Embed presentation

Download to read offline

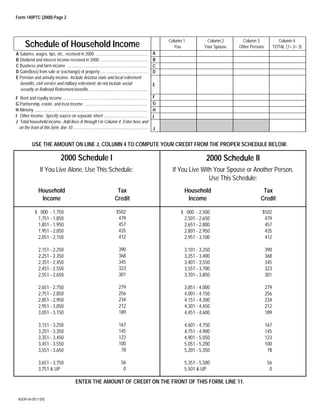

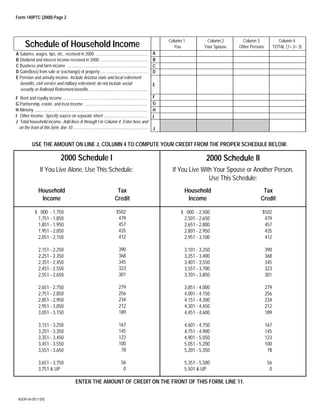

This 3 sentence summary provides the high level information from the Arizona property tax refund claim document: The document is an Arizona property tax refund claim form for tax year 2000, where the claimant provides their personal information and answers questions to determine if they qualify for the refund based on being an Arizona resident, age, income level, and whether they paid property taxes or rent. The claimant is instructed to provide the total household income and their property taxes paid, and the form calculates the potential refund amount.