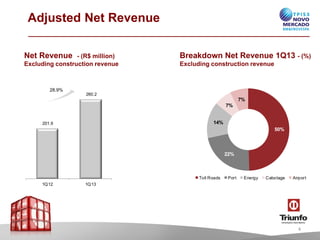

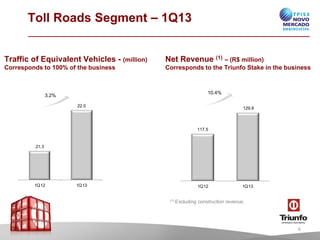

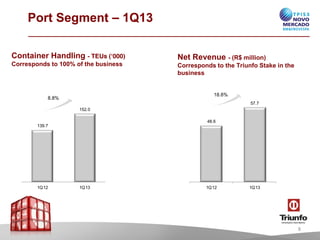

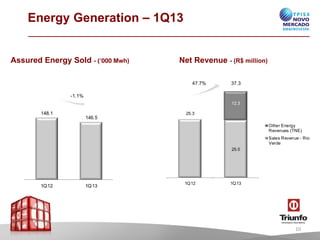

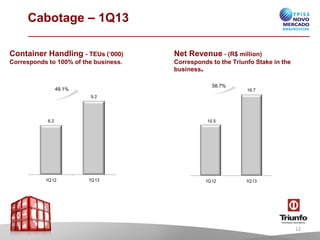

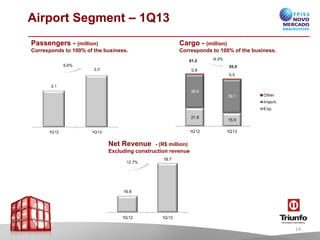

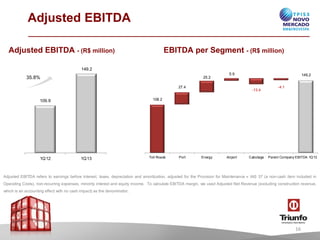

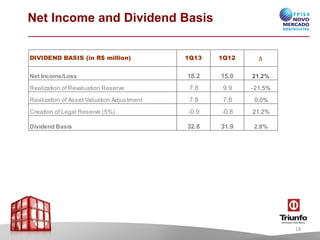

This presentation summarizes the key financial and operational highlights from Triunfo Participacoes e Investimentos's 1Q13 earnings. Traffic increased 3.2% to 22 million vehicles in 1Q13. Net operating revenue grew 28.9% to R$260.2 million in 1Q13. Adjusted EBITDA increased 35.8% to R$149.2 million in 1Q13 with an EBITDA margin of 57.3%. Net income grew 21.3% to R$18.2 million in 1Q13.