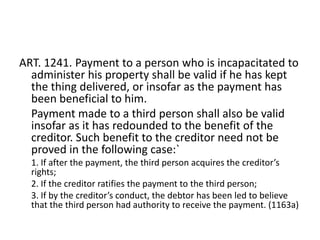

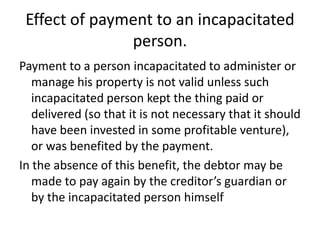

The document discusses the rules around valid payments to creditors or third parties. It states that payment is valid if made to the creditor, their successor, or authorized person. Payment to an incapacitated person is valid if they kept or benefited from the payment. Payment to a third party is also valid if it benefited the creditor, such as if the third party later acquires the debt or the creditor ratifies the payment.

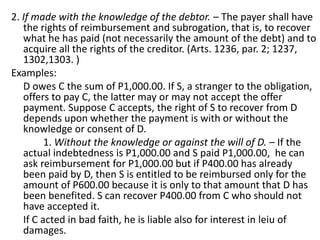

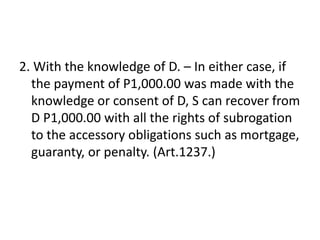

![Right of third person to subrogation

Whoever pays on behalf of the debtor is

entitle to subrogation if the payment is with the

consent of the latter.(Art. 1237, 1302[2].) if the

payment is without the knowledge are against

the will of the debtor, the third person cannot

compel the creditor to subrogate him in the

latter’s accessory right of mortgage, guaranty, or

penalty.

Legal subrogation by operation of law is

presumed in certain cases. (see Art. 1302.)](https://image.slidesharecdn.com/law1-130227214912-phpapp01/85/Law-1-5-320.jpg)