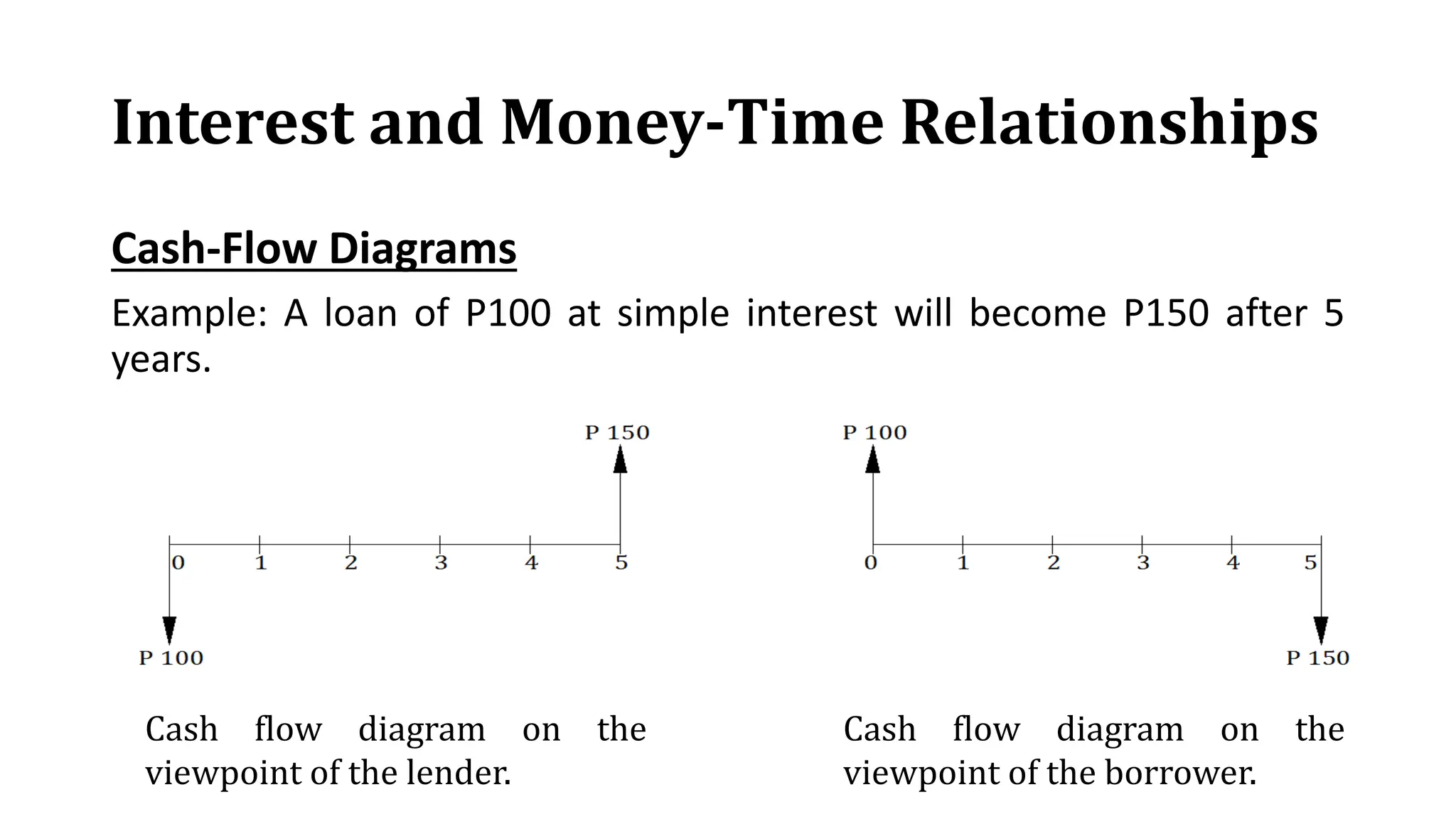

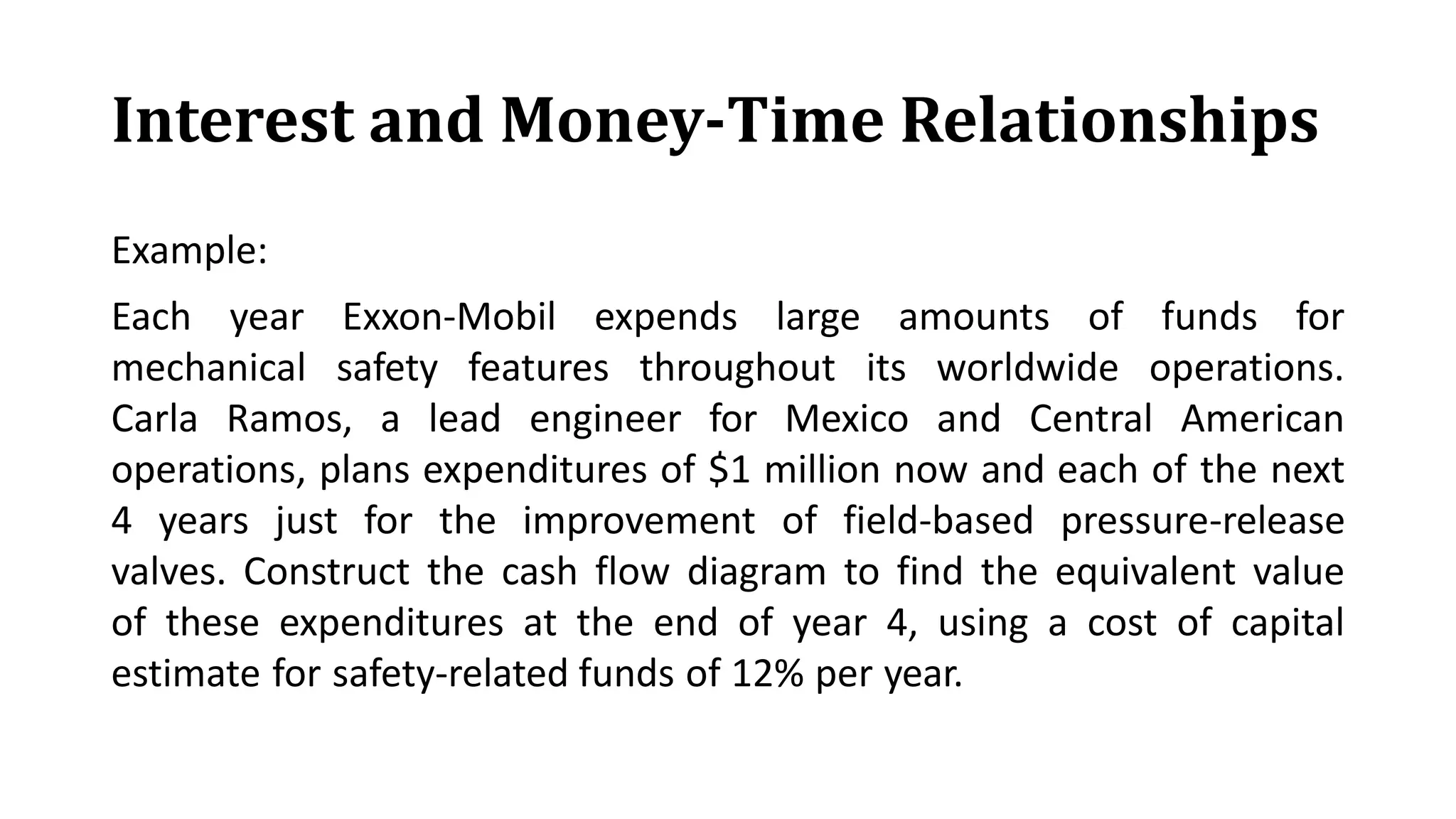

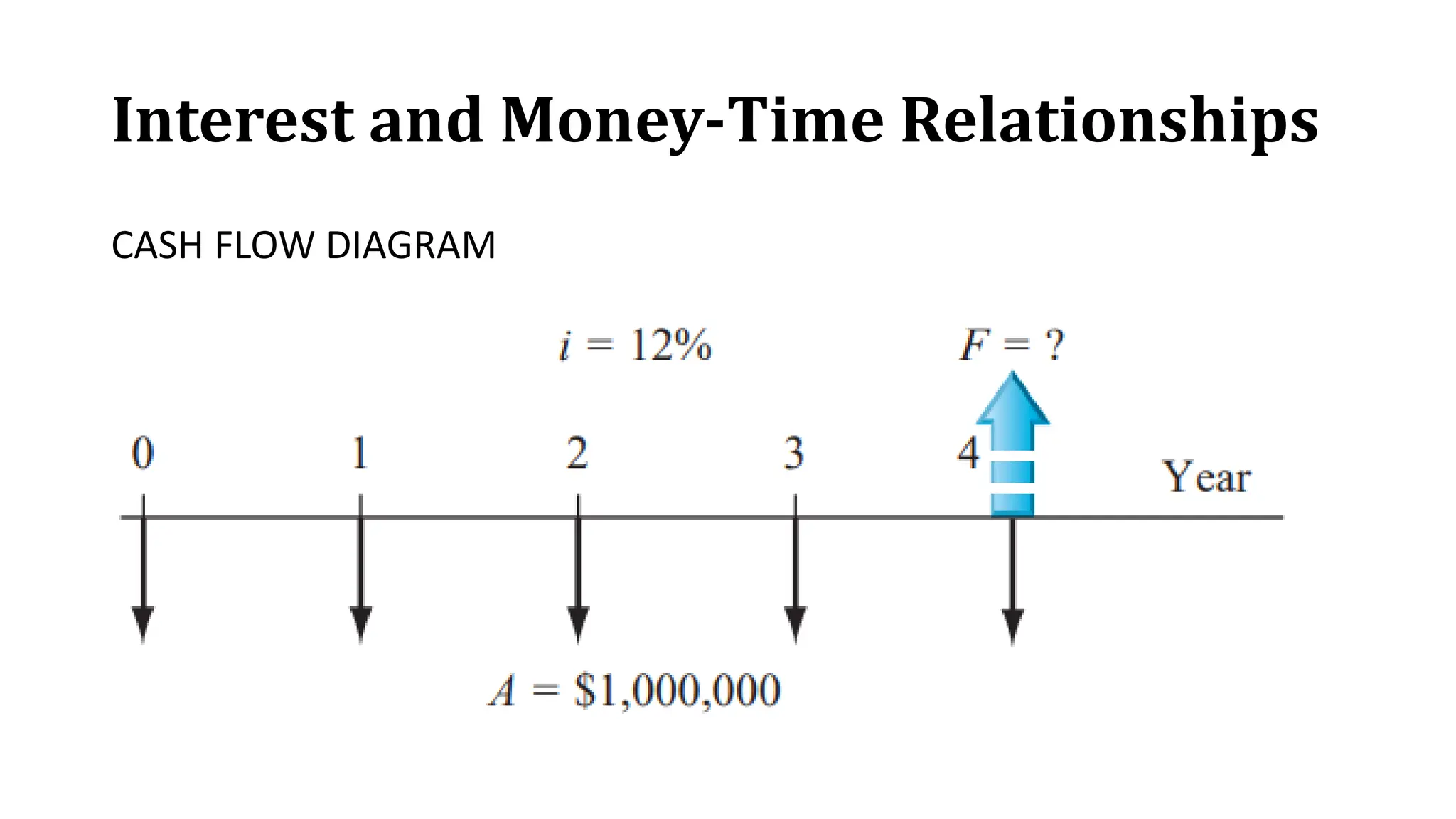

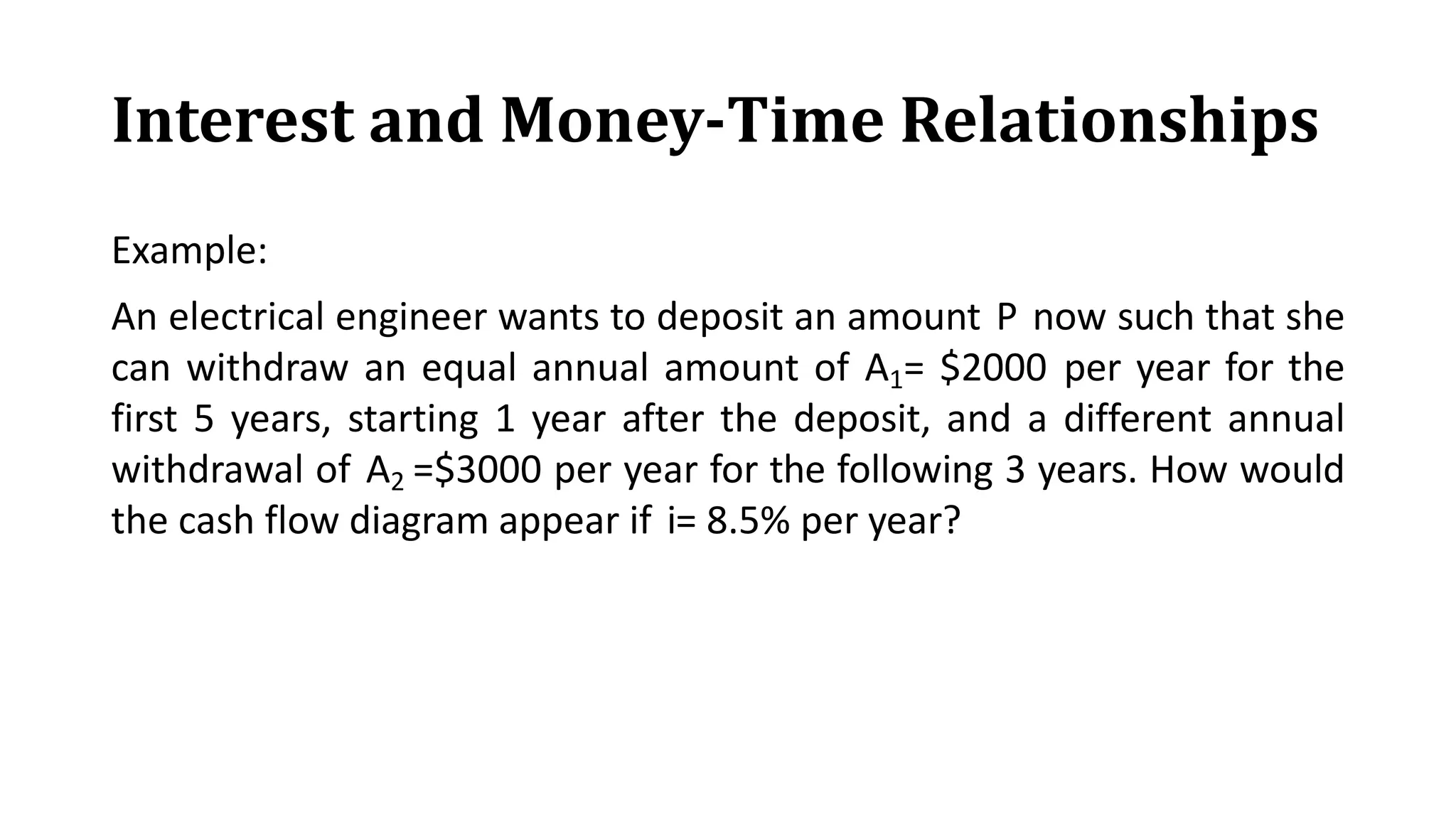

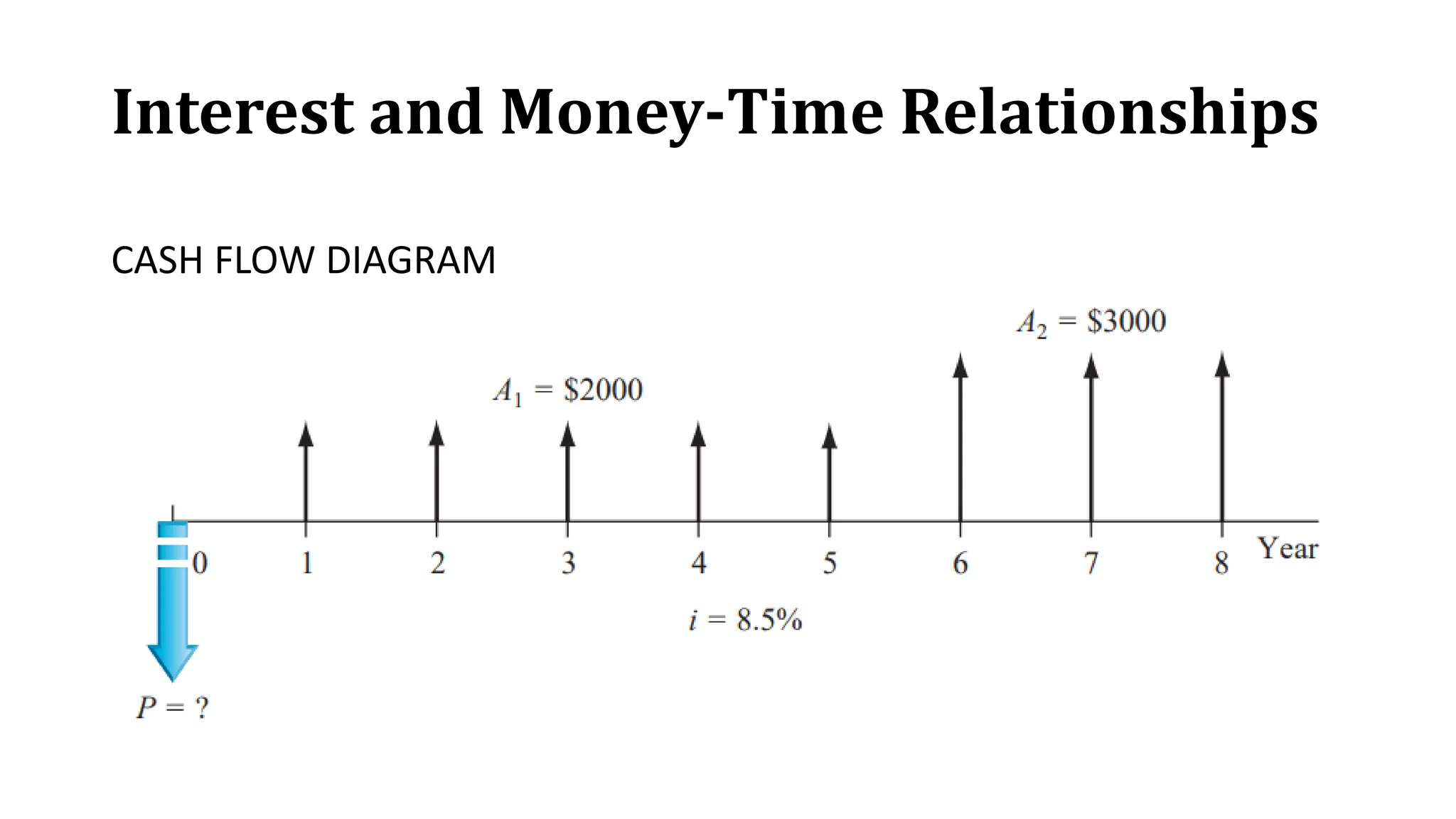

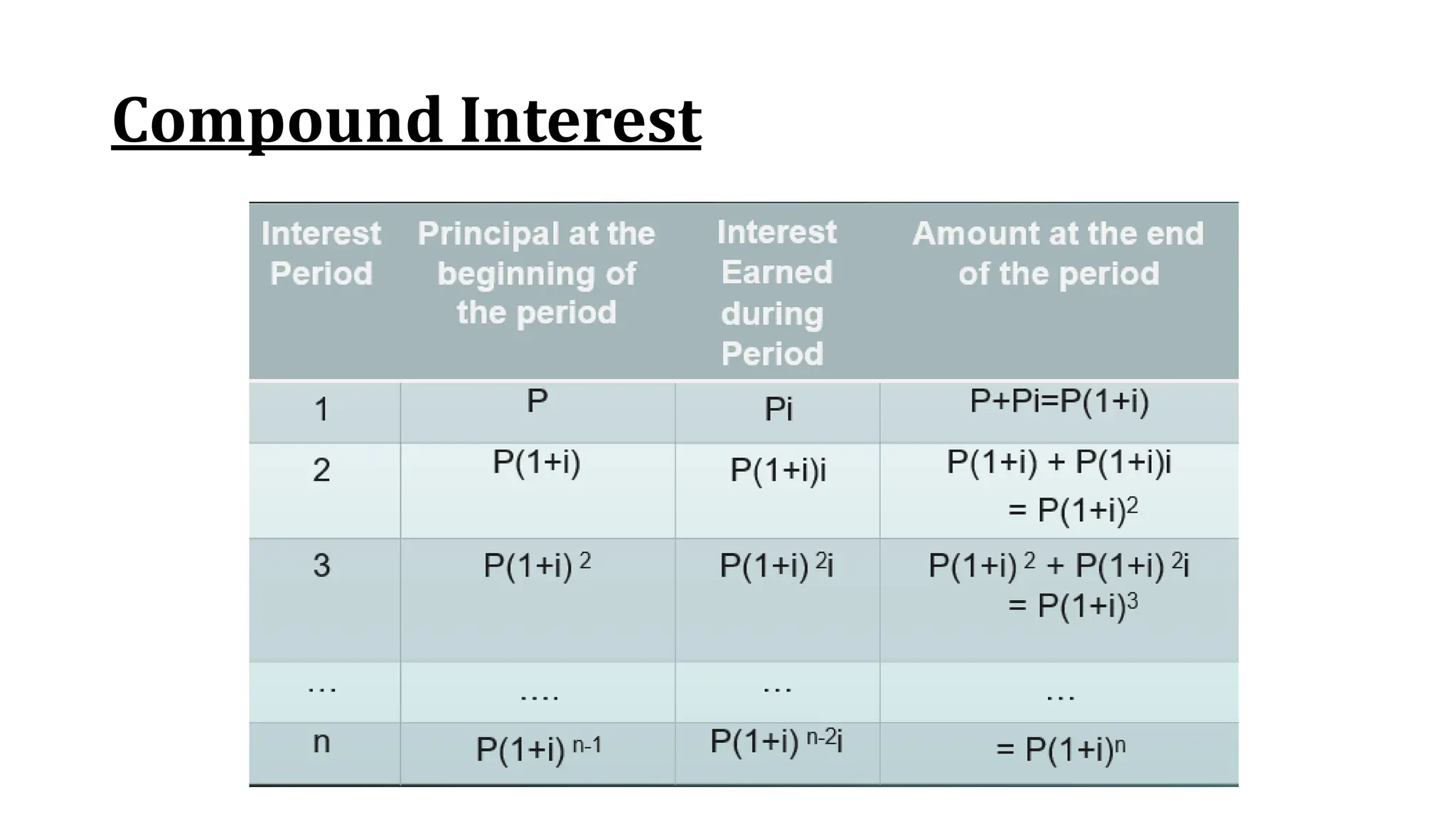

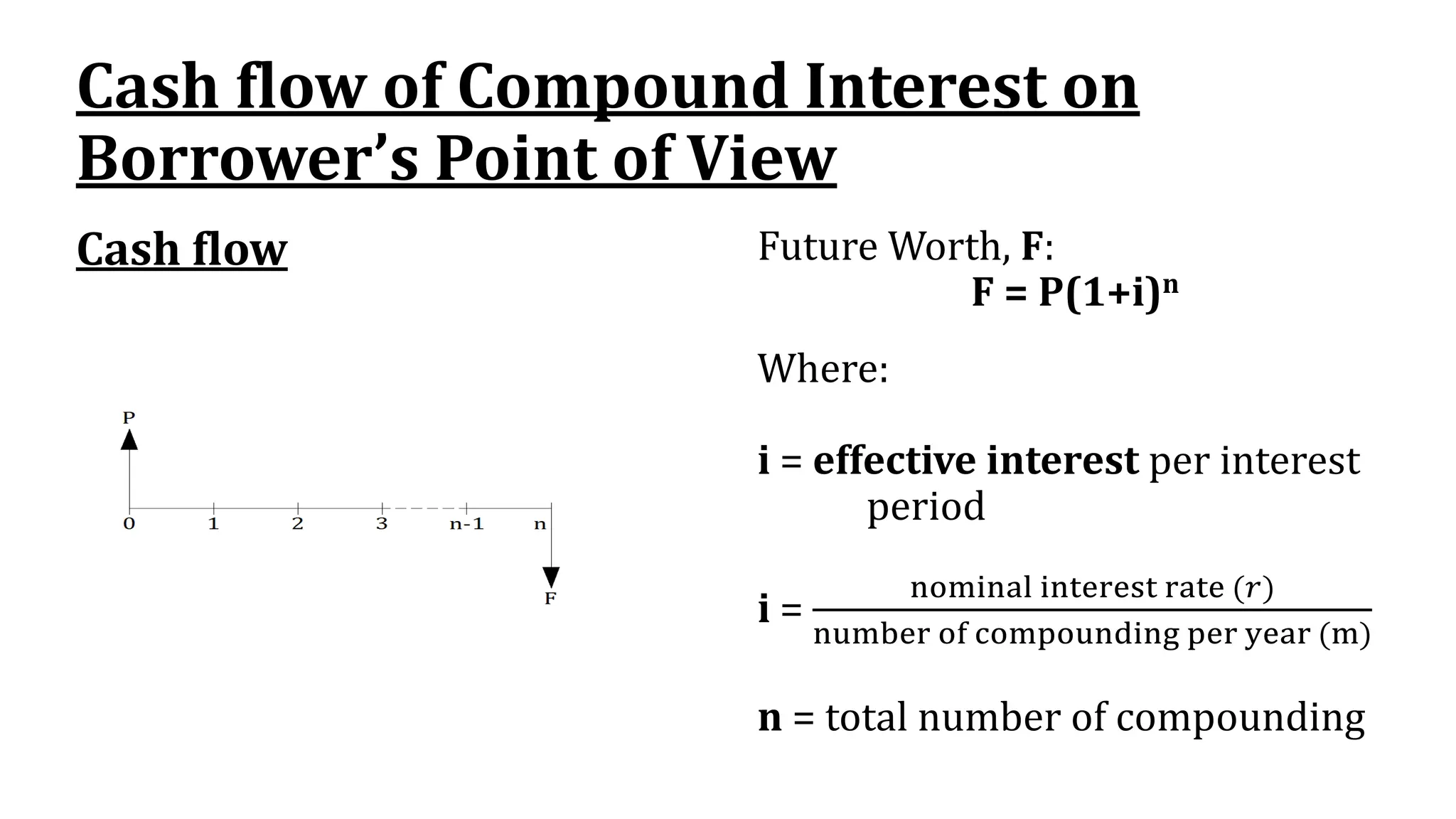

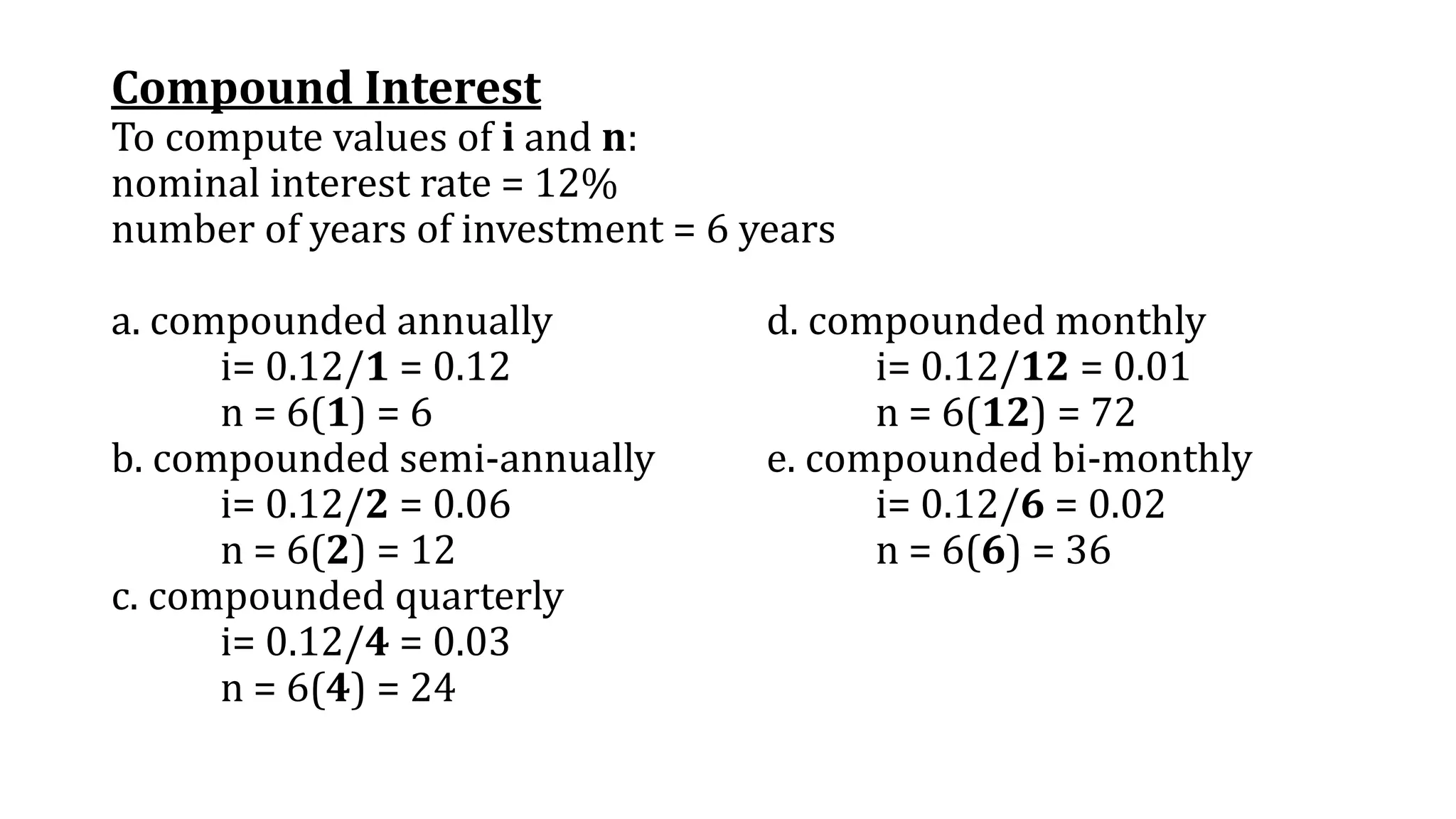

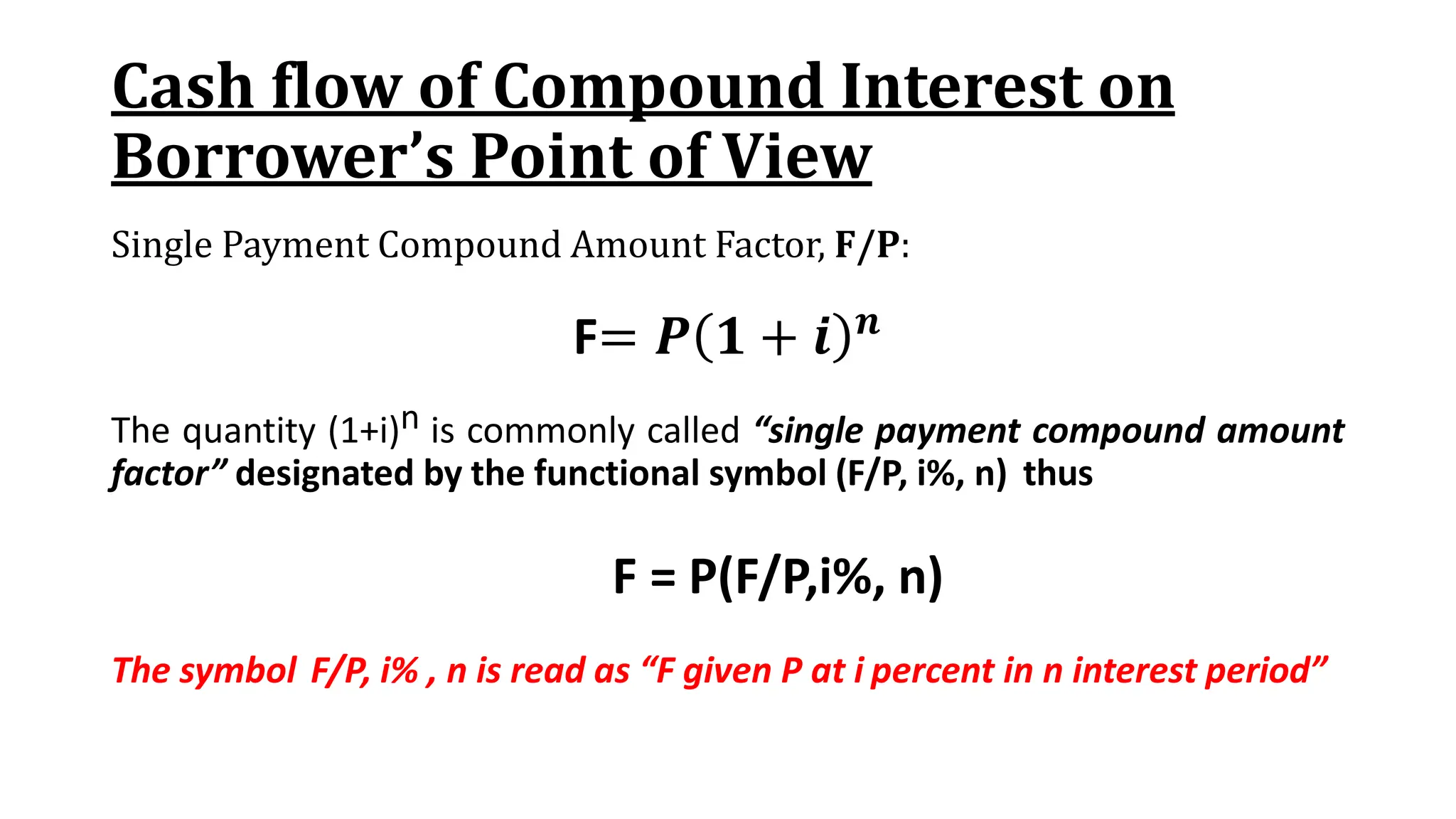

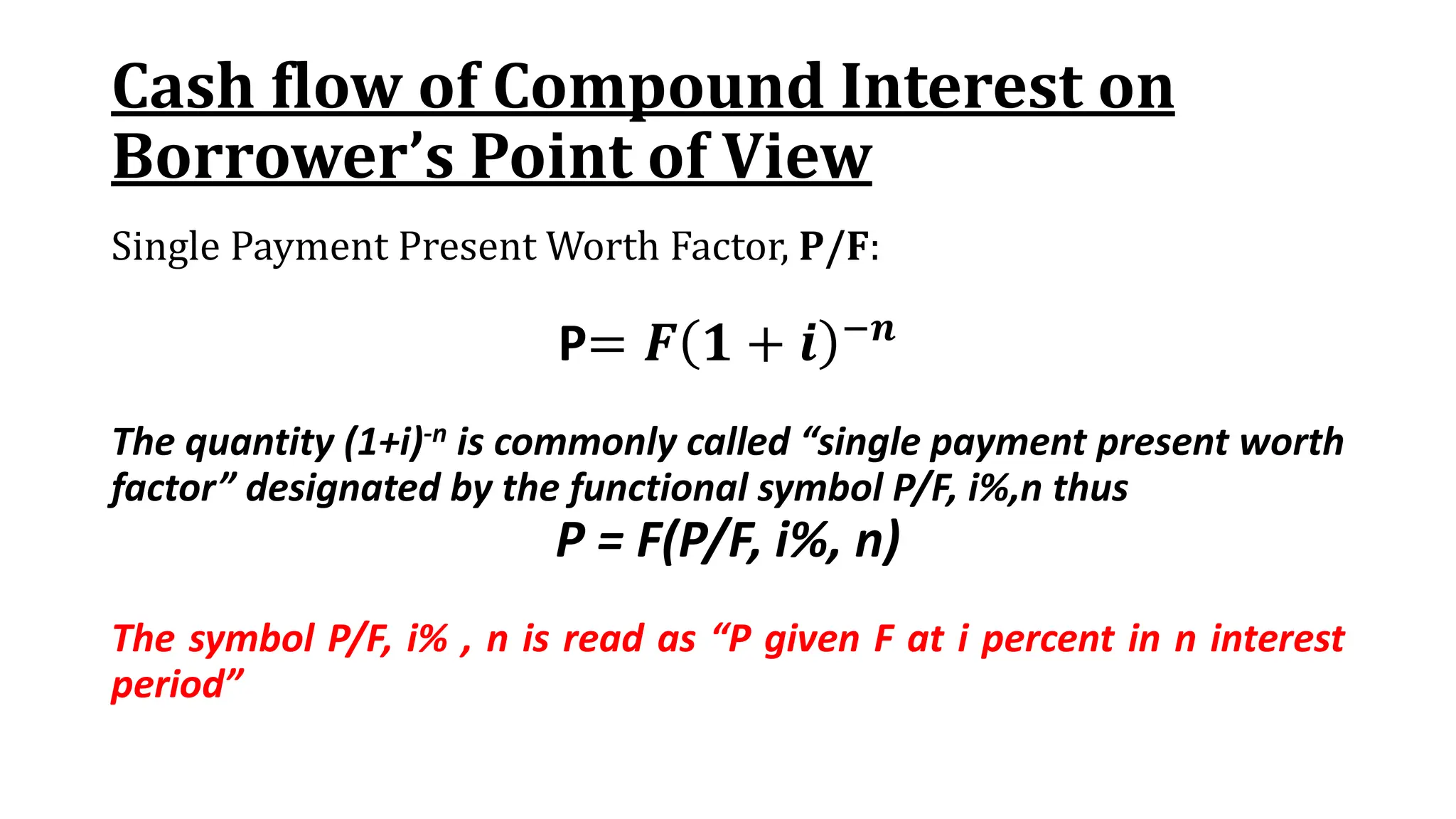

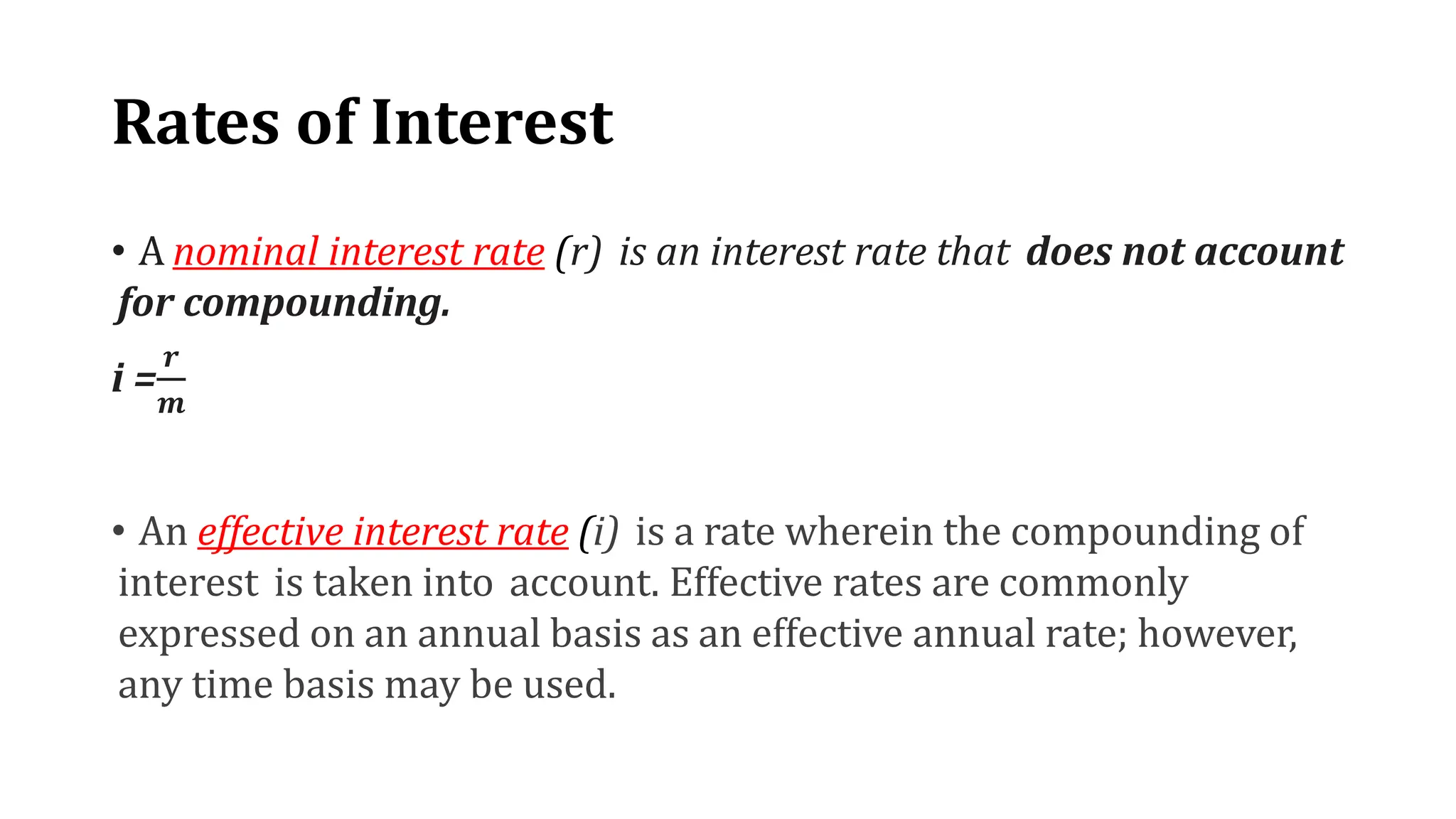

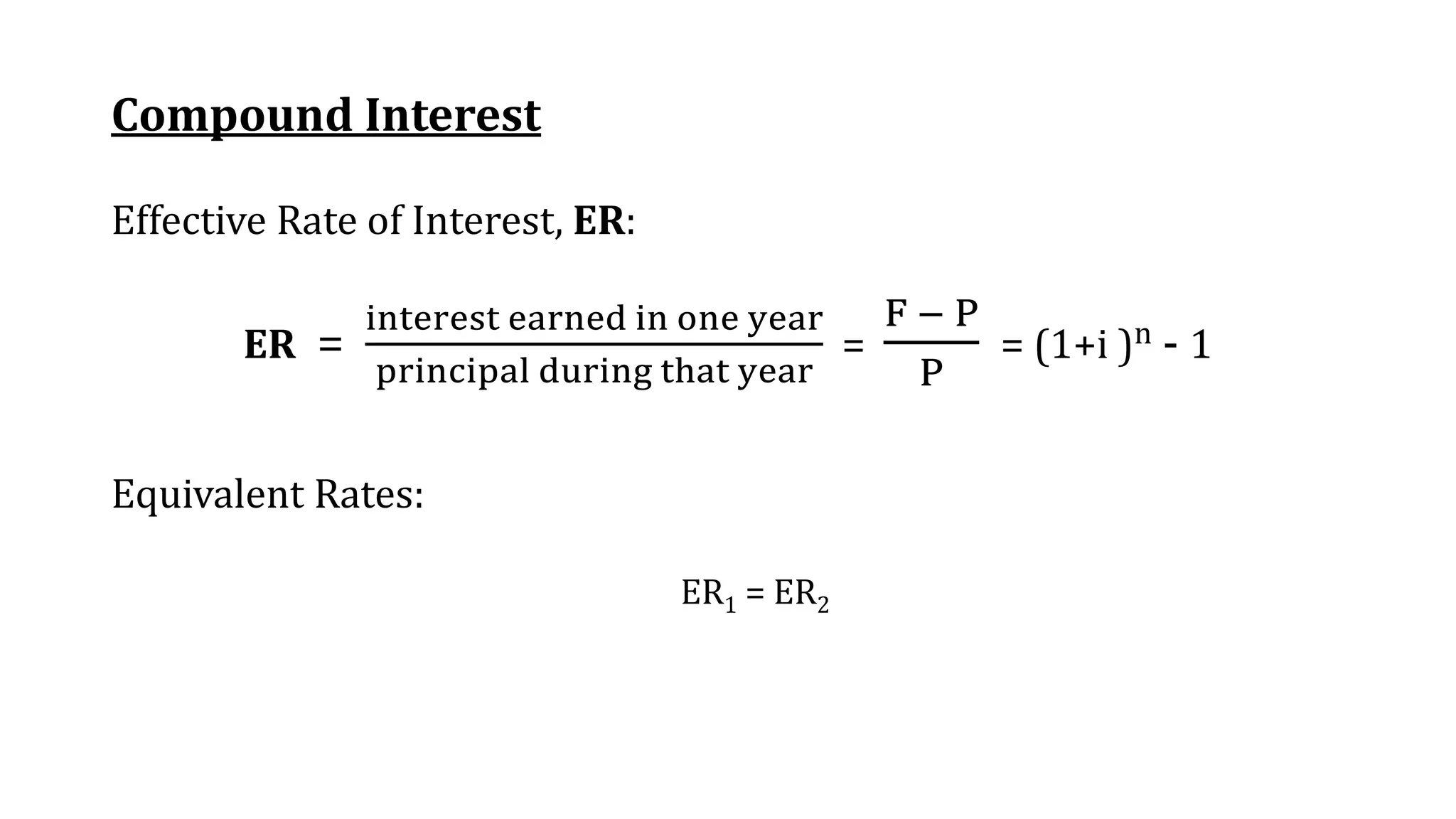

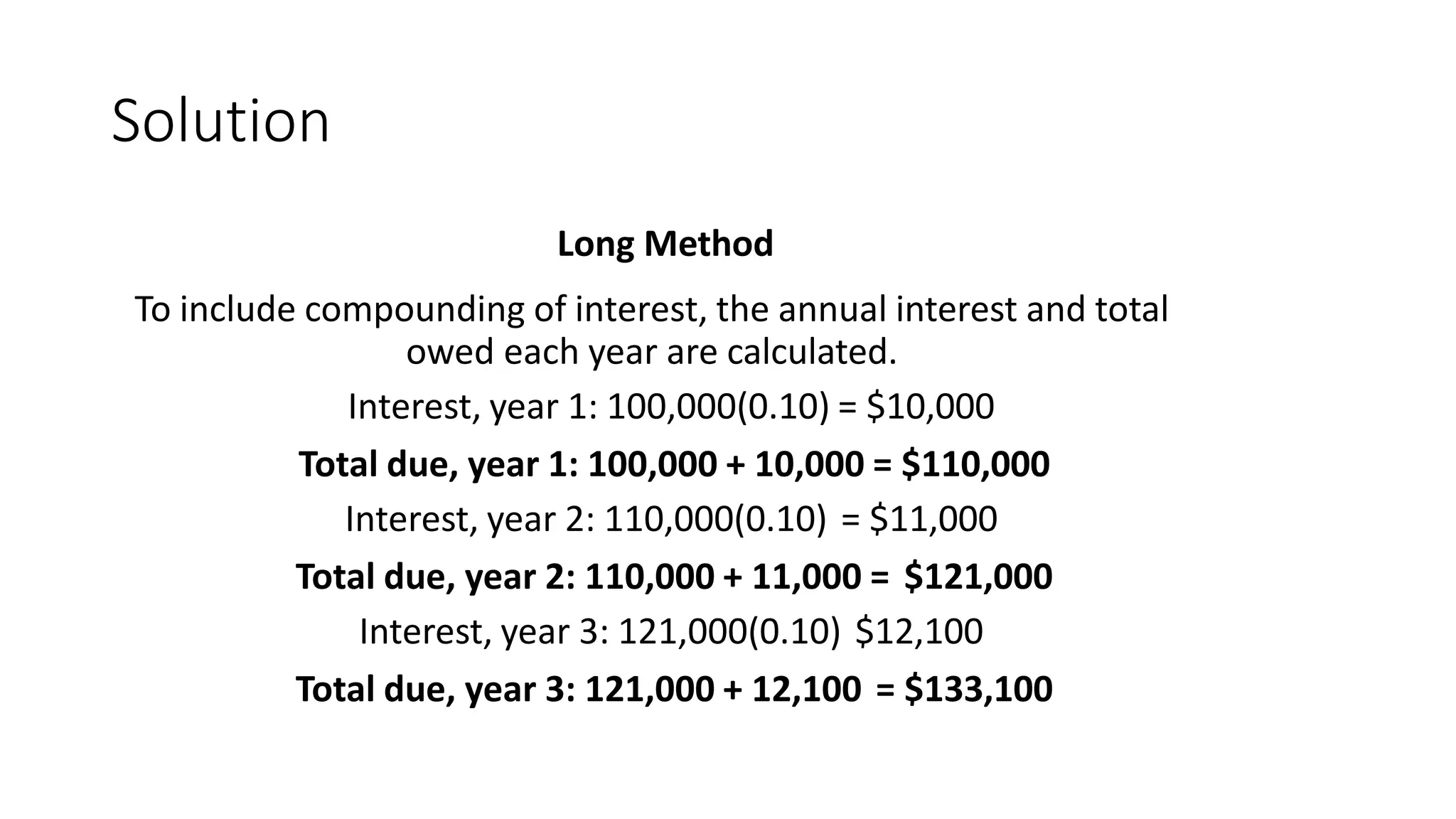

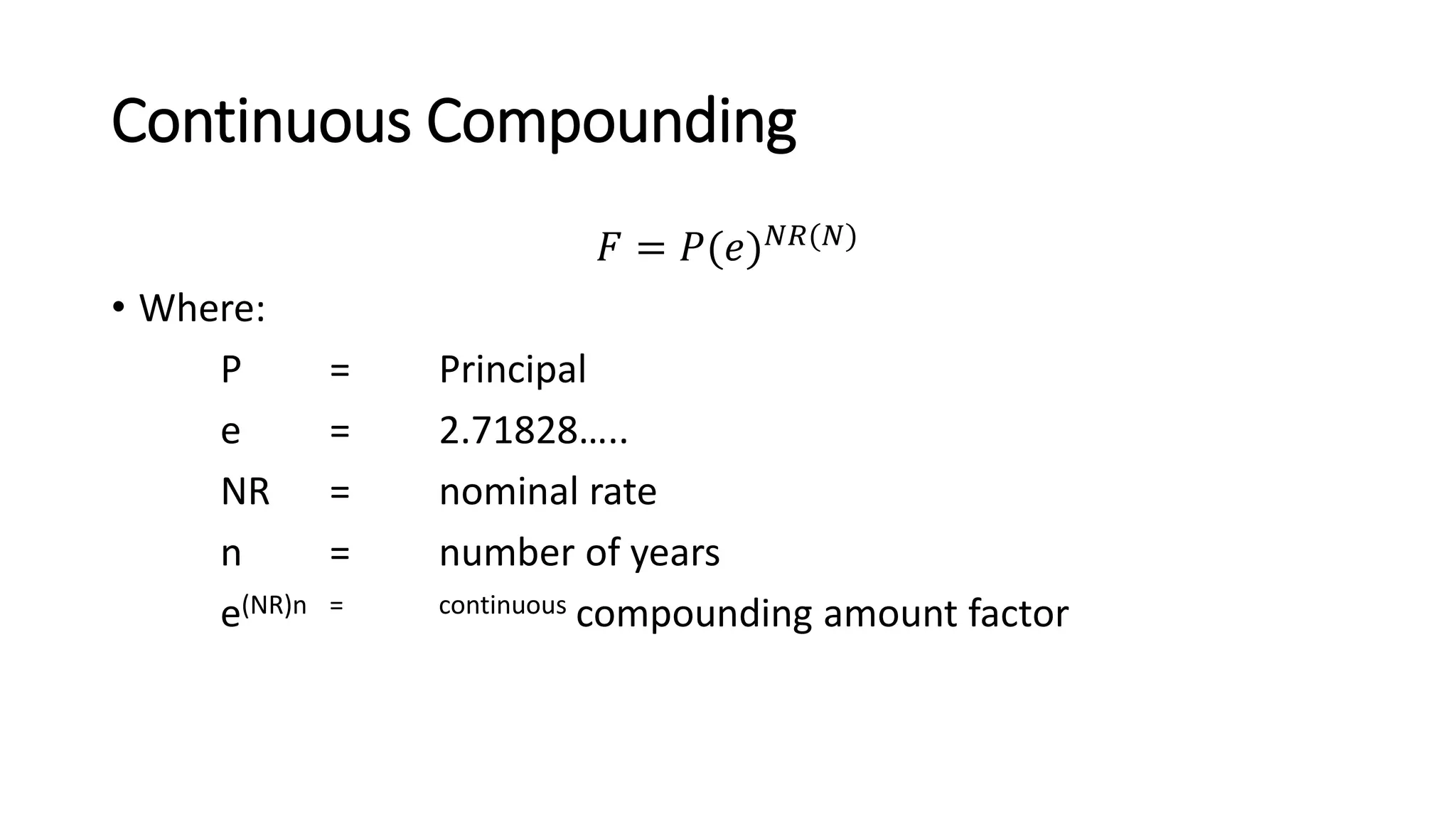

The document outlines key learning outcomes related to cash flow and interest rates, including calculations for compound interest and the use of cash flow diagrams. It provides examples for different scenarios involving loans, investments, and effective vs. nominal interest rates, demonstrating how to calculate future worth and present value. Additionally, the document addresses continuous compounding and compares different compounding frequencies.