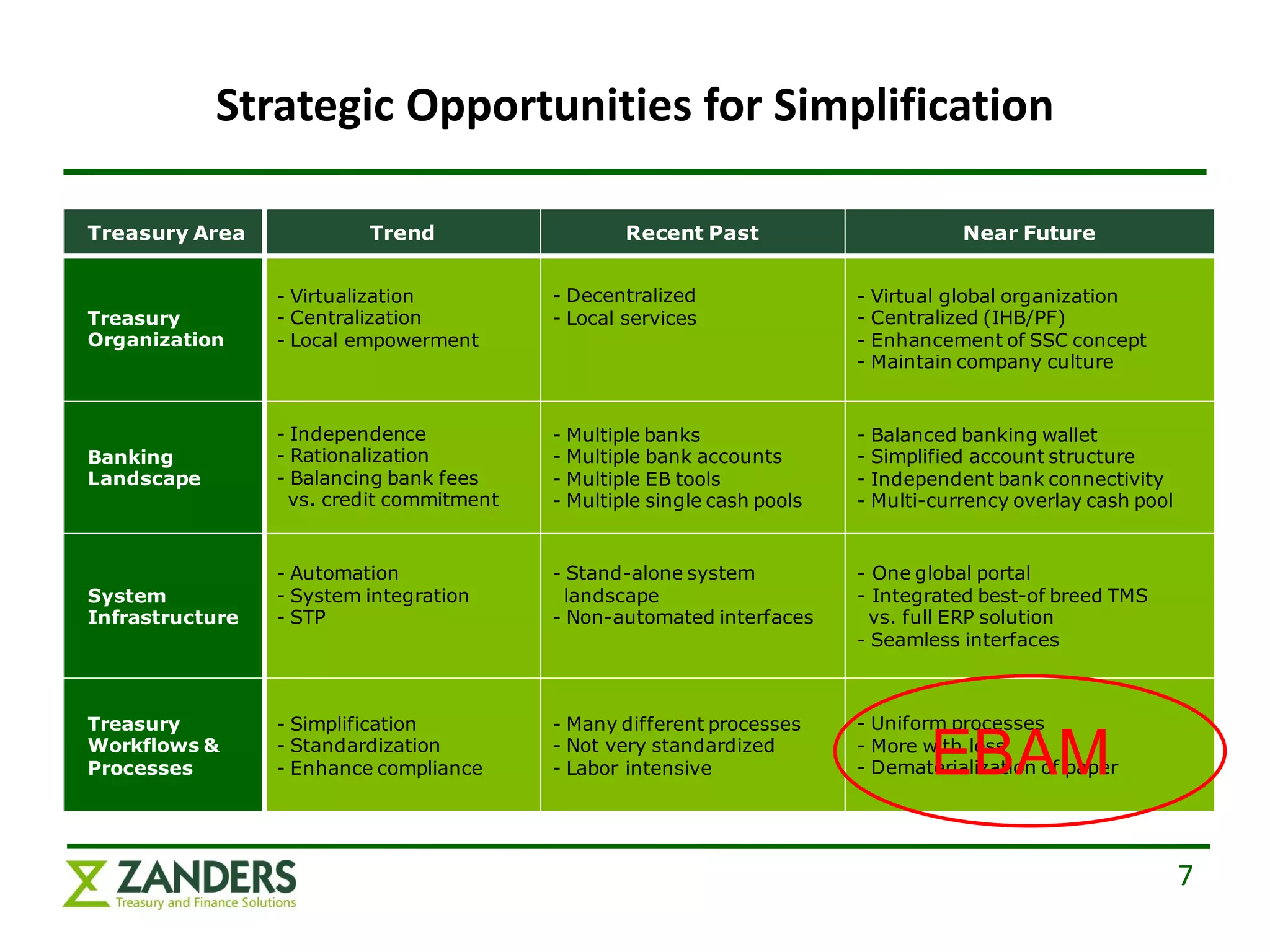

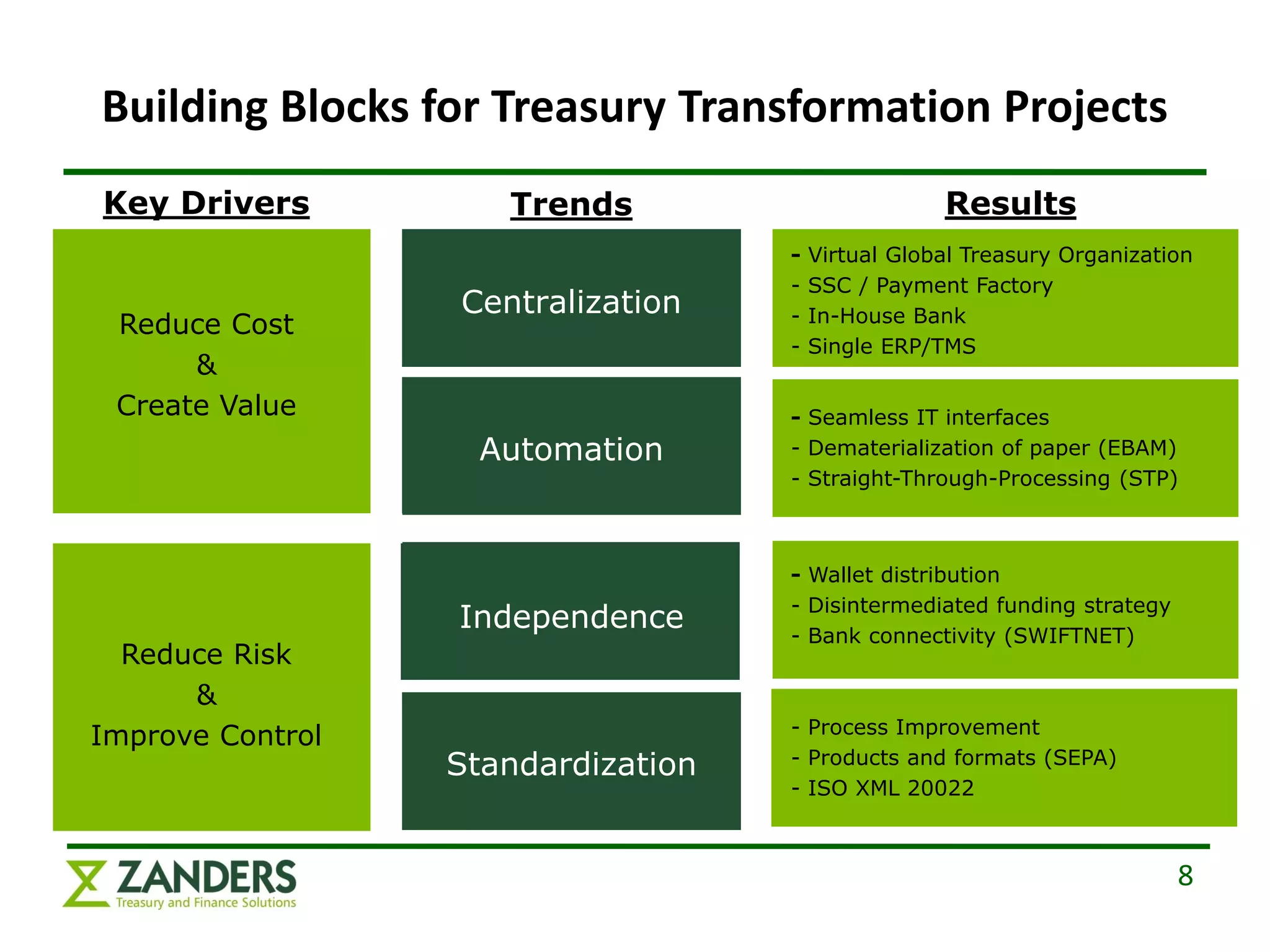

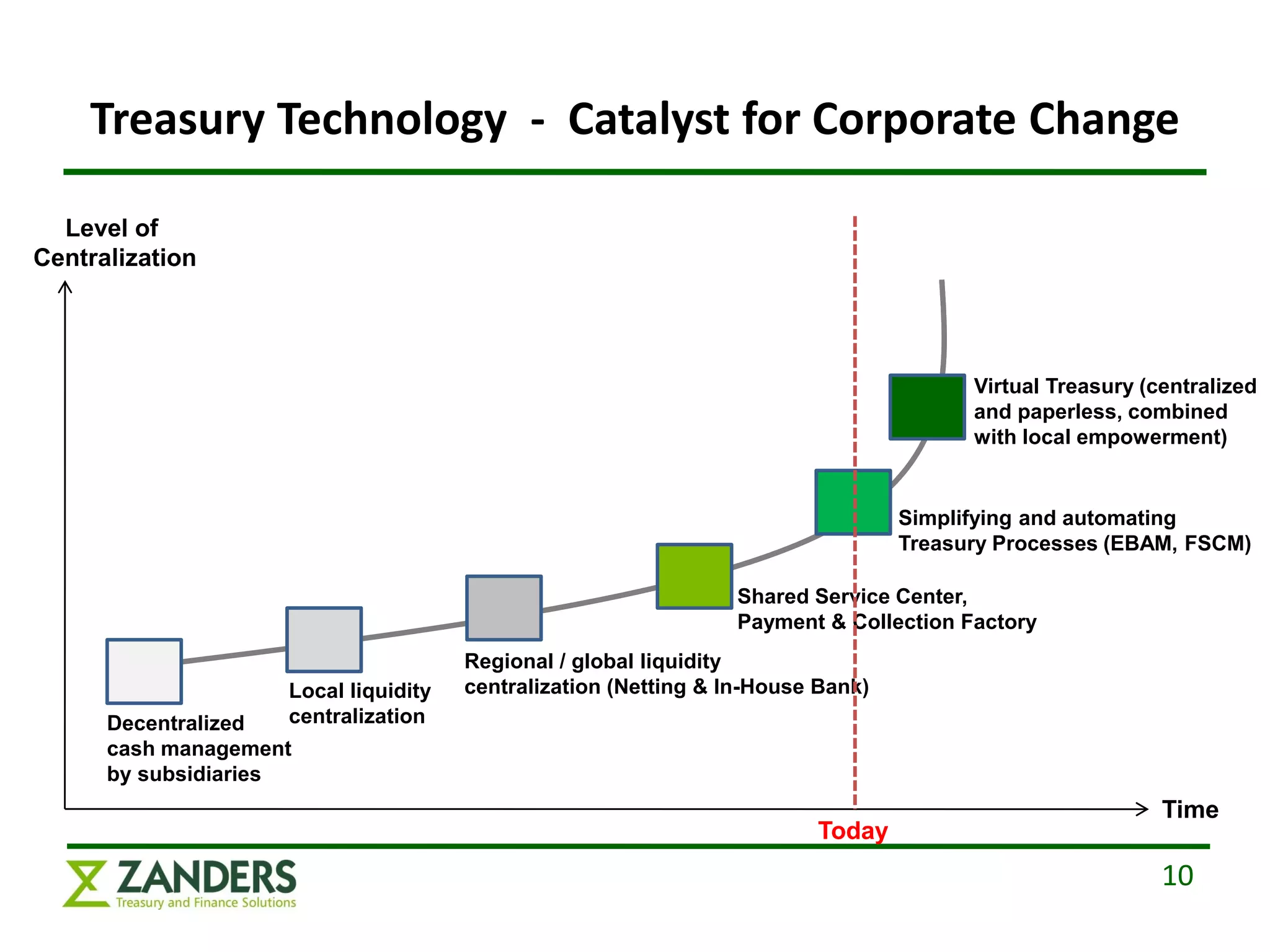

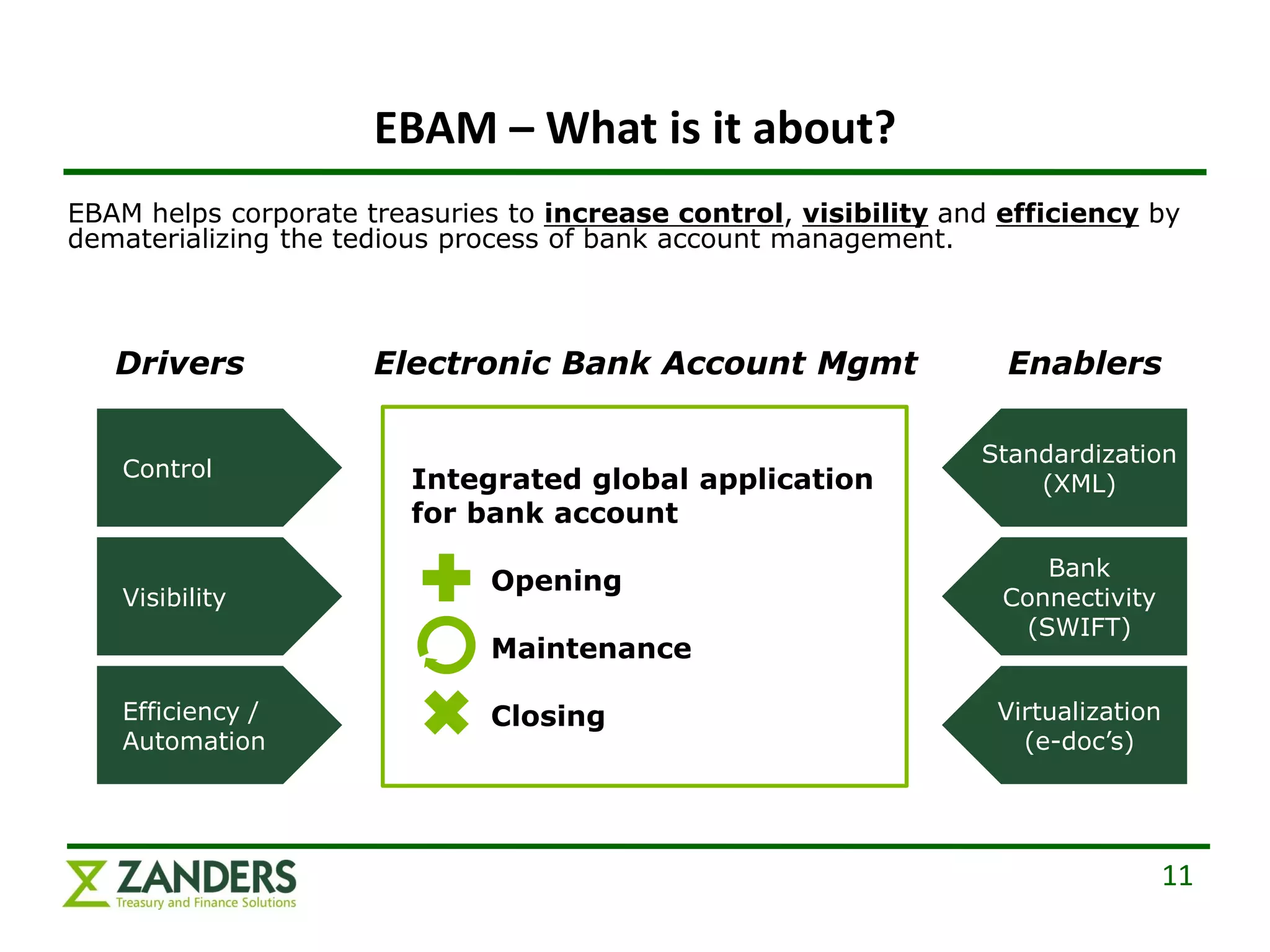

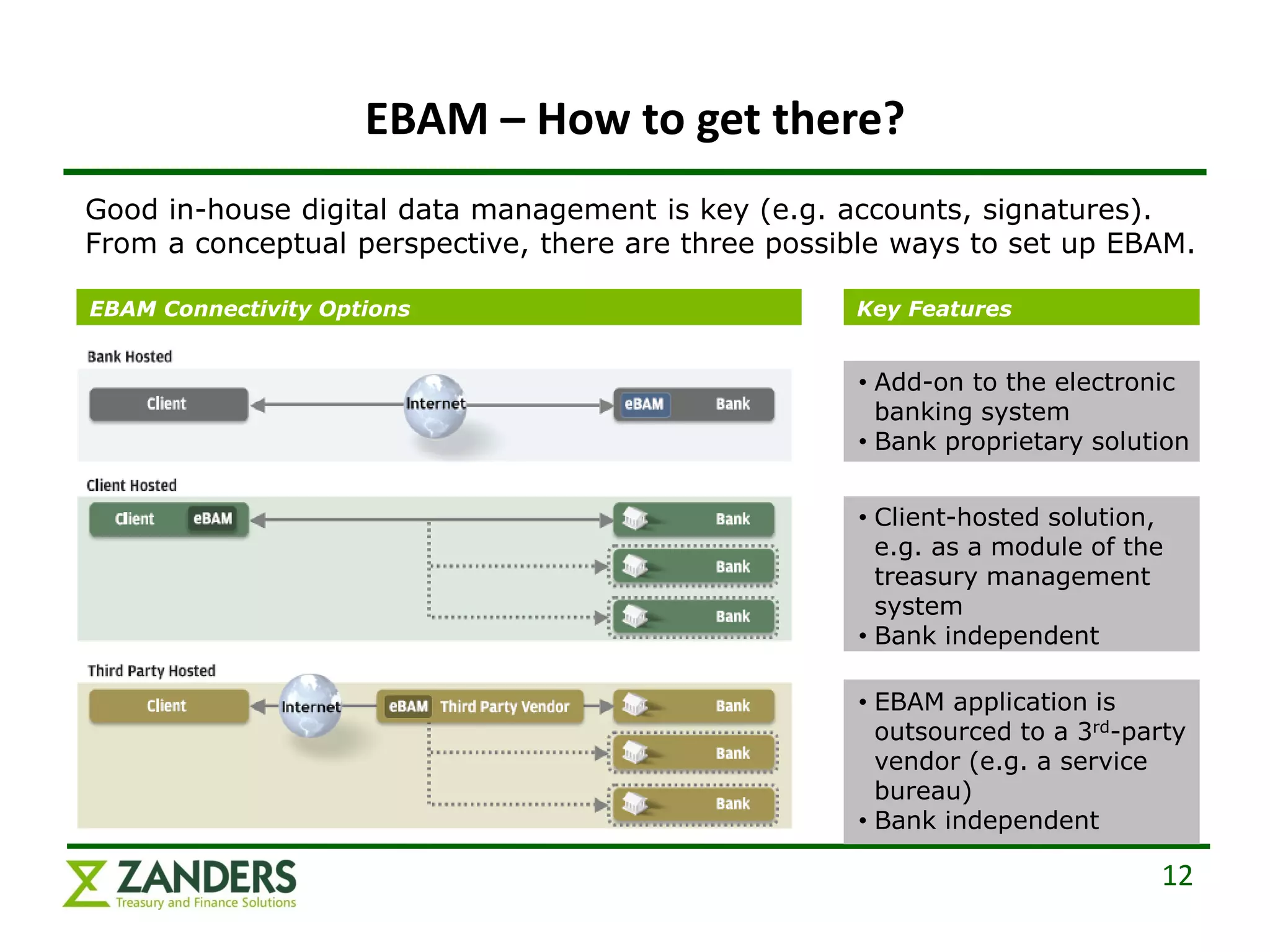

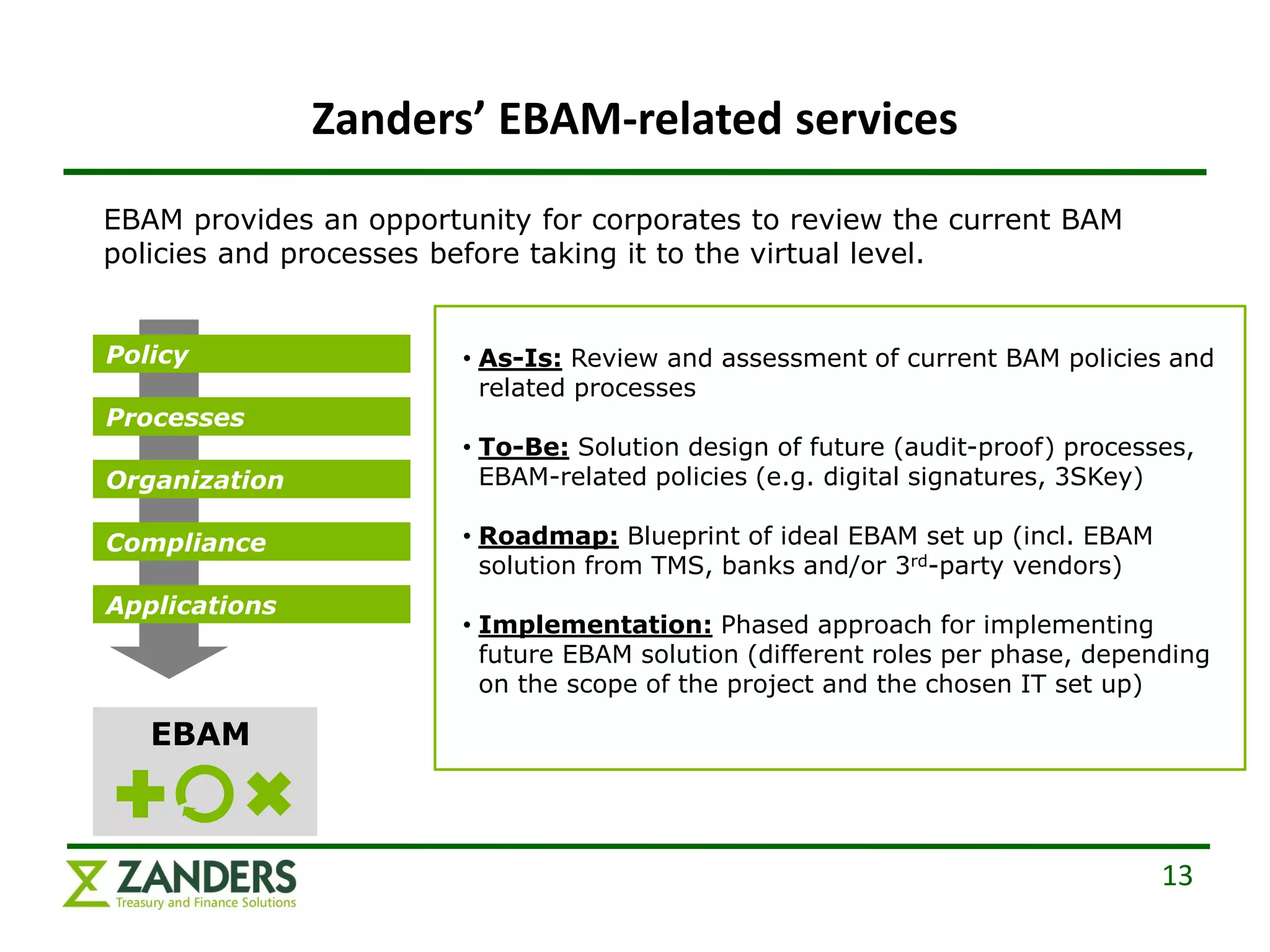

The document discusses trends in corporate treasury technology, particularly focusing on Electronic Bank Account Management (EBAM) as a method to enhance control, visibility, and efficiency in bank account management. It emphasizes the importance of digital transformation in treasury functions and outlines various approaches and services related to implementing EBAM. Additionally, it highlights the shift towards a virtual, paperless treasury organization as a key benefit of adopting these technologies.