Embed presentation

Download to read offline

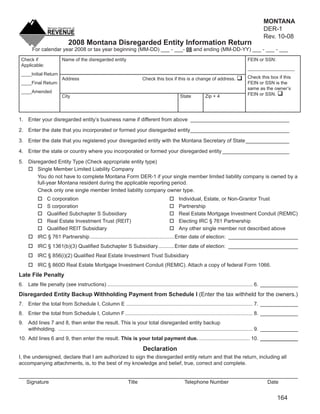

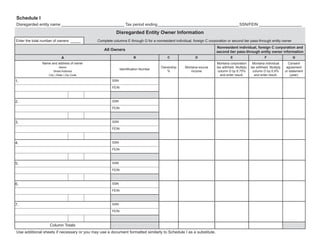

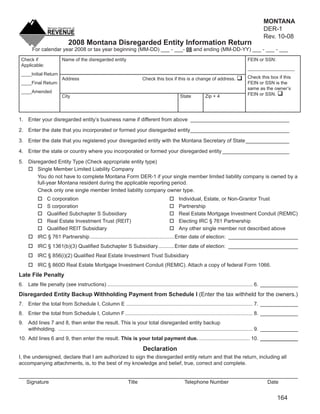

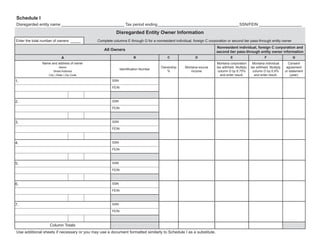

This document is a 2008 Montana Disregarded Entity Information Return form. It requires basic information about the disregarded entity such as its name, address, FEIN/SSN, date of formation, entity type, and ownership structure. It also requires calculating any late filing penalties owed and total backup withholding payments that were withheld from the entity's owners and are being remitted. Accompanying schedules collect details on each owner such as their identification number, ownership percentage, Montana source income, and any tax withholding amounts.