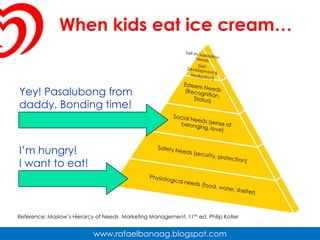

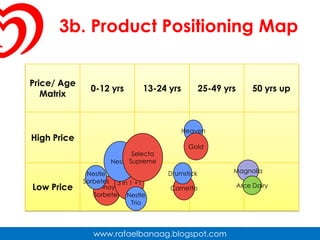

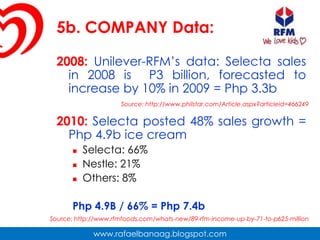

Selecta's primary target market is kids aged 4-12 who want to satisfy their craving for smooth, creamy ice cream. The Philippine ice cream industry is worth Php8.5 billion. Selecta offers various flavors and sizes priced similarly to competitors like Nestle and Magnolia. They use aggressive television advertising and nationwide distribution to differentiate themselves, leveraging supply chain partnerships to be the number one ice cream brand in the country.