1. Long term care insurance pays for long term care services such as help with daily activities like eating, bathing, and dressing. It can cover care at home or in facilities like nursing homes.

2. Some key things to know before buying long term care insurance are getting the right amount of coverage, choosing a company unlikely to raise premiums, understanding rejection doesn't mean you can never get coverage, and getting advice from a specialist.

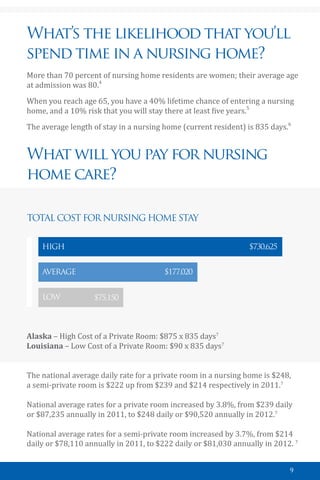

3. Long term care is an important issue for women as they are often caregivers, live longer, and make up a large portion of nursing home residents.