New base 807 special 14 march 2016

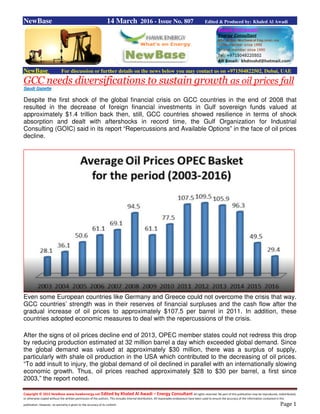

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 14 March 2016 - Issue No. 807 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE GCC needs diversifications to sustain growth as oil prices fall Saudi Gazette Despite the first shock of the global financial crisis on GCC countries in the end of 2008 that resulted in the decrease of foreign financial investments in Gulf sovereign funds valued at approximately $1.4 trillion back then, still, GCC countries showed resilience in terms of shock absorption and dealt with aftershocks in record time, the Gulf Organization for Industrial Consulting (GOIC) said in its report “Repercussions and Available Options” in the face of oil prices decline. Even some European countries like Germany and Greece could not overcome the crisis that way. GCC countries’ strength was in their reserves of financial surpluses and the cash flow after the gradual increase of oil prices to approximately $107.5 per barrel in 2011. In addition, these countries adopted economic measures to deal with the repercussions of the crisis. After the signs of oil prices decline end of 2013, OPEC member states could not redress this drop by reducing production estimated at 32 million barrel a day which exceeded global demand. Since the global demand was valued at approximately $30 million, there was a surplus of supply, particularly with shale oil production in the USA which contributed to the decreasing of oil prices. “To add insult to injury, the global demand of oil declined in parallel with an internationally slowing economic growth. Thus, oil prices reached approximately $28 to $30 per barrel, a first since 2003,” the report noted.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Economic sectors in GCC countries, particularly industries, construction and commerce, witnessed a remarkable prosperity throughout the last decade. In this regard, KSA and UAE have become key players in the world of commerce and investments, particularly in the Arab world. GCC countries secured huge financial surpluses between 2005 and 2015 of approximately $416.3 billion in 2014. A large share of these surpluses was spent on infrastructure which provided liquidity to banks allowing for the development of private sector investments. The GCC industrial sector received foreign investments worth approximately $53 billion contributing to about 15% of the GCC GDP. Traditional industries such as food and aluminum industries in the GCC became stronger, while new industries were born like ship production and aircraft spare parts. Furthermore, GCC countries offered financial support to other Arab economies that suffered from the so-called Arab Spring like Egypt, Jordan and Yemen. Thus, oil is at the core of the GCC development process. It is the economic shield against financial crises and shocks. Therefore, the current drop of oil prices will undoubtedly have negative repercussions on national economies in GCC countries, notably mid-term and short-term consequences. “This is why it is necessary for GCC countries to start looking for new sources to finance their budgets, as oil’s share is currently 75% of these budgets,” the report noted. In this regard, oil income is expected to drop to about $287 billion in 2016 should oil prices remain the same. If GCC countries are counting on the growth of non-oil sectors of about 3% per year to compensate for the shortage of oil income, this growth is not enough to cover the demographic growth rate and is unsustainable, for the momentum pushing growth forward in these sectors has always been backed by oil surpluses providing necessary financing for investments on the one hand and purchasing powers of its products on the other, in addition to the financing of the expansion of necessary infrastructure to attract and sustain investments, report said. The GCC’s endeavors of diversification have created a positive environment for non-oil economic activities should oil income drop. In fact, the economic pattern adopted in the past decades aimed at diversifying production base to develop GCC infrastructure, update economic legislations, develop institutions, and prepare the private sector to play a bigger role in the development process. Strategic decisions also need to be made in terms of economic reforms like the gradual lifting of subsidies, particularly hydrocarbons, the shift towards renewable energy, the deeper role of the private sector in development, the participation of the private sector in decision making, the preparation of Gulf citizens for a bigger participation in the private sector, the diversification of export base and income and profits taxation.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: Enoc considering Jebel Ali refinery expansion The National - Dania Saadi Emirates National Oil Company (Enoc), the state-owned energy firm, is considering an expansion of its Jebel Ali refinery to increase income, its chief financial officer said yesterday. It is evaluating the expansion of the 140,000 barrels per day refinery in Jebel Ali by adding capacity of 75,000 bpd. “The UAE is a growing economy and right now there is not enough [refining] capacity," said Petri Pentti in an interview last week. “We are also importing a lot of finished products like gasoline, diesel, jet fuel." The Dubai government-owned company, which last year secured a US$1.5 billion syndicated loan, expects to borrow from banks to help fund the expansion of the refinery, which could start operations by 2020. Mr Pentti said Enoc could also issue an Islamic bond or sukuk in the next two to three years to help fund its operations and diversify funding sources, on top of acquiring bank loans. Enoc’s consolidated revenue last year fell to $15bn, down 28.6 per cent from $21bn a year earlier, and could drop further this year owing to the lower oil prices.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 But the company’s diversified portfolio, which includes oil trading, refining and oil storage, has helped the company to be profitable. “$15bn is a baseline figure for 2015 and it could be lower than that [this year] even if volumes are going up," said Mr Pentti. “What is important is the margin. Generally it is well known in the industry, that in 2015 for downstream operations, it was reasonably good and that has been the case for Enoc as well." Enoc’s sales of crude and petroleum products rose by 16 per cent last year to a record 220 million barrels. The company’s sales figures included oil traded out of its offices in London, Singapore and Dubai. “Volumes [this year] are good and as long as this is the case I am optimistic of continued good performance overall," said Mr Pentti, declining to give figures. Armed with a healthy cash flow, Enoc is seeking assets to expand its business portfolio, which includes upstream, midstream and downstream operations. Last year, Enoc acquired Dragon Oil for £1.7bn (Dh8.83bn), ending a six-year battle to purchase the remaining 46 per cent it did not already own in the energy company. The acquisition means Enoc has assets capable of producing 100,000 barrels of oil per day. “We are very selective and very careful, but we could see that acquisitions are very much part of Enoc strategy going forward," said Mr Pentti. “Right now, because oil prices are low, it is widely expected there are quite a few opportunities out there. For the time being we have a diversified portfolio, a profitable portfolio of business that is creating sufficient cash flows to finance our businesses as well as potential acquisitions." The company is looking at downstream, upstream and midstream assets in the Arabian Gulf region, South East Asia and Africa, he said. Enoc Retail will also increase its number of petrol stations by 40 per cent between this year and 2020 in Dubai and the Northern Emirates. With 112 stations in the UAE, Enoc will renovate two stations and build 54 more as part of the expansion plan. In Saudi Arabia, the company plans to add 11 stations this year to the current three.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 India's ONGC plans $5 bln investment to develop eastern gas asset Source: Reuters India's Oil and Natural Gas Corp said it will unveil an investment of around $5 billion by the end of March to develop a major gas asset in the east, with a view to tapping higher gas prices. The asset, which the state-owned company acquired in 2005 under a swap agreement with UK's Cairn Energy, can produce up to 17 million metric standard cubic metres per day (mmscmd) of natural gas and 75,000 barrels of oil per day by 2020. The level of output will make it ONGC's second biggest hydrocarbon asset in India, D.K. Sarraf, chairman and managing director of the country's biggest explorer, told reporters on Saturday. He indicated that the investment could be more than $5 billion. The announcement follows a government decision to allow producers demand a higher price for gas extracted from hydrocarbon basins located in the deepwater and ultra deepwater, where costs can be significantly higher. 'With the new gas price announced by the government, our discoveries in the KG (Krishna Godavari) basin are now viable,' Sarraf said, adding that an investment plan would be announced by the end of March or by the first week of April at the latest. The new investment may boost ONGC's natural gas output by a quarter and crude oil production by almost 15 percent over the next 4-5 years, a major leap for a company often criticized for failing to arrest a production decline from its ageing fields. After a decade-long trend of falling production, the company reported a marginal rise in its overall production for the fiscal year ended March 2015. Sarraf said the company expected to maintain the annual production growth.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Civil nuclear deal helps Pakistan overcome energy crisis: China Daily BY INP China’s civil nuclear power support to Pakistan is meant to help the time-tested friend to overcome its energy crisis, said Chinese scholar in an article published in China Daily. While setting aside the misperception and unfounded allegations in regard to Sino-Pak nuclear deal, an associate professor at Peking University’s School of International Studies said that some vested interest groups were pointing a finger at China over the two-country cooperation in nuclear field issue. He clarified that the sale of nuclear reactors to Pakistan was part of their long-term nuclear cooperation agreements reached in the late 1980s. Chinese companies joined Pakistani side to build a nuclear plant at Chashma in 1991, he said. By 2000, the first reactor at Chashma was ready to generate electricity. Five years later, Chinese companies began building Chashma 2, which is scheduled to be operational next year. China and Pakistan both assert that the proposed sale is not only in line with the Nuclear Suppliers’ Group (NSG) rules, but it is also transparent and peaceful in nature. It has already been clarified officially that the “China-Pakistan cooperation on civilian nuclear energy is consistent with the two countries’ respective international obligations, and is for peaceful purposes and subject to IAEA (International Atomic Energy Agency) safeguard and supervision”. The article further said: “India, seen as a long-time foe of Pakistan, seems to be using diplomacy to block the Sino-Pakistani deal, even though it signed a similar deal with the US in 2006. Most China-baiters, particularly in the US, allege Chashma 3 and 4 violate NSG guidelines, which prohibit nuclear states from exporting nuclear technology and materials to non-nuclear states which, like Pakistan, are not signatories to the Nuclear Non-proliferation Treaty (NPT) and have not adopted IAEA safeguards for nuclear establishments.” Ever since China joined the NSG in 2004, some critics have been saying it has to fulfill its non- proliferation commitment and comply with the group’s rules and guidelines. And because Chashma 3 and 4 were initiated after 2004, they have to be approved by NSG, most probably by seeking an “exemption” solution from its 46 member states as the US-Indian nuclear deal did in 2008. Non-proliferation proponents have expressed concern over the Sino-Pakistani nuclear deal. But some doubt whether it could be blocked like the 2006 US-Indian nuclear deal was for setting “a dangerous precedent”, because if Washington opposes it openly, it would face charges of exercising “hypocrisy” in non-proliferation. Ashley Tellis, a senior associate at Carnegie Endowment, who as part of the George W Bush administration played a key role in negotiating the nuclear deal with India, draws a line between the US-Indian and Sino-Pakistani nuclear deals, saying the latter is not the outcome of a public debate in Washington or in NSG. But the fact is that “integrity” of the shattered global non- proliferation regime was already breached when India, which is outside NPT, NSG and other non- proliferation regimes, was “exempted” and the US-Indian nuclear deal was allowed to go ahead. Pakistan faces severe electricity shortage leading to economic difficulties. The BBC, citing Pakistani government sources, said Pakistan faced an energy shortfall of 3,668 MW per day. Expanding the nuclear energy industry is one way Pakistan can meet its electricity shortfall, which in turn causes social unrest and extremism. At present, nuclear power comprises just 2.34 per cent of Pakistan’s total energy generation, it said.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Norway:Eni begins output at world's most northerly producing oilfield Reuters Italian firm Eni began producing oil from its Goliat field in the Norwegian Arctic late on Saturday, making it the world's most northerly oilfield in production. "It started last night," said an Eni spokesman on Sunday. "We have reached an important milestone not only for Eni, but also for the industry and for Norway." The start-up of the field has been delayed several times since the initial planned date of 2012. Costs also surged to 46.7 billion crowns ($5.56 billion) from an original estimate of around 30 billion in 2009, when the development plan was approved. Output from the field is due to peak at around 100,000 barrels of oil per day. The production facility also has storage capacity for one million barrels of oil. Asked about the multiple delays, Eni said Goliat was a "pioneering project" that involved new technology on which the oil industry would build for the future. Goliat field is an offshore oil field in the Norwegian sector of the Barents Sea. It is located 85 kilometres (53 mi) northwest of Hammerfest.[1] The license owned by Eni Norge AS (operator, 65%) and Statoil Petroleum AS (35%). It was awarded in 1997. Oil was discovered in 2000. The field development concept was approved by the Government of Norway on 8 May 2009. The field will be developed by using Goliat FPSO, a floating production storage and offloading unit .

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Goliat field has two main formations (Kobbe and Realgrunnen) and two minor formations (Snadd and Klappmyss). Recoverable reserves are 174 million barrels (27.7×106 m3). The production is expected to start in summer 2015 on Goliat oil platform which will be northmost sea oil platform at that time.[4] Production is estimated to continue for 10–15 years. The associated gas will be reinjected to increase oil recovery or will be transported to the processing plant at Melkøya. NewBase 14 March 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices stable as market seen bottoming, but oversupply lingers Reuters + NewBase Oil prices were stable in early trading on Monday, with global oversupply and slowing economic growth weighing on markets but prospects of falling production lending crude some support. U.S. West Texas Intermediate (WTI) crude futures were trading at $38.36 per barrel at 0055 GMT, down 14 cents from their last settlement, but international benchmark Brent futures were up 3 cents at $40.42 a barrel. Morgan Stanley said that oil prices had likely bottomed out, but warned that a slowdown in economic growth and high production would prevent sharp rises. "Oil prices now seem to have bottomed, even though they are likely to stay subdued for the rest of this year before starting to move higher in 2017," the U.S. bank said. Morgan Stanley also said that cheap oil had not provided the economic boost to growth that many had hoped for. "When oil prices are falling below production costs, the income gains for Oil price special coverage

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 consumers will be smaller than the costs to producers and falling oil prices become a negative- sum game," it said. For 2016, the bank said it was "no longer looking for an acceleration in 2016 GDP growth" and that the risk of a global recession was now 30 percent. Following a 70 percent price rout between mid-2014 and early 2016, oil markets are in flux. Goldman sees ‘green shoots’ in oil prices as storage risks recede Bloomberg + Gulf News The oil market may be starting to rebalance as US production shows signs of declining and output in Nigeria and Kurdistan is disrupted, potentially shrinking the global oversupply, according to Goldman Sachs Group Inc. “Storage constraints and a still large oversupply in coming months will continue to keep prices in a trendless and volatile range,” Goldman analysts including Damien Courvalin wrote in a report dated March 11. The bank expects oil to trade between $25 to $45 a barrel in the second quarter of this year, compared with a range of $20 to $40 in the first three months. Oil has rallied from a 12-year low last month amid speculation that falling US output will reduce stockpiles, which remain at the most in more than eight decades. While US shale drillers have idled more than two-thirds of the country’s oil rigs in the past 17 months, Goldman expects US supplies to continue to rise through April, potentially sending prices “sharply lower” in the coming weeks. “As we do not expect growth from Opec and Russia after 2Q and given our expectation for resilient demand growth, our confidence that stocks will draw in 2016 if prices remain low is rising,” the analysts wrote. The risk of crude storage hitting capacity declines as inventories shrink, they said.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 US crude stockpiles rose by 3.9mn to 521.9mn in the week before last, the highest level since 1930, and production held near the least since November 2014, data from the Energy Information Administration on Wednesday. The nation’s output will drop to its lowest since 2013 next year as battered shale drillers idle rigs to conserve cash, the EIA said in its monthly Short-Term Energy Outlook on Tuesday. Goldman reduced its 2017 oil forecast to $57 a barrel from $60 to reflect the smaller required US production growth this year. Oil prices may have passed their lowest point as shrinking supplies outside Opec and disruptions inside the group erode the global surplus, the International Energy Agency said on Friday. Supplies from non-Opec producers will decline by 750,000 bpd this year, or 150,000 bpd more than estimated last month, the agency said. Declines in production have been helped by disruptions in Kurdistan and Nigeria, which are expected to remain curtailed through April, according to Goldman, predicting bigger cuts to non- Opec output if prices stay below $40 a barrel. Within Opec, production is expected to be price sensitive this year, with Southern Iraq forecast to pump less as new projects are scaled back unless crude prices move higher to encourage investments, the analysts said. While Saudi Arabia and Russia reached an agreement last month to cap output at peak levels, only a small growth in production was expected this year from both nations, so any freeze accord will have a “negligible impact” on the oil balance, they said. Boom built on junk debt sees $19bn default wave Investors are facing $19bn in energy defaults as the worst oil crash in a generation leaves drillers struggling to stay afloat, Bloomberg reported. The wave could begin within days if Energy XXI Ltd, SandRidge Energy Inc and Goodrich Petroleum Corp fail to reach agreements with creditors and shareholders. Those are three of at least eight oil and gas producers that have announced missed debt payments, triggering a countdown to default. “Shale was a hot growth area and companies made the mistake of borrowing too much,” said George Schultze, founder and chief investment officer of Schultze Asset Management in New York, which has been betting against several distressed energy companies. “It’s amazing that so

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 many people were willing to lend them money. Many are going to file for bankruptcy, and bondholders and equity are going to get wiped out en masse.” Bondholders are paying dearly for backing a shale boom that was built on high-yield credit. Since the start of 2015, 48 oil and gas producers have gone bankrupt owing more than $17bn, according to law firm Haynes and Boone. NewBase Special Coverage News Agencies News Release 14 March 2016 Turning to frack tech, US oil drillers test new limits Reuters + Gulf Times Fifty-stage frack jobs. Fifteen-foot cluster spacing. More than 2,000 pounds of proppant concentrate per foot. Top US shale producers are pushing fracking technology to new extremes to get more oil out of their wells, as they weather lower-for-longer oil prices. While the impact of the techniques may be scarcely noticeable on current US output with so few wells in operation, it could mean drillers are able to accelerate production more fiercely than ever once prices recover. The hunt for the next big technology to transform the process of fracking is still on, with companies looking at methods such as using carbon dioxide to coax more oil out of wells that have already been hydraulically fractured. A Pioneer Drilling Co sign is seen at the entrance to an Alta Resources natural gas well site near Montrose, Pennsylvania. Top US shale producers are pushing fracking technology to new extremes to get more oil out of their wells, as they weather low oil

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Commentary from executives in recent weeks suggests they are doubling down on existing accomplishments and innovations to boost production. Pioneer Natural Resources is increasing the length of stages in its wells, Hess Corp is raising the total number of stages, EOG Resources is drilling in extremely tight windows, while Whiting Petroleum Corp and Devon Energy Corp have loaded up more sand in their wells, fourth-quarter earnings call comments show. Sector experts say these techniques could boost initial output per well by between 5 and 50%, demonstrating the resilience of the industry. “We have got to keep moving ahead in terms of our knowledge base so that when things improve we can hit it with all cylinders,” Pioneer COO, Tim Dove, said on a recent quarterly results call. The company plans to cut spacing between clusters, or small perforations that provide fluid and sand access to the formation, to as little as 15 feet — a move it said would have been “unheard of” in the past. For a typical well in the Bakken, a jump to 15-foot spacing could easily boost initial output by as much as 50%, Monte Besler, who runs FRACN8R Consulting in North Dakota, estimated. Many of the techniques have been around for the last four years as the US shale boom took off, but drillers are deploying them at a greater rate as prices show little sign of recovering significantly amid concerns about a global glut.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 “The increase in proppant amounts and fluid amounts and the decrease in cluster spacing, all of those are directions that industry in general has been headed,” said Jennifer Miskimins, senior consulting engineer with Barree & Associates in Lakewood, Colorado. “In some places it is helping with long-term recoveries and that’s why we’re starting to see people push the envelope a little bit.” Drillers have already idled slower rigs, shifted crews and high-speed rigs to “sweet spots” with the most oil during the punishing 20-month price rout. With the major shale companies ready to crank up the spigots if oil prices recover to $40-$45 a barrel, the latest steps are all the more significant. For many, efforts to boost production while keeping costs in check are already paying off. In the fourth quarter, Pioneer slashed stage lengths by 60%, added one cluster per stage, and pumped more fluid — about 36 barrels per foot, up from 30 — in all of its wells. The results? Initial production jumped by more than 15% from the prior quarter to 2,200 barrels per day in about 22 of its wells in the Permian, the company said, describing the result as “exceedingly strong.” A frack stage is a portion of the horizontal section of the well. Typically, the larger the number of stages used, the better initial production is expected to be. Hess’ decision to increase stage counts by about 40% to 50 delivered a more than 20% average increase in initial production rates for basically the same cost, the company said. The costs for producers for these techniques is also dropping dramatically as service providers compete aggressively for the limited amount of work on offer, experts said. Others are turning to sand, which is pumped with a mixture of chemicals and water to induce pressure and crack rocks. Whiting, Devon and Continental Resources Inc have all loaded up well completions with higher proppant concentrations, or essentially, sand. The benefit for a company like Devon, which is pumping about 2,500 to 2,700 pounds per lateral foot in some of its wells, could be as much as a 50% rise in initial rates, Besler estimated.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The moves highlight that these companies are not yet considering raising the white flag in the face of the downturn. “Even in 2016 we’re changing what we’re doing in terms of optimization, we’re pushing the limits.” Pioneer’s Dove said. NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 14 March 2016 K. Al Awadi

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17