Credit Value Adjustment

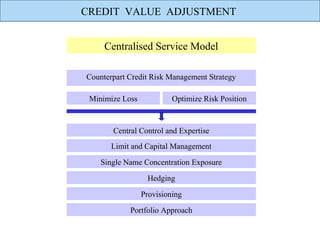

- 1. CREDIT VALUE ADJUSTMENT Centralised Service Model Counterpart Credit Risk Management Strategy Minimize Loss Optimize Risk Position Central Control and Expertise Limit and Capital Management Single Name Concentration Exposure Hedging Provisioning Portfolio Approach

- 2. CREDIT VALUE ADJUSTMENT Position valuation and exposure calculation at trade level MODEL COMPONENTS CVA applied at netting level to account for expected loss Risk neutral scenarios calibrated to current market conditions CVA Calc = Discounted Expected Exposure x Default Probability x Loss Given Default Incremental CVA charge for new trade Aggregate portfolio level for netting, collateral, wrong way risk

- 3. CREDIT VALUE ADJUSTMENT Pre-Trade Pricing • Exposure and pricing methodology • Calculation of credit charge incorporating netting, wrong way risk and collateral CVA PROCESS APPLIED • Account for portfolio offset • Transfer price between trading and central desk • Default probability reference and assignment Provisioning • Method and agreement between Finance and Risk Hedging • Assessment of un-hedged / un-covered portion and methods • Treatment of collateral Reporting • P&L impact analysis • Counterparty assessment process • Central limit and exposure management • Treatment of incremental unexpected losses at portfolio level

- 4. CREDIT VALUE ADJUSTMENT Credit and Debit Valuation Adjustments (CVA and DVA) are applied to over-the-counter derivative exposures with counterparties that are not subject to standard interbank collateral arrangements. These exposures largely relate to the provision of risk management solutions for corporate entities. A CVA is undertaken where there is a positive future uncollateralised exposure (asset). A DVA is undertaken where there is a negative future uncollateralised exposure (liability). CVA EXPLAINED These adjustments reflect interest rates and expectations of counterparty creditworthiness and the Bank’s own credit spread respectively. The CVA is sensitive to: • the current size of the mark-to-market position on the uncollateralised asset; • expectations of future market volatility of the underlying asset; and • expectations of counterparty creditworthiness. The DVA is sensitive to: • the current size of the mark-to-market position on the uncollateralised liability; • expectations of future market volatility of the underlying liability; and • the Bank’s own CDS spread. Market Credit Default Swap (CDS) spreads are used to develop the probability of default for quoted counterparties. For unquoted counterparties, internal credit ratings and market sector CDS curves and recovery rates are used. The Loss Given Default (LGD) is based on market recovery rates and internal credit assessments. The combination of deterioration in the credit rating of derivative counterparties and an increase in LGD increases the CVA. Current market value is used to estimate the projected exposure for products not supported by the CVA model, for these, the CVA is calculated on an add-on basis.