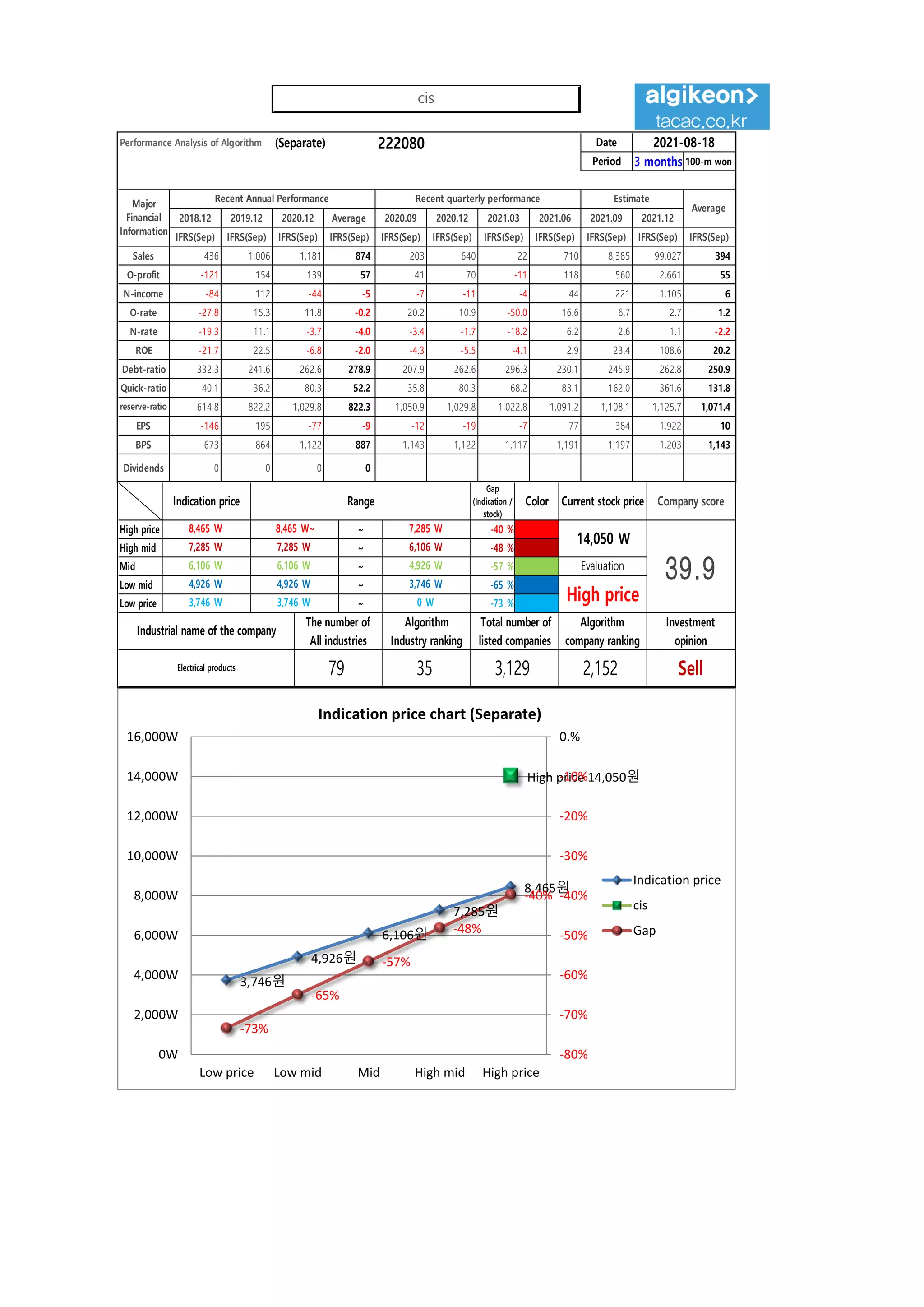

This document provides a summary of a company's financial performance and stock price information over several periods of time. It includes data on sales, profits, debt ratios, and stock prices on a quarterly and annual basis. It also analyzes the company's stock price against indication price ranges and provides a probability score for price increases. The analysis suggests the stock as a "sell" and provides prospective purchase amounts at different price levels.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (Separate) 222080 Date

Period

Gap

(Indication /

stock)

Color

low price 3,746 W 3,746 W ~ 0 W -73 % 120,936 W 32

Low mid 4,926 W 4,926 W ~ 3,746 W -65 % 107,089 W 22

Mid 6,106 W 6,106 W ~ 4,926 W -57 % 93,243 W 15

High mid 7,285 W 7,285 W ~ 6,106 W -48 % 79,396 W 11

Suggested Purchase

Amount 164,906 W

Number of stocks

purchased 12

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 8,465 W 8,465 W~ ~ 7,285 W -40 % 65,549 W 8

2021-08-18

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

14,050 W High price 17.7 Sell 2,000,000 W

Stock price rise

probability score

A Sector 50.1 44.1 43.4 47.7 50.7 54.0

17.7

B Sector 40.4 29.2 47.7 47.7 40.8 14.6

Total average 45.3 36.6 31.5 30.4 45.8 34.3

2021.03.25 2021.04.22 2021.05.24 2021.06.21 2021.07.19 2021.08.17

2021.05.24 2021.06.21 2021.07.19 2021.08.17

Total of

increase rate

Total score

A Sector -14 % -2 % 9 % 6 % 6 %

-9 % 39.0

B Sector -39 % -49 % 59 % -17 % -180 %

Total average -23 % -16 % -4 % 34 % -33 %

2021.04.22

-14%

-2% 9% 6% 6%

-39% -49%

59%

-17%

-180%

-23% -16%

-4%

34%

-33%

-200%

-150%

-100%

-50%

0%

50%

100%

2021.04.22 2021.05.24 2021.06.21 2021.07.19 2021.08.17

Increase rate of stock price rise

A sector

B sector

Total average

cis

50

44 43

48

51

54

40

29

20

48

41

15

45

37

32 30

46

34

0

10

20

30

40

50

60

2021.03.25 2021.04.22 2021.05.24 2021.06.21 2021.07.19 2021.08.17

Stock price rise probability score

A sector

B sector

Total average](https://image.slidesharecdn.com/cis222080algorithminvestmentreport-210818011424/75/cis-222080-Algorithm-Investment-Report-2-2048.jpg)