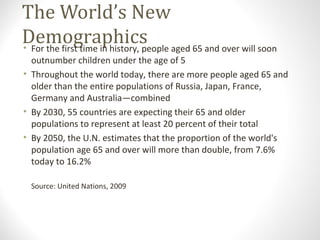

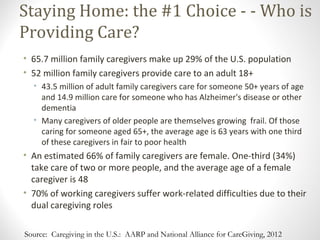

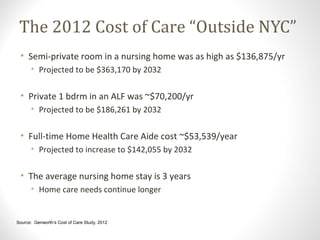

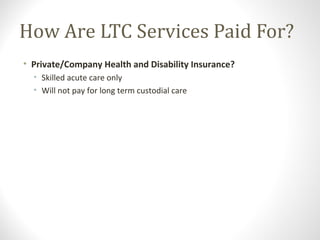

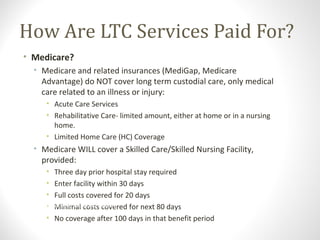

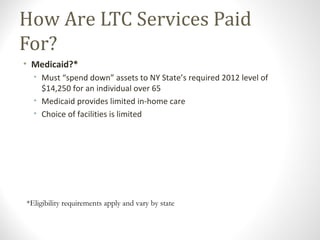

The document discusses the increasing need for long-term care (LTC) due to aging populations, with predictions that by 2030, many countries will have significant portions of their populations aged 65 and older. It defines LTC, outlines the costs and payment options, and emphasizes the importance of planning ahead for future care needs to avoid financial strain. Lastly, it suggests having open discussions with family members about plans and preferences for long-term care to ensure informed decision-making.