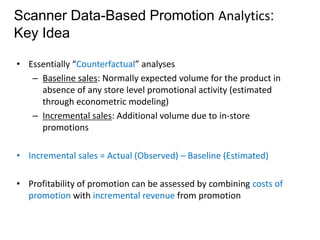

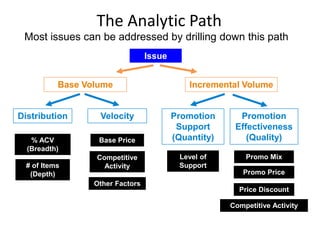

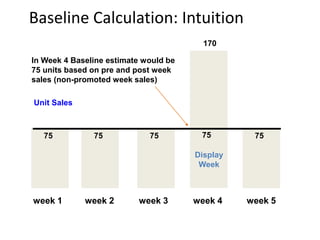

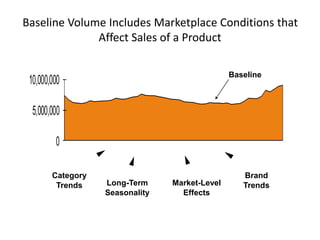

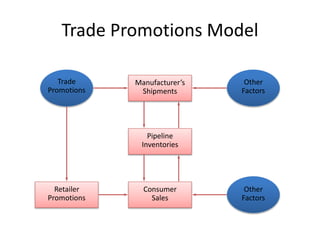

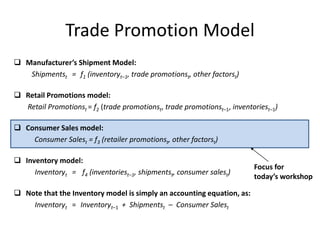

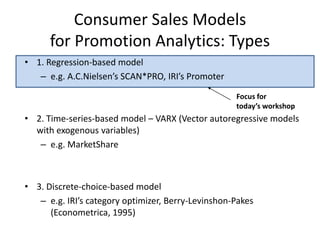

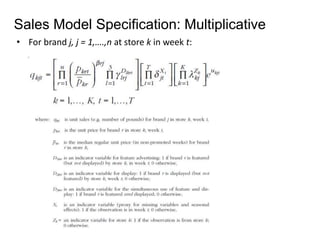

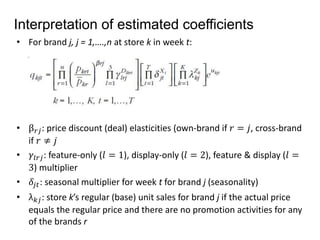

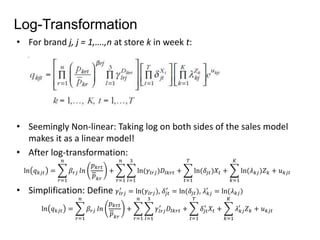

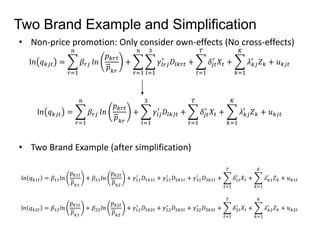

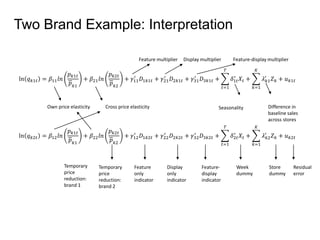

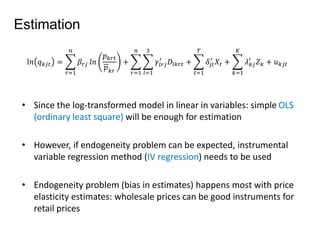

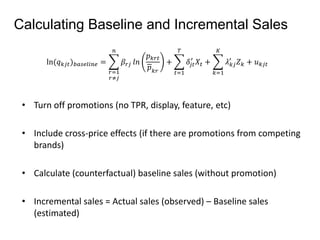

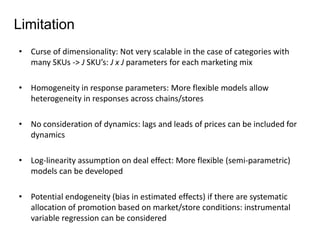

This document provides an overview of promotion analytics using scanner data. It discusses estimating baseline and incremental sales from promotions through econometric modeling. Key aspects covered include model specification, interpretation of coefficients, and limitations. The modeling approach involves log-transforming a multiplicative sales model to make it linear and estimating it using ordinary least squares regression. Baseline sales are estimated by turning off promotions, and incremental sales are calculated as the difference between actual and baseline sales.