Sample Investment PropertyAverage InlandSan Diego HomeASSUMPTION.docx

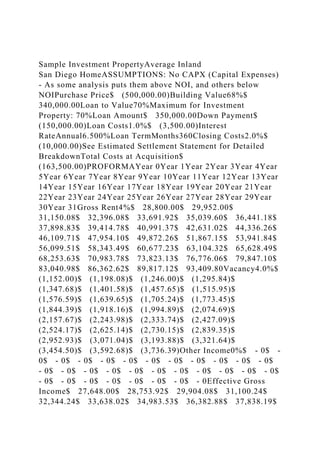

- 1. Sample Investment PropertyAverage Inland San Diego HomeASSUMPTIONS: No CAPX (Capital Expenses) - As some analysis puts them above NOI, and others below NOIPurchase Price$ (500,000.00)Building Value68%$ 340,000.00Loan to Value70%Maximum for Investment Property: 70%Loan Amount$ 350,000.00Down Payment$ (150,000.00)Loan Costs1.0%$ (3,500.00)Interest RateAnnual6.500%Loan TermMonths360Closing Costs2.0%$ (10,000.00)See Estimated Settlement Statement for Detailed BreakdownTotal Costs at Acquisition$ (163,500.00)PROFORMAYear 0Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year 10Year 11Year 12Year 13Year 14Year 15Year 16Year 17Year 18Year 19Year 20Year 21Year 22Year 23Year 24Year 25Year 26Year 27Year 28Year 29Year 30Year 31Gross Rent4%$ 28,800.00$ 29,952.00$ 31,150.08$ 32,396.08$ 33,691.92$ 35,039.60$ 36,441.18$ 37,898.83$ 39,414.78$ 40,991.37$ 42,631.02$ 44,336.26$ 46,109.71$ 47,954.10$ 49,872.26$ 51,867.15$ 53,941.84$ 56,099.51$ 58,343.49$ 60,677.23$ 63,104.32$ 65,628.49$ 68,253.63$ 70,983.78$ 73,823.13$ 76,776.06$ 79,847.10$ 83,040.98$ 86,362.62$ 89,817.12$ 93,409.80Vacancy4.0%$ (1,152.00)$ (1,198.08)$ (1,246.00)$ (1,295.84)$ (1,347.68)$ (1,401.58)$ (1,457.65)$ (1,515.95)$ (1,576.59)$ (1,639.65)$ (1,705.24)$ (1,773.45)$ (1,844.39)$ (1,918.16)$ (1,994.89)$ (2,074.69)$ (2,157.67)$ (2,243.98)$ (2,333.74)$ (2,427.09)$ (2,524.17)$ (2,625.14)$ (2,730.15)$ (2,839.35)$ (2,952.93)$ (3,071.04)$ (3,193.88)$ (3,321.64)$ (3,454.50)$ (3,592.68)$ (3,736.39)Other Income0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Effective Gross Income$ 27,648.00$ 28,753.92$ 29,904.08$ 31,100.24$ 32,344.24$ 33,638.02$ 34,983.53$ 36,382.88$ 37,838.19$

- 2. 39,351.72$ 40,925.78$ 42,562.81$ 44,265.32$ 46,035.94$ 47,877.37$ 49,792.46$ 51,784.17$ 53,855.53$ 56,009.75$ 58,250.14$ 60,580.15$ 63,003.35$ 65,523.48$ 68,144.43$ 70,870.20$ 73,705.02$ 76,653.22$ 79,719.34$ 82,908.12$ 86,224.44$ 89,673.41OPERATING EXPENSESProperty Taxes 1.1%2%$ (5,500.00)$ (5,610.00)$ (5,722.20)$ (5,836.64)$ (5,953.37)$ (6,072.44)$ (6,193.89)$ (6,317.77)$ (6,444.13)$ (6,573.01)$ (6,704.47)$ (6,838.56)$ (6,975.33)$ (7,114.84)$ (7,257.14)$ (7,402.28)$ (7,550.33)$ (7,701.34)$ (7,855.37)$ (8,012.48)$ (8,172.73)$ (8,336.18)$ (8,502.90)$ (8,672.96)$ (8,846.42)$ (9,023.35)$ (9,203.82)$ (9,387.90)$ (9,575.66)$ (9,767.17)$ (9,962.51)Insurance: Fire3%$ (1,000.00)$ (1,030.00)$ (1,060.90)$ (1,092.73)$ (1,125.51)$ (1,159.28)$ (1,194.06)$ (1,229.88)$ (1,266.78)$ (1,304.78)$ (1,343.92)$ (1,384.24)$ (1,425.77)$ (1,468.54)$ (1,512.60)$ (1,557.98)$ (1,604.72)$ (1,652.86)$ (1,702.45)$ (1,753.52)$ (1,806.13)$ (1,860.31)$ (1,916.12)$ (1,973.60)$ (2,032.81)$ (2,093.79)$ (2,156.60)$ (2,221.30)$ (2,287.94)$ (2,356.58)$ (2,427.28)Insurance: EQ3%$ (650.00)$ (669.50)$ (689.59)$ (710.28)$ (731.59)$ (753.54)$ (776.15)$ (799.43)$ (823.41)$ (848.11)$ (873.55)$ (899.76)$ (926.75)$ (954.55)$ (983.19)$ (1,012.69)$ (1,043.07)$ (1,074.36)$ (1,106.59)$ (1,139.79)$ (1,173.98)$ (1,209.20)$ (1,245.48)$ (1,282.84)$ (1,321.33)$ (1,360.97)$ (1,401.80)$ (1,443.85)$ (1,487.17)$ (1,531.79)$ (1,577.74)Insurance: Umbrella3%$ (250.00)$ (257.50)$ (265.23)$ (273.19)$ (281.39)$ (289.83)$ (298.52)$ (307.48)$ (316.70)$ (326.20)$ (335.99)$ (346.07)$ (356.45)$ (367.14)$ (378.15)$ (389.49)$ (401.17)$ (413.21)$ (425.61)$ (438.38)$ (451.53)$ (465.08)$ (479.03)$ (493.40)$ (508.20)$ (523.45)$ (539.15)$ (555.32)$ (571.98)$ (589.14)$ (606.81)Homeowners Assoc3%$ (1,200.00)$ (1,236.00)$ (1,273.08)$ (1,311.27)$ (1,350.61)$

- 3. (1,391.13)$ (1,432.86)$ (1,475.85)$ (1,520.13)$ (1,565.73)$ (1,612.70)$ (1,661.08)$ (1,710.91)$ (1,762.24)$ (1,815.11)$ (1,869.56)$ (1,925.65)$ (1,983.42)$ (2,042.92)$ (2,104.21)$ (2,167.34)$ (2,232.36)$ (2,299.33)$ (2,368.31)$ (2,439.36)$ (2,512.54)$ (2,587.92)$ (2,665.56)$ (2,745.53)$ (2,827.90)$ (2,912.74)Maintenance3%$ (3,000.00)$ (3,090.00)$ (3,182.70)$ (3,278.18)$ (3,376.53)$ (3,477.83)$ (3,582.16)$ (3,689.62)$ (3,800.31)$ (3,914.32)$ (4,031.75)$ (4,152.70)$ (4,277.28)$ (4,405.60)$ (4,537.77)$ (4,673.90)$ (4,814.12)$ (4,958.54)$ (5,107.30)$ (5,260.52)$ (5,418.34)$ (5,580.89)$ (5,748.32)$ (5,920.77)$ (6,098.39)$ (6,281.34)$ (6,469.78)$ (6,663.87)$ (6,863.79)$ (7,069.70)$ (7,281.79)Landscape0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Utilities0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Management Fee 10%4%$ (2,764.80)$ (2,875.39)$ (2,990.41)$ (3,110.03)$ (3,234.43)$ (3,363.81)$ (3,498.36)$ (3,638.29)$ (3,783.82)$ (3,935.17)$ (4,092.58)$ (4,256.28)$ (4,426.53)$ (4,603.59)$ (4,787.73)$ (4,979.24)$ (5,178.41)$ (5,385.55)$ (5,600.97)$ (5,825.01)$ (6,058.01)$ (6,300.33)$ (6,552.34)$ (6,814.43)$ (7,087.01)$ (7,370.49)$ (7,665.31)$ (7,971.92)$ (8,290.80)$ (8,622.43)$ (8,967.33)Total Operating Expenses$ (14,364.80)$ (14,768.39)$ (15,184.11)$ (15,612.32)$ (16,053.43)$ (16,507.86)$ (16,976.00)$ (17,458.32)$ (17,955.28)$ (18,467.32)$ (18,994.96)$ (19,538.69)$ (20,099.02)$ (20,676.50)$ (21,271.69)$ (21,885.14)$ (22,517.47)$ (23,169.28)$ (23,841.21)$ (24,533.91)$ (25,248.06)$ (25,984.35)$ (26,743.52)$ (27,526.31)$ (28,333.52)$ (29,165.93)$ (30,024.38)$ (30,909.72)$

- 4. (31,822.87)$ (32,764.71)$ (33,736.20)NET OPERATING INCOME$ 13,283.20$ 13,985.53$ 14,719.97$ 15,487.92$ 16,290.81$ 17,130.16$ 18,007.53$ 18,924.56$ 19,882.91$ 20,884.40$ 21,930.82$ 23,024.12$ 24,166.30$ 25,359.44$ 26,605.68$ 27,907.32$ 29,266.70$ 30,686.25$ 32,168.54$ 33,716.23$ 35,332.09$ 37,019.00$ 38,779.96$ 40,618.12$ 42,536.68$ 44,539.09$ 46,628.84$ 48,809.62$ 51,085.25$ 53,459.73$ 55,937.21Debt ServiceInterest$ - 0Principal$ - 0Total Debt Service$ (26,546.88)$ - 0BTCF (Before Tax Cash Flow)$ (13,263.68)$ 55,937.21BTCF (Before Tax Cash Flow)$ (13,263.68)$ 55,937.21Tax Calculation (Include BTCF)add Principal Reduction$ - 0minus Depreciation27.5$ 340,000$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (6,181.82)$ - 0$ - 0$ - 0minus Amortization$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Taxable Income (Loss)$ 55,937.21Tax Paid (Tax Reduction) 35%Tax Rate$ 19,578.02AFTER TAX CASH FLOW$ 36,359.19Property Value8.0%$ 500,000.00$ 540,000.00$ 583,200.00$ 629,856.00$ 680,244.48$ 734,664.04$ 793,437.16$ 856,912.13$ 925,465.11$ 999,502.31$ 1,079,462.50$ 1,165,819.50$ 1,259,085.06$ 1,359,811.86$ 1,468,596.81$ 1,586,084.56$ 1,712,971.32$ 1,850,009.03$ 1,998,009.75$ 2,157,850.53$ 2,330,478.57$ 2,516,916.86$ 2,718,270.21$ 2,935,731.82$ 3,170,590.37$ 3,424,237.60$ 3,698,176.61$ 3,994,030.73$ 4,313,553.19$ 4,658,637.45$ 5,031,328.44$ 5,433,834.72Loan PayoffMatch with Amortization ScheduleCommissions6.0%$ (326,030.08)Closing Costs2.0%$ (108,676.69)Before Tax Sale ProceedsINCOME TAX

- 5. CALULATION FOR CAPITAL APPRECIATIONSale Price$ 5,433,834.72minus Purchase Price$ (500,000.00)minus Acquisition Costs$ (10,000.00)minus Commissions$ (326,030.08)minus Sales Costs$ (108,676.69)Total Capital Gain (Sale Price - Adj Basis)$ 4,489,127.94Depreciation Recapture$ 340,000.1025%$ (85,000.03)Income Tax: Cap Gain$ 4,149,127.8415%$ (622,369.18)Total Income Tax$ 4,489,127.94$ (707,369.20)Net After Tax Sale ProceedsTOTAL CASH FLOW$ (163,500.00)IRR Hurdle RateAlternative Investment OR "Risk Free" Interest Rate9.0%IRR in excess of Hurdle RateFINAL DECISION: If positive, then investIRR PARTITIONINGTotal IRRPartition to Cap AppZero B55, If "#NUM!" then IRR not allocated to Cap App0Cap App0.00%Partition to Tax BenefitZero Row 47- 510Tax Benefit0.00%Partition to Equity IncreaseZero Row 410Equity Incr0.00%Partition to Cash FlowCalculatedCalculatedCash Flow0.00%0IRR0.00%NOTE: To Reduce Number of Years in ProForma, take the following steps: (Example reducing ProForma to 6 years)1. Delete Columns for Year 6 through Year 30 (Column I through AG inclusive)2. Copy Fill from H17-H59 inclusive to I17-I59 Inclusive to re-establish formulas from 2nd-to-last-year column3. Fix Last Year Interest by adding 12 to the link from H39 into I39 (Cell I39 becomes [='Sample HomeBuy Amort Sch'!I86]3. Fix Last Year Principal by adding 12 to the link from H40 into I40 (Cell I40 becomes [='Sample HomeBuy Amort Sch'!H86] &"Arial,Regular"&14&K000000Sample Class Proforma &18Name: ________________________ &"Arial,Regular"&10&K000000Page &P of &N 11/7/14 6:29 PM Sample Investment Amort SchAssumptions in Proforma:Stable compounding rate for income, expenses & pricesExpenses are a

- 6. function of rent priceAcqusition on Jan 1 of YearDisposition on Dec 31 of YearTax Reductions are fully offset by other income (otherwise lost)Straight Line Depreciation & AmortizationLoan Amount350,000.00 Term360 30 Interest Rate0.54%6.50%Payment(2,212.24)(26,546.88)Add as Negative NumberPeriodBeginning BalInterestPrincipalPaymentAddt PymtEnd BalAnnual PrincipalAnnual Interest1 350,000.00 (1,895.83)0.00 2 0.00 3 0.00 4 0.00 5 0.00 6 0.00 7 0.00 8 0.00 9 0.00 10 0.00 11 0.00 12 0.00 13 0.00 14 0.00 15 0.00 16 0.00 17 0.00 18 0.00 19 0.00 20 0.00 21 0.00 22 0.00 23 0.00 24 0.00 25 0.00 26 0.00 27 0.00 28 0.00 29 0.00 30 0.00 31 0.00 32 0.00 33 0.00 34 0.00 35 0.00 36 0.00 37 0.00 38 0.00 39 0.00 40 0.00 41 0.00 42 0.00 43 0.00 44 0.00 45 0.00 46 0.00 47 0.00 48 0.00 49 0.00 50 0.00 51 0.00 52 0.00 53 0.00 54 0.00 55 0.00 56 0.00 57 0.00 58 0.00 59 0.00 60 0.00 61 0.00 62 0.00 63 0.00 64 0.00 65 0.00 66 0.00 67 0.00 68 0.00 69 0.00 70 0.00 71 0.00 72 0.00 73 0.00 74 0.00 75 0.00 76 0.00 77 0.00 78 0.00 79 0.00 80 0.00 81 0.00 82 0.00 83 0.00 84 0.00 85 0.00 86 0.00 87 0.00 88 0.00 89 0.00 90 0.00 91 0.00 92 0.00 93 0.00 94 0.00 95 0.00 96 0.00 97 0.00 98 0.00 99 0.00 100 0.00 101 0.00 102 0.00 103 0.00 104 0.00 105 0.00 106 0.00 107 0.00 108 0.00 109 0.00 110 0.00 111 0.00 112 0.00 113 0.00 114 0.00 115 0.00 116 0.00 117 0.00 118 0.00 119 0.00 120 0.00 121 0.00 122 0.00 123 0.00 124 0.00 125 0.00 126 0.00 127 0.00 128 0.00 129 0.00 130 0.00 131 0.00 132 0.00 133 0.00 134 0.00 135 0.00 136 0.00 137 0.00 138 0.00 139 0.00 140 0.00 141 0.00 142 0.00 143 0.00 144 0.00 145 0.00 146 0.00 147 0.00 148 0.00 149 0.00 150 0.00 151 0.00 152 0.00 153 0.00 154 0.00 155 0.00 156 0.00 157 0.00 158 0.00 159 0.00 160 0.00 161 0.00 162 0.00 163 0.00 164 0.00 165 0.00 166 0.00 167 0.00 168 0.00 169 0.00 170 0.00 171 0.00 172 0.00 173 0.00 174 0.00 175 0.00 176 0.00 177 0.00 178 0.00 179 0.00 180 0.00 181 0.00 182 0.00 183 0.00 184 0.00 185 0.00 186 0.00 187 0.00 188 0.00 189 0.00 190 0.00 191 0.00 192 0.00

- 7. 193 0.00 194 0.00 195 0.00 196 0.00 197 0.00 198 0.00 199 0.00 200 0.00 201 0.00 202 0.00 203 0.00 204 0.00 205 0.00 206 0.00 207 0.00 208 0.00 209 0.00 210 0.00 211 0.00 212 0.00 213 0.00 214 0.00 215 0.00 216 0.00 217 0.00 218 0.00 219 0.00 220 0.00 221 0.00 222 0.00 223 0.00 224 0.00 225 0.00 226 0.00 227 0.00 228 0.00 229 0.00 230 0.00 231 0.00 232 0.00 233 0.00 234 0.00 235 0.00 236 0.00 237 0.00 238 0.00 239 0.00 240 0.00 241 0.00 242 0.00 243 0.00 244 0.00 245 0.00 246 0.00 247 0.00 248 0.00 249 0.00 250 0.00 251 0.00 252 0.00 253 0.00 254 0.00 255 0.00 256 0.00 257 0.00 258 0.00 259 0.00 260 0.00 261 0.00 262 0.00 263 0.00 264 0.00 265 0.00 266 0.00 267 0.00 268 0.00 269 0.00 270 0.00 271 0.00 272 0.00 273 0.00 274 0.00 275 0.00 276 0.00 277 0.00 278 0.00 279 0.00 280 0.00 281 0.00 282 0.00 283 0.00 284 0.00 285 0.00 286 0.00 287 0.00 288 0.00 289 0.00 290 0.00 291 0.00 292 0.00 293 0.00 294 0.00 295 0.00 296 0.00 297 0.00 298 0.00 299 0.00 300 0.00 301 0.00 302 0.00 303 0.00 304 0.00 305 0.00 306 0.00 307 0.00 308 0.00 309 0.00 310 0.00 311 0.00 312 0.00 313 0.00 314 0.00 315 0.00 316 0.00 317 0.00 318 0.00 319 0.00 320 0.00 321 0.00 322 0.00 323 0.00 324 0.00 325 0.00 326 0.00 327 0.00 328 0.00 329 0.00 330 0.00 331 0.00 332 0.00 333 0.00 334 0.00 335 0.00 336 0.00 337 0.00 338 0.00 339 0.00 340 0.00 341 0.00 342 0.00 343 0.00 344 0.00 345 0.00 346 0.00 347 0.00 348 0.00 349 0.00 350 0.00 351 0.00 352 0.00 353 0.00 354 0.00 355 0.00 356 0.00 357 0.00 358 0.00 359 0.00 360 0.00 Totals0.00 &"Arial,Regular"&14&K000000Sample Proforma Amortization Schedule &"Arial,Regular"&10&K000000Page &P of &N 11/7/14 The Case Assignment focuses on several concepts from the labor market including marginal production, total production, and wage determination. These terms are important in determining how many workers a firm will hire.

- 8. Write a 4- to 5-page paper that’s addresses the following questions: 1 . Discuss two factors that would increase demand for labor. (Hint: Recall that the demand for factors of production or resources is called a derived demand) 2 . If the market price of the good or service that a firm produces increases, what happen to the demand of labor? Explain. 3 . Numerical Problems. Answer the two questions below. a. Take a look at the numerical example on page 76 of the online text Principles of Microeconomics. What would be the marginal production at a level of 20 workers? Calculate. What can be said about the total production of cars as more workers are added (Hint: use the economic concept from the chapter in your answer)? b. Using your answer from (a) and using the information below: i. Each worker costs the firm $4,000 per month. ii. Each acre of land costs the firm $1,000 per month. iii. Each machine costs the firm $600 per month. -Each worker costs the firm $4,000 per month. -Price of the output (car) is $20,000 Should the firm move from the 15th to the 20th worker? In other words, should the firm hire 20 workers? Why? (Hint: You need to calculate the cost of total workers and the marginal revenue product [MRP = price of output * marginal product of labor].) Assignment Expectations Use concepts from the modular background readings as well as any good-quality resources you can find. Be sure to cite all sources within the text and provide a reference list at the end of the paper.

- 9. Length: 4–5 pages double-spaced and typed. Font: Times New Roman The following items will be assessed in particular: · Your ability to understand marginal productivity and how firms make decisions. · Some in-text references to the modular background material (APA formatting not required). The essay should address each element of the assignment. Remember to support your answers with solid references including the case readings. Sample Investment PropertyAverage Inland San Diego HomeASSUMPTIONS: No CAPX (Capital Expenses) - As some analysis puts them above NOI, and others below NOIPurchase Price$ (500,000.00)Building Value68%$ 340,000.00Loan to Value70%Maximum for Investment Property: 70%Loan Amount$ 350,000.00Down Payment$ (150,000.00)Loan Costs1.0%$ (3,500.00)Interest RateAnnual6.500%Loan TermMonths360Closing Costs2.0%$ (10,000.00)See Estimated Settlement Statement for Detailed BreakdownTotal Costs at Acquisition$ (163,500.00)PROFORMAYear 0Year 1Year 2Year 3Year 4Year 5Year 6Gross Rent4%$ 28,800.00$ 29,952.00$ 31,150.08$ 32,396.08$ 33,691.92$ 35,039.60Vacancy4.0%$ (1,152.00)$ (1,198.08)$ (1,246.00)$ (1,295.84)$ (1,347.68)$ (1,401.58)Other Income0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Effective Gross Income$ 27,648.00$ 28,753.92$ 29,904.08$ 31,100.24$ 32,344.24$ 33,638.02OPERATING EXPENSESProperty Taxes 1.1%2%$ (5,500.00)$ (5,610.00)$ (5,722.20)$ (5,836.64)$ (5,953.37)$ (6,072.44)Insurance: Fire3%$ (1,000.00)$ (1,030.00)$ (1,060.90)$ (1,092.73)$ (1,125.51)$ (1,159.28)Insurance: EQ3%$ (650.00)$ (669.50)$ (689.59)$ (710.28)$ (731.59)$ (753.54)Insurance: Umbrella3%$ (250.00)$

- 10. (257.50)$ (265.23)$ (273.19)$ (281.39)$ (289.83)Homeowners Assoc3%$ (1,200.00)$ (1,236.00)$ (1,273.08)$ (1,311.27)$ (1,350.61)$ (1,391.13)Maintenance3%$ (3,000.00)$ (3,090.00)$ (3,182.70)$ (3,278.18)$ (3,376.53)$ (3,477.83)Landscape0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Utilities0%$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Management Fee 10%4%$ (2,764.80)$ (2,875.39)$ (2,990.41)$ (3,110.03)$ (3,234.43)$ (3,363.81)Total Operating Expenses$ (14,364.80)$ (14,768.39)$ (15,184.11)$ (15,612.32)$ (16,053.43)$ (16,507.86)NET OPERATING INCOME$ 13,283.20$ 13,985.53$ 14,719.97$ 15,487.92$ 16,290.81$ 17,130.16Debt ServiceInterestPrincipalTotal Debt Service$ (26,546.88)BTCF (Before Tax Cash Flow)$ (13,263.68)BTCF (Before Tax Cash Flow)$ (13,263.68)Tax Calculation (Include BTCF)add Principal Reductionminus Depreciation27.5$ 340,000$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)$ (12,363.64)minus Amortization$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0Taxable Income (Loss)Tax Paid (Tax Reduction) 35%Tax RateAFTER TAX CASH FLOWProperty Value8.0%$ 500,000.00$ 540,000.00$ 583,200.00$ 629,856.00$ 680,244.48$ 734,664.04$ 793,437.16Loan PayoffMatch with Amortization ScheduleCommissions6.0%$ (47,606.23)Closing Costs2.0%$ (15,868.74)Before Tax Sale ProceedsINCOME TAX CALULATION FOR CAPITAL APPRECIATIONSale Price$ 793,437.16minus Purchase Price$ (500,000.00)minus Acquisition Costs$ (10,000.00)minus Commissions$ (47,606.23)minus Sales Costs$ (15,868.74)Total Capital Gain (Sale Price - Adj Basis)$ 219,962.19Depreciation Recapture$ 74,181.8425%$ (18,545.46)Income Tax: Cap Gain$ 145,780.3515%$ (21,867.05)Total Income Tax$ 219,962.19$ (40,412.51)Net After Tax Sale ProceedsTOTAL CASH FLOW$ (163,500.00)IRR Hurdle RateAlternative Investment OR "Risk Free" Interest Rate9.0%IRR in excess of Hurdle RateFINAL DECISION: If positive, then investIRR PARTITIONINGTotal

- 11. IRRPartition to Cap AppZero B55, If "#NUM!" then IRR not allocated to Cap App0Cap App0.00%Partition to Tax BenefitZero Row 47-510Tax Benefit0.00%Partition to Equity IncreaseZero Row 410Equity Incr0.00%Partition to Cash FlowCalculatedCalculatedCash Flow0.00%0IRR0.00%NOTE: To Reduce Number of Years in ProForma, take the following steps: (Example reducing ProForma to 6 years)1. Delete Columns for Year 6 through Year 30 (Column I through AG inclusive)2. Copy Fill from H17-H59 inclusive to I17-I59 Inclusive to re-establish formulas from 2nd-to-last-year column3. Fix Last Year Interest by adding 12 to the link from H39 into I39 (Cell I39 becomes [='Sample HomeBuy Amort Sch'!I86]3. Fix Last Year Principal by adding 12 to the link from H40 into I40 (Cell I40 becomes [='Sample HomeBuy Amort Sch'!H86] &"Arial,Regular"&14&K000000Sample Class Proforma &18Name: ________________________ &"Arial,Regular"&10&K000000Page &P of &N 11/7/14 6:30 PM Sample Investment Amort SchAssumptions in Proforma:Stable compounding rate for income, expenses & pricesExpenses are a function of rent priceAcqusition on Jan 1 of YearDisposition on Dec 31 of YearTax Reductions are fully offset by other income (otherwise lost)Straight Line Depreciation & AmortizationLoan Amount350,000.00 Term360 30 Interest Rate0.54%6.50%Payment(2,212.24)(26,546.88)Add as Negative NumberPeriodBeginning BalInterestPrincipalPaymentAddt PymtEnd BalAnnual PrincipalAnnual Interest1 350,000.00 (1,895.83)2 0.00 3 0.00 4 0.00 5 0.00 6 0.00 7 0.00 8 0.00 9 0.00 10 0.00 11 0.00 12 0.00 13 0.00 14 0.00 15 0.00 16 0.00 17 0.00 18 0.00 19 0.00 20 0.00 21 0.00 22 0.00 23 0.00 24 0.00 25 0.00 26 0.00 27 0.00 28 0.00 29 0.00 30

- 12. 0.00 31 0.00 32 0.00 33 0.00 34 0.00 35 0.00 36 0.00 37 0.00 38 0.00 39 0.00 40 0.00 41 0.00 42 0.00 43 0.00 44 0.00 45 0.00 46 0.00 47 0.00 48 0.00 49 0.00 50 0.00 51 0.00 52 0.00 53 0.00 54 0.00 55 0.00 56 0.00 57 0.00 58 0.00 59 0.00 60 0.00 61 0.00 62 0.00 63 0.00 64 0.00 65 0.00 66 0.00 67 0.00 68 0.00 69 0.00 70 0.00 71 0.00 72 0.00 73 0.00 74 0.00 75 0.00 76 0.00 77 0.00 78 0.00 79 0.00 80 0.00 81 0.00 82 0.00 83 0.00 84 0.00 85 0.00 86 0.00 87 0.00 88 0.00 89 0.00 90 0.00 91 0.00 92 0.00 93 0.00 94 0.00 95 0.00 96 0.00 97 0.00 98 0.00 99 0.00 100 0.00 101 0.00 102 0.00 103 0.00 104 0.00 105 0.00 106 0.00 107 0.00 108 0.00 109 0.00 110 0.00 111 0.00 112 0.00 113 0.00 114 0.00 115 0.00 116 0.00 117 0.00 118 0.00 119 0.00 120 0.00 121 0.00 122 0.00 123 0.00 124 0.00 125 0.00 126 0.00 127 0.00 128 0.00 129 0.00 130 0.00 131 0.00 132 0.00 133 0.00 134 0.00 135 0.00 136 0.00 137 0.00 138 0.00 139 0.00 140 0.00 141 0.00 142 0.00 143 0.00 144 0.00 145 0.00 146 0.00 147 0.00 148 0.00 149 0.00 150 0.00 151 0.00 152 0.00 153 0.00 154 0.00 155 0.00 156 0.00 157 0.00 158 0.00 159 0.00 160 0.00 161 0.00 162 0.00 163 0.00 164 0.00 165 0.00 166 0.00 167 0.00 168 0.00 169 0.00 170 0.00 171 0.00 172 0.00 173 0.00 174 0.00 175 0.00 176 0.00 177 0.00 178 0.00 179 0.00 180 0.00 181 0.00 182 0.00 183 0.00 184 0.00 185 0.00 186 0.00 187 0.00 188 0.00 189 0.00 190 0.00 191 0.00 192 0.00 193 0.00 194 0.00 195 0.00 196 0.00 197 0.00 198 0.00 199 0.00 200 0.00 201 0.00 202 0.00 203 0.00 204 0.00 205 0.00 206 0.00 207 0.00 208 0.00 209 0.00 210 0.00 211 0.00 212 0.00 213 0.00 214 0.00 215 0.00 216 0.00 217 0.00 218 0.00 219 0.00 220 0.00 221 0.00 222 0.00 223 0.00 224 0.00 225 0.00 226 0.00 227 0.00 228 0.00 229 0.00 230 0.00 231 0.00 232 0.00 233 0.00 234 0.00 235 0.00 236 0.00 237 0.00 238 0.00 239 0.00 240 0.00 241 0.00 242 0.00 243 0.00 244 0.00 245 0.00 246 0.00 247 0.00 248 0.00 249 0.00 250 0.00 251 0.00 252 0.00 253 0.00 254 0.00 255 0.00 256 0.00 257 0.00 258 0.00 259 0.00 260 0.00 261 0.00 262 0.00 263 0.00 264 0.00 265 0.00 266 0.00 267 0.00 268 0.00 269 0.00 270 0.00 271 0.00 272 0.00 273 0.00 274 0.00 275 0.00 276 0.00 277

- 13. 0.00 278 0.00 279 0.00 280 0.00 281 0.00 282 0.00 283 0.00 284 0.00 285 0.00 286 0.00 287 0.00 288 0.00 289 0.00 290 0.00 291 0.00 292 0.00 293 0.00 294 0.00 295 0.00 296 0.00 297 0.00 298 0.00 299 0.00 300 0.00 301 0.00 302 0.00 303 0.00 304 0.00 305 0.00 306 0.00 307 0.00 308 0.00 309 0.00 310 0.00 311 0.00 312 0.00 313 0.00 314 0.00 315 0.00 316 0.00 317 0.00 318 0.00 319 0.00 320 0.00 321 0.00 322 0.00 323 0.00 324 0.00 325 0.00 326 0.00 327 0.00 328 0.00 329 0.00 330 0.00 331 0.00 332 0.00 333 0.00 334 0.00 335 0.00 336 0.00 337 0.00 338 0.00 339 0.00 340 0.00 341 0.00 342 0.00 343 0.00 344 0.00 345 0.00 346 0.00 347 0.00 348 0.00 349 0.00 350 0.00 351 0.00 352 0.00 353 0.00 354 0.00 355 0.00 356 0.00 357 0.00 358 0.00 359 0.00 360 0.00 Totals0.00 &"Arial,Regular"&14&K000000Sample Proforma Amortization Schedule &"Arial,Regular"&10&K000000Page &P of &N 11/7/14 REAL 320 – Principles of Real Estate ASSIGNMENT #2 – Buy Your First Investment 1. Please print out and turn in an excel spreadsheet, in which you have prepared a ProForma reflecting the information provided below. You are considering purchasing a neighborhood location which would be perfect for an Olive Garden location. You’ve spoken with an Olive Garden site selection manager, who is excited about your proposed location, and now you need to determine if the purchase makes economic sense.

- 14. You have retained Lou Galuppo of the University of San Diego, who is an expert in providing forecasting assumptions regarding your proposed site. Lou has estimated that there is a very high probability that you would earn an 11% rate of return by investing in the “Corleone Godfather Fund,” which is an independent portfolio of publicly traded securities, known for extremely predictable earnings, especially in turbulent stock market conditions. After paying Lou’s outrageous fee of $30,000.00 for his data, you sit down to decide whether you should invest in the real estate, buy the securities portfolio, or quit the business and retire by working for your relatives in Palermo. REPORT FROM LOU GALUPPO Dear Prospective Olive Garden Property Location Owner: At your request, I have completed my analysis of the market conditions for this property. At the location you are considering, an appraisal has been completed on the property, and you can purchase the property, built to Olive Garden specifications, for $6,300,000.00 ($2,300,000.00 for the land, and $4,000,000.00 for the building). At the close of escrow, you can expect to pay about 2.7% of the purchase price in closing costs.

- 15. Because this is a commercial investment property, Pavarotti Bank Services, LLC can provide you with the best commercial loan at the lowest interest rate – a no- cost, no-points 30 year amortized loan at a fixed 6.75% interest rate. The maximum loan-to-value you can borrow is 70% of the purchase price. Loan costs are estimated at .8% of the value of the loan. You will need to personally guarantee the loan. Page ! of ! 1 4 Additionally, Pavarotti Bank Services, LLC will require you to create a single asset California-based LLC in order to hold this property. It will cost you $3,000.00 to set up the LLC, and each year your accountant has estimated that you will pay only the $800.00 minimum California Franchise Tax Board Fee for the entity. This property will appreciate at an annual 5% compounded rate for the term of ownership. Your closing costs at the time of sale will be 8% of the sale price at that time, inclusive of a 5.0% commission and 3.0% for other closing costs. Olive Garden has agreed to pay annual base rent calculated as 8% of the purchase price of the property, increasing 5% each year.

- 16. Additionally, Olive Garden will share its profits with you as part of the lease. Olive Garden estimates that your portion of the profits will be $75,000.00 per year, estimated to increase at 5% per year over the course of ownership. Olive Garden will be your only tenant, and they have already signed a 20 year lease, to be effective on the date construction is completed. They have guaranteed payment of both the rental and incentive payment, even if they no longer have an Olive Garden at this location. The negotiated lease is a triple-net lease, meaning that Olive Garden will pay for taxes, insurance, and maintenance on the property. We have agreed, however, to pay for the Owners Association fee for the common area, which is $2,000.00 per month (estimated to increase at 4% per year), and the water supplied to this location, since Olive Garden’ failure to pay this utility could cause a lien to be put on the property. The estimated water bill is $2,800 per month, and we expect this cost to increase at 13% per year, given San Diego’s huge water infrastructure problems. Depreciation is calculated over 39 years, your ordinary income tax rate is 35%, and your capital gains rate is 20%. Fortunately, you are fabulously successful, and have plenty of income to offset any loss – so any tax benefit

- 17. associated with having negative income is of real value to you, since it offsets taxes on other income streams. You initially expect to hold this property 31 years. You remember than in calculating an IRR, the initial funds are negative, since they represent funds going OUT of your pocket. If you make any additional assumptions, they should be reasonable, and clearly outlined on your paper. Do not add assumptions unless you are stuck. Page ! of !2 4 2. After completing your initial evaluation based on Lou Galuppo’s forecast, you decide that additional information may help to determine the strength of your model. You should prepare additional Excel printouts detailing the differences in assumptions. USD Professor Alan Gin is also a trusted advisor, and has suggested that the assumptions provided by Louis Galuppo should be adjusted as described below. Alan doesn’t believe that Lou is wrong, lying or insensitive, but merely has a different view of the future economic outlook. Sensitivity Analysis should be used to test the impact on the return for the following variables:

- 18. a. Real Estate Value Appreciation Rate: Real Estate appreciation is more likely to come in at 2% per year compounded over the next 10 years. Also, 2% is a fair amount to use for any relevant holding period. b. Holding Period: Perhaps the optimal time to hold this particular piece of real estate is 10 years, rather than the 31 years you initially modeled. He thinks you should also test holding periods at 5 years and 15 years. c. Real Estate Rental Rate Appreciation Rate: Alan Gin suggests that appreciation of the rental rate will go up only 3% over the next 10 years. Then, while he doesn’t have an opinion, the 3% is a fair amount to use for any relevant holding period. d. Capital Gains Tax Rate: Alan Gin suggests that capital gains rates will increase to 25%. Additionally, he thinks that Capital Gains could go as high as 35%. e. Ordinary Income Tax Rate: Alan Gin believes that the ordinary tax rate (both Federal and State combined) will increase to 45% this year. f. Water Rate: Future water problems are likely to be extremely acute,

- 19. and will result in a 40% annual increase in water costs. g. Interest Rate: The interest rates will drop to 4.5% h. Triple Net Lease: Instead of offering a triple net lease, where the tenant pays for maintenance, taxes and insurance, you should consider the economic impact of a lease where the landlord is responsible for the following costs: • Property Taxes at 1.1% of the total purchase price of the property • Fire and Hazard Insurance at $8,000.00 per year • Maintenance costs estimated at $15,000.00 per year Page ! of !3 4 3. Please provide a 2-3 page executive summary summarizing your findings describing why or why not the investment described in this assignment should be made. Your narrative should describe the differences between the Galuppo Assumptions and the Gin Assumptions, and should identify the five input assumptions which are most sensitive to your rate of return. If it turns out that only the Galuppo Assumptions or the Gin Assumptions suggest you should make the investment, then you should provide an

- 20. analysis as to whether you should make the investment or not. Remember, the investment can either be made, or not be made – you cannot make the investment only premised on the most favorable set of assumptions. 4. Complete the Comprehensive Peer Evaluation for yourself and your group, pursuant to the instructions in the Syllabus and on the evaluation form. Page ! of !4 4