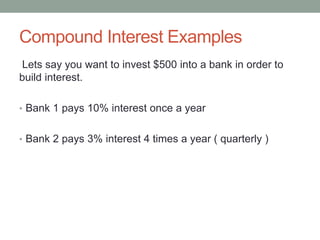

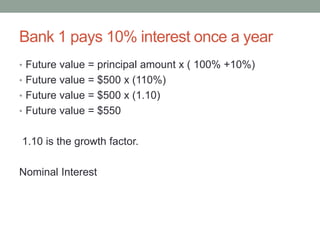

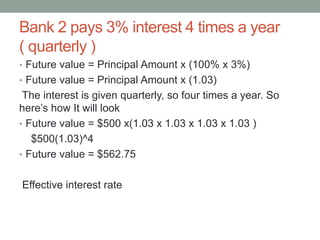

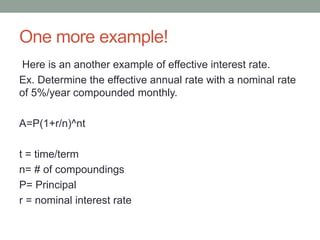

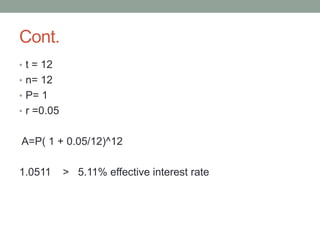

This document discusses compound interest and effective interest rates. It provides examples to illustrate the difference between nominal interest rates, which are stated as an annual percentage, and effective interest rates, which take into account interest compounding over time. The examples show that banking strategies that compound interest more frequently, such as quarterly instead of annually, result in higher overall returns. The document concludes with a formula for calculating effective annual interest rates when interest is compounded more frequently than annually.