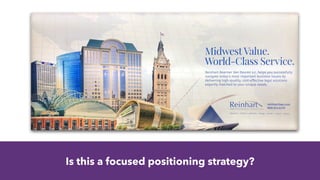

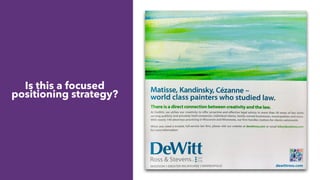

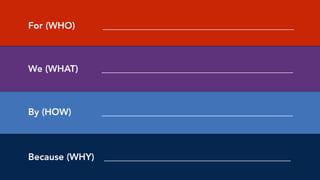

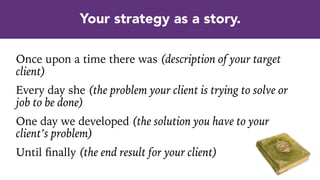

The document discusses the importance of having a focused positioning strategy for law firms, emphasizing the need for a clear value proposition, target market, and unique solutions that distinguish them in a competitive landscape. It outlines essential questions to define what firms do, whom they serve, and how they create value, while also illustrating the relationship between strategy and superior business performance. Additionally, it touches on the significance of aligning company culture and purpose with strategic objectives to enhance overall business effectiveness.