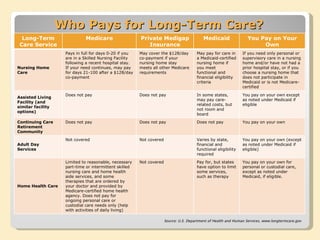

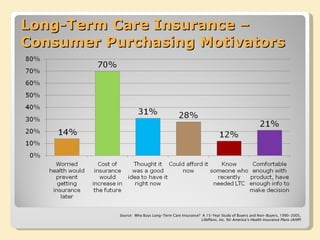

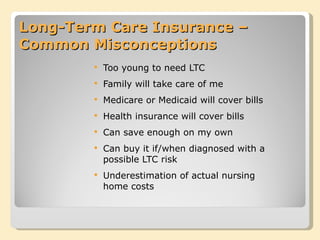

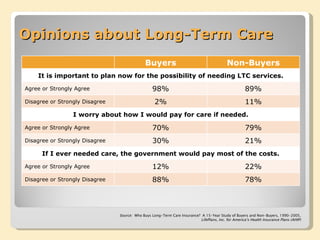

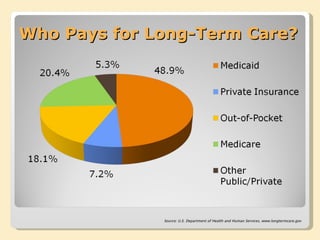

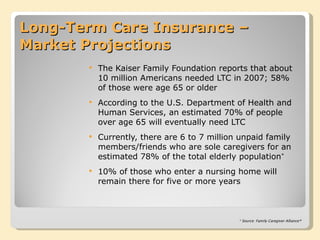

Long-term care (LTC) refers to both medical and non-medical care for people who cannot independently perform daily activities or who have cognitive impairments. As lifespans increase, more people will need LTC, but it is very expensive - the average daily rate for a private nursing home room is over $200. Few have private LTC insurance to cover these costs. Private LTC insurance pays for only 7% of LTC costs currently. While it is growing as an alternative to relying on family or public programs, many are unaware of its benefits or mistakenly believe other options will cover LTC expenses.