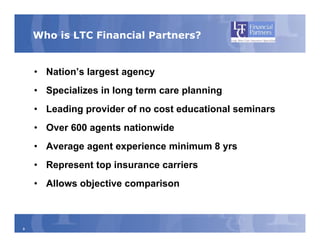

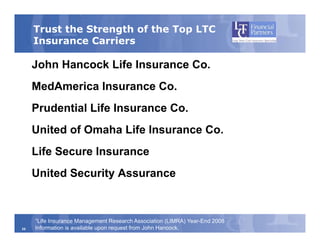

This document provides information about long-term care planning services offered by LTC Financial Partners. It discusses the need for long-term care planning given rising costs and risks, and how long-term care insurance can help cover costs and protect assets. Key details include common long-term care policy components like benefits amounts, eligibility periods, and inflation protection.