The document summarizes Aksigorta's financial results for the first quarter of 2015. Key points include:

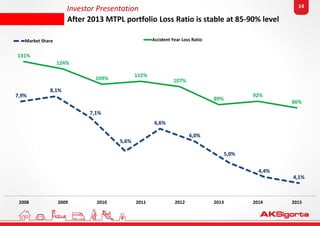

- Net loss of TL 140 million for Q1 2015 due to a TL 183 million adjustment to increase motor third-party liability (MTPL) claim provisions.

- Excluding MTPL, Q1 2015 net profit was TL 24 million and combined ratio was 97%.

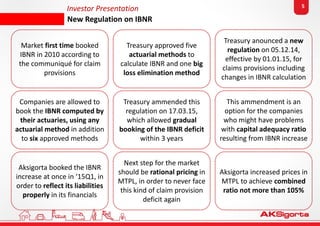

- New regulations effective in 2015 required insurers to book incurred but not reported (IBNR) claims, significantly impacting MTPL provisions.

- Guidance for 2015 forecasts 9-12% gross written premium growth excluding MTPL, a 1-2 percentage point improvement in combined ratio also excluding MTPL, and over 50% growth