Best CaseIncome Statement (Unaudited)(for years ending September 1.docx

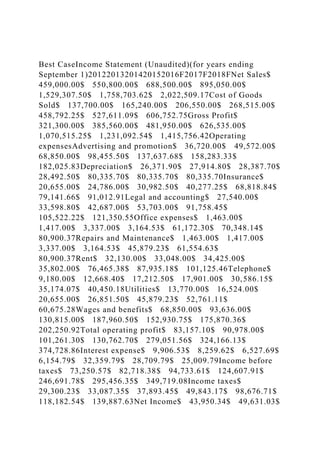

- 1. Best CaseIncome Statement (Unaudited)(for years ending September 1)20122013201420152016F2017F2018FNet Sales$ 459,000.00$ 550,800.00$ 688,500.00$ 895,050.00$ 1,529,307.50$ 1,758,703.62$ 2,022,509.17Cost of Goods Sold$ 137,700.00$ 165,240.00$ 206,550.00$ 268,515.00$ 458,792.25$ 527,611.09$ 606,752.75Gross Profit$ 321,300.00$ 385,560.00$ 481,950.00$ 626,535.00$ 1,070,515.25$ 1,231,092.54$ 1,415,756.42Operating expensesAdvertising and promotion$ 36,720.00$ 49,572.00$ 68,850.00$ 98,455.50$ 137,637.68$ 158,283.33$ 182,025.83Depreciation$ 26,371.90$ 27,914.80$ 28,387.70$ 28,492.50$ 80,335.70$ 80,335.70$ 80,335.70Insurance$ 20,655.00$ 24,786.00$ 30,982.50$ 40,277.25$ 68,818.84$ 79,141.66$ 91,012.91Legal and accounting$ 27,540.00$ 33,598.80$ 42,687.00$ 53,703.00$ 91,758.45$ 105,522.22$ 121,350.55Office expenses$ 1,463.00$ 1,417.00$ 3,337.00$ 3,164.53$ 61,172.30$ 70,348.14$ 80,900.37Repairs and Maintenance$ 1,463.00$ 1,417.00$ 3,337.00$ 3,164.53$ 45,879.23$ 61,554.63$ 80,900.37Rent$ 32,130.00$ 33,048.00$ 34,425.00$ 35,802.00$ 76,465.38$ 87,935.18$ 101,125.46Telephone$ 9,180.00$ 12,668.40$ 17,212.50$ 17,901.00$ 30,586.15$ 35,174.07$ 40,450.18Utilities$ 13,770.00$ 16,524.00$ 20,655.00$ 26,851.50$ 45,879.23$ 52,761.11$ 60,675.28Wages and benefits$ 68,850.00$ 93,636.00$ 130,815.00$ 187,960.50$ 152,930.75$ 175,870.36$ 202,250.92Total operating profit$ 83,157.10$ 90,978.00$ 101,261.30$ 130,762.70$ 279,051.56$ 324,166.13$ 374,728.86Interest expense$ 9,906.53$ 8,259.62$ 6,527.69$ 6,154.79$ 32,359.79$ 28,709.79$ 25,009.79Income before taxes$ 73,250.57$ 82,718.38$ 94,733.61$ 124,607.91$ 246,691.78$ 295,456.35$ 349,719.08Income taxes$ 29,300.23$ 33,087.35$ 37,893.45$ 49,843.17$ 98,676.71$ 118,182.54$ 139,887.63Net Income$ 43,950.34$ 49,631.03$

- 2. 56,840.17$ 74,764.75$ 148,015.07$ 177,273.81$ 209,831.45Statement of Retained Earnings (Unaudited)(for years ending September 1)20122013201420152016F2017F2018FBeginning retained earnings$ 39,506.00$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 412,707.35$ 589,981.16Add: Net Income43,950.3449,631.0356,840.1774,764.75148,015.07177,2 73.81209,831.45Ending retained earnings$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 412,707.35$ 589,981.16$ 799,812.61Balance Sheet (Unaudited)(as at September 1)20122013201420152016F2017F2018FASSETSCurrent Assets:Cash$ 83,908.08$ 73,963.91$ 71,971.28$ 95,208.03$ 129,326.32$ 273,659.18$ 428,521.69Accounts Receivable$ 82,620.00$ 99,144.00$ 123,930.00$ 161,109.00$ 275,275.35$ 316,566.65$ 364,051.65Inventory$ 59,670.00$ 82,620.00$ 106,717.50$ 143,208.00$ 229,396.13$ 228,631.47$ 242,701.10Prepaid expenses$ 12,341.00$ 13,528.00$ 13,459.00$ 13,002.00$ 13,000.00$ 13,250.00$ 13,500.00Total Current Assets$ 238,539.08$ 269,255.91$ 316,077.78$ 412,527.03$ 646,997.79$ 832,107.30$ 1,048,774.44Fixed Assets:Computer hardware & software$ 17,190.00$ 17,190.00$ 18,060.00$ 18,060.00$ 18,060.00$ 18,060.00$ 18,060.00Furniture & fixtures$ 11,688.00$ 26,662.00$ 30,521.00$ 30,521.00$ 40,000.00$ 40,000.00$ 40,000.00Signage$ 9,545.00$ 10,000.00$ 10,000.00$ 12,000.00$ 20,000.00$ 20,000.00$ 20,000.00Real Estate$ 225,296.00$ 225,296.00$ 225,296.00$ 225,296.00$ 725,297.00$ 725,297.00$ 725,297.00Total Fixed Assets (cost)$ 263,719.00$ 279,148.00$ 283,877.00$ 285,877.00$ 803,357.00$ 803,357.00$ 803,357.00Less: Accumulated depreciation$ 98,398.00$ 126,312.80$ 154,700.50$ 183,193.00$ 263,528.70$ 343,864.40$ 424,200.10Net fixed assets$ 165,321.00$ 152,835.20$ 129,176.50$ 102,684.00$ 539,828.30$ 459,492.60$ 379,156.90TOTAL ASSETS$

- 3. 403,860.08$ 422,091.11$ 445,254.28$ 515,211.03$ 1,186,826.09$ 1,291,599.90$ 1,427,931.34LIABILITIESCurrent Liabilities:Operating line of credit ($40,000 limit)$ 26,736.00$ 34,442.00$ 36,000.00$ 40,000.00$ 35,000.00$ 35,000.00$ 35,000.00Accounts Payable$ 19,503.00$ 19,500.00$ 20,150.00$ 22,000.00$ 22,500.00$ 23,000.00$ 23,500.00Current Portion of Long Term Debt$ 35,755.00$ 32,407.00$ 28,929.00$ 22,200.00$ 72,500.00$ 72,000.00$ 70,000.00Total Current Liabilities$ 81,994.00$ 86,349.00$ 85,079.00$ 84,200.00$ 130,000.00$ 130,000.00$ 128,500.00Long Term Liabilities:Term Bank Loans$ 140,986.74$ 105,231.74$ 72,824.74$ 68,895.74$ 546,695.74$ 474,195.74$ 402,195.74Deferred Income Taxes$ 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00Total Long Term Liabilities$ 154,373.74$ 118,618.74$ 86,211.74$ 82,282.74$ 560,082.74$ 487,582.74$ 415,582.74TOTAL LIABILITIES$ 236,367.74$ 204,967.74$ 171,290.74$ 166,482.74$ 690,082.74$ 617,582.74$ 544,082.74Shareholder's EquityShare Capital$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00Retained Earnings$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 412,707.35$ 589,981.16$ 799,812.61Total Shareholder's Equity$ 167,492.34$ 217,123.37$ 273,963.54$ 348,728.29$ 496,743.35$ 674,017.16$ 883,848.61TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY$ 403,860.08$ 422,091.11$ 445,254.28$ 515,211.03$ 1,186,826.09$ 1,291,599.90$ 1,427,931.35Statement of Cash Flows(for the year ending September 1)2013201420152016F2017F2018FOPERATIONS:Net Income$ 49,631.03$ 56,840.17$ 74,764.75$ 148,015.07$ 177,273.81$ 209,831.45Adjustments to Cash Basis:Depreciation$ 27,914.80$ 28,387.70$ 28,492.50$ 80,335.70$ 80,335.70$ 80,335.70Accounts Receivable$ (16,524.00)$ (24,786.00)$ (37,179.00)$ (114,166.35)$

- 4. (41,291.30)$ (47,485.00)Inventory$ (22,950.00)$ (24,097.50)$ (36,490.50)$ (86,188.13)$ 764.65$ (14,069.63)Prepaid Expenses$ (1,187.00)$ 69.00$ 457.00$ 2.00$ (250.00)$ (250.00)Accounts Payable$ (3.00)$ 650.00$ 1,850.00$ 500.00$ 500.00$ 500.00Deferred Income taxes$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ (12,749.20)$ (19,776.80)$ (42,870.00)$ (119,516.77)$ 40,059.05$ 19,031.07Net Cash Flow From Operations$ 36,881.83$ 37,063.37$ 31,894.75$ 28,498.29$ 217,332.86$ 228,862.52FINANCING ACTIVITIESOperating Line of Credit$ 7,706.00$ 1,558.00$ 4,000.00$ (5,000.00)$ - 0$ - 0Current Portion of Long Term Debt$ (3,348.00)$ (3,478.00)$ (6,729.00)$ 50,300.00$ (500.00)$ (2,000.00)Term Bank Loans$ (35,755.00)$ (32,407.00)$ (3,929.00)$ 477,800.00$ (72,500.00)$ (72,000.00)Net Cash Flow From Financing Activities$ (31,397.00)$ (34,327.00)$ (6,658.00)$ 523,100.00$ (73,000.00)$ (74,000.00)INVESTING ACTIVITIESFixed Assets$ (15,429.00)$ (4,729.00)$ (2,000.00)$ (517,480.00)$ - 0$ - 0Net Cash Flow$ (9,944.17)$ (1,992.63)$ 23,236.75$ 34,118.29$ 144,332.86$ 154,862.52Beginning Cash$ 83,908.08$ 73,963.91$ 71,971.28$ 95,208.03$ 129,326.32$ 273,659.18Ending Cash$ 73,963.91$ 71,971.28$ 95,208.03$ 129,326.32$ 273,659.18$ 428,521.69 Worst CaseIncome Statement (Unaudited)(for years ending September 1)20122013201420152016F2017F2018FNet Sales$ 459,000.00$ 550,800.00$ 688,500.00$ 895,050.00$ 1,234,555.00$ 1,358,010.50$ 1,493,811.55Cost of Goods Sold$ 137,700.00$ 165,240.00$ 206,550.00$ 268,515.00$ 432,094.25$ 475,303.68$ 522,834.04Gross Profit$ 321,300.00$ 385,560.00$ 481,950.00$ 626,535.00$ 802,460.75$ 882,706.83$ 970,977.51Operating expensesAdvertising and promotion$ 36,720.00$ 49,572.00$ 68,850.00$ 98,455.50$ 111,109.95$ 122,220.94$ 134,443.04Depreciation$ 26,371.90$ 27,914.80$ 28,387.70$

- 5. 28,492.50$ 80,335.70$ 80,335.70$ 80,335.70Insurance$ 20,655.00$ 24,786.00$ 30,982.50$ 40,277.25$ 55,554.98$ 61,110.47$ 67,221.52Legal and accounting$ 27,540.00$ 33,598.80$ 42,687.00$ 53,703.00$ 74,073.30$ 81,480.63$ 89,628.69Office expenses$ 1,463.00$ 1,417.00$ 3,337.00$ 3,164.53$ 49,382.20$ 54,320.42$ 59,752.46Repairs and Maintenance$ 1,463.00$ 1,417.00$ 3,337.00$ 3,164.53$ 37,036.65$ 47,530.37$ 59,752.46Rent$ 32,130.00$ 33,048.00$ 34,425.00$ 35,802.00$ 61,727.75$ 67,900.53$ 74,690.58Telephone$ 9,180.00$ 12,668.40$ 17,212.50$ 17,901.00$ 24,691.10$ 27,160.21$ 29,876.23Utilities$ 13,770.00$ 16,524.00$ 20,655.00$ 26,851.50$ 37,036.65$ 40,740.31$ 44,814.35Wages and benefits$ 68,850.00$ 93,636.00$ 130,815.00$ 187,960.50$ 185,183.25$ 203,701.57$ 224,071.73Total operating profit$ 83,157.10$ 90,978.00$ 101,261.30$ 130,762.70$ 86,329.22$ 96,205.67$ 106,390.74Interest expense$ 9,906.53$ 8,259.62$ 6,527.69$ 6,154.79$ 51,985.66$ 46,145.66$ 40,225.66Income before taxes$ 73,250.57$ 82,718.38$ 94,733.61$ 124,607.91$ 34,343.57$ 50,060.01$ 66,165.08Income taxes$ 29,300.23$ 33,087.35$ 37,893.45$ 49,843.17$ 13,737.43$ 20,024.00$ 26,466.03Net Income$ 43,950.34$ 49,631.03$ 56,840.17$ 74,764.75$ 20,606.14$ 30,036.00$ 39,699.05Statement of Retained Earnings (Unaudited)(for years ending September 1)20122013201420152016F2017F2018FBeginning retained earnings$ 39,506.00$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 285,298.43$ 315,334.43Add: Net Income43,950.3449,631.0356,840.1774,764.7520,606.1430,036. 0039,699.05Ending retained earnings$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 285,298.43$ 315,334.43$ 355,033.48Balance Sheet (Unaudited)(as at September 1)20122013201420152016F2017F2018FASSETSCurrent Assets:Cash$ 83,908.08$ 73,963.91$ 71,971.28$ 95,208.03$ 99,185.71$ 123,227.31$ 142,351.85Accounts

- 6. Receivable$ 82,620.00$ 99,144.00$ 123,930.00$ 161,109.00$ 222,219.90$ 244,441.89$ 268,886.08Inventory$ 59,670.00$ 82,620.00$ 106,717.50$ 143,208.00$ 185,183.25$ 176,541.37$ 179,257.39Prepaid expenses$ 12,341.00$ 13,528.00$ 13,459.00$ 13,002.00$ 13,000.00$ 13,250.00$ 13,500.00Total Current Assets$ 238,539.08$ 269,255.91$ 316,077.78$ 412,527.03$ 519,588.86$ 557,460.57$ 603,995.32Fixed Assets:Computer hardware & software$ 17,190.00$ 17,190.00$ 18,060.00$ 18,060.00$ 18,060.00$ 18,060.00$ 18,060.00Furniture & fixtures$ 11,688.00$ 26,662.00$ 30,521.00$ 30,521.00$ 40,000.00$ 40,000.00$ 40,000.00Signage$ 9,545.00$ 10,000.00$ 10,000.00$ 12,000.00$ 20,000.00$ 20,000.00$ 20,000.00Real Estate$ 225,296.00$ 225,296.00$ 225,296.00$ 225,296.00$ 725,297.00$ 725,297.00$ 725,297.00Total Fixed Assets (cost)$ 263,719.00$ 279,148.00$ 283,877.00$ 285,877.00$ 803,357.00$ 803,357.00$ 803,357.00Less: Accumulated depreciation$ 98,398.00$ 126,312.80$ 154,700.50$ 183,193.00$ 263,528.70$ 343,864.40$ 424,200.10Net fixed assets$ 165,321.00$ 152,835.20$ 129,176.50$ 102,684.00$ 539,828.30$ 459,492.60$ 379,156.90TOTAL ASSETS$ 403,860.08$ 422,091.11$ 445,254.28$ 515,211.03$ 1,059,417.16$ 1,016,953.17$ 983,152.22LIABILITIESCurrent Liabilities:Operating line of credit ($40,000 limit)$ 26,736.00$ 34,442.00$ 36,000.00$ 40,000.00$ 35,000.00$ 35,000.00$ 35,000.00Accounts Payable$ 19,503.00$ 19,500.00$ 20,150.00$ 22,000.00$ 22,500.00$ 23,000.00$ 23,500.00Current Portion of Long Term Debt$ 35,755.00$ 32,407.00$ 28,929.00$ 22,200.00$ 72,500.00$ 72,000.00$ 70,000.00Total Current Liabilities$ 81,994.00$ 86,349.00$ 85,079.00$ 84,200.00$ 130,000.00$ 130,000.00$ 128,500.00Long Term Liabilities:Term Bank Loans$ 140,986.74$ 105,231.74$ 72,824.74$ 68,895.74$ 546,695.74$ 474,195.74$ 402,195.74Deferred Income Taxes$ 13,387.00$ 13,387.00$

- 7. 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00$ 13,387.00Total Long Term Liabilities$ 154,373.74$ 118,618.74$ 86,211.74$ 82,282.74$ 560,082.74$ 487,582.74$ 415,582.74TOTAL LIABILITIES$ 236,367.74$ 204,967.74$ 171,290.74$ 166,482.74$ 690,082.74$ 617,582.74$ 544,082.74Shareholder's EquityShare Capital$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00$ 84,036.00Retained Earnings$ 83,456.34$ 133,087.37$ 189,927.54$ 264,692.29$ 285,298.43$ 315,334.43$ 355,033.48Total Shareholder's Equity$ 167,492.34$ 217,123.37$ 273,963.54$ 348,728.29$ 369,334.43$ 399,370.43$ 439,069.48TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY$ 403,860.08$ 422,091.11$ 445,254.28$ 515,211.03$ 1,059,417.17$ 1,016,953.17$ 983,152.22Statement of Cash Flows(for the year ending September 1)2013201420152016F2017F2018FOPERATIONS:Net Income$ 49,631.03$ 56,840.17$ 74,764.75$ 20,606.14$ 30,036.00$ 39,699.05Adjustments to Cash Basis:Depreciation$ 27,914.80$ 28,387.70$ 28,492.50$ 80,335.70$ 80,335.70$ 80,335.70Accounts Receivable$ (16,524.00)$ (24,786.00)$ (37,179.00)$ (61,110.90)$ (22,221.99)$ (24,444.19)Inventory$ (22,950.00)$ (24,097.50)$ (36,490.50)$ (41,975.25)$ 8,641.88$ (2,716.02)Prepaid Expenses$ (1,187.00)$ 69.00$ 457.00$ 2.00$ (250.00)$ (250.00)Accounts Payable$ (3.00)$ 650.00$ 1,850.00$ 500.00$ 500.00$ 500.00Deferred Income taxes$ - 0$ - 0$ - 0$ - 0$ - 0$ - 0$ (12,749.20)$ (19,776.80)$ (42,870.00)$ (22,248.45)$ 67,005.60$ 53,425.49Net Cash Flow From Operations$ 36,881.83$ 37,063.37$ 31,894.75$ (1,642.31)$ 97,041.60$ 93,124.54FINANCING ACTIVITIESOperating Line of Credit$ 7,706.00$ 1,558.00$ 4,000.00$ (5,000.00)$ - 0$ - 0Current Portion of Long Term Debt$ (3,348.00)$ (3,478.00)$ (6,729.00)$ 50,300.00$ (500.00)$ (2,000.00)Term Bank Loans$ (35,755.00)$ (32,407.00)$ (3,929.00)$ 477,800.00$ (72,500.00)$

- 8. (72,000.00)Net Cash Flow From Financing Activities$ (31,397.00)$ (34,327.00)$ (6,658.00)$ 523,100.00$ (73,000.00)$ (74,000.00)INVESTING ACTIVITIESFixed Assets$ (15,429.00)$ (4,729.00)$ (2,000.00)$ (517,480.00)$ - 0$ - 0Net Cash Flow$ (9,944.17)$ (1,992.63)$ 23,236.75$ 3,977.69$ 24,041.60$ 19,124.54Beginning Cash$ 83,908.08$ 73,963.91$ 71,971.28$ 95,208.03$ 99,185.71$ 123,227.31Ending Cash$ 73,963.91$ 71,971.28$ 95,208.03$ 99,185.71$ 123,227.31$ 142,351.85 Agricultural Loan Analysis Bobby Carnley – Regional Lending Manager Kyle Eagerton – Principal Credit Analyst September 20, 2016 We know Ag. We love Ag. We Are Ag. Farm Credit of Florida 2 www.farmcreditfl.com Liquidity Current ratio - range desirable > 1.15 (FCF) Working capital Working capital/gross revenues ratio

- 9. Solvency Debt/asset ratio Equity/asset ratio - range desirable > 0.4 (FCF) Debt/equity ratio Profitability Net farm income Rate of return on farm assets Rate of return on farm equity Operating profit margin EBITDA Farm Financial Ratios and Guidelines Farm Financial Ratios and Guidelines 4 Repayment Capacity Capital debt repayment capacity Capital debt repayment margin Replacement margin Term debt coverage ratio - range desirable > 1.25 (FCF) Replacement Margin Coverage Ratio Financial Efficiency Asset turnover ratio Operating expense ratio Depreciation expense ratio Interest expense ratio Net farm income ratio

- 10. Farm Financial Standards Council Farm Financial Ratios and Guidelines 5 How do we apply these ratios and guidelines? The five C’s of credit are generally the guiding principles of credit analysis: Character Conditions Capital Capacity Collateral The 5 C’s of Credit 6 Character (Primary Lending Factor): Credit Scores – one of the best indicators of future performance is past performance Reputation – an applicant’s favorable reputation in the business community is critical Experience – can applicant manage the business they are wanting to finance Legal Structure – what is the ownership structure of the borrowing entity Succession – is the borrower looking ahead with a defined succession plan Conditions (Industry): What is the condition of the industry that provides the majority of the applicant’s income – current & future outlook What is the condition of the industry that the applicant wants to

- 11. finance – current and future outlook Applicant should take the initiative in explaining why the loan request is constructive for applicant & lender What programs are available to support the applicant’s primary industry – USDA, ASCS, FSA, tax credits, etc. The 5 C’s of Credit 7 Capital (Financial Position): Does applicant have strong equity or are they highly leveraged – attitude toward debt – prefer over 40% equity Does applicant have a strong liquidity position – can they continue to perform in the event of adversity – cash is king – prefer at least a 1.15:1 current ratio Are applicant’s debts properly structured – does repayment match depreciation Are debts constructive – Any killer toys What is the applicants financial trend – positive, negative or stable Quality of financial information – compiled, reviewed, audited - good quality information is critical for managing a business Frequency of information provided – applicant can’t properly manage a rapidly changing business with annual financials and tax returns. Financial analysis is an area that can be more or less complicated based on applicant’s ownership structure. For tax planning, estate planning and other reasons, complicated ownership structures are becoming more and more common. Financial analysis typically only includes those assets & income sources that are owned & controlled by parties liable on the loan. Some examples are as follows: Applicant is married and spouse is not party to the loan, we do

- 12. not show any values for jointly held assets, but show all jointly held liabilities Assets have been moved into a legal entity (trust, LLC, Partnership). These are handled on a case by case basis depending on ownership, control, history The 5 C’s of Credit 8 Capacity (Ability to Repay): Typically want at least a 1.25 coverage What is the trend – positive, negative, stable Is applicant heavily dependent upon new sources/ projections – proven or unproven income Does applicant have multiple sources or only one source of income Are applicant’s projections reasonable – supported by historical information How much adversity can they withstand – typically use 5-5-3 stress test or break-even analysis Collateral (If All Else Fails): Is the collateral highly specialized – highly depreciable How liquid is the collateral Is the collateral marketable in normal conditions What is applicant’s commitment to the collateral What is the income producing capacity of the collateral Are there any environmental concerns Realities of Agricultural Lending 9 Can be more of an art than a science

- 13. Credit standards reflect precise values, but they are derived from imprecise numbers The financial trend is rarely consistent – wide swings in prices and yields Most operations are constantly changing – difficult to project Many applications are for new ventures with no historical trend Applicants rarely have a written business plan Financial information is typically not high quality/complete is typically dated – prefer within 6 months cash basis vs. modified cash basis vs. accrual cost vs. fair market value We realize that a borrower may be weaker in some areas than desired, but we do consider compensating strengths. Considering all of the credit factors, we have to determine if the credit is safe and sound. 10 Real World Example: Albert & Alberta Angus, LLC 11 Albert & Alberta Angus Farms, LLC is requesting a loan to finance 75% of the purchase price of a $200,000 piece of

- 14. equipment. Take a look a the financials we have provided. What are some questions you might ask? What kind of information should you look for? We know Ag. We love Ag. We Are Ag. 12