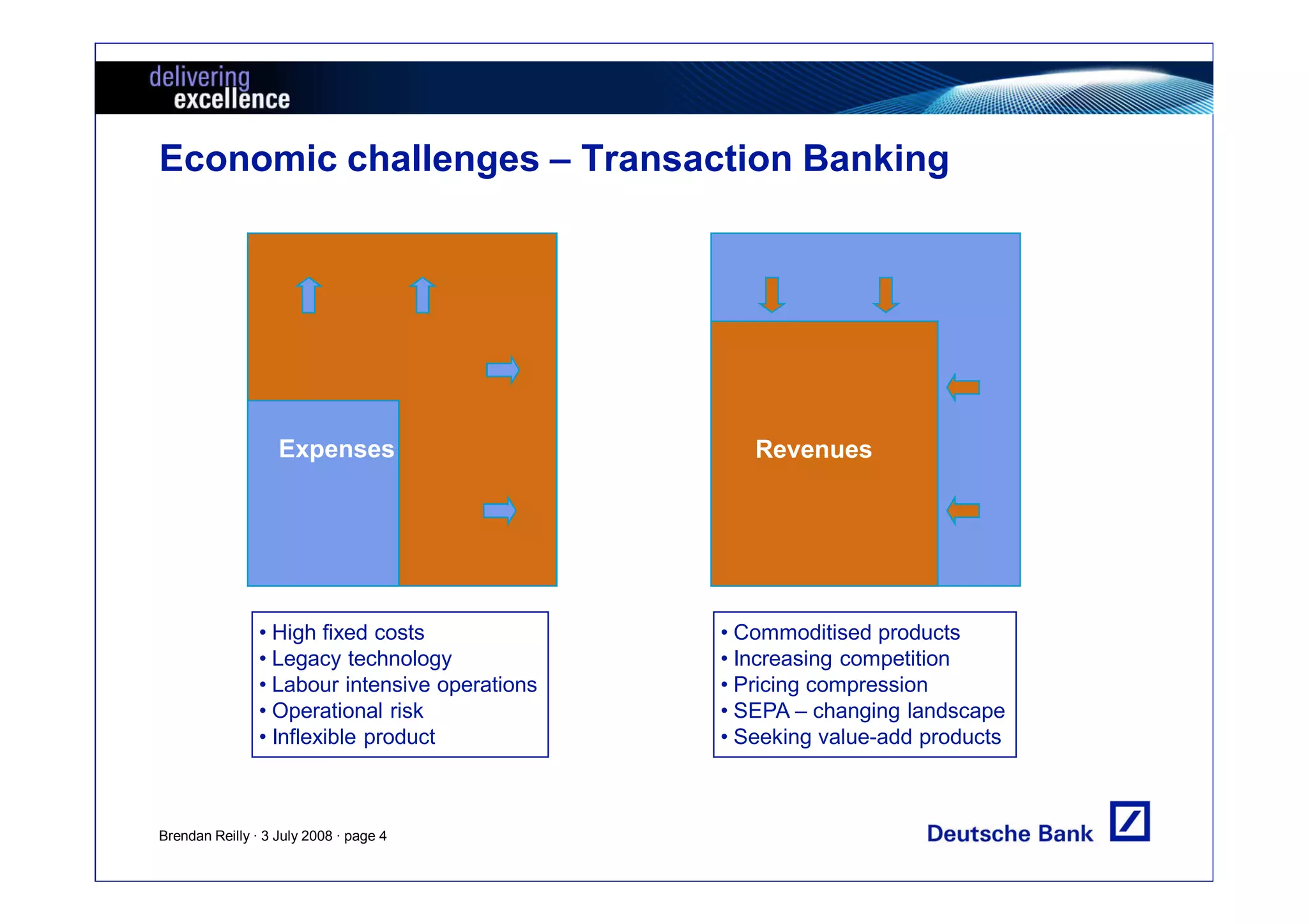

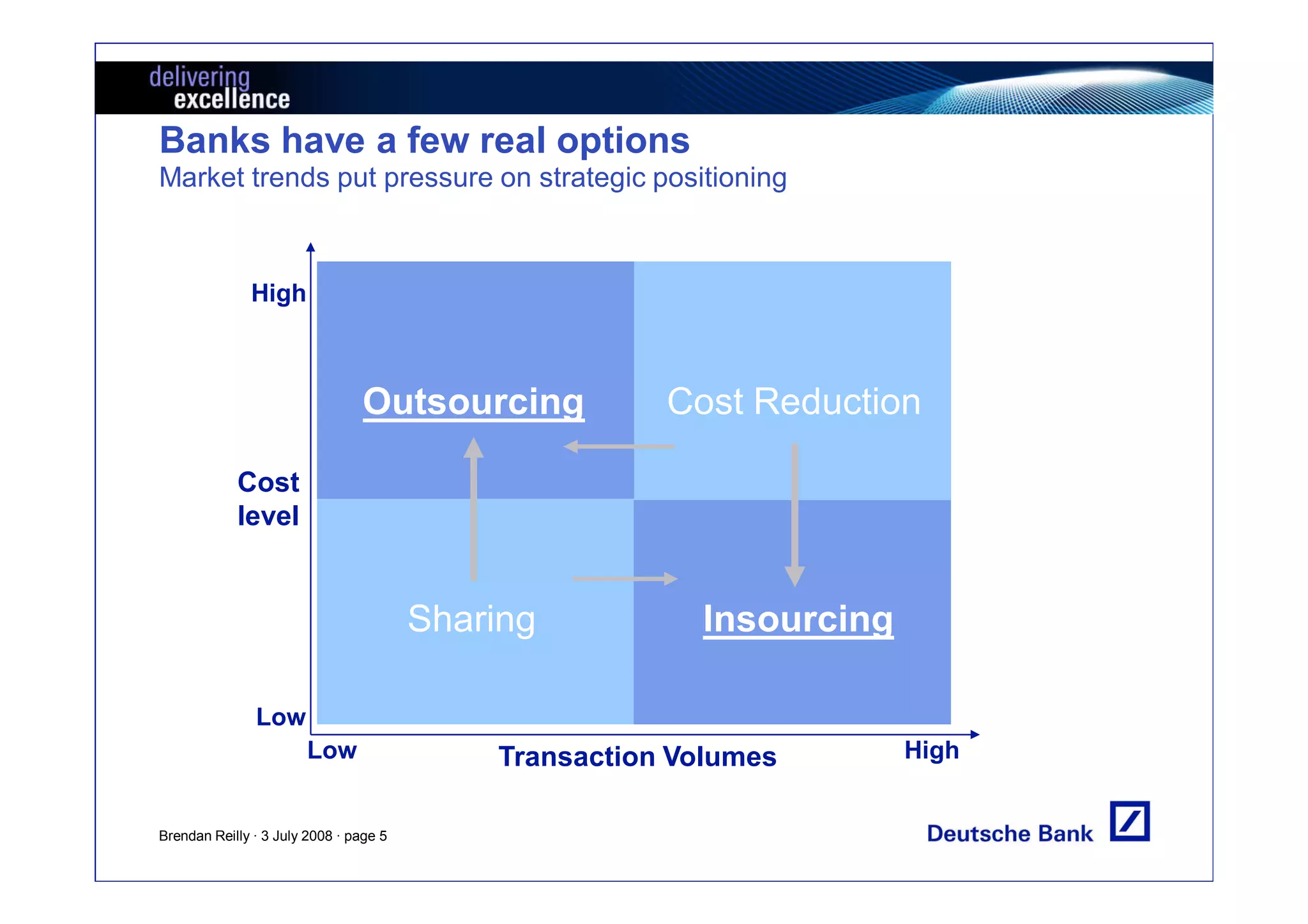

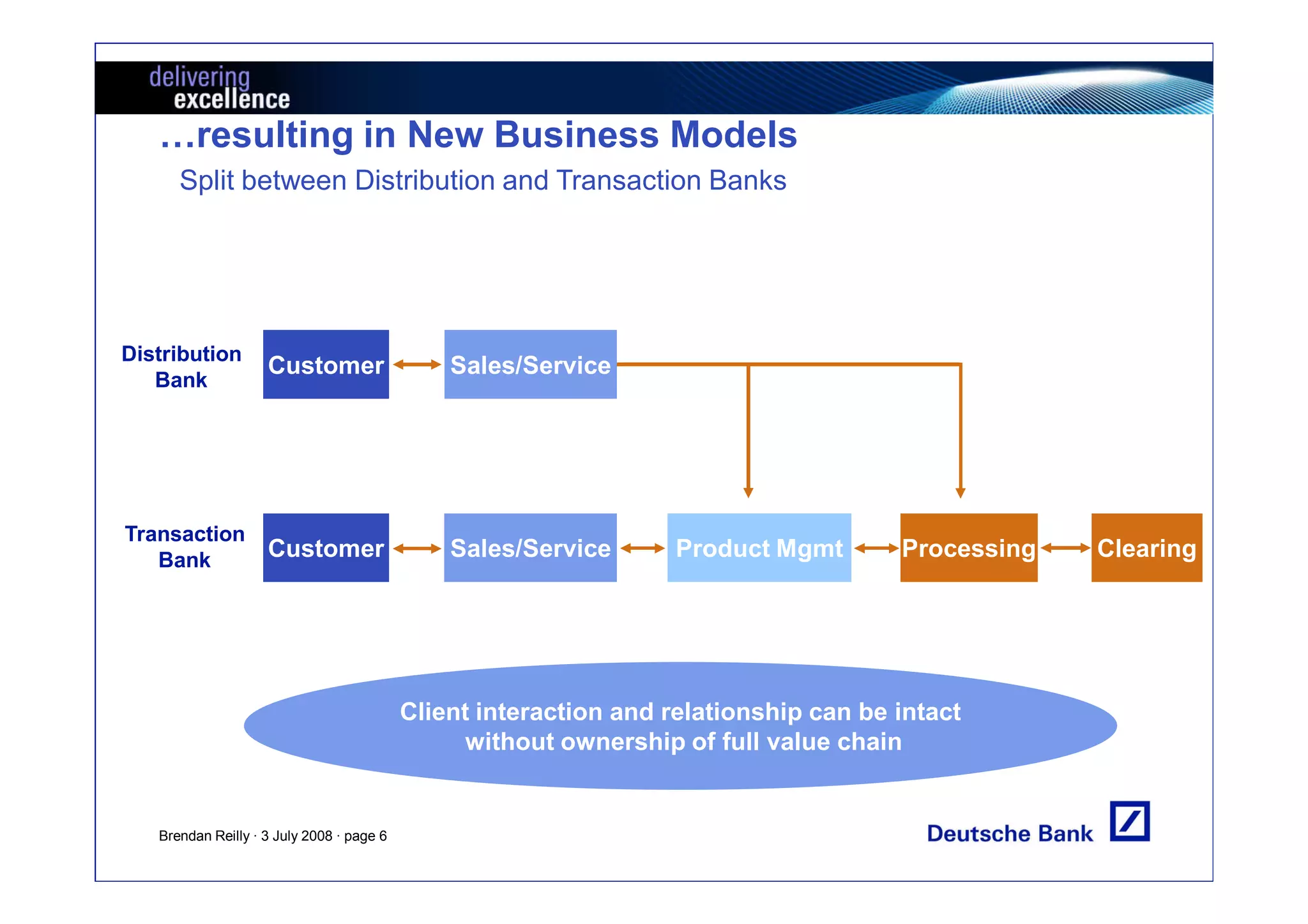

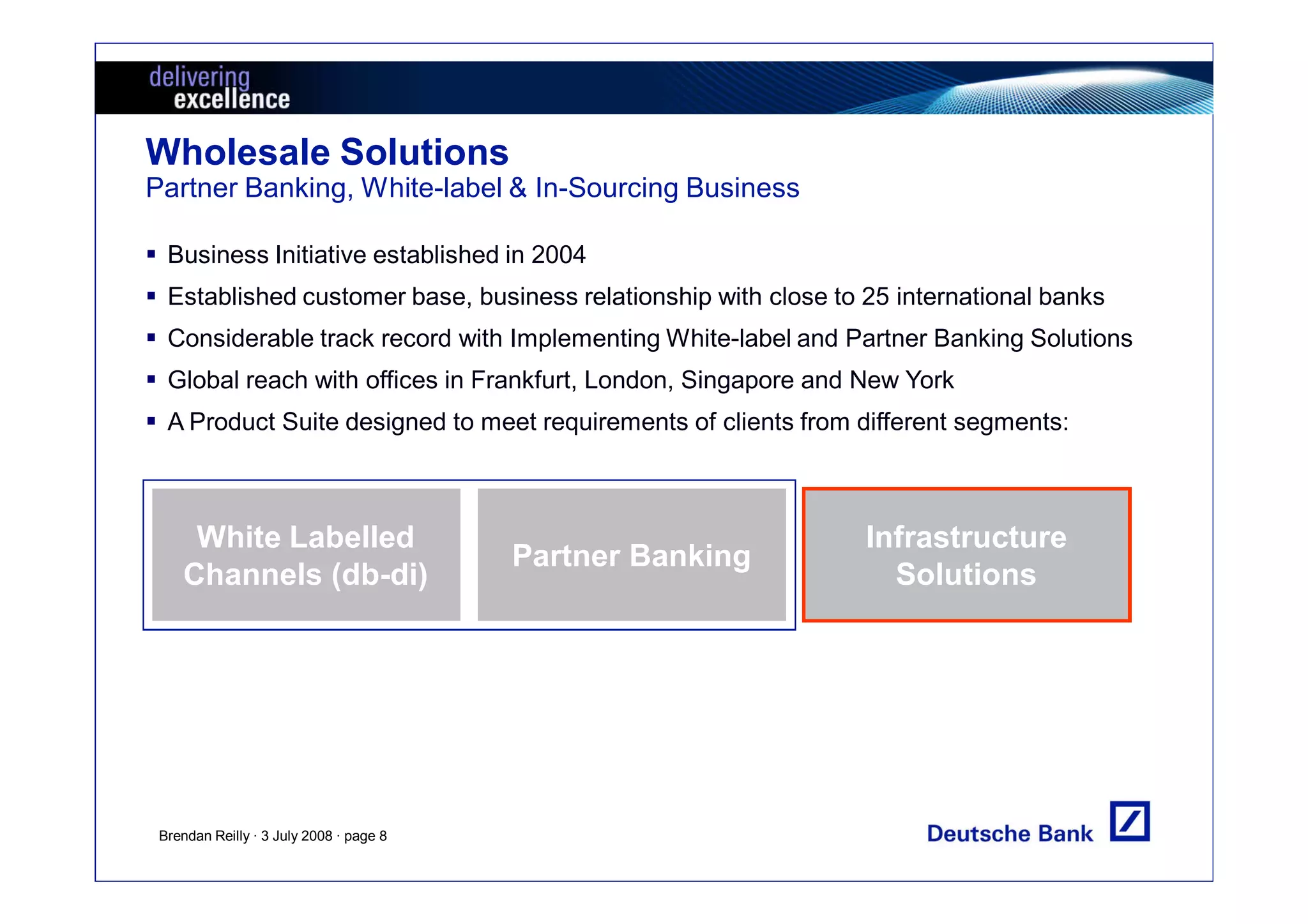

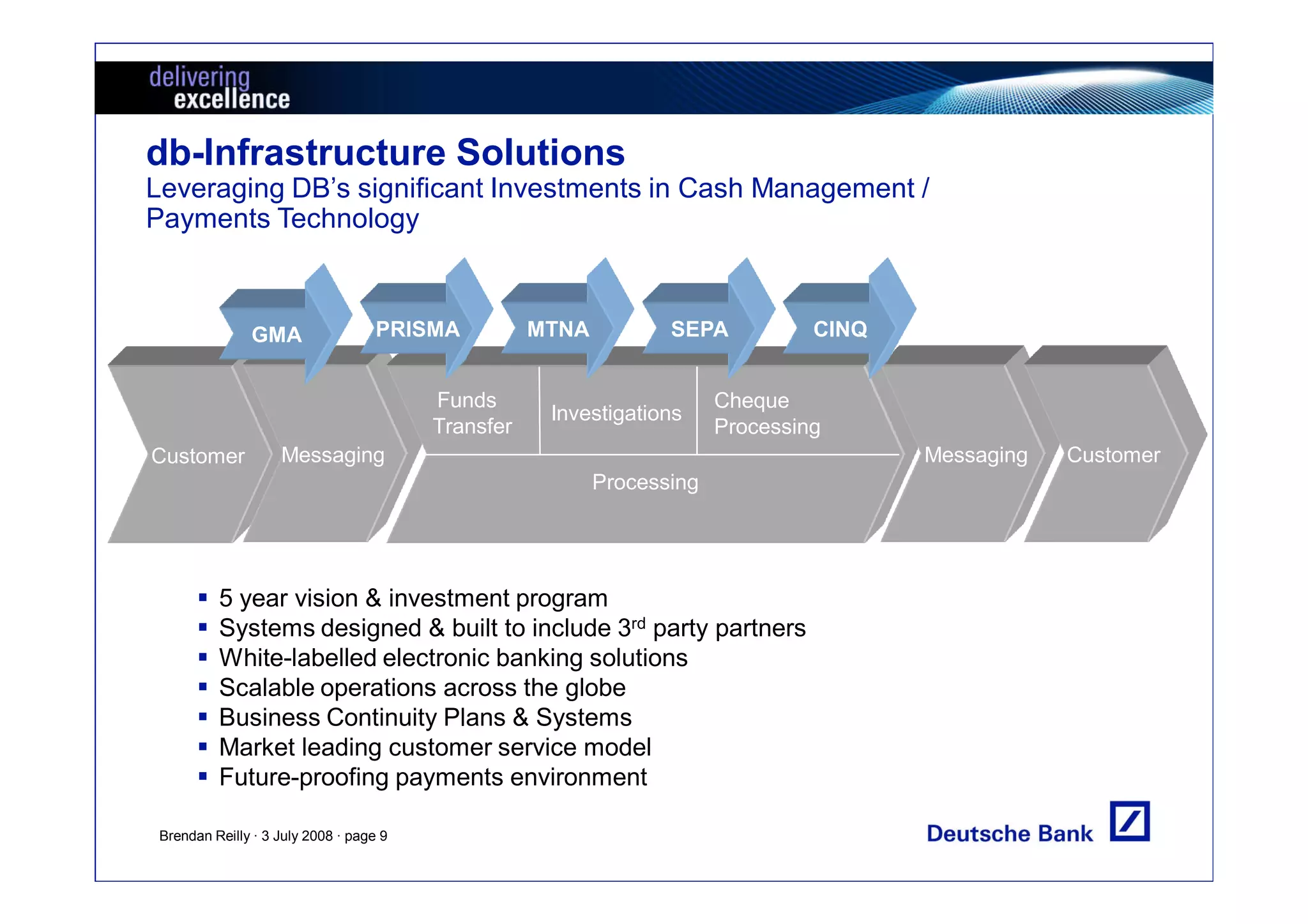

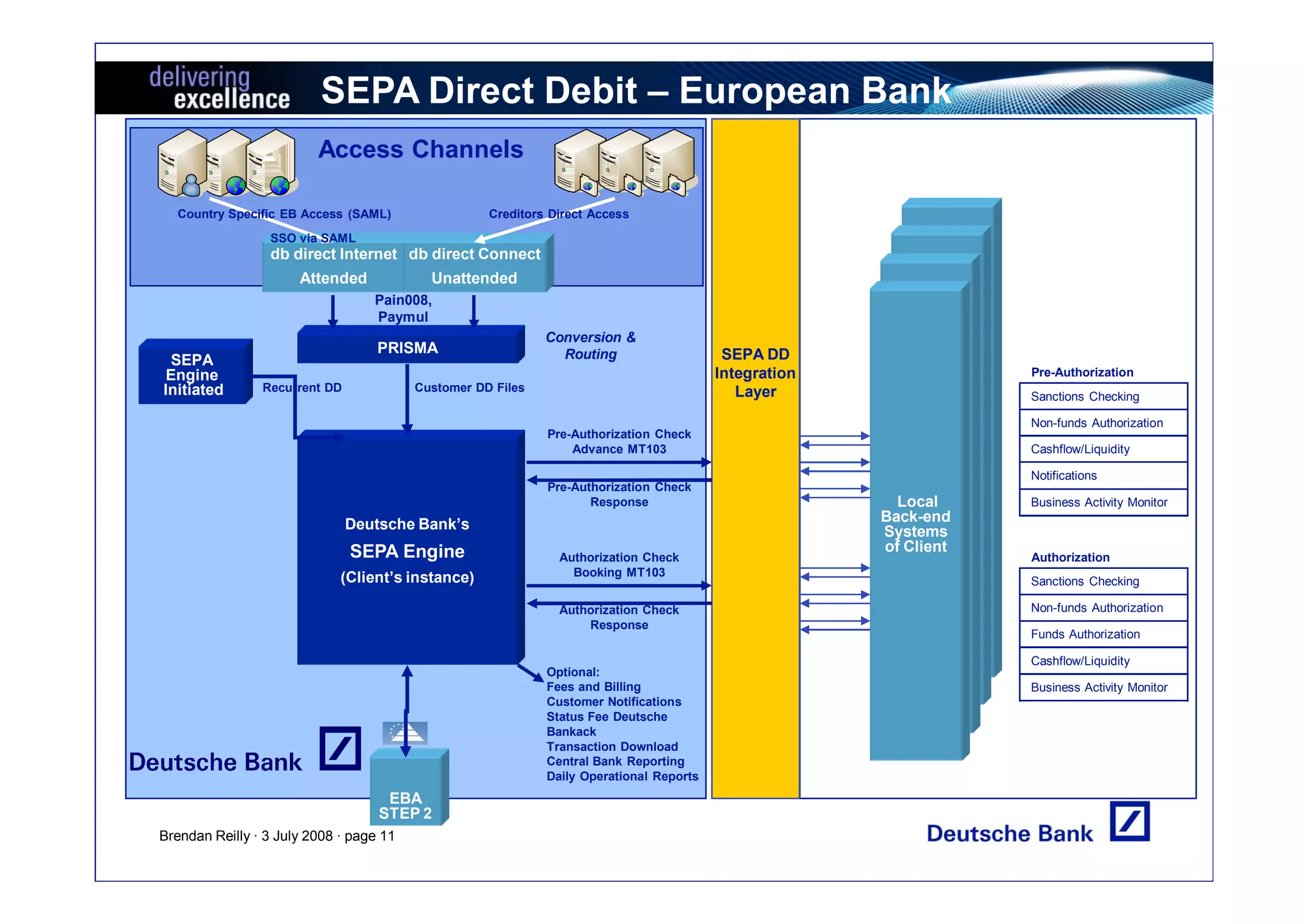

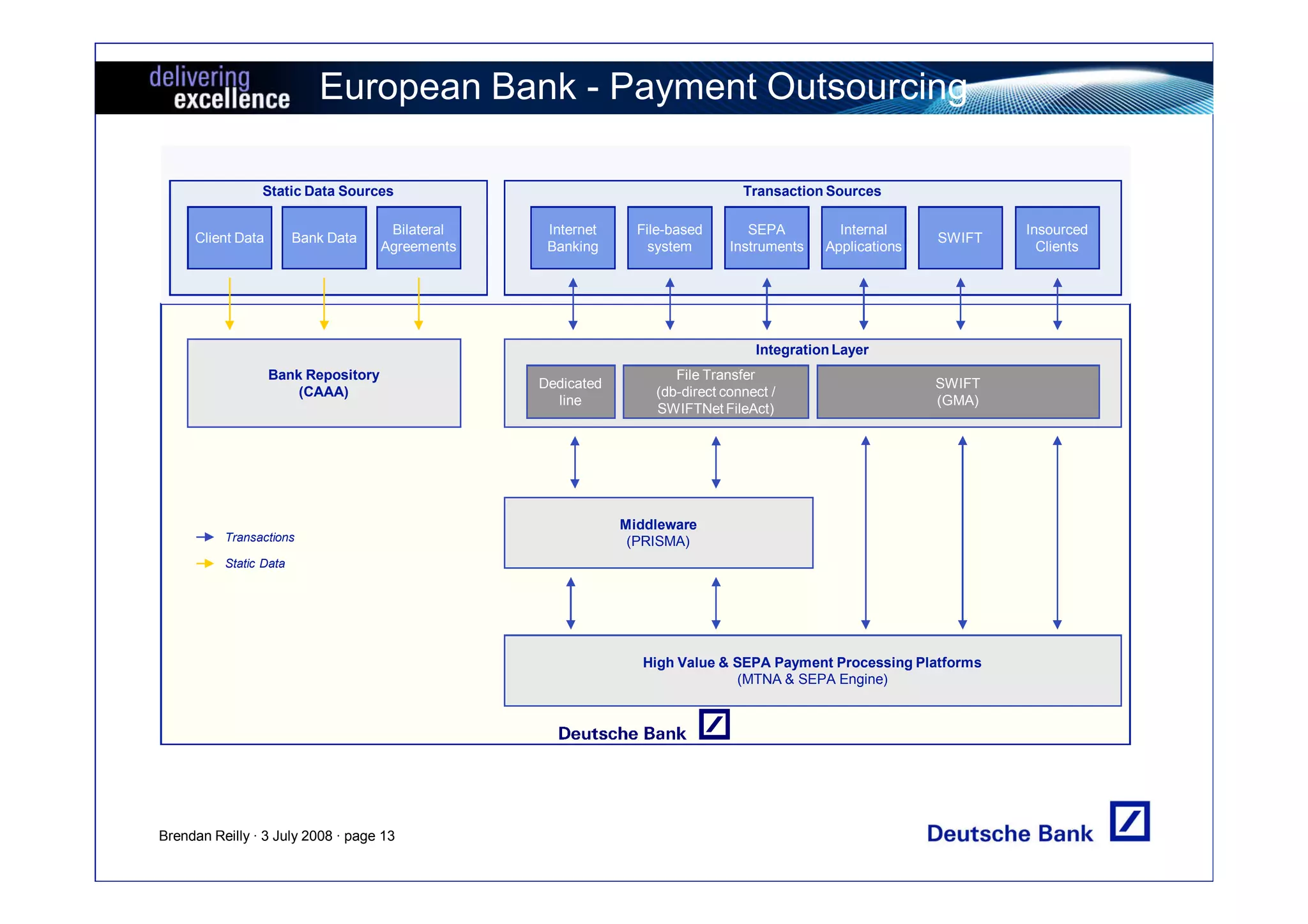

The document discusses strategies for banks to pursue growth in a post-SEPA world. It outlines the economic challenges banks face from high fixed costs, legacy technology, and increasing competition. Two strategies presented are outsourcing transactions to lower costs and splitting into distribution and transaction banks. The document provides two case studies, one of a European bank implementing SEPA direct debits and another of a pan-European payments outsourcing deal. It concludes by asking if there are any other examples of deals not being seen in the market.