Embed presentation

Download to read offline

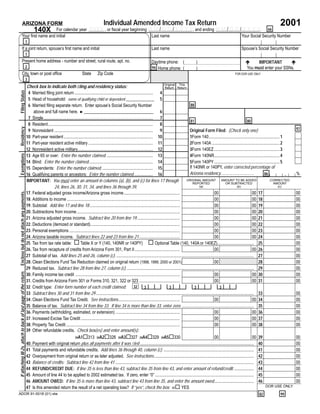

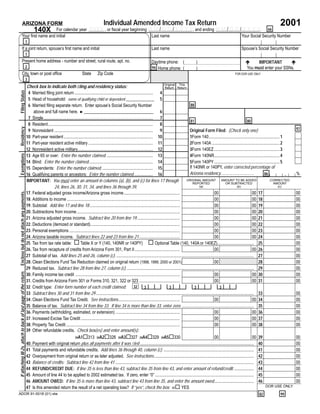

This document is an individual amended income tax return for the year 2001 filed in Arizona. It contains fields for identifying information of the filer such as name, address, social security number. It includes sections to indicate filing status, residency status, and exemptions. The main sections calculate federal adjusted gross income, additions and subtractions to income, deductions, and exemptions to determine the tax amount.