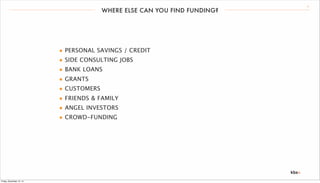

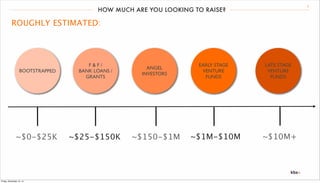

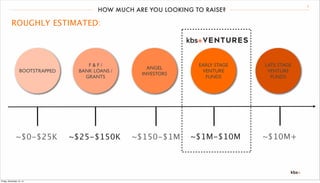

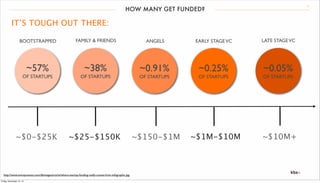

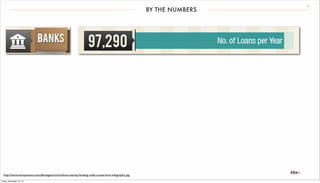

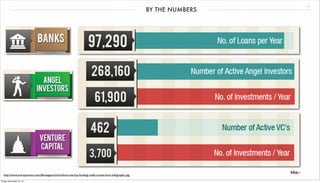

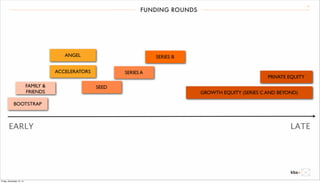

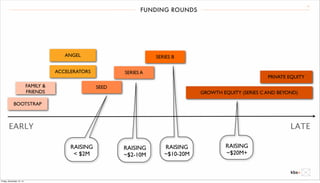

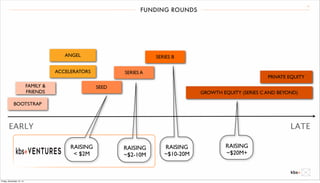

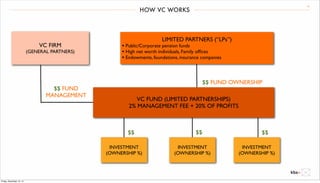

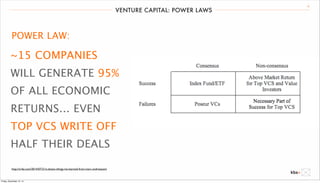

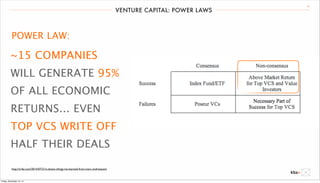

This document summarizes a class about raising capital for startups. It discusses various sources of funding for startups like personal savings, bank loans, friends and family, angel investors, and venture capital. Venture capital is broken down into early stage and late stage investors. Early stage VCs invest in seed and Series A rounds while late stage invests in later rounds after a product has gained traction. The document provides statistics on success rates for different funding sources and rounds. It also covers topics like power laws in venture returns and perspectives from a partner at 500 Startups.