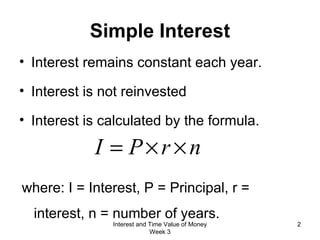

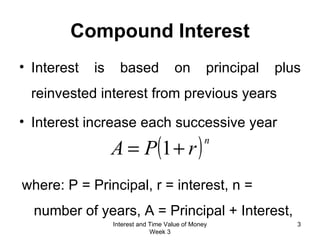

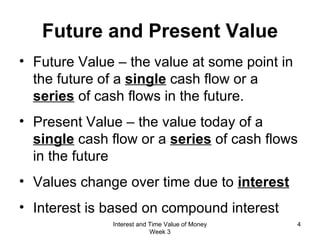

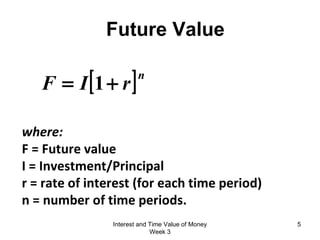

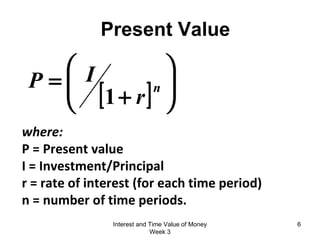

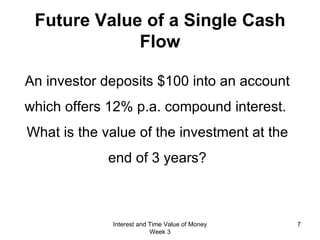

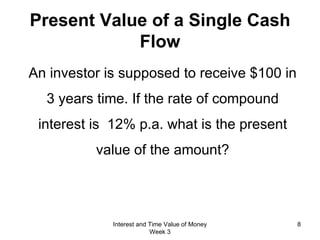

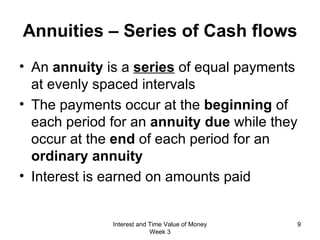

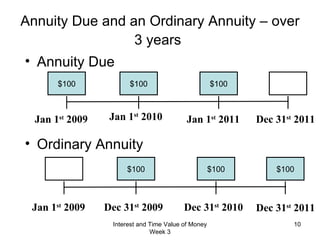

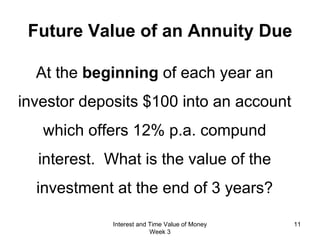

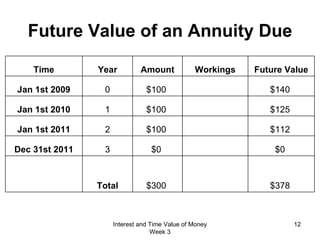

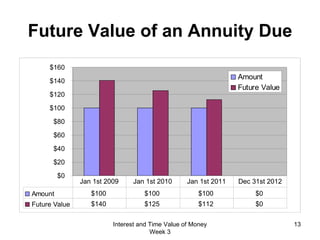

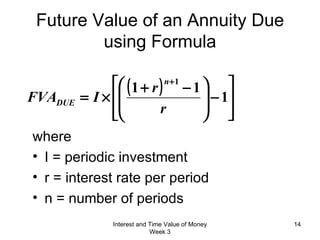

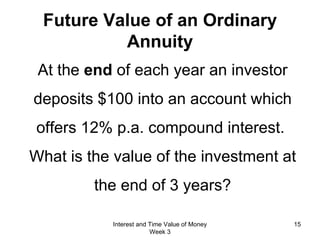

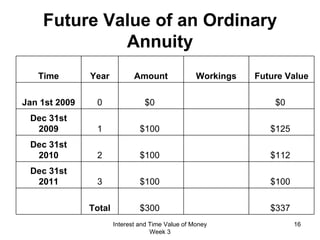

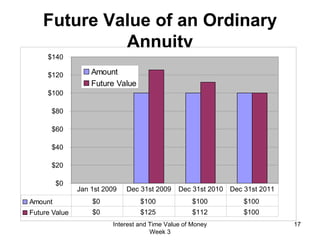

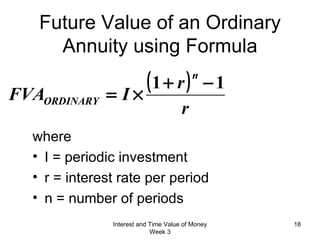

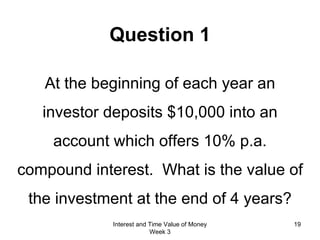

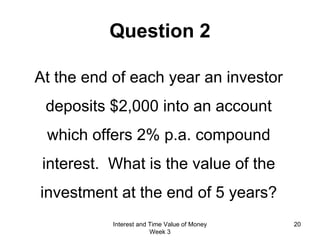

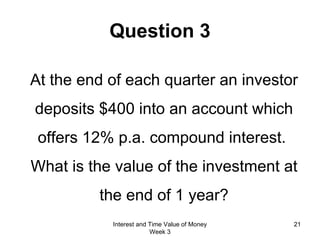

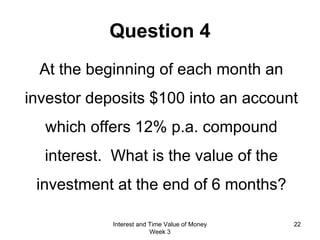

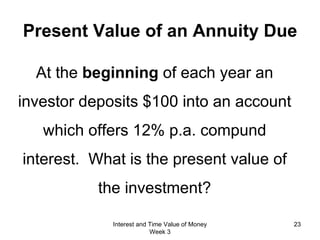

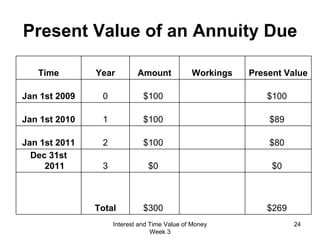

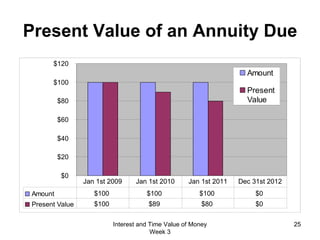

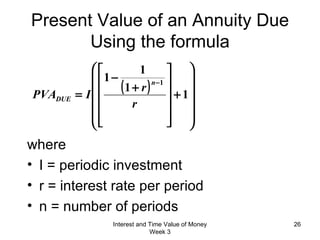

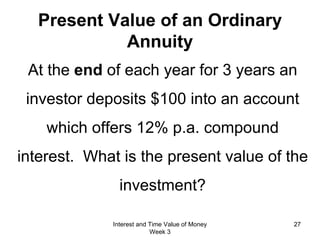

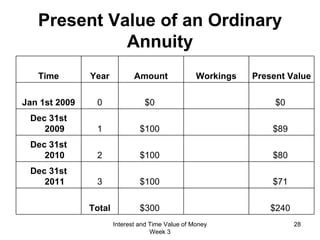

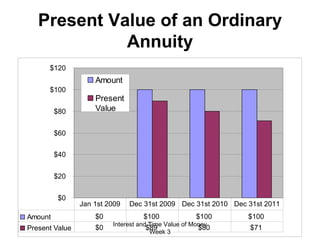

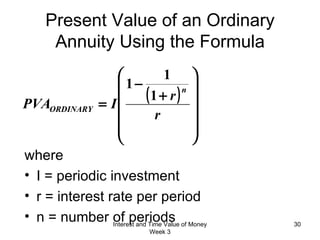

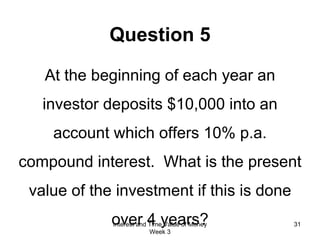

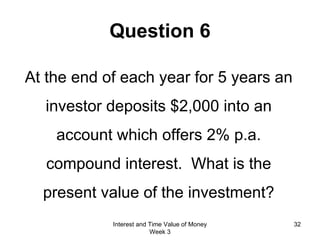

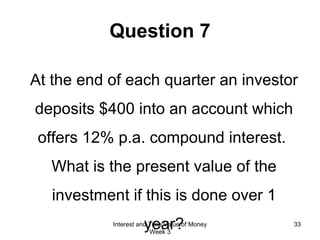

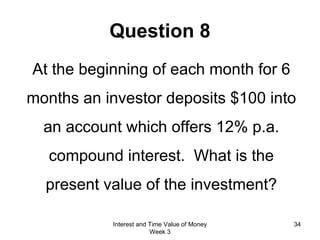

The document discusses concepts related to interest and the time value of money, including simple vs compound interest, future value and present value calculations, and calculations related to annuities. It provides examples of calculating future and present values for single cash flows and annuities using formulas, and asks questions requiring the use of these formulas.