This document is the Reserve Bank of India's annual report on trends and progress in banking in India for the year ending June 30, 2011. Some key points:

- It provides an overview of developments in the Indian banking sector as well as global banking trends.

- It discusses the policy environment in India, including monetary policy, credit delivery, financial inclusion, and prudential regulatory policies.

- It analyzes the operations and performance of commercial banks in India, including their balance sheets, financial results, asset quality, lending patterns, and technological developments.

- It also covers cooperative banking and non-banking financial institutions.

- The report is submitted to the Central Government of India as required

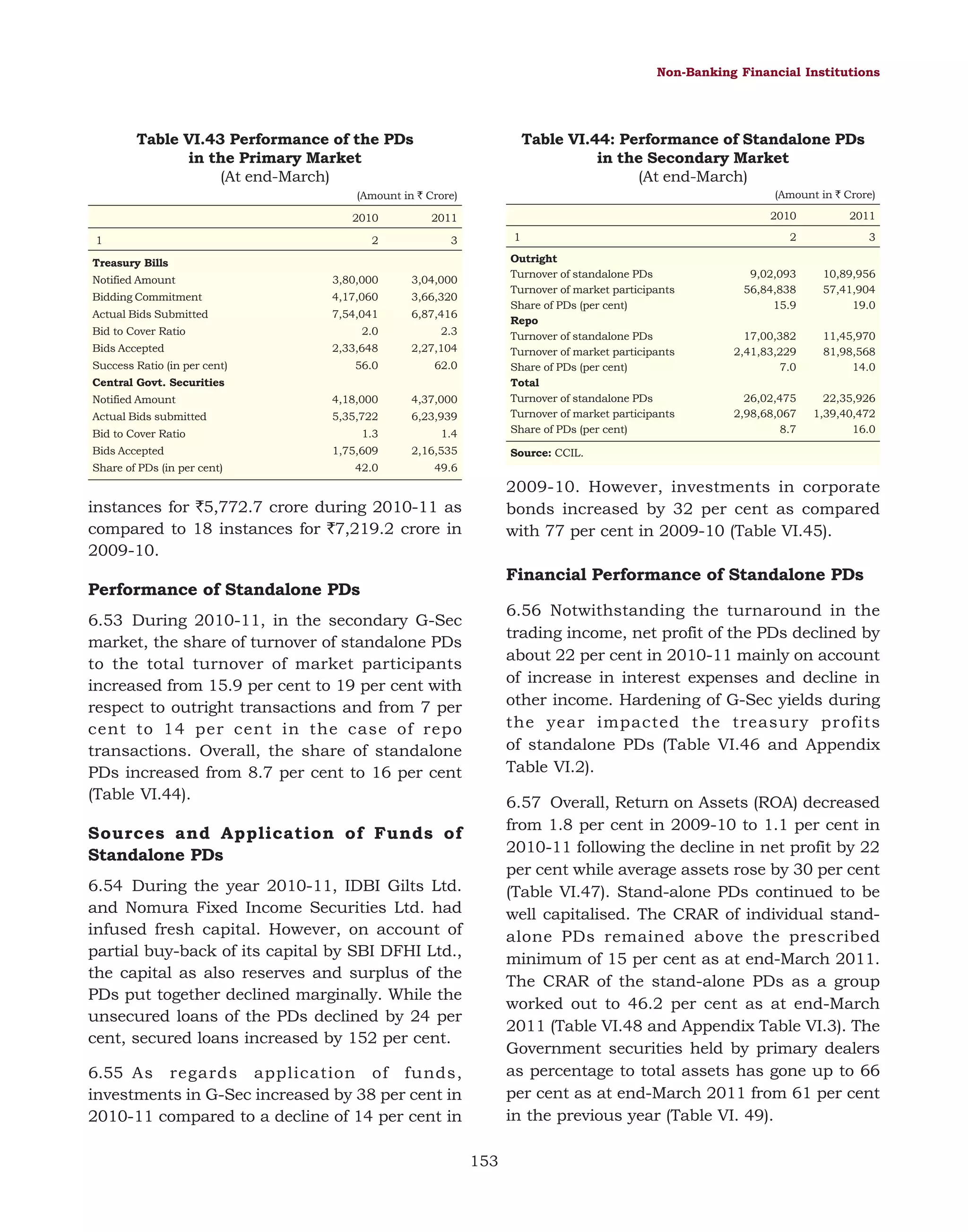

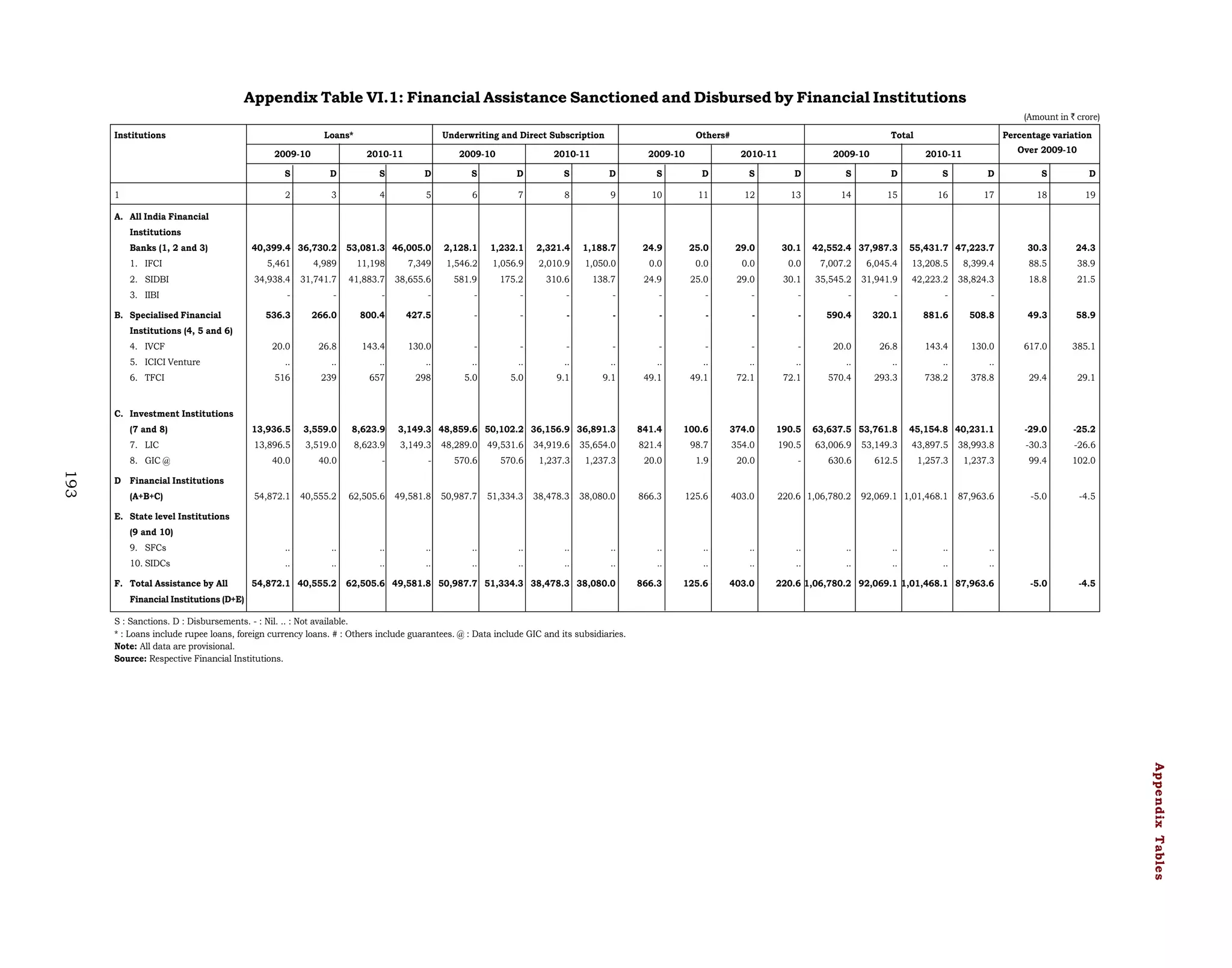

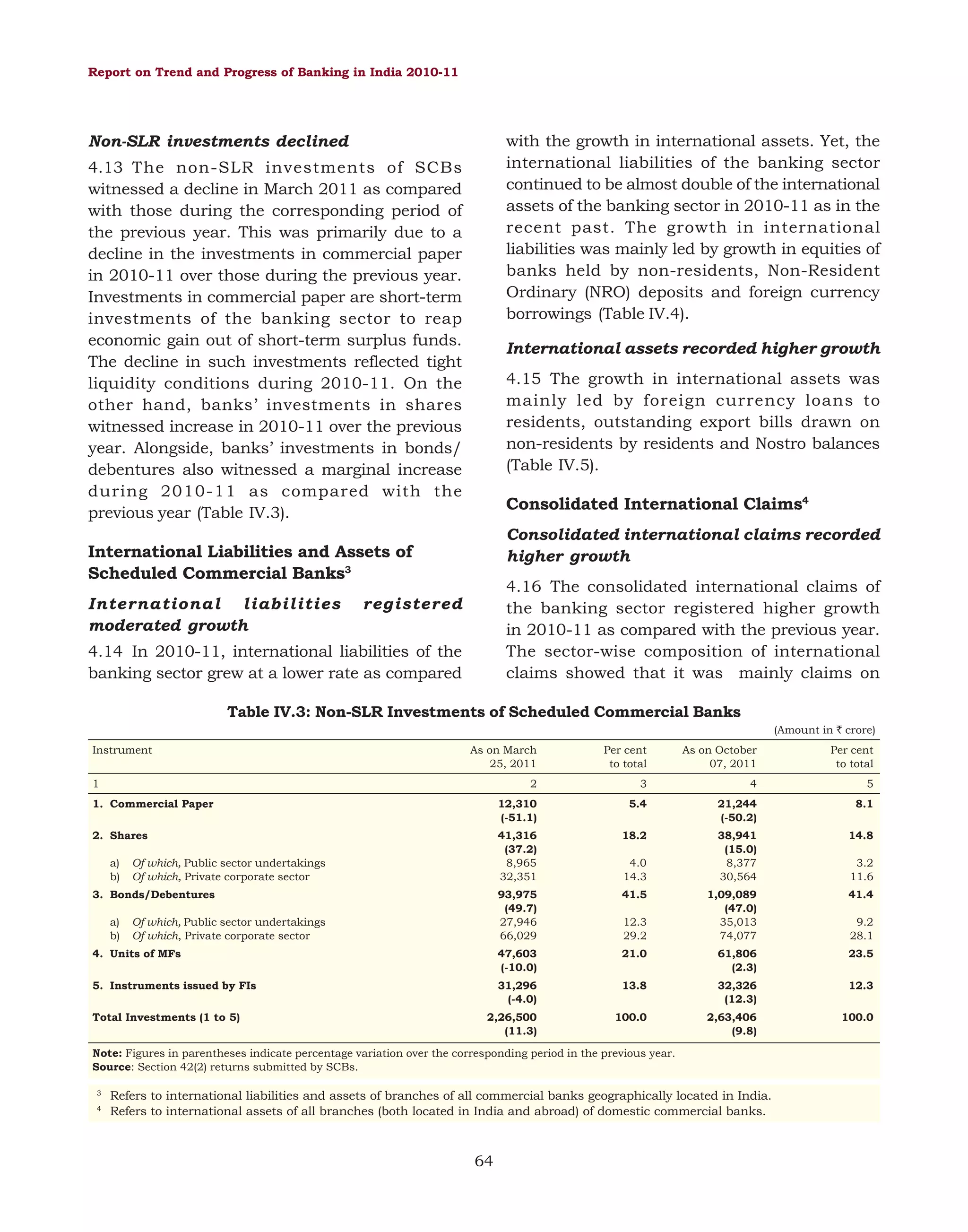

![Operations and Performance of Commercial Banks

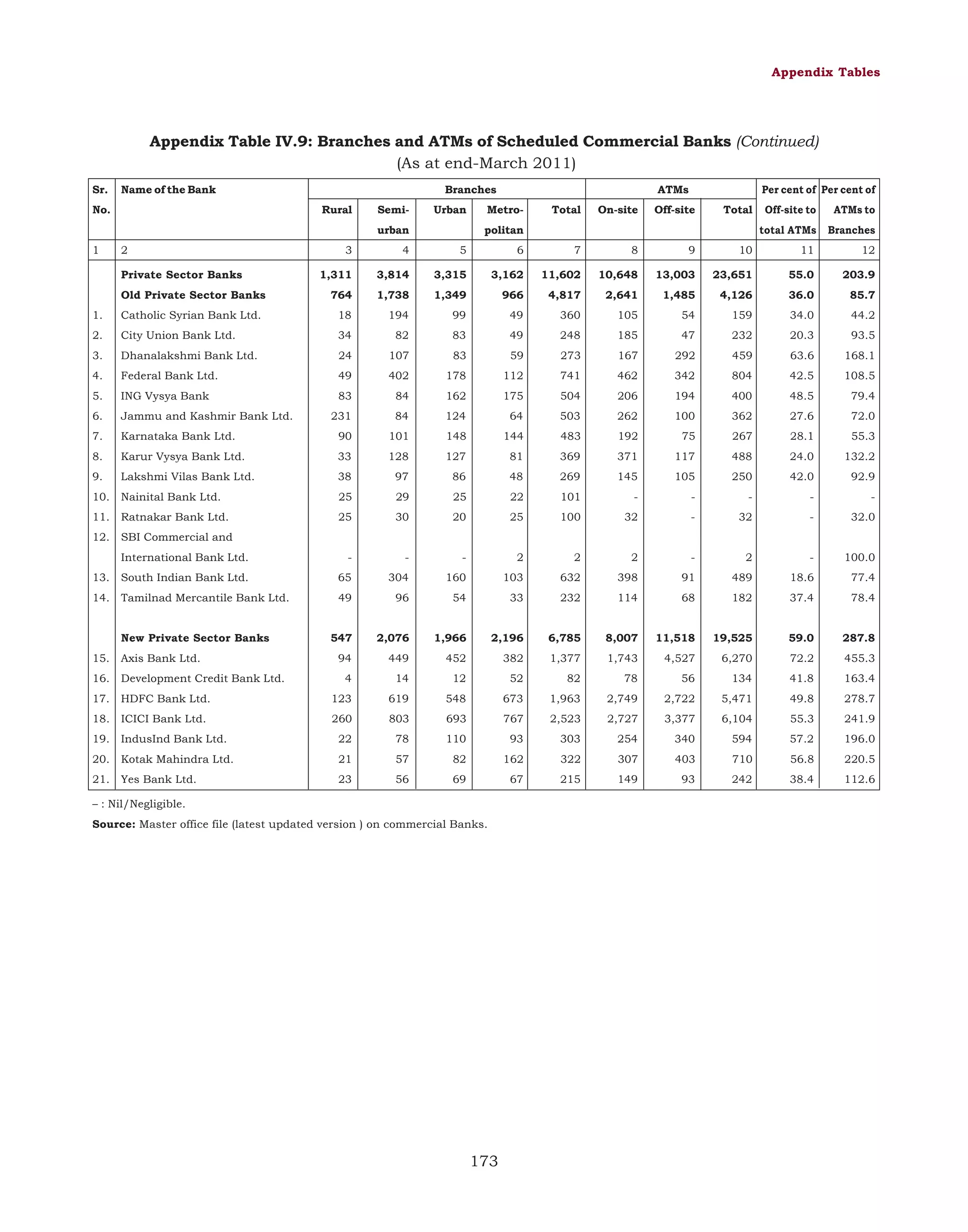

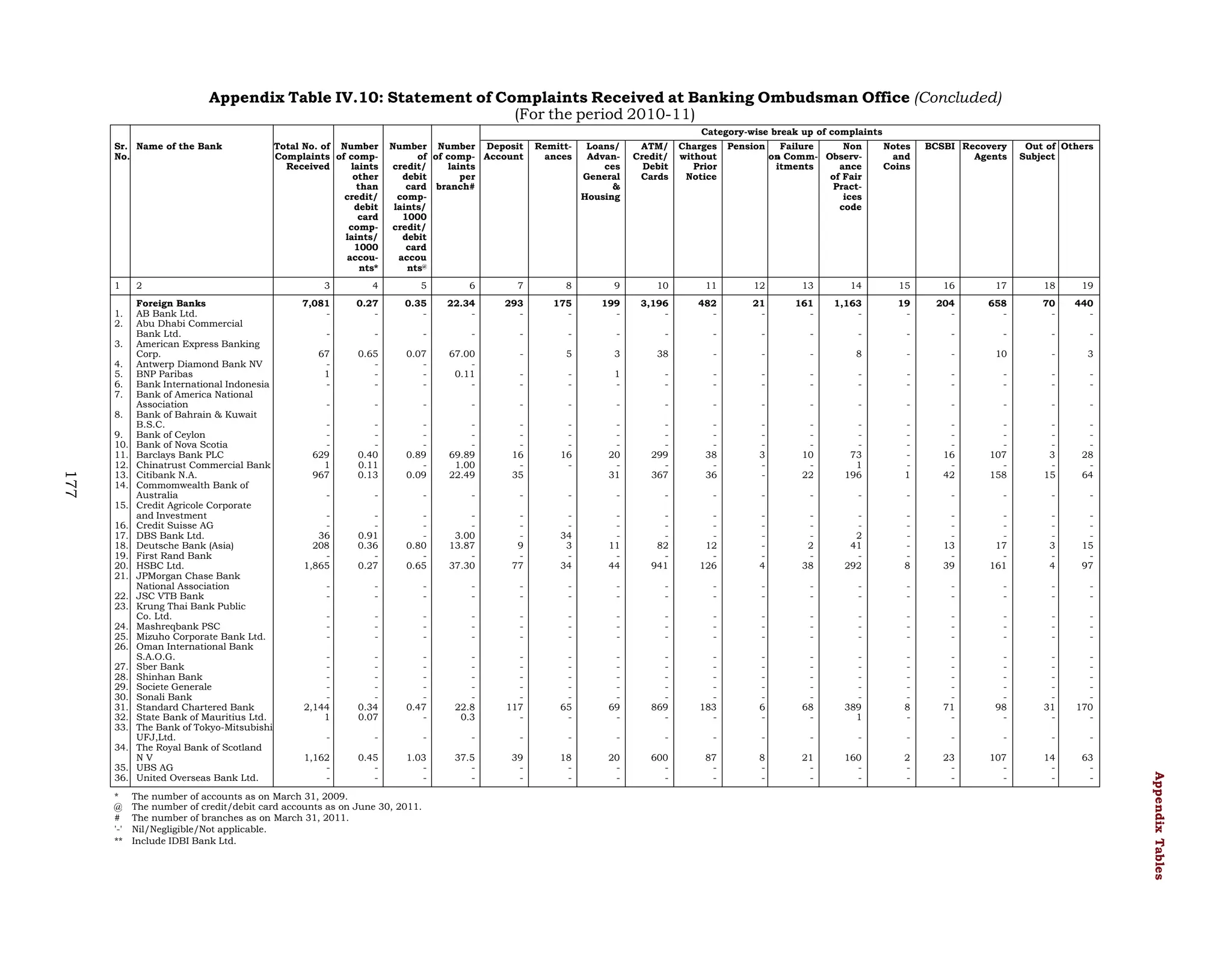

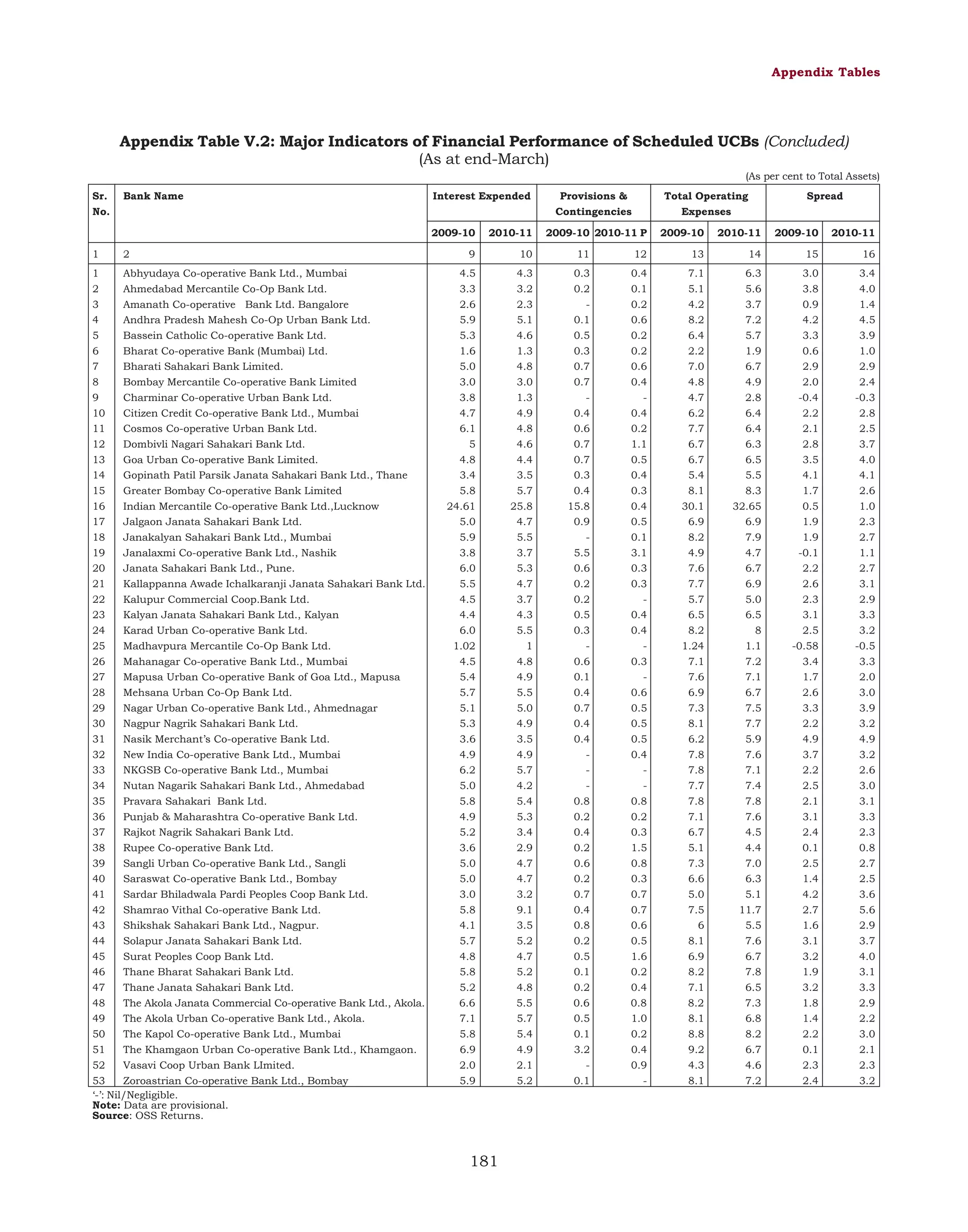

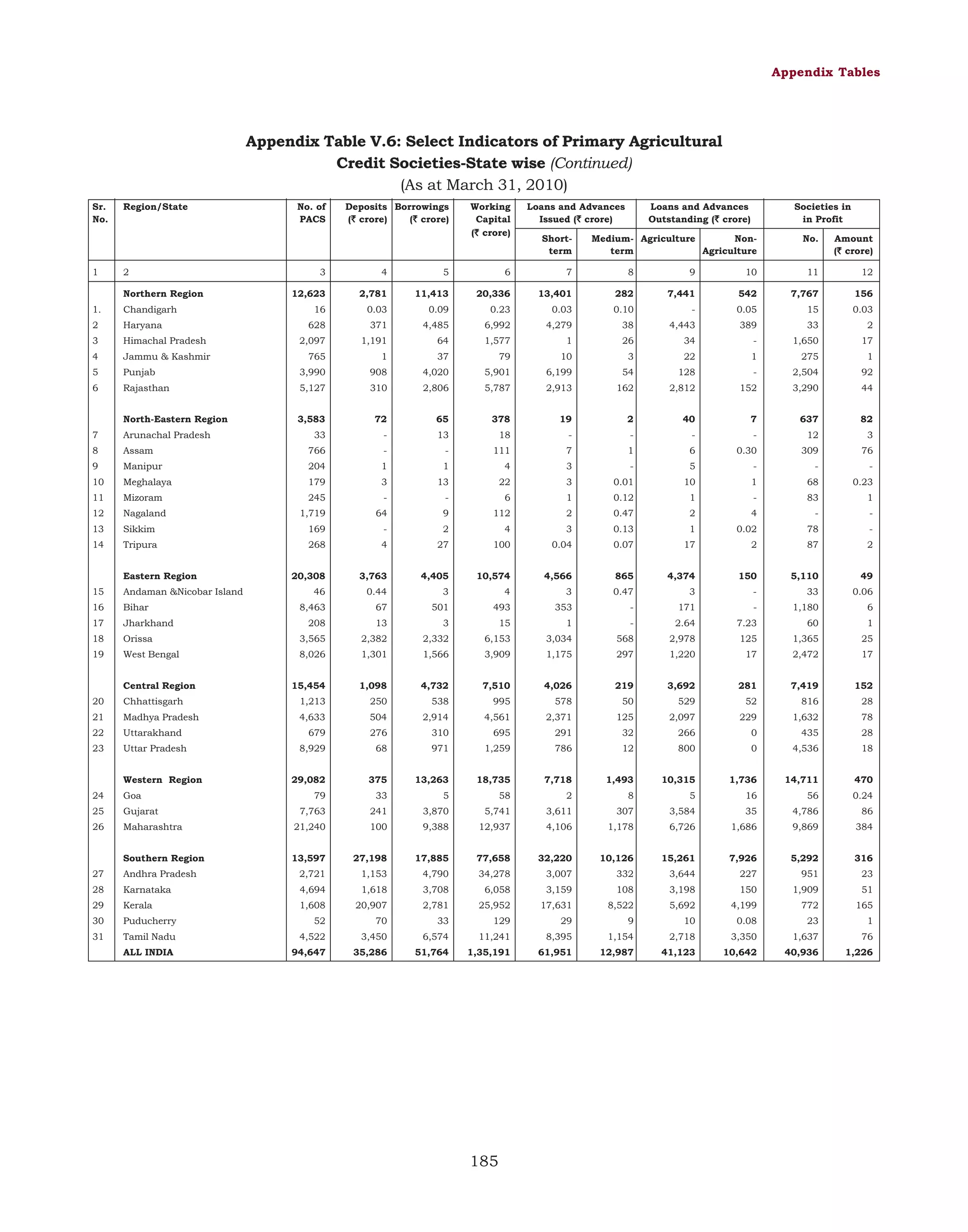

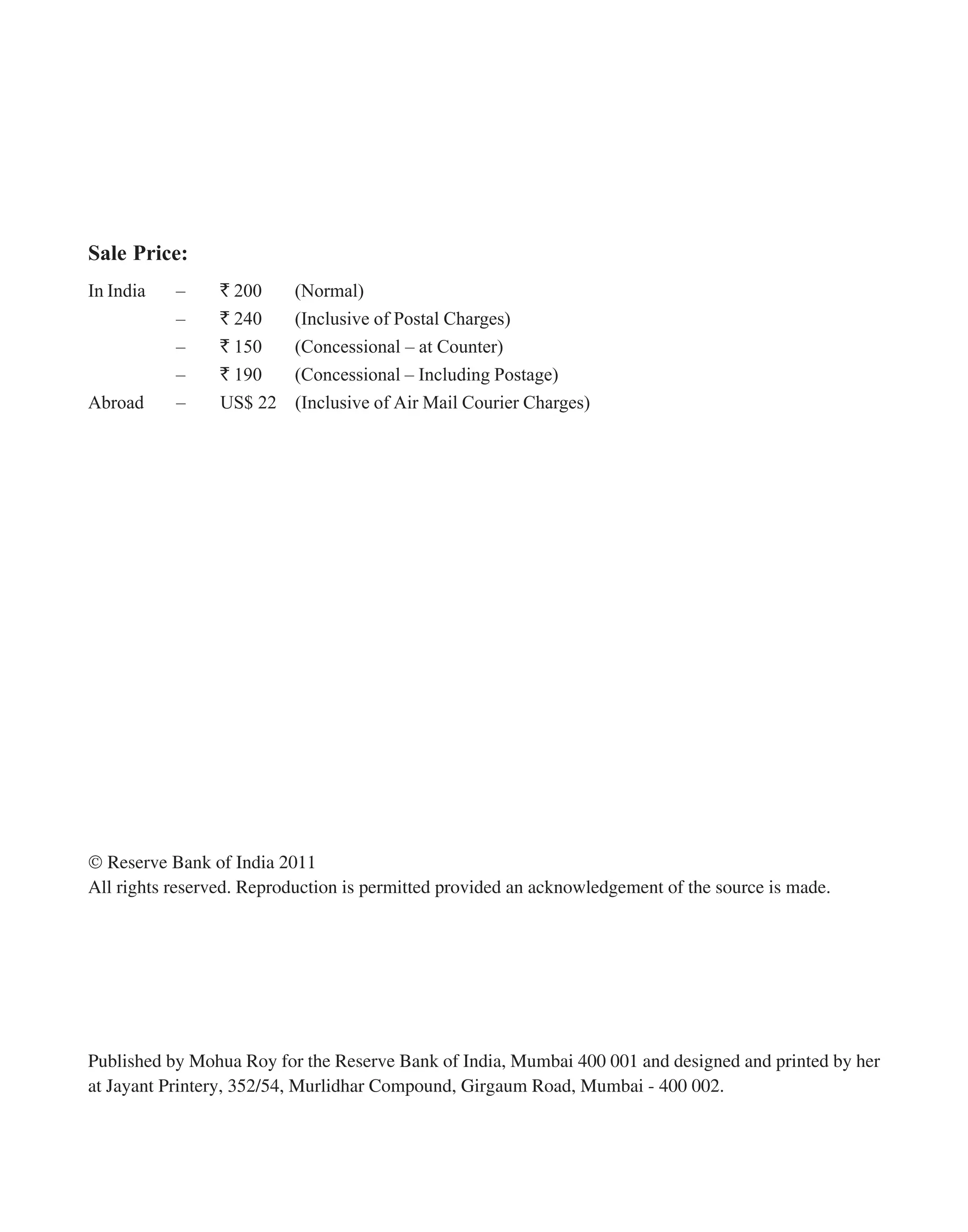

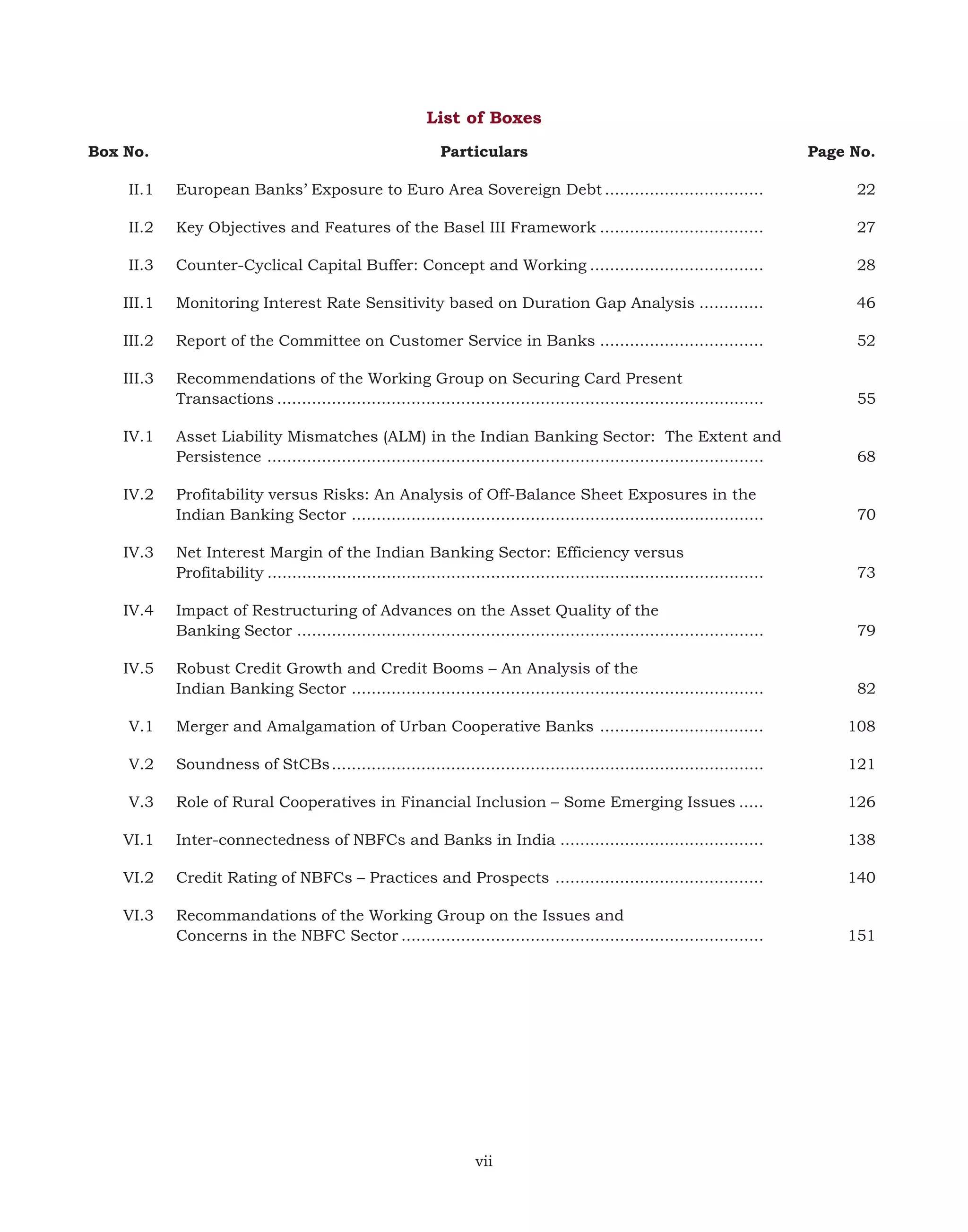

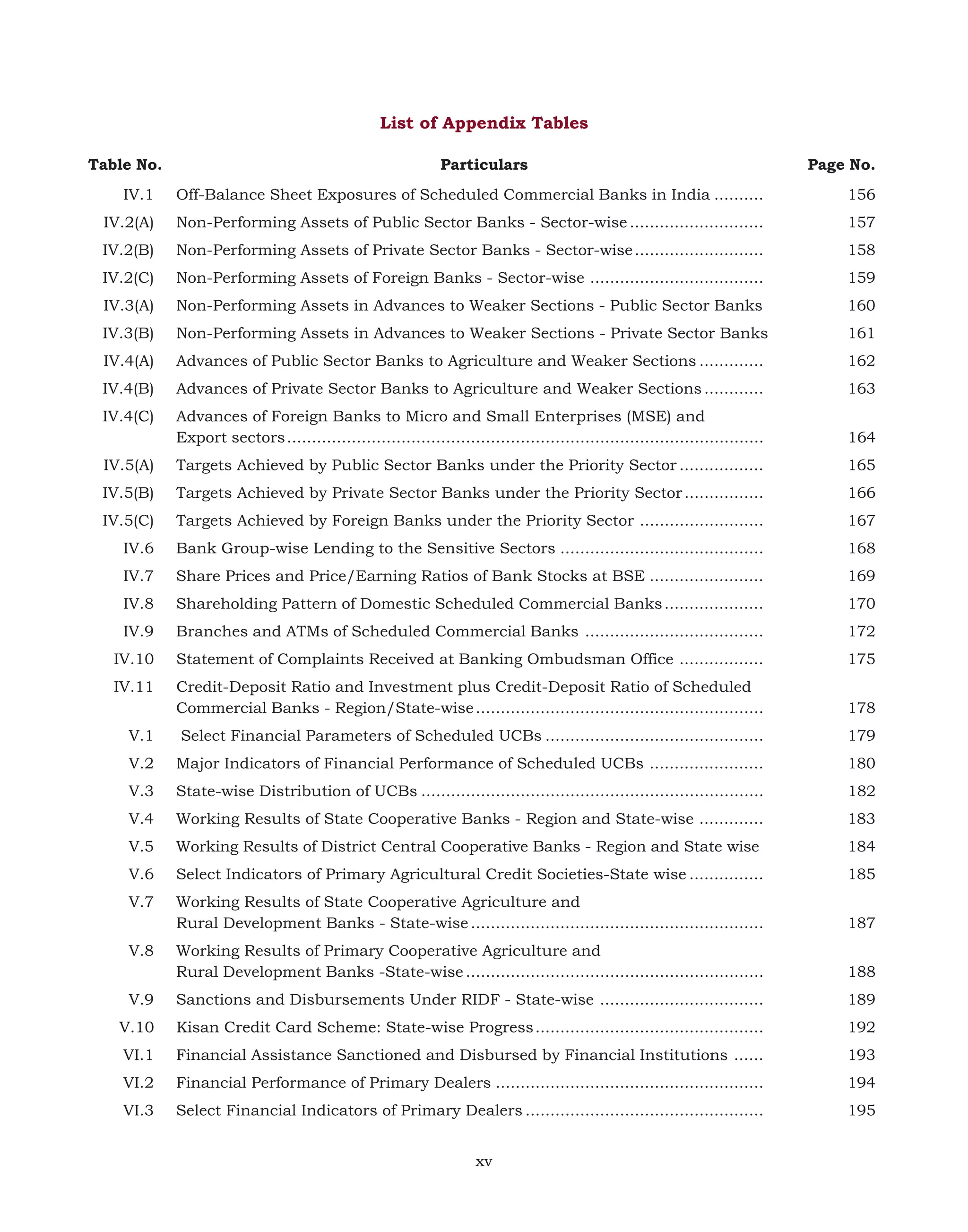

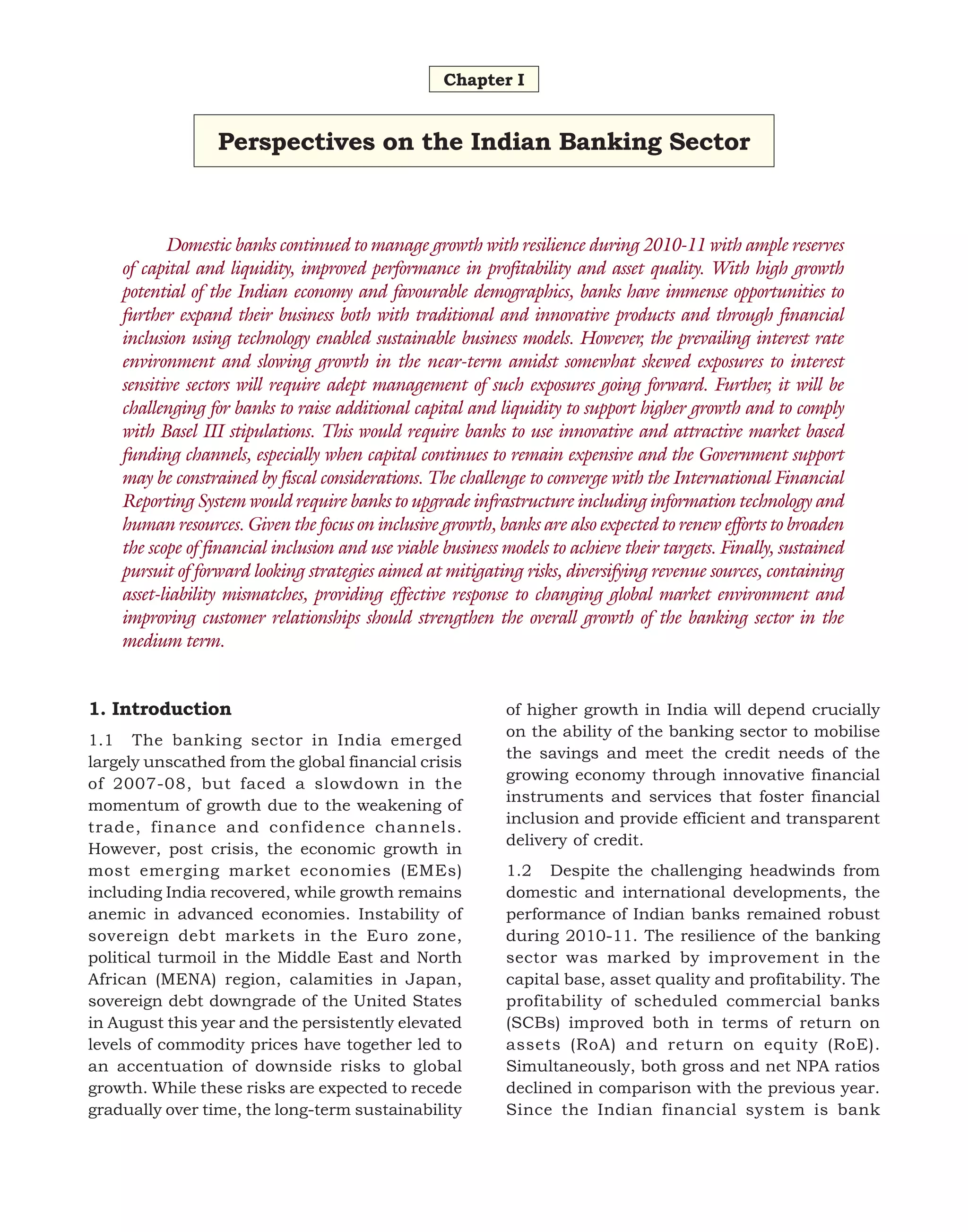

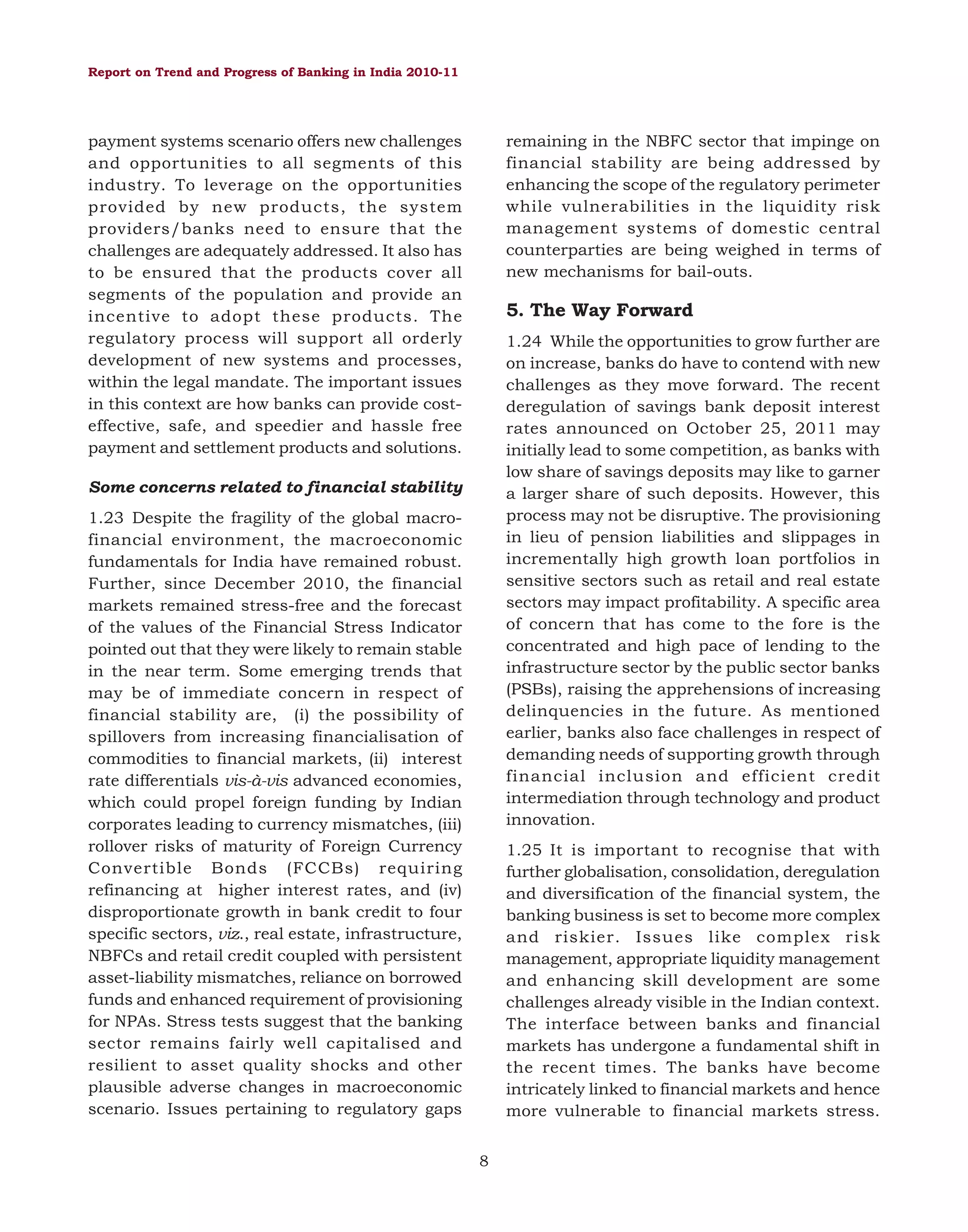

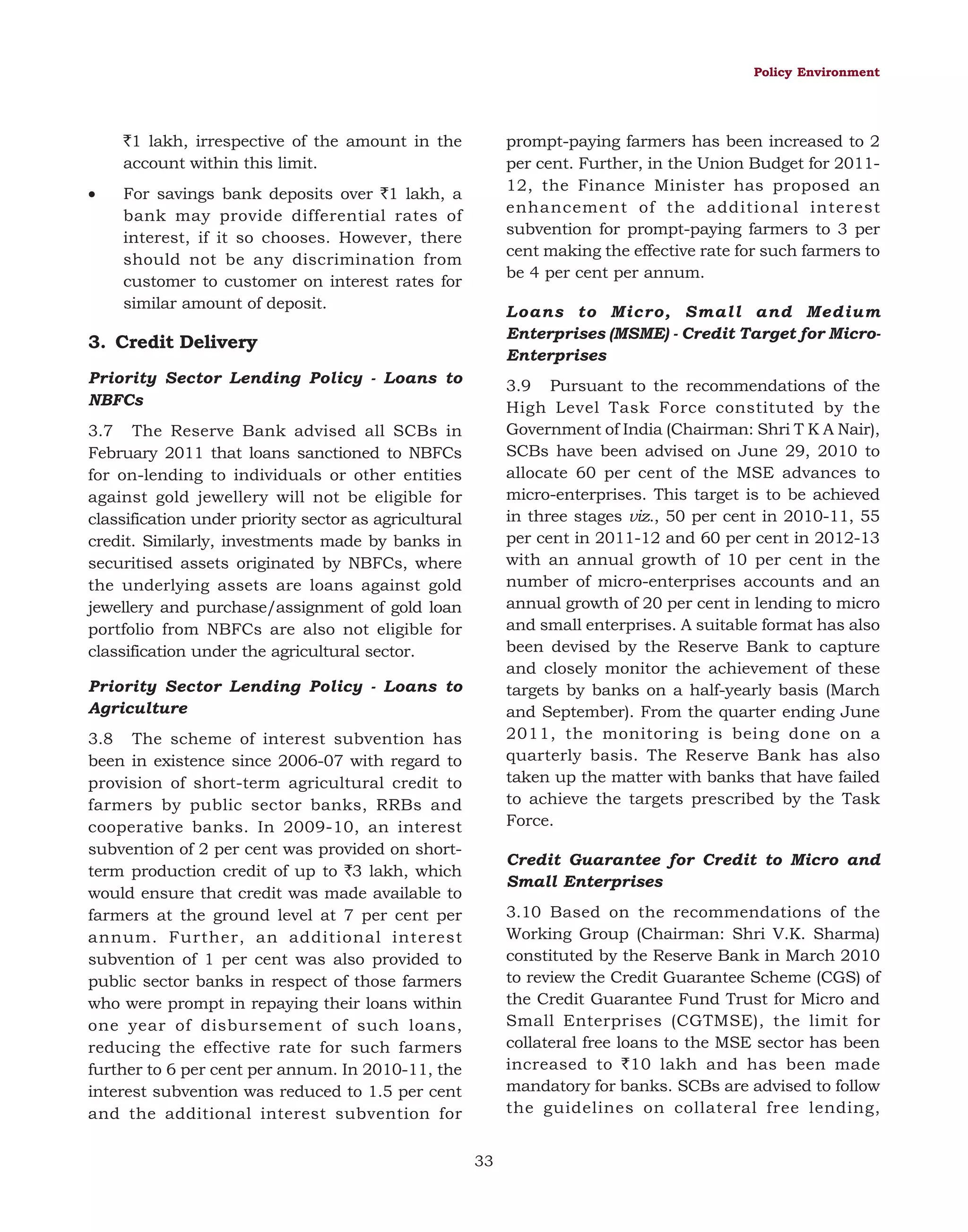

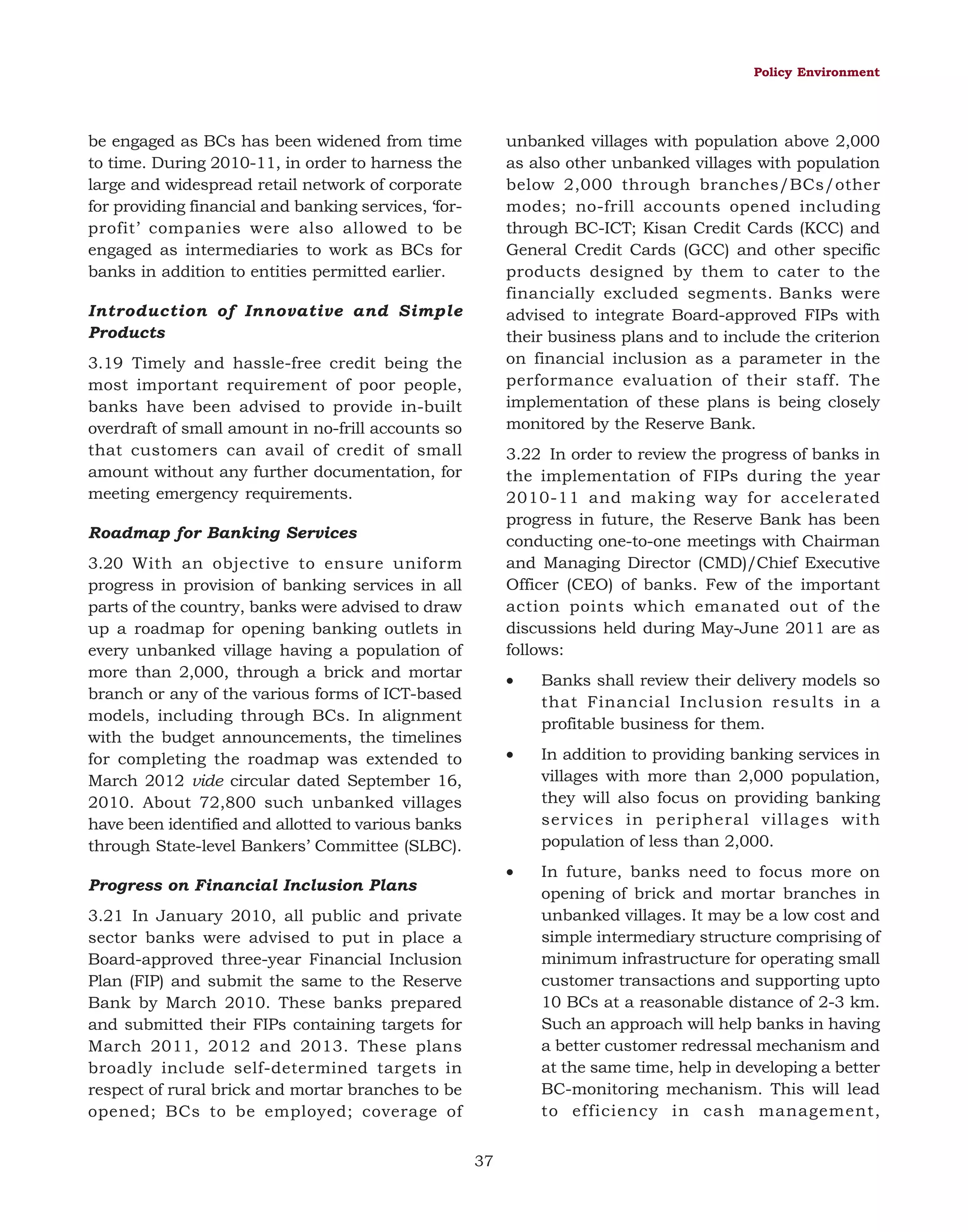

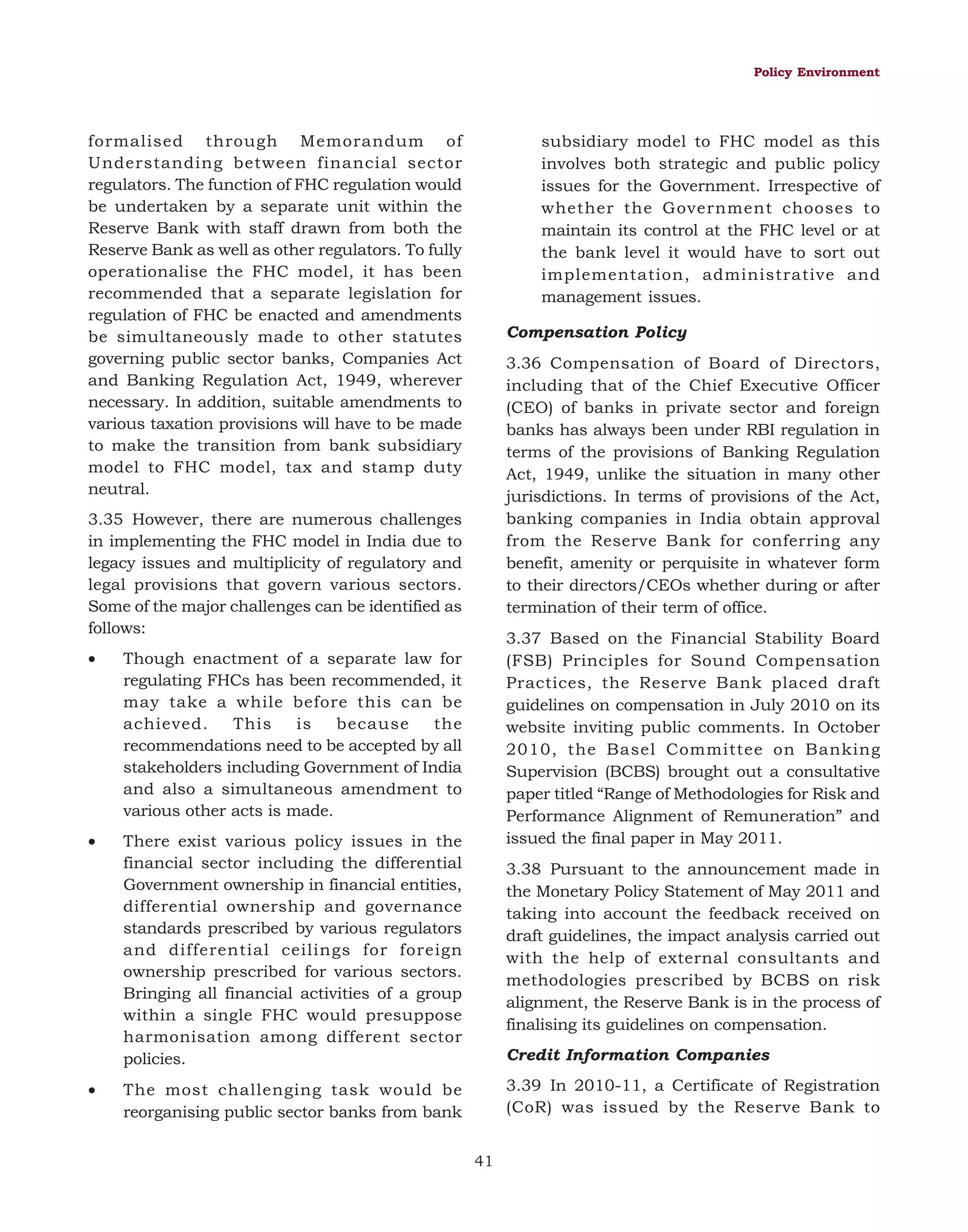

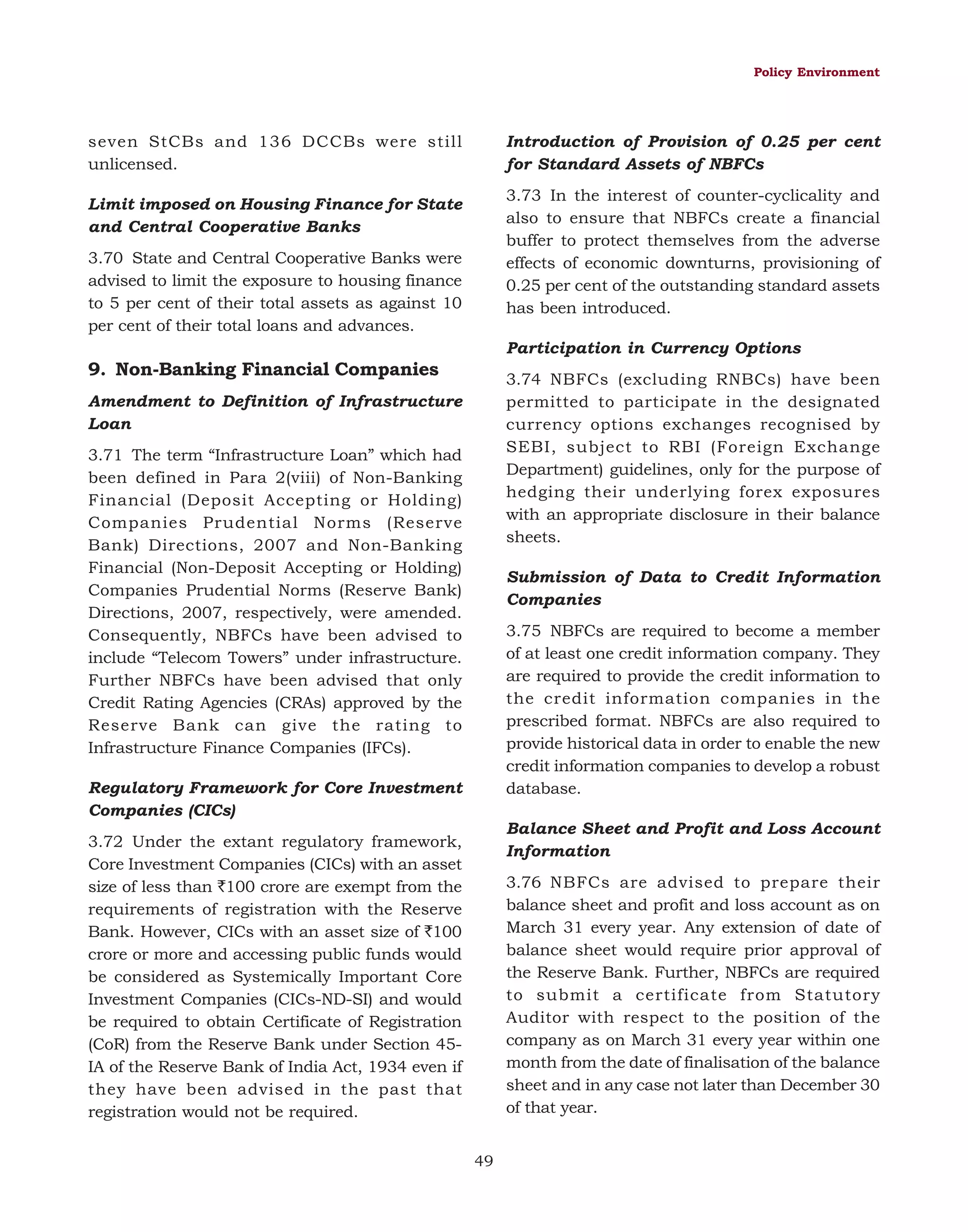

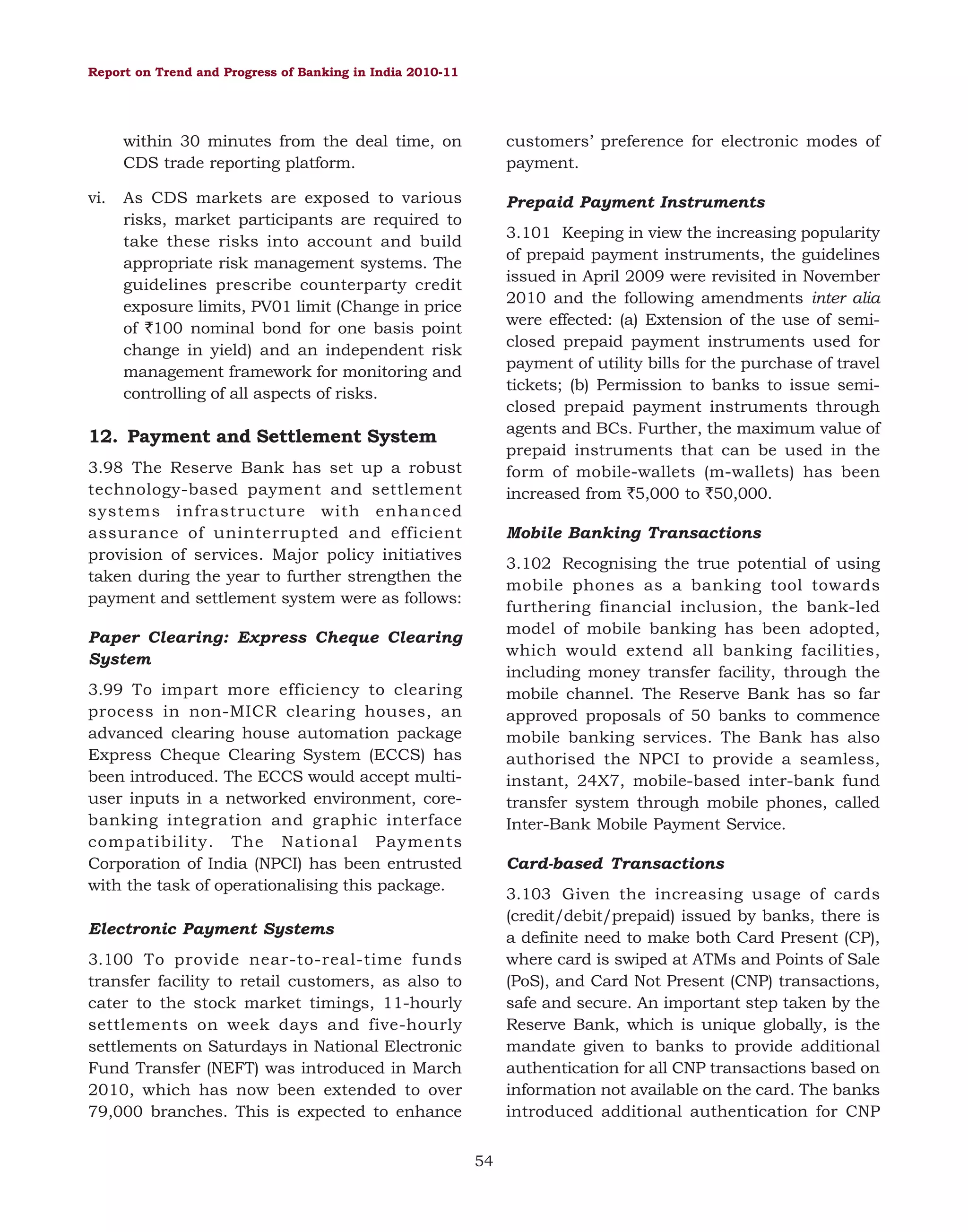

Table IV.4: International Liabilities of Banks – By Type

(As at end-March)

(Amount in ` crore)

Percentage Variation

Item

2010

1

2011

2010

2011

2

Non-resident External Rupee (NRE) Deposits

Non-Resident Ordinary (NRO) Rupee Deposits

2. Own Issues of Securities/Bonds

3. Other Liabilities

of which:

ADRs/GDRs

Equities of banks held by non-residents

Capital/remittable Profits of Foreign Banks in India

and other unclassified International Liabilities

Total International Liabilities

3

4

5

3,38,574

(74.9)

72,234

(16.0)

74,354

(16.4)

1,22,380

(27.1)

30,824

(6.8)

5,439

(1.2)

1,08,166

(23.9)

30,391

(6.7)

50,313

(11.1)

27,462

(6.1)

3,78,221

(74.9)

77,413

(14.8)

95,419

(18.3)

1,21,229

(23.2)

41,072

(7.9)

4,575

(0.9)

1,38,658

(26.6)

34,699

(6.7)

73,159

(14.0)

30,799

(5.9)

4.8

11.7

-0.8

7.2

-1.4

28.3

-1.7

-0.9

49.0

33.2

-20.8

-15.9

91.3

28.2

193.4

14.2

165.8

45.4

0.8

12.2

4,52,179

1. Deposits and Borrowings

of which:

Foreign Currency Non Resident Deposits (Bank)

[FCNR (B)] scheme

Foreign Currency Borrowings *

5,21,454

17.0

15.3

* : Include inter-bank borrowings in India and from abroad, and external commercial borrowings of banks.

Note: Figures in parentheses are percentages to total International liabilities.

Source: Locational Banking Statistics.

banks, which led the growth in total

international claims of banks (Table IV.6).

was mainly led by claims of banks on Germany,

UAE and USA. In contrast, claims of banks on UK

and Hong Kong registered a decline in 2010-11

as compared with the previous year (Table IV.7).

4.17 The growth in the consolidated international

claims of banks on countries other than India

Table IV.5: International Assets of Banks - By Type

(As at end-March)

(Amount in ` crore)

Percentage Variation

Item

2010

2011

2010

2

3

4

5

2,37,181

(96.3)

2,78,741

(96.8)

8.0

17.5

10,196

(4.1)

1,23,476

(50.1)

50,496

(20.5)

52,135

(21.2)

39

(0.0)

9,139

(3.7)

14,414

(5.0)

1,40,083

(48.6)

61,321

(21.3)

62,343

(21.6)

179

(0.1)

9,147

(3.2)

22.2

41.4

23.5

13.4

13.3

21.4

-21.6

19.6

-48.7

359.0

-6.1

0.1

2,46,359

(100.0)

2,88,067

(100.0)

7.4

16.9

1

1. Loans and Investments

of which :

a) Loans to Non-Residents*

b)

Foreign Currency Loans to Residents**

c)

Outstanding Export Bills drawn on

Non-Residents by Residents

Nostro Balances @

d)

2. Holdings of Debt Securities

3. Other Assets

@@

Total International Assets

2011

*

: Include rupee loans and Foreign Currency (FC) loans out of non-residents (NR) deposits;

** : Include loans out of FCNR (B) deposits, Packing Credit in Foreign Currency (PCFC), FC lending to and FC deposits with banks in India.

@ : Include placements made abroad and balances in term deposits with non-resident banks.

@@ : Include capital supplied to and receivable profits from foreign branches/subsidiaries of Indian banks and other unclassified international assets.

Note : Figures in parentheses are percentages to total international assets.

Source: Locational Banking Statistics.

65](https://image.slidesharecdn.com/0tpbi121111full-140101004243-phpapp02/75/0-tpbi121111-full-85-2048.jpg)

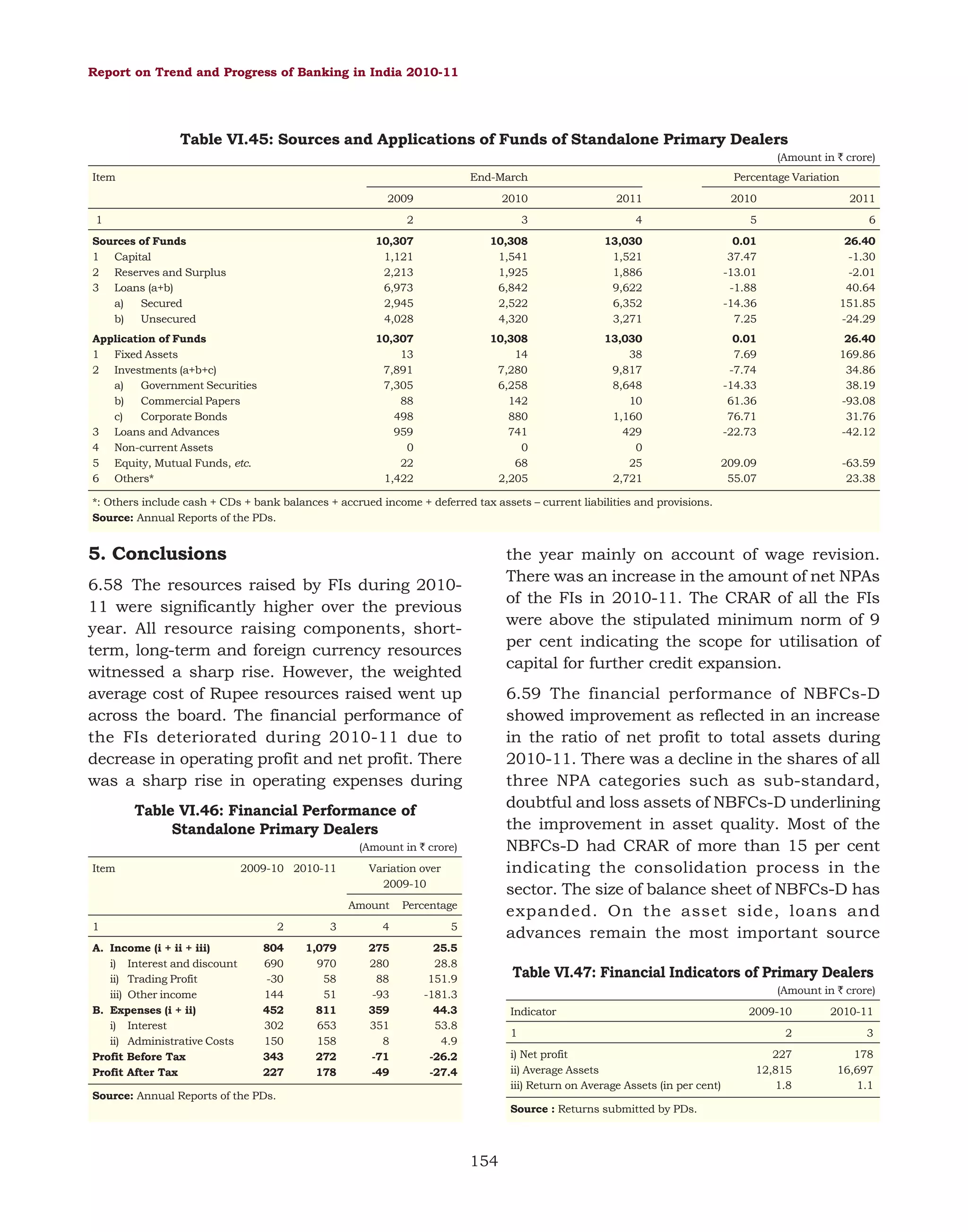

![Report on Trend and Progress of Banking in India 2010-11

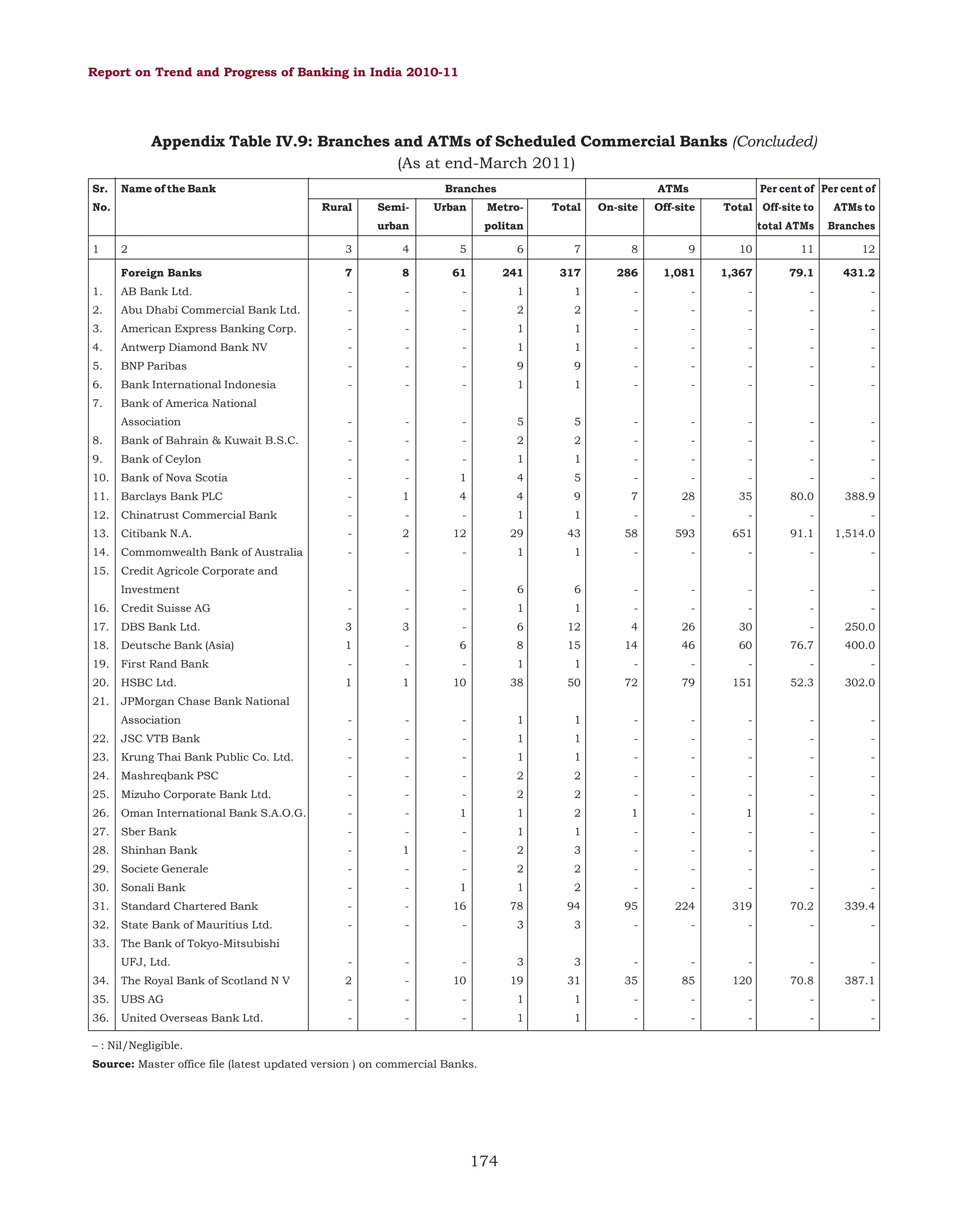

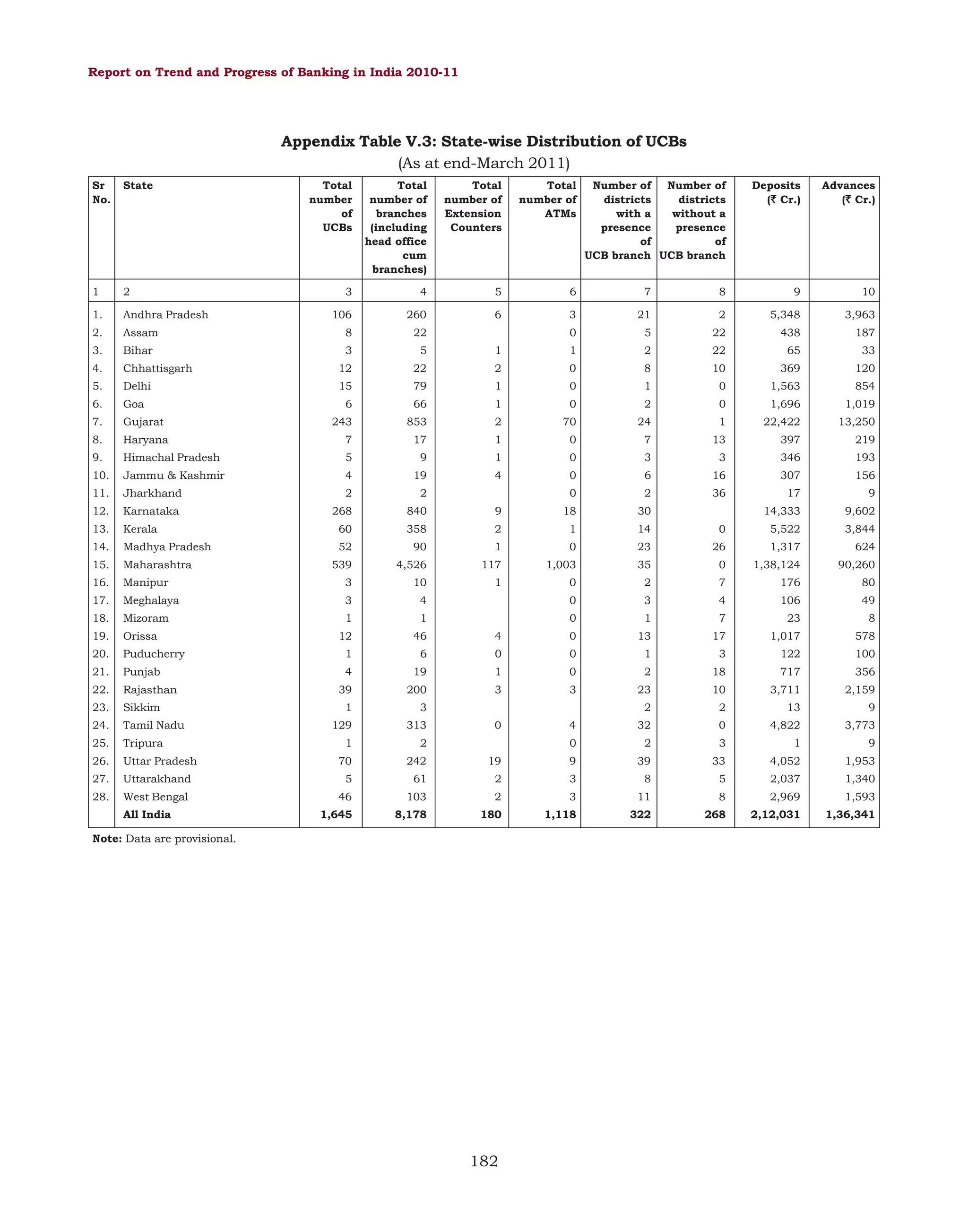

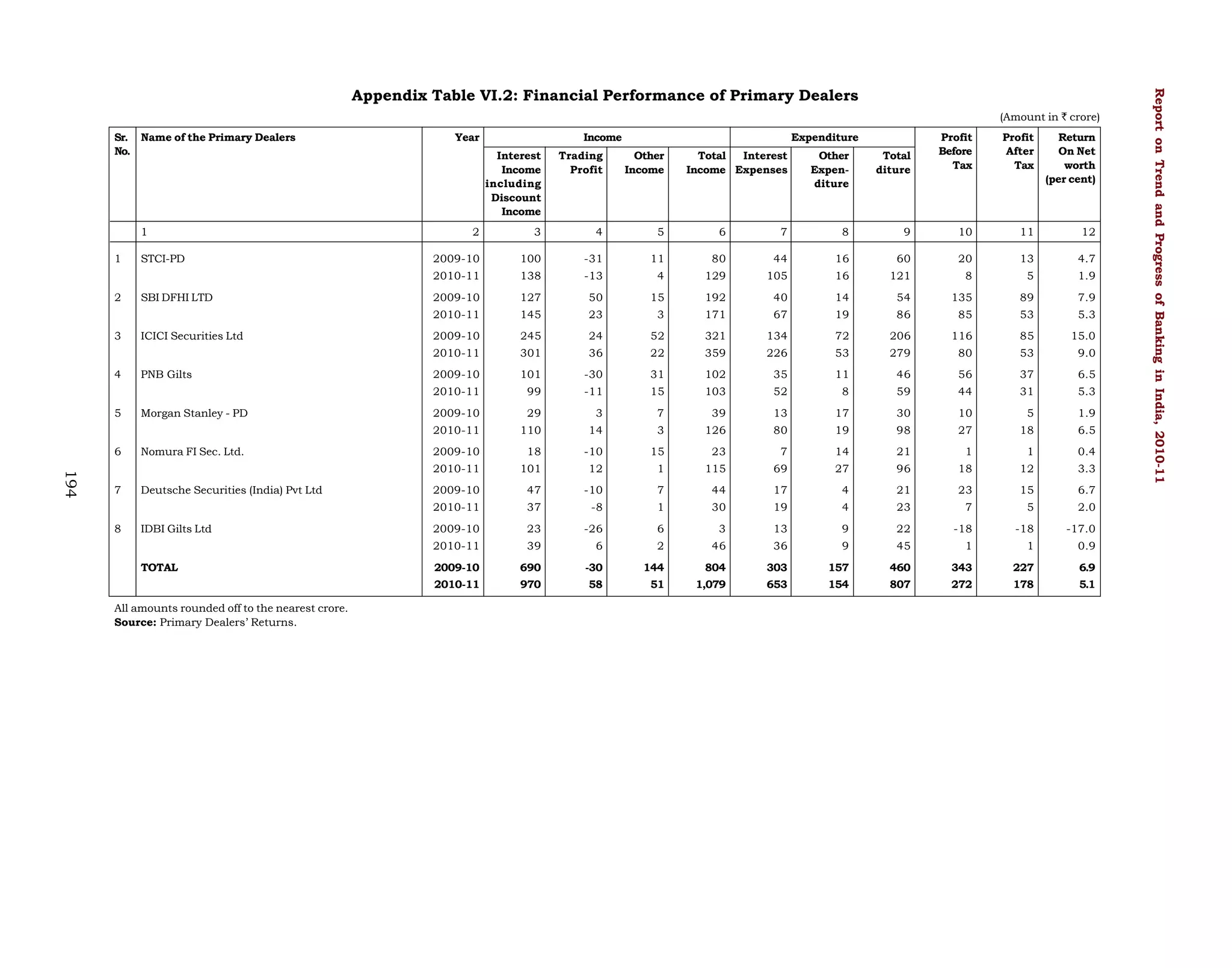

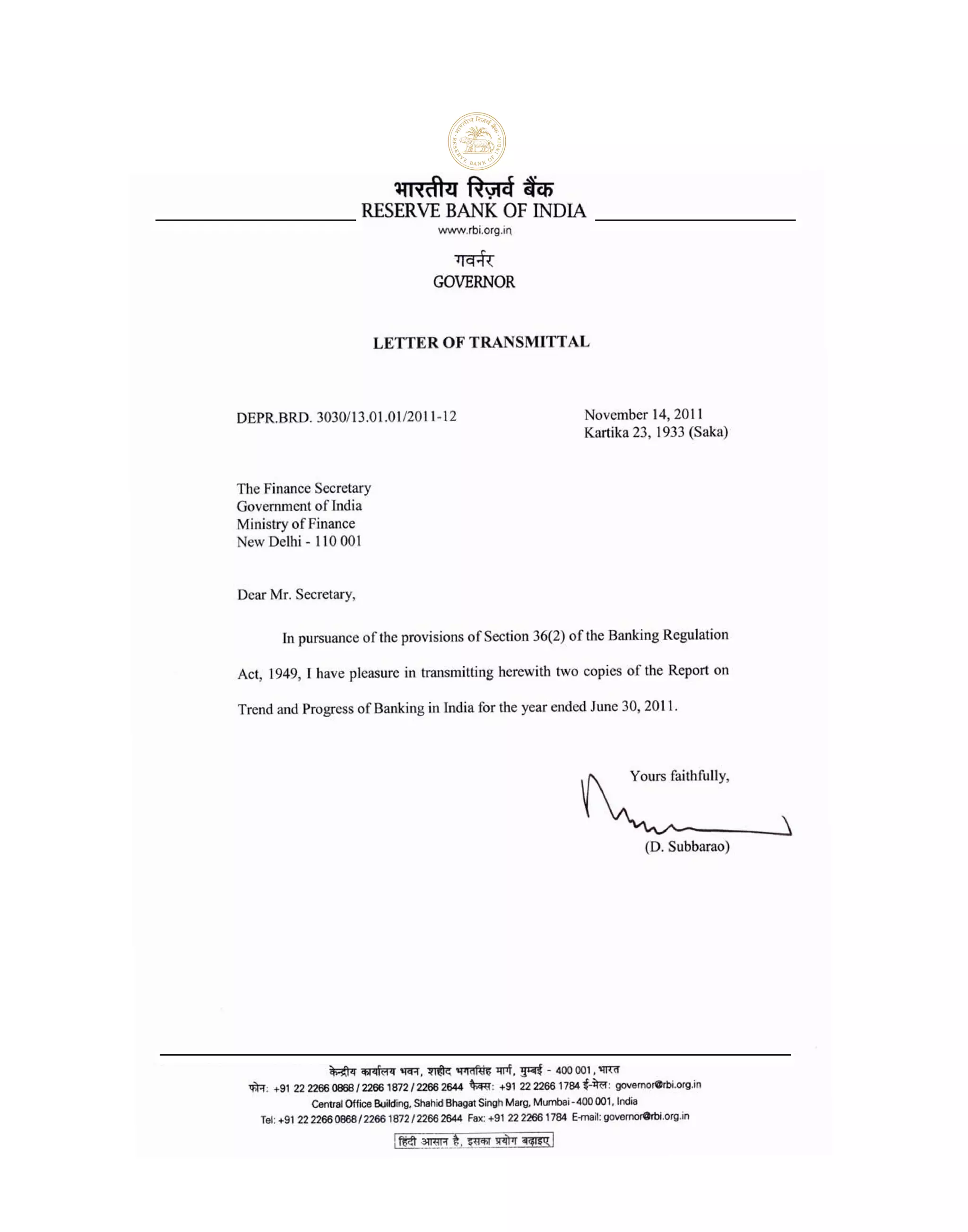

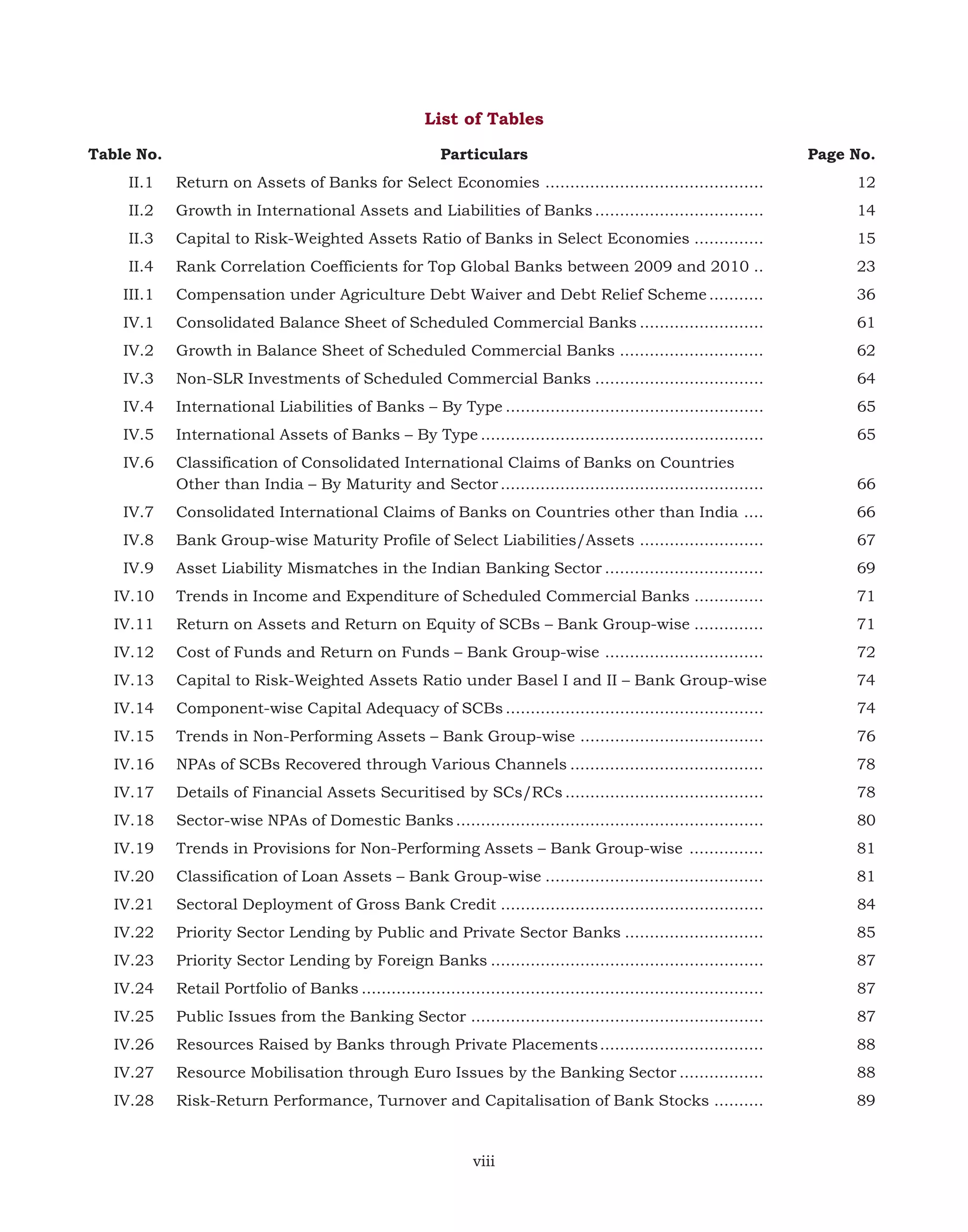

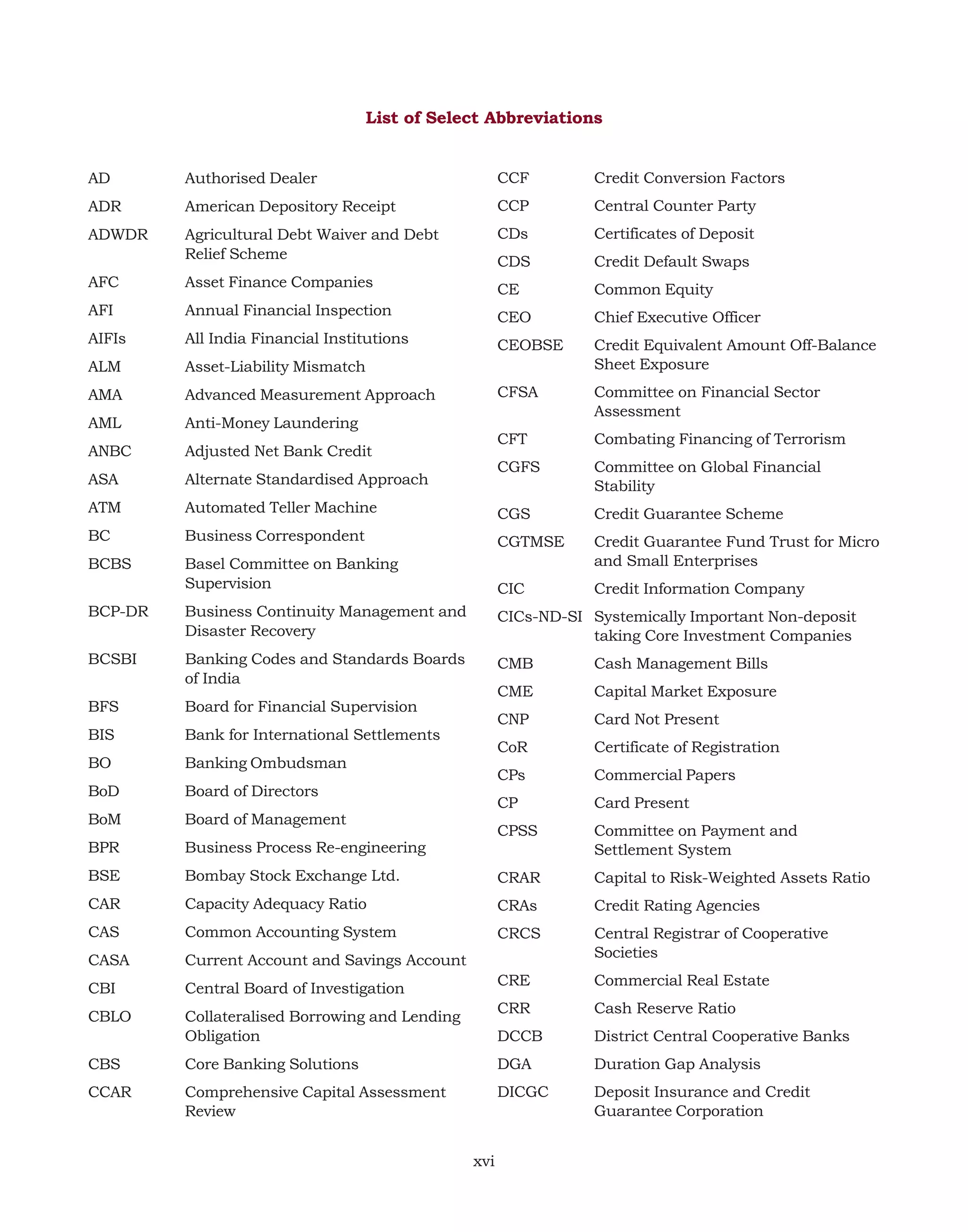

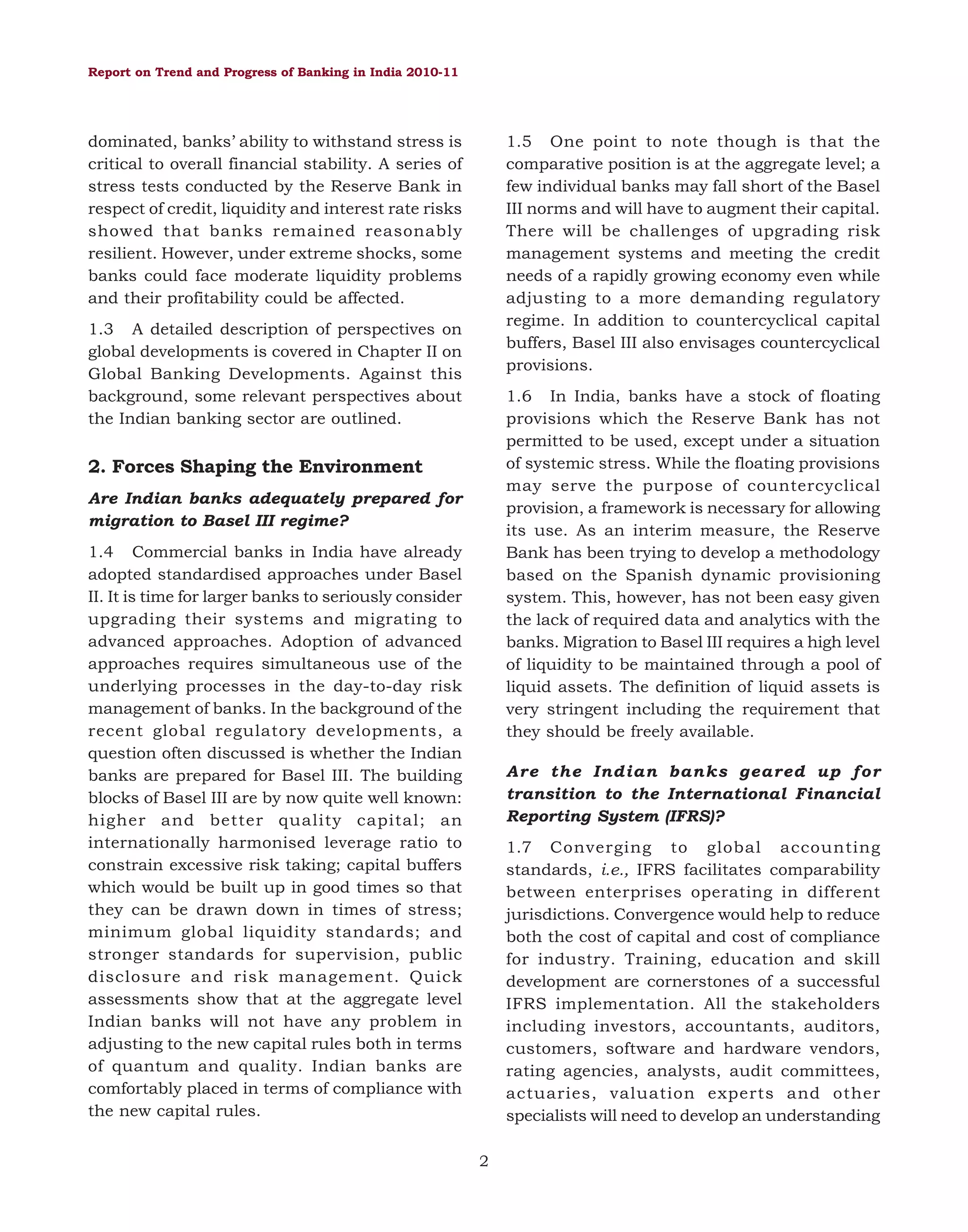

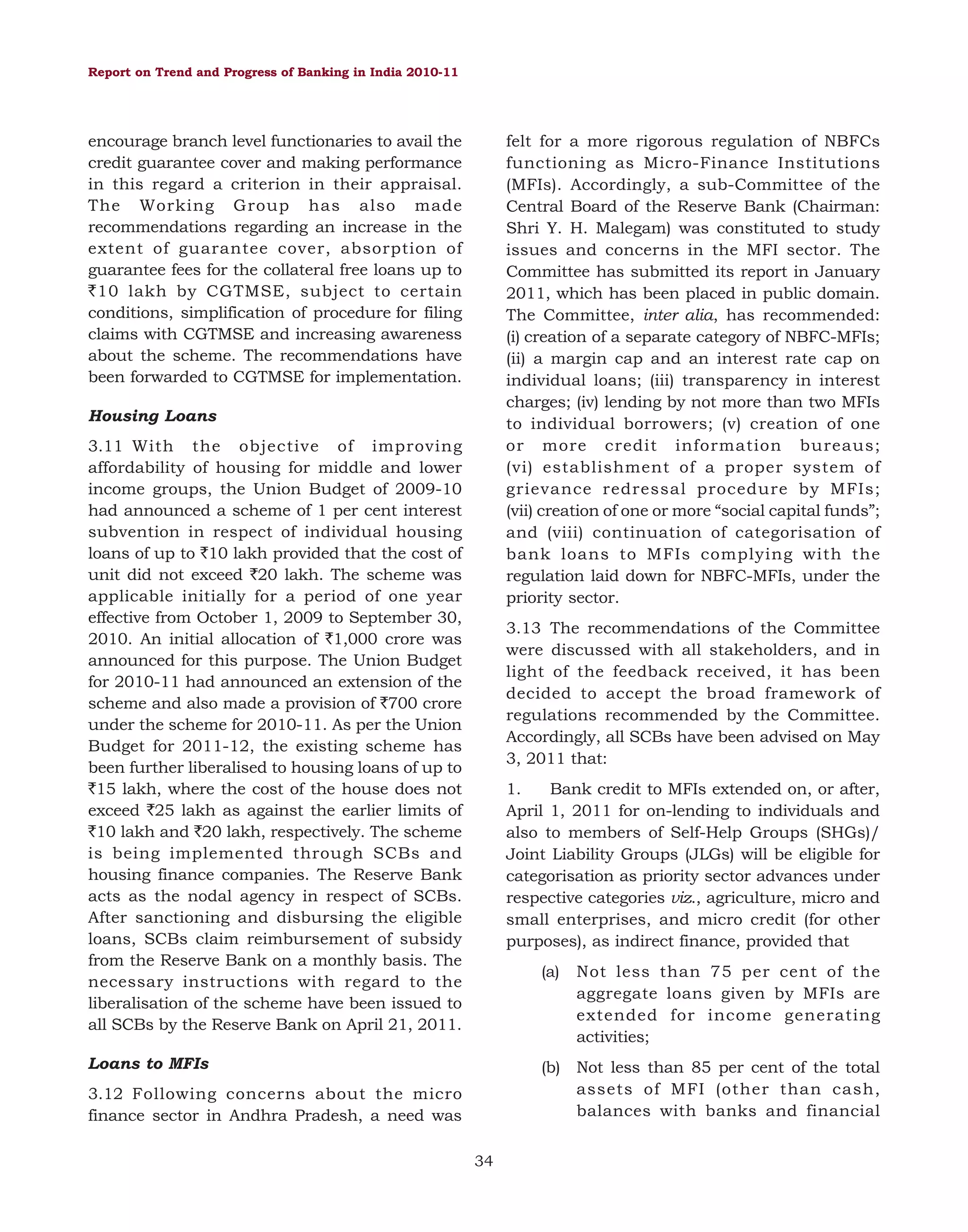

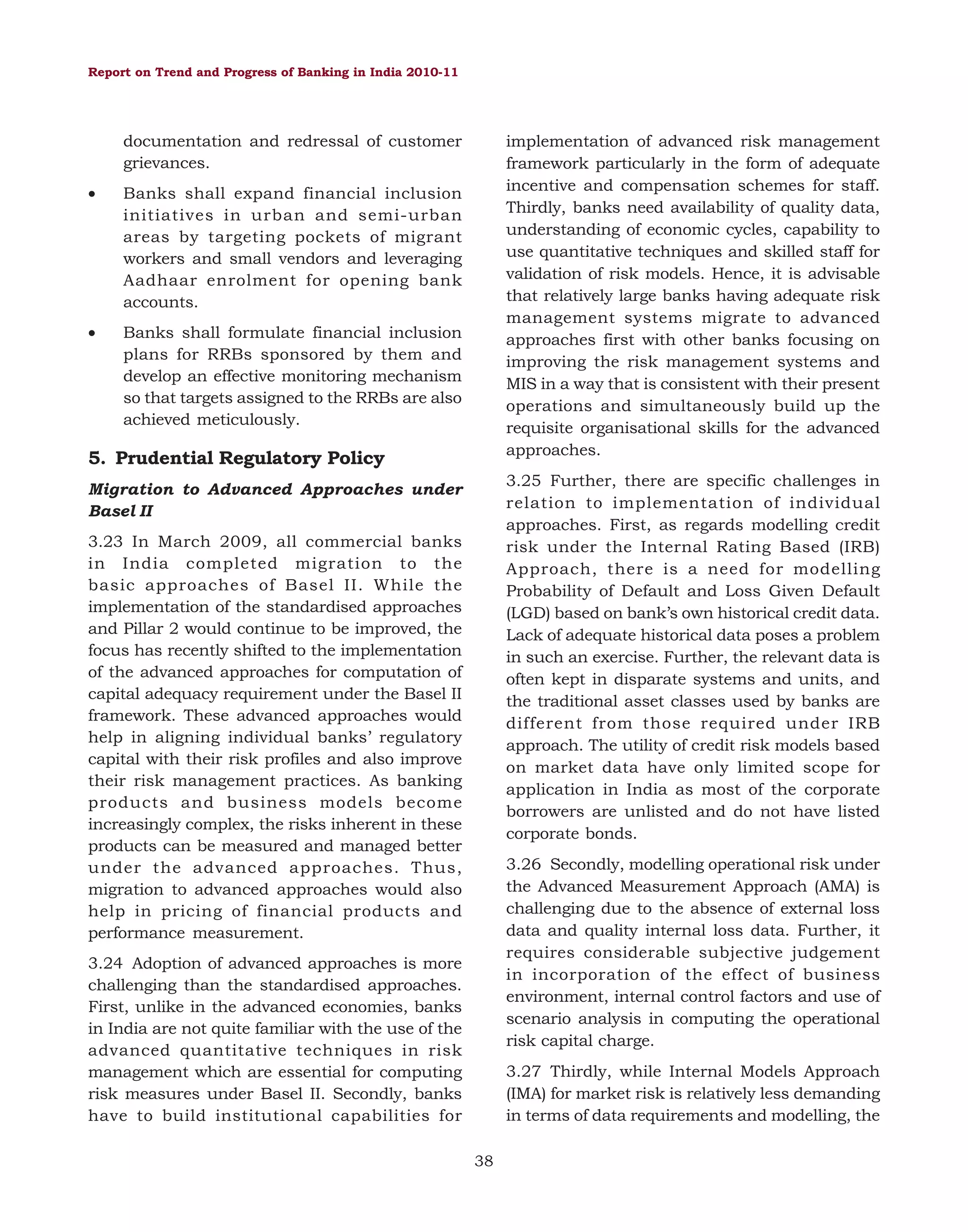

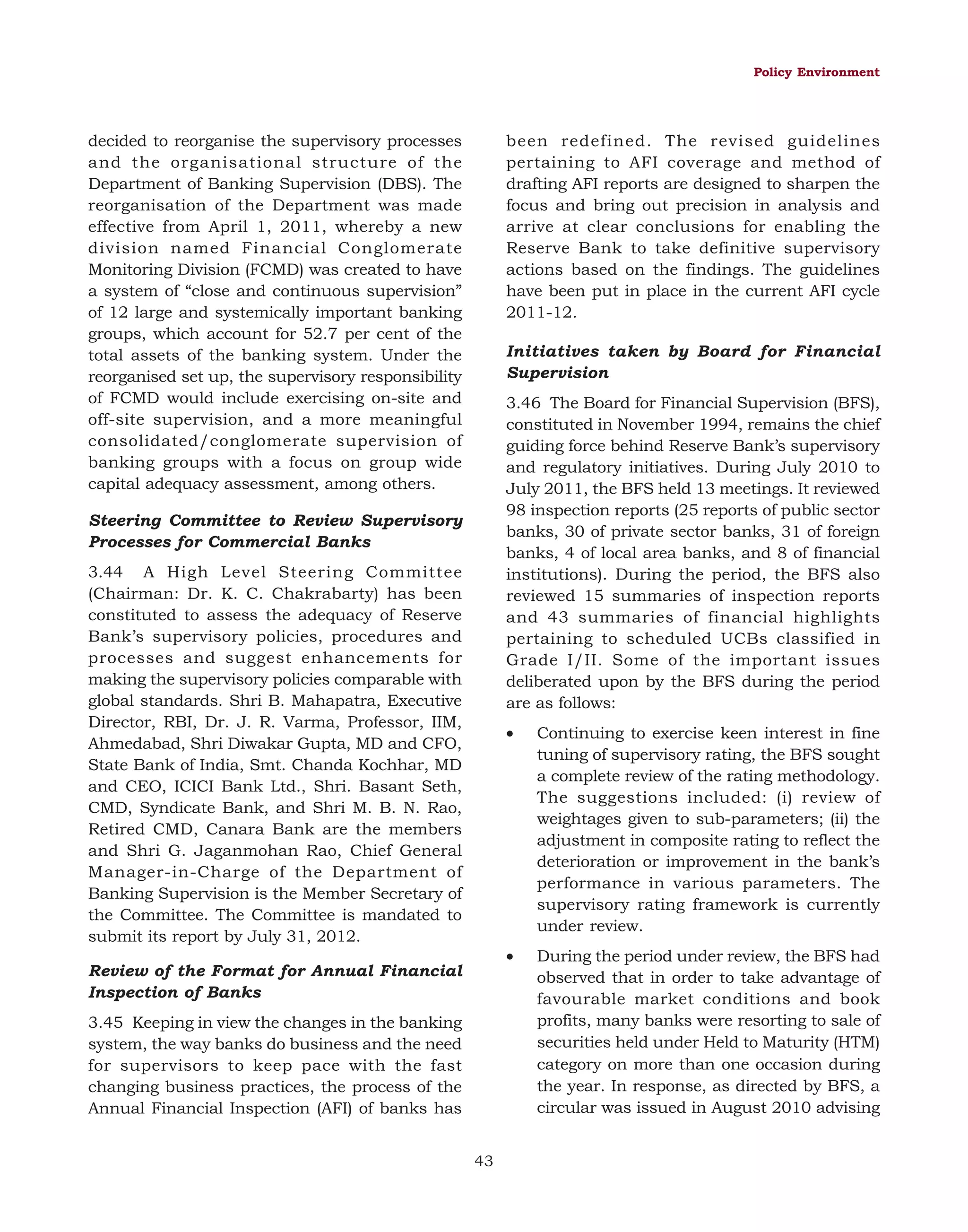

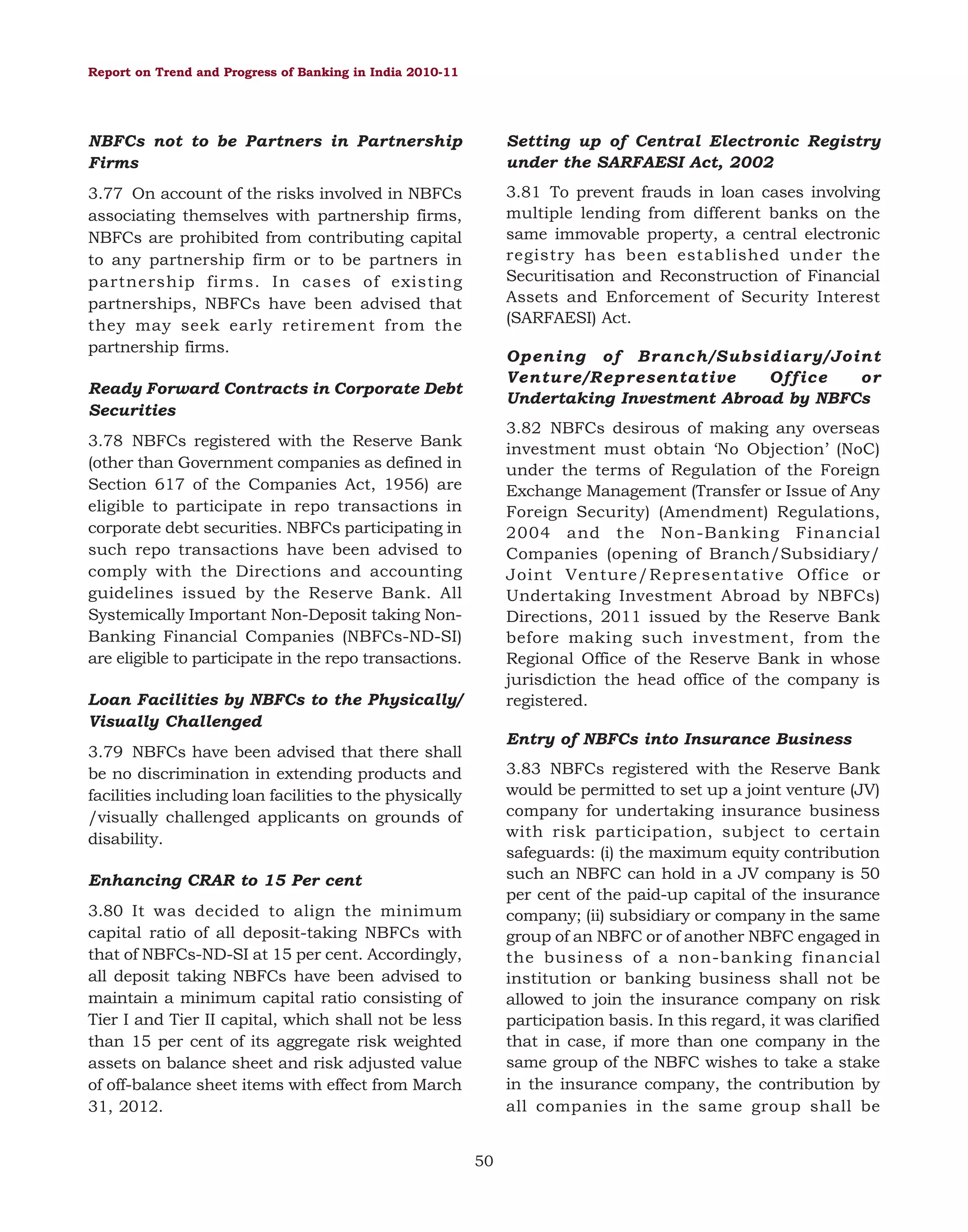

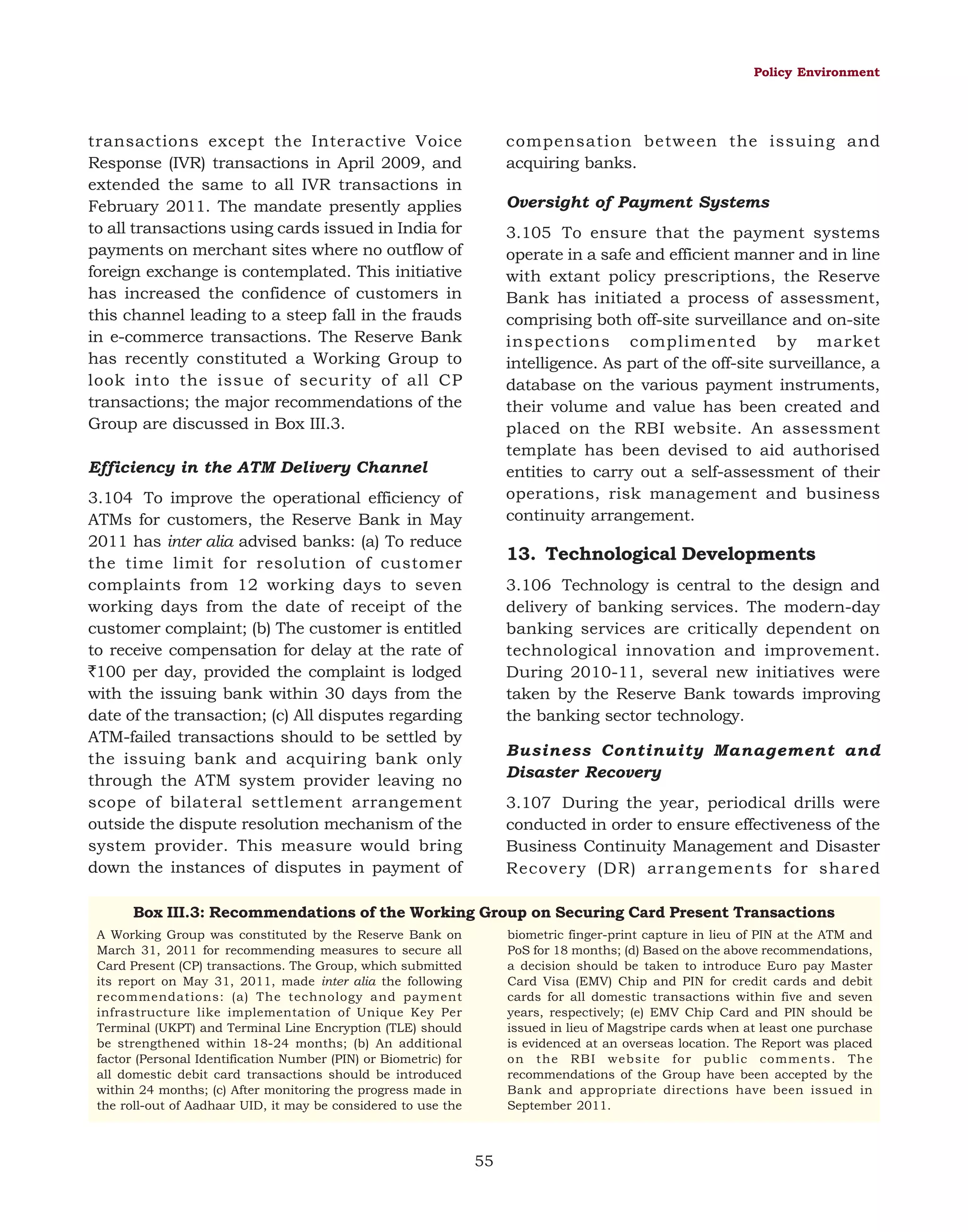

Table IV.39: Number of ATMs of SCBs Located

at Various Locations

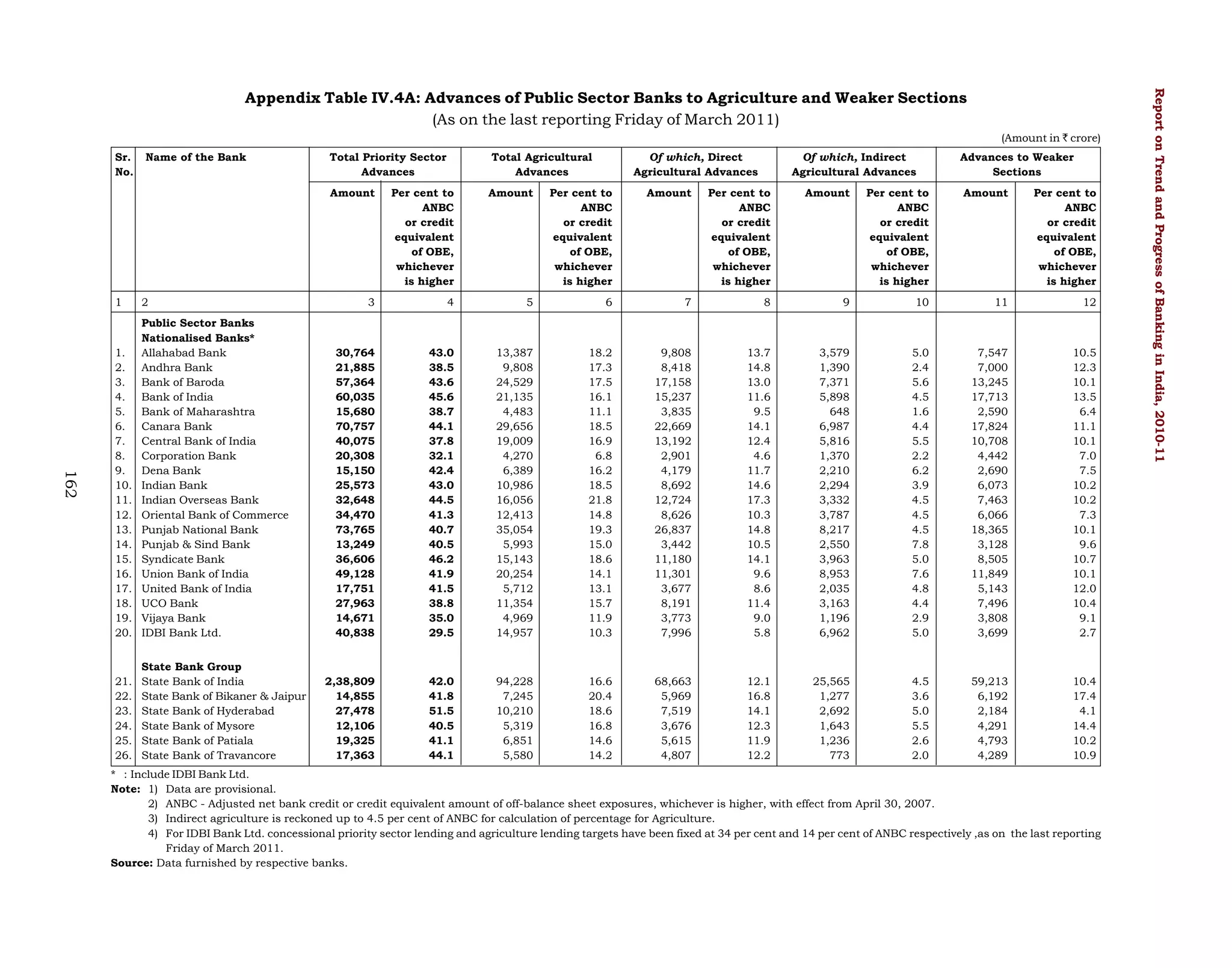

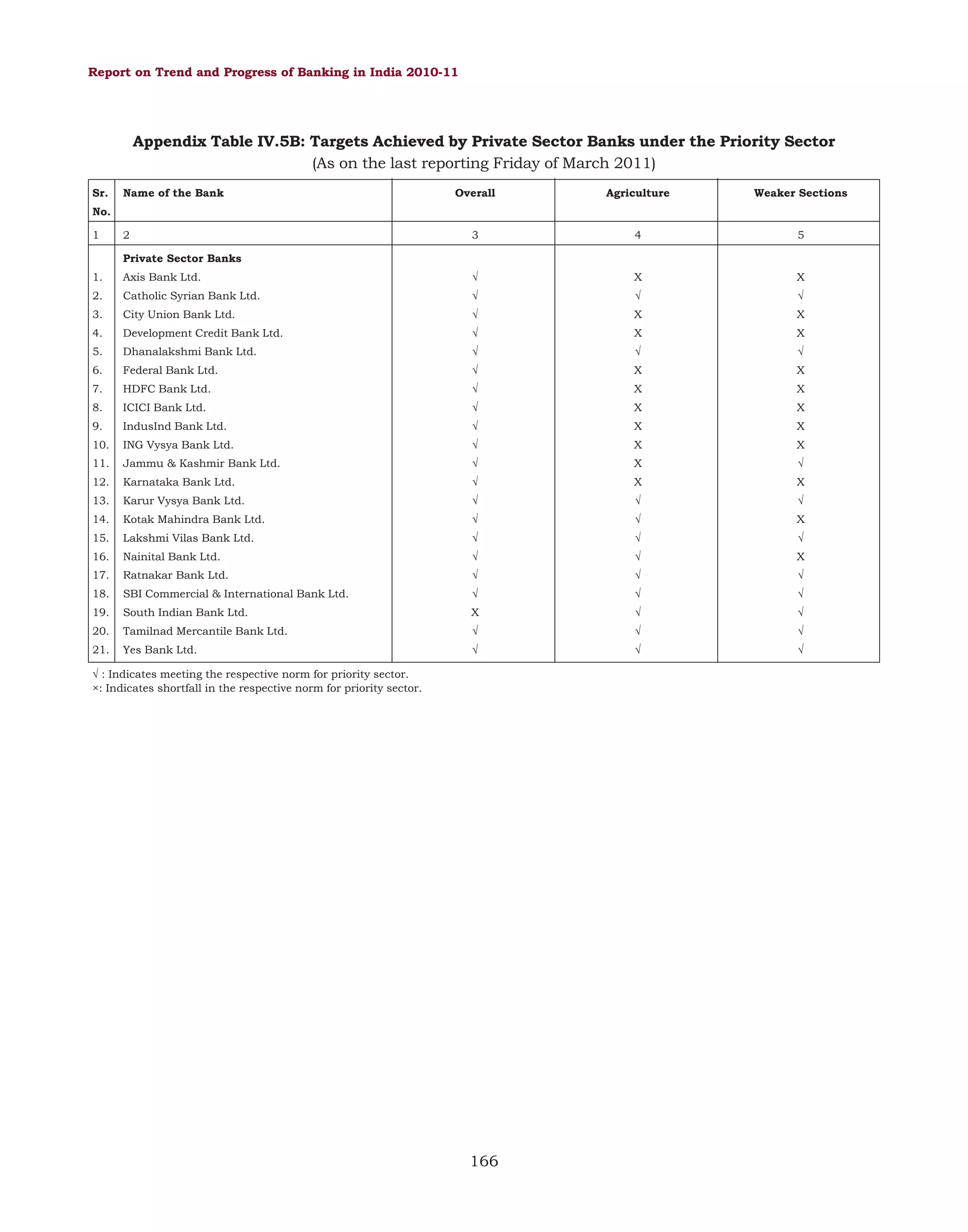

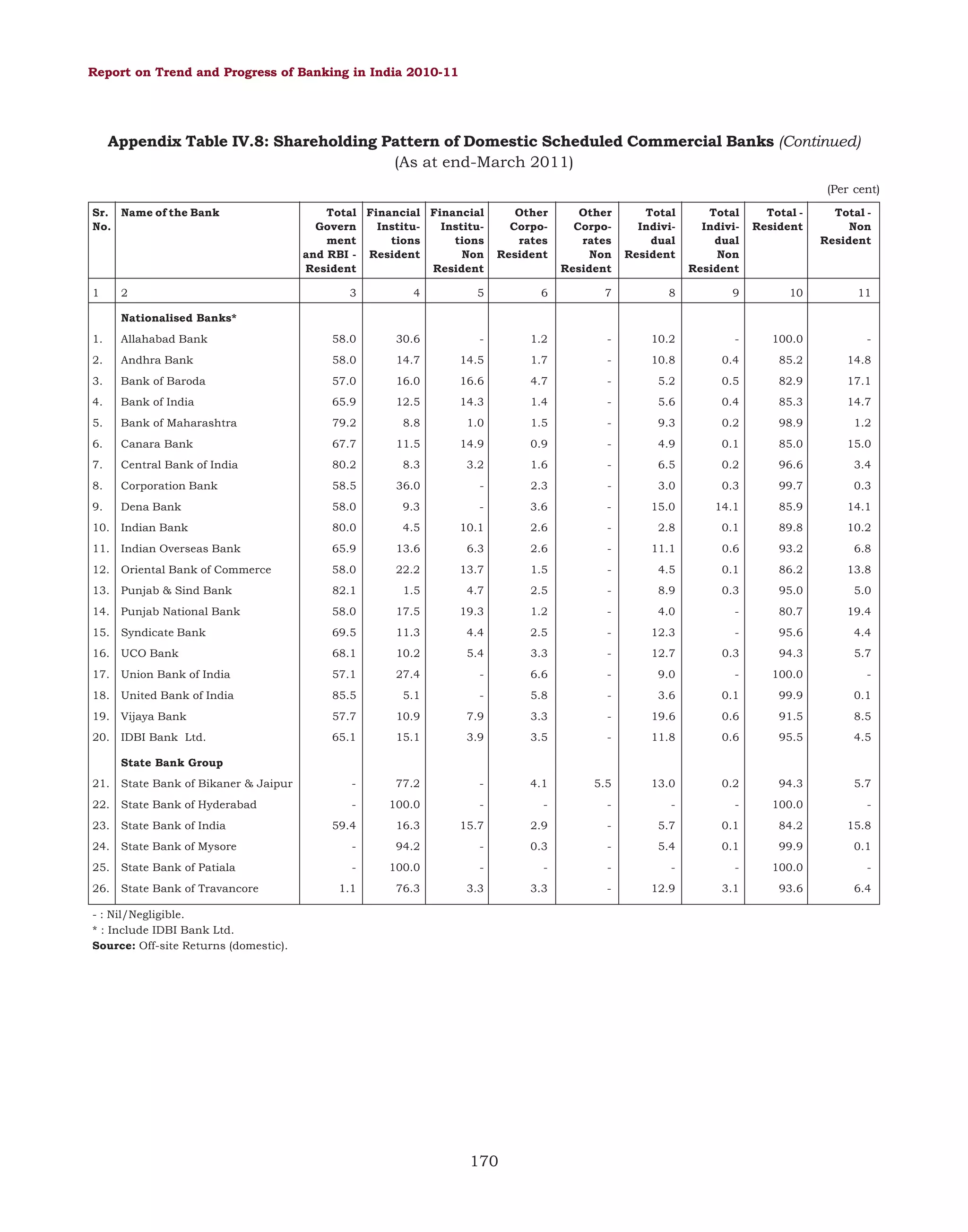

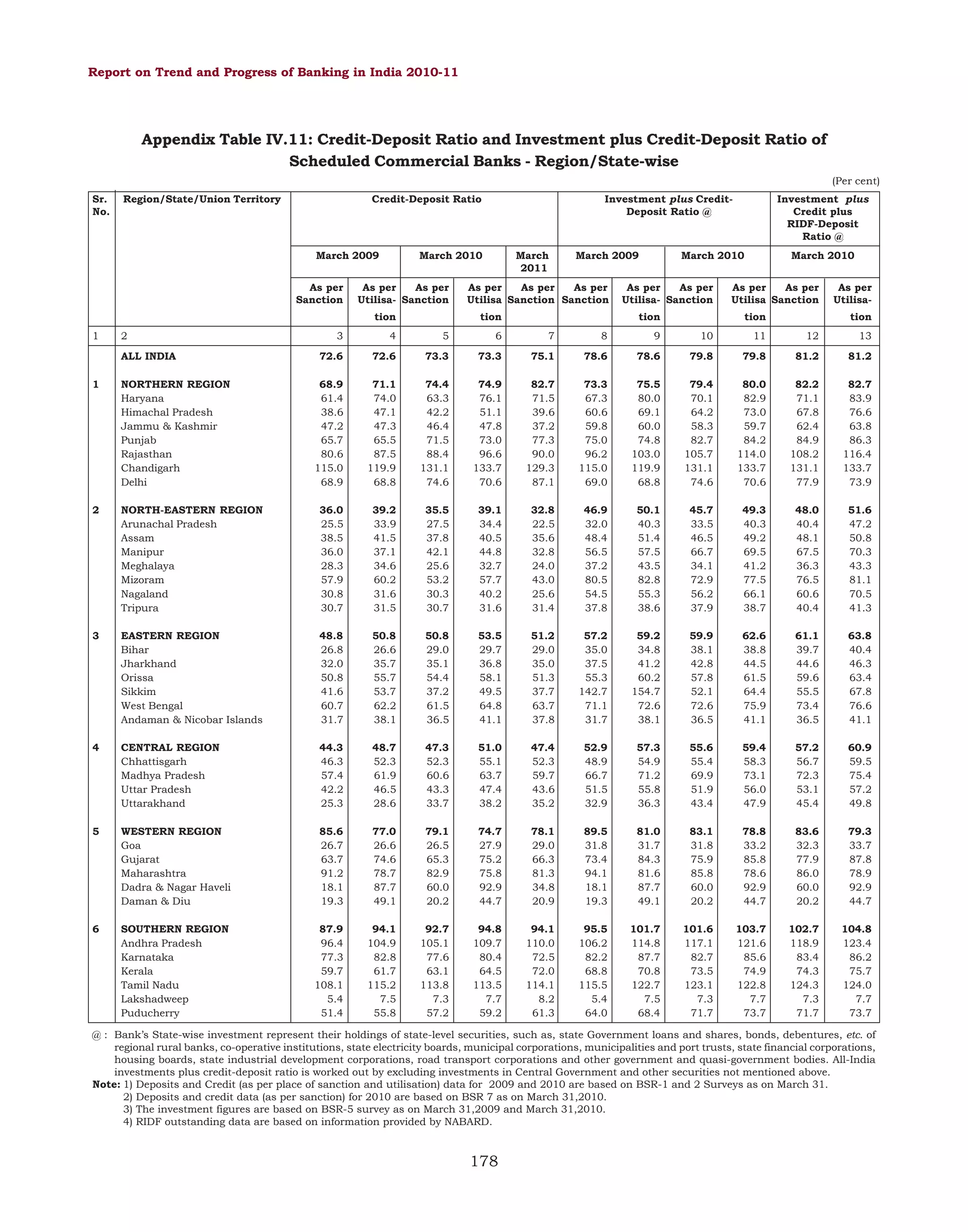

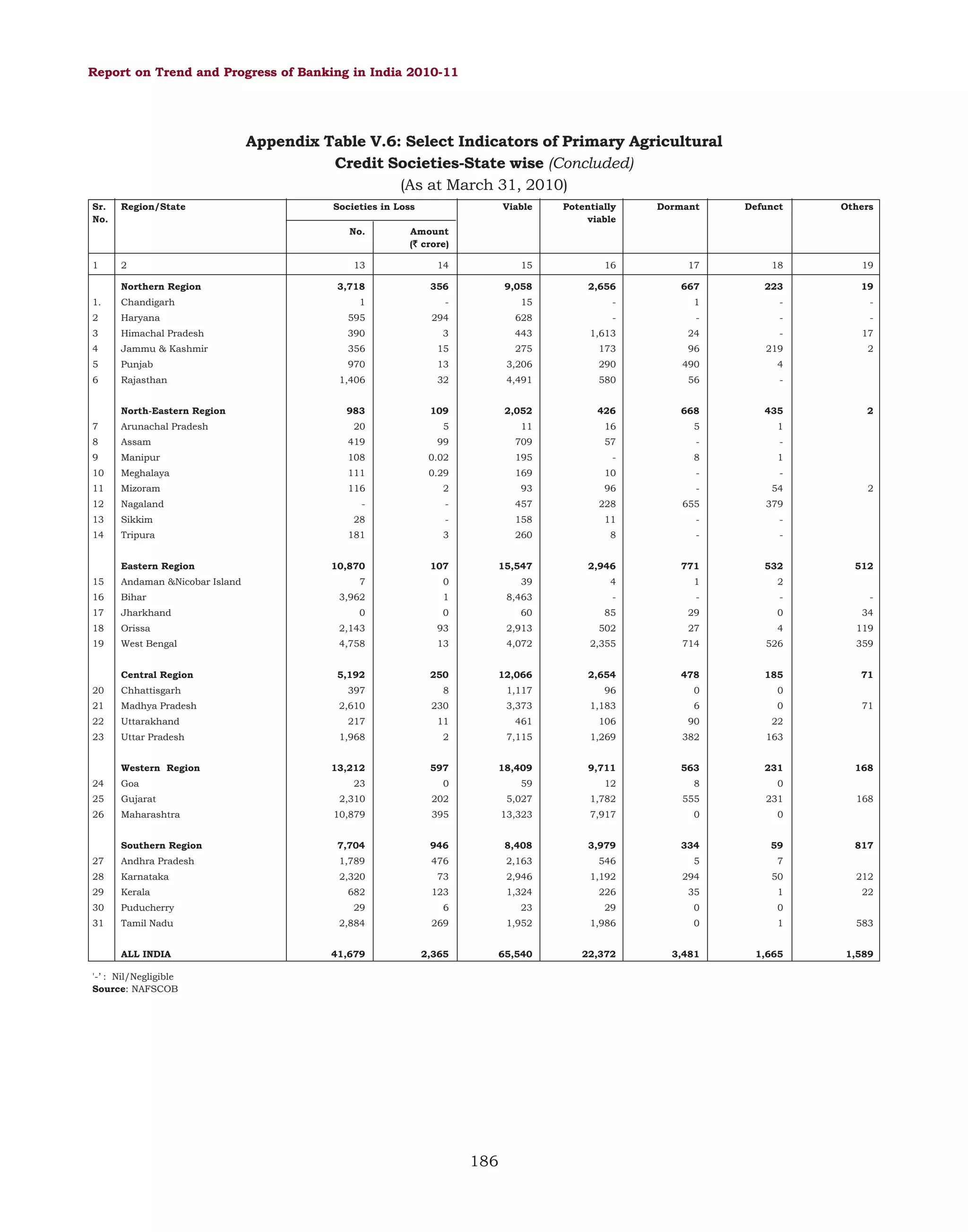

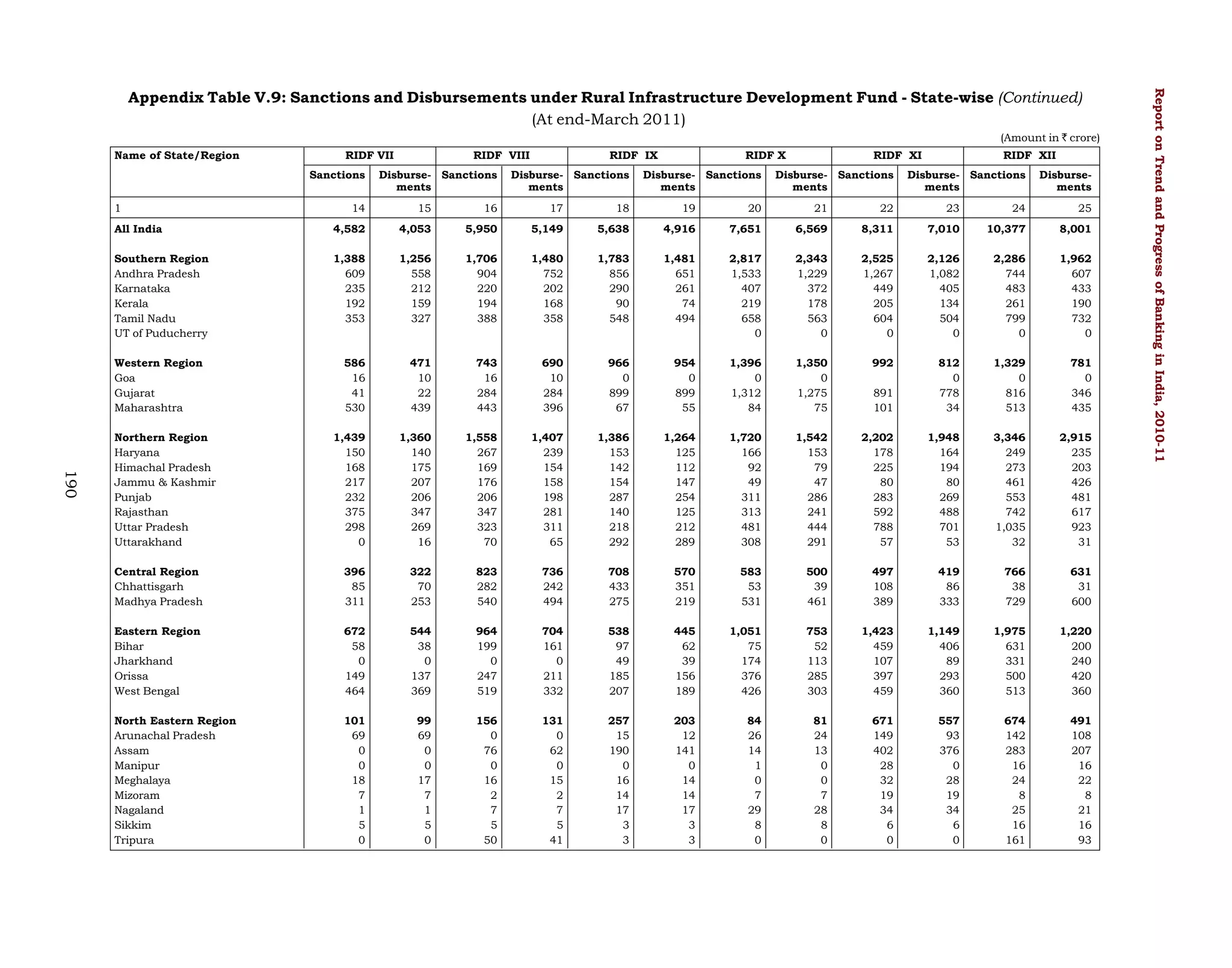

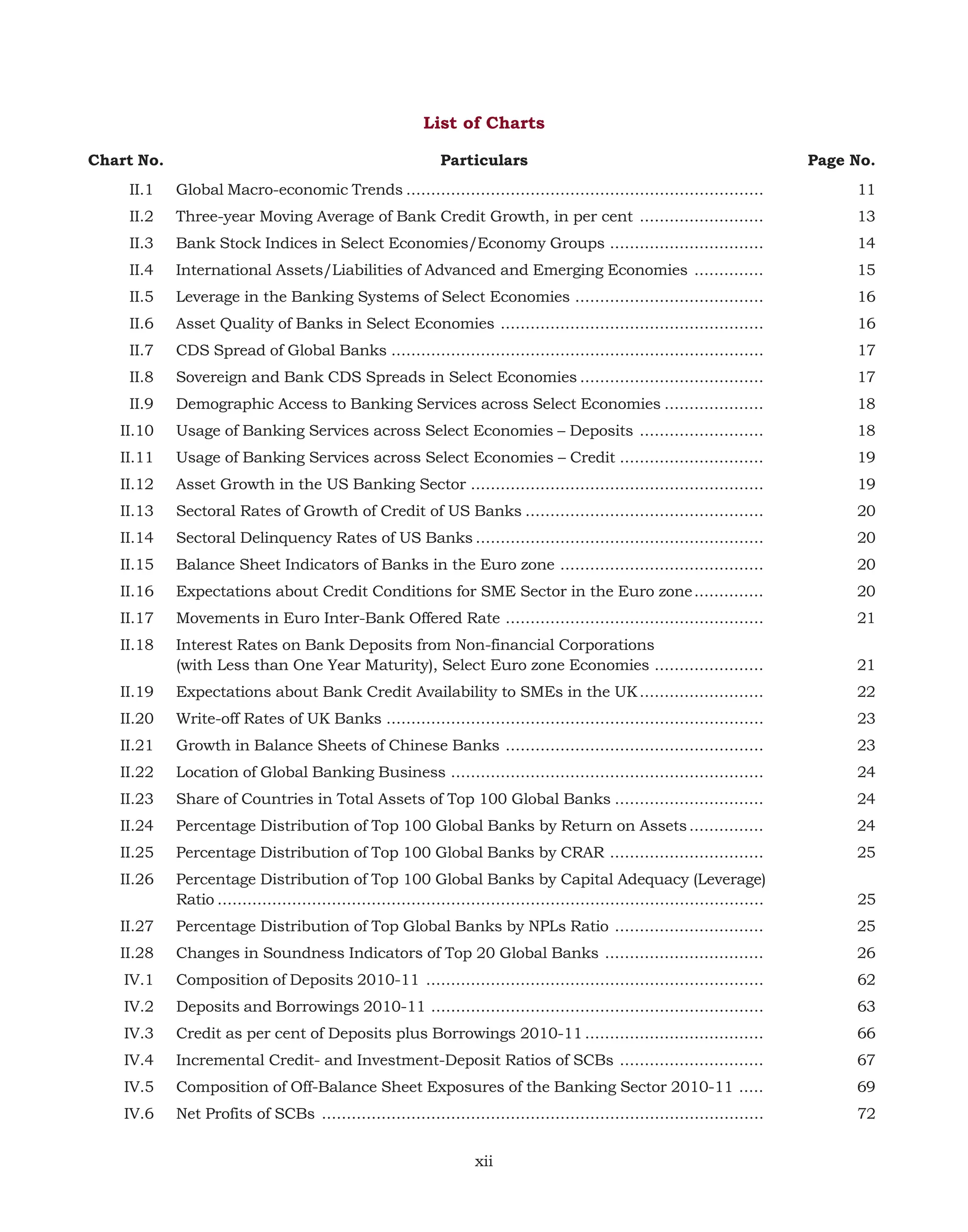

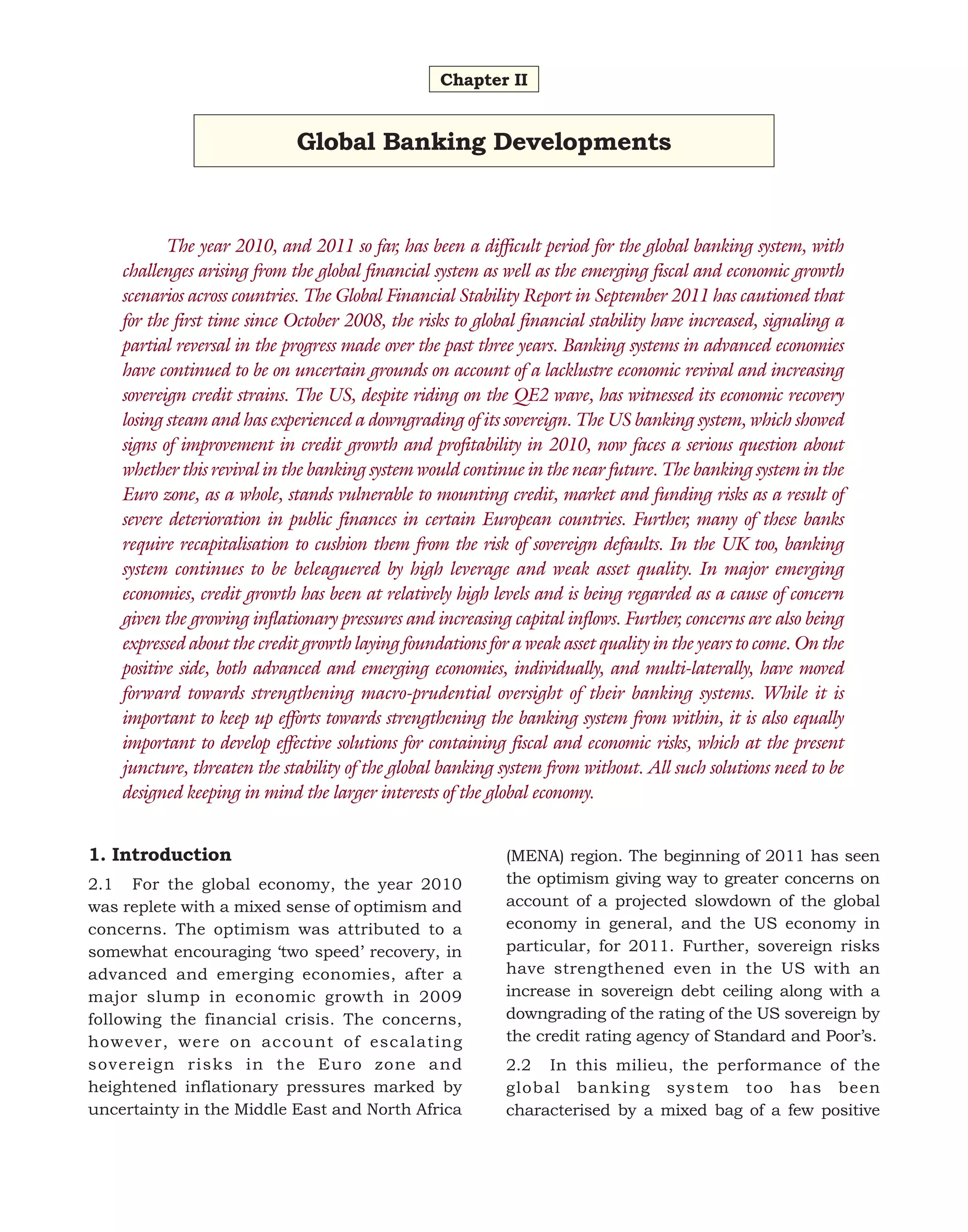

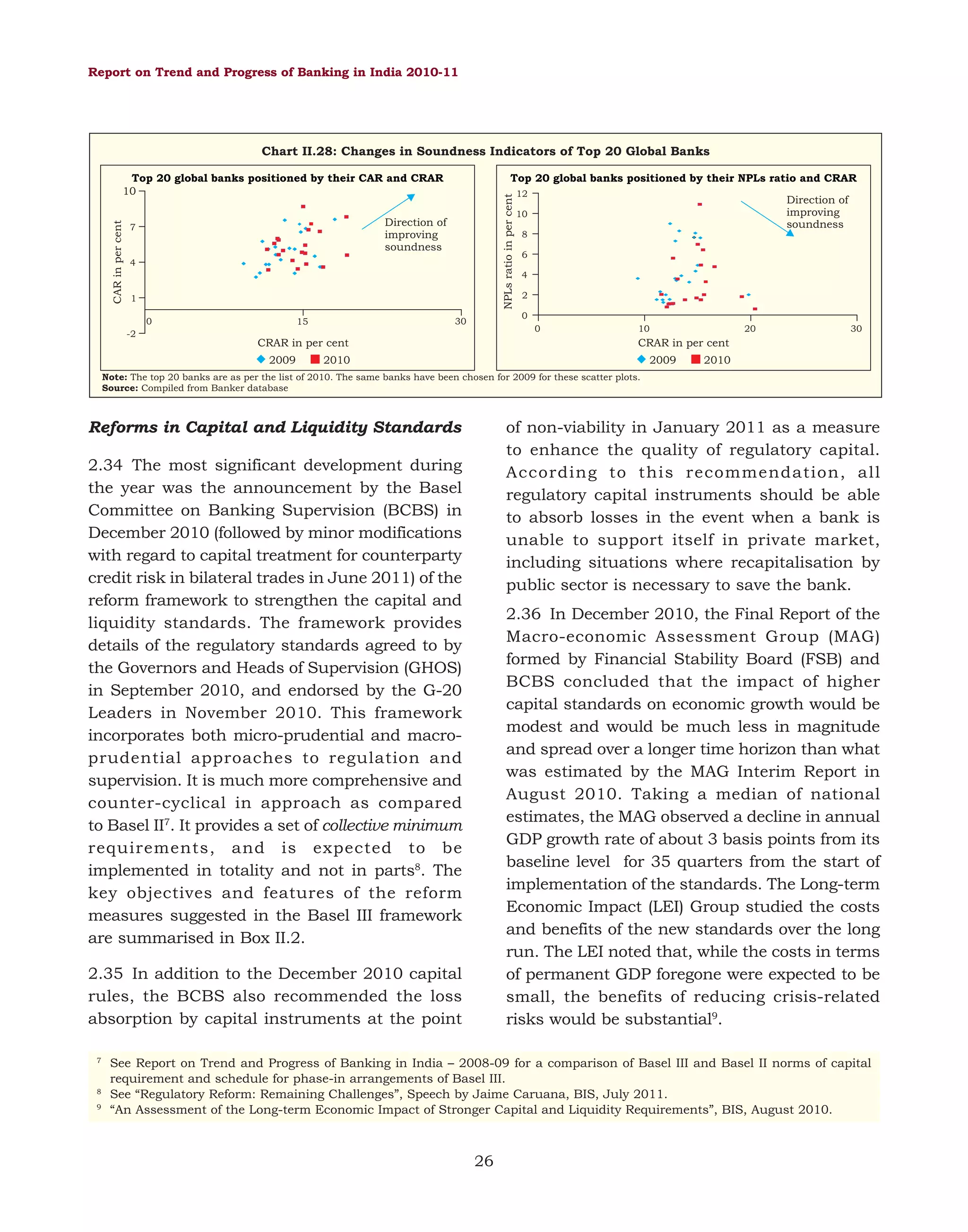

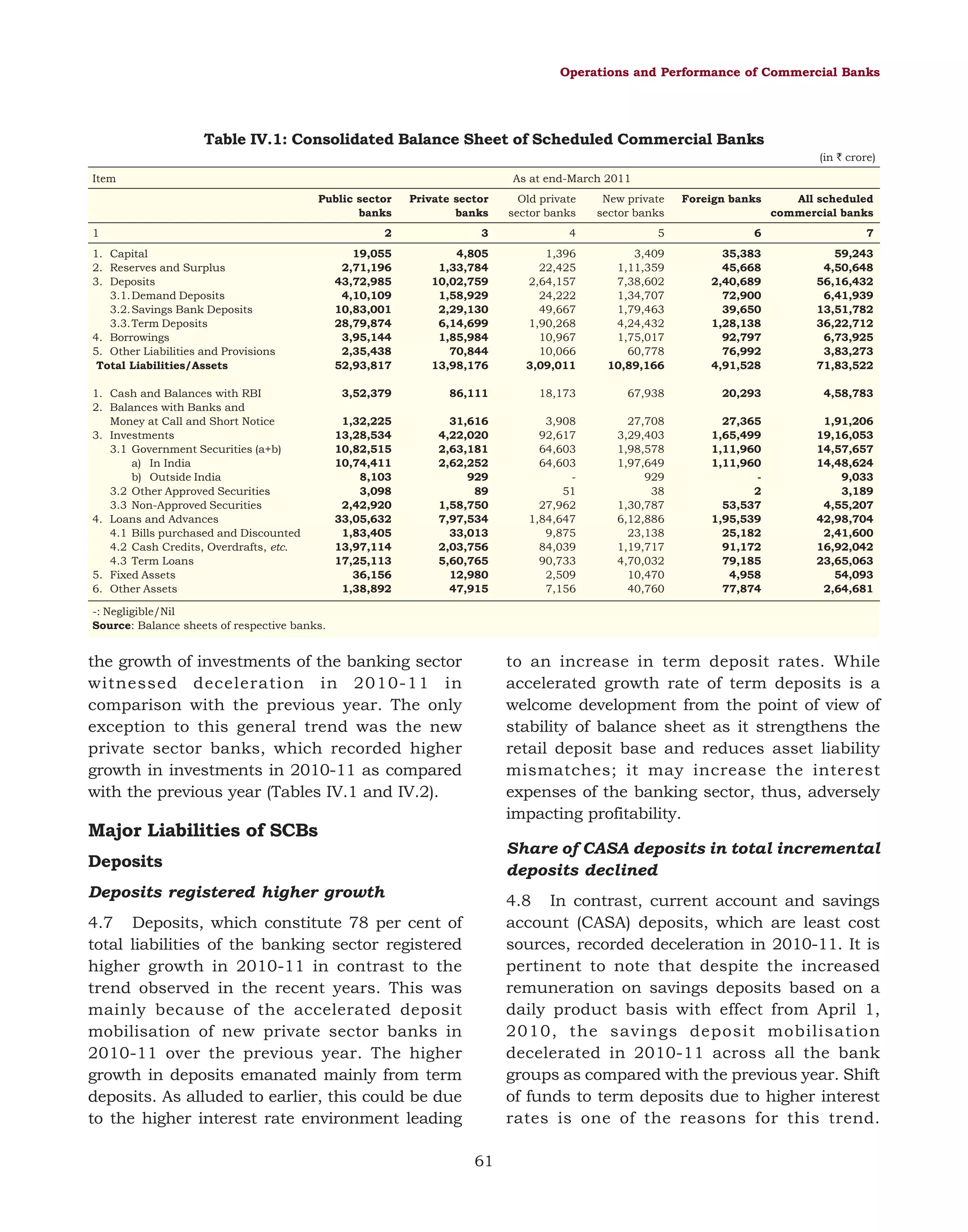

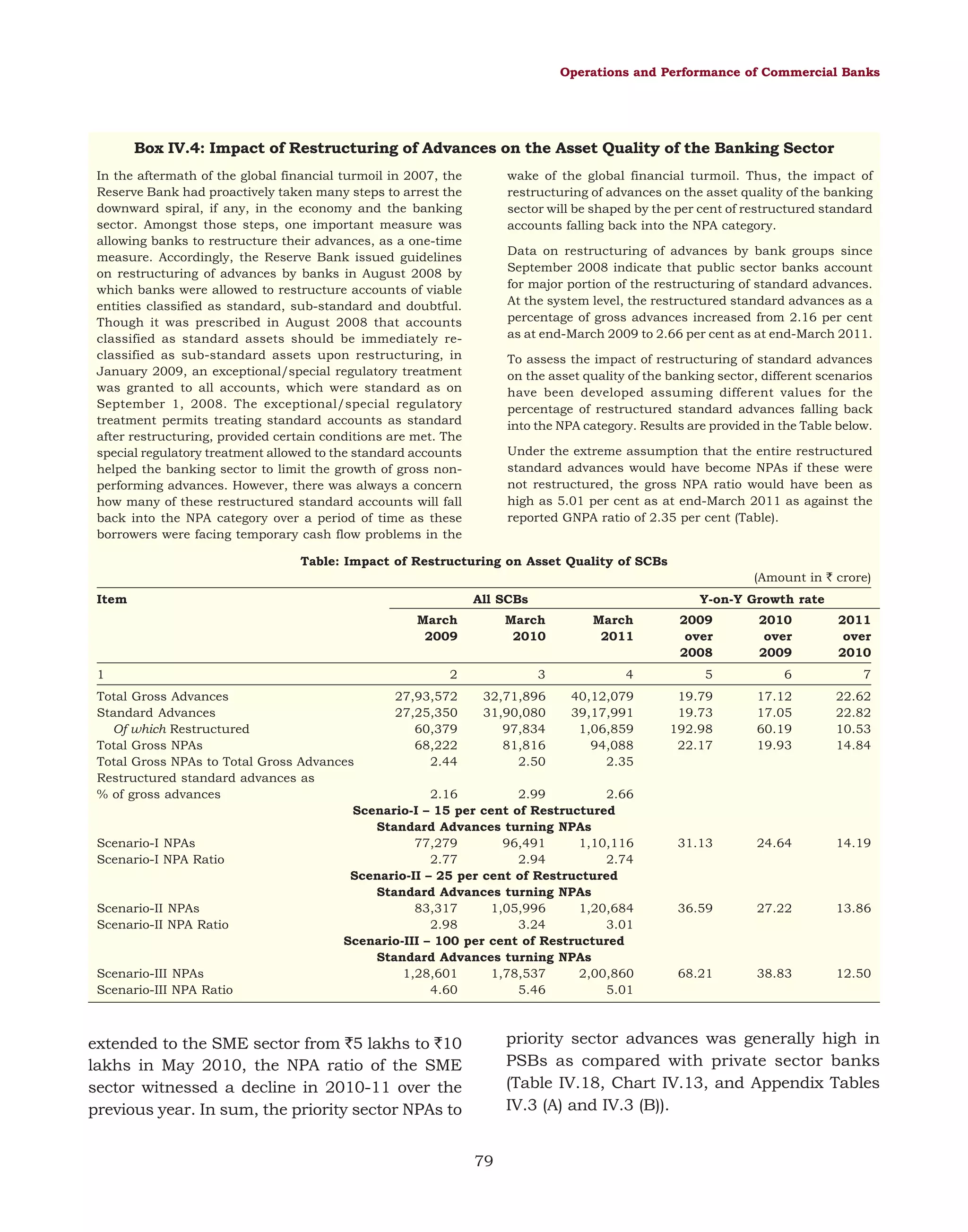

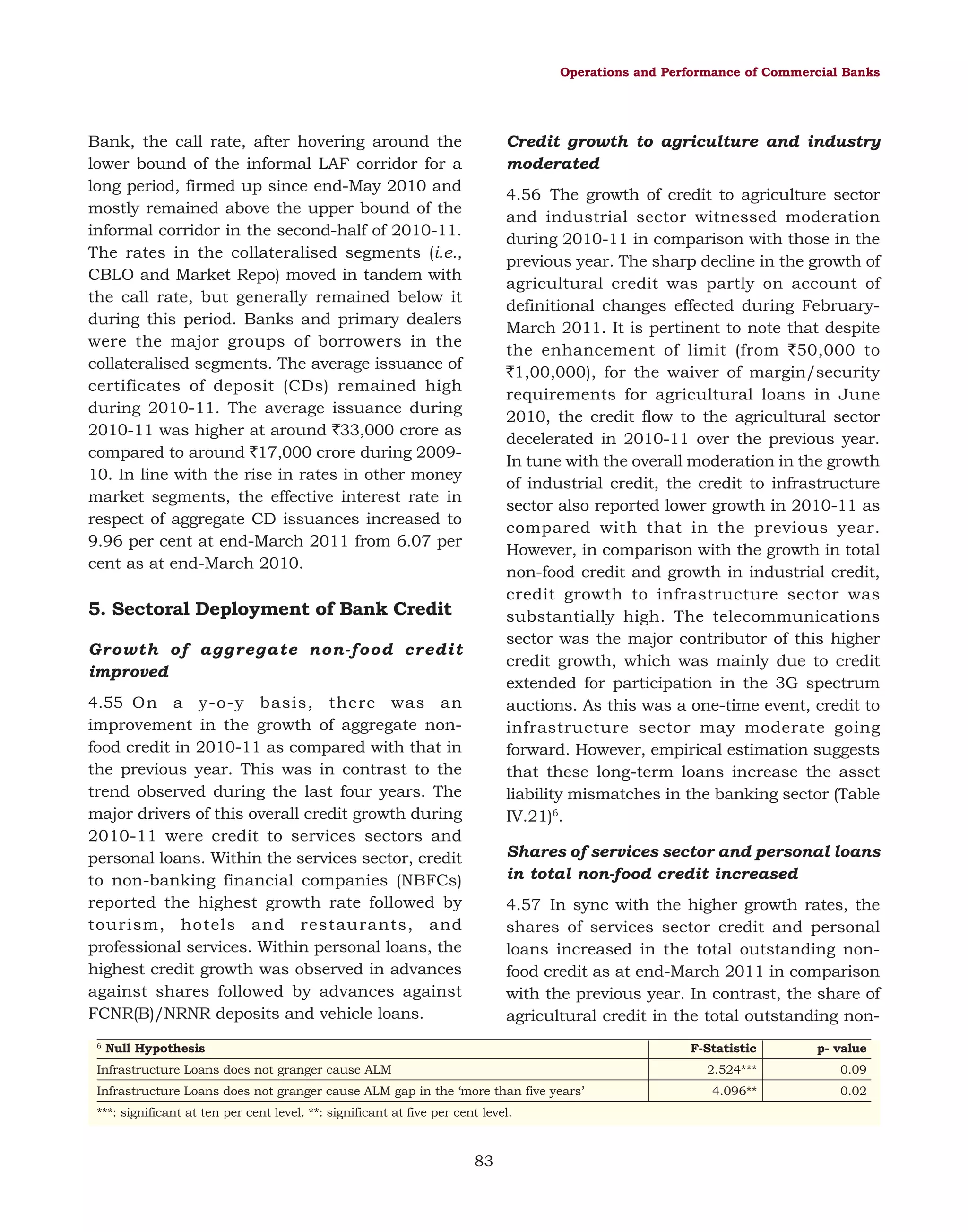

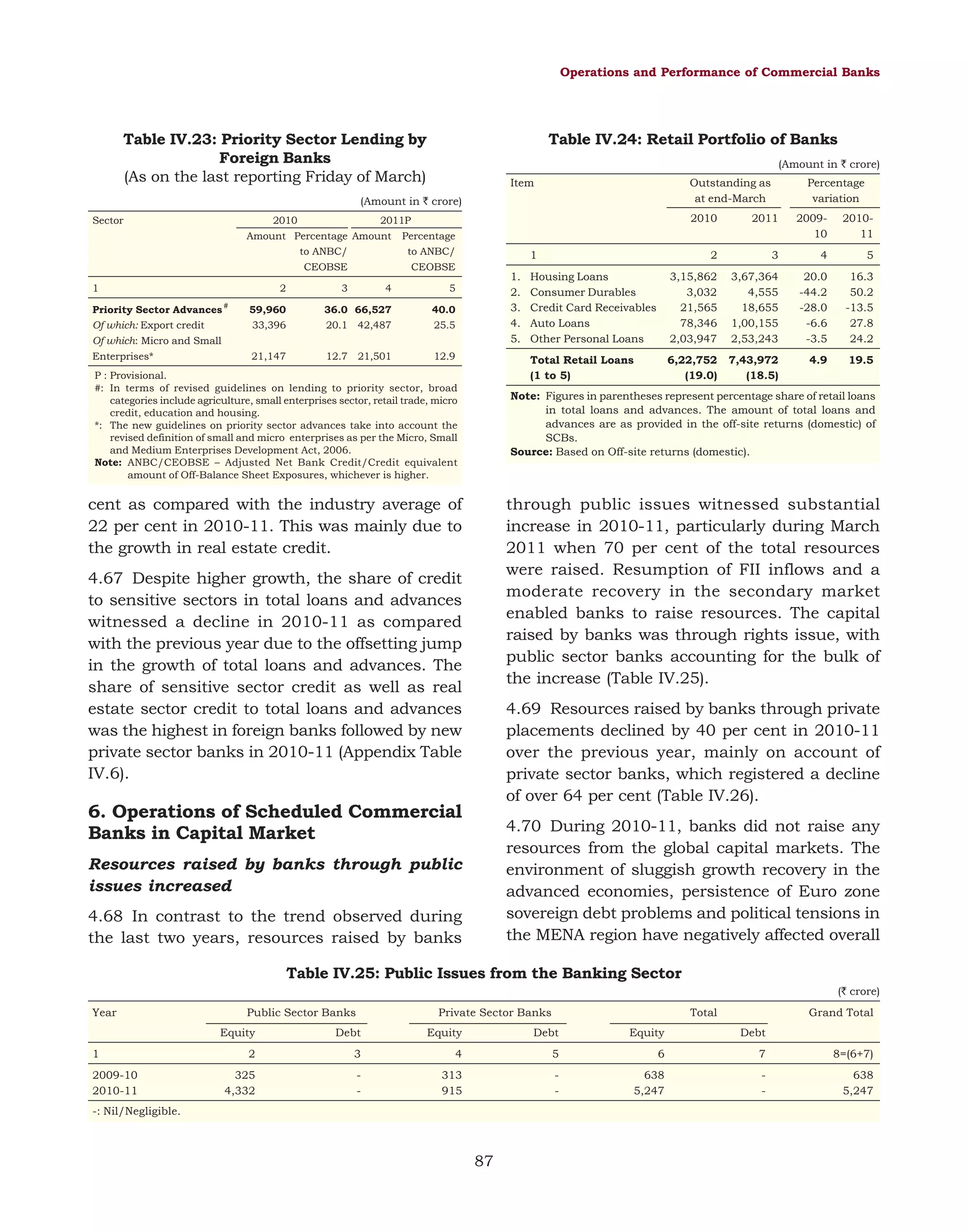

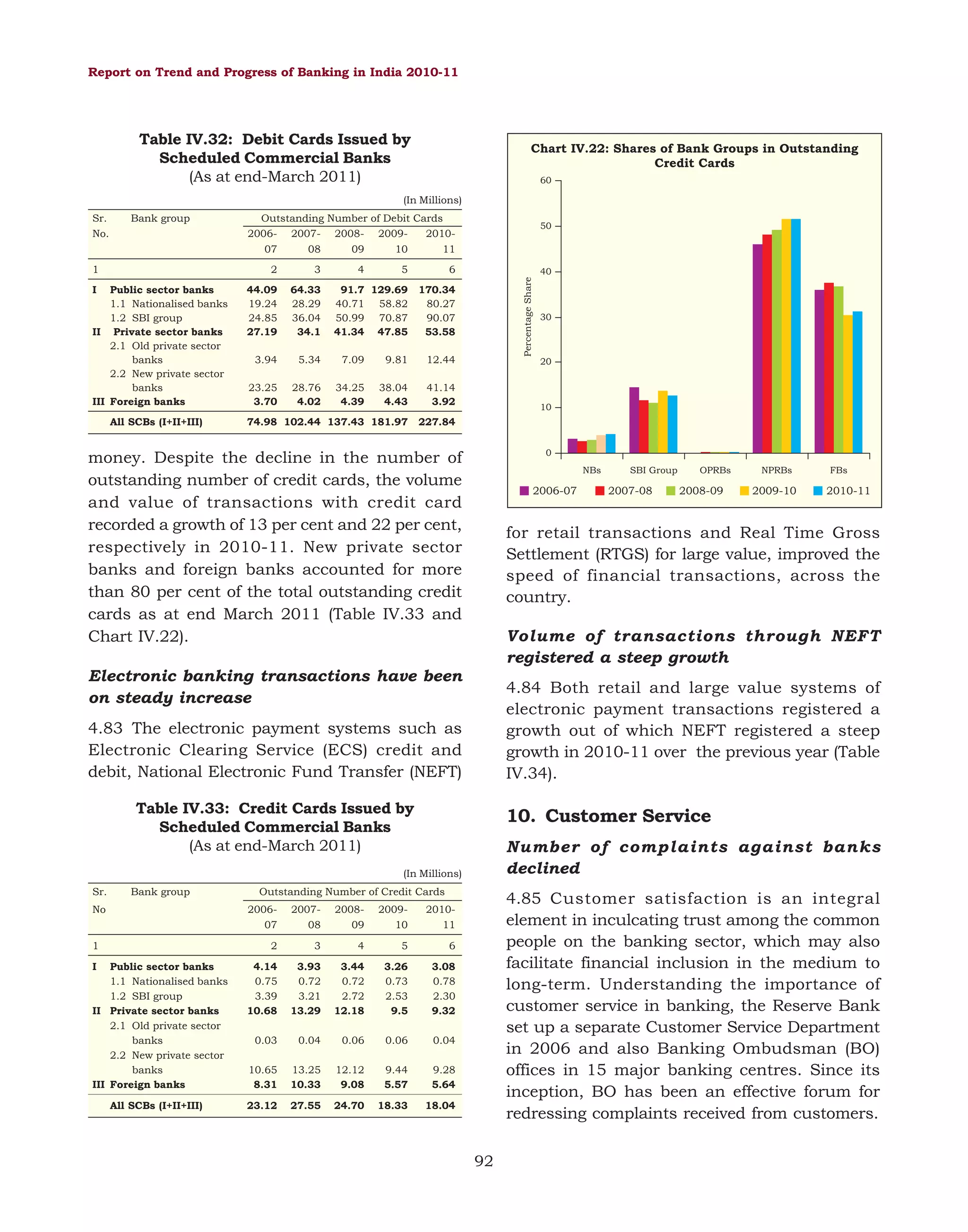

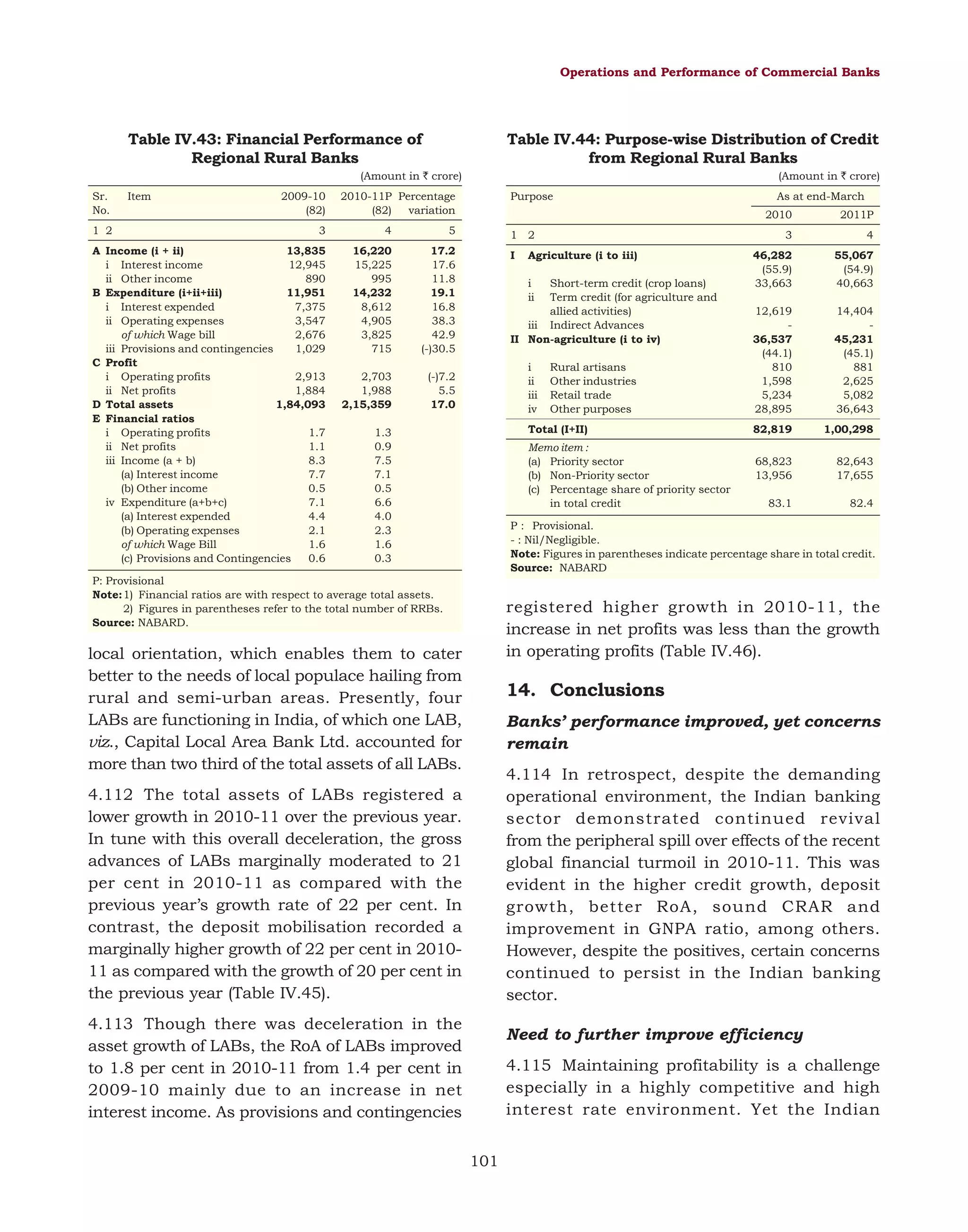

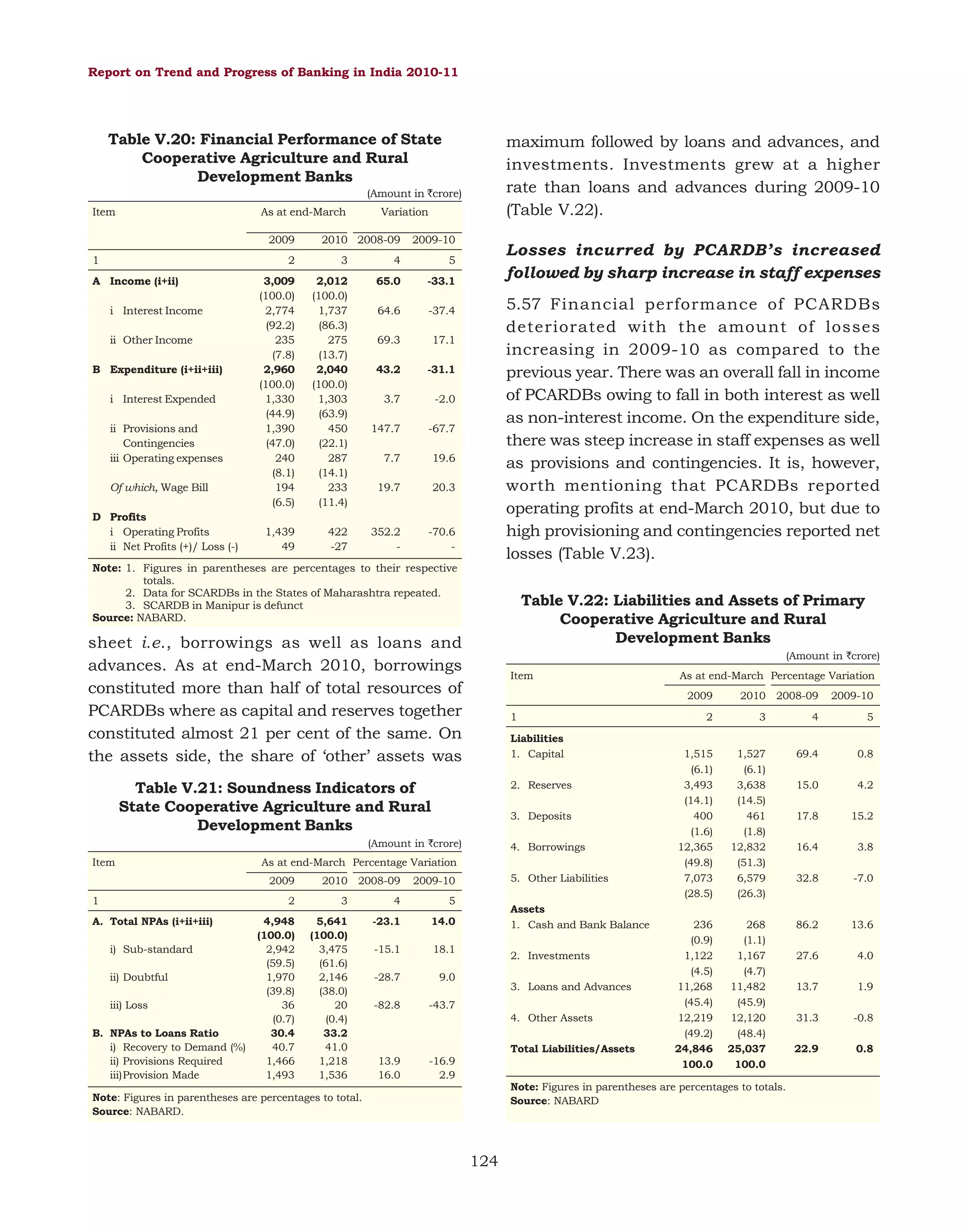

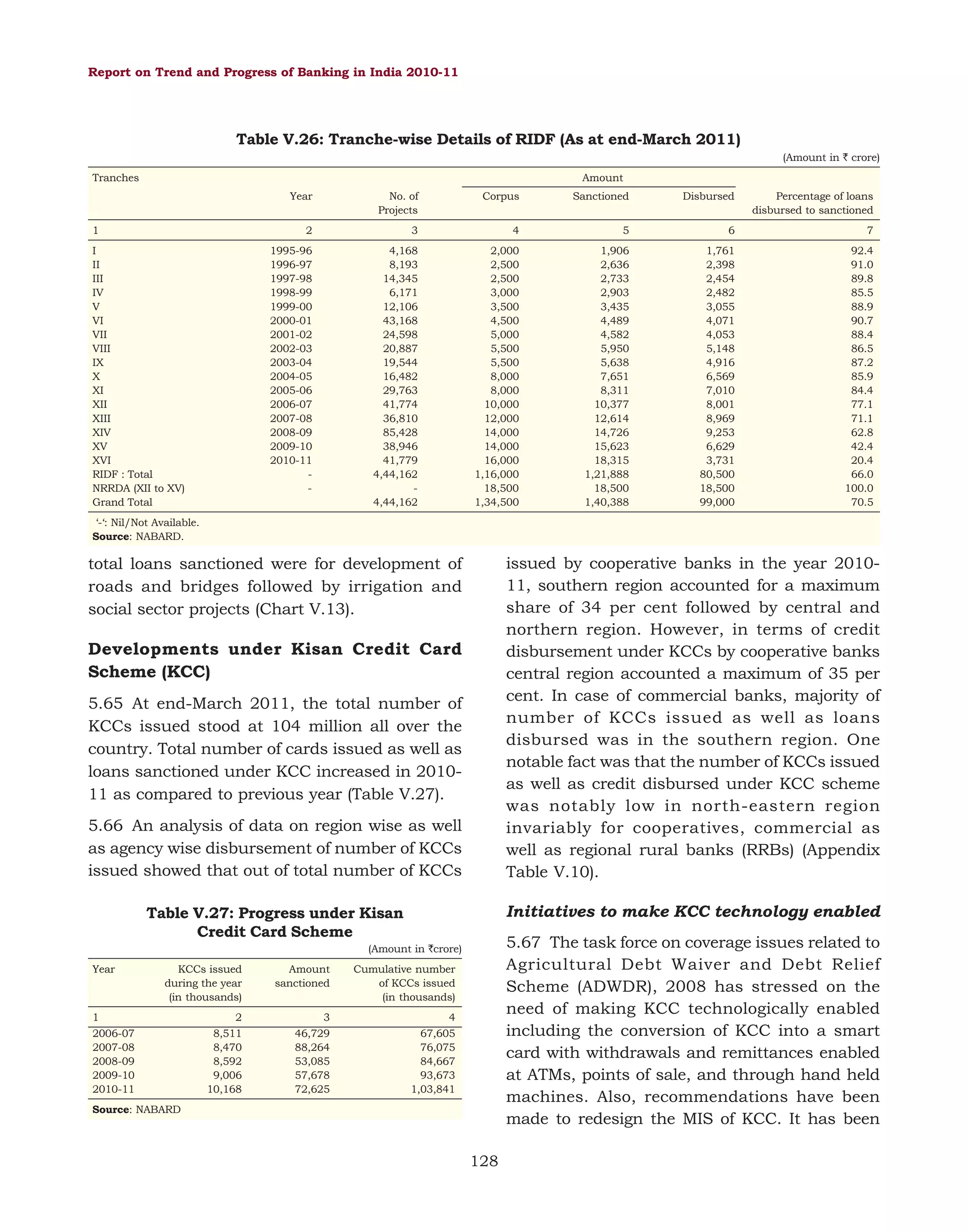

4.95 Despite the efforts taken, the population

per bank branch (after including branches of

RRBs) in North Eastern, Eastern and Central

regions continued to be substantially higher than

the national average in 2010-11 (Chart IV.25).

Bank group

(At end-March 2011)

Rural

1

Semi–

urban

Urban

Metro

politan

Total

2

3

4

5

6

5,872

(11.9)

Nationalised Banks*

2,718

(10.9)

State Bank Group

3,154

(12.8)

Private sector banks

1,262

(5.3)

Old Private Sector Banks

332

(8.0)

New Private Sector Banks

930

(4.8)

Foreign Banks

21

(1.5)

13,278

(26.8)

5,680

(22.9)

7,598

(30.8)

4,784

(20.2)

1,339

(32.5)

3,445

(17.6)

20

(1.5)

16,186

(32.7)

8,132

(32.7)

8,054

(32.7)

7,576

(32.0)

1,401

(34.0)

6,175

(31.6)

300

(21.9)

14,151

(28.6)

8,306

(33.4)

5,845

(23.7)

10,029

(42.4)

1,054

(25.5)

8,975

(46.0)

1,026

(75.1)

49,487

(100.0)

24,836

(100.0)

24,651

(100.0)

23,651

(100.0)

4,126

(100.0)

19,525

(100.0)

1,367

(100.0)

Total

18,082

(24.3)

[24.9]

24,062

(32.3)

[21.8]

25,206

(33.8)

[21.7]

74,505

(100.0)

[23.9]

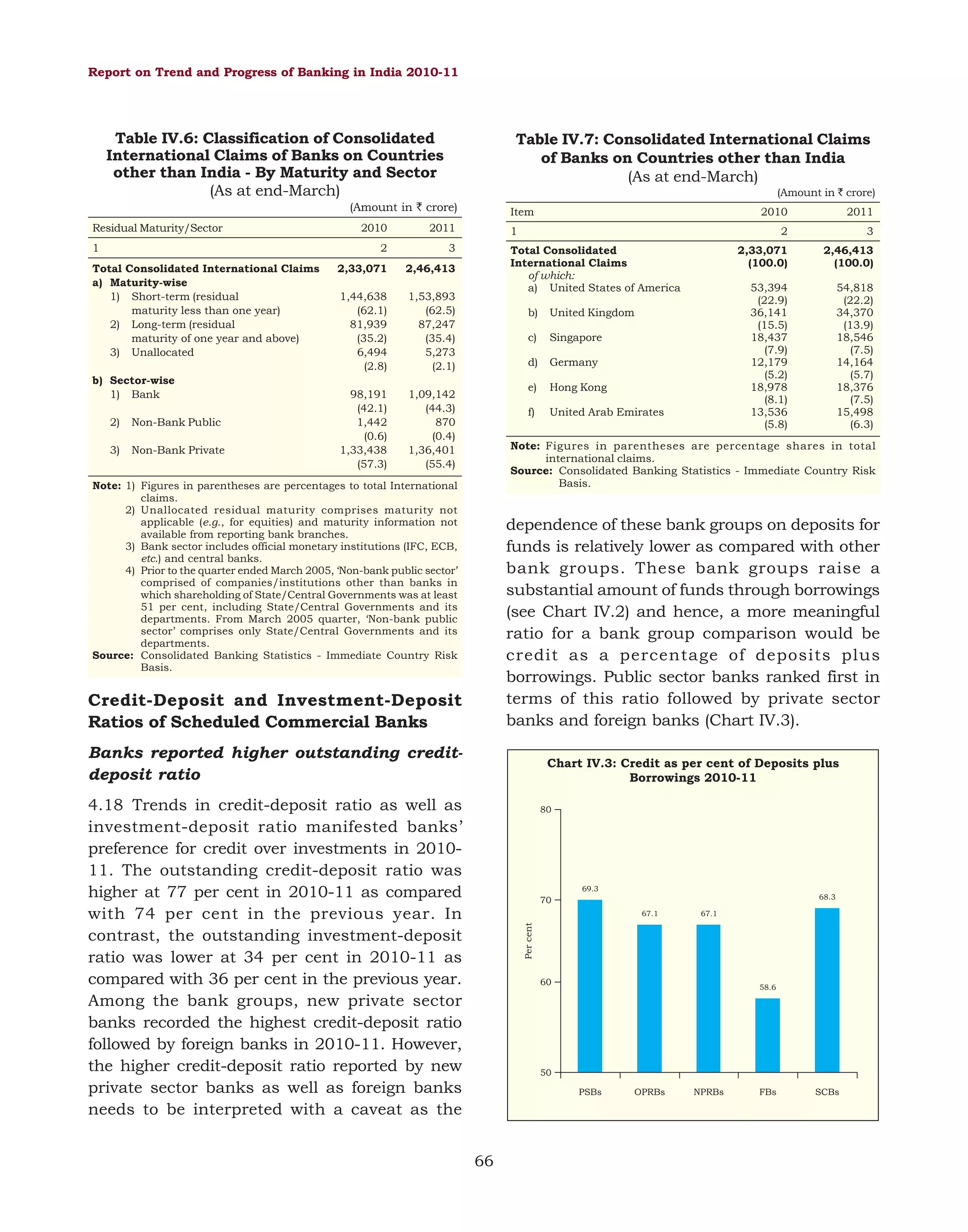

Public sector banks

Expansion of Banking Network through

ATMs

Nearly 50 per cent of the net increase in

ATMs was at off-site locations

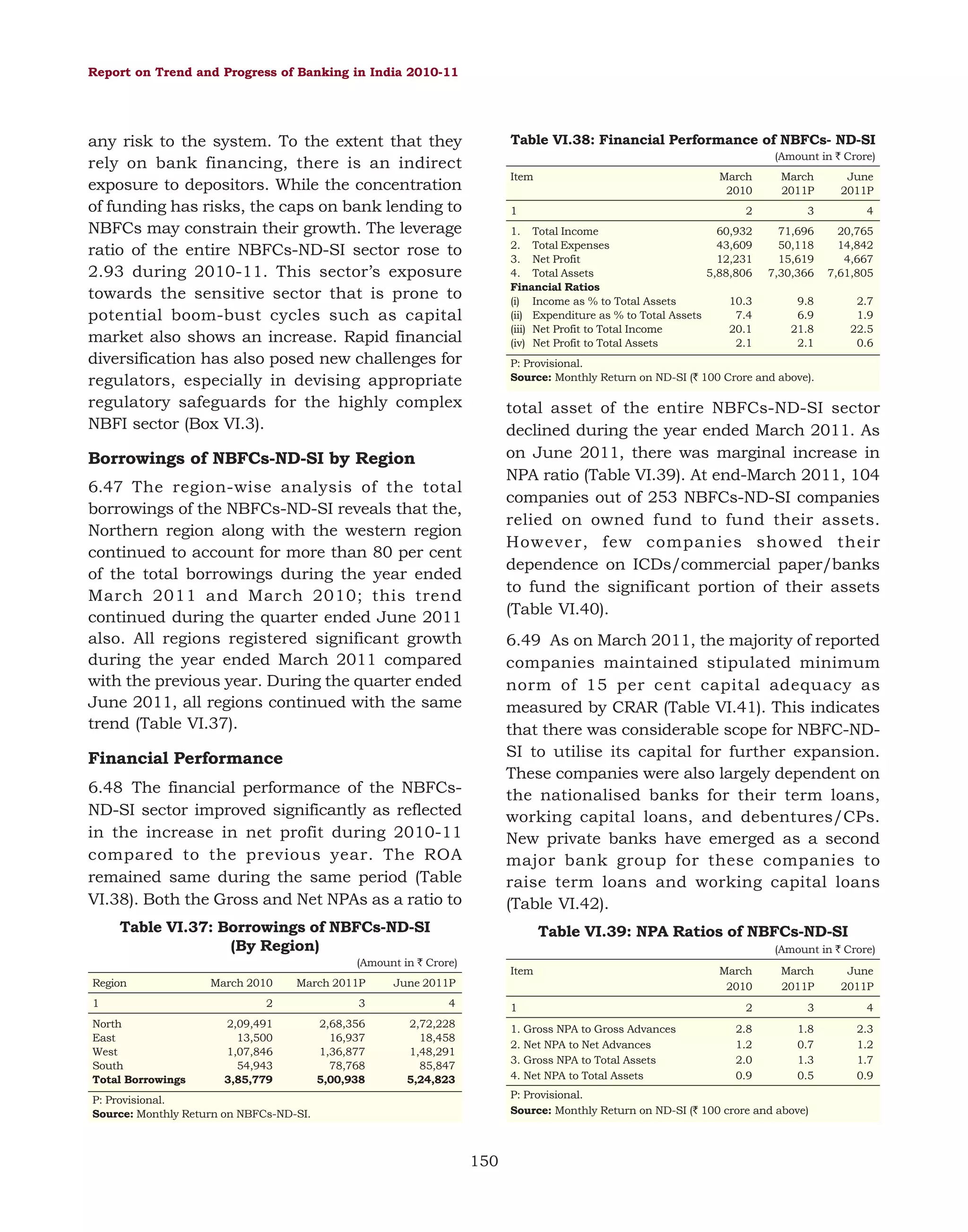

4.96 From the point of view of banking

penetration, off-site ATMs have more relevance

than on-site ATMs. Out of the total net increase

in ATMs in 2010-11, 44 per cent were off-site

ATMs. Sixty three per cent of the net addition of

ATMs by new private sector banks and 98 per

cent of net addition of ATMs by foreign banks

were at off-site locations in 2010-11. Almost 41

per cent and 49 per cent, respectively of the net

addition of ATMs by nationalised banks and old

private sector banks were also at off-site

locations.

7,155

(9.6)

[37.7]

*: Include IDBI Bank Ltd.

Note: 1) Figures in parentheses indicate percentage share of total ATMs

under each bank group.

2) Figures in square brackets are percentage variation over the

previous year.

followed by nationalised banks (38 per cent)

(Table IV.39 and Chart IV.26).

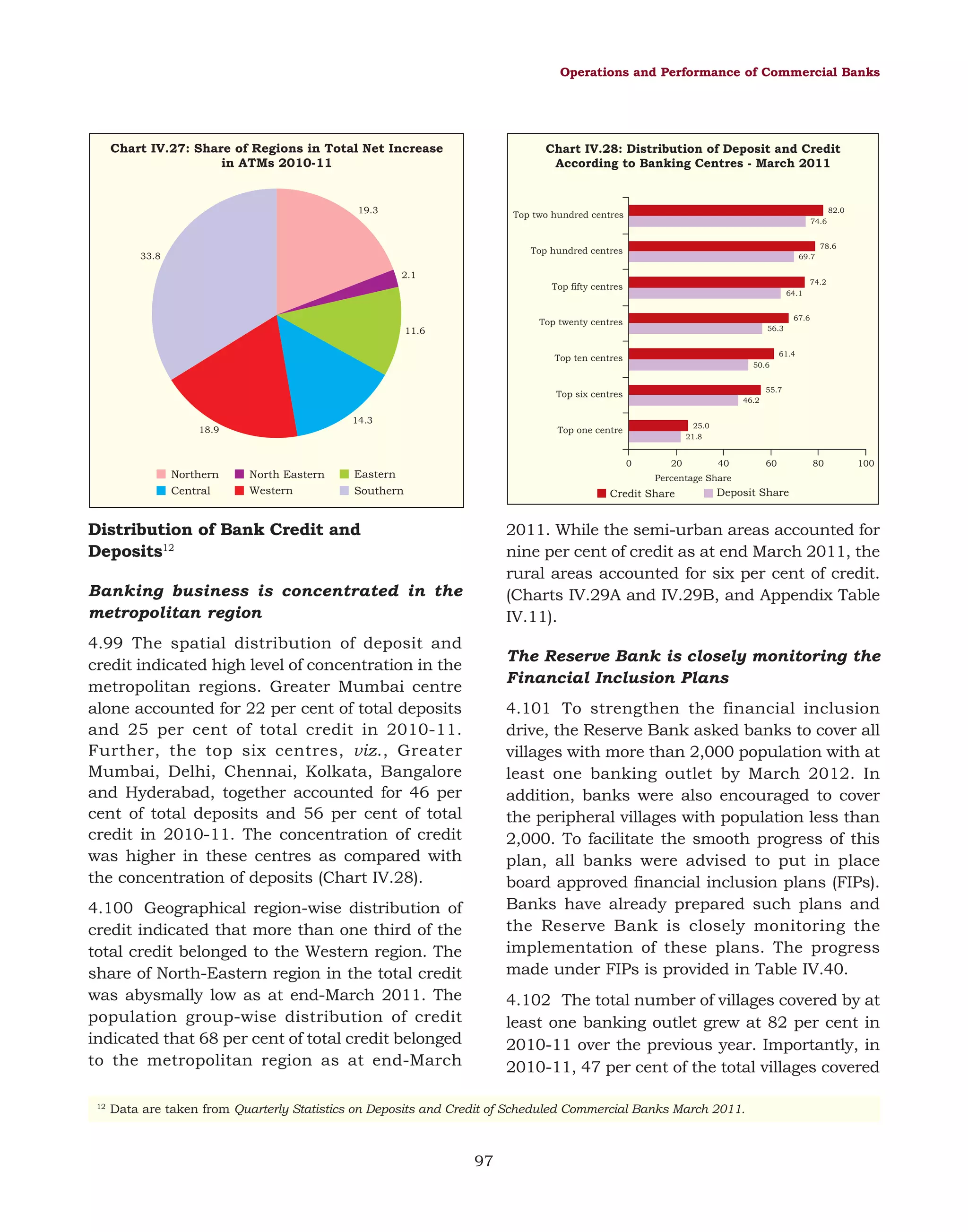

4.98 The share of the North Eastern region was

the lowest in the incremental deployment of

ATMs in 2010-11 (Chart IV.27).

Chart IV.25: Region-wise Population per Bank Branch

(end March 2011)

Chart IV.26: Population Group-wise Distribution of ATMs

(end-March 2011)

17,260

20000

18000

19,255

4.97 In 2010-11, almost one tenth of the total

ATMs were located in rural areas out of which

the State Bank group accounted for 44 per cent

18,328

Rural areas accounted for ten per cent of

total outstanding ATMs

North-Eastern region had the lowest share in

the incremental increase in the deployment

of ATMs

Metropolitan

centres, 33.8

10000

10,077

Population

12000

All India (13,466)

10,043

14000

12,496

16000

Public Sector

Banks, 82.1

Rural

centres, 9.6

8000

6000

Private Sector

Banks, 17.6

Urban

centres,

32.3

4000

FB, 0.3

2000

Semi–urban

centres, 24.3

0

Southern Northern Western

Central

Population per Bank Branch

Eastern

North

Eastern

All-India

96](https://image.slidesharecdn.com/0tpbi121111full-140101004243-phpapp02/75/0-tpbi121111-full-116-2048.jpg)

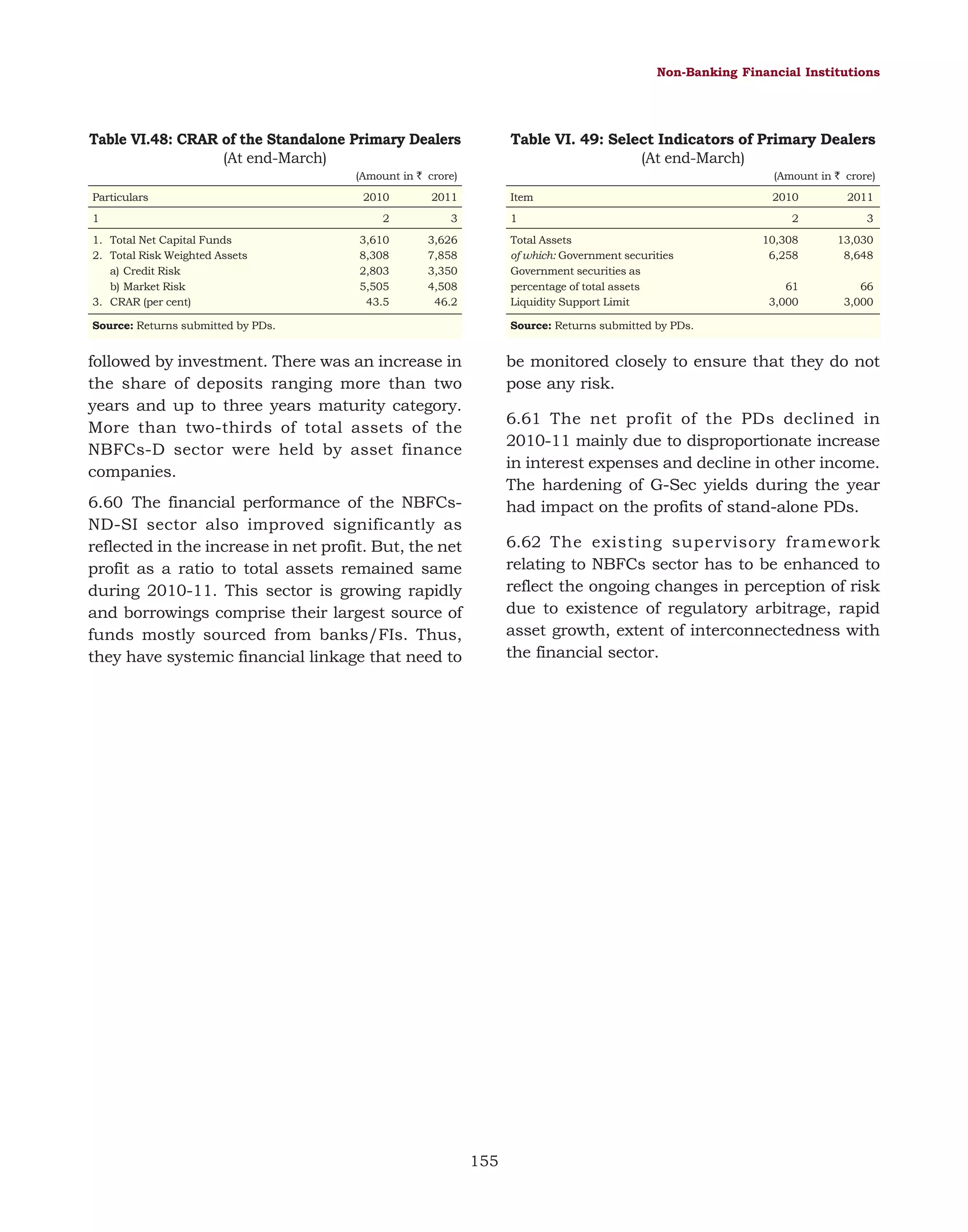

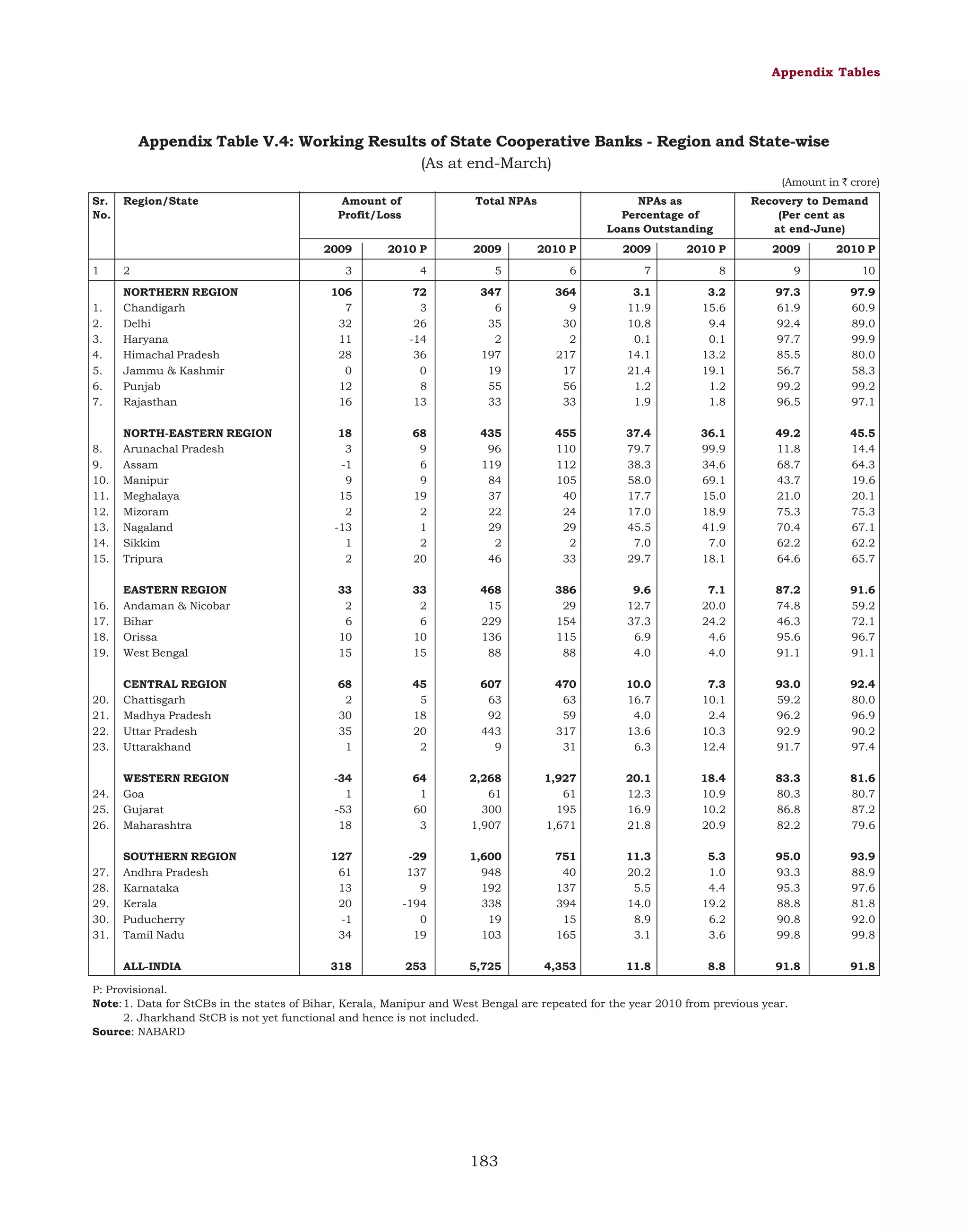

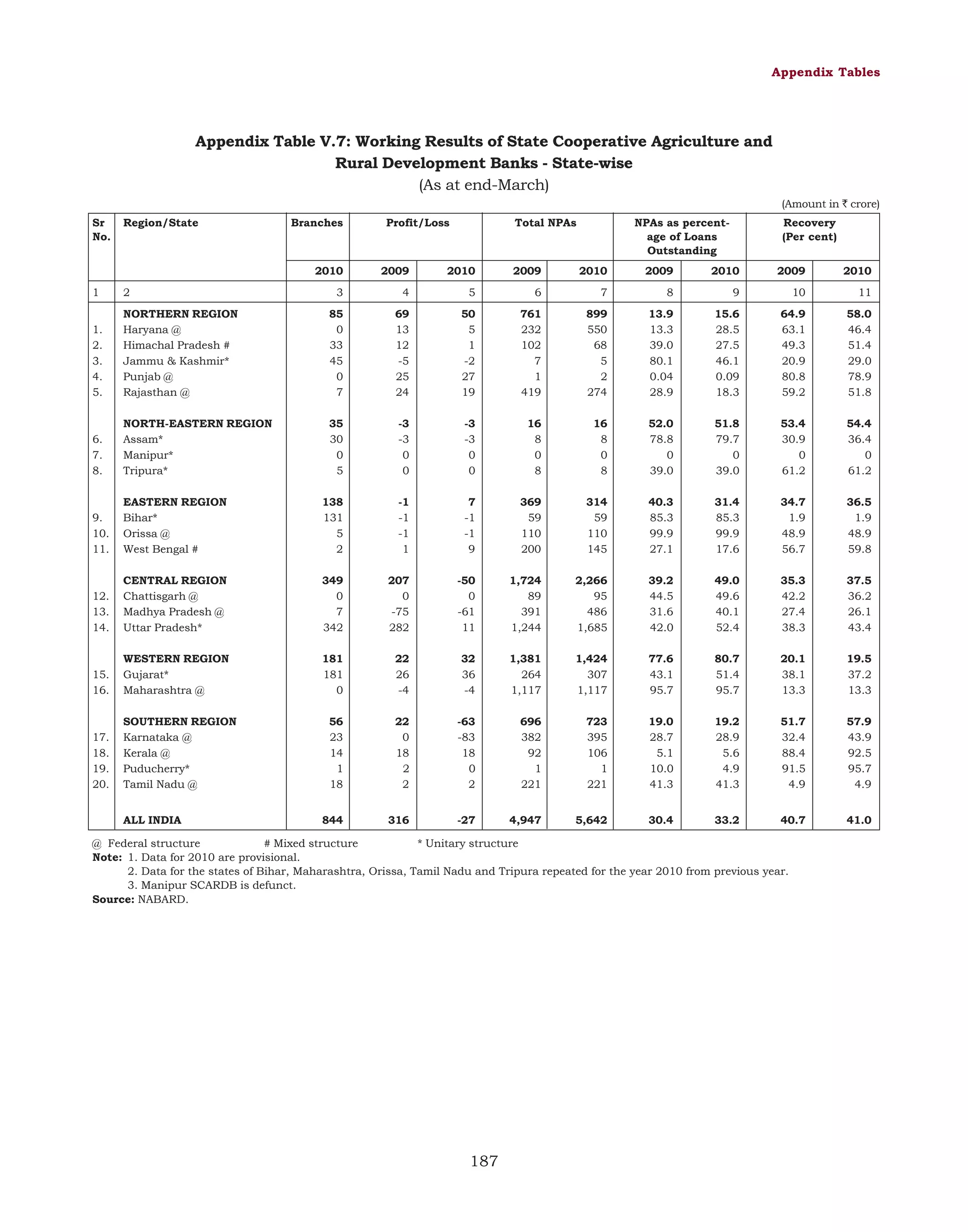

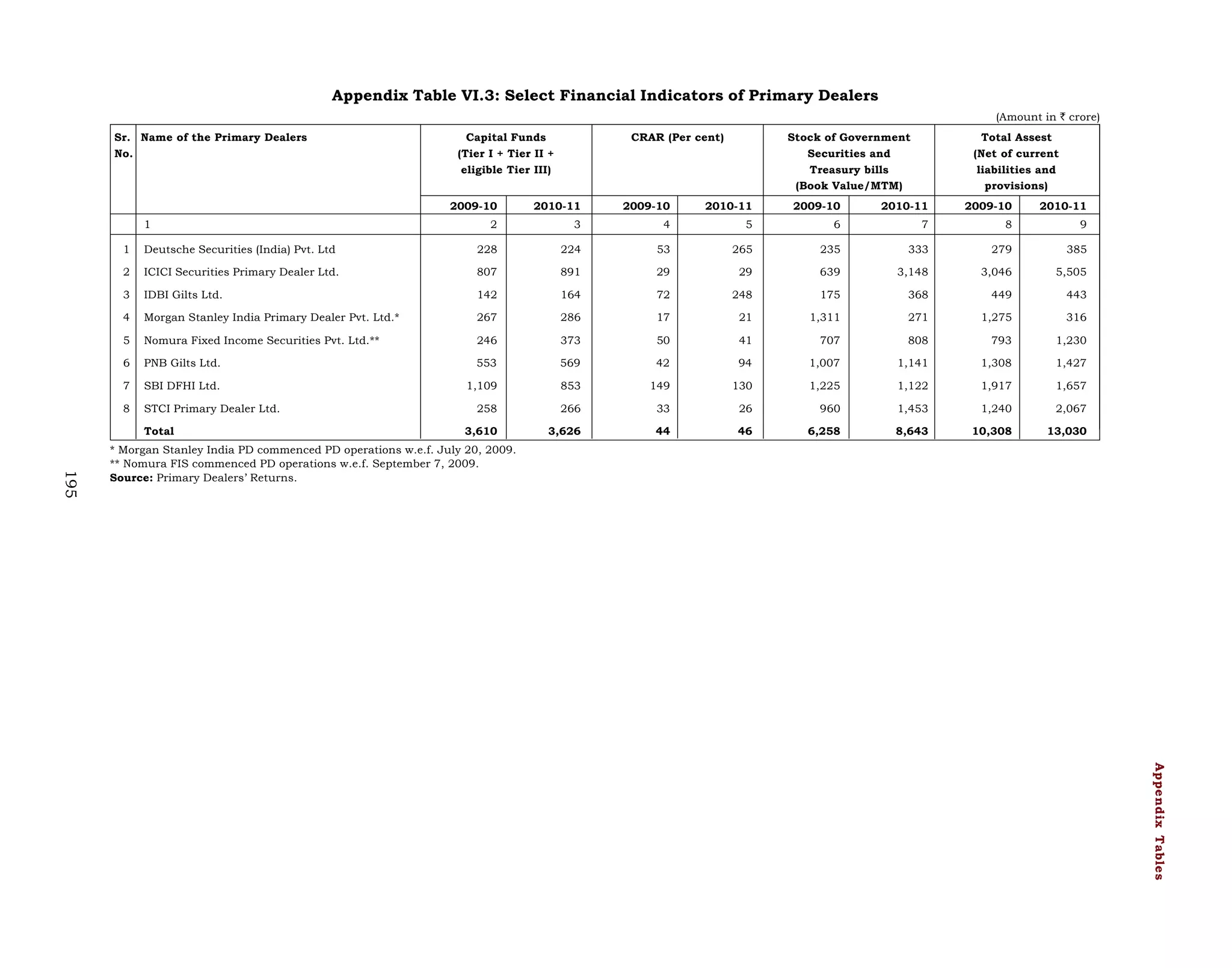

![Developments in Cooperative Banking

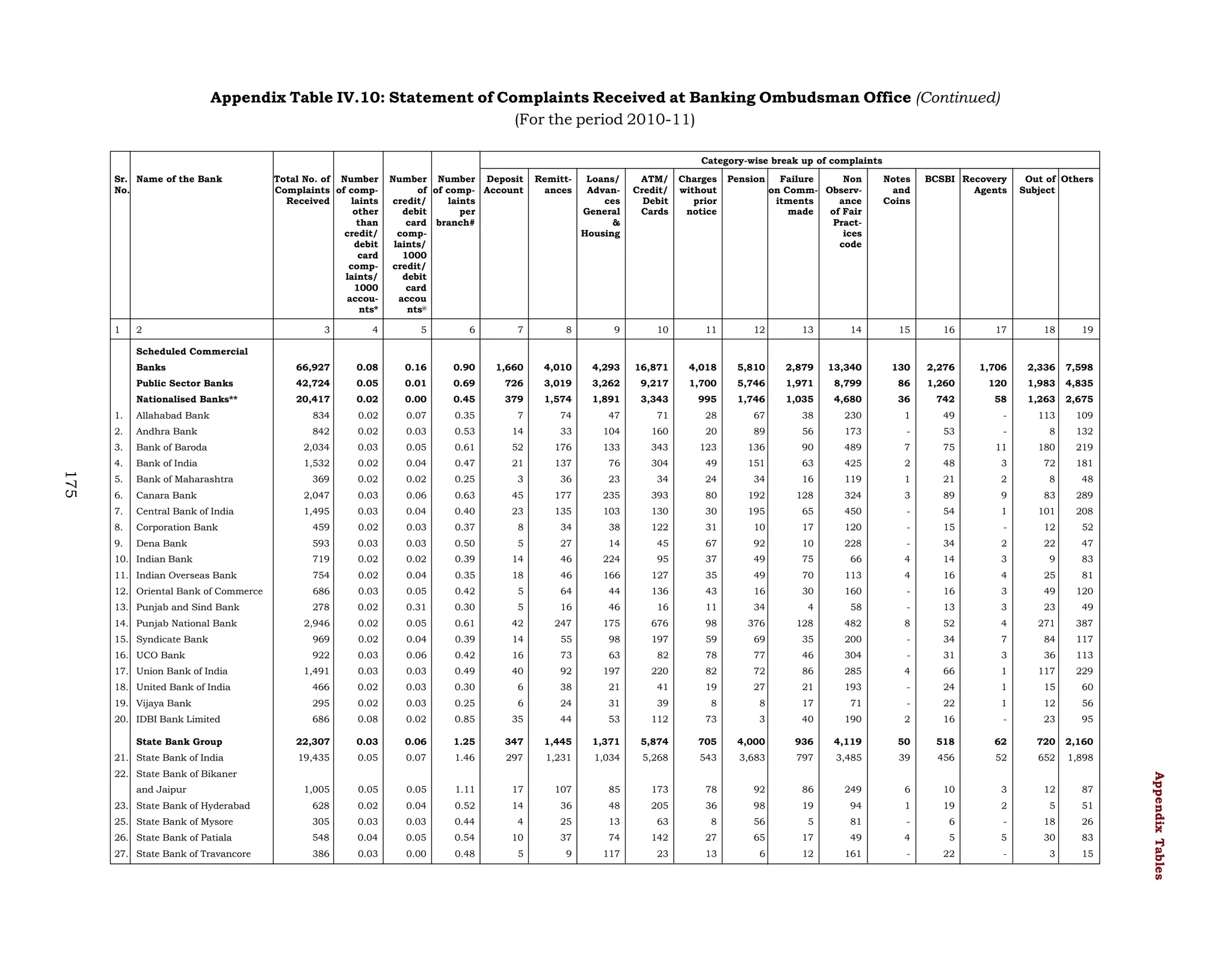

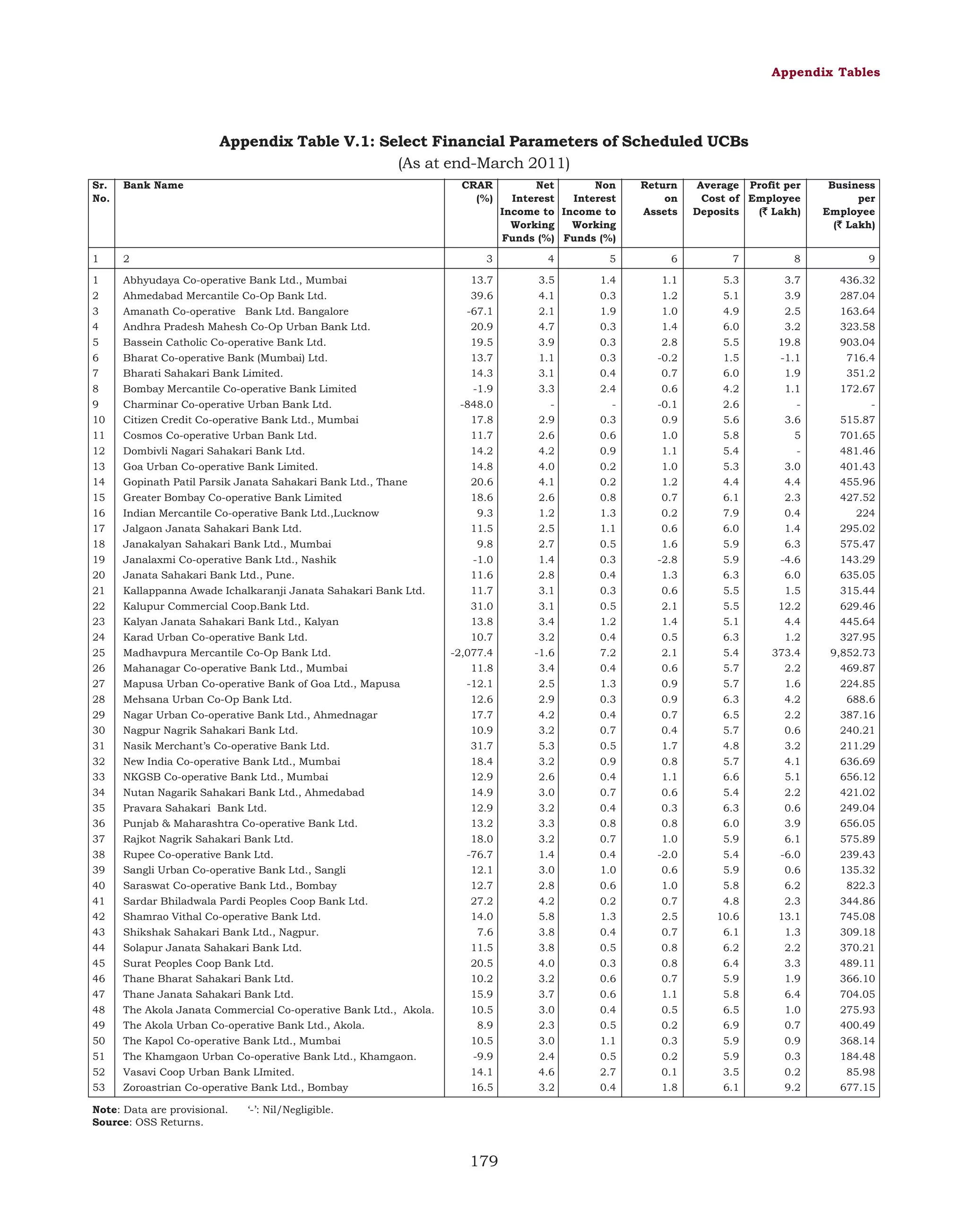

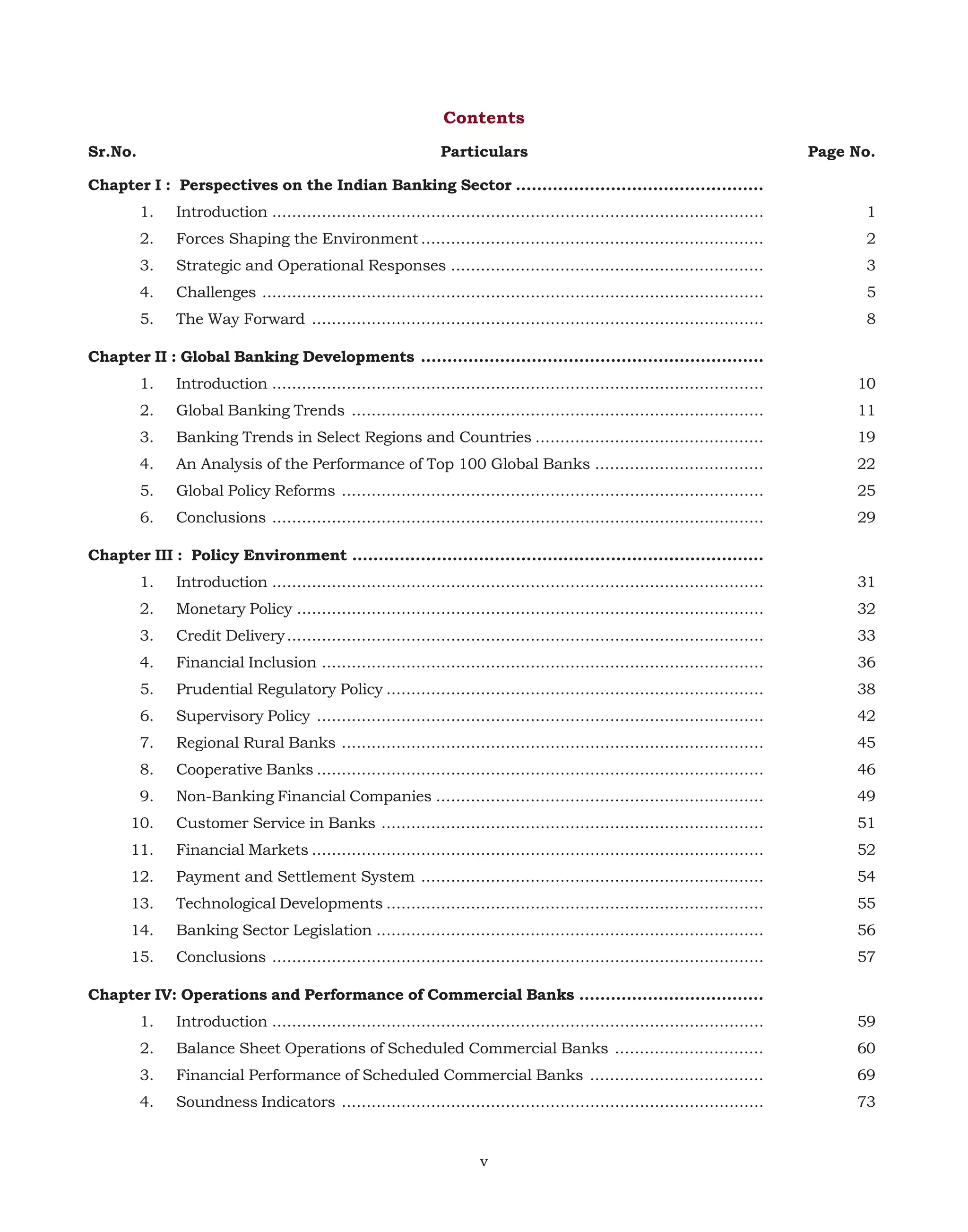

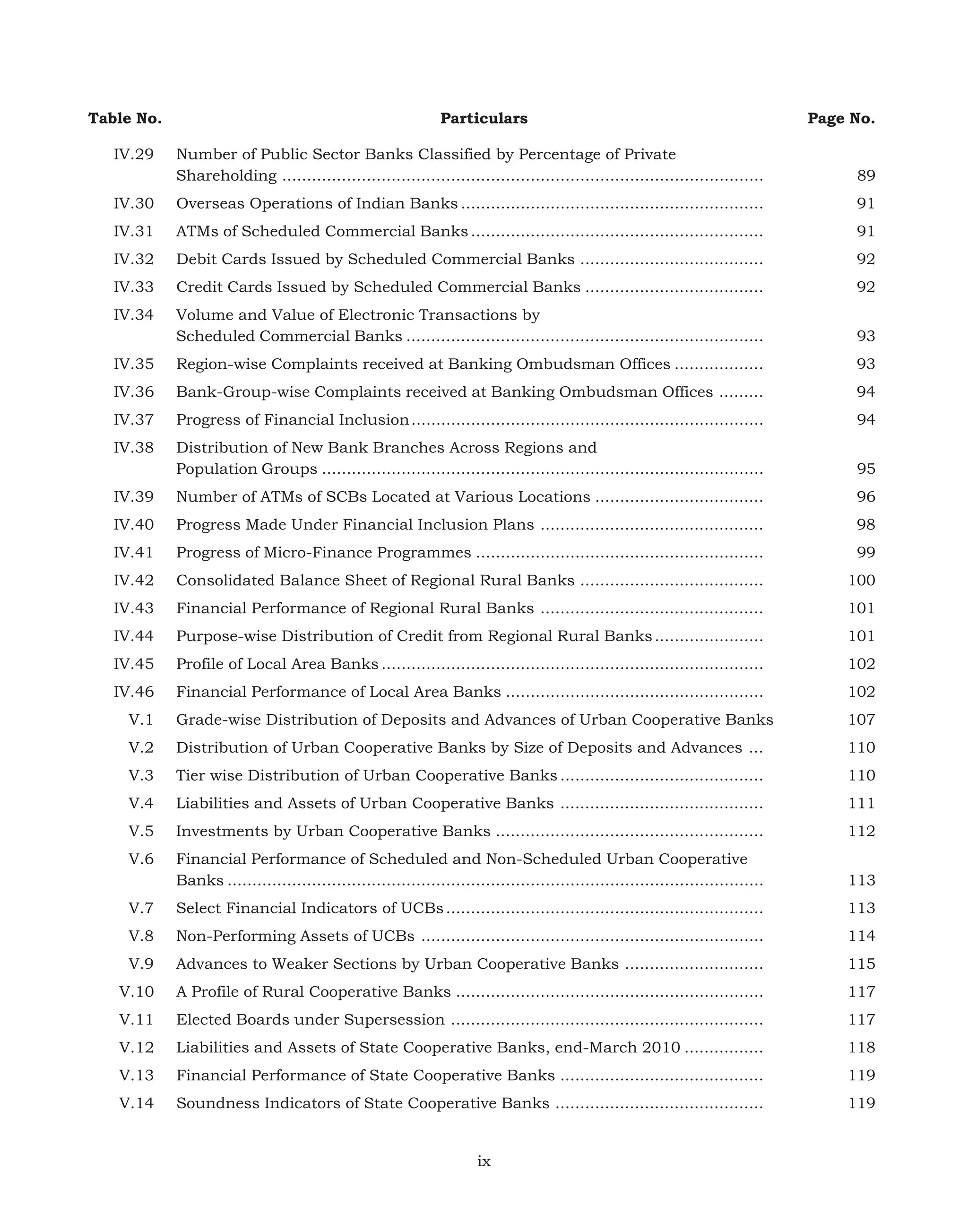

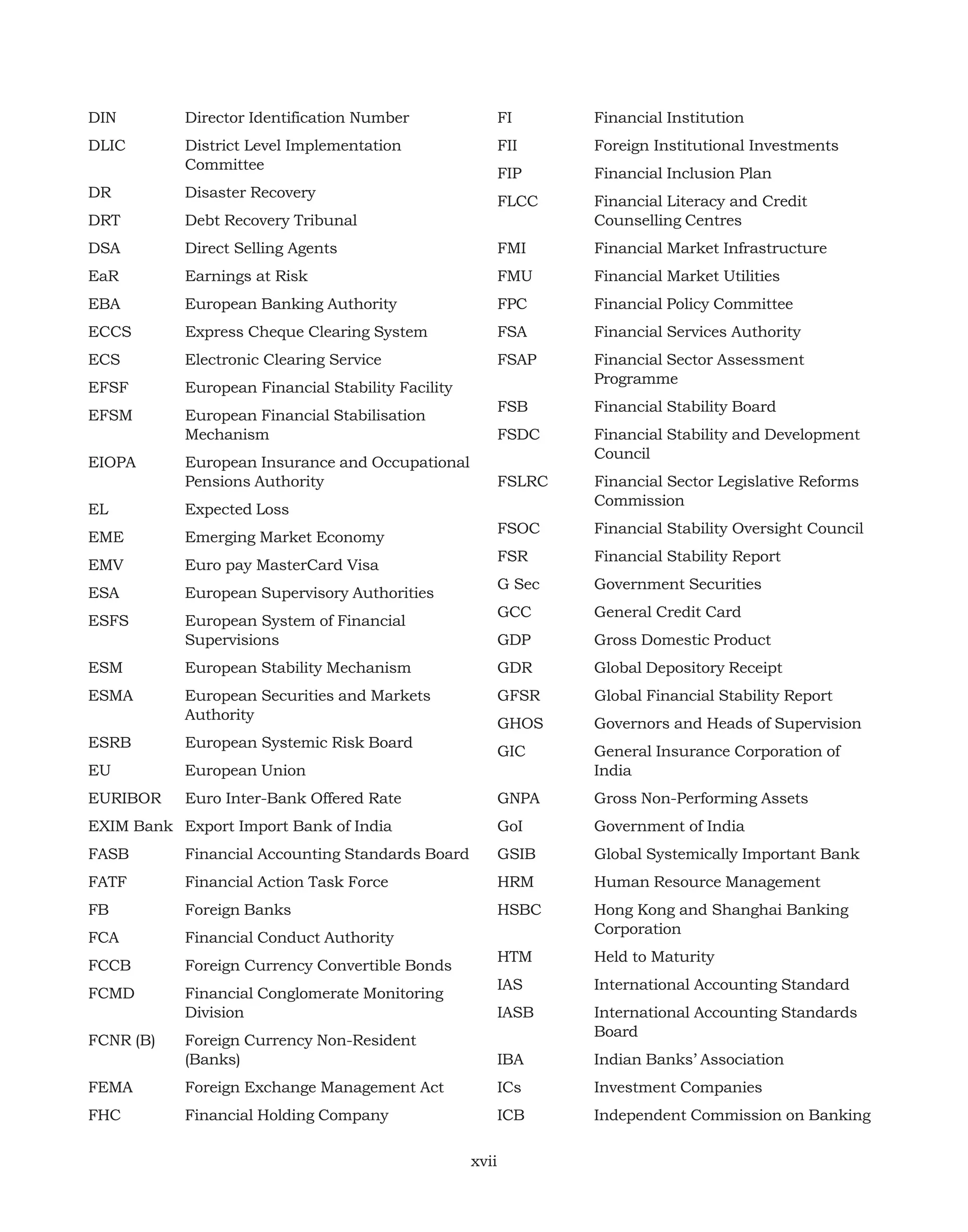

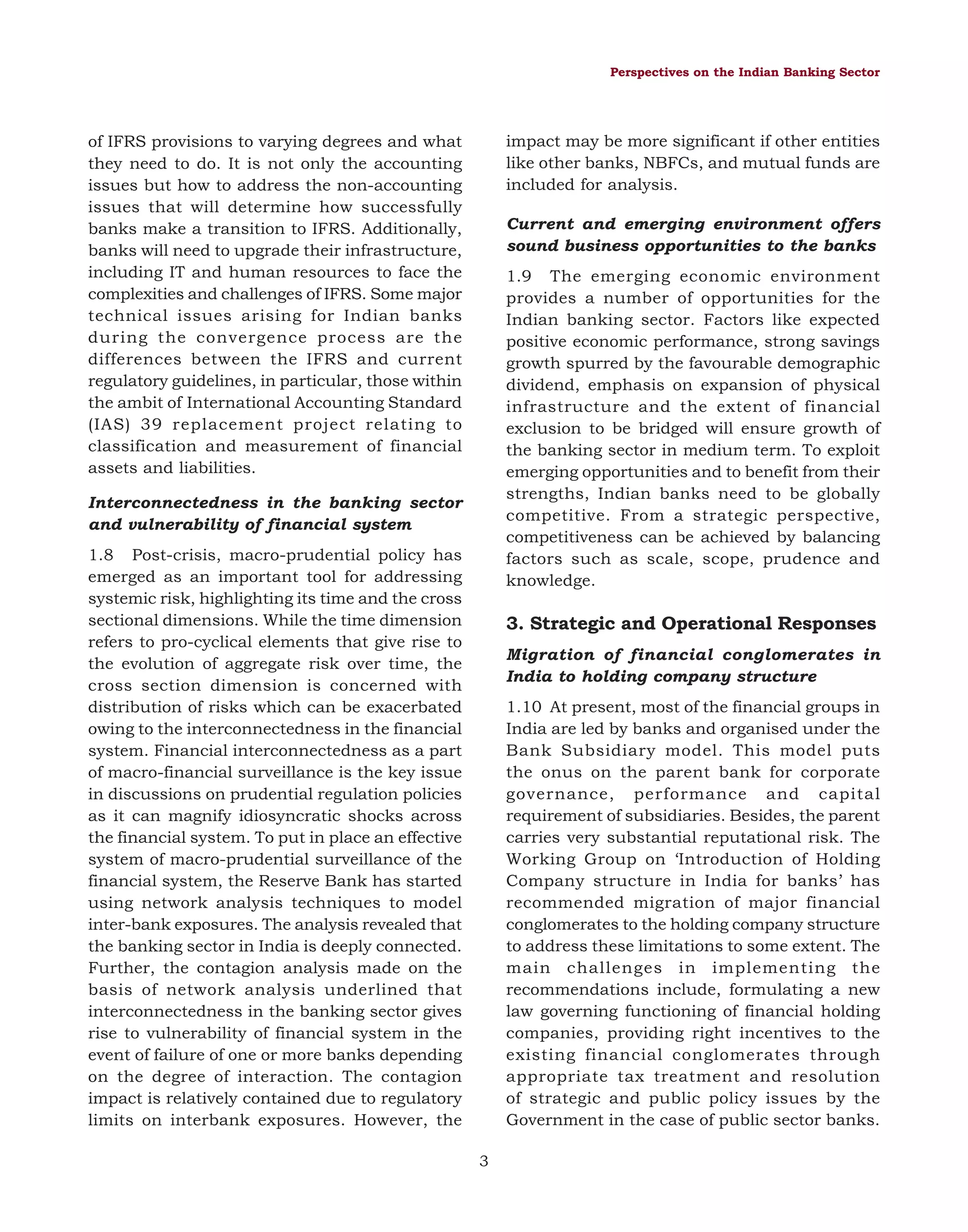

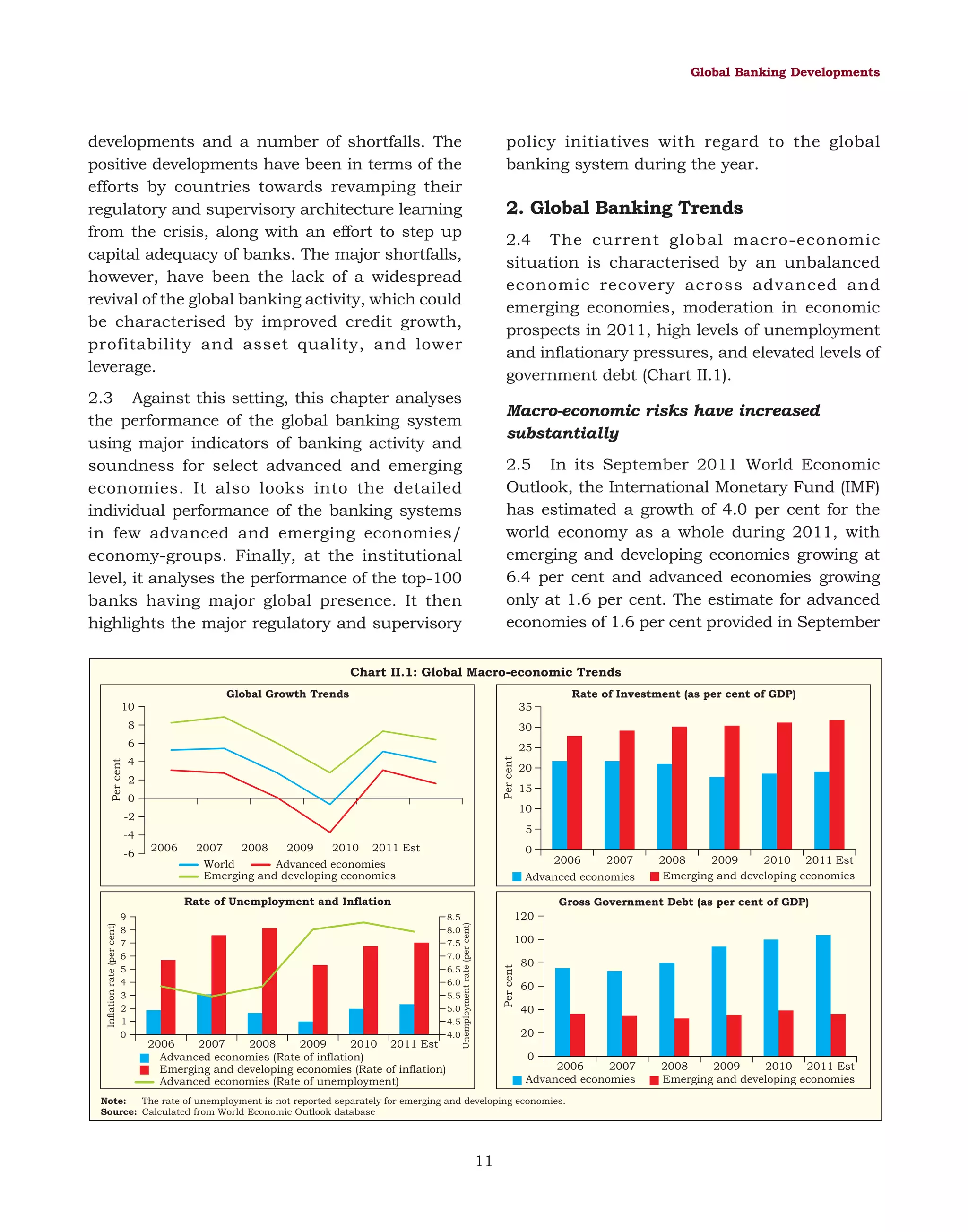

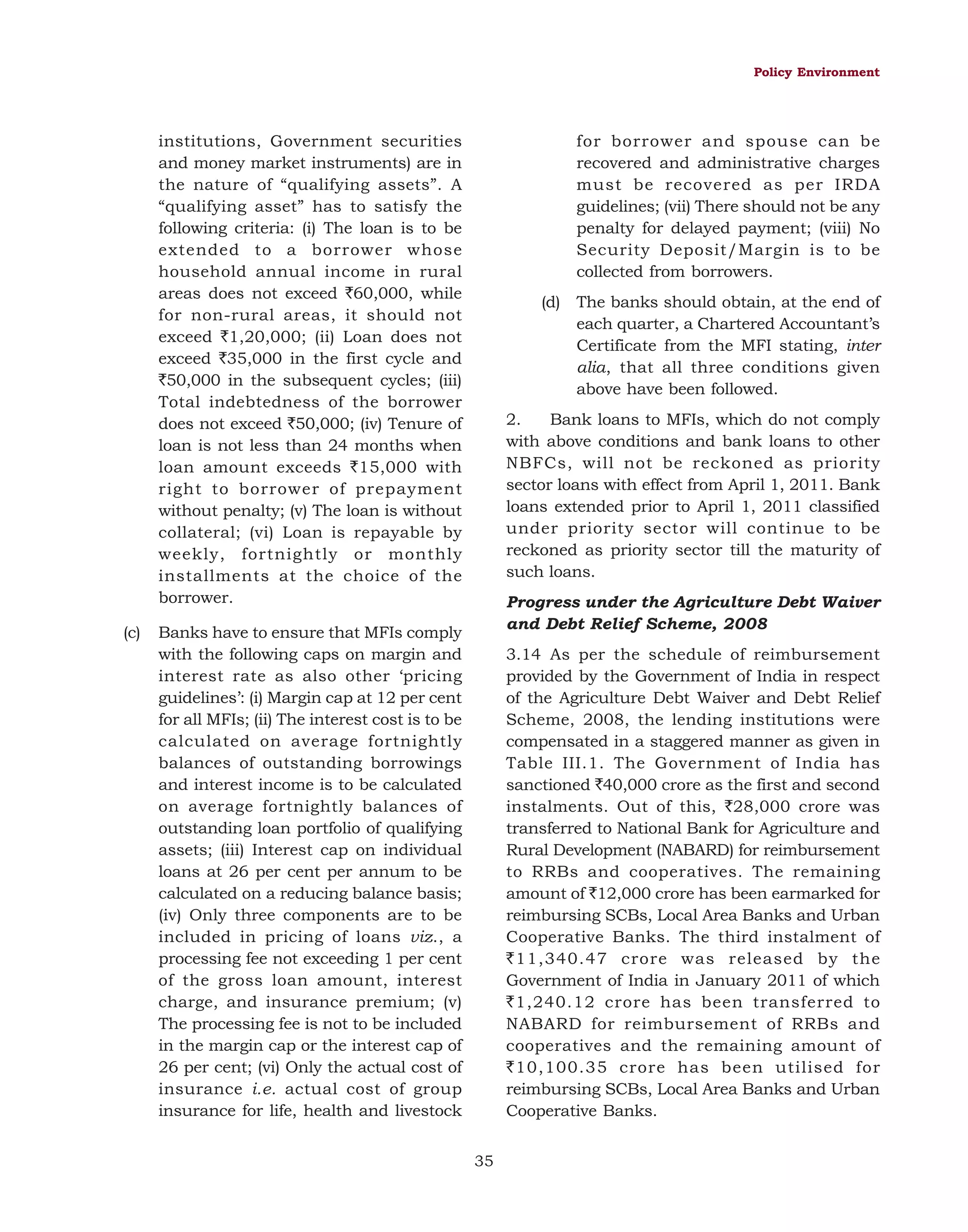

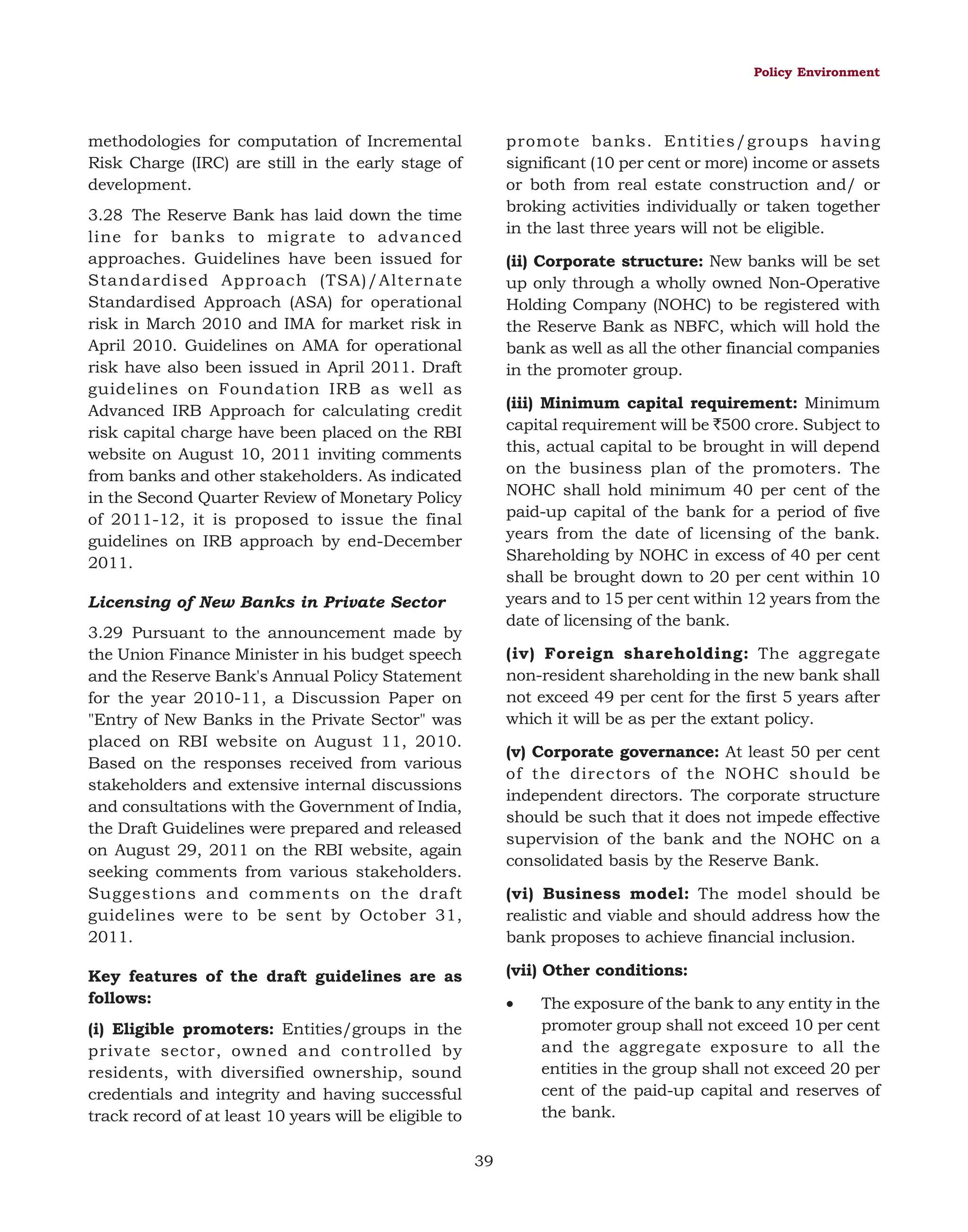

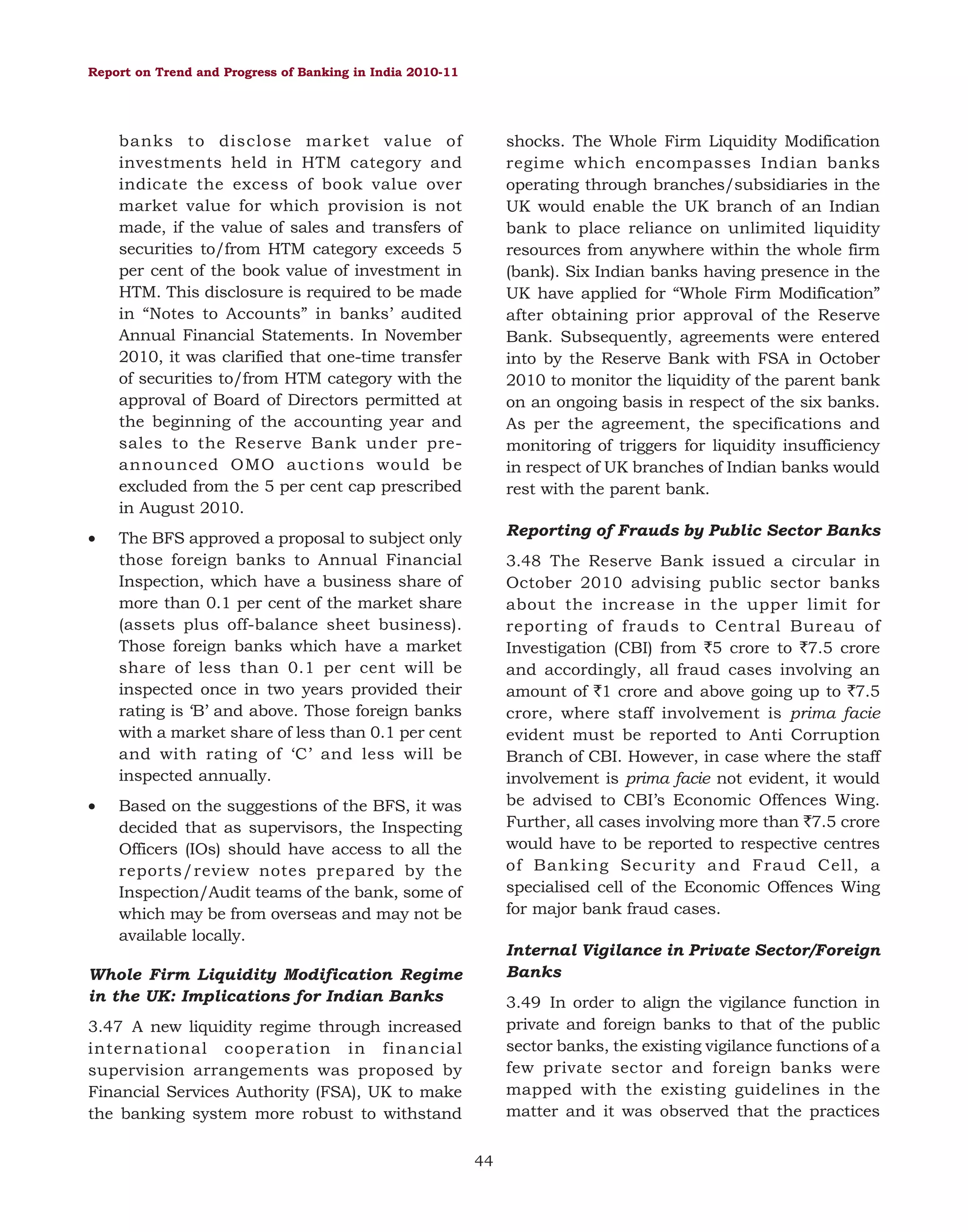

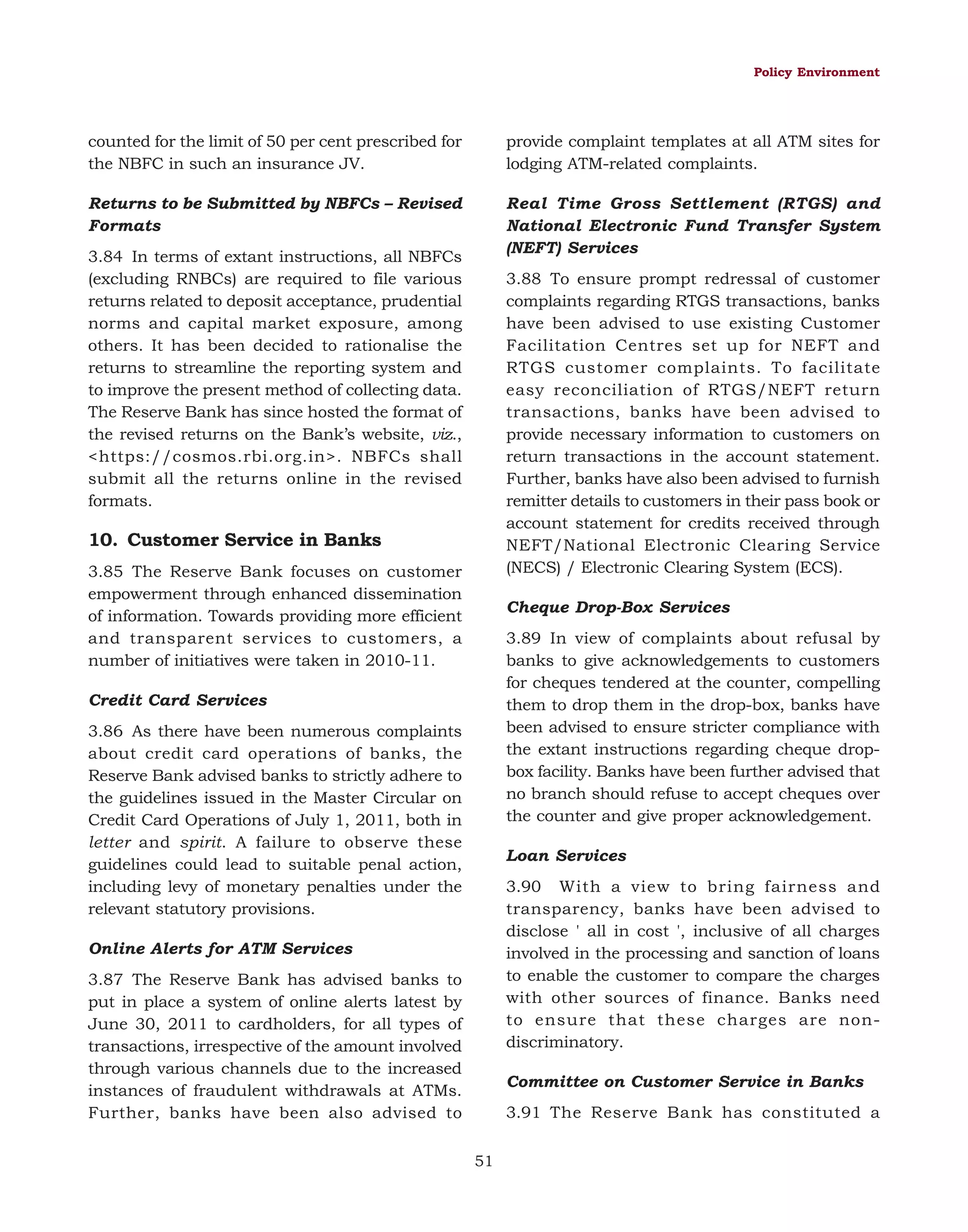

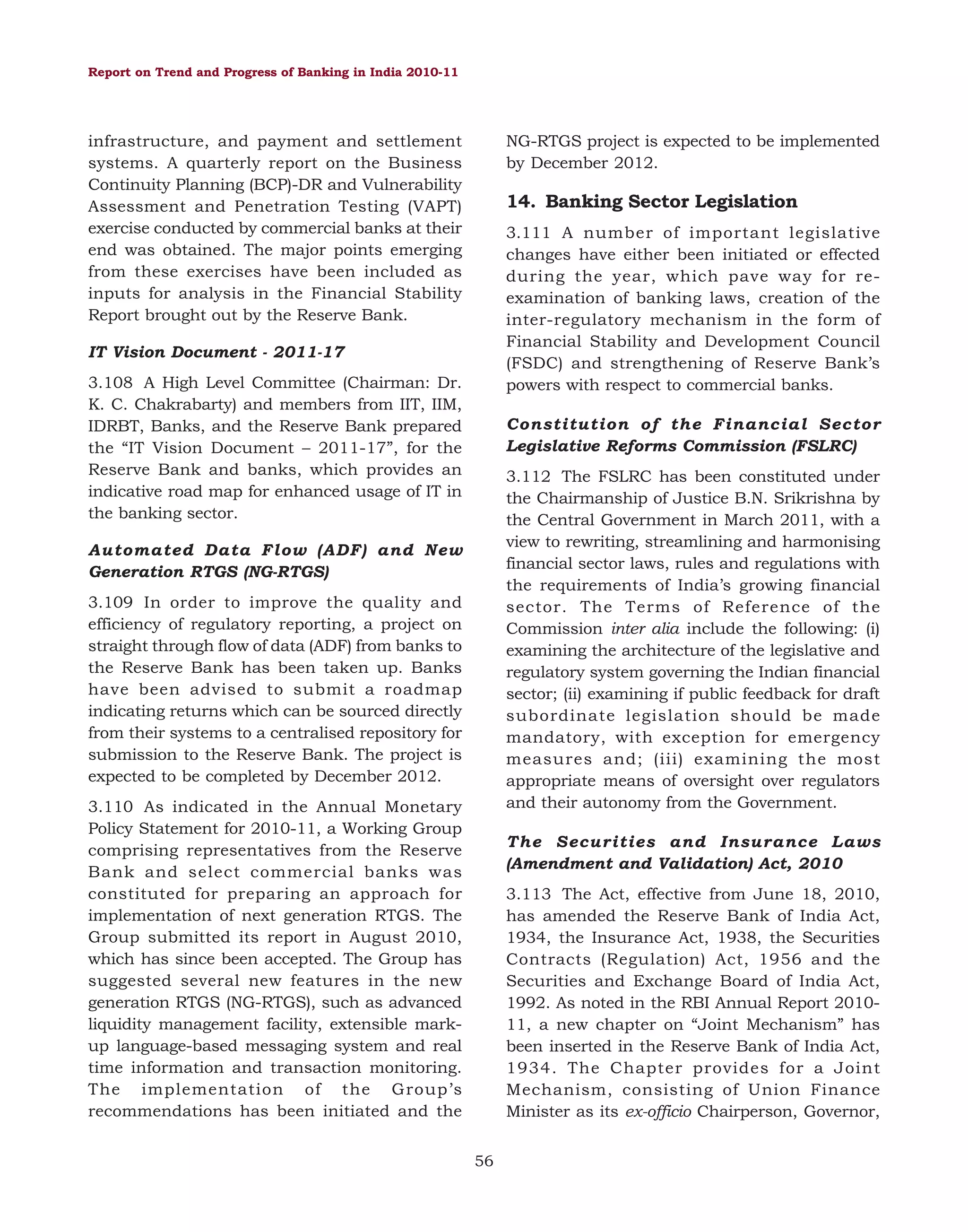

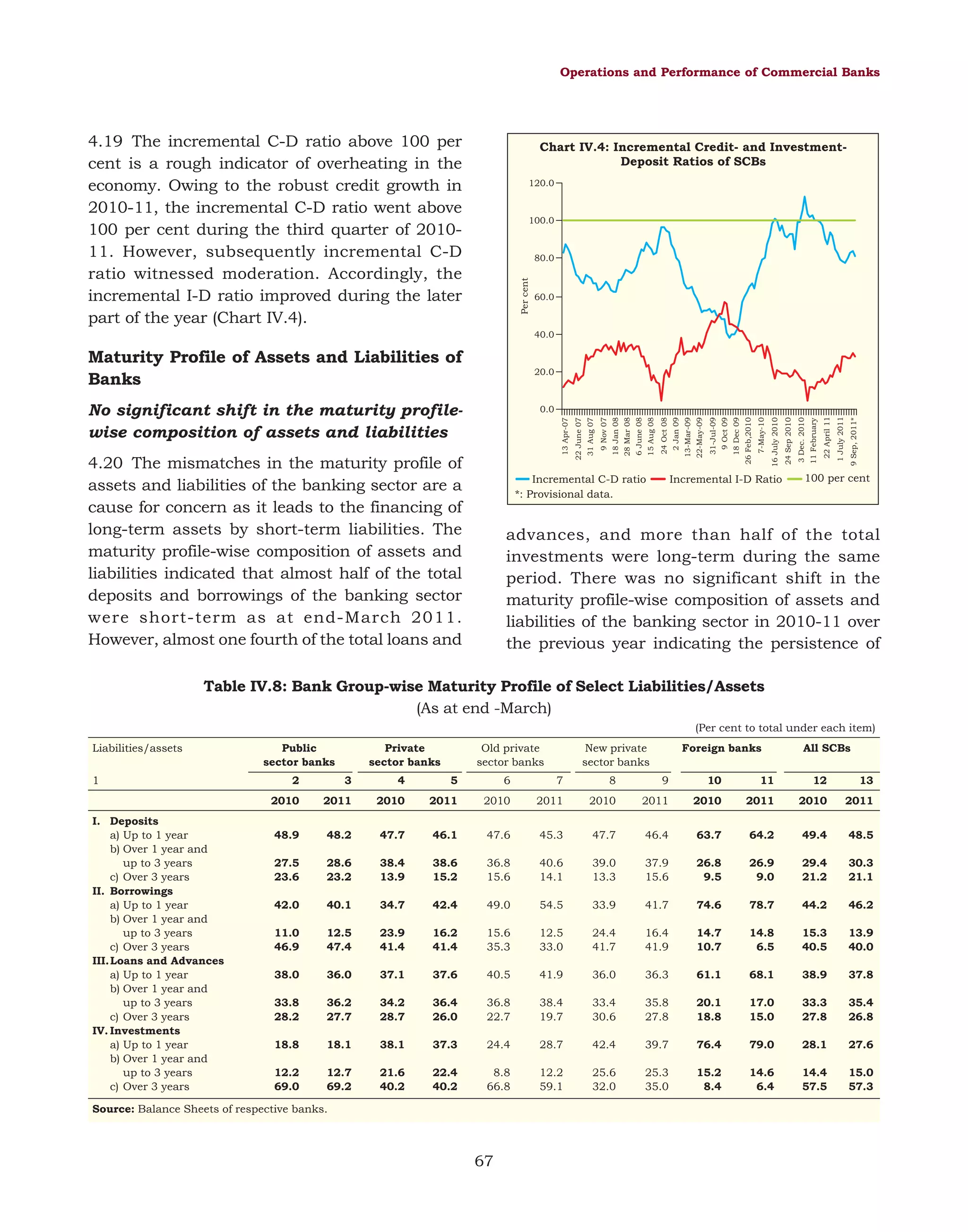

Table V.10: A Profile of Rural Cooperative Banks

(As at 31st March, 2010)

(Amount in `crore)

Item

Short-Term

Long-Term

StCBs

DCCBs

PACS

SCARDBs

PCARDBs

2

3

4

5

6

31

370

94,647

20

697

11,871

79,150

23,559

53,588

49,629

1,20,662

31,370

1,46,404

28,735

1,18,393

1,07,466

2,18,676

4,510

759

15,581

3,205

17,000

25,562

5,165

461

12,832

2,465

11,482

25,037

29

462

322

1,659

40,936

1,132

10

127

276

123

2

209

253

575

47*

523

1,136

4757

41,679

2,347

-1,215

-

9

155

-27

1,190

416

538

-415

4154

4353

8.8

91.8

16,234

12.9

75.7

39,524 ++

41.3

-

5,642

33.2

41.0

4,841

42.0

41.5

1

A.

B.

C.

D.

No. of Cooperative Banks

Balance Sheet Indicators

i. Owned Funds (Capital + Reserves)

ii. Deposits

iii. Borrowings

iv. Loans and Advances Issued

v. Loans and Advances Outstanding

vi. Total Liabilities/Assets

Financial Performance

i. Institutions in Profit

a. No.

b. Amount of Profits

ii. Institutions in Loss

a. No.

b. Amount of Loss

iii. Overall Profit (+)/Loss (-)

iv. Accumulated Loss

Non-performing Assets

i. Amount

ii. As Percentage of Loans Outstanding

iii. Recovery of Loans to Demand (Per cent)

12,479

35,286

51,764

74,938

76,480

1,35,192 +

StCBs: State Cooperative Banks, DCCBs: District Central Cooperative Banks, PACS: Primary Agricultural Credit Societies, SCARDBs: State Cooperative

Agriculture and Rural Development Banks, PCARDBs: Primary Cooperative Agriculture and Rural Development Banks.

‘-‘ : Not available.

+: Working capital.

++: Total overdues.

*: Nayagarh DCCB in Orissa is in no profits no loss situation.

Note: 1 StCBs in the states of Bihar, Manipur, Kerala and West Bengal are repeated for the year 2009-10 from previous year due to lack of information.

2 Data are repeated for DCCBs operating in the States Bihar, West Bengal and Kerala.

3 Manipur SCARDB is defunct.

4 Data for 5 SCARDB are not available for 2010.

Source: NABARD and NAFSCOB.

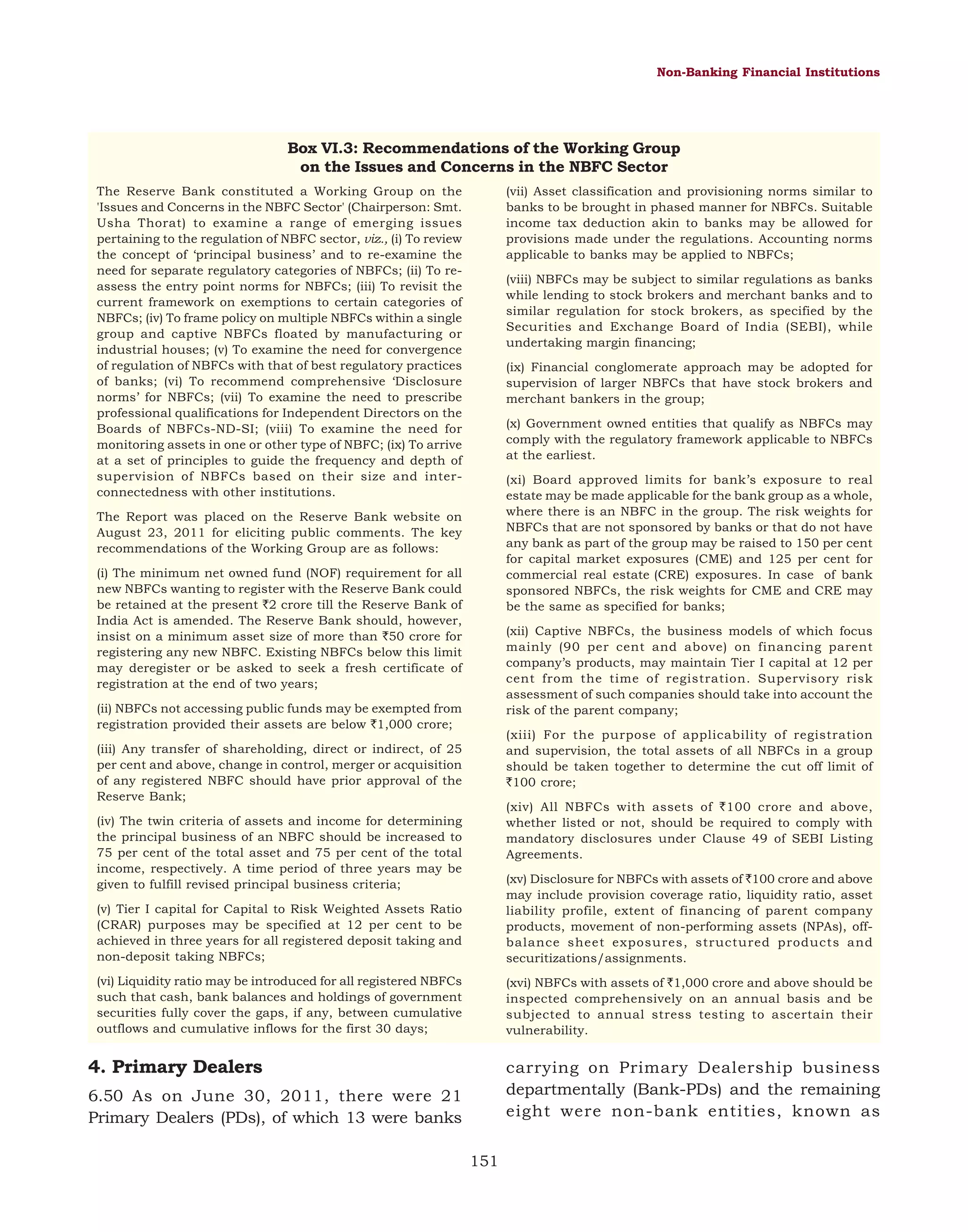

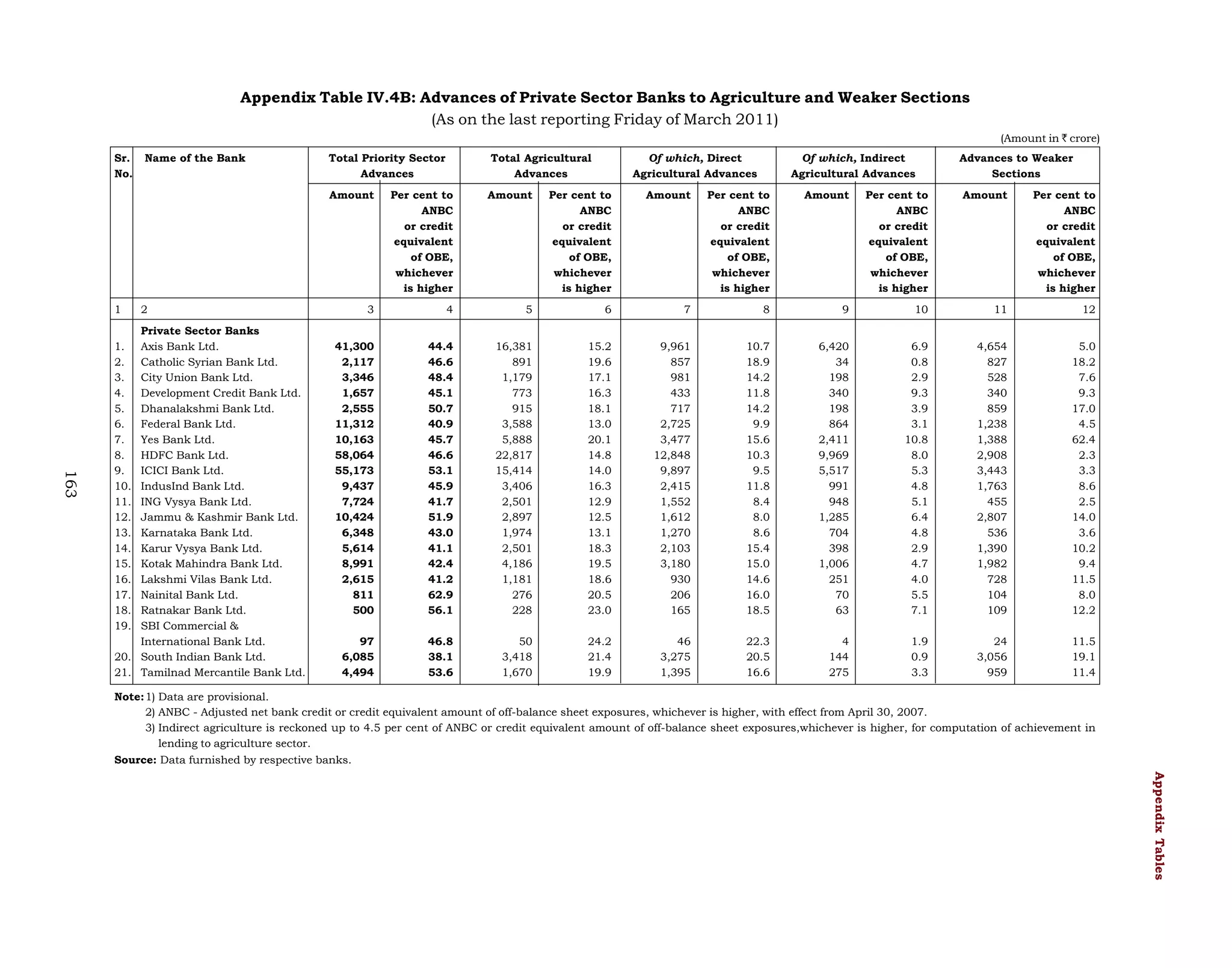

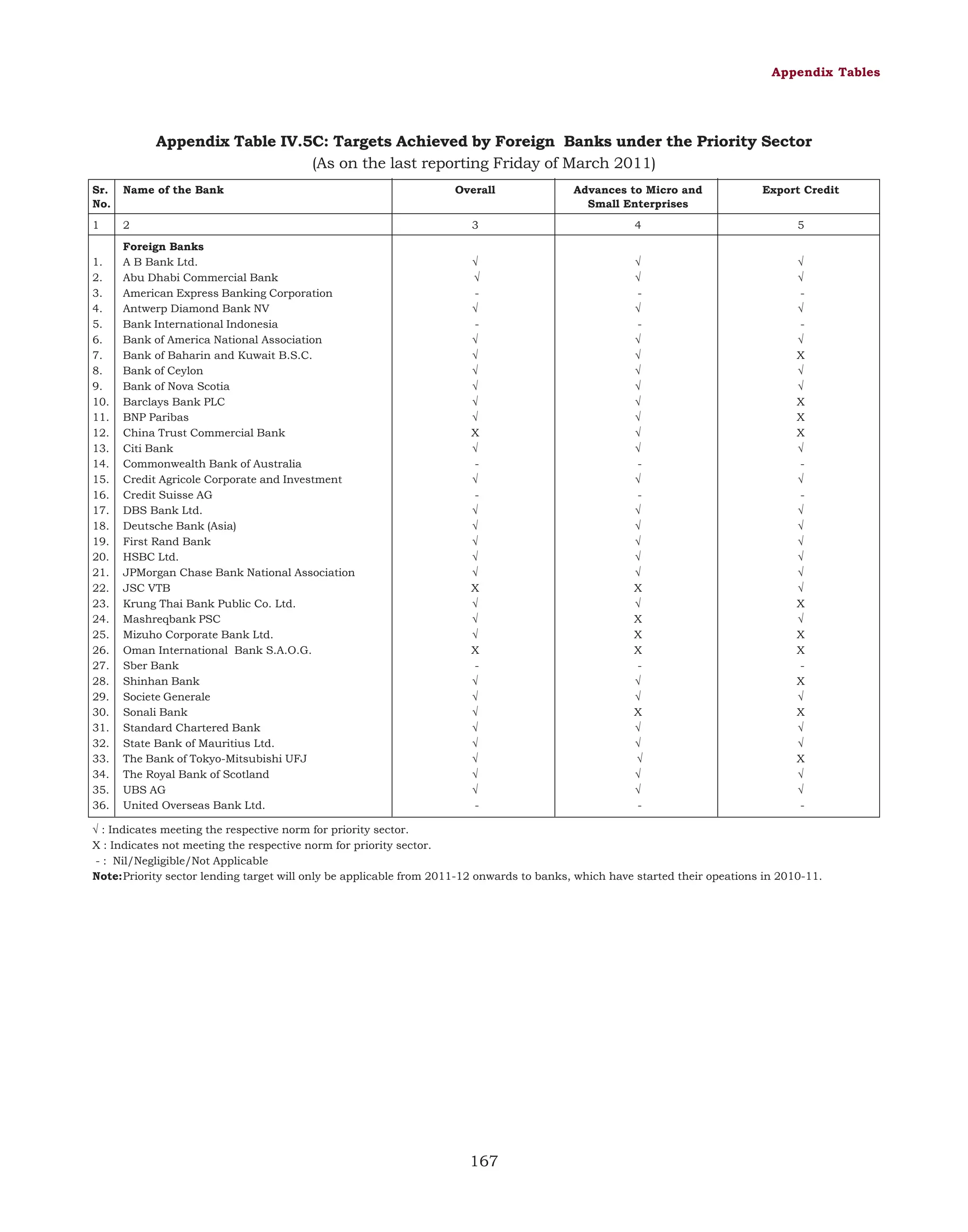

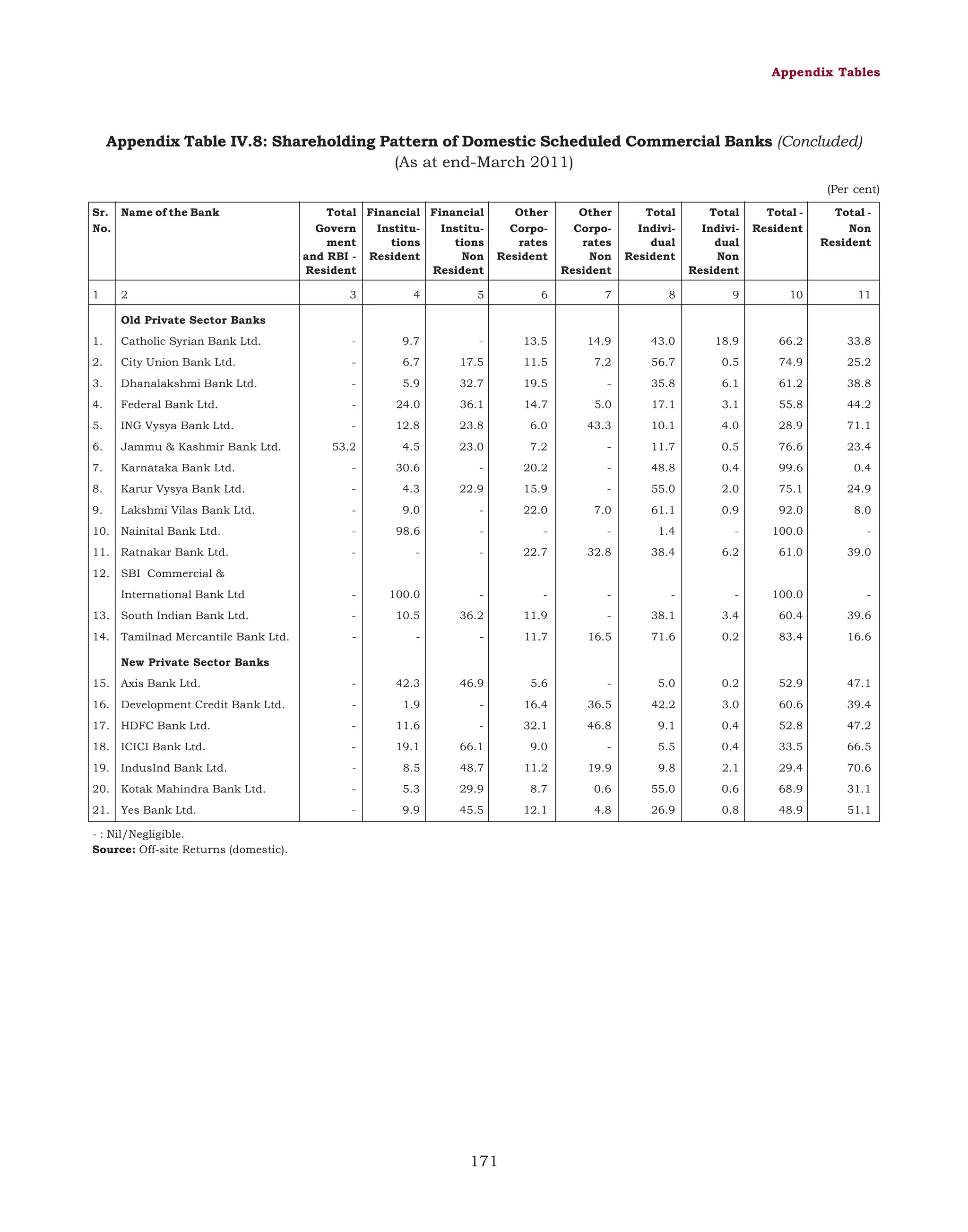

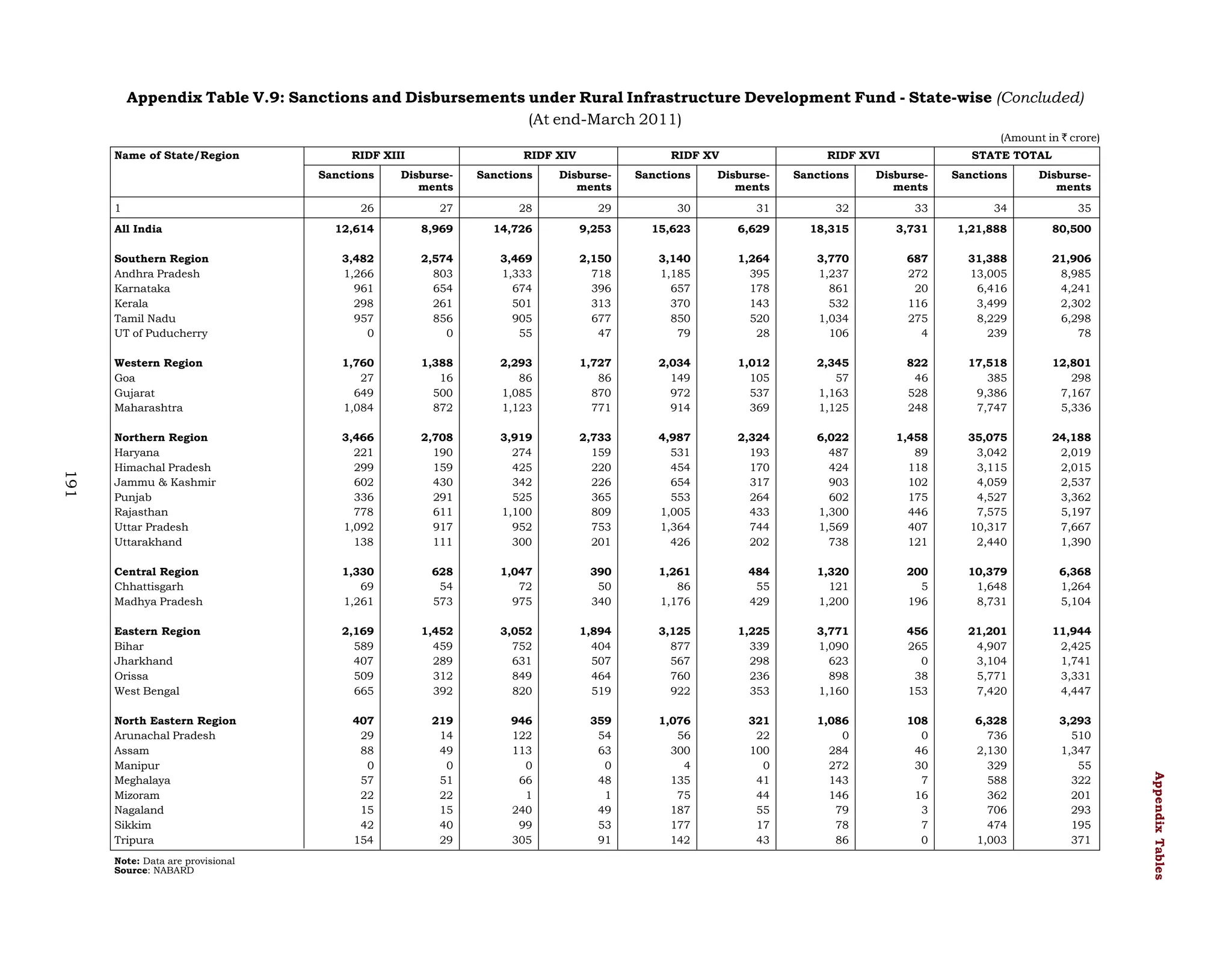

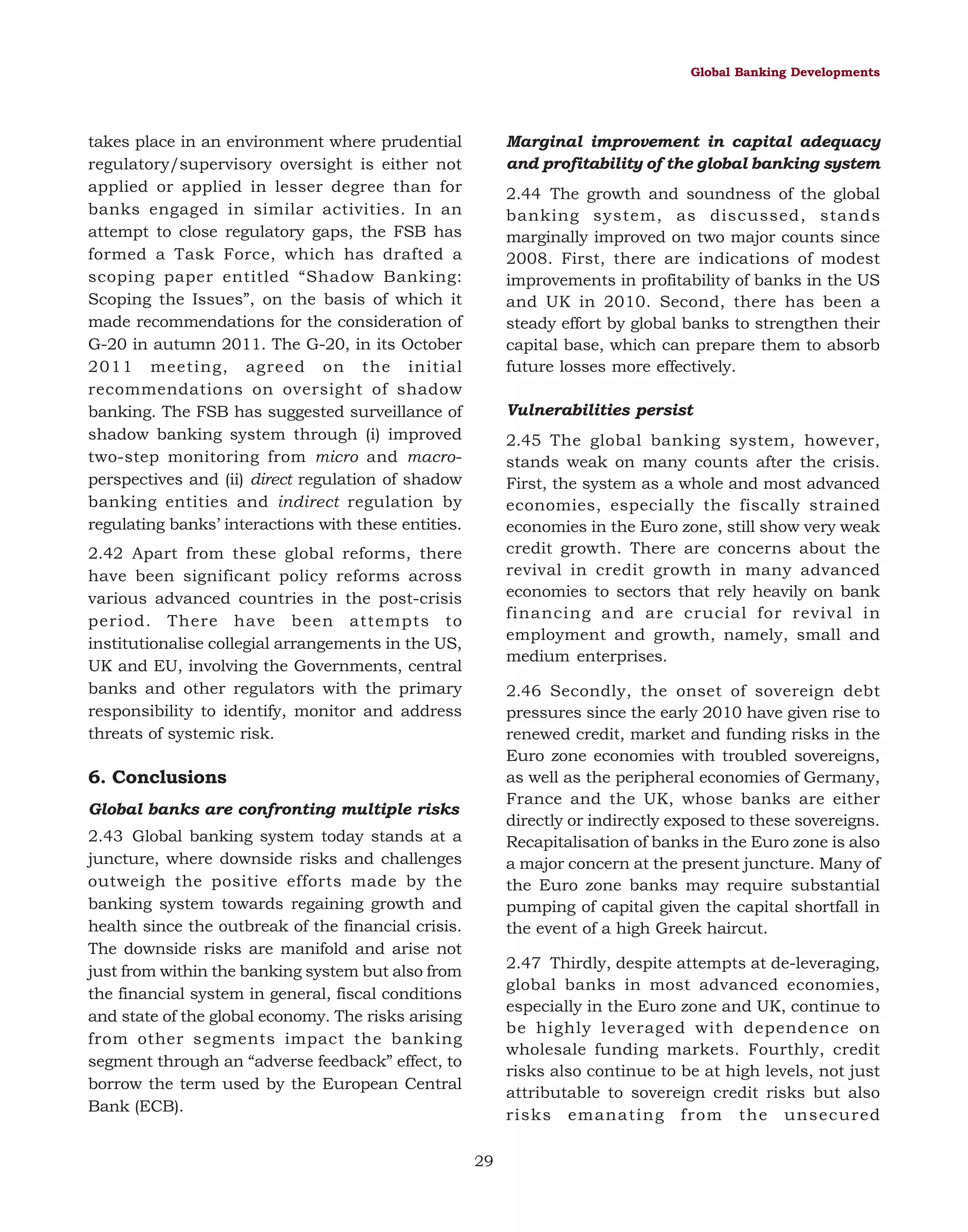

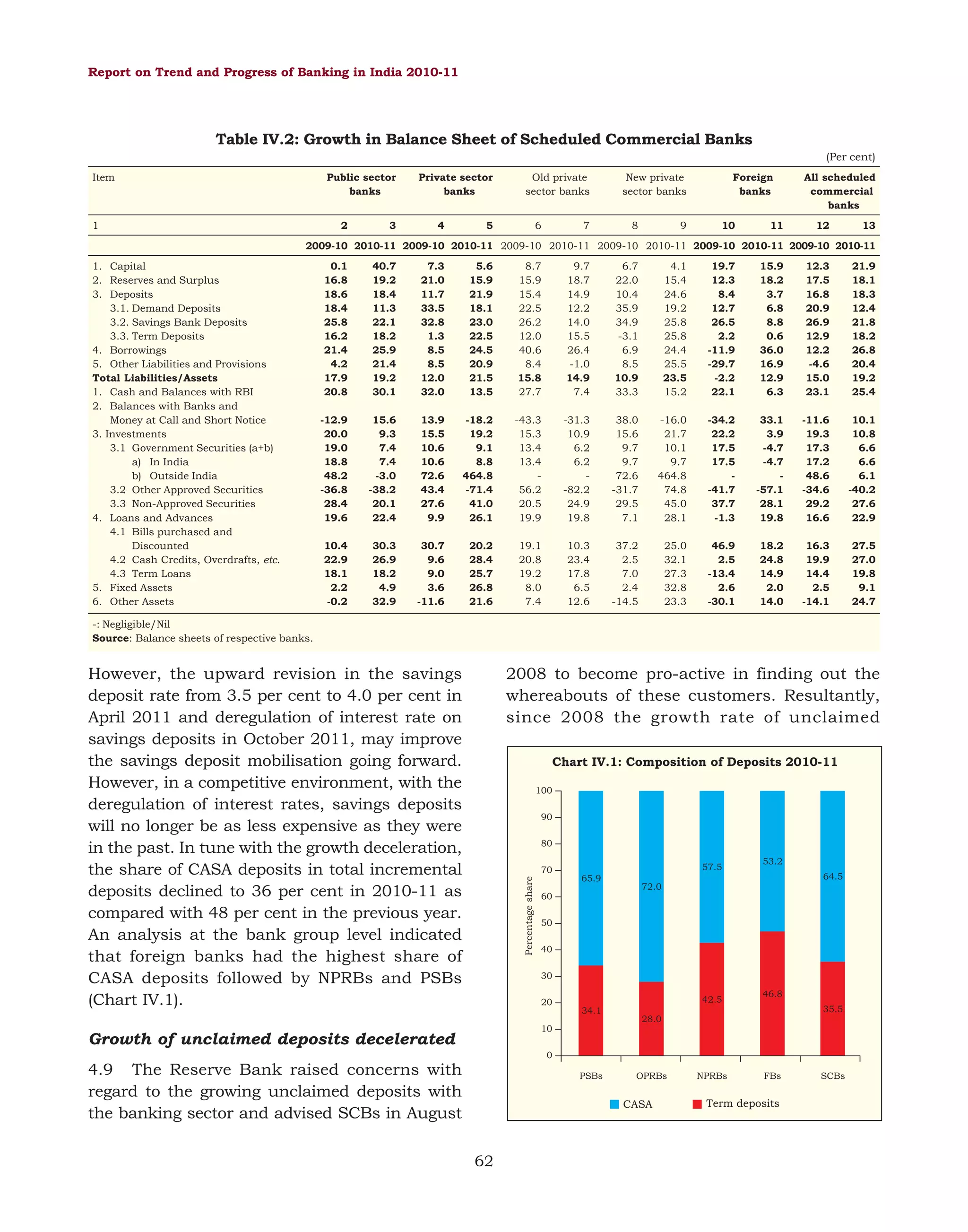

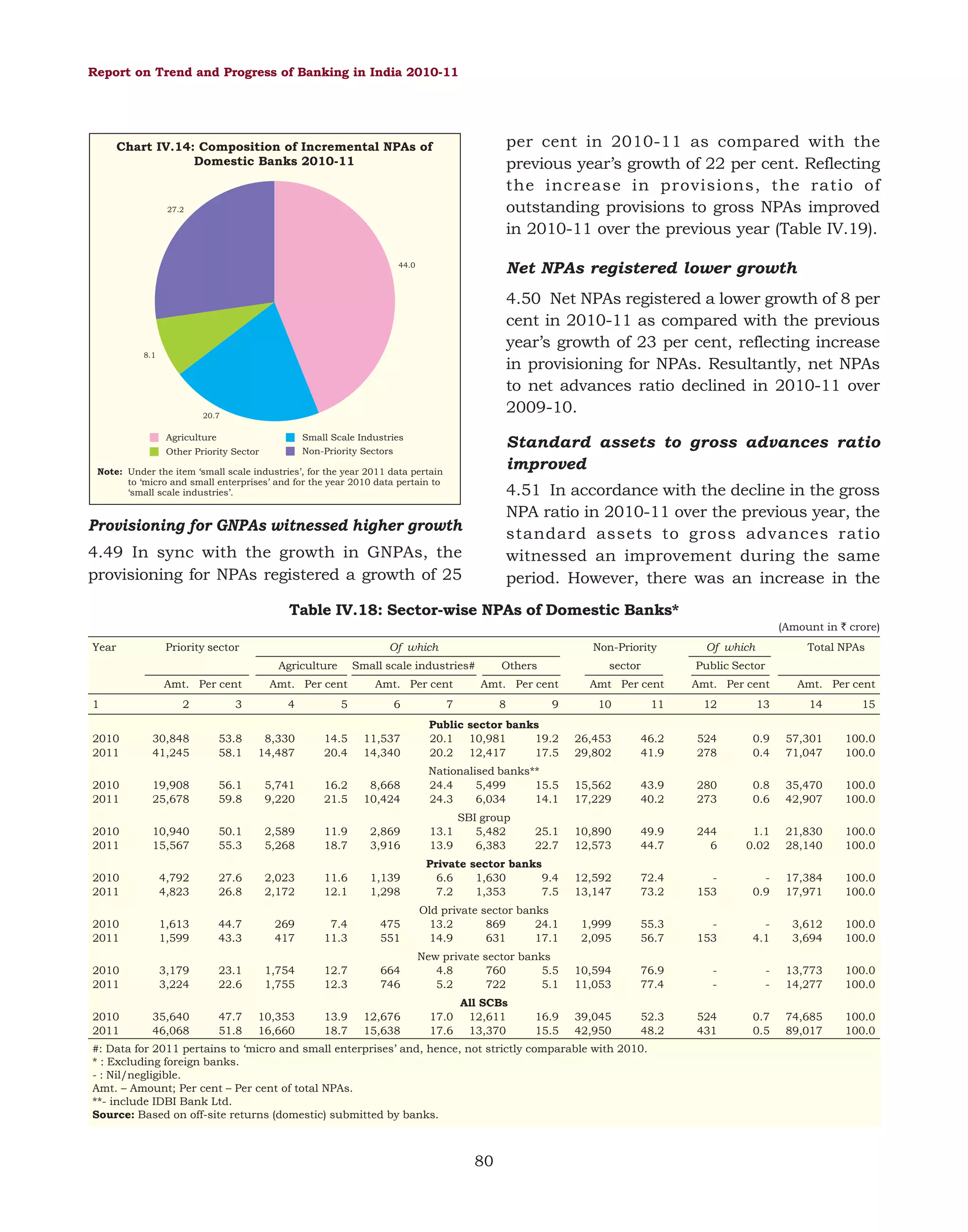

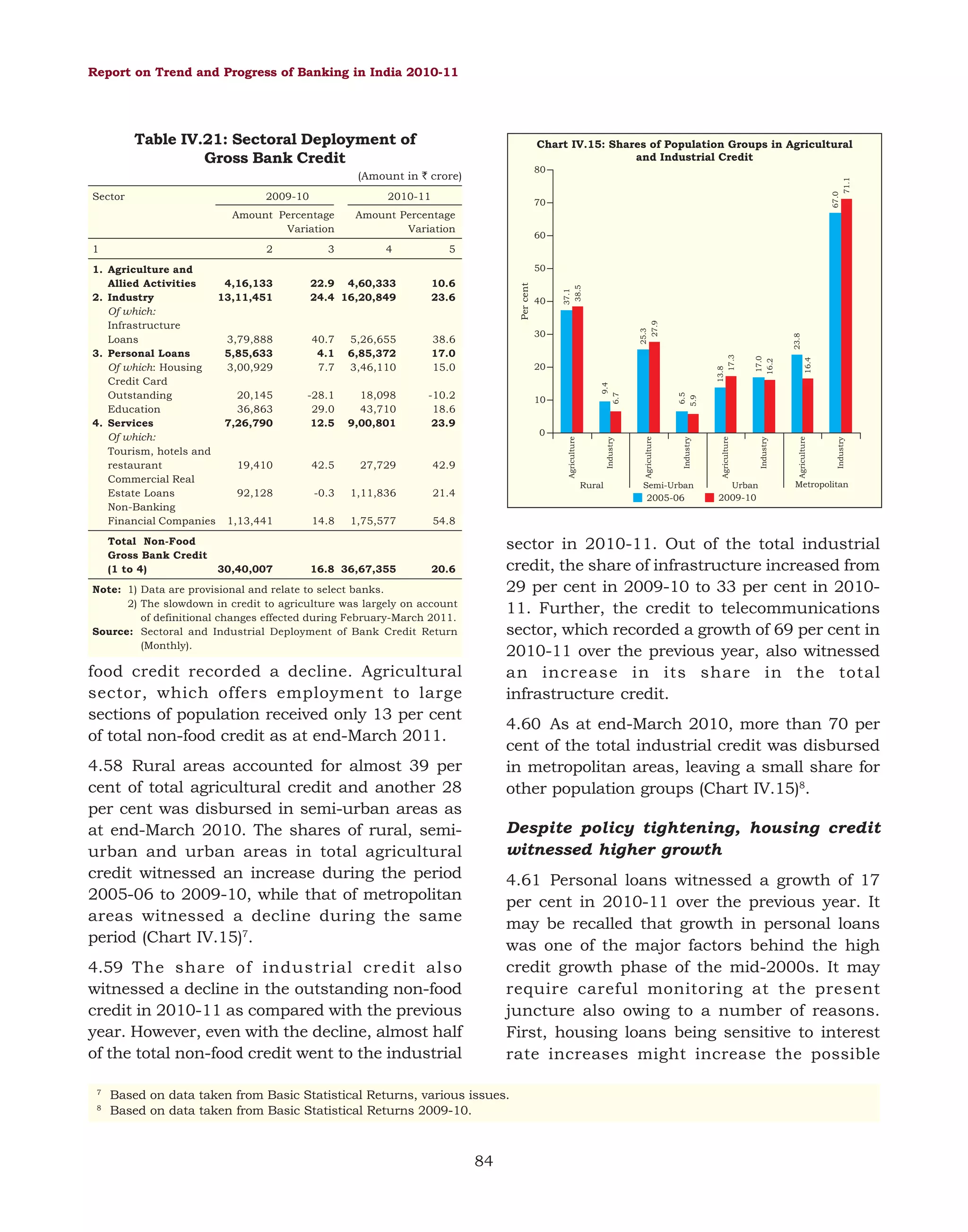

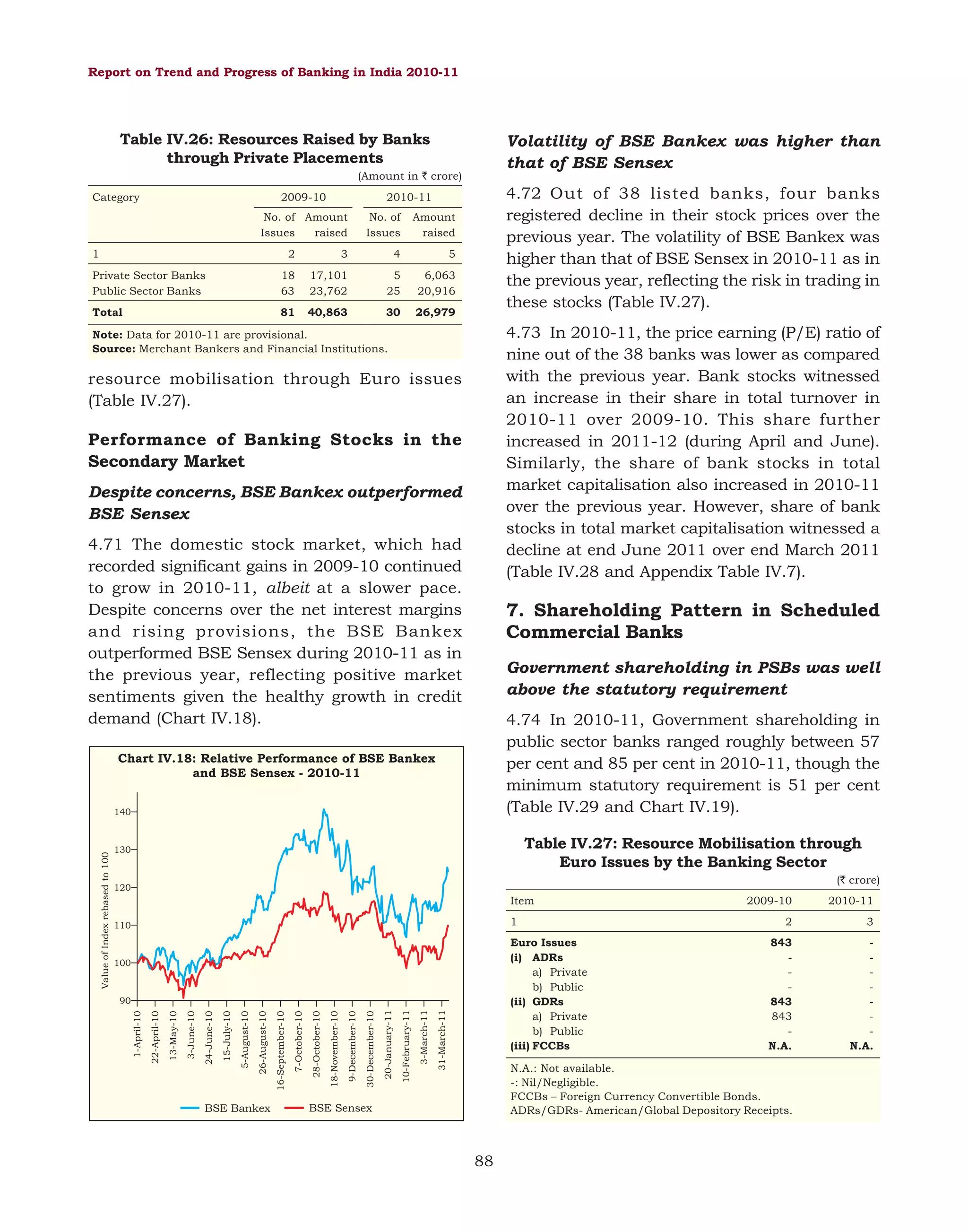

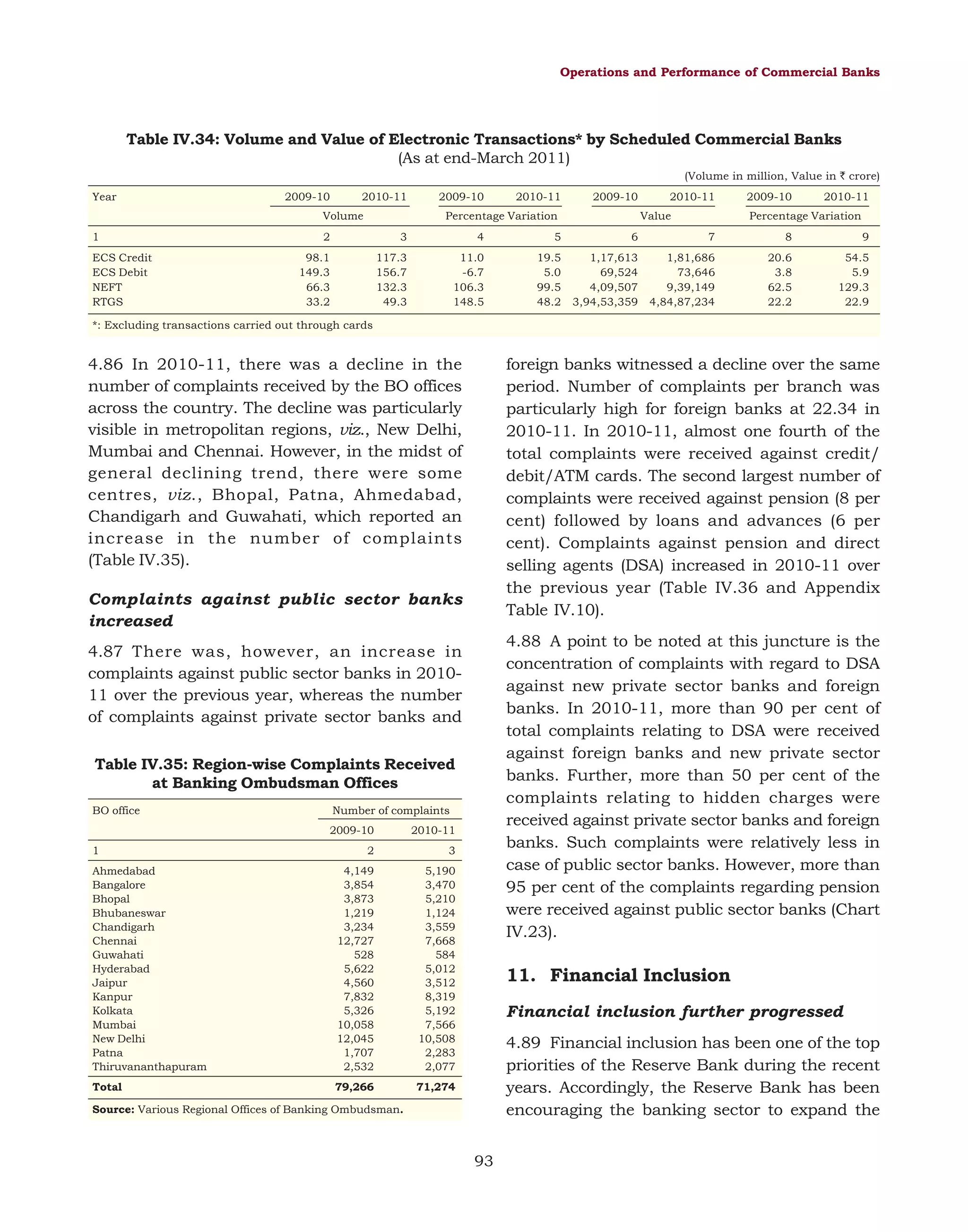

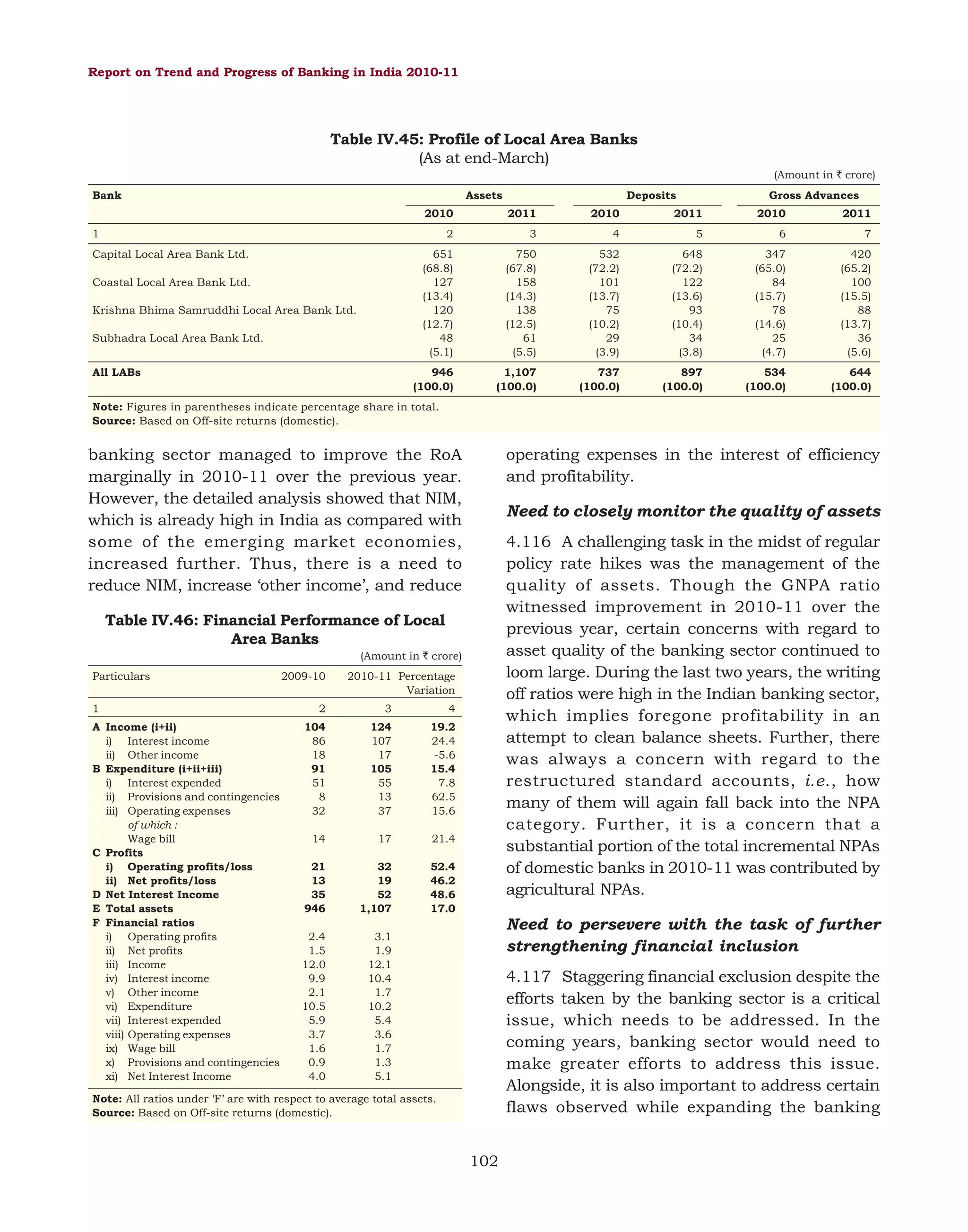

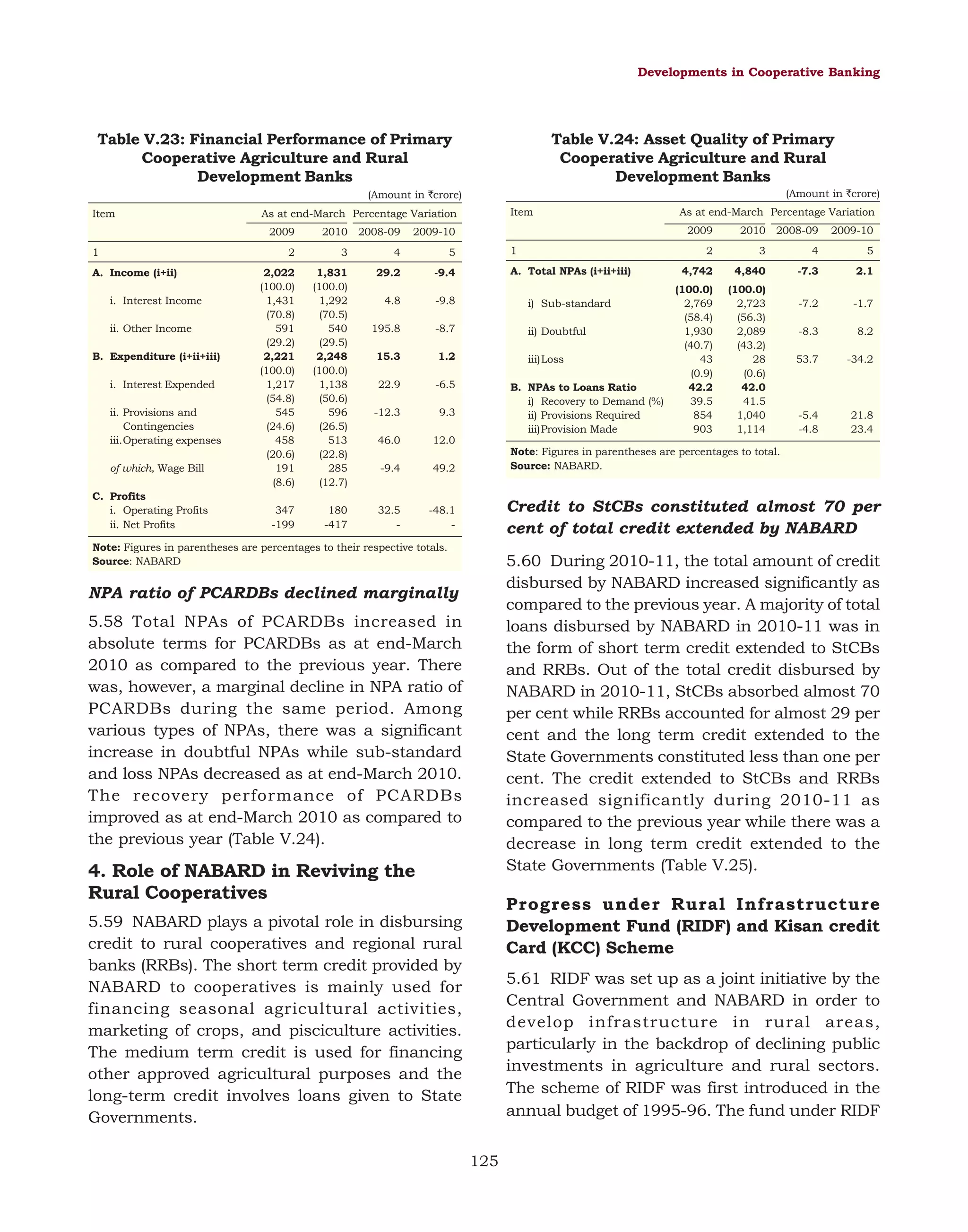

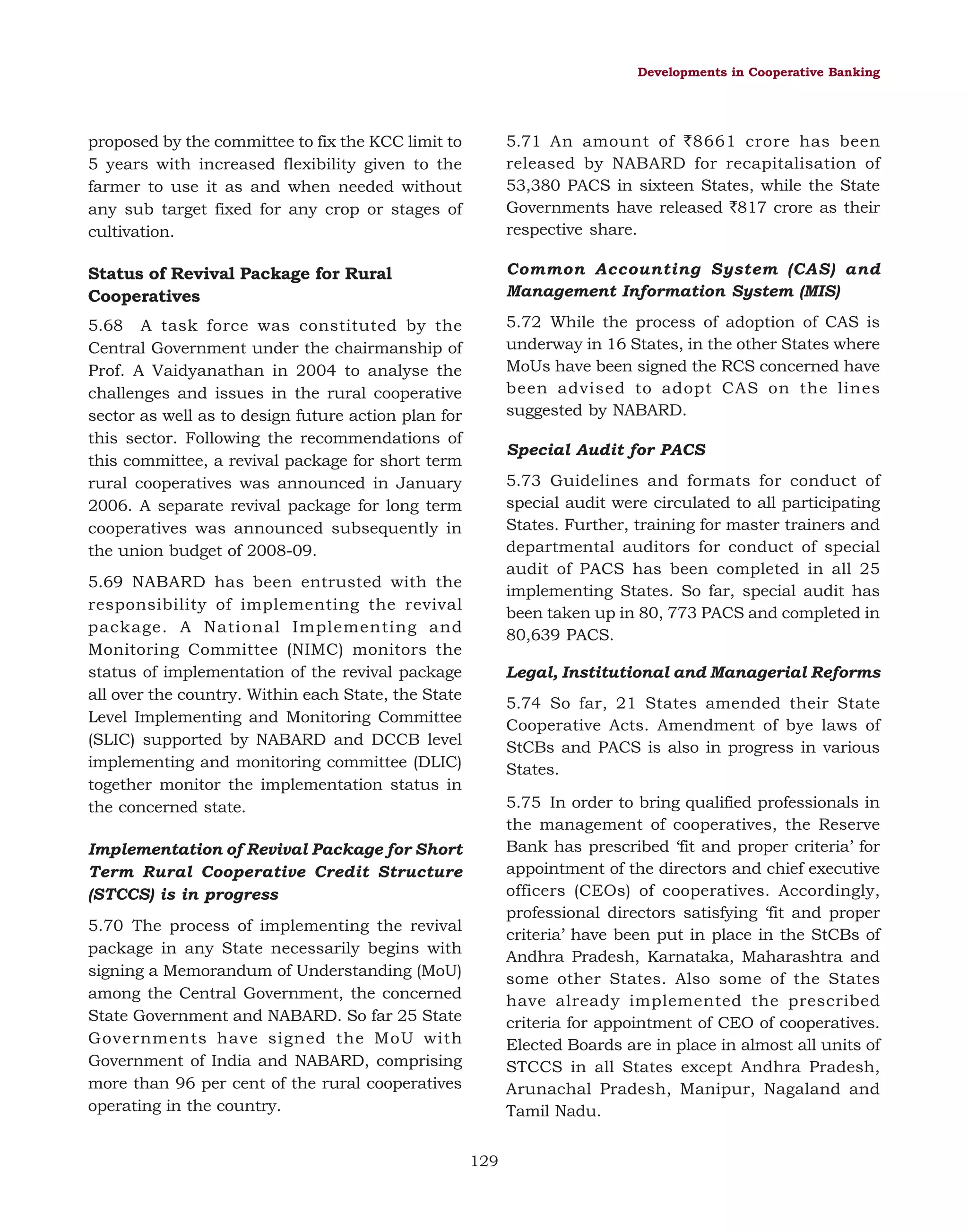

accounted for the almost 45 per cent of total

assets. During 2009-10, investments increased

at a higher rate than loans and advances.

Also, the percentage share of investments

in total assets increased with a decline in

the share of loans and advances as at endMarch 2010 as compared to the previous year

(Table V.12).

was lower than the growth observed during

2008-09. The growth in StCB’s balance sheet

was mainly due to increase in borrowings and

other liabilities on the liabilities side, and cash

and bank balances, and other assets on the

assets side. On the liabilities side, deposits

continued to account for the largest share of the

resources of StCBs, while investment

Table V.11: Elected Boards under Supersession

(Position as on March 31, 2010)

(Amount in `crore)

Item

StCBs

1

(i) Total number of institutions

(ii) Number of institutions where Boards were under Supersession

Percentage of reporting Boards under supersession [(ii) as per cent of (i)]

DCCBs

SCARDBs

PCARDBs

Total

2

3

4

5

6

31

9

29.0

370

86

23.2

20

9

45.0

697

265

38.0

1,118

369

33.0

Note: 1. Data related to StCBs in Bihar, Sikkim, Pondicherry and West Bengal and DCCBs in Bihar, Jharkhand and West Bengal are repeated for 2009-10 due

to lack of information.

2. SCARDB in Tripura is defunct.

Source: NABARD.

117](https://image.slidesharecdn.com/0tpbi121111full-140101004243-phpapp02/75/0-tpbi121111-full-137-2048.jpg)

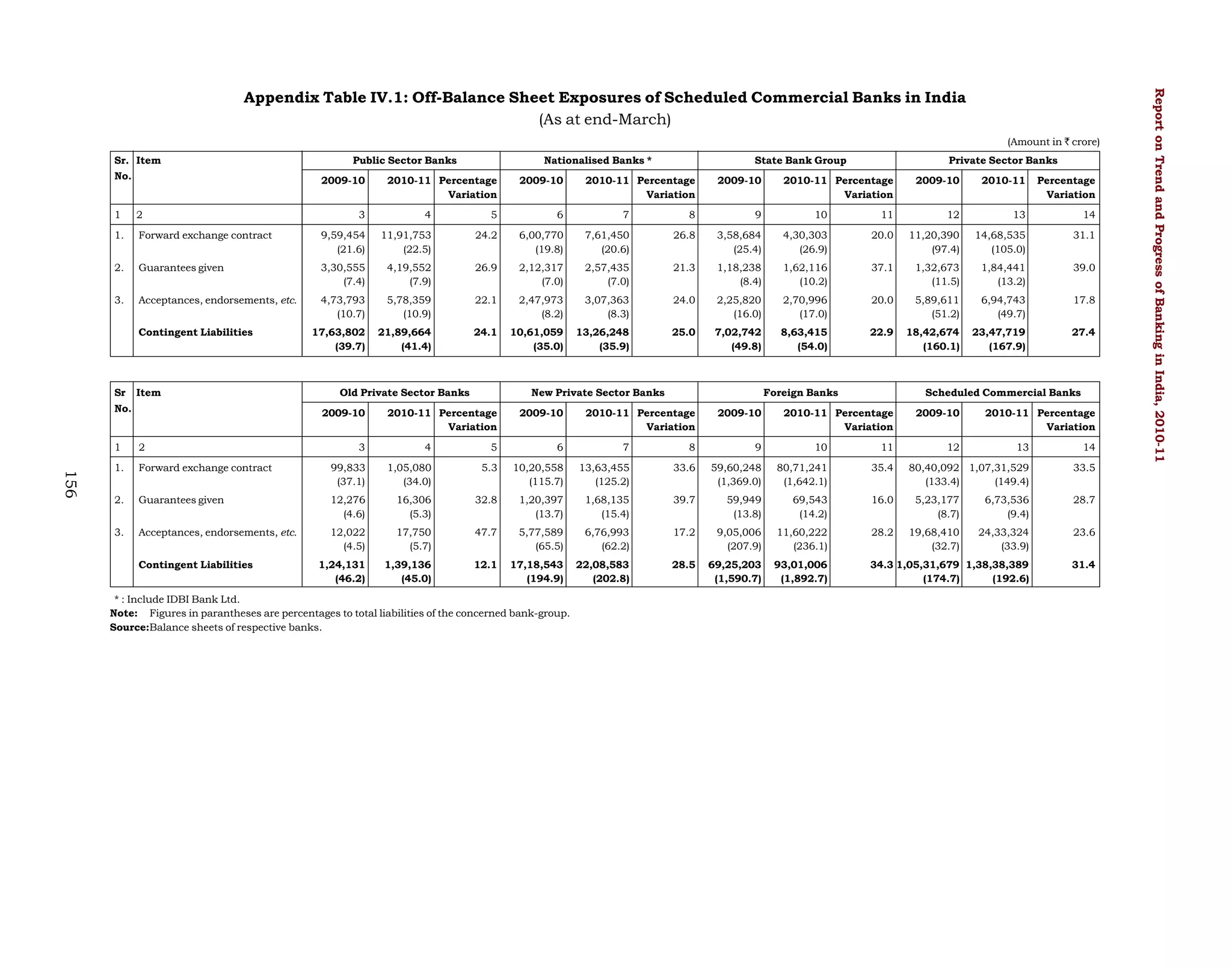

![Report on Trend and Progress of Banking in India 2010-11

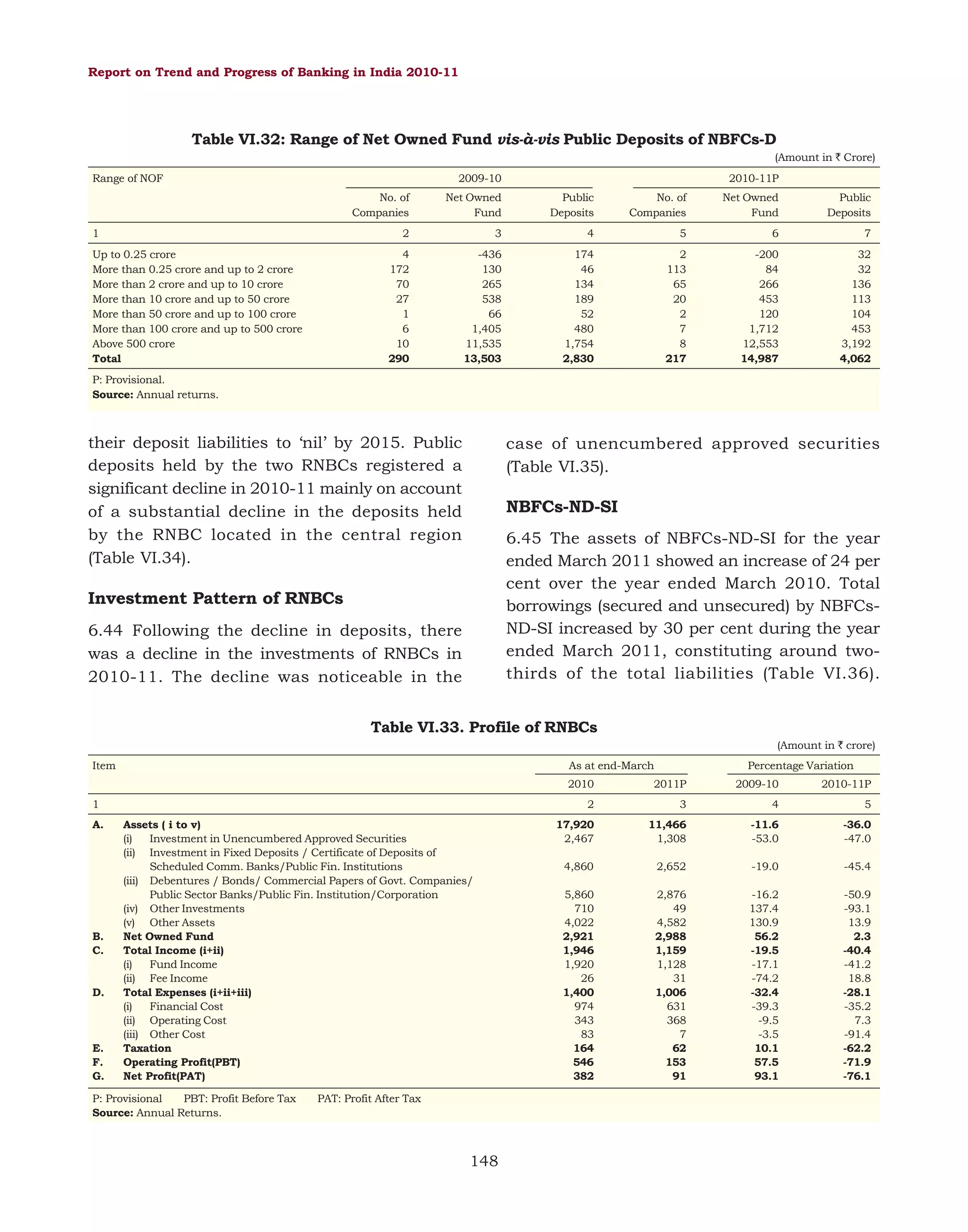

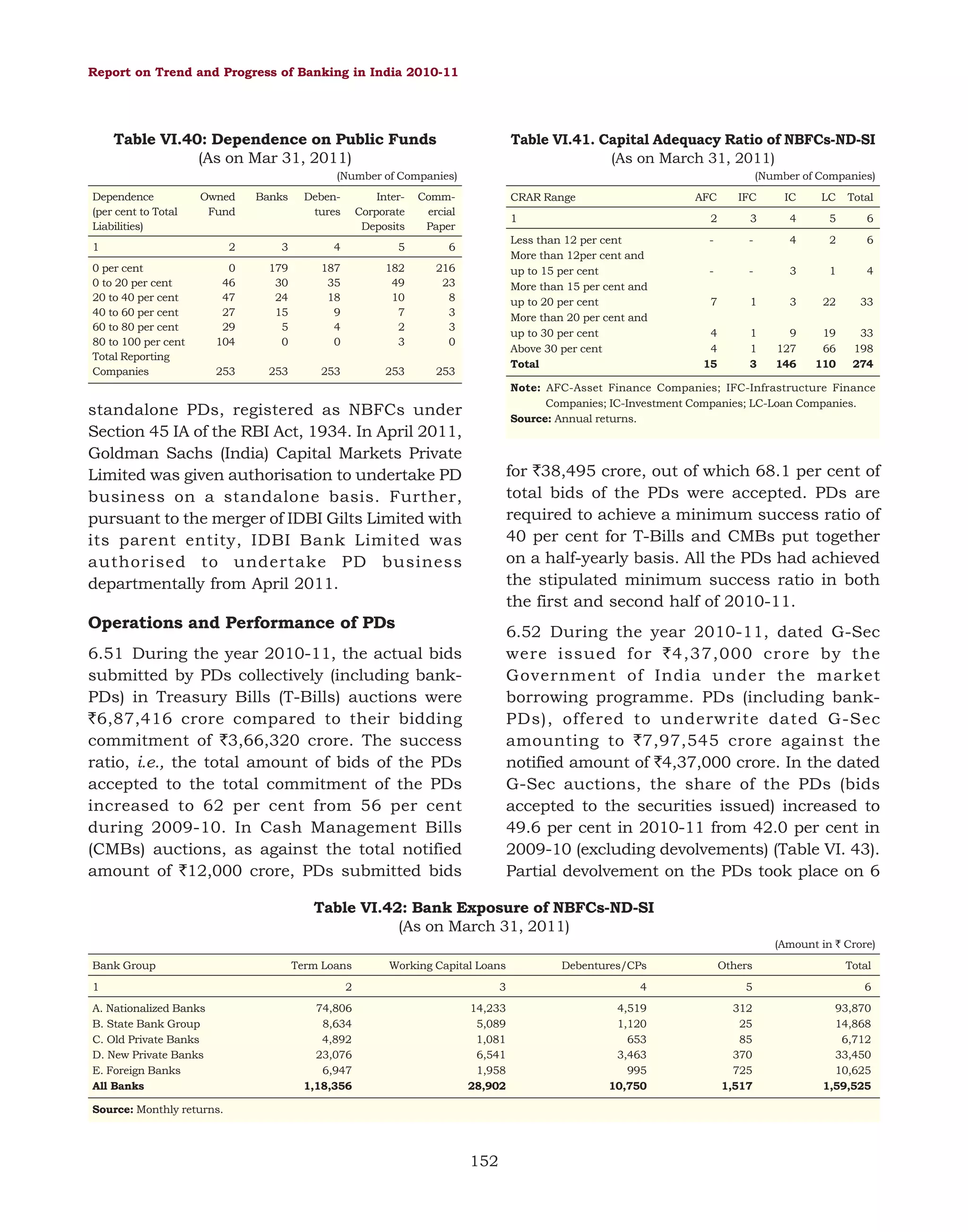

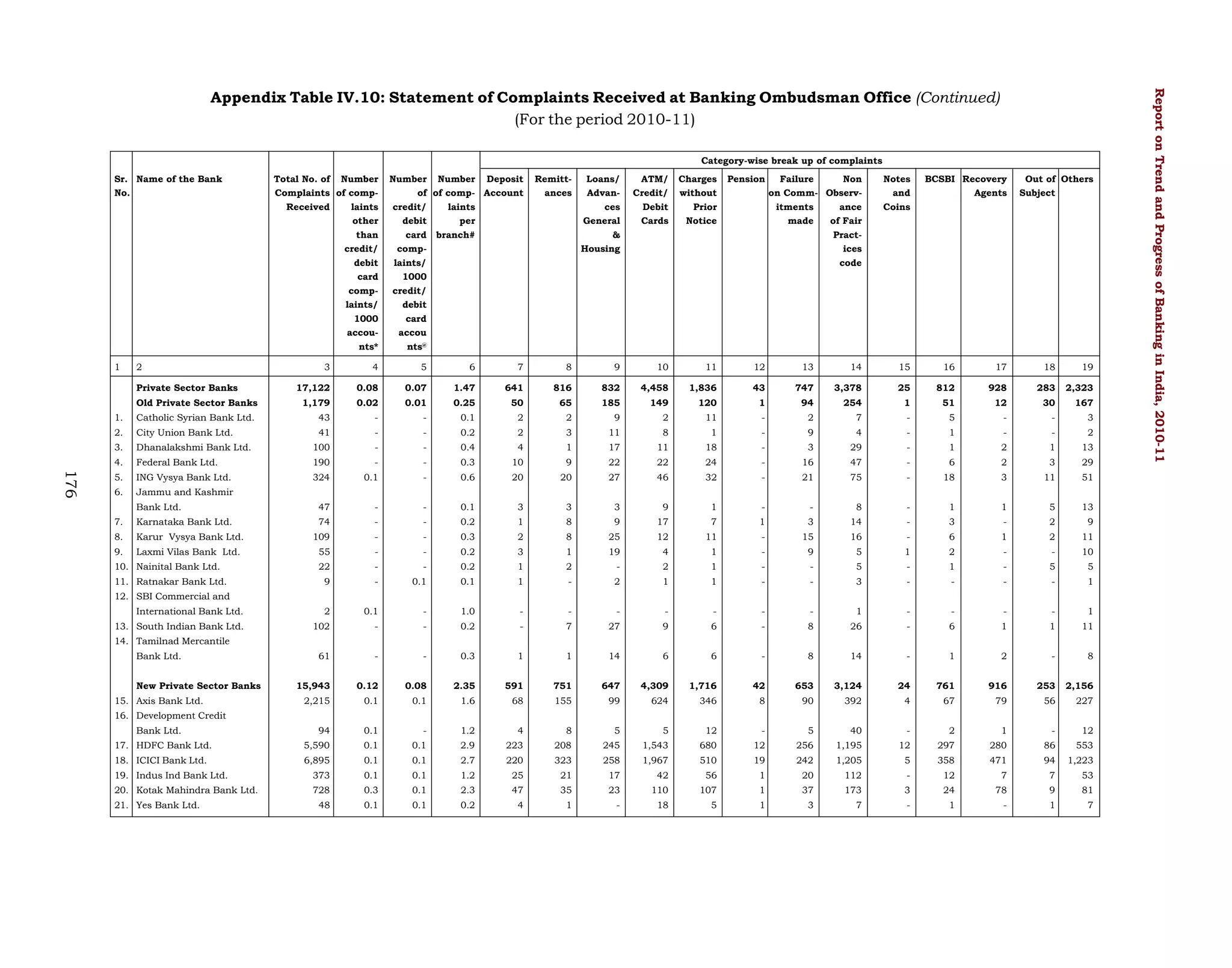

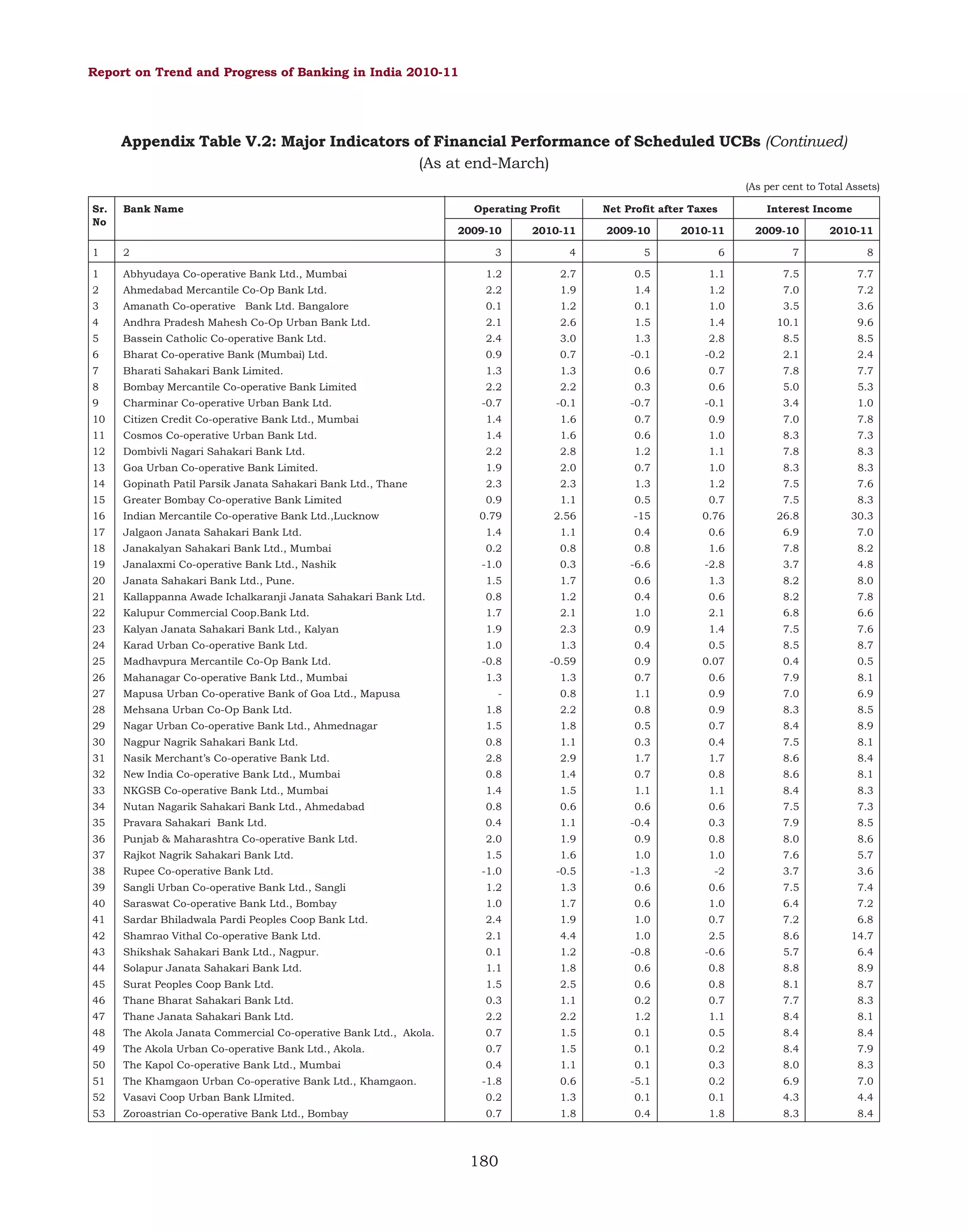

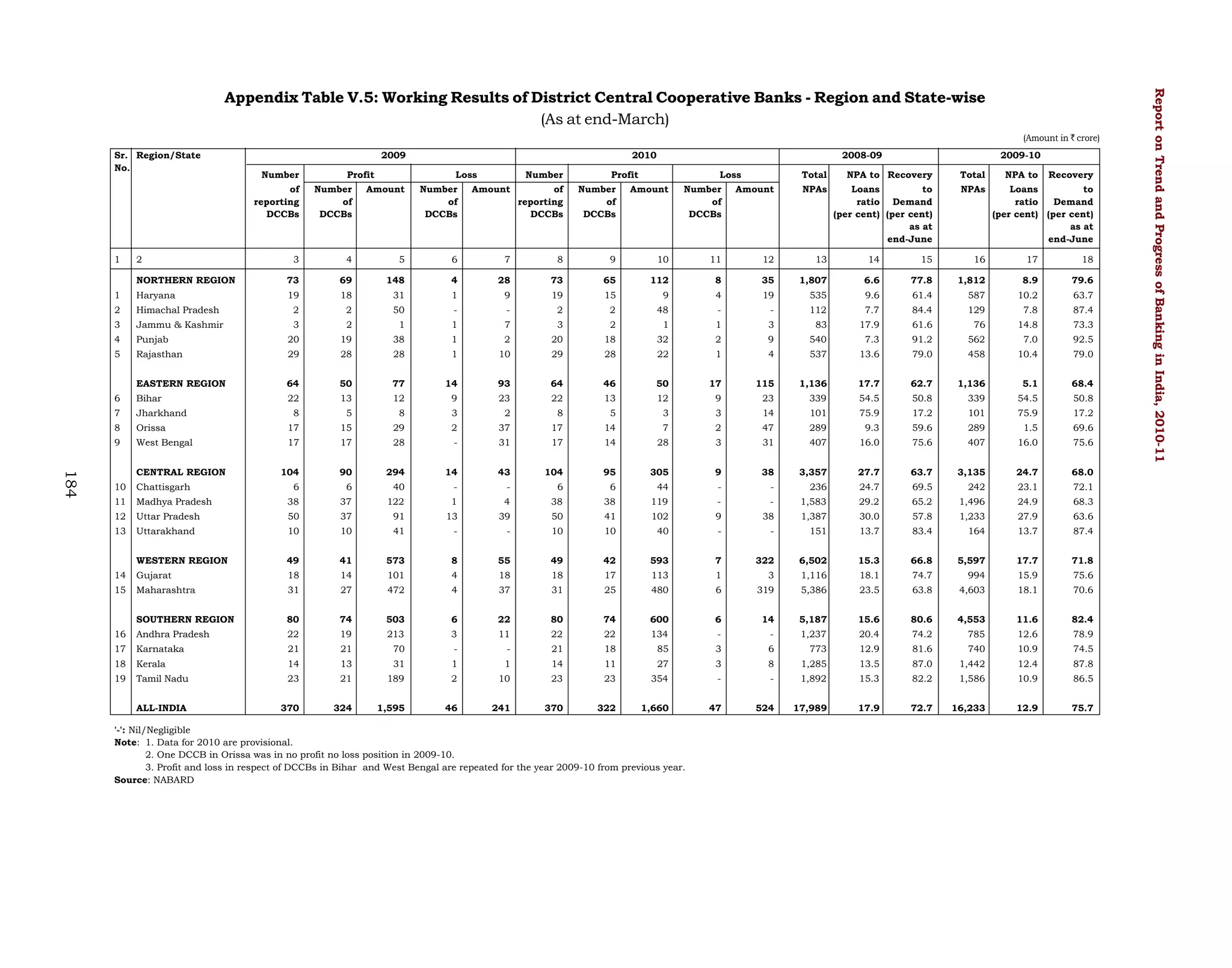

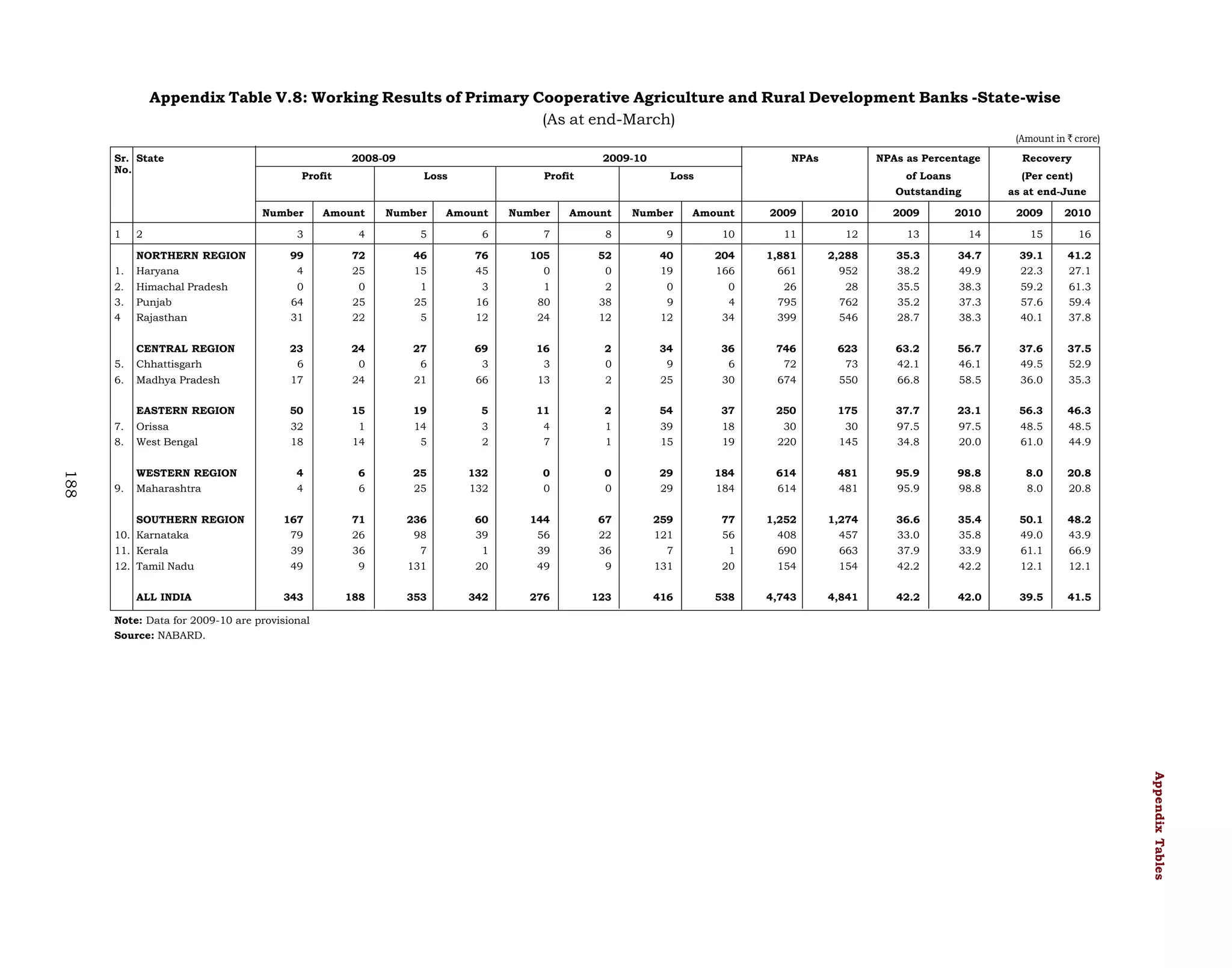

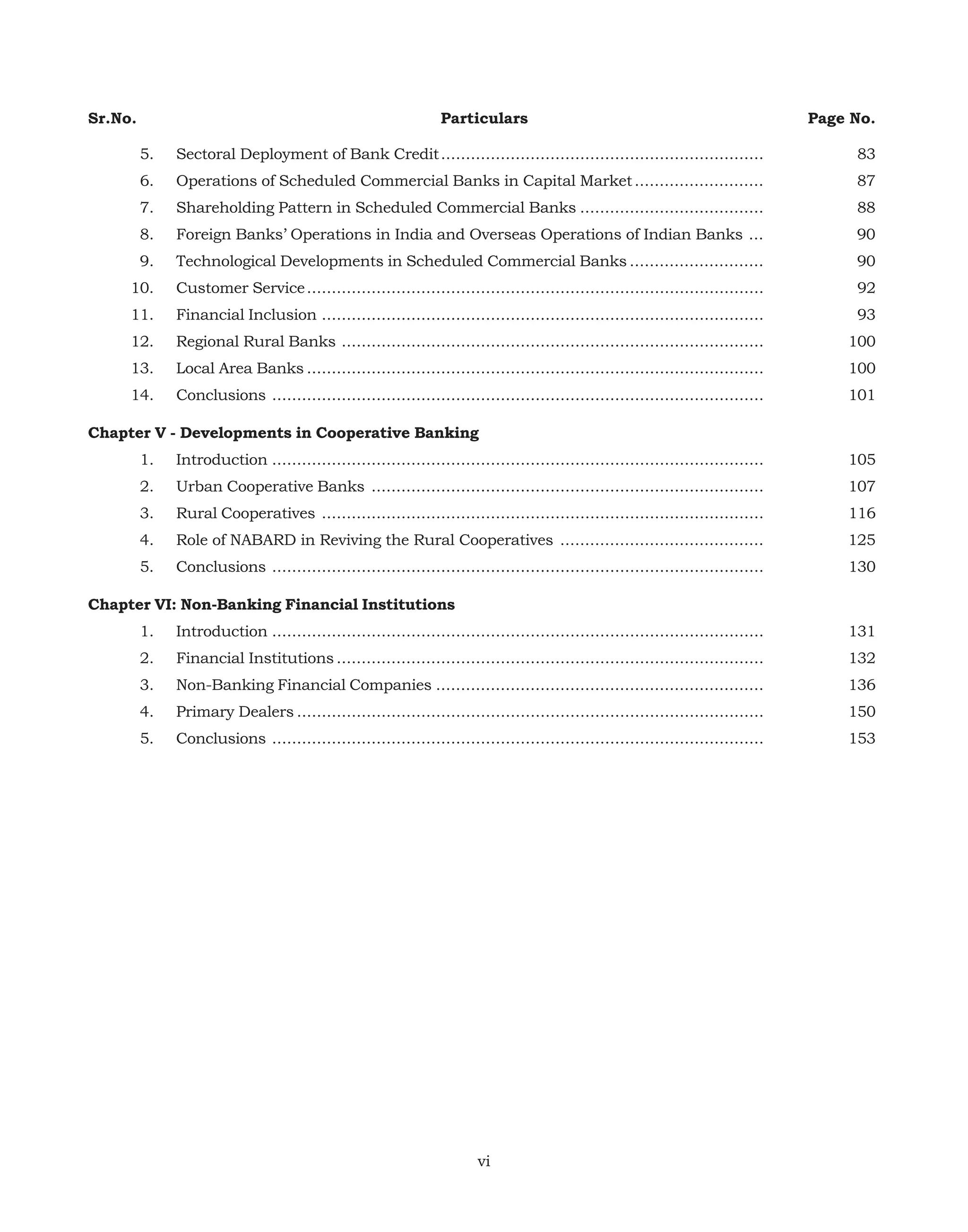

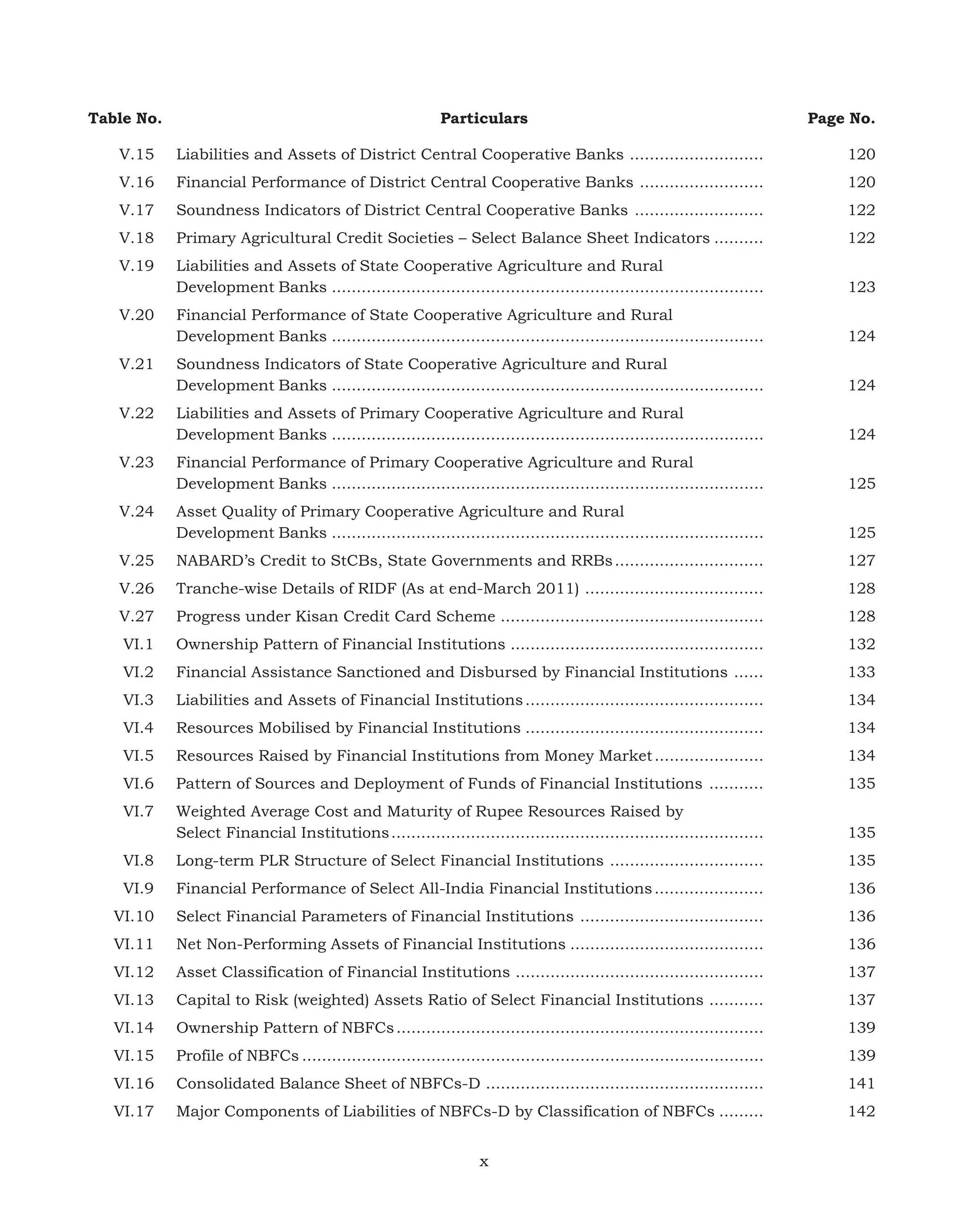

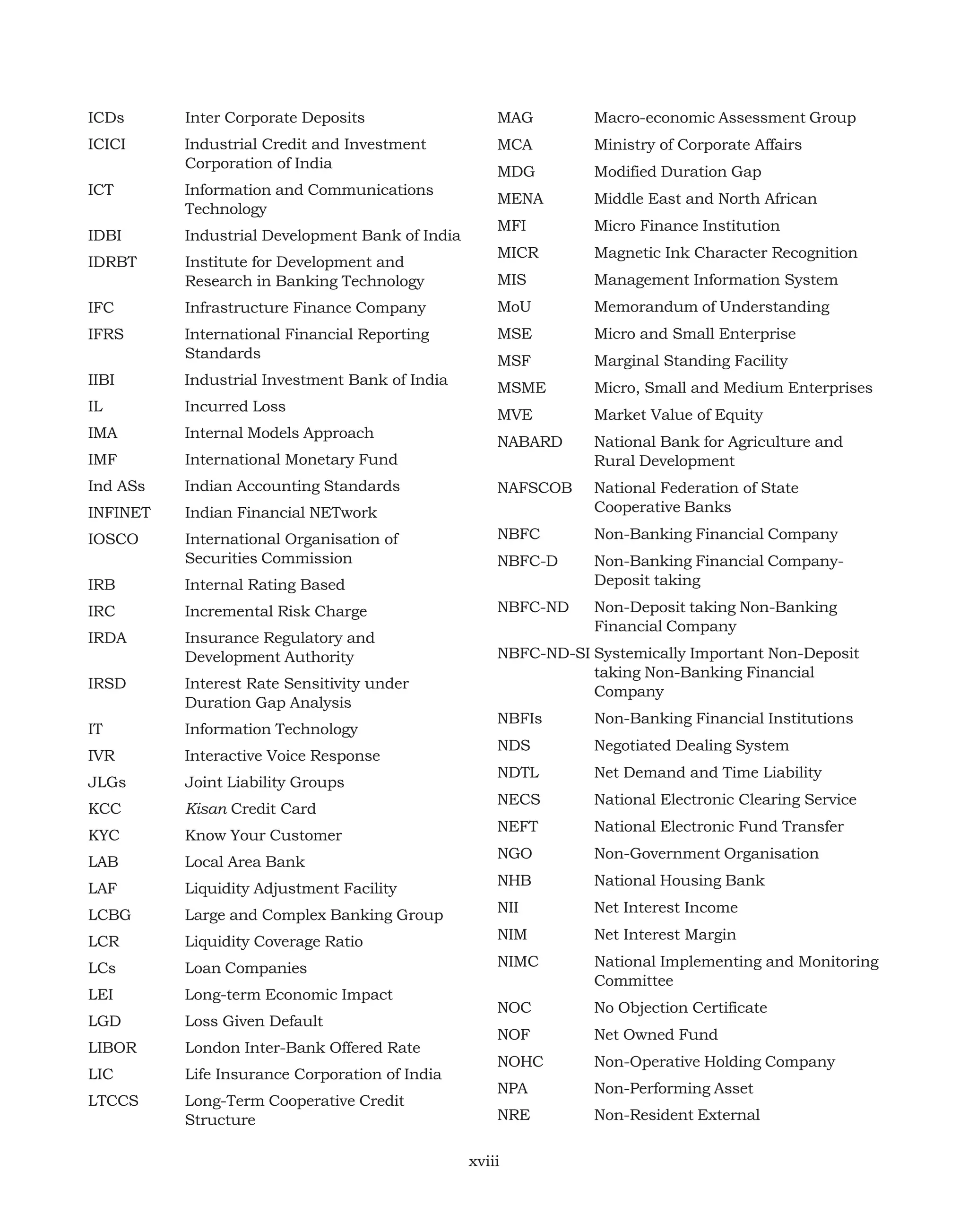

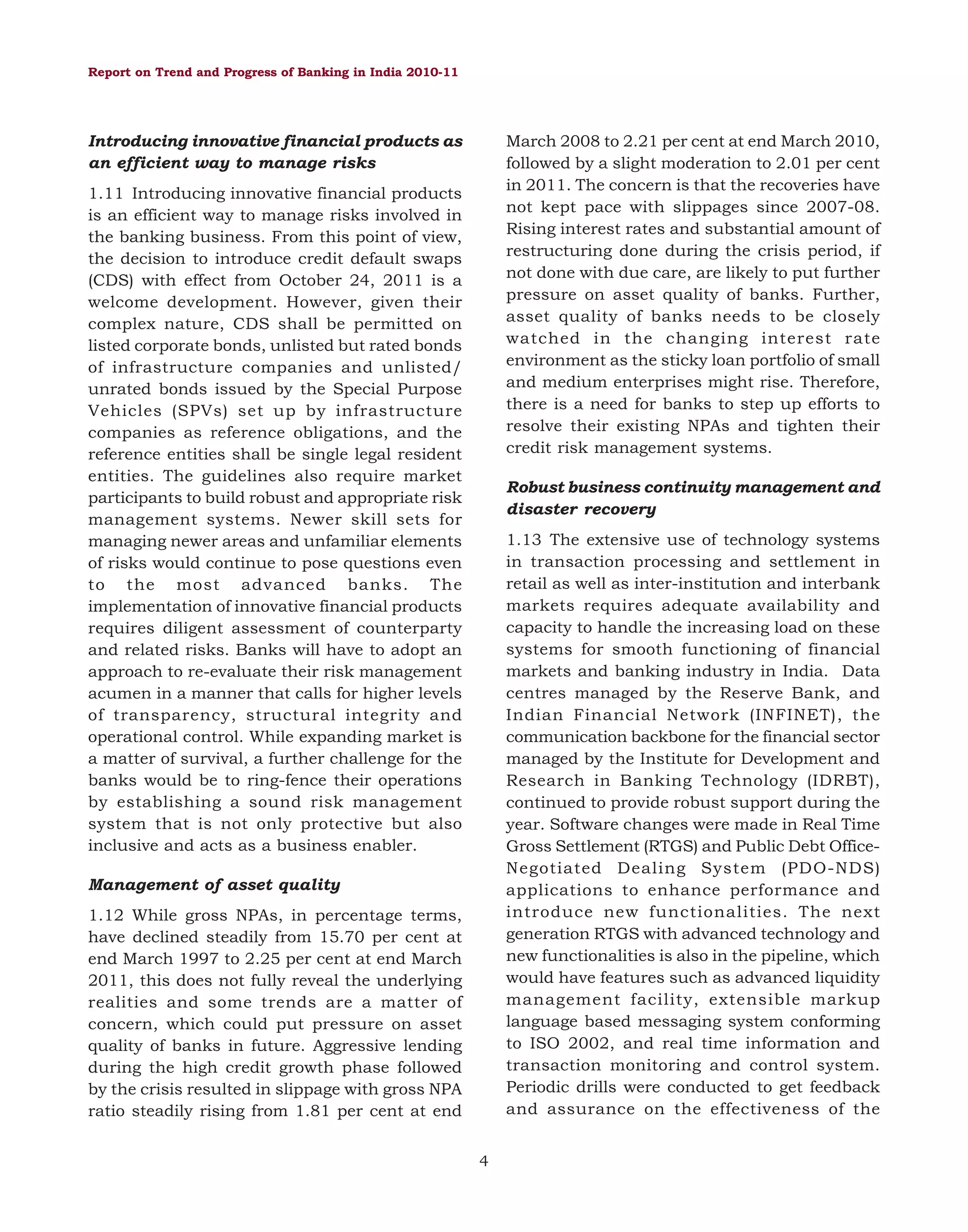

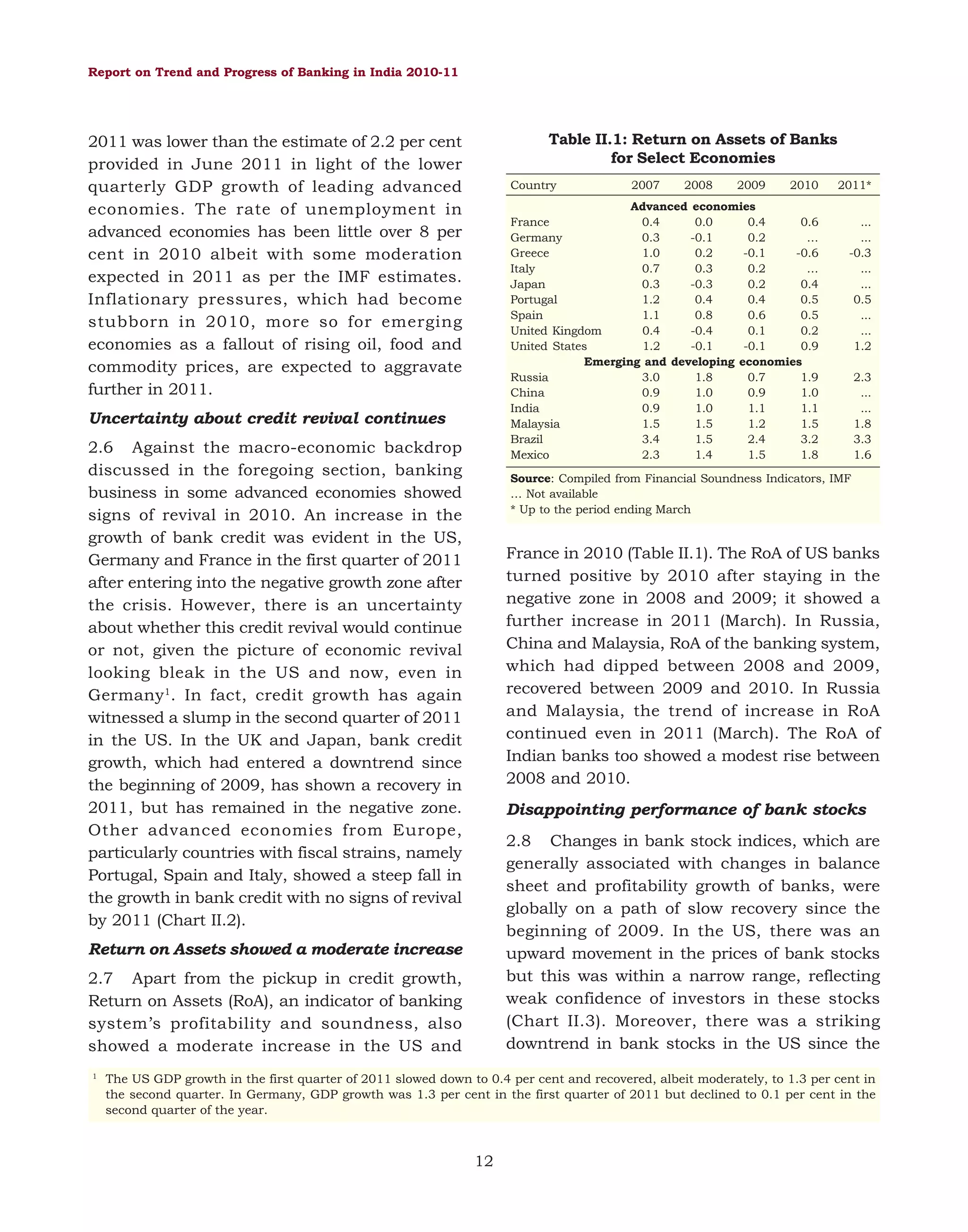

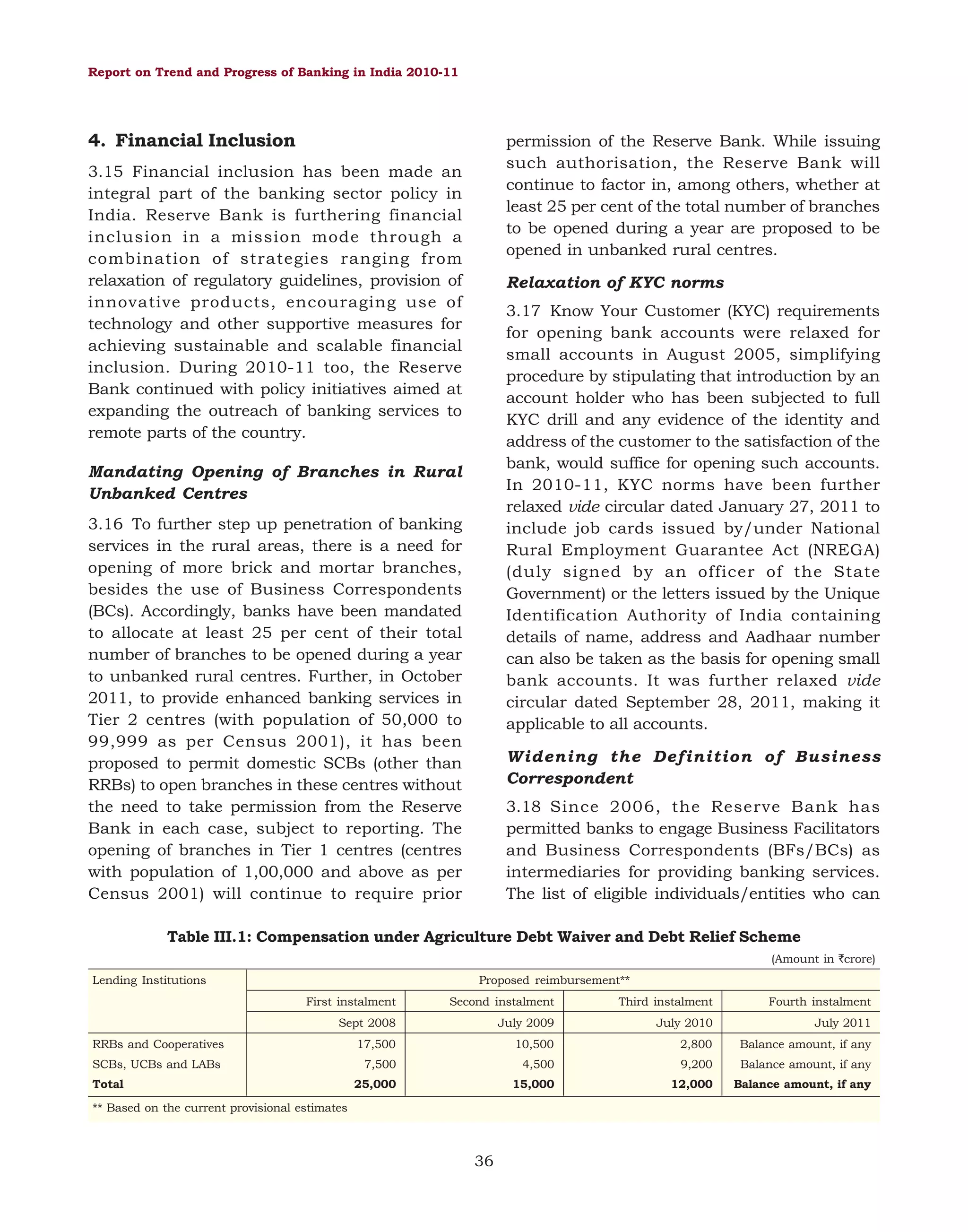

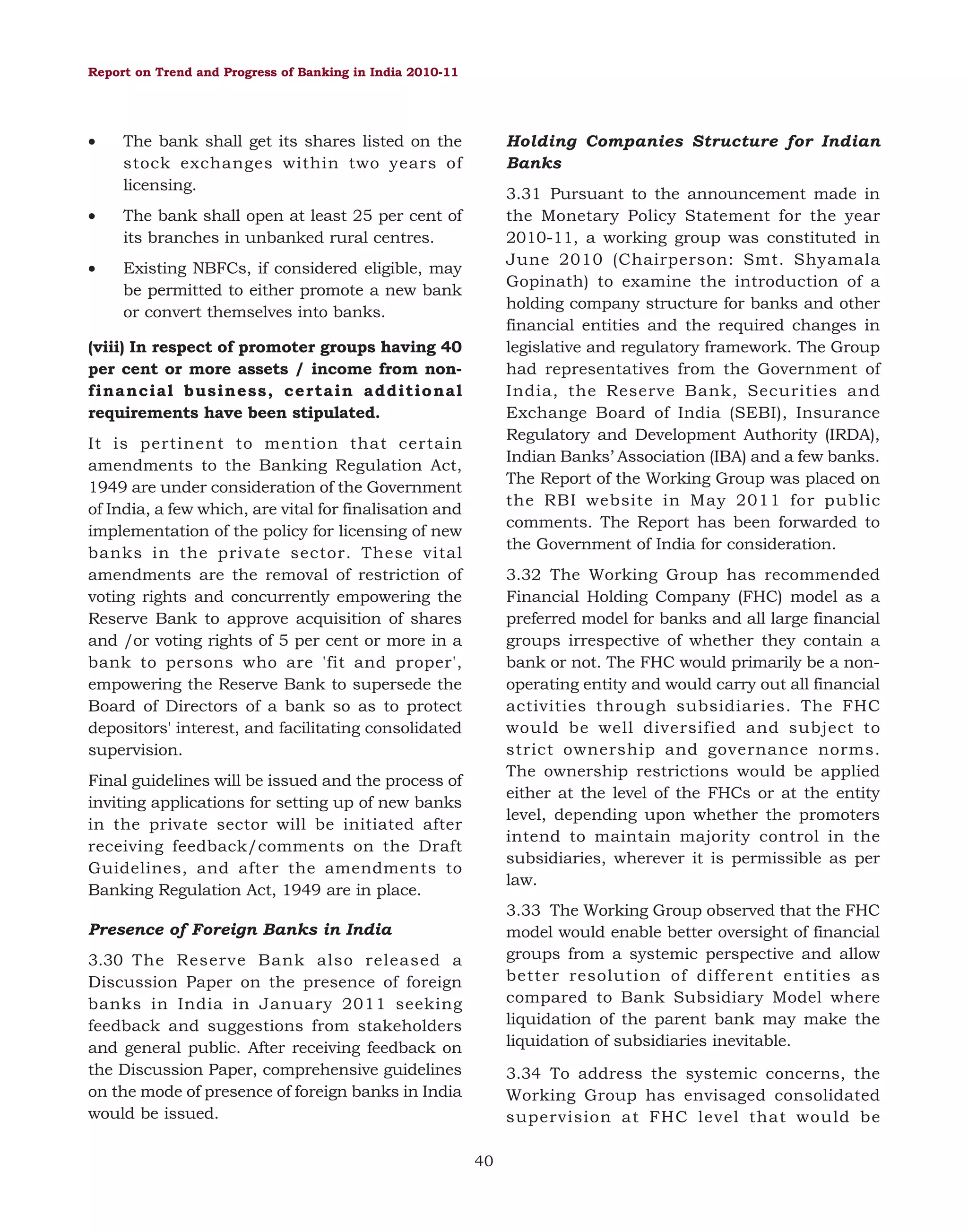

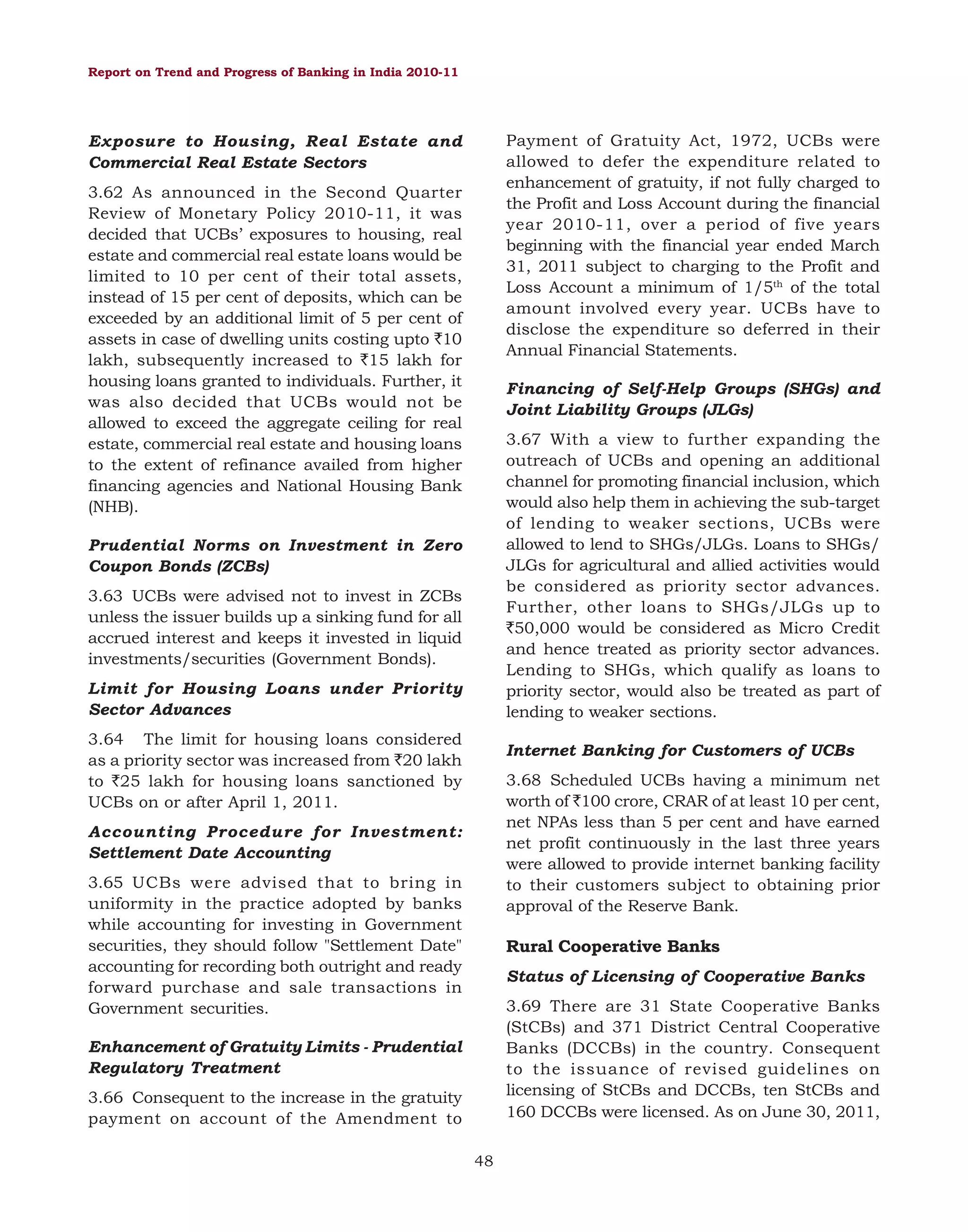

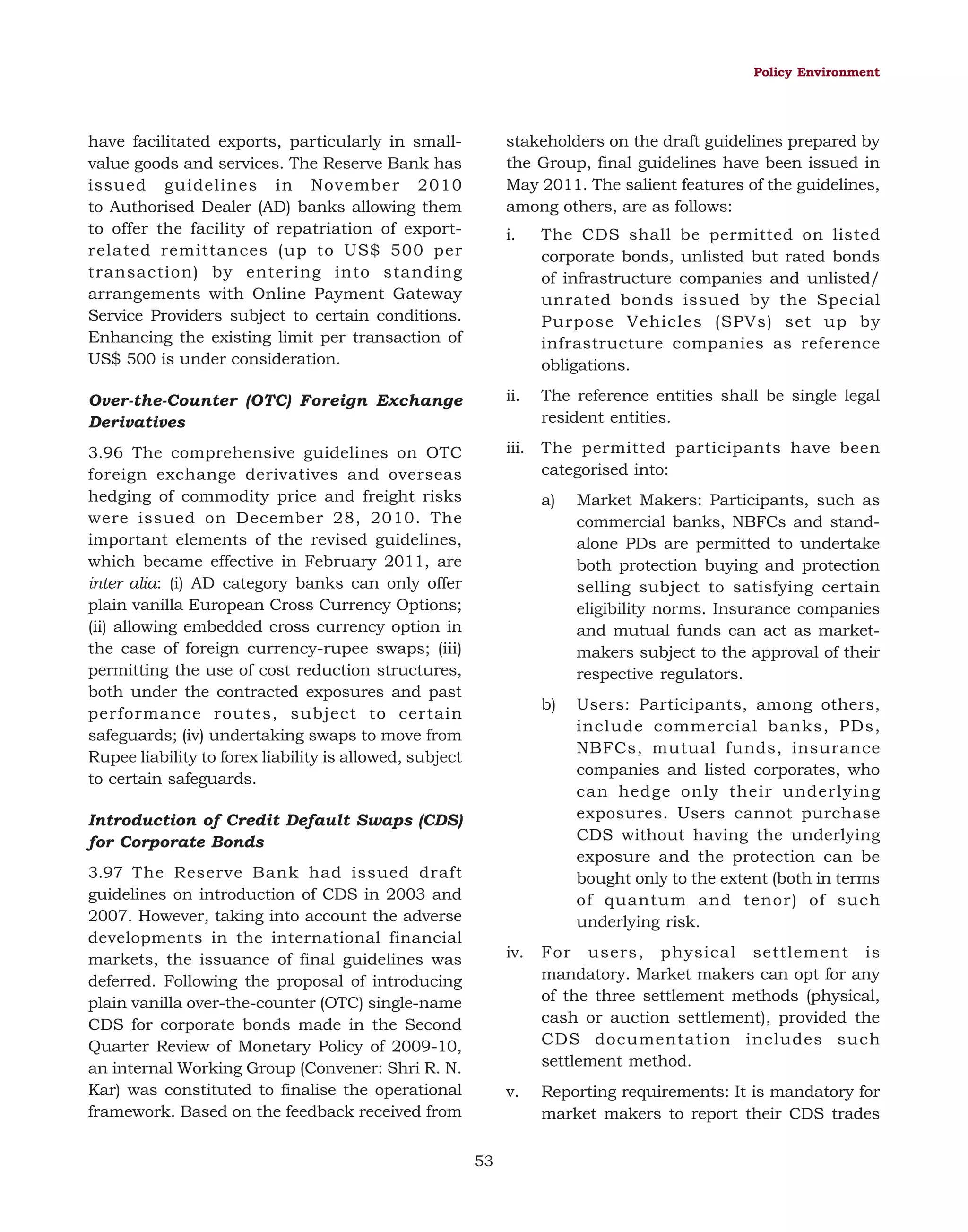

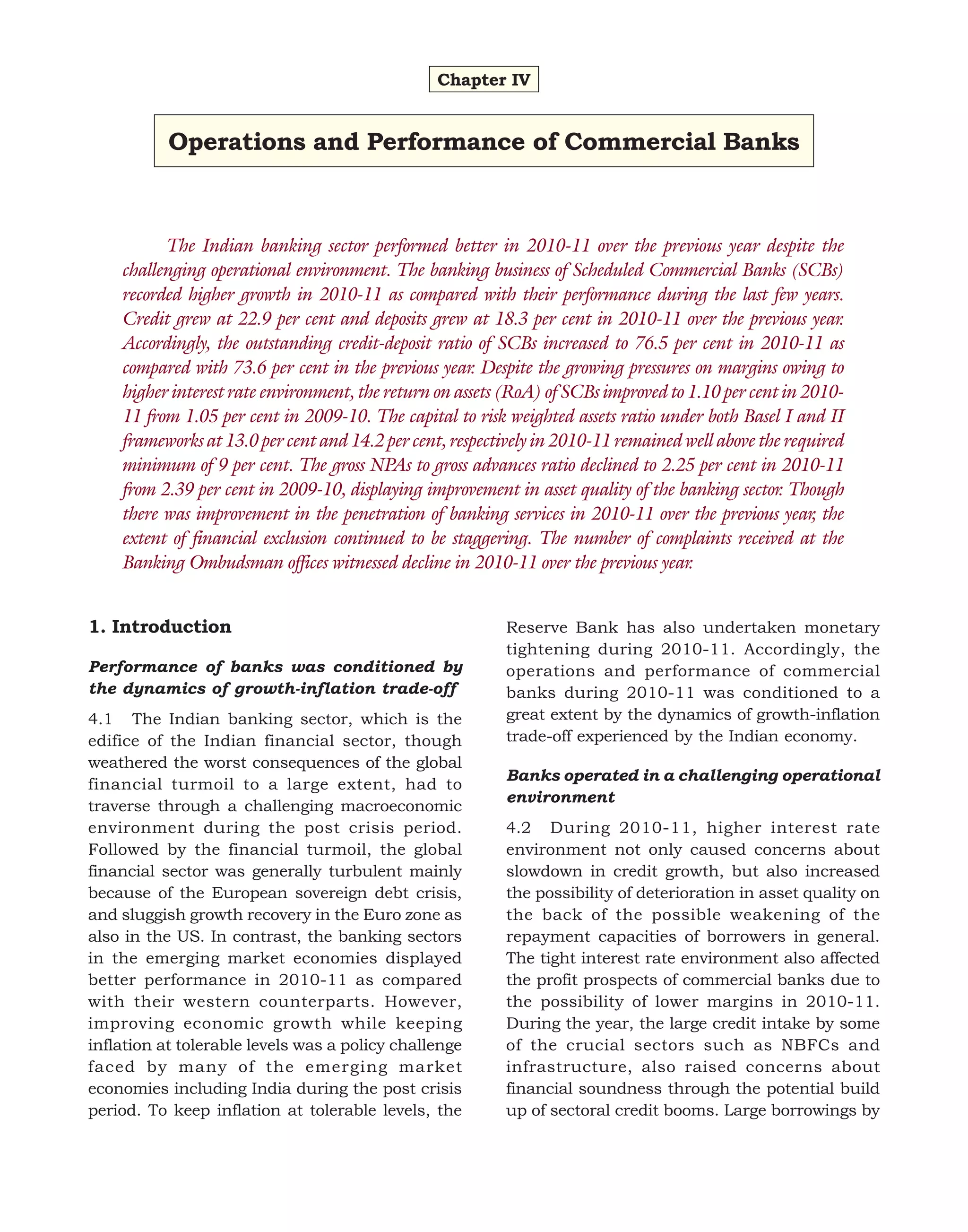

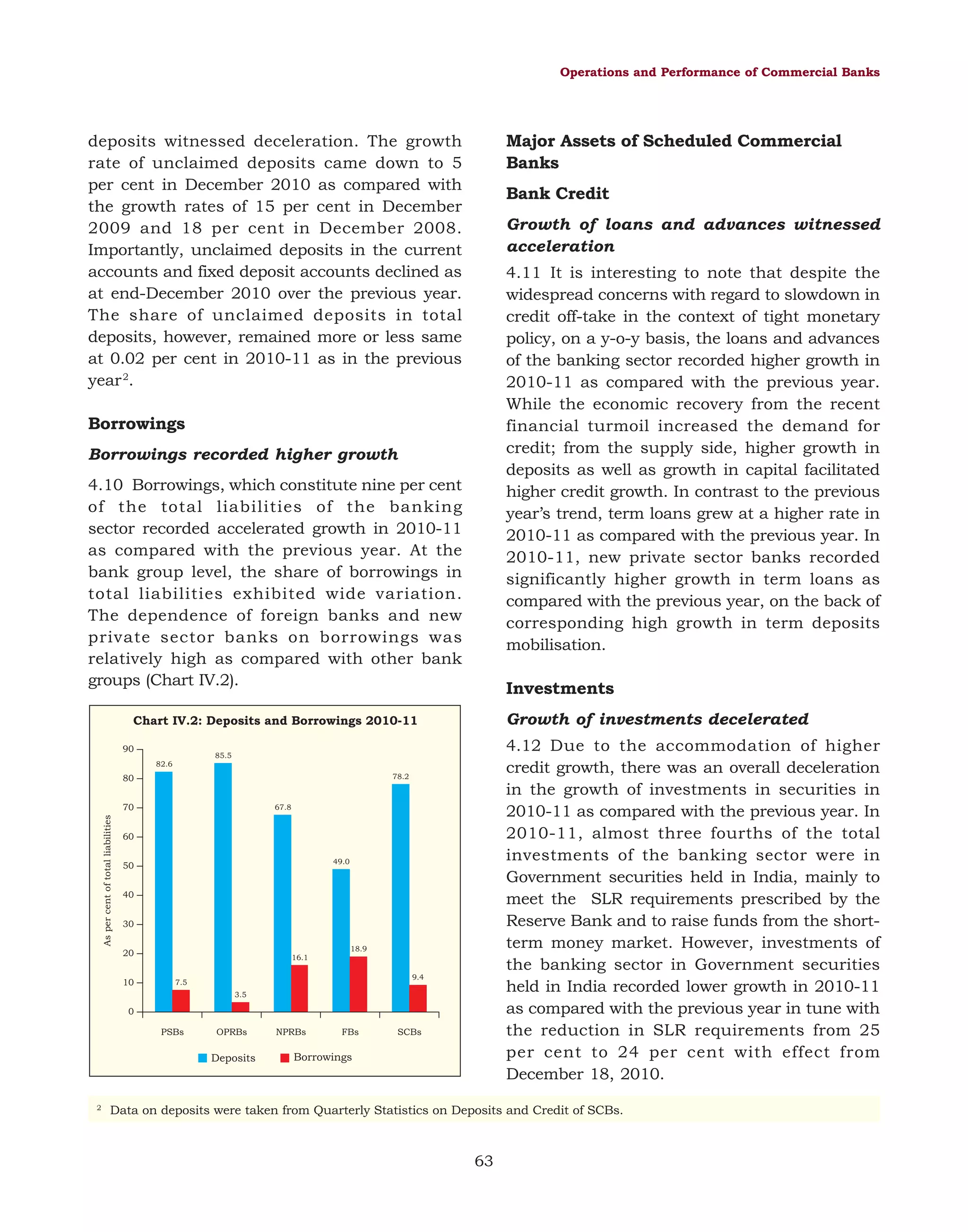

Box VI.2: Credit Rating of NBFCs – Practices and Prospects

as well, and being so it could be more volatile or difficult to

predict.

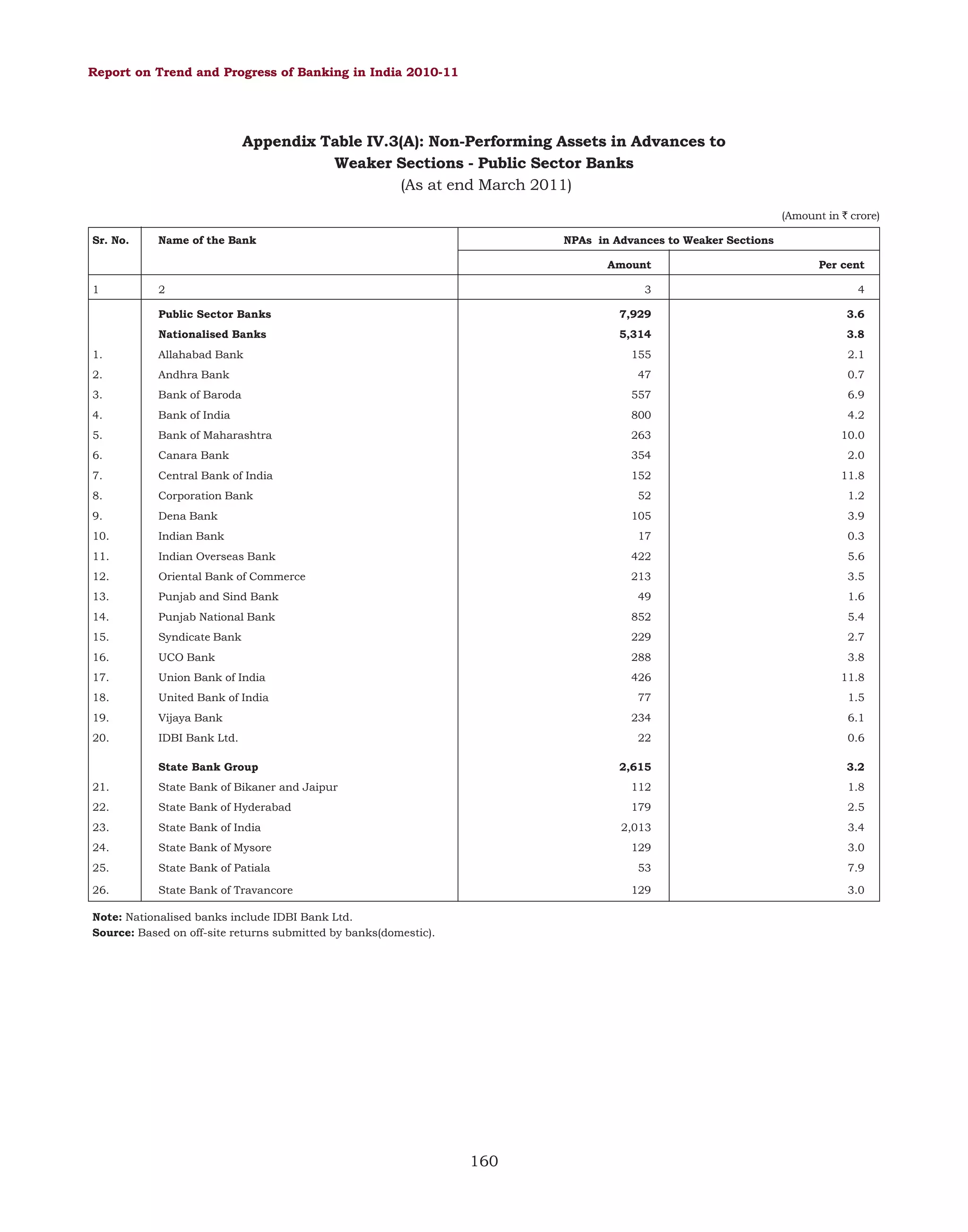

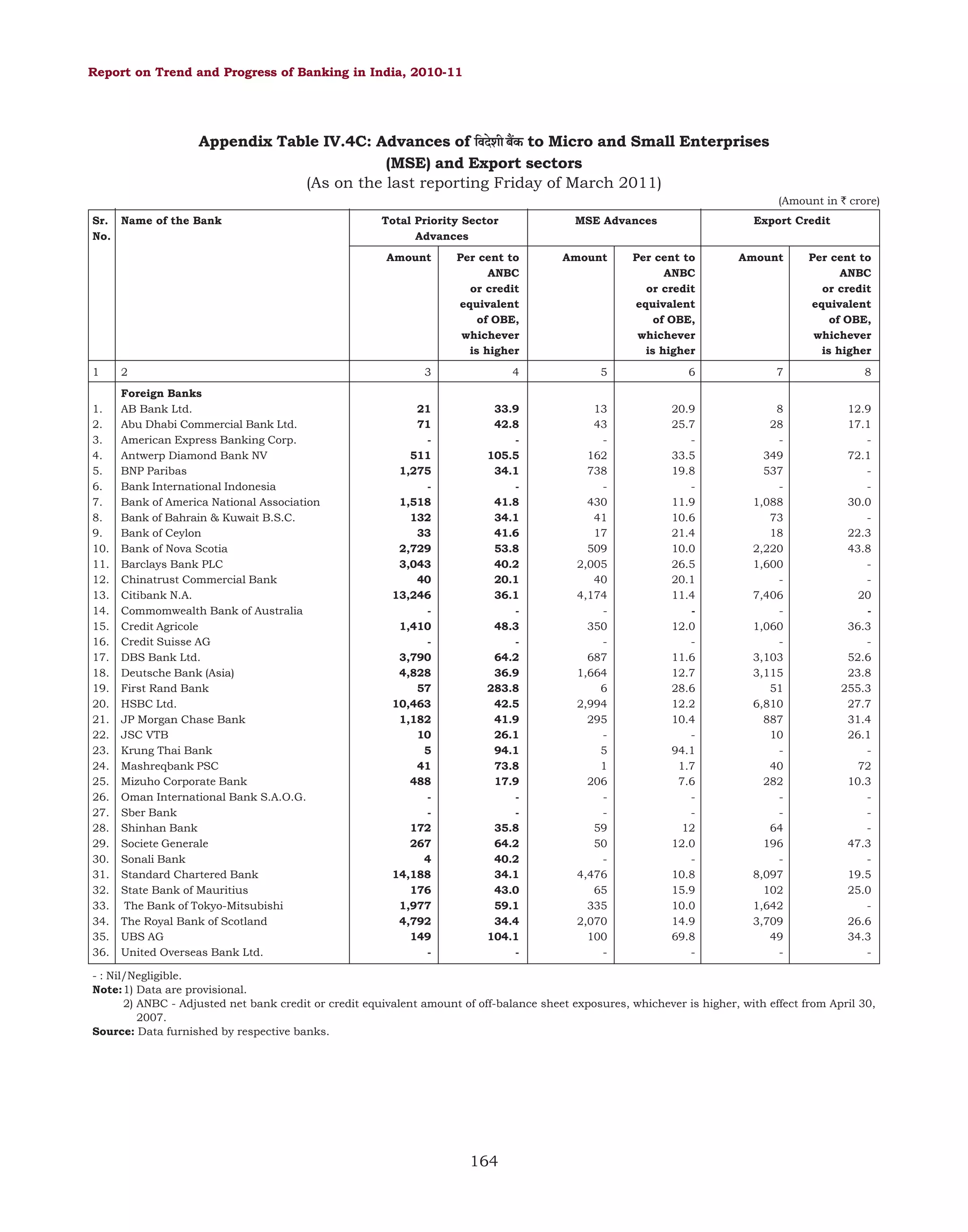

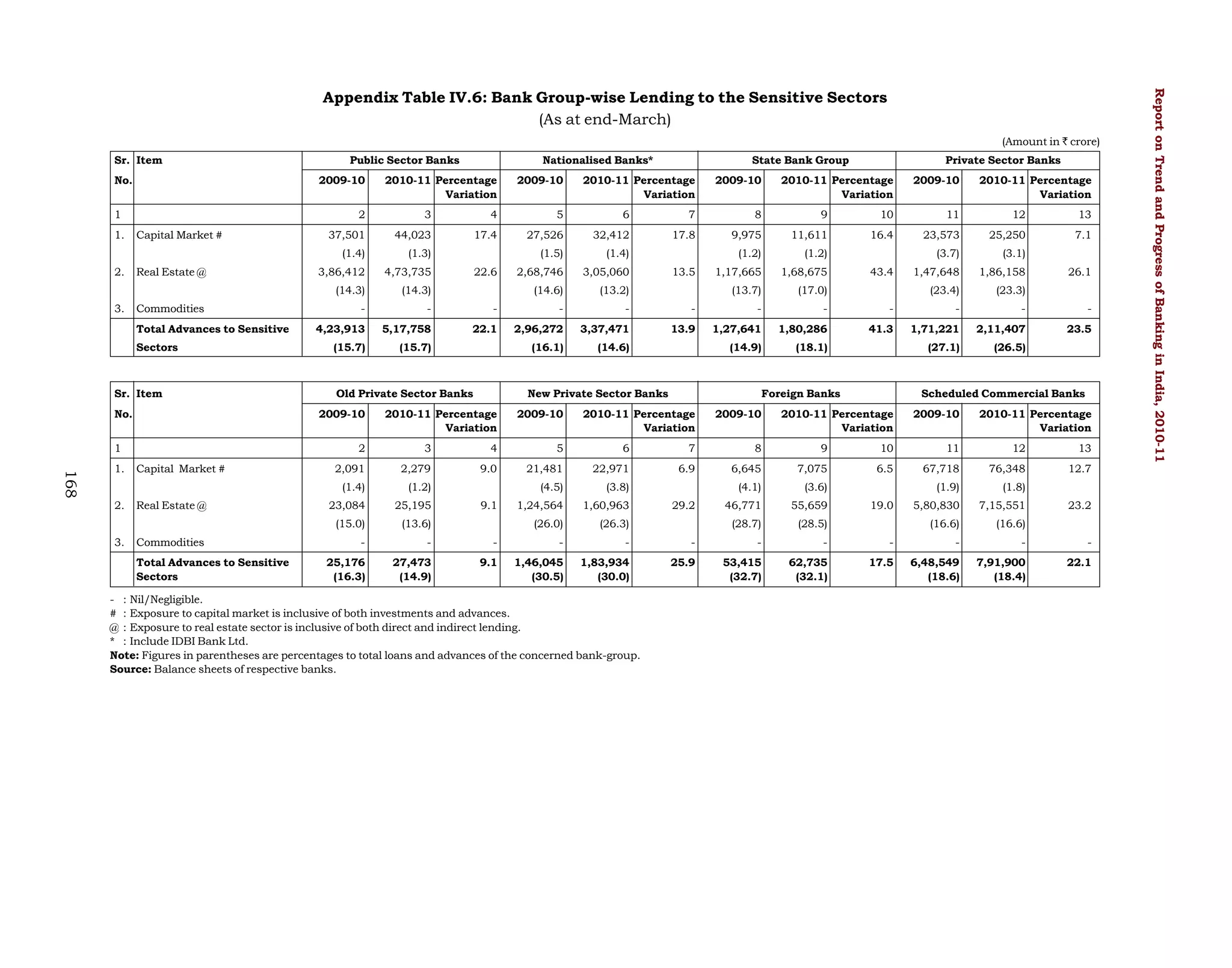

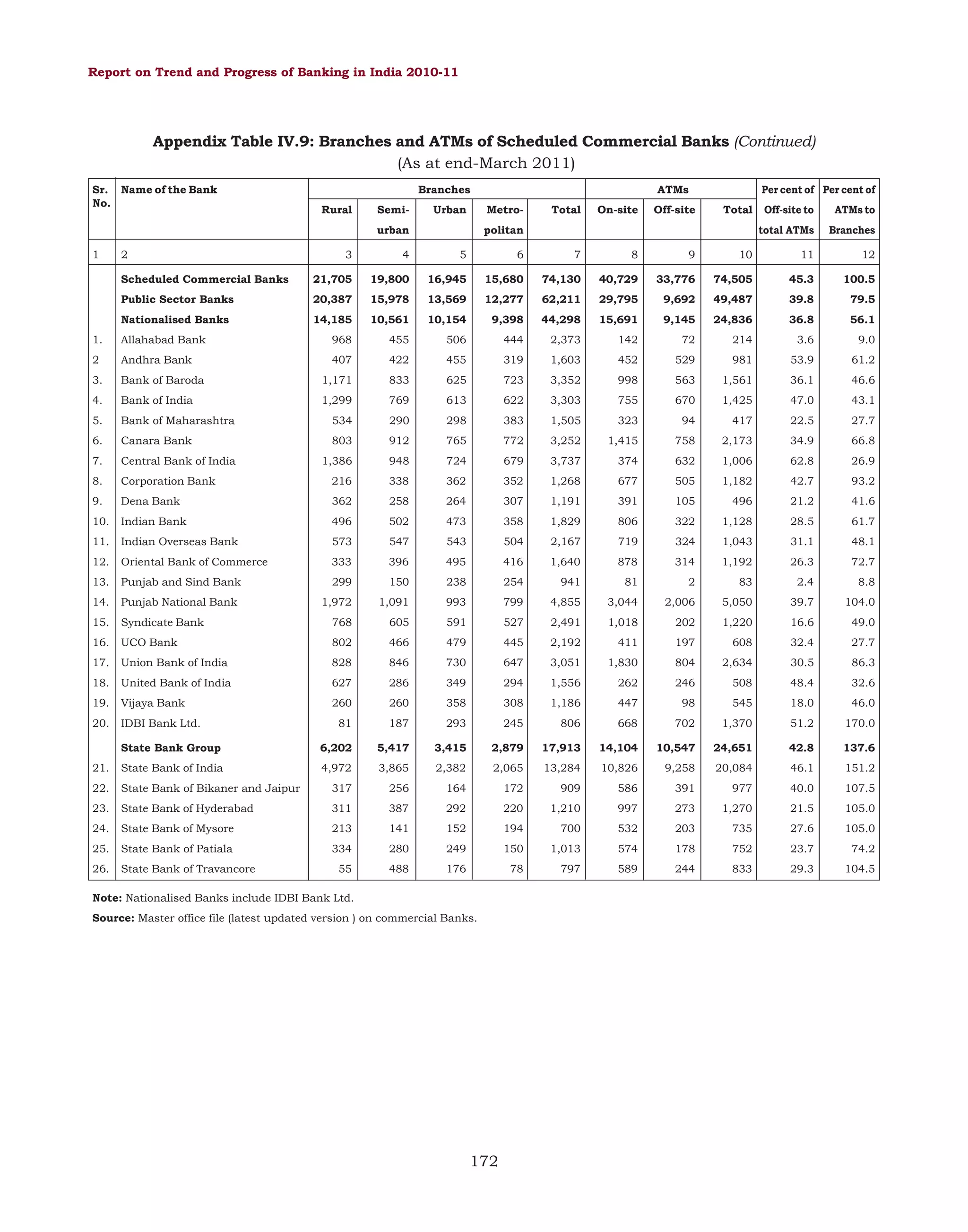

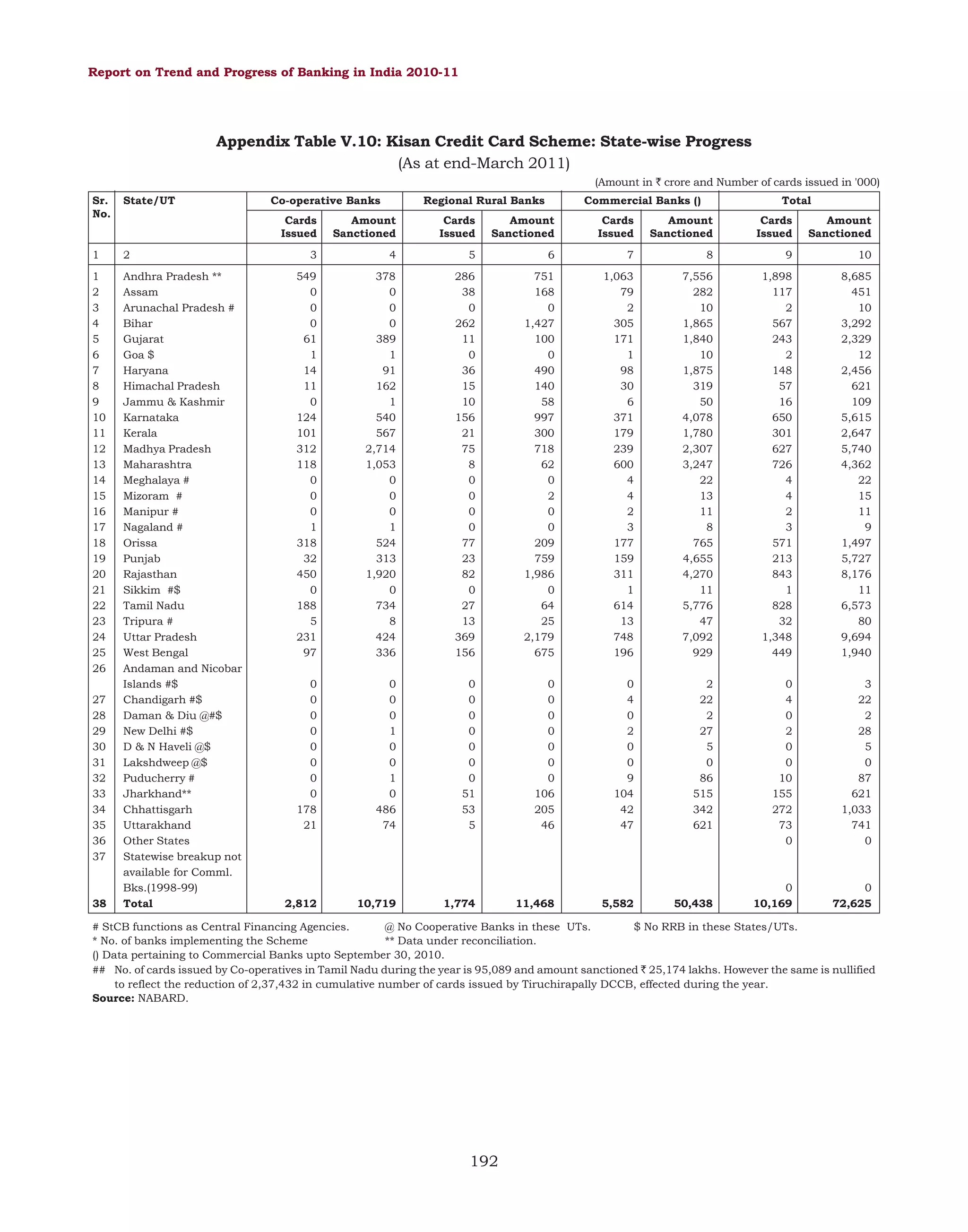

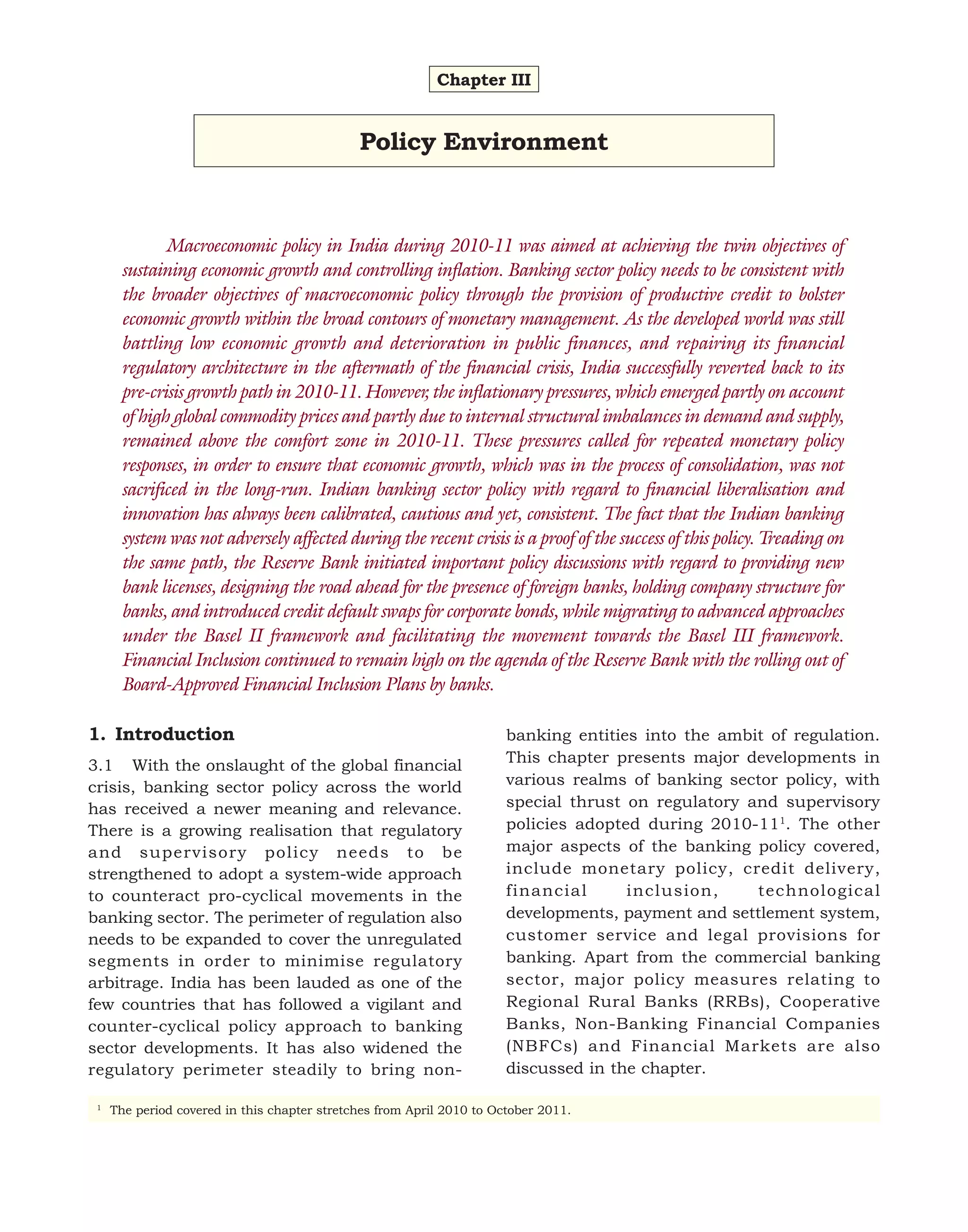

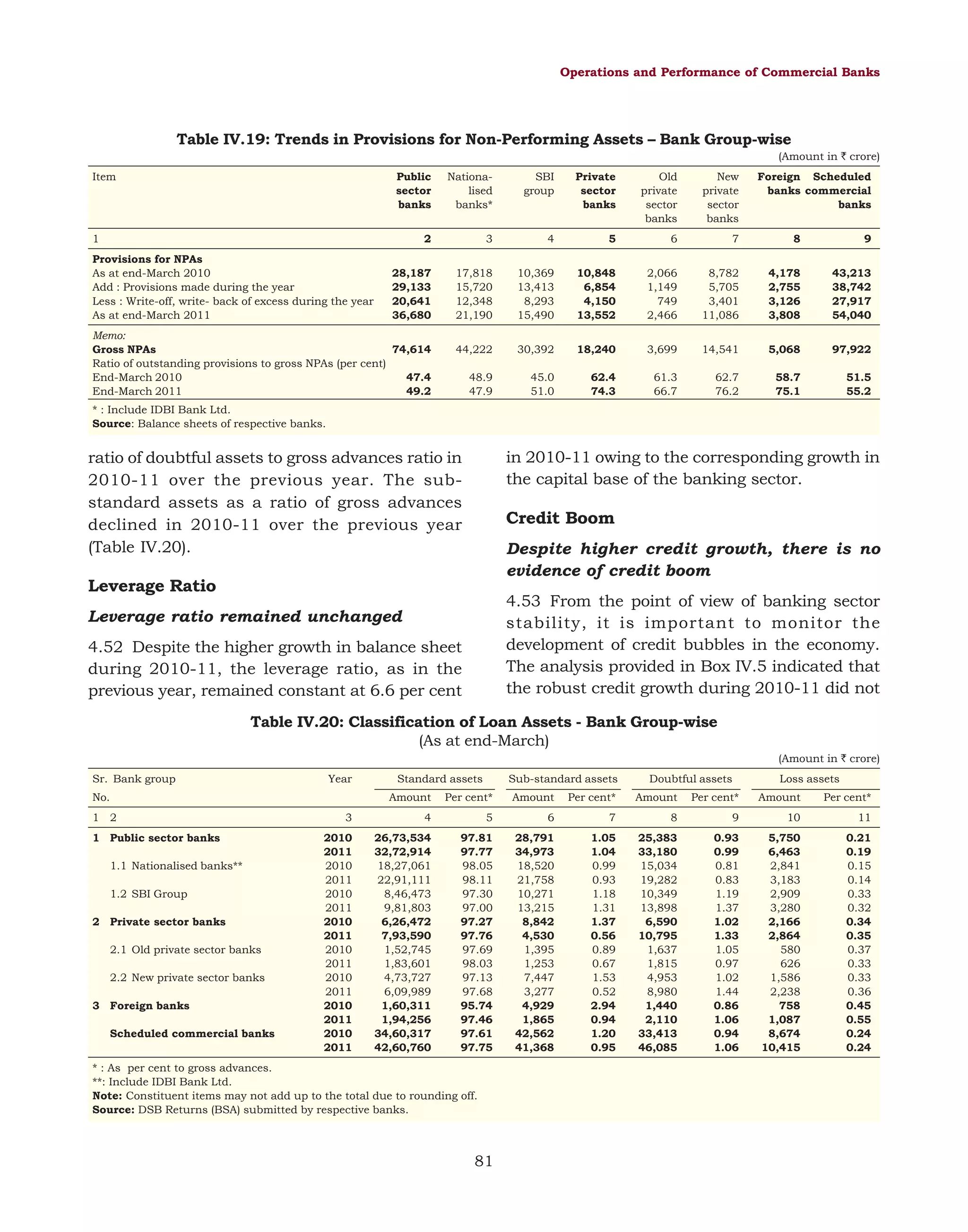

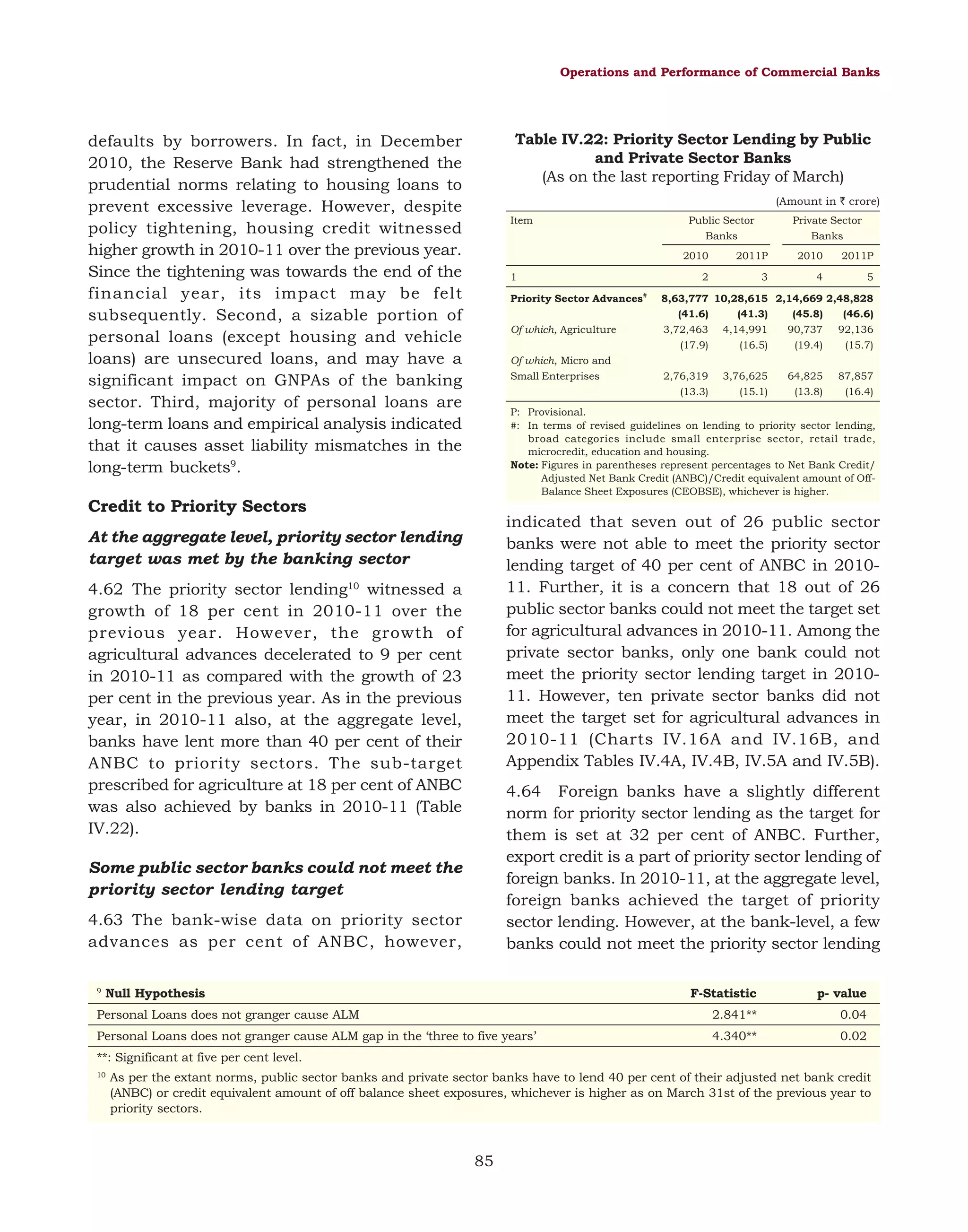

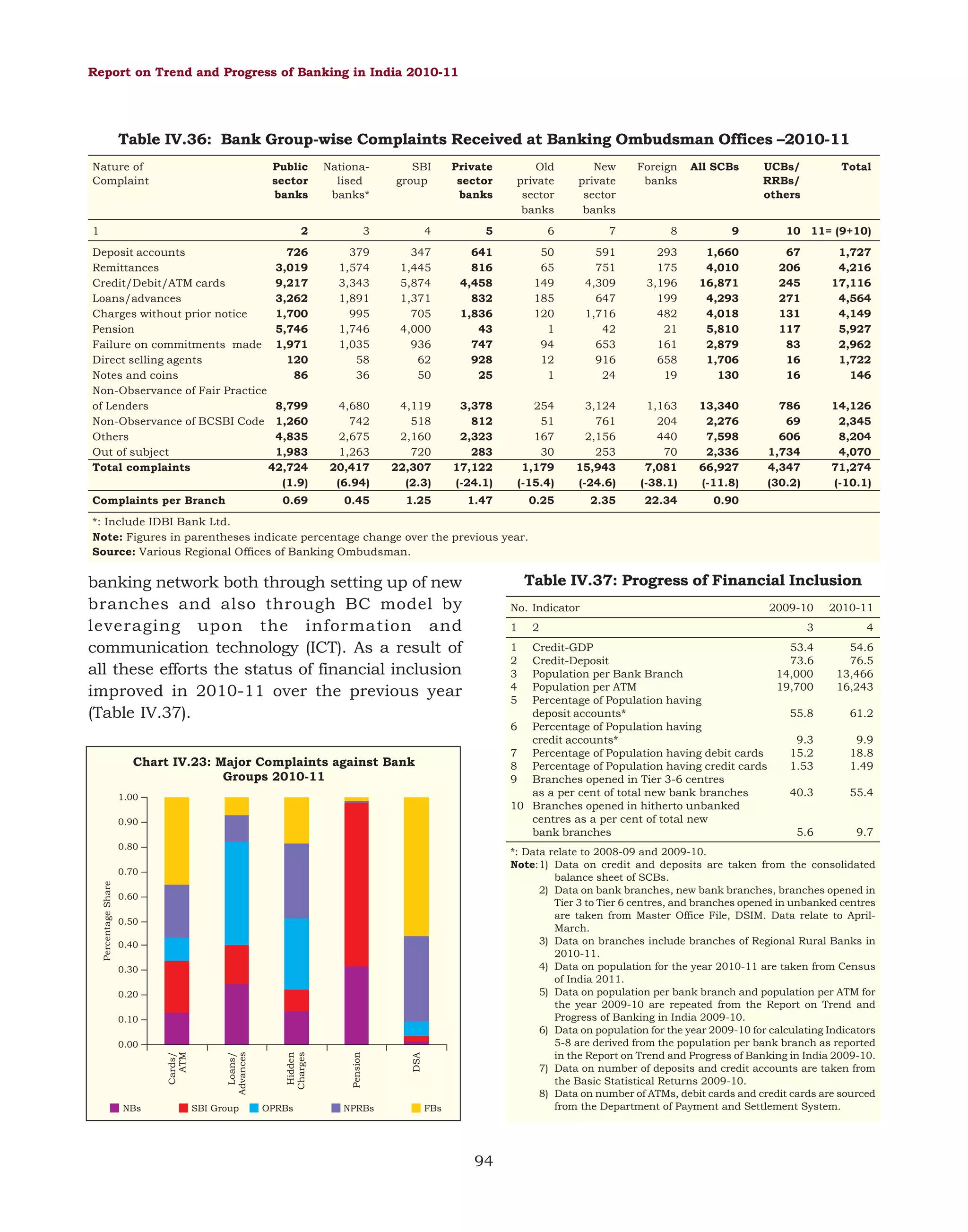

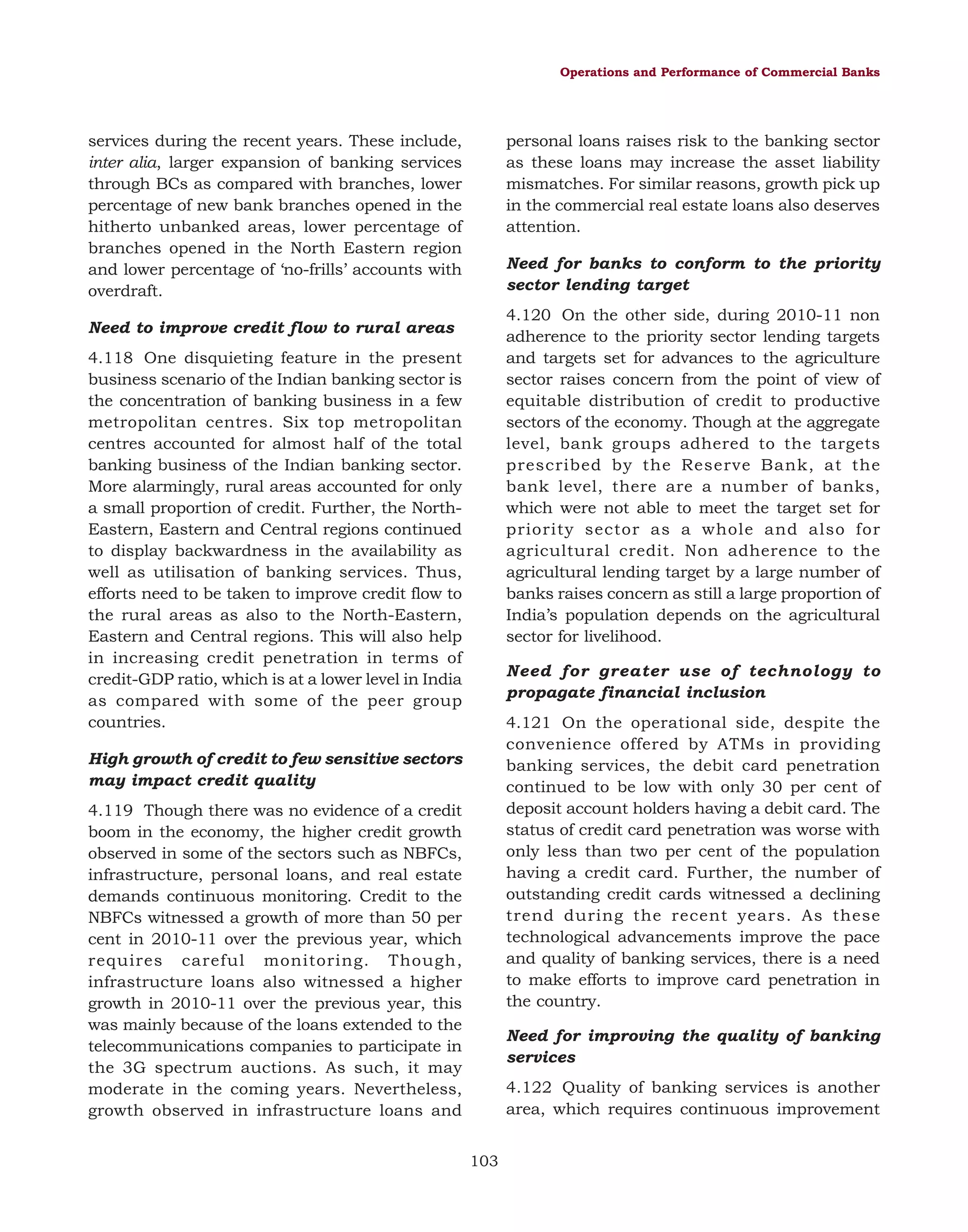

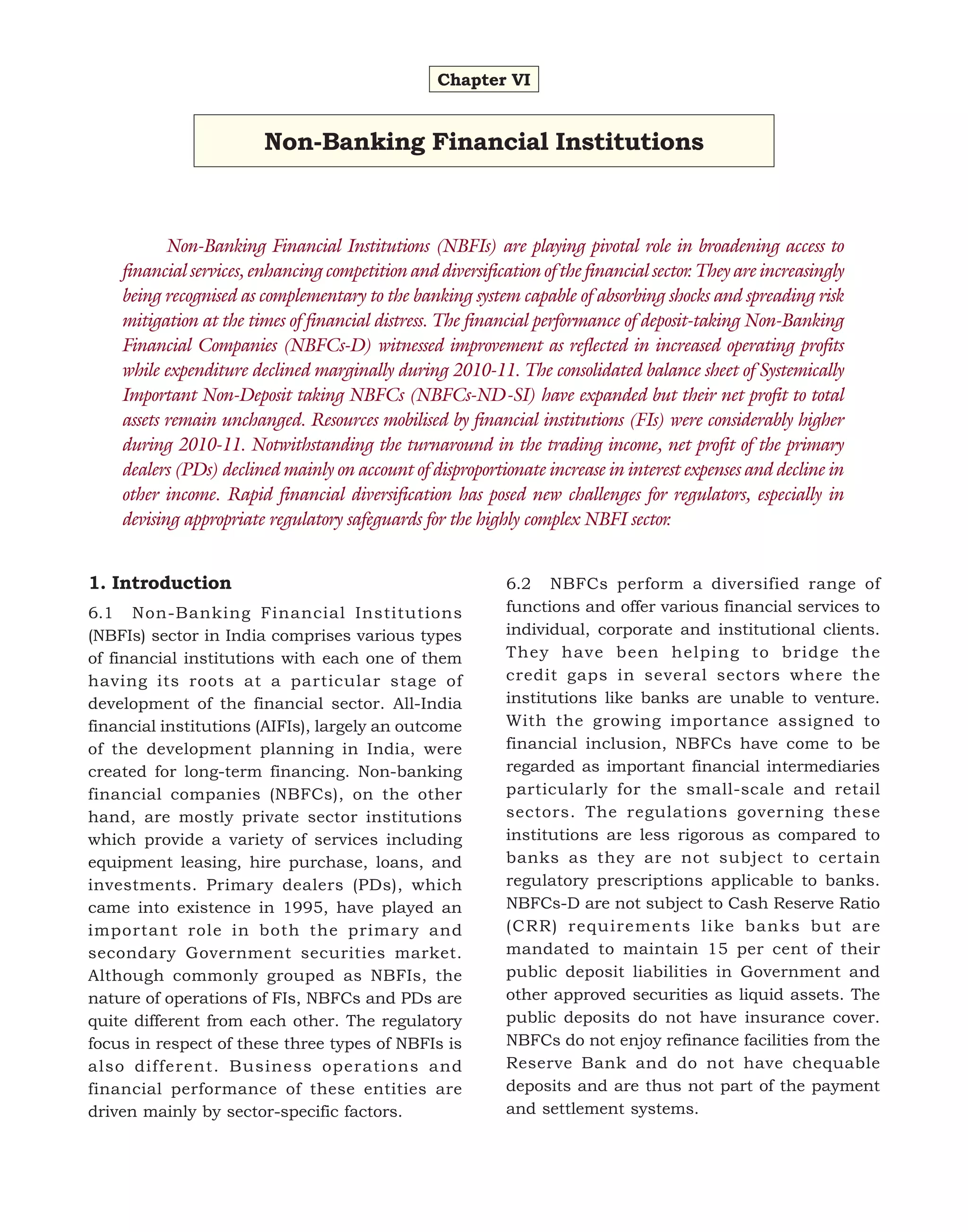

Non-Banking Finance Companies (NBFCs) being

heterogeneous in their operations, they are broadly grouped

under four heads (i) asset finance companies, (ii) loan

companies, (iii) investment companies, and (iv) infrastructure

finance companies for regulatory compliance by the Reserve

Bank. Credit rating for deposit taking NBFCs was

recommended by ‘Working Group on Financial Companies

(Chairman: A. C. Shah) in 1992. However, it was in January

1998 that the new regulatory framework for NBFCs by the

Reserve Bank made it mandatory for NBFCs to get rated in

order to protect the interest of the retail depositors.

All ratings are kept under continuous monitoring throughout

the period of validity.

Regulatory Requirements for Credit Rating of NBFCs

Effective January 31, 1998 the Reserve Bank made credit

rating mandatory to all deposit taking NBFCs with NoF of ` 25

lakh and above. Presently, NBFCs-D with NoF of ` 2 crore and

above have to necessarily get rated by one of the approved

CRAs at least once a year. It is also mandated that they

cannot raise public deposits without the ‘minimum

investment grade’ and the copy of the rating should be

submitted to the Reserve Bank. Moreover, any upgradation or

downgrading of the rating also need to be informed to the

regulator immediately.

The credit ratings assigned are a symbolic representation of

current opinion on the relative credit risk associated with the

instruments rated by credit rating agency(CRA). This opinion

is arrived at after a detailed evaluation of the issuer’s

business and financial risks and on using such evaluation to

project the level and stability of the future financial

performance in various likely scenarios of the rated

companies. Thus, conclusion derived from the analysis of the

particular company based on the detailed information CRA

received from within the company as well as from outside

sources by the rating agency is reflected in a credit rating.

Agency

Minimum grade

The Credit Rating Information Services of

India Ltd (CRISIL)

FA- (FA minus)

ICRA Ltd

MA- (MA minus)

Credit Analysis and Research Ltd (CARE)

Rating Methodology

In rating an NBFC, the credit rating agency evaluates the

company’s business and financial risks, and uses this

evaluation to project the level and stability of its future

financial performance in various likely scenarios. The broad

parameters for assessing the risks of NBFCs are based on

Business Risk: (i) Operating Environment, (ii) Ownership

Structure, (iii) Franchise and Size, (iv) Competitive position,

(v) Management, Systems and Strategy, and (vi) Governance

structure; Financial Risk: (i) Asset Quality, (ii) Liquidity, (iii)

Profitability, and (iv) Capital Adequacy.

CARE BBB (FD)

FITCH Ratings India Pvt. Ltd

[tA- (ind) (FD)]

Prospects for Credit Ratings of NBFCs

The quantum of deposit raised by an NBFC is linked to the

ratings. NBFCs have been incentivized to get rated by credit

rating agencies through linking of their CRAR to the ratings.

Accordingly, as of now a rated NBFC is required to maintain

only 12 per cent of CRAR while unrated NBFCs need to

maintain 15 per cent. Incidentally, the non-deposit taking

NBFCs, though the rating is not mandatory by the regulator,

get their instruments rated by the CRAs.

In the wake of the sub-prime financial crisis, there is a

growing concern among the regulators about the potential

gap between expectation and realization, i.e., between

reliance on credit ratings and the reliability of such ratings.

The concern emanates mainly from the fact that inaccurate

credit ratings could disturb the market allocation incentives,

cost structures and competition. With growing competition

among credit rating agencies commercial aspirations appear

to be too high. The most oft repeated complaint against CRAs

are that they lack accountability as credit rating agencies do

not have a legal duty of accuracy and are often protected from

liability in case of inaccurate ratings. This requires the

attention of regulators and the government.

However, the relative importance of each of these parameters

can vary across companies, depending on its potential to

change the overall risk profile of the company concerned.

Moreover, as many of these parameters are qualitative, the

rating companies try to reduce the subjectivity by capturing

and assessing information on defined sub-parameters and by

comparison across various companies. One of the common

practices among CRAs being that a careful evaluation of the

risk management policies of the NBFC is done as it provides

important guidance for assessing the impact of stress events

on the liquidity, profitability, and capitalisation of the

company concerned.

The CRA evaluates the quality of an NBFC’s capital, apart

from the level of capital. An NBFC’s ability to meet regulatory

capital adequacy requirement is also evaluated. A very high

return on equity may not necessarily translate into a high

credit rating, given that the underlying risk could be very high

References:

RBI (1992): Report of the Working Group on Financial

Companies (Chairman: Shri A. C. Shah), Reserve Bank of

India, Mumbai.

140](https://image.slidesharecdn.com/0tpbi121111full-140101004243-phpapp02/75/0-tpbi121111-full-160-2048.jpg)