Embed presentation

Download to read offline

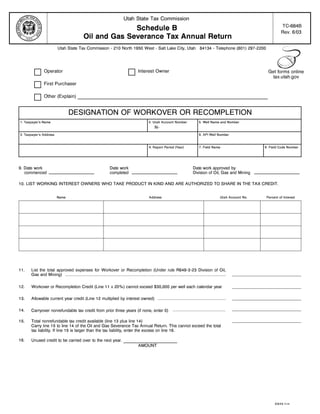

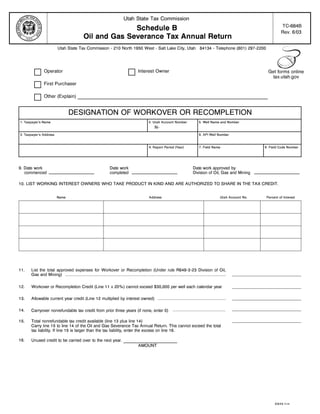

This document is a schedule from a Utah State Tax Commission oil and gas severance tax annual return. It allows taxpayers to claim a nonrefundable tax credit for approved workover or recompletion expenses on an oil or gas well. The schedule requires taxpayers to provide well identification details, ownership information, approved expenses, and tax credit calculations to carry unused amounts forward for up to three years.