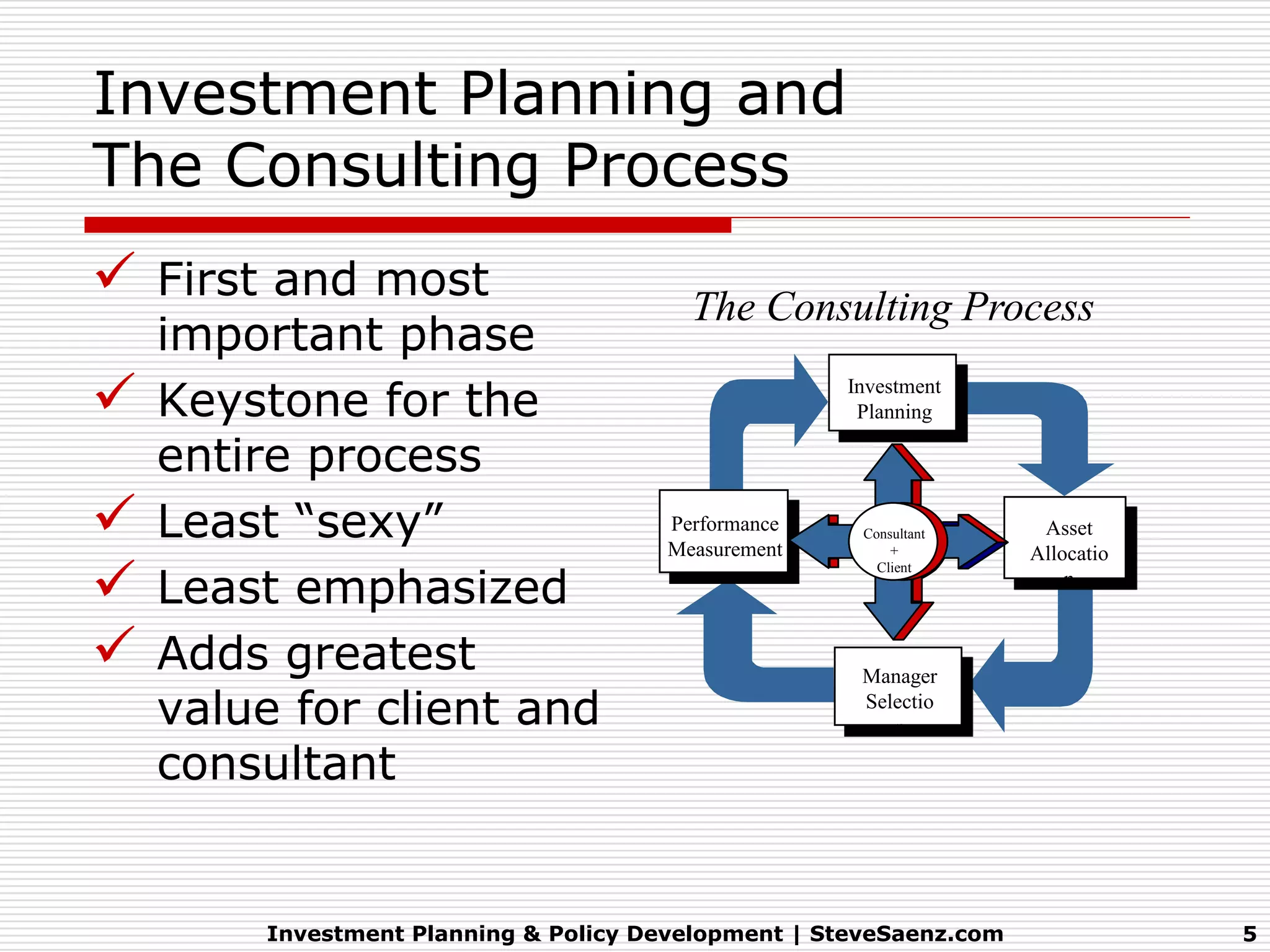

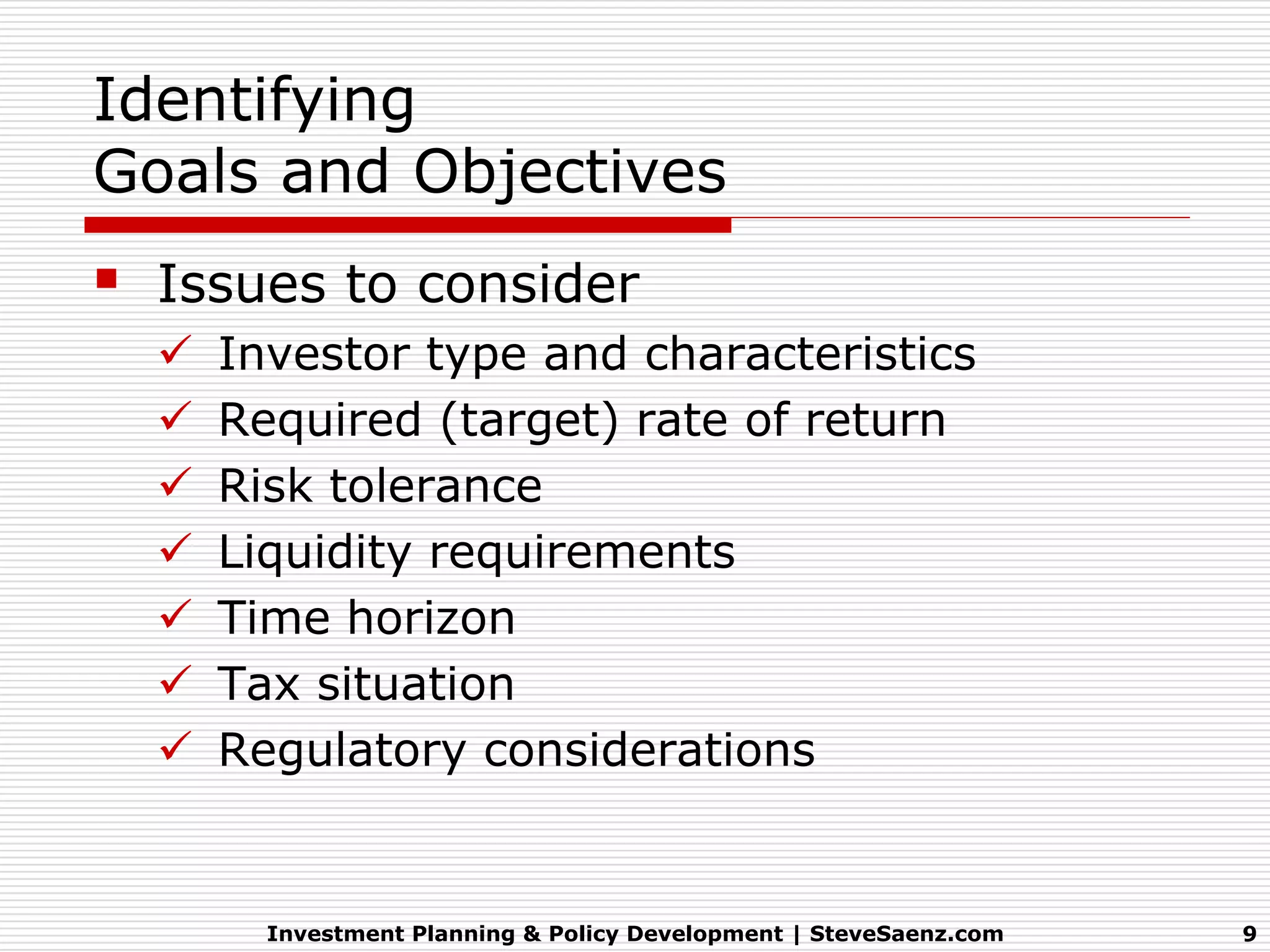

The document emphasizes the critical importance of investment planning and policy development in the consulting process, highlighting its potential to enhance investment success and client relationships. It outlines essential elements of an investment policy, including client education, goal identification, strategic asset allocation, and performance measurement. Practical applications are discussed to implement and review investment policies effectively.

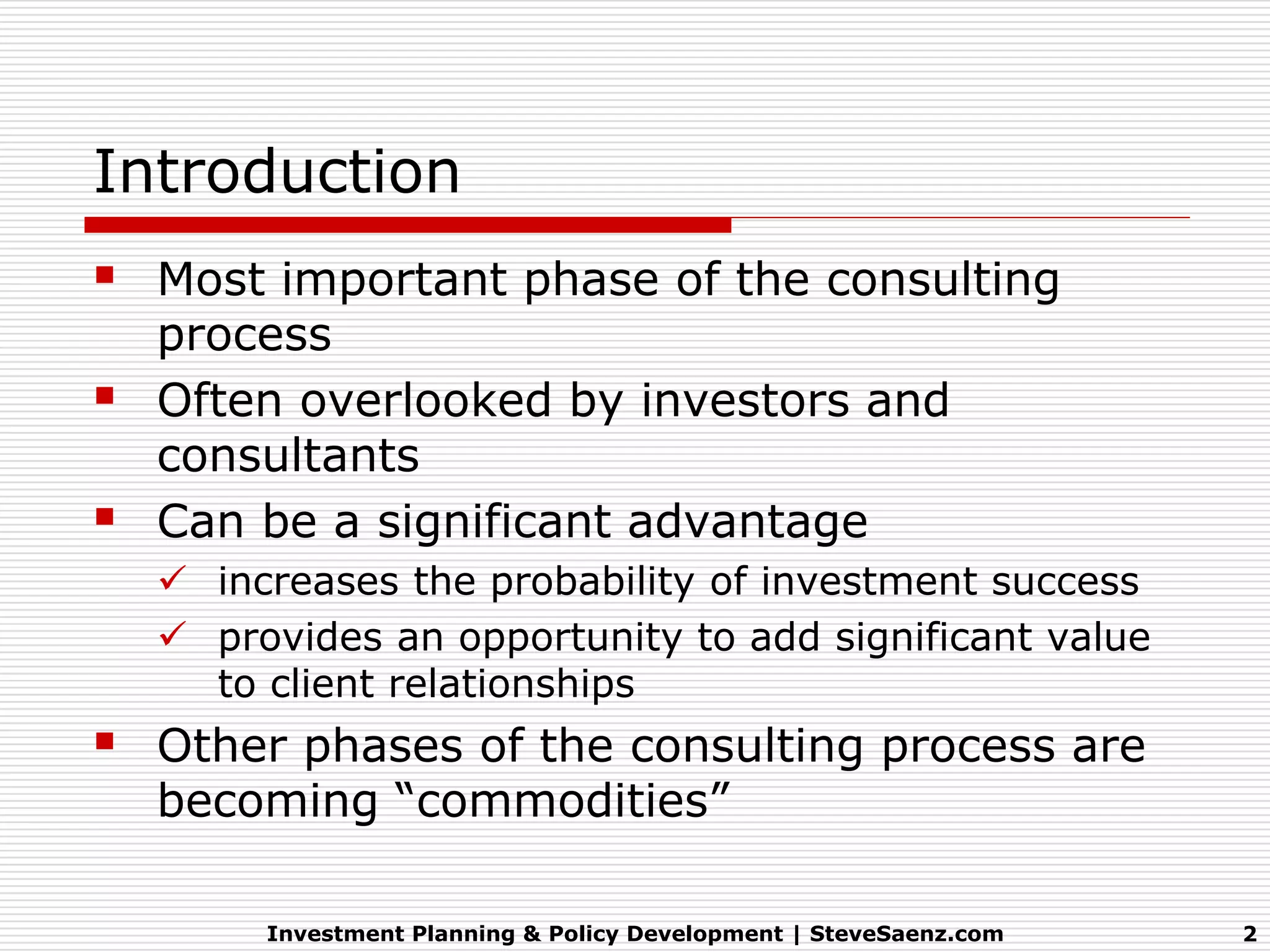

![Identifying

Goals and Objectives

Investor Types and Characteristics

Institutional investors Individual investors

Corporate Taxable

Public Tax-deferred [IRA,

Unions (Taft-Hartley) 401(k)]

Endowments Trusts

Foundations

Investment Planning & Policy Development | SteveSaenz.com 10](https://image.slidesharecdn.com/investmentplanningpolicydevelopment-120808230402-phpapp01/75/Investment-Planning-Policy-Development-10-2048.jpg)