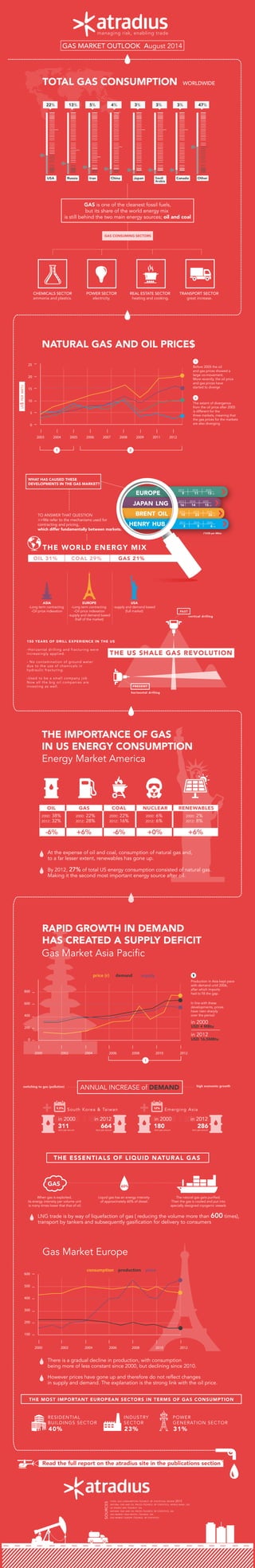

Linkman | Infographic | Atradius | Gas Market Outlook

- 1. managing risk, enabling trade GAS MARKET OUTLOOK August 2014 NATURAL GAS AND OIL PRICE$ THE IMPORTANCE OF GAS IN US ENERGY CONSUMPTION RAPID GROWTH IN DEMAND HAS CREATED A SUPPLY DEFICIT Gas Market Asia Pacific Energy Market America Gas Market Europe 25 20 15 10 5 0 2003 2004 2005 2006 2007 2008 2009 2011 2012 US$PERMBTU OIL GAS COAL NUCLEAR RENEWABLES TOTAL GAS CONSUMPTION WORLDWIDE WHAT HAS CAUSED THESE DEVELOPMENTS IN THE GAS MARKET? THE WORLD ENERGY MIX GAS is one of the cleanest fossil fuels, but its share of the world energy mix is still behind the two main energy sources; oil and coal GAS CONSUMING SECTORS Before 2005 the oil and gas prices showed a large co-movement. More recently, the oil price and gas prices have started to diverge The extent of divergence from the oil price after 2005 is different for the three markets, meaning that the gas prices for the markets are also diverging 21 1 2 EUROPE 2012 2018 2035 19 23 26 (*) JAPAN LNG 2012 2018 2035 16 14 15 (*) BRENT OIL 2012 2018 2035 9 11 13 (*) HENRY HUB 2012 2018 2035 3 5 6 (*) REAL ESTATE SECTOR heating and cooking. TRANSPORT SECTOR great increase. POWER SECTOR electricity. CHEMICALS SECTOR ammonia and plastics. TO ANSWER THAT QUESTION >>We refer to the mechanisms used for contracting and pricing, which differ fundamentally between markets. ASIA -Long term contracting -Oil price indexation EUROPE -Long term contracting -Oil price indexation -supply and demand based (half of the market) USA -supply and demand based (full market) 2000: 38% 2012: 32% 2000: 22% 2012: 28% 2000: 22% 2012: 16% 2000: 6% 2012: 6% 2000: 2% 2012: 8% -6% +6% -6% +0% +6% At the expense of oil and coal, consumption of natural gas and, to a far lesser extent, renewables has gone up. There is a gradual decline in production, with consumption being more of less constant since 2000, but declining since 2010. LNG trade is by way of liquefaction of gas ( reducing the volume more than 600 times), transport by tankers and subsequently gasification for delivery to consumers However prices have gone up and therefore do not reflect changes in supply and demand. The explanation is the strong link with the oil price. By 2012, 27% of total US energy consumption consisted of natural gas. Making it the second most important energy source after oil. 800 600 400 200 0 2000 2002 2004 2008 2010 20122006 price (r) demand supply 600 500 400 300 200 100 2000 2002 2004 2008 2010 20122006 consumption production price in 2000 in 2000 in 2012 311bcm per annum 664bcm per annum in 2000 in 2012 180bcm per annum 286bcm per annum ANNUAL INCREASE of DEMAND 9,5% + OIL 31% COAL 29% GAS 21% PAST PRESENT THE US SHALE GAS REVOLUTION vertical drilling horizontal drilling 150 YEARS OF DRILL EXPERIENCE IN THE US -Horizontal drilling and fracturing were increasingly applied. - No contamination of ground water due to the use of chemicals in hydraulic fracturing. -Used to be a small company job Now all the big oil companies are investing as well. South Korea & Taiwan 12% + Emerging Asia 1 Production in Asia kept pace with demand until 2006, after which imports had to fill the gap. 1 In line with these developments, prices have risen sharply over the period USD 4 MBtu in 2012 USD 16,5MBtu high economic growthswitching to gas (pollution) THE ESSENTIALS OF LIQUID NATURAL GAS GAS When gas is exploited, its energy intensity per volume unit is many times lower that that of oil. Liquid gas has an energy intensity of approximately 60% of diesel. The natural gas gets purified. Then the gas is cooled and put into specially designed cryogenic vessels 40% 23% RESIDENTIAL BUILDINGS SECTOR INDUSTRY SECTOR 31% POWER GENERATION SECTOR THE MOST IMPORTANT EUROPEAN SECTORS IN TERMS OF GAS CONSUMPTION USA Russia Iran China Japan Saudi Arabia Canada Other 22% 13% 5% 4% 3% 3% 3% 47% TOTAL GAS CONSUMPTION /SOURCE: BP STATISTICAL REVIEW 2013 NATURAL GAS AND OIL PRICES /SOURCE: BP STATISTICS, WORLD BANK, IEA US ENERGY MIX /SOURCE: IEA NATURAL GAS AND OIL PRICES /SOURCE: BP STATISTICS, IEA GAS MARKET ASIA-PACIFIC /SOURCE: IEA GAS MARKET EUROPE /SOURCE: BP STATISTICS SOURCES 60% (*)US$ per Mbtu Read the full report on the atradius site in the publications section