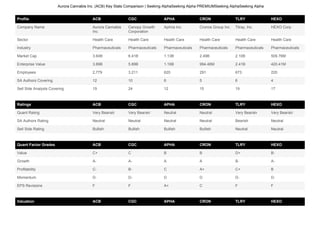

Aurora Cannabis Inc. (ACB) Key Stats Comparison | Seeking Alpha PREMIUM | Peers on Nov. 14, 2019 after Q3 earnings

- 1. Aurora Cannabis Inc. (ACB) Key Stats Comparison | Seeking AlphaSeeking Alpha PREMIUMSeeking AlphaSeeking Alpha Profile ACB CGC APHA CRON TLRY HEXO Company Name Aurora Cannabis Inc. Canopy Growth Corporation Aphria Inc. Cronos Group Inc. Tilray, Inc. HEXO Corp. Sector Health Care Health Care Health Care Health Care Health Care Health Care Industry Pharmaceuticals Pharmaceuticals Pharmaceuticals Pharmaceuticals Pharmaceuticals Pharmaceuticals Market Cap 3.64B 6.41B 1.13B 2.49B 2.10B 509.76M Enterprise Value 3.89B 5.89B 1.16B 994.46M 2.41B 420.41M Employees 2,779 3,211 620 291 673 220 SA Authors Covering 12 10 6 5 6 4 Sell Side Analysts Covering 19 24 12 15 19 17 Ratings ACB CGC APHA CRON TLRY HEXO Quant Rating Very Bearish Very Bearish Neutral Neutral Very Bearish Very Bearish SA Authors Rating Neutral Neutral Neutral Neutral Bearish Neutral Sell Side Rating Bullish Bullish Bullish Bullish Neutral Neutral Quant Factor Grades ACB CGC APHA CRON TLRY HEXO Value C+ C B B D+ B- Growth A- A- A A B- A- Profitability C- B- C A+ C+ B Momentum D- D- D D D- D- EPS Revisions F F A+ C F F Valuation ACB CGC APHA CRON TLRY HEXO

- 2. Valuation ACB CGC APHA CRON TLRY HEXO P/E Non-GAAP (FWD) - - 35.68 - - - P/E Non-GAAP (TTM) - - - - - - P/E GAAP (FWD) - - 58.66 7.82 - - P/E GAAP (TTM) - - - 7.18 - - PEG Non-GAAP (FWD) - - - - - - PEG GAAP (TTM) - - - - - - Price/Sales (TTM) 18.99 25.22 5.82 73.59 13.23 11.72 EV/Sales (TTM) 20.55 26.51 6.04 37.63 17.80 11.67 EV/EBITDA (TTM) - - - - - - Price to Book (TTM) 1.08 1.46 0.86 1.52 5.05 0.87 Price/Cash Flow (TTM) - - - - - - Growth ACB CGC APHA CRON TLRY HEXO Revenue Growth (YoY) 349.20% 230.61% 477.48% 198.98% 314.45% 863.54% Revenue Growth (FWD) 148.32% 140.26% 177.52% 245.85% 149.15% 262.71% Revenue 3 Year (CAGR) 456.45% 152.96% 177.93% 147.93% - 193.95% Revenue 5 Year (CAGR) - - - NM - - EBITDA Growth (YoY) 209.43% 589.50% 198.90% 1,527.71% 186.13% 381.14% EBITDA Growth (FWD) - - 168.24% - - - EBITDA 3 Year (CAGR) NM NM NM NM - NM EBIT 3 Year (CAGR) NM NM NM NM - NM Net Income 3 Year (CAGR) NM NM NM NM - NM EPS Growth Diluted (YoY) -293.33% 718.69% -144.26% -4,118.57% 274.82% 120.30%

- 3. Growth ACB CGC APHA CRON TLRY HEXO EPS Growth Diluted (FWD) - - 11.50% - - - EPS Diluted 3 Year (CAGR) NM NM NM NM - NM Tang Book Value 3 Year (CAGR) 347.57% 240.53% 117.06% 365.19% - 370.22% Total Assets 3 Year (CAGR) 568.79% 284.38% 209.01% 311.63% - 352.48% Levered FCF 3 Year (CAGR) NM NM NM NM - NM Profitability ACB CGC APHA CRON TLRY HEXO Gross Profit Margin 64.46% 52.60% 4.62% 2.27% 27.03% 56.64% EBIT Margin -119.80% -218.20% -19.50% -247.37% -82.13% -177.86% EBITDA Margin -84.67% -197.06% -8.78% -239.43% -74.44% -171.48% Net Income Margin -117.30% -649.08% -8.34% 4,158.35% -97.39% -171.57% Levered FCF Margin -234.24% -347.00% -107.57% 1,180.63% -62.09% -554.12% Return on Equity -10.03% -52.27% -1.32% 122.77% -43.73% -14.83% Return on Assets -5.02% -7.38% -1.53% -3.61% -11.01% -8.69% Return on Total Capital -5.47% -7.99% -1.66% -4.54% -13.14% -9.33% Asset Turnover Ratio 0.07% 0.05% 0.13% 0.02% 0.21% 0.08% Cash From Operations -146.79M -466.65M -54.19M -59.55M -153.57M -94.48M Revenue Per Employee 68,122.50 52,747.80 282,907.97 39,533.18 64,086.00 17,242.39 Net Income Per Employee -79,909.65 -374,480.38 -25,725.71 3.78M -196,197.62 -75,177.69 Momentum ACB CGC APHA CRON TLRY HEXO 3 Month Price Performance -46.70% -45.91% -35.55% -47.84% -54.52% -59.72% 6 Month Price Performance -55.74% -57.72% -34.02% -49.05% -54.96% -69.76%

- 4. Momentum ACB CGC APHA CRON TLRY HEXO 9 Month Price Performance -51.03% -59.83% -51.73% -64.50% -72.92% -63.69% YTD Price Performance -28.43% -31.15% -21.62% -30.13% -70.33% -41.98% 1Y Price Performance -47.01% -51.92% -56.70% -12.64% -81.24% -56.76% 3 Year Price Performance 128.50% 167.34% 30.03% 757.24% - - 5 Year Price Performance - 761.27% - - - - EPS Revisions ACB CGC APHA CRON TLRY HEXO EPS: FQ1 Up Revisions 0 3 1 1 1 0 EPS: FQ1 Down Revisions 4 1 0 4 7 2 Revenue: FQ1 Up Revisions 0 0 1 0 1 0 Revenue: FQ1 Down Revisions 7 11 1 2 5 6 EPS Beats (last 2 years) 5 0 6 6 0 1 Revenue Beats (last 2 years) 3 4 2 2 5 4 Dividends ACB CGC APHA CRON TLRY HEXO Dividend Yield (FWD) - - - - - - Dividend Yield (TTM) - - - - - - 4 Year Average Yield 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Dividend Rate (FWD) - - - - - - Dividend Rate (TTM) - - - - - - Payout Ratio - - - - - - Dividend Growth 3 Yr (CAGR) - - - - - - Dividend Growth 5 Yr (CAGR) - - - - - -

- 5. Dividends ACB CGC APHA CRON TLRY HEXO Years of Dividend Growth 0 Years 0 Years 0 Years 0 Years 0 Years 0 Years Total Return ACB CGC APHA CRON TLRY HEXO 1 Month Return -3.53% -4.79% -5.31% -7.46% -0.14% -21.34% YTD Return -28.43% -31.15% -21.62% -30.13% -70.33% -41.98% 1 Year Return -47.01% -51.92% -56.70% -12.64% -81.24% -56.76% 3 Year Return 128.50% 167.34% 30.03% 757.24% - - 5 Year Return - 761.27% - - - - 10 Year Return - - - - - - Income Statement (TTM) ACB CGC APHA CRON TLRY HEXO Revenue 189.31M 222.12M 191.25M 26.43M 135.57M 36.02M Revenue Per Share 0 1 1 0 2 0 EPS Diluted -293 719 -144 -4,119 275 120 Net Income -222.07M -1.44B -15.95M 1.10B -132.04M -61.80M Gross Profit 122.03M 116.83M 8.83M 600,067.93 36.65M 20.40M EBITDA -160.30M -437.72M -16.79M -63.27M -100.92M -61.77M Operating Income -226.80M -484.66M -37.29M -65.37M -111.34M -64.06M Net Income Avail. to Comm. -222.07M -1.44B -15.95M 1.10B -132.04M -61.80M Balance Sheet (TTM) ACB CGC APHA CRON TLRY HEXO Total Cash 241.26M 2.43B 348.77M 1.50B 122.37M 115.81M Total Cash Per Share 0 7 1 4 1 0

- 6. Balance Sheet (TTM) ACB CGC APHA CRON TLRY HEXO Total Debt 492.36M 1.68B 356.05M 6.16M 437.28M 25.29M Total Debt to Equity 15 37 27 0 105 4 Short Term Debt - - - - - - Long Term Debt 301.72M 1.57B 346.55M - 427.98M 22.92M Current Ratio 2 10 6 3 3 6 Quick Ratio 1 9 4 3 1 4 Covered Ratio NM NM NM - NM NM Book Value Per Share 0 7 2 4 -1 2 Debt/Free Cash Flow -1 -2 -2 - - -0 Long Term Debt/Total Capital 8 26 21 0 51 4 Cash Flow Statement (TTM) ACB CGC APHA CRON TLRY HEXO Net Operating Cash Flow -146.79M -466.65M -54.19M -59.55M -153.57M -94.48M Levered Free Cash Flow -443.44M -770.76M -205.73M 312.00M - -199.59M Cash from Operations -146.79M -466.65M -54.19M -59.55M -153.57M -94.48M Capital Expenditures -316.34M -536.49M -140.88M -69.79M - -104.58M