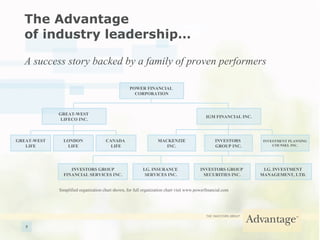

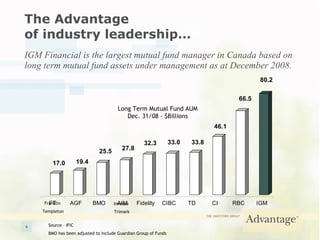

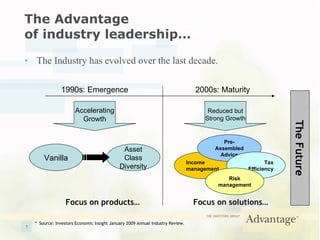

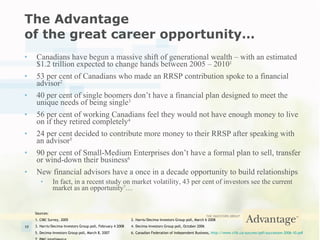

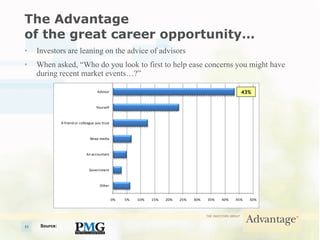

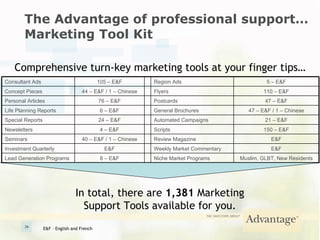

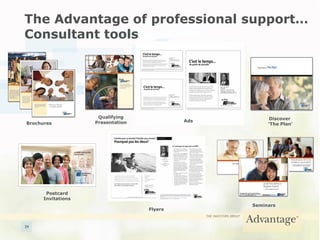

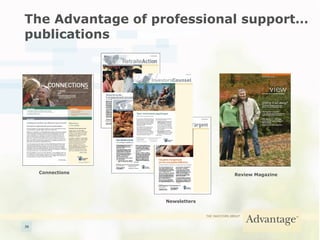

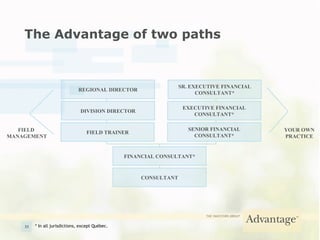

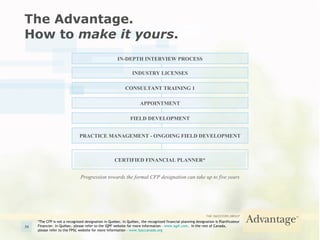

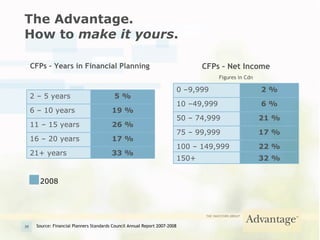

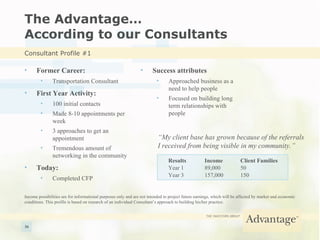

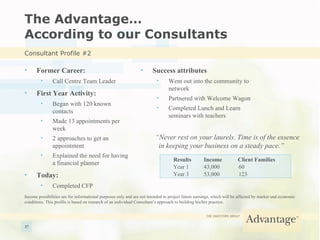

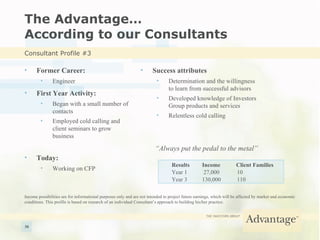

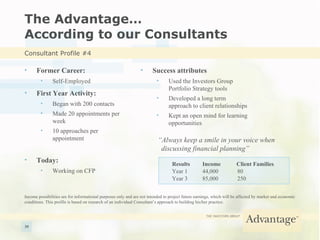

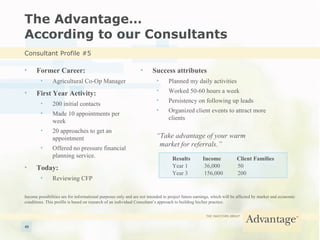

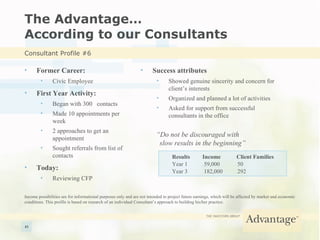

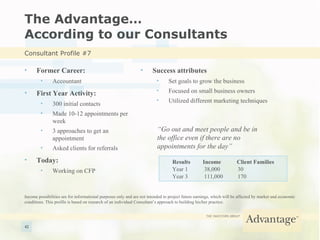

The document summarizes the advantages of becoming a financial consultant with Investors Group, including an entrepreneurial environment, industry-leading training, flexibility and independence, mentorship and support, and exceptional income potential. It outlines the training, tools, and support provided to consultants, including marketing support, technology, publications, and the opportunity to advance to management roles. Consultants can build their own business and generate residual income by providing financial planning and products to clients.