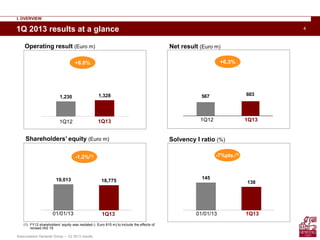

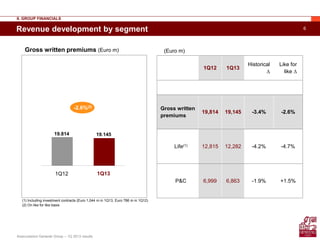

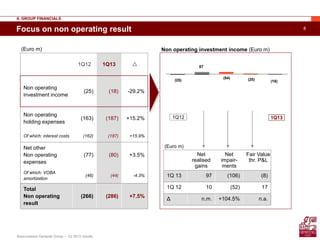

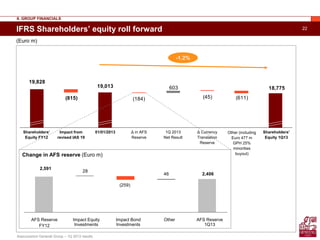

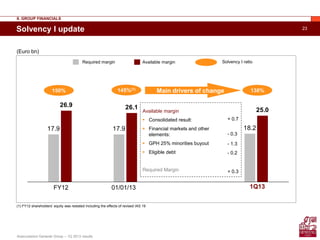

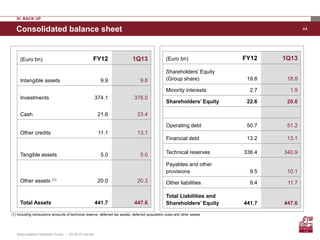

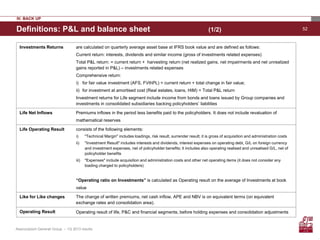

The document provides an overview of Generali Group's 1Q 2013 results. Key highlights include:

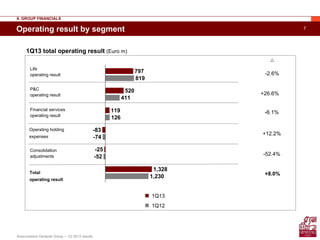

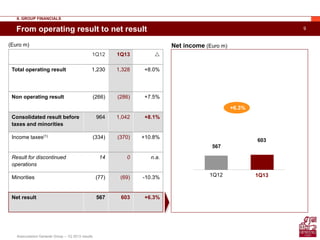

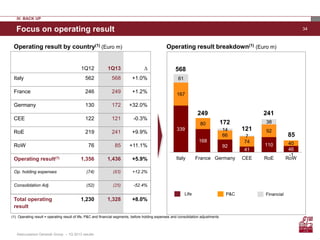

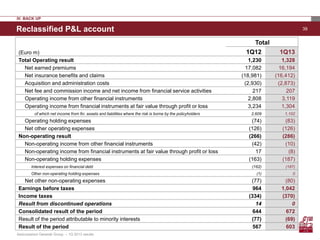

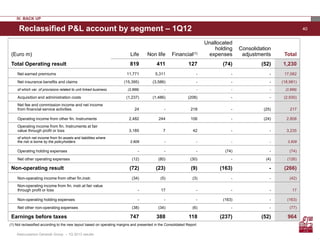

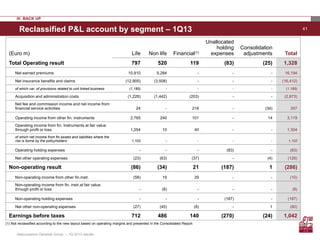

- Total operating result increased 8.0% to €1.328 billion compared to 1Q 2012.

- Net income increased 6.3% to €603 million.

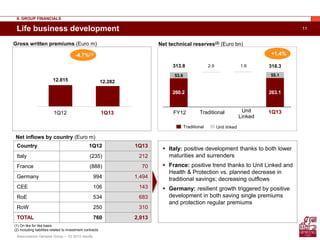

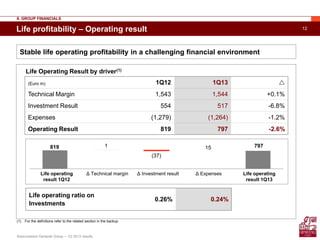

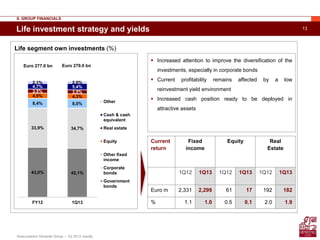

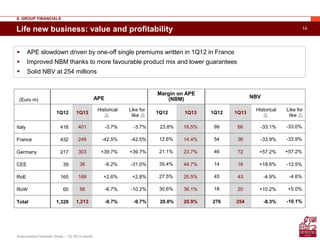

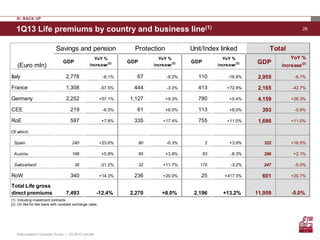

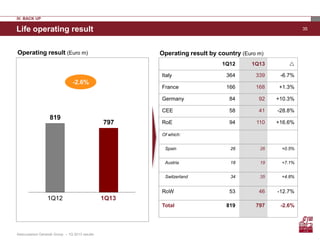

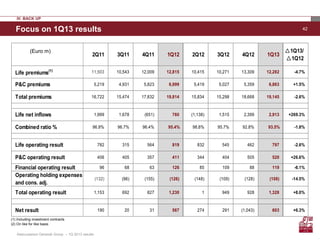

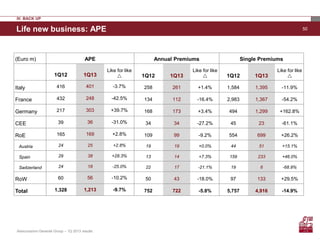

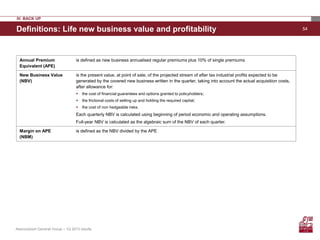

- Life operating result was €797 million, down slightly from 1Q 2012. New business value was €254 million.

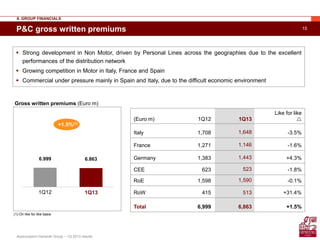

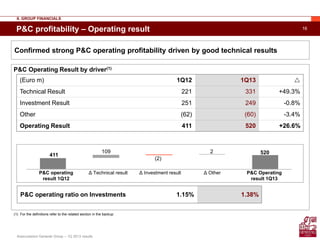

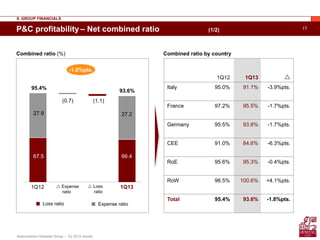

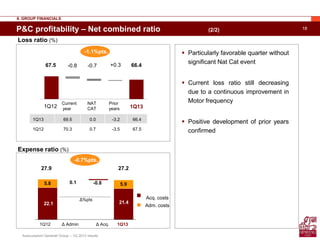

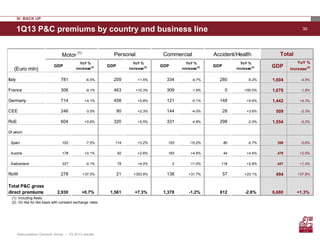

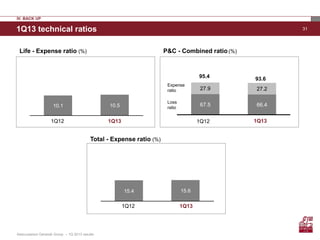

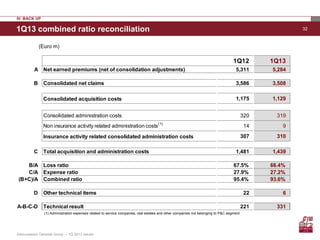

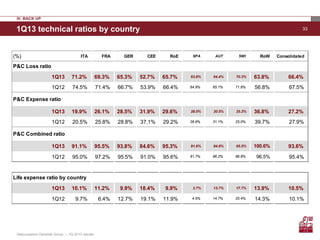

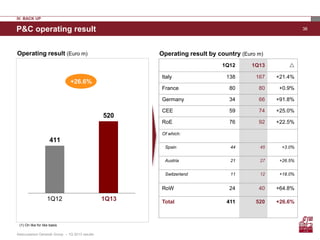

- P&C operating result increased 26.6% to €520 million, with a net combined ratio improved 1.8 percentage points to 93.6%.