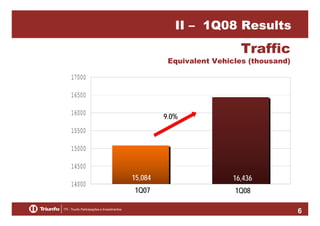

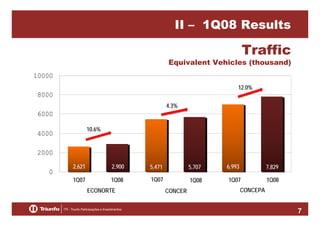

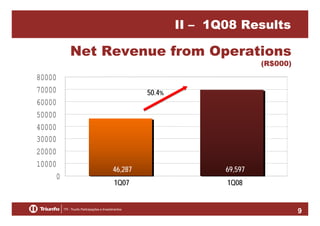

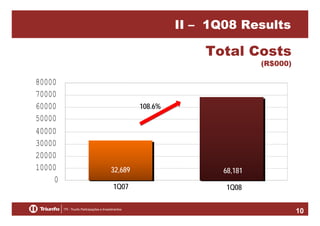

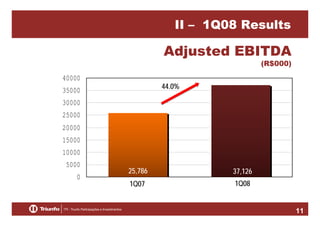

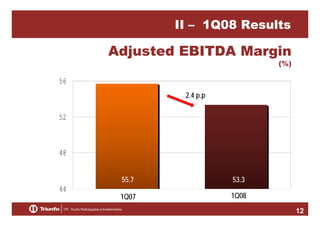

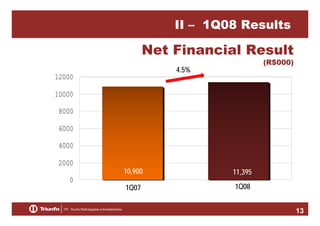

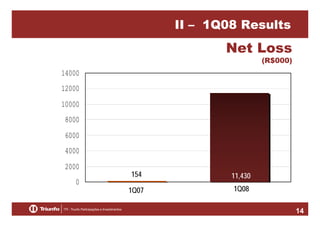

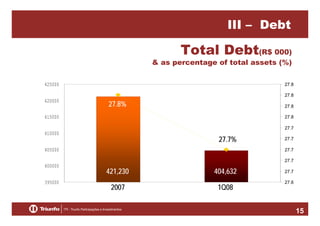

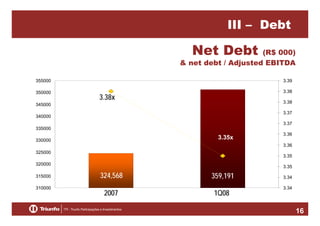

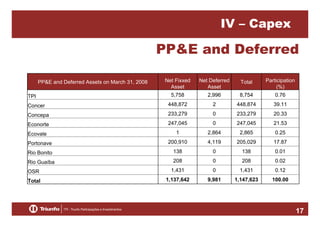

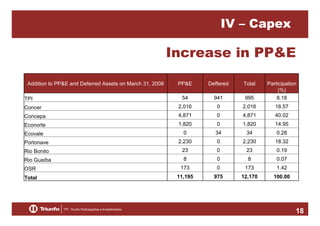

TPI reported its 1Q08 earnings results. Total traffic across its toll road concessions increased 9.0% compared to 1Q07. Net operating revenue grew 50.4% to R$69.6 million while adjusted EBITDA increased 44.0% to R$37.1 million. However, net loss was R$11.4 million compared to a net loss of R$154 thousand in 1Q07. Total debt increased to R$404.6 million while net debt rose to R$359.2 million, representing a net debt to adjusted EBITDA ratio of 3.38x. Capital expenditures totaled R$12.2 million in the quarter.