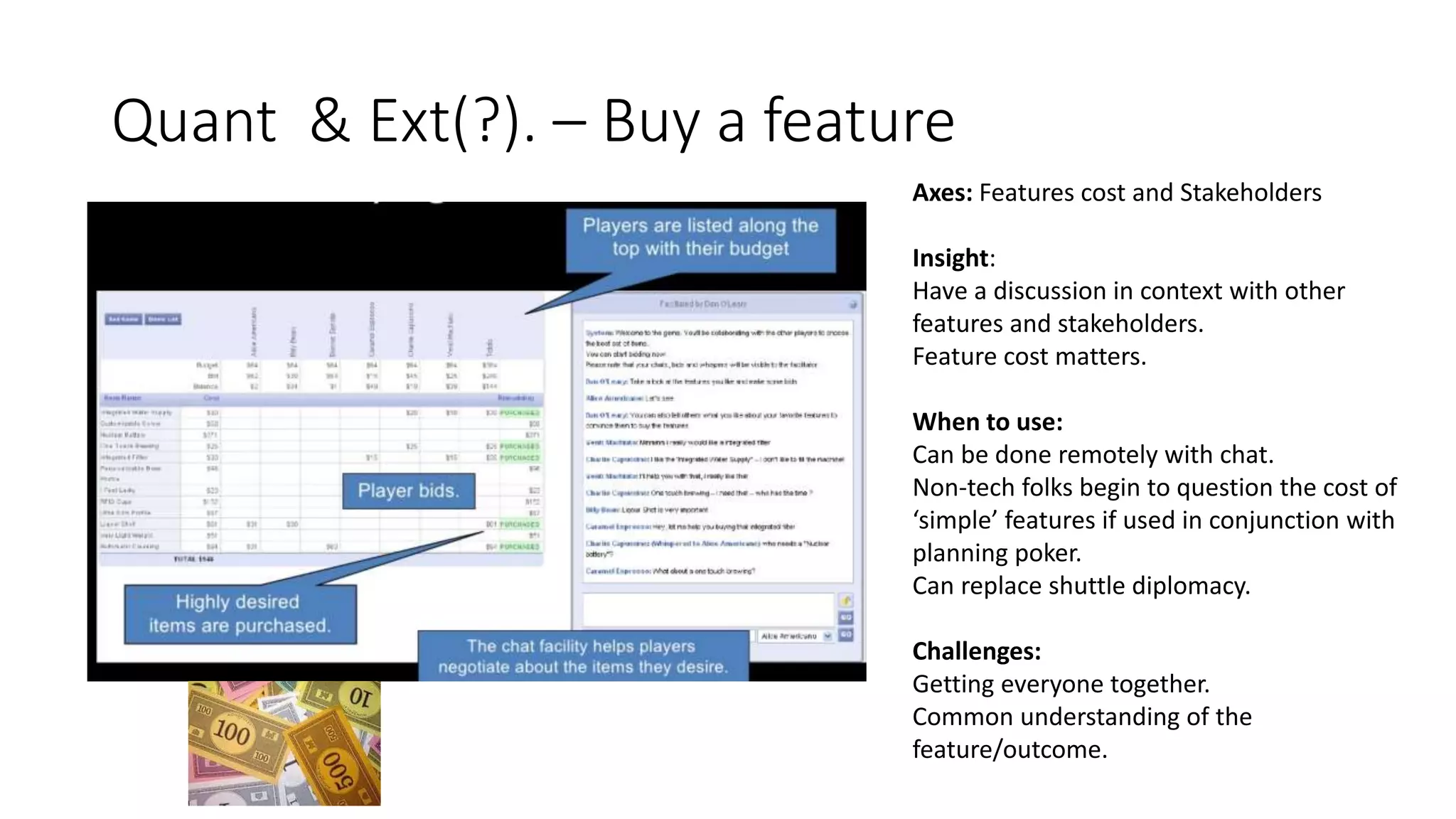

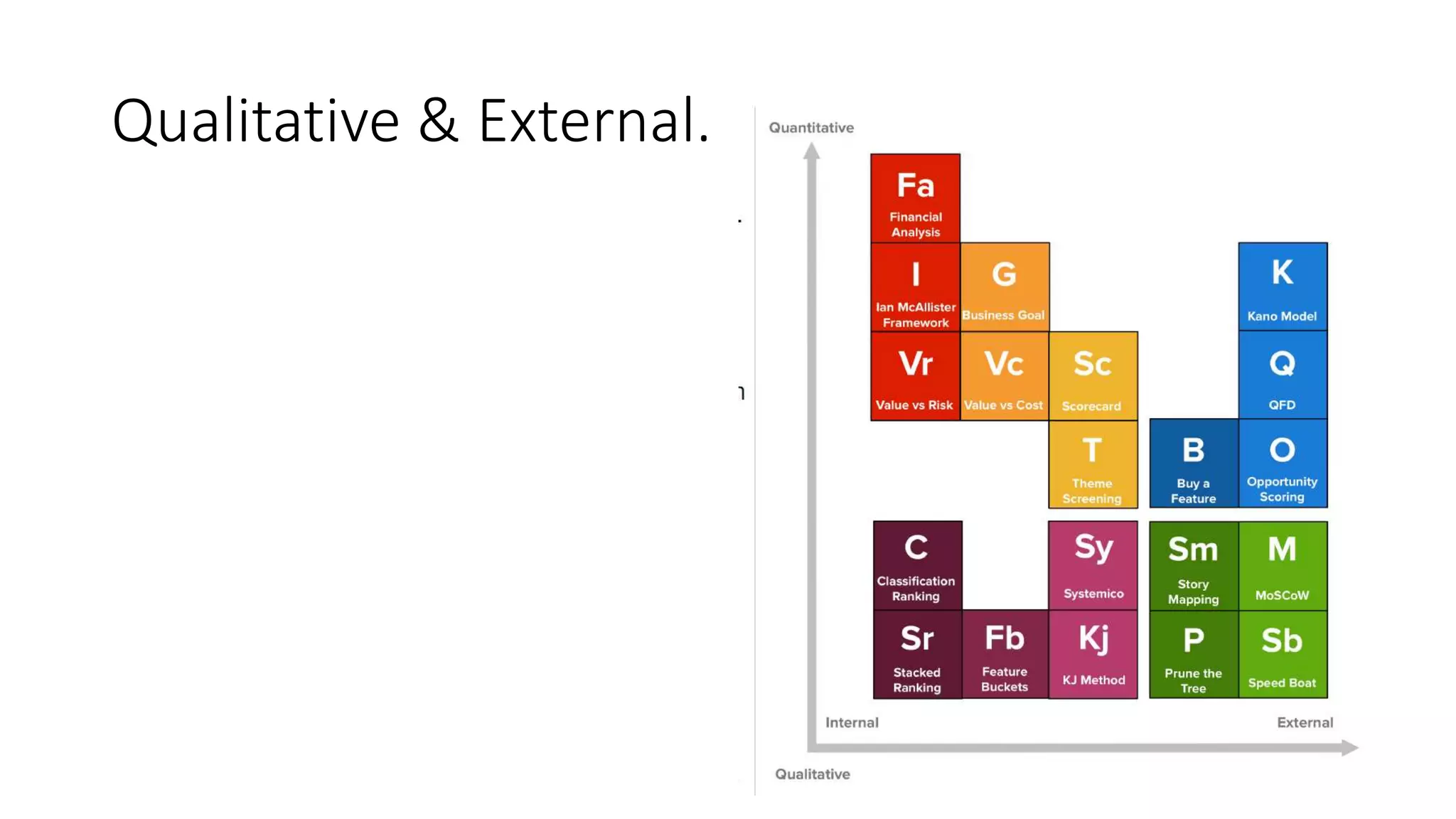

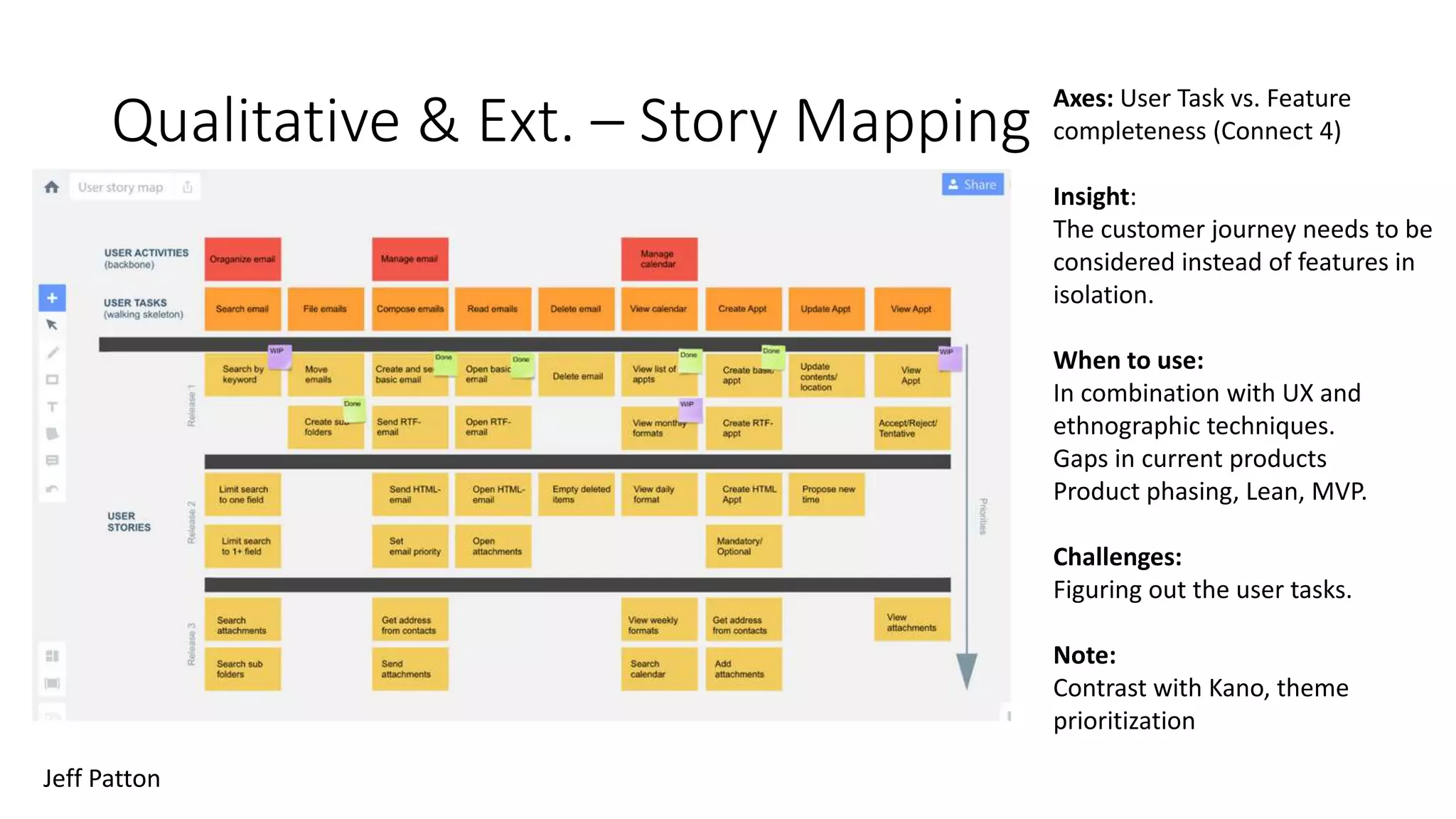

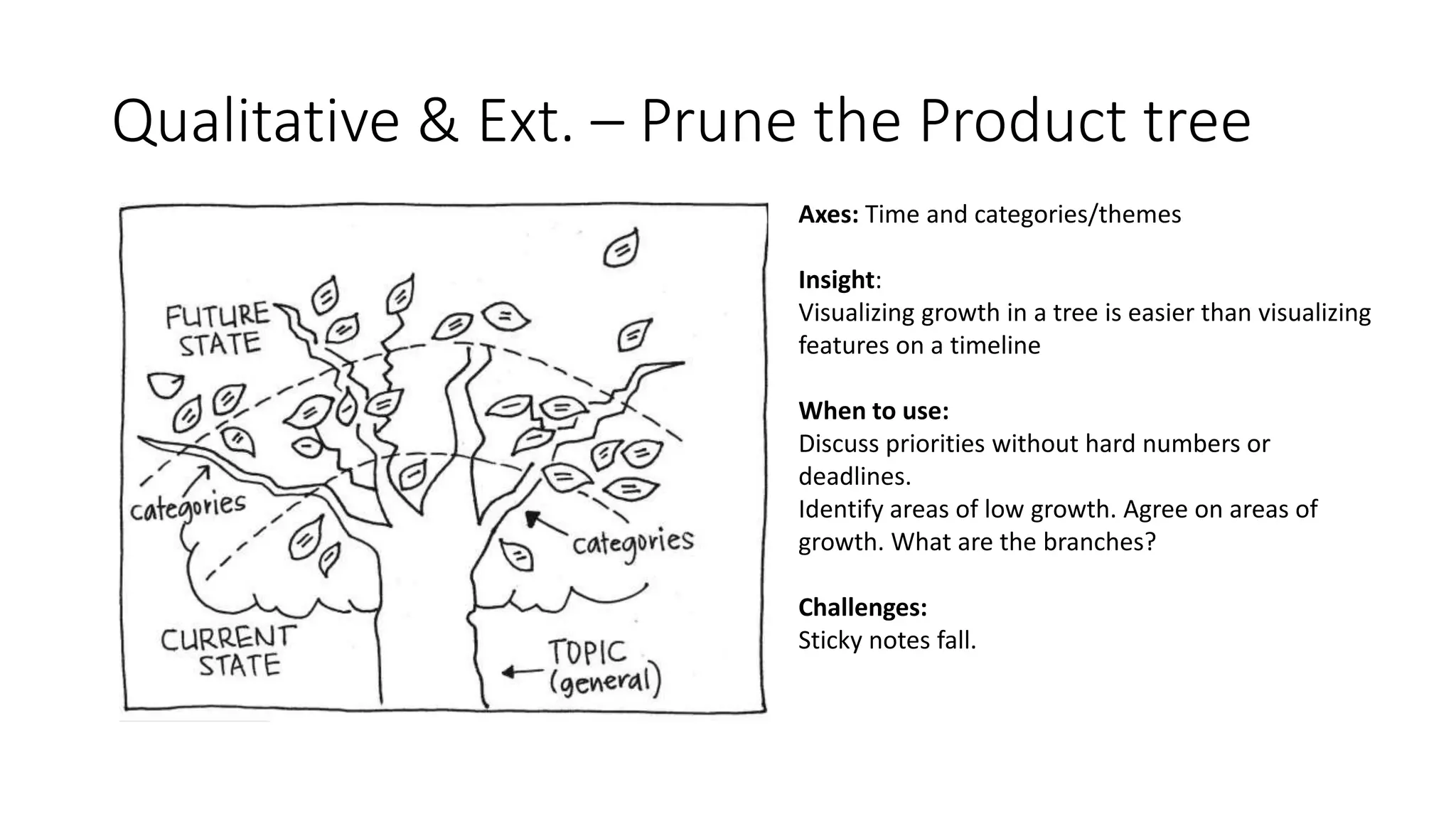

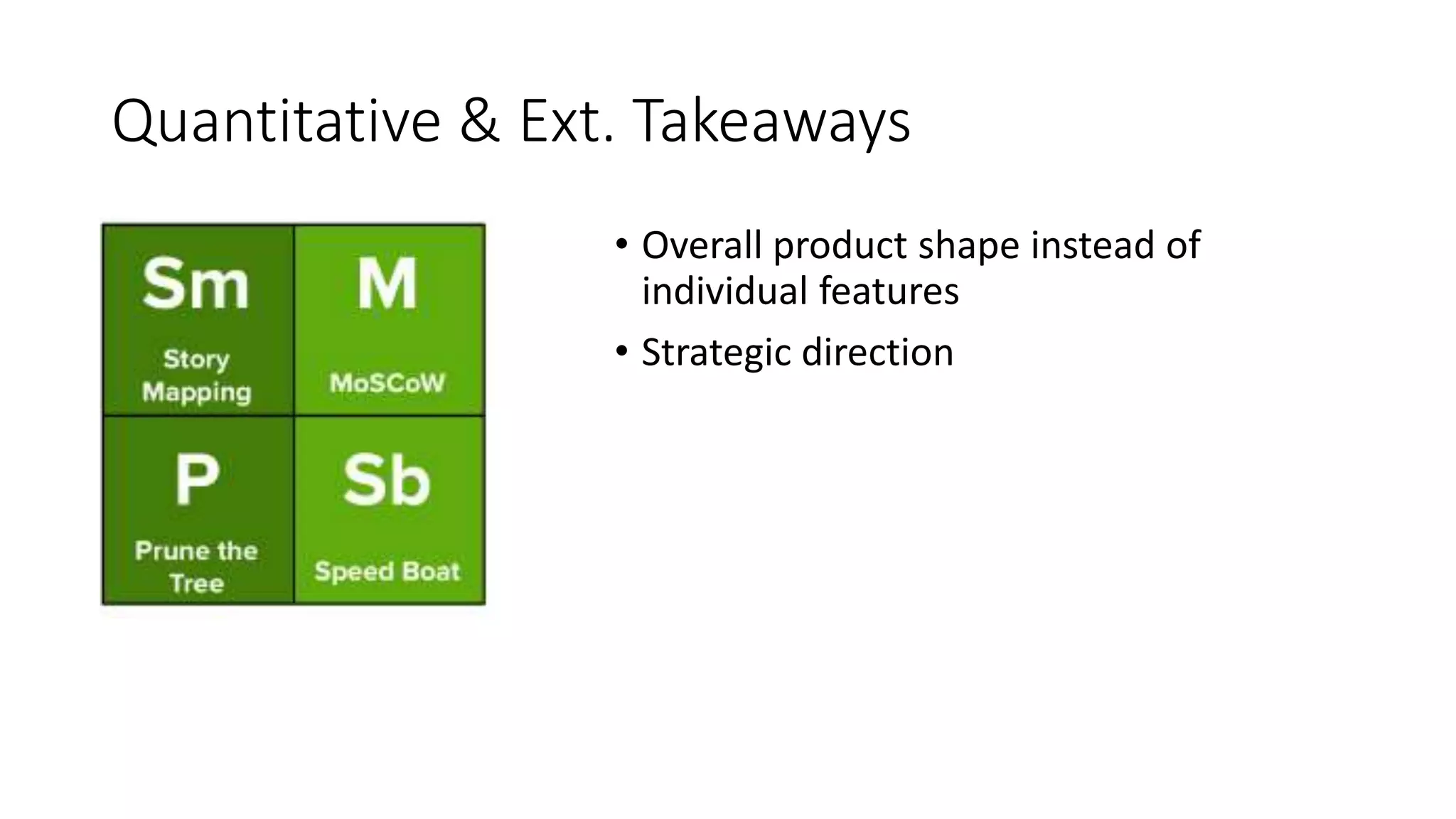

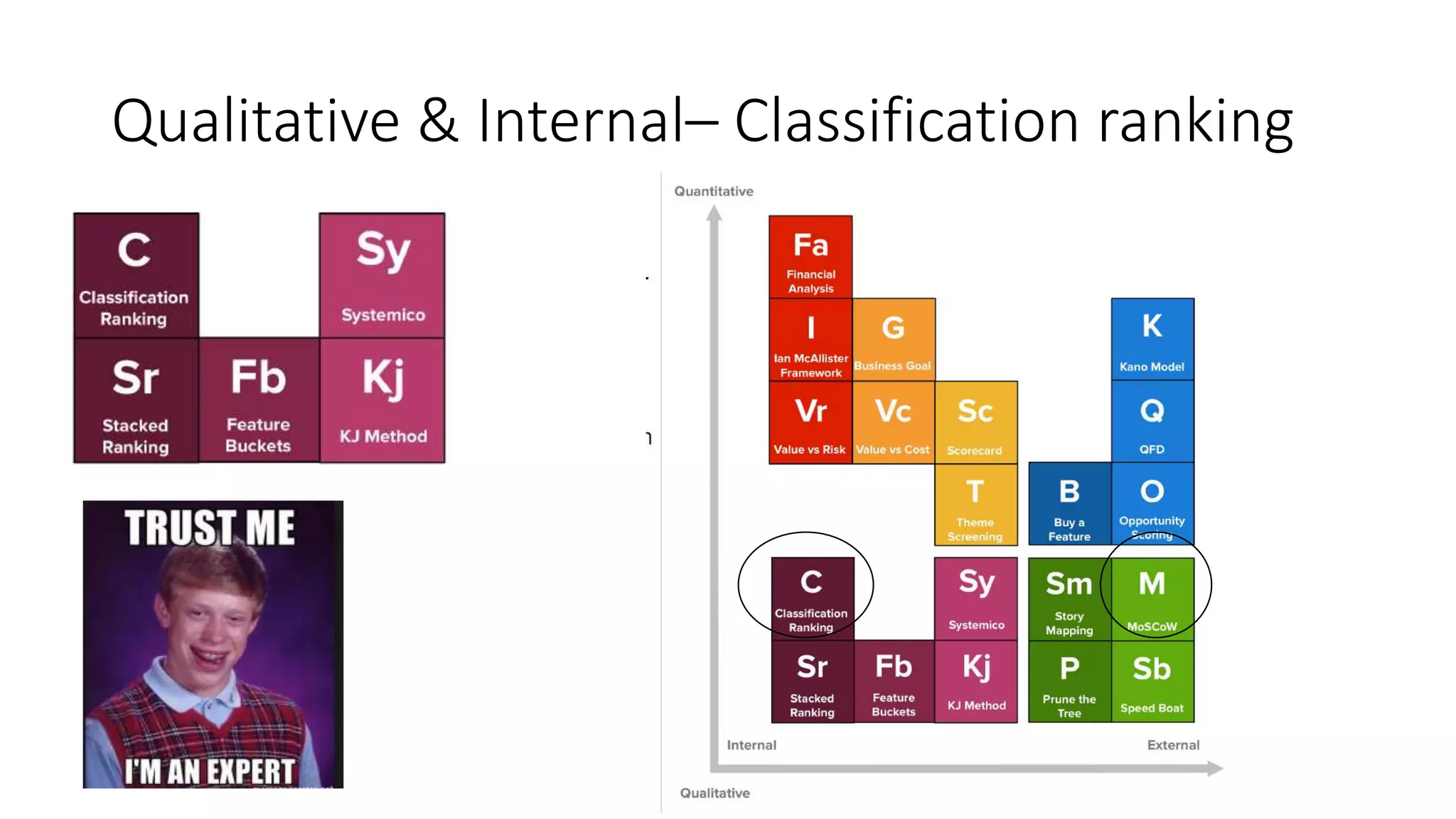

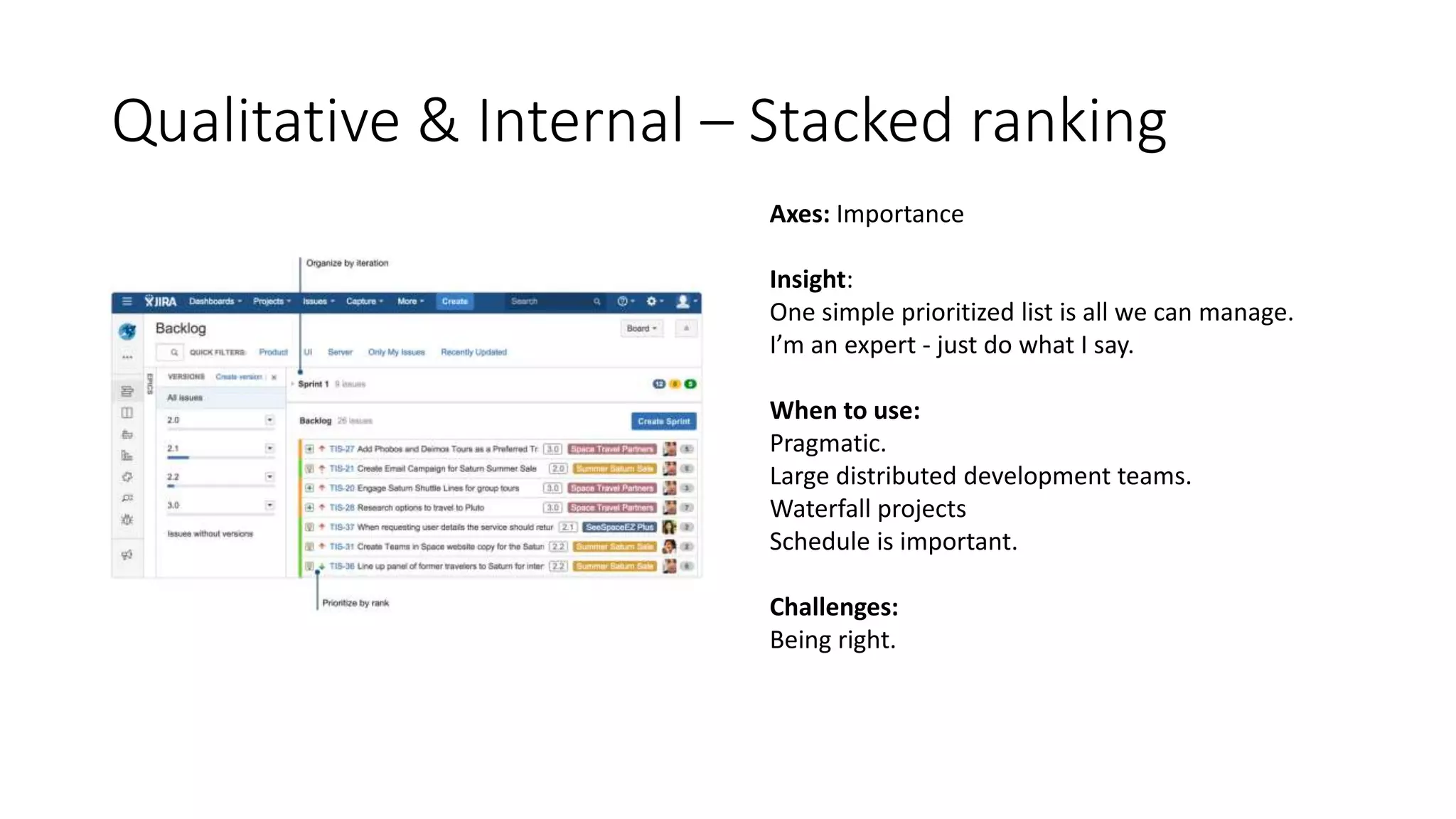

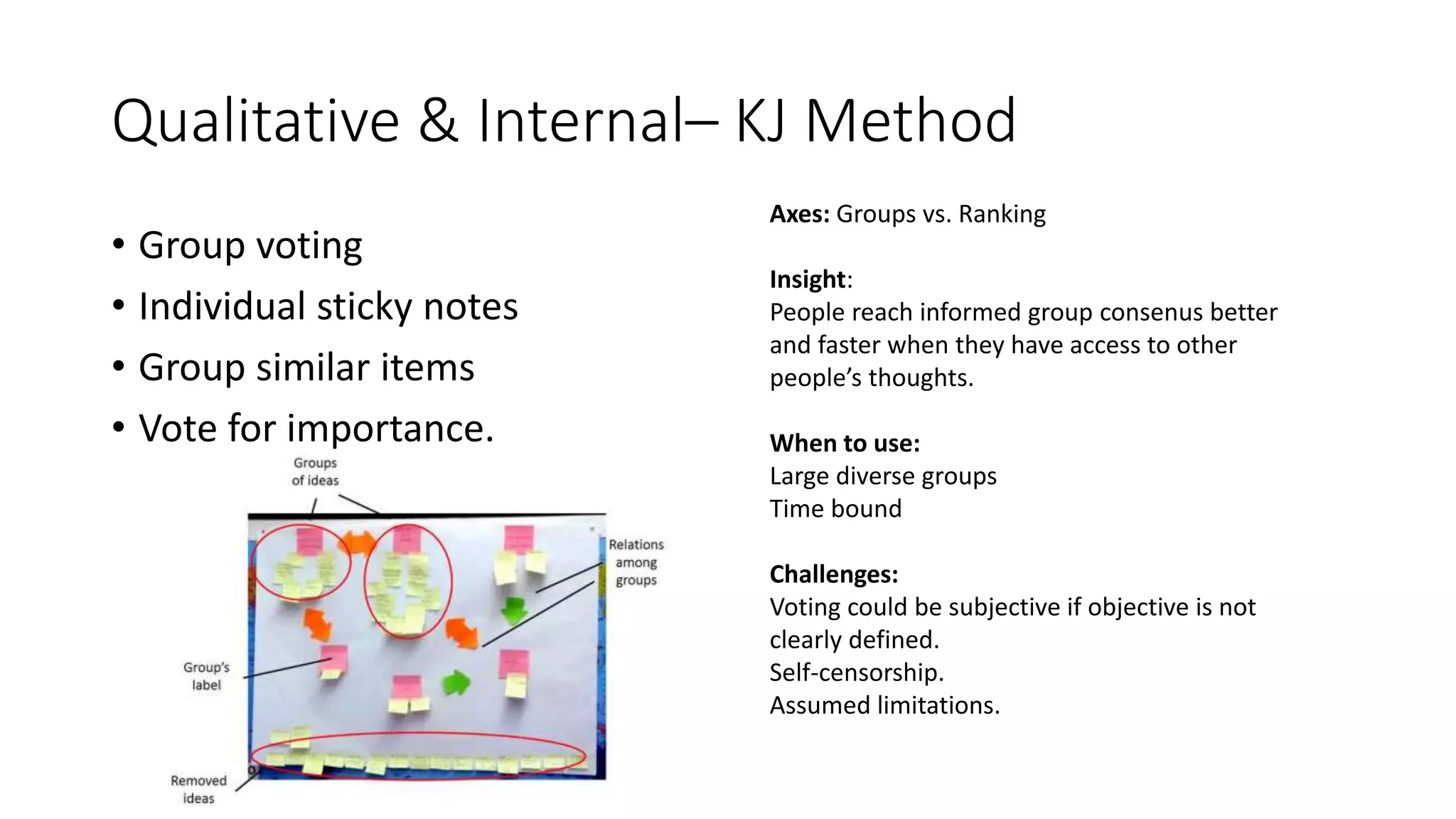

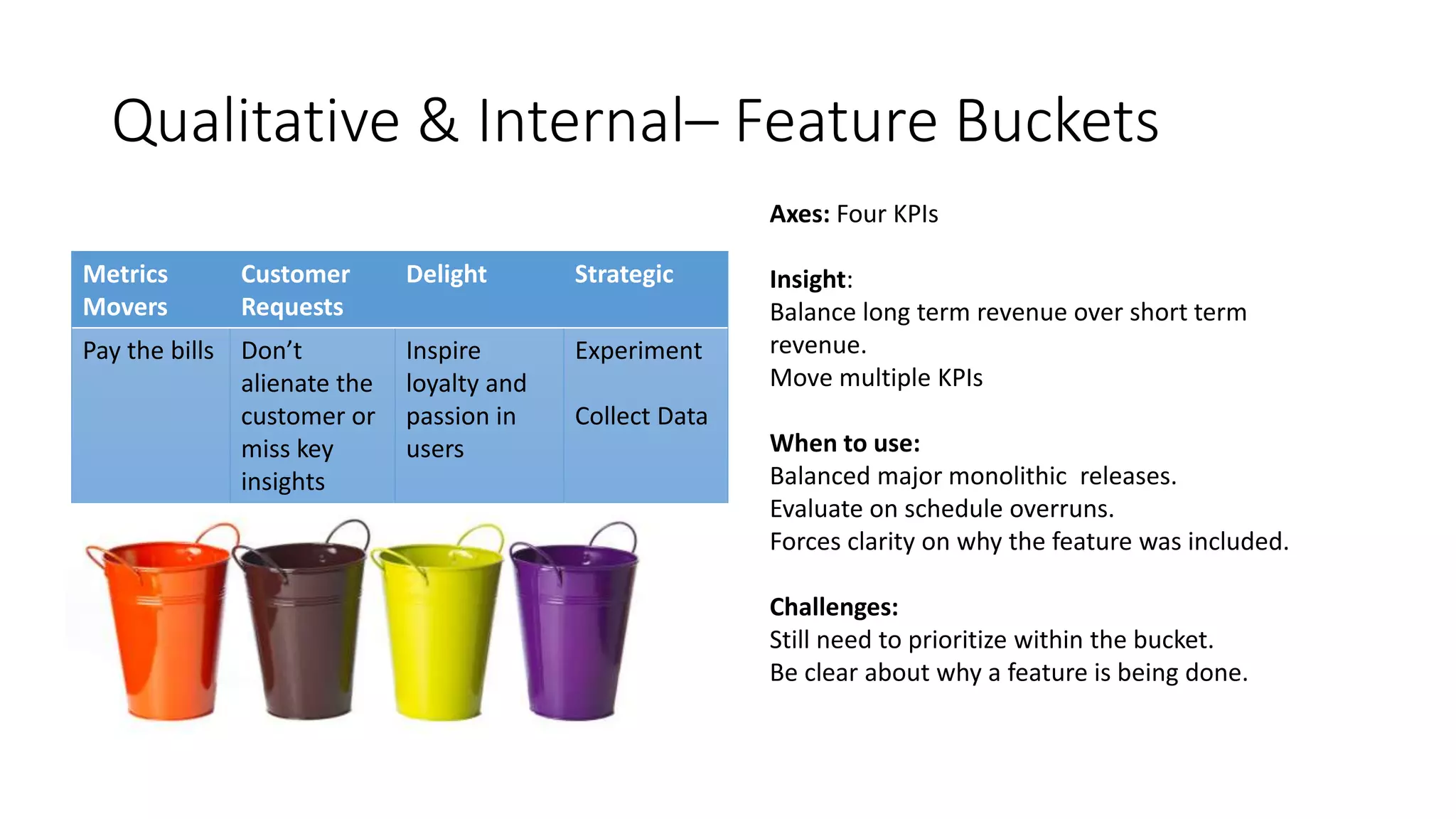

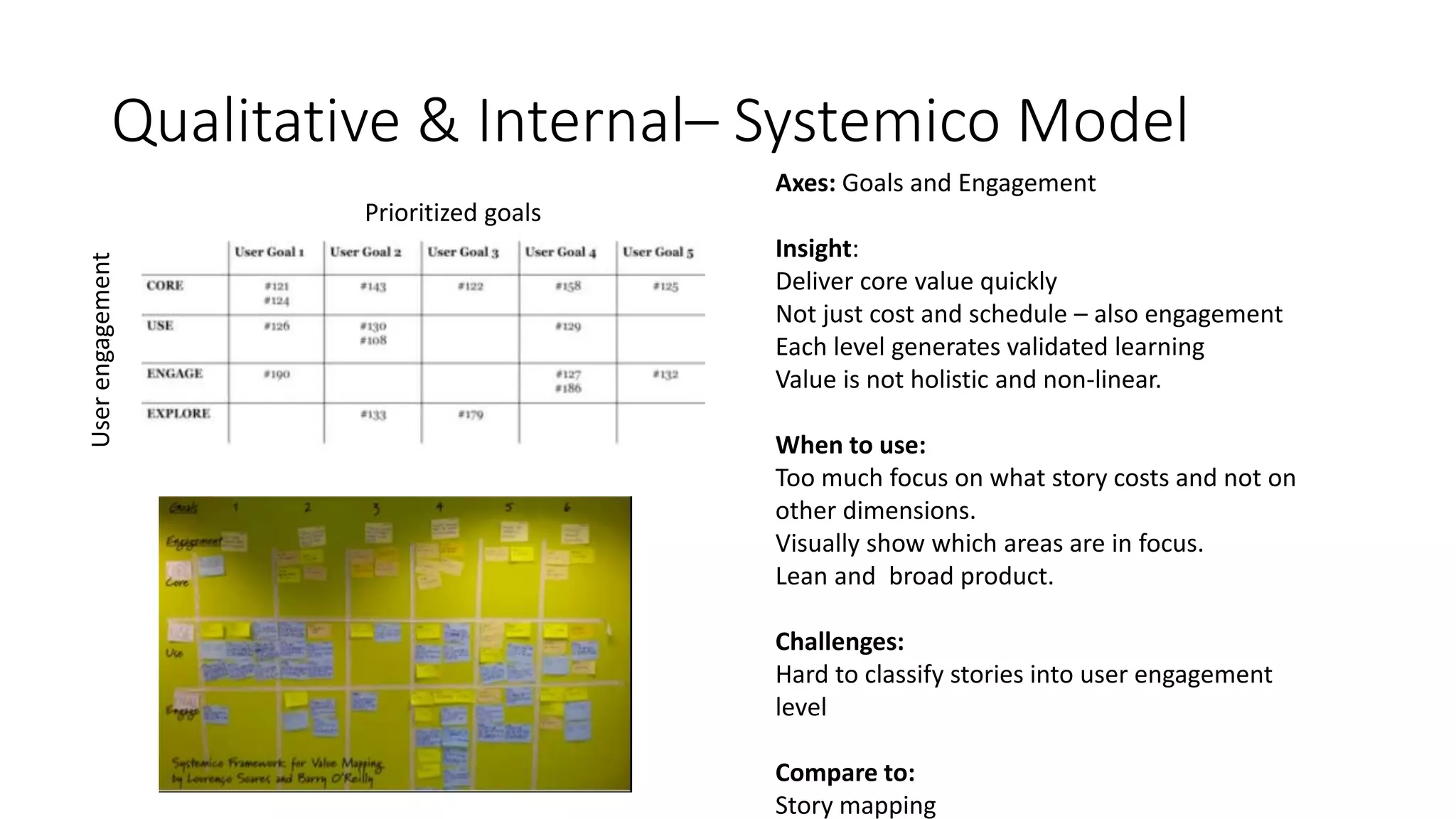

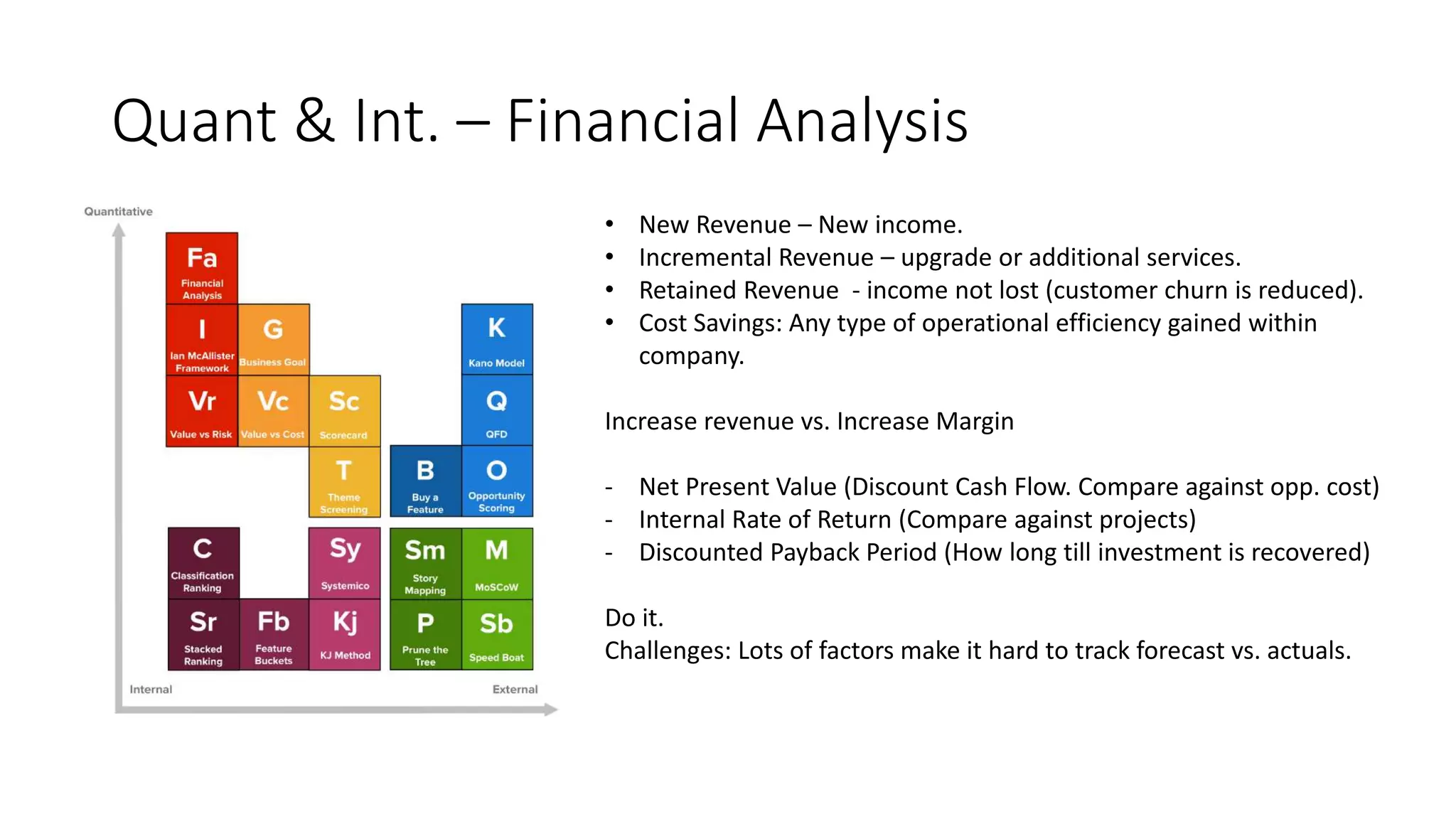

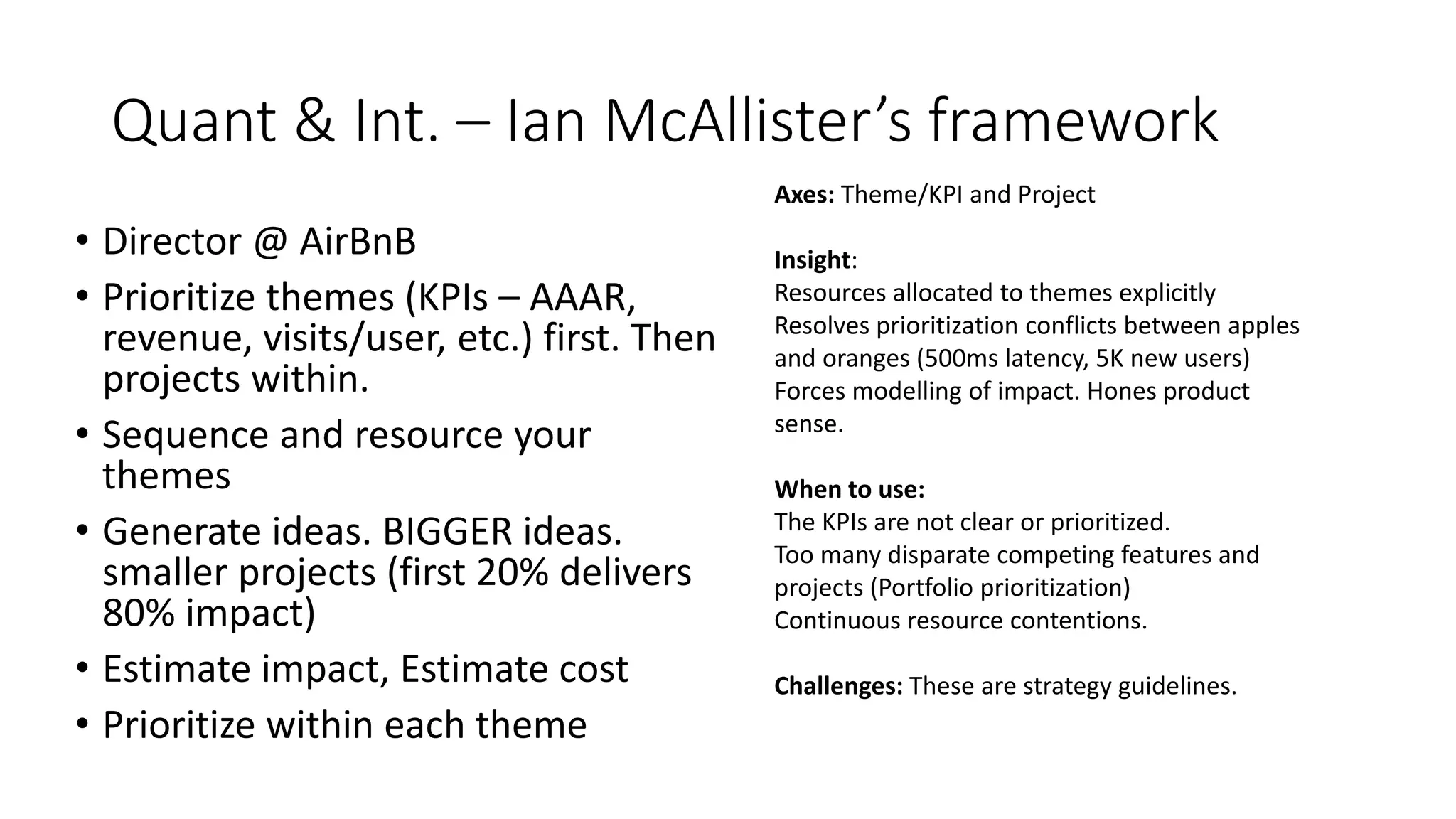

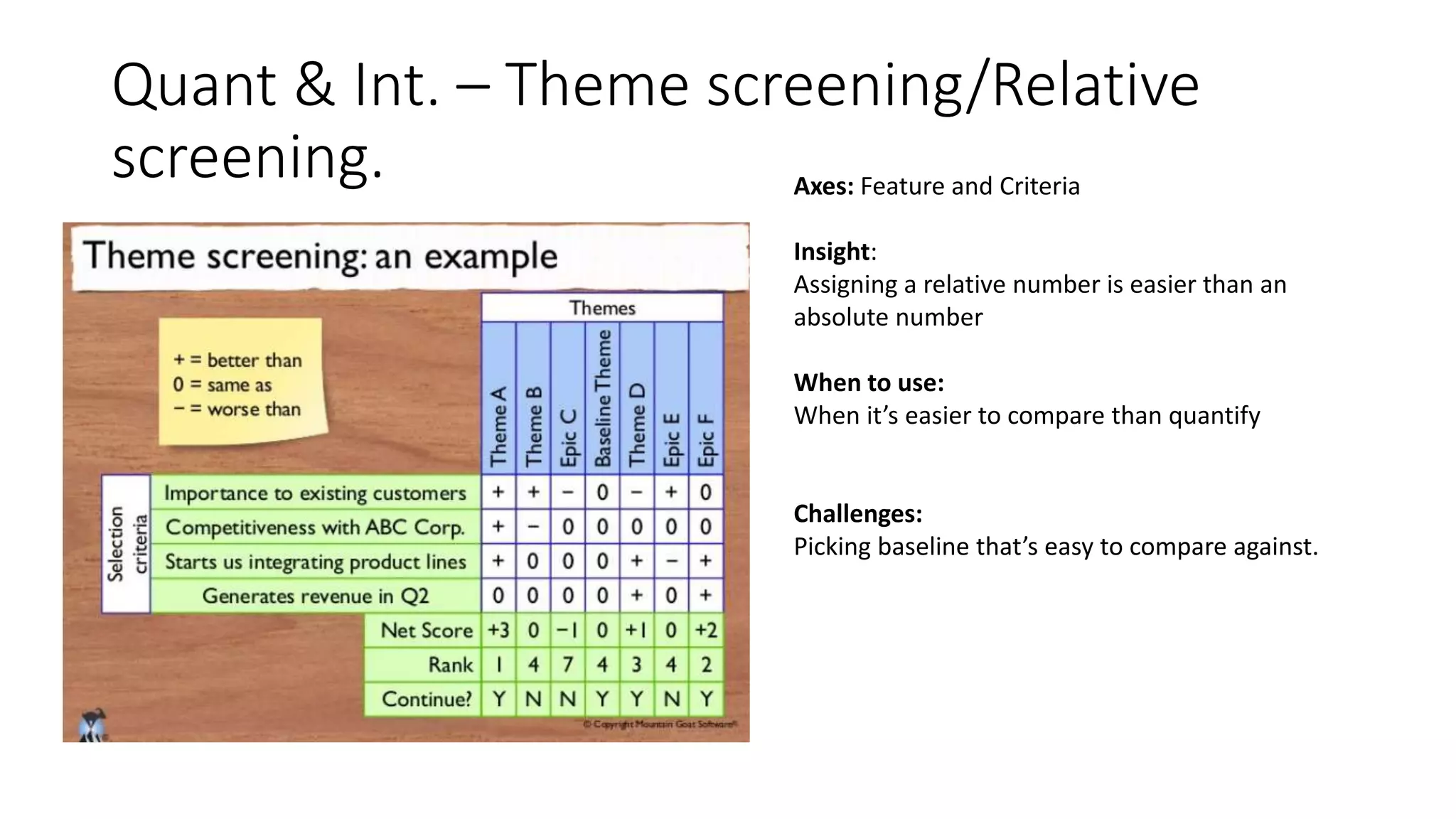

The document discusses 20 techniques for product prioritization, emphasizing the importance of aligning features with customer needs and organizational capabilities. It explores various qualitative and quantitative methods to prioritize work, such as the Kano model, opportunity scoring, and financial analysis, each with specific use cases and challenges. Key takeaways highlight the importance of external validation, thematic grouping, and understanding the customer journey in the prioritization process.