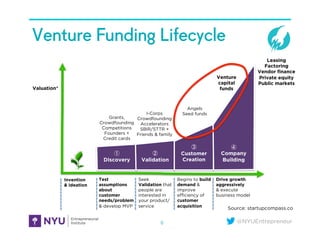

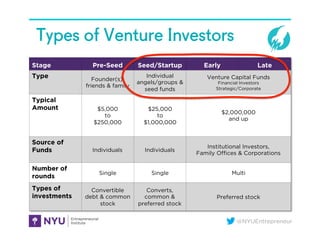

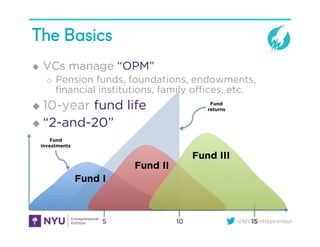

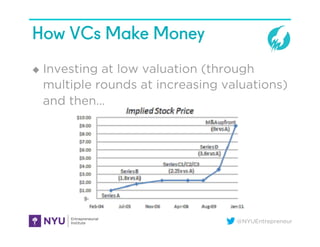

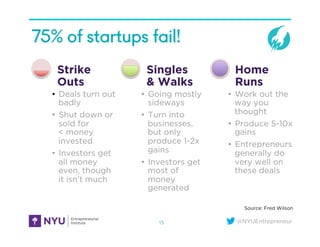

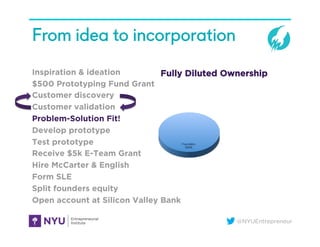

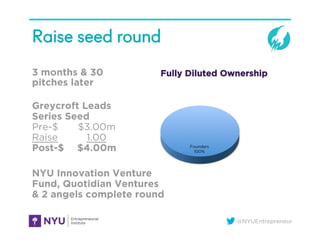

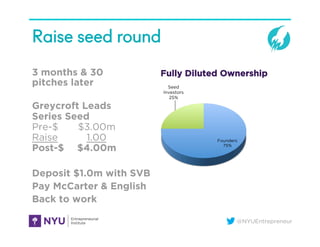

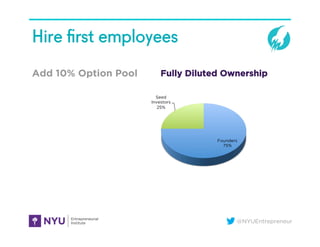

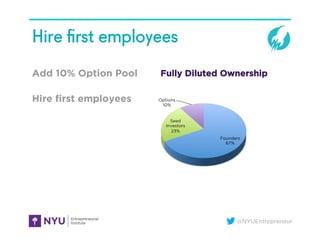

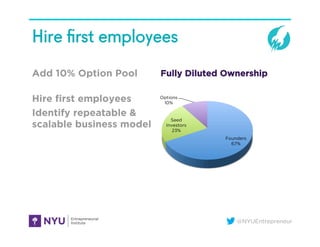

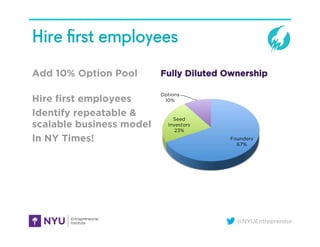

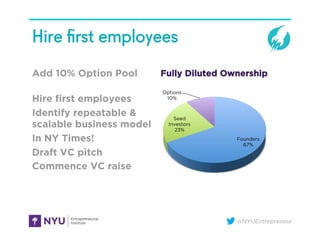

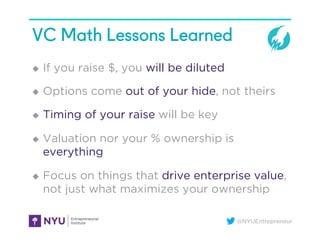

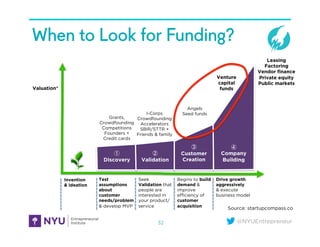

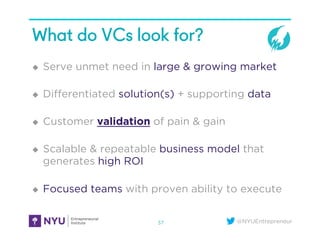

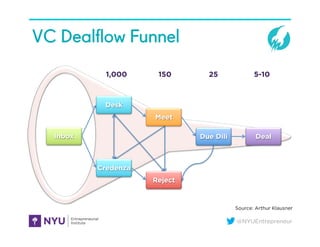

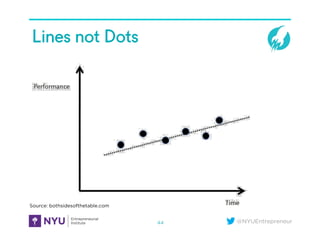

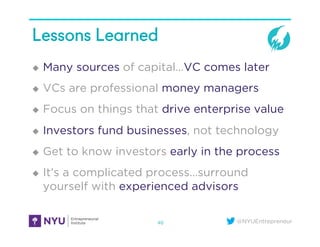

Frank Rimalovski gave a presentation on when and how to raise venture capital. He discussed the different types of venture investors including angels, seed funds, and venture capital funds. He explained how VC funds work using a 2-and-20 fee structure and how they aim to make returns through investing at low valuations and exiting at higher valuations through IPOs or acquisitions. Rimalovski also covered VC math through an example of startup ownership dilution over multiple funding rounds. He advised founders to seek funding after achieving product-market fit and provided tips for what VCs look for in investments.