The document discusses asset liability management (ALM) in banking. It covers several key topics in 3 paragraphs:

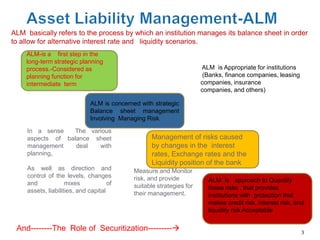

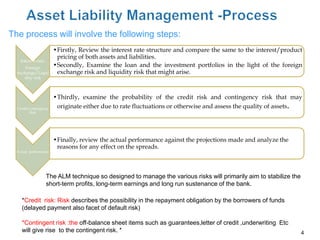

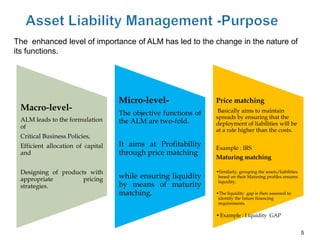

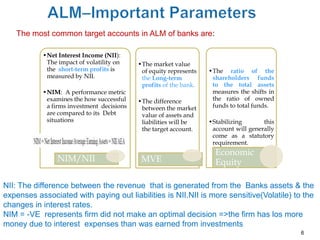

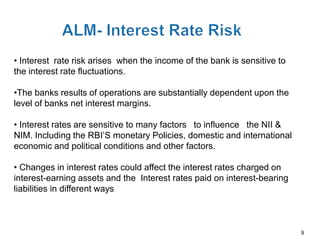

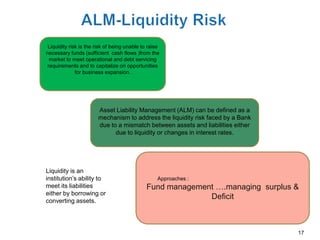

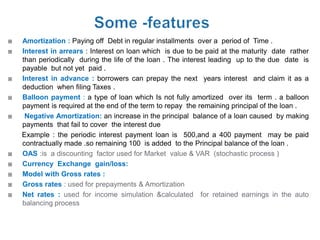

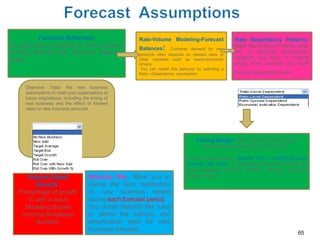

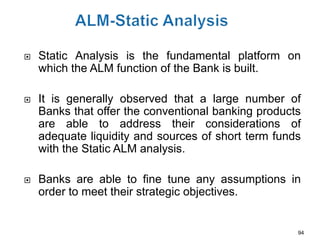

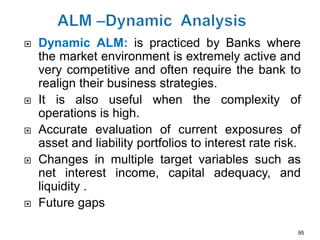

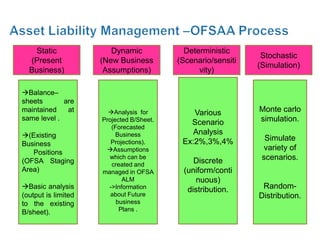

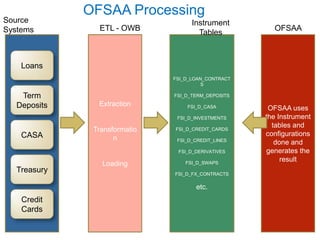

1) ALM refers to managing a bank's balance sheet to allow for different interest rate and liquidity scenarios. This involves assessing risks from changes in interest rates, exchange rates, and liquidity. ALM aims to quantify these risks and provide strategies to make credit, interest, and liquidity risks acceptable.

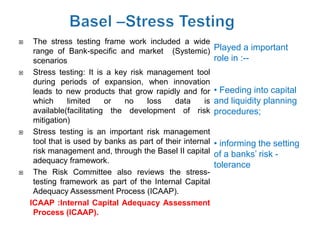

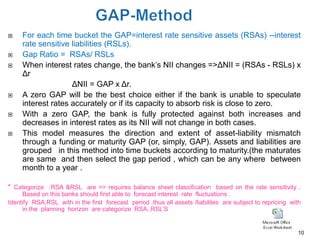

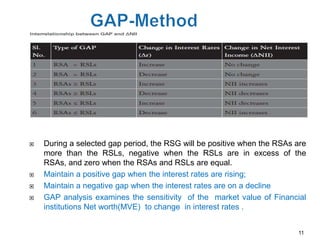

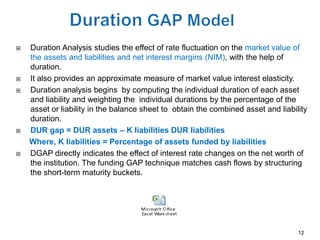

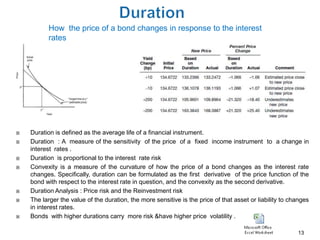

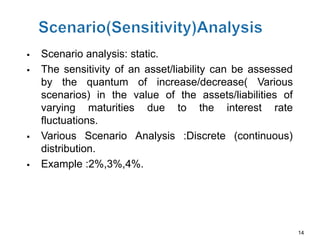

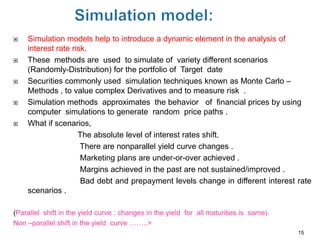

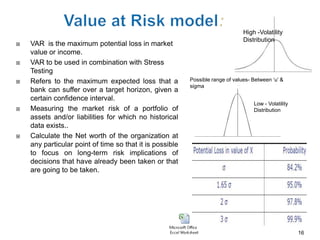

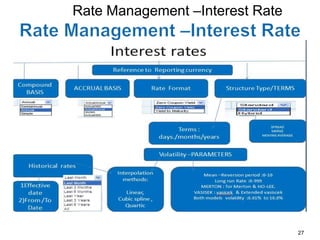

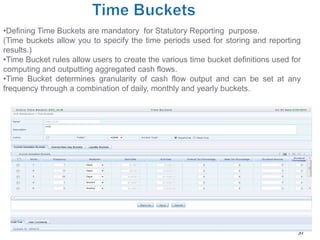

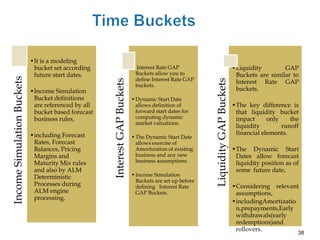

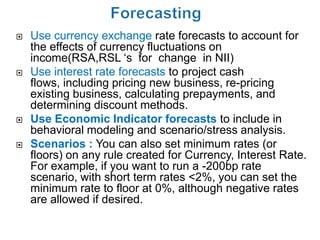

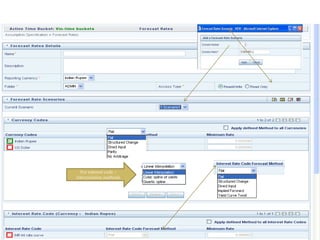

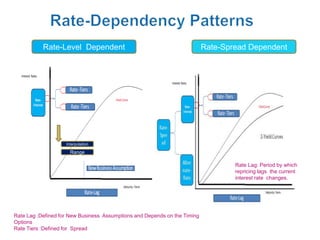

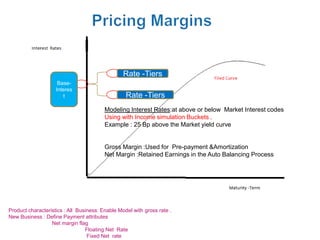

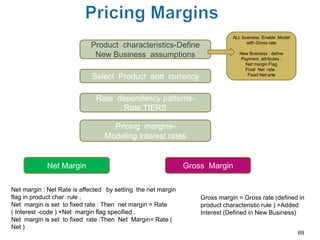

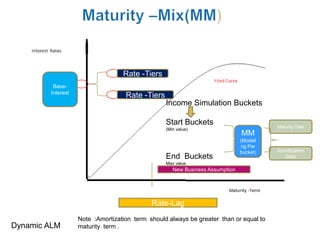

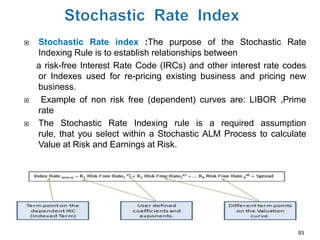

2) Common ALM techniques include gap analysis, duration analysis, scenario analysis, simulation, and value-at-risk to measure risks. Interest rate risk is a major focus, and tools like gap and duration analysis examine how changes in rates impact profits and asset values.

3)