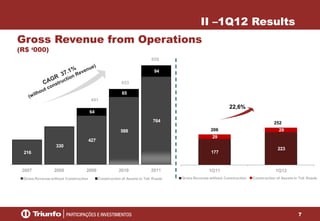

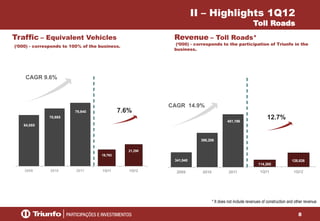

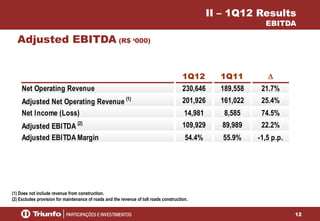

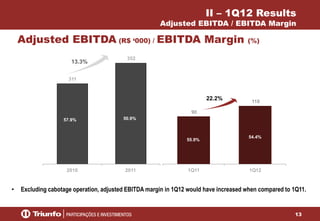

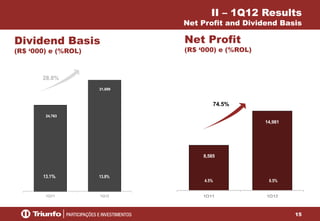

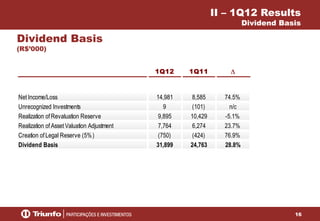

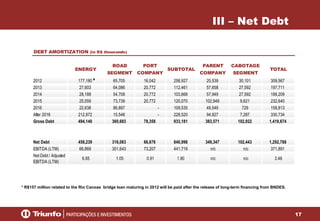

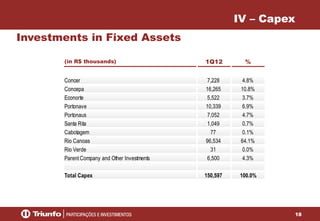

Triunfo Participações e Investimentos S.A. reported its 1Q12 earnings results. Net revenue grew 21.7% to R$231 million due to a 7.6% increase in traffic volume. Adjusted EBITDA was R$110 million, up 22.2% from 1Q11 with a margin of 54.4%. Net income was R$15 million. The company also won an airport expansion bid and issued R$300 million in promissory notes for investments.