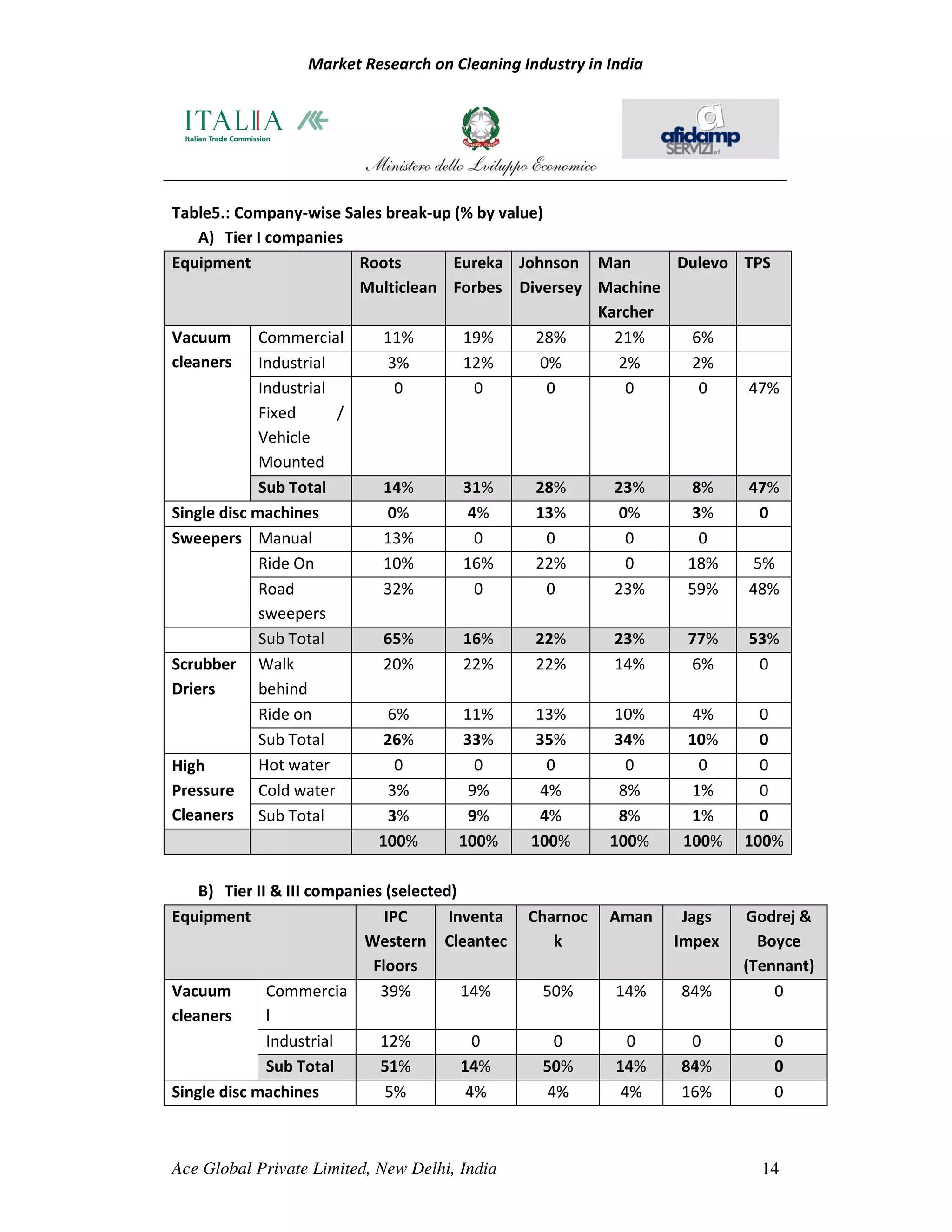

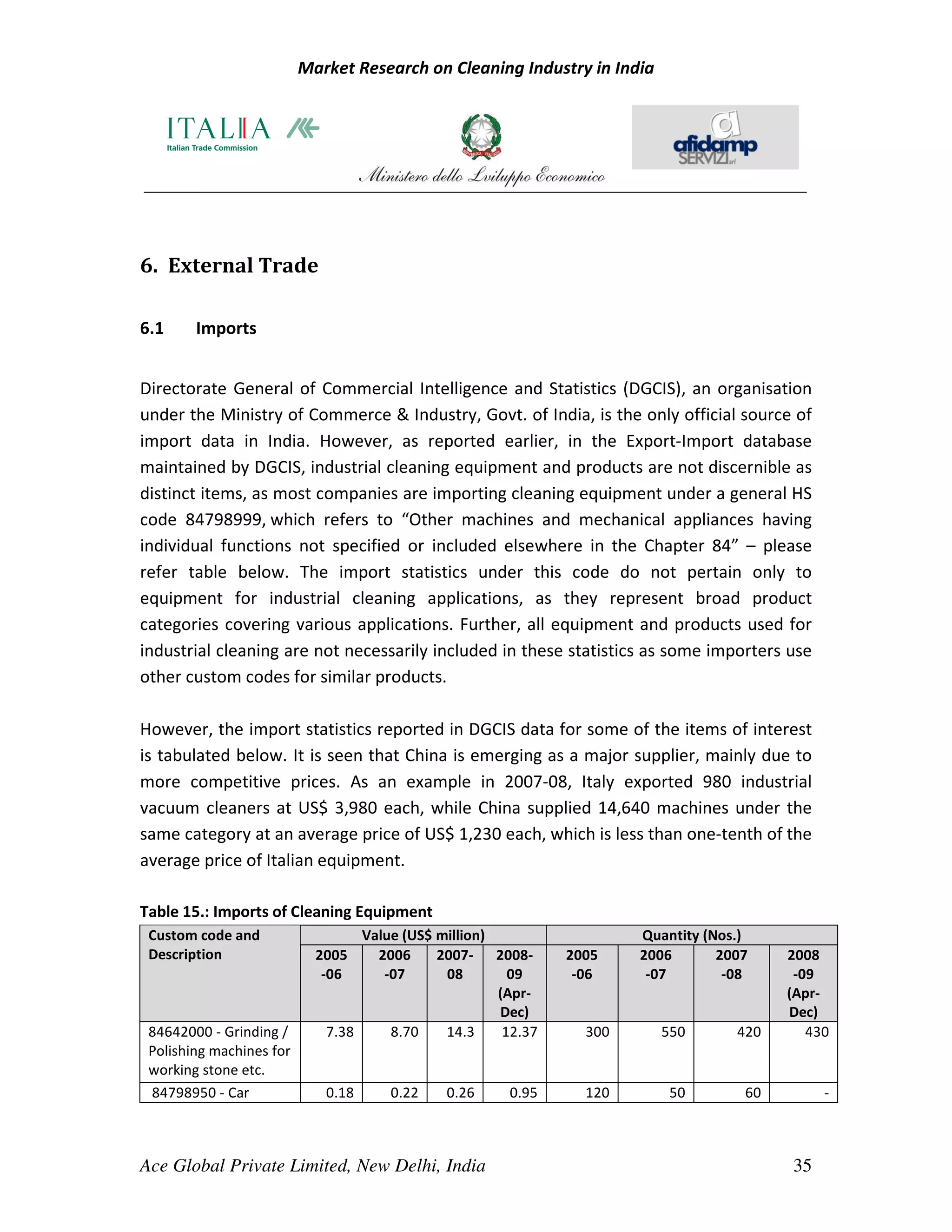

This document provides an overview and market research on the industrial cleaning sector in India. It describes the objectives and methodology of the research, which included a primary survey of 39 industry players and secondary research. It also includes an economic profile of India and discusses factors like GDP, trade, currency, economic growth trends, and the business environment. Finally, it outlines the scope and structure of the industrial cleaning sector in India.