NABARD in entrepreneurship

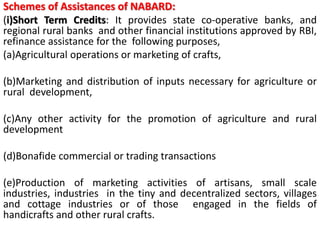

- 1. Schemes of Assistances of NABARD: (i)Short Term Credits: It provides state co-operative banks, and regional rural banks and other financial institutions approved by RBI, refinance assistance for the following purposes, (a)Agricultural operations or marketing of crafts, (b)Marketing and distribution of inputs necessary for agriculture or rural development, (c)Any other activity for the promotion of agriculture and rural development (d)Bonafide commercial or trading transactions (e)Production of marketing activities of artisans, small scale industries, industries in the tiny and decentralized sectors, villages and cottage industries or of those engaged in the fields of handicrafts and other rural crafts.

- 2. (ii)Medium Term Credit: NABARD provides medium term credit for the periods between 18 months and 7 years for agriculture and rural development purposes. (iii )Long Term Credit: NABARD provides long term loans & advances by way of refinance through financial institutions like loans development banks and regional rural banks, scheduled banks and other financial institutions. The long term loan extends for a period of 25 years. It also provides advances to state governments for period not exceeding 20 years to enable them to subscribe directly or indirectly to the share capital of co-operative credit societies. (iv) Conversions/Rescheduling facilities: NABARD is empowered to convert short term loans granted to commercial banks and regional rural banks into medium term loans for periods not exceeding 7 years, under conditions of draught, famine and other natural calamities, military operations, enemy or terrorist operations.

- 3. Financing of cottage/village industries: NABARD is providing the refinance assistance for rural development activity, including those relating to production of goods and services, promotion of cottage industries and other rural crafts. The main problem faced by NABARD is the over dues of loans. 35% of loans given by NABARD are overdue. This has resulted in blocking up funds. NABARD has created volunteer groups consisting of those people who have improved their living through bank assistance. This group is educating the borrowers about the proper use of bank loans and the timely repayment of such loans.

- 4. Industrial Development Bank of India (IDBI): IDBI Was established on 01.07.1964 both as apex institution co- coordinating the activities of other financial institution providing long term finance to industry, and as an agency to provide direct financial assistance to industrial units. When IDBI came into existence, it was subordinate to RBI. However, from 16th Feb.1976, it was delinked from RBI and was designated as the principal financial institution of the country for co- coordinating, in conformity with national priorities, the working of the institutions engaged in financing, promoting or developing industry, for assisting the development of such institutions and for providing credit and other facilities. The IDBI was started initially with an authorized capital of 50 crores, which could be later raised to Rs.100 crores or more with the approval of the GOI.

- 5. Functions of IDBI: The activities of the IDBI can be broadly grouped into various categories. They are: (a) Direct Assistance: To industrial concerns in the forms of loans, under-writing of the subscription to shares and debentures and guarantees; soft loans assistance for modernization, loans under technical development funds and rehabilitation assistance for sick units. (b)Indirect assistance which include (i) refinancing of industrial loans granted by financial institutions, (ii)Rediscounting of bills arising out of sale of indigenous machinery on deferred payment basis, (iii)Assistance to other financial institutions by way of subscription to their shares and bonds, Export Finance: providing export finance in the form of direct loans and guarantees to exporters in participation with banks, refinancing of medium term export credit granted by banks and overseas buyers credit. Promotional activities: This includes bringing about widely defused, yet viable process of industrialization.

- 6. This bank undertakes various activities such as marketing and investment research & surveys and carries out techno-economic studies. It provides technical and administrative assistance to any industrial enterprises for promotion, management or expansion-interestingly it is expected to play a positive role in the process of industrialization through planning, promoting and developing of new industries to fill the gaps in the industrial structure of the country.

- 7. Small Industries Development Organisation (SIDO): The small & medium enterprises sector is a fast growing sector in India. Many countries have recognized the contribution of SME (Small & Medium Enterprises) and formed a nodal agency Small & Medium Enterprises Development Authority (SMEDA) to co-ordinate& oversee the development of this potential sector. Even though the term “SME‟ is not defined, government of India has SIDO function under the Ministry of Small Scale Industries. SIDO was established in 1954 on the recommendations of Ford Foundations. Over the years, SIDO has grown & has over 60 offices and 21 autonomous bodies under its management each distinctively functioning for total industrialization. The tool rooms, training institutions and project cum process development centre are under its belt besides known for facilities testing, tool mending, training entrepreneurship development, preparation of project and product profiles, technical and managerial consultancy, pollution & energy audits etc

- 8. • The outstanding support & service of SIDO can be seen as follows: 1. Entrepreneurship training & Management Development, 2. Extension & training service, 3. Skill development, 4. Entrepreneurship Development Institutes, 5. Preparation of project profiles, 6. Plant Modernization studies,

- 9. 7. Marketing support, 8. Collection of data, 9. Promotion & Implementation of PMRY,(Prime Minster‟sRozgarYojana) 10. Institution & declaration of National Awards, 11. Prototype Development and Training Centre, 12. Administration of various schemes such as ISO 9000, 14001, 13. Credit Linked Capital Subsidy Scheme for tech up- gradation, Credit Guarantee scheme, Integrated Infra- structure Development Etc.

- 10. Indian Institute of Entrepreneurship - DIC With an aim to undertake training, research and consultancy activities in the small industry sector focusing on entrepreneurship development, the Indian Institute of Entrepreneurship (IIE) was established in the year 1993 at Guwahati by the erstwhile Ministry of Industry (now Ministry of Small Scale Industry), Government of India as an autonomous national institute. The institute started its operations from April 1994 with North East Council (NEC), Govts. of Assam, Arunachal Pradesh and Nagaland and SIDBI as other stakeholders The policy direction and guidance is provided to the institute by its Board of Management whose Chairman is the Secretary to the Government of India, Ministry of Small Scale Industries. The governing council of the institute is headed by Chairman, NEC and the Executive Committee is headed by the Secretary SSI & ARI, Govt. of India.

- 11. • The Objectives of IIE are: To organize and conduct training for entrepreneurship development. To evolve strategies and methodologies for different target groups and locations and conduct field tests. To identify training needs and offer training programmes to Government and non- Government organizations engaged in promoting and supporting entrepreneurship. To document and disseminate information needed for policy formulation and implementation related to self-employment. To identify, design and conduct training programmes for existing entrepreneurs. To prepare and publish literature related to entrepreneurship and industrial development. To organize seminars, workshops and confer conferences for providing a forum for interaction and exchange of views by various agencies and entrepreneurs. To conduct research for generating knowledge to accelerate the process of entrepreneurship development.

- 12. Activities: The activities of the institute include identification of training needs, designing and organizing programmes both for development functionaries and entrepreneurs; evolving effective training strategies and methodologies for different target groups and locations; organize seminars, workshops and conferences for providing forum for interaction and exchange of views by various agencies and entrepreneurs; undertaking research on entrepreneurship development, documenting and disseminating information needed for policy formulation and implementation on self-employment and entrepreneurship. The institute acts as a catalyst for entrepreneurship development by creating an environment for entrepreneurship in the support system, developing new entrepreneurship, helping in the growth of existing entrepreneurs and propagation of entrepreneurial education.

- 13. District Industrial Centre (DIC): In order to extend the promotion of small-scale and cottage industries beyond big cities and state capital to the district headquarters, the District Industrial Centre program was initiated in May, 1978, as a centrally sponsored scheme with the objectives of developing small, tiny and cottage sector industries in the country. DIC’s were also established with the aim of generating greater employment opportunities especially in the rural and backward areas in the country. The centre provides support facilities/concessional services in widely dispersed rural areas and other small towns. There were 430 centrally approved DICs, which covered almost all the district of the country (except the metro cities) at the time of the withdrawal of the central sponsorship in 1993-94. These days the DIC‟s are operating under state government budget support.

- 14. The following are the areas where DIC extend their services; economic investigation of local resources, Supply of Machinery &Equipments, Provision of raw materials, Arrangement for credit facilities, Marketing, Quality inputs, Consultancy & extension services.

- 15. Single Window Scheme: Entrepreneurs are setting up new projects in small scale industries and tiny sector, new promoters acquiring unencumbered fixed assets of existing small industries and Primary Lending Institutions (PLIs) as also existing well run units undertaking modernizing and technology up- gradation and potentially viable sick units under rehabilitation schemes. The Scheme envisages sanction and disbursement of working capital and term loan together from a single agency. It is applicable to projects with cost up to Rs. 50 lakhs. The Scheme is operated both by banks and financial institutions. State Financial Corporations under Single Window Scheme provide working capital loan along with the term loan to new tiny and small scale sector units so as to overcome the initial difficulties and delays faced by them to start production expeditiously.