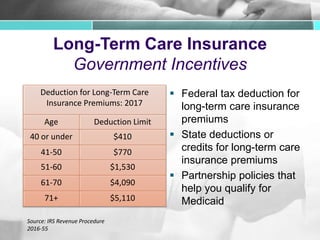

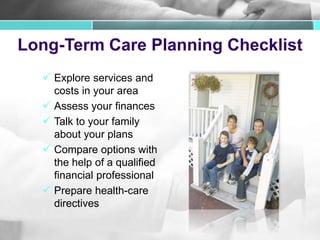

The document discusses the need for long-term care and its associated costs, highlighting that 70% of individuals over age 65 are likely to require such care. It outlines various payment methods, including out-of-pocket expenses, Medicare, Medicaid, and long-term care insurance, along with strategies for asset protection and eligibility for Medicaid. A planning checklist is provided to assist individuals in preparing for long-term care while managing financial implications.