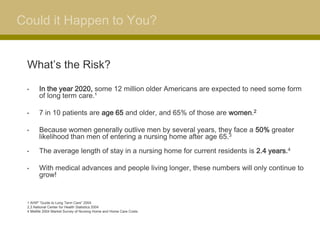

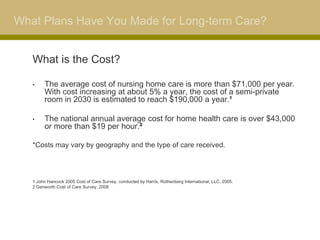

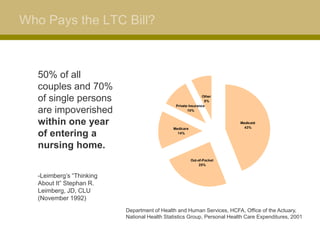

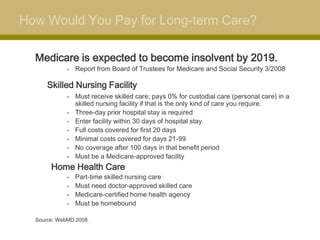

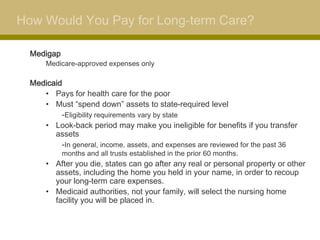

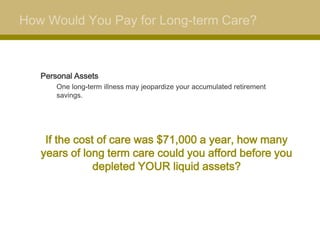

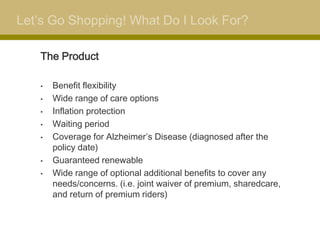

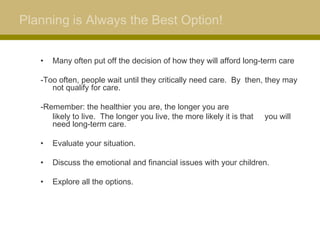

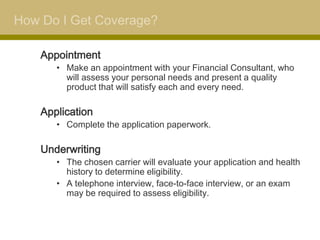

This document provides an overview of long-term care planning and options. It discusses that long-term care is needed when one can no longer independently care for themselves, and may involve assistance with daily tasks. Common places of long-term care include home care, assisted living facilities, adult day care, hospice, and nursing homes. The costs of long-term care are significant and most individuals and families are not adequately prepared to pay for extended care needs. Private long-term care insurance can help cover costs and protect assets from being depleted by long-term care expenses. The document encourages planning early for long-term care needs through exploring insurance options.