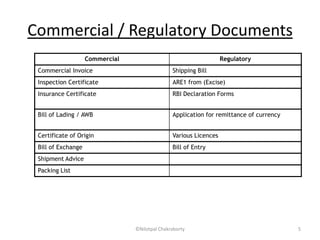

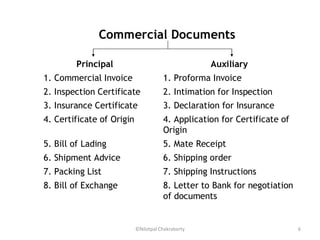

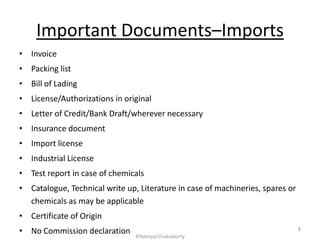

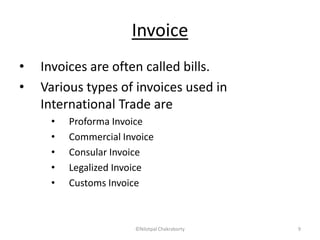

This document provides an overview of key export and import documents. It discusses commercial documents needed for export such as export sales contracts, proforma invoices, certificates of origin, bills of lading, and airway bills. It also discusses regulatory documents required for export like shipping bills and export declaration forms. For imports, it outlines important documents like invoices, packing lists, bills of lading, import licenses, and bills of entry that must be submitted to customs. Overall, the document emphasizes the importance of documentation in international trade for legal and commercial purposes.

![Certificate of Origin [COO]

• It is a certificate indicating the fact that the goods which have

been exported have originated or manufactured in a

particular country. So it is a sort of declaration testifying the

origin of export.

• It is normally required by an importer to clear goods from the

customs.

• For political and social reasons, it is insisted by Customs

Authority of importing country before goods are allowed to

enter in the country.

• It helps the importer to take an advantage in duty concession,

if any. For e.g. goods imported under Free Trade Agreement.

©Nilotpal Chakraborty

14](https://image.slidesharecdn.com/documentsforimportsandexports-130415145801-phpapp02/85/Documents-for-imports-and-exports-14-320.jpg)

![Bill of Exchange

• Bill of Exchange [BE] is a document drawn and is an order by

the exporter to the buyer to pay the money in specified

exchange.

• It is also known as a draft.

• A bill of exchange is accompanied by commercial documents

which are presented by a bank and released to the buyer

either against payment (at sight) or against a signature for

payment on a specified future date.

• It is an unconditional written order.

©Nilotpal Chakraborty 16](https://image.slidesharecdn.com/documentsforimportsandexports-130415145801-phpapp02/85/Documents-for-imports-and-exports-16-320.jpg)