QNBFS Daily Market Report April 12, 2018

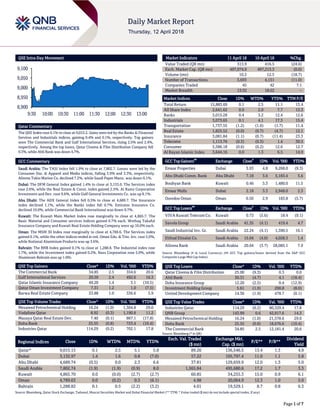

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.1% to close at 9,015.2. Gains were led by the Banks & Financial Services and Industrials indices, gaining 0.4% and 0.1%, respectively. Top gainers were The Commercial Bank and Gulf International Services, rising 2.5% and 2.4%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.3%, while Ahli Bank was down 4.7%. GCC Commentary Saudi Arabia: The TASI Index fell 1.9% to close at 7,802.7. Losses were led by the Consumer Dur. & Apparel and Media indices, falling 3.9% and 3.3%, respectively. Alinma Tokio Marine Co. declined 7.2%, while Saudi Paper Manu. was down 6.1%. Dubai: The DFM General Index gained 1.4% to close at 3,133.0. The Services index rose 2.6%, while the Real Estate & Const. index gained 2.5%. Al Ramz Corporation Investment and Dev. rose 9.6%, while Gulf General Investments Co. was up 8.1%. Abu Dhabi: The ADX General Index fell 0.5% to close at 4,689.7. The Insurance index declined 1.1%, while the Banks index fell 0.7%. Emirates Insurance Co. declined 10.0%, while Commercial Bank International was down 9.7%. Kuwait: The Kuwait Main Market Index rose marginally to close at 4,865.7. The Basic Material and Consumer services indices gained 0.7% each. Wethaq Takaful Insurance Company and Kuwait Real Estate Holding Company were up 10.0% each. Oman: The MSM 30 Index rose marginally to close at 4,789.6. The Services index gained 0.1%, while the other indices ended in red. Oman Edu. & Trin. Inv. rose 5.0%, while National Aluminium Products was up 3.6%. Bahrain: The BHB Index gained 0.1% to close at 1,288.8. The Industrial index rose 1.7%, while the Investment index gained 0.2%. Nass Corporation rose 5.0%, while Aluminum Bahrain was up 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% The Commercial Bank 34.85 2.5 354.6 20.6 Gulf International Services 20.59 2.4 492.6 16.3 Qatar Islamic Insurance Company 49.20 1.4 3.1 (10.5) Qatar Oman Investment Company 7.31 1.2 1.0 (7.5) Barwa Real Estate Company 33.88 1.0 336.6 5.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.24 (1.0) 1,304.8 29.0 Vodafone Qatar 8.92 (0.3) 1,190.8 11.2 Mazaya Qatar Real Estate Dev. 7.40 (0.1) 867.1 (17.8) Doha Bank 25.55 (0.8) 723.4 (10.4) Industries Qatar 114.29 (0.2) 702.1 17.8 Market Indicators 11 April 18 10 April 18 %Chg. Value Traded (QR mn) 313.9 416.5 (24.6) Exch. Market Cap. (QR mn) 497,074.9 497,213.3 (0.0) Volume (mn) 10.2 12.5 (18.7) Number of Transactions 3,693 4,151 (11.0) Companies Traded 45 42 7.1 Market Breadth 13:32 18:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,883.69 0.1 2.5 11.1 13.4 All Share Index 2,641.62 0.0 2.0 7.7 13.3 Banks 3,015.28 0.4 3.2 12.4 12.6 Industrials 3,073.65 0.1 4.1 17.3 15.4 Transportation 1,737.55 (1.2) (1.6) (1.7) 11.4 Real Estate 1,825.52 (0.0) (0.7) (4.7) 12.1 Insurance 3,081.84 (1.1) (0.7) (11.4) 23.3 Telecoms 1,113.76 (0.3) (0.3) 1.4 30.5 Consumer 5,586.18 (0.6) (0.2) 12.6 12.7 Al Rayan Islamic Index 3,644.16 0.0 1.3 6.5 14.9 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Emaar Properties Dubai 5.93 4.8 9,268.0 (9.3) Abu Dhabi Comm. Bank Abu Dhabi 7.18 3.6 5,183.4 5.6 Boubyan Bank Kuwait 0.46 3.3 1,480.0 11.5 Emaar Malls Dubai 2.18 3.3 2,948.0 2.3 Ooredoo Oman Oman 0.50 2.9 183.8 (5.7) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% VIVA Kuwait Telecom Co. Kuwait 0.73 (5.6) 18.4 (9.1) Savola Group Saudi Arabia 41.35 (4.1) 419.4 4.7 Saudi Industrial Inv. Gr. Saudi Arabia 22.24 (4.1) 1,390.5 16.1 Etihad Etisalat Co. Saudi Arabia 15.04 (4.0) 4,028.3 1.4 Alinma Bank Saudi Arabia 20.64 (3.7) 28,085.1 7.9 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 25.00 (9.3) 0.3 0.0 Ahli Bank 30.31 (4.7) 4.1 (18.4) Doha Insurance Group 12.20 (2.5) 0.4 (12.9) Investment Holding Group 5.61 (1.9) 200.8 (8.0) United Development Company 14.36 (1.9) 478.7 (0.1) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 114.29 (0.2) 80,329.4 17.8 QNB Group 143.99 0.6 42,817.6 14.3 Mesaieed Petrochemical Holding 16.24 (1.0) 21,578.6 29.0 Doha Bank 25.55 (0.8) 18,676.6 (10.4) The Commercial Bank 34.85 2.5 12,181.4 20.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,015.15 0.1 2.5 5.1 5.8 89.20 136,546.5 13.4 1.3 4.9 Dubai 3,132.97 1.4 1.6 0.8 (7.0) 57.22 105,797.4 11.0 1.1 5.8 Abu Dhabi 4,689.74 (0.5) 0.0 2.3 6.6 37.81 129,659.9 12.0 1.3 5.0 Saudi Arabia 7,802.74 (1.9) (1.9) (0.9) 8.0 1,565.84 495,680.6 17.2 1.7 3.3 Kuwait 4,865.70 0.0 (0.0) (2.7) (2.7) 60.85 34,255.3 15.0 0.9 6.1 Oman 4,789.63 0.0 (0.2) 0.3 (6.1) 4.98 20,064.9 12.3 1.0 5.0 Bahrain 1,288.82 0.1 0.5 (2.2) (3.2) 4.01 19,529.1 8.7 0.8 6.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,900 8,950 9,000 9,050 9,100 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 0.1% to close at 9,015.2. The Banks & Financial Services and Industrials indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. The Commercial Bank and Gulf International Services were the top gainers, rising 2.5% and 2.4%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.3%, while Ahli Bank was down 4.7%. Volume of shares traded on Wednesday fell by 18.7% to 10.2mn from 12.5mn on Tuesday. Further, as compared to the 30-day moving average of 12.4mn, volume for the day was 17.5% lower. Mesaieed Petrochemical Holding Company and Vodafone Qatar were the most active stocks, contributing 12.8% and 11.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2018 % Change YoY Operating Profit (mn) 1Q2018 % Change YoY Net Profit (mn) 1Q2018 % Change YoY Majan Glass Oman OMR 1.7 -5.8% – – -0.6 N/A SMN Power Holding Oman OMR 18.4 6.9% 3.5 -22.7% 1.1 N/A Dhofar Cattle Feed Oman OMR 8.6 0.7% -0.4 N/A -0.1 N/A Renaissance Services Oman OMR 51.5 10.6% 8.5 15.5% 0.2 N/A Oman Chromite Oman OMR 0.4 -26.6% – – 0.1 40.1% National Finance Oman OMR 10.4 N/A – – 2.6 N/A Al Batinah Hotels Oman OMR 0.3 12.5% – – -0.1 N/A Financial Services# Oman OMR 143.2 -30.0% – – 30.3 -64.1% Dhofar Int. Dev. & Inv. Hold. Oman OMR 10.0 0.3% – – 2.1 -81.4% Dhofar Poultry Oman OMR 2.6 -0.6% 0.1 0.7% 0.1 -5.5% Gulf Hotels Oman OMR 2.6 9.9% – – 0.9 45.3% Source: Company data, DFM, ADX, MSM, TASI, BHB. ( # Values in ‘000) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/11 US Mortgage Bankers Association MBA Mortgage Applications 6-April -1.9% – -3.3% 04/11 US Bureau of Labor Statistics CPI MoM March -0.1% 0.0% 0.2% 04/11 US Bureau of Labor Statistics CPI YoY March 2.4% 2.4% 2.2% 04/11 UK UK Office for National Statistics Trade Balance February -£965 -£2,600 -£2,949 04/11 UK UK Office for National Statistics Industrial Production MoM February 0.1% 0.4% 1.3% 04/11 UK UK Office for National Statistics Industrial Production YoY February 2.2% 2.9% 1.2% 04/11 UK UK Office for National Statistics Manufacturing Production MoM February -0.2% 0.2% 0.0% 04/11 UK UK Office for National Statistics Manufacturing Production YoY February 2.5% 3.3% 2.2% 04/11 Japan Bank of Japan PPI YoY March 2.1% 2.0% 2.6% 04/11 Japan Bank of Japan PPI MoM March -0.1% -0.1% 0.1% 04/11 China National Bureau of Statistics PPI YoY March 3.1% 3.3% 3.7% 04/11 China National Bureau of Statistics CPI YoY March 2.1% 2.6% 2.9% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2018 results No. of days remaining Status NLCS Alijarah Holding 12-Apr-18 0 Due QIIK Qatar International Islamic Bank 15-Apr-18 3 Due QIBK Qatar Islamic Bank 15-Apr-18 3 Due QISI Qatar Islamic Insurance Company 16-Apr-18 4 Due MCGS Medicare Group 16-Apr-18 4 Due GWCS Gulf Warehousing Company 16-Apr-18 4 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 29.13% 29.09% 118,050.20 Qatari Institutions 23.56% 31.71% (25,571,142.03) Qatari 52.69% 60.80% (25,453,091.83) GCC Individuals 1.11% 0.84% 820,459.01 GCC Institutions 2.40% 2.35% 133,130.00 GCC 3.51% 3.19% 953,589.01 Non-Qatari Individuals 8.38% 9.37% (3,101,137.77) Non-Qatari Institutions 35.43% 26.63% 27,600,640.59 Non-Qatari 43.81% 36.00% 24,499,502.82

- 3. Page 3 of 7 MARK Masraf Al Rayan 16-Apr-18 4 Due CBQK The Commercial Bank 17-Apr-18 5 Due QNCD Qatar National Cement Company 18-Apr-18 6 Due QEWS Qatar Electricity & Water Company 18-Apr-18 6 Due DOHI Doha Insurance Group 18-Apr-18 6 Due KCBK Al Khalij Commercial Bank 19-Apr-18 7 Due ABQK Ahli Bank 19-Apr-18 7 Due DHBK Doha Bank 22-Apr-18 10 Due SIIS Salam International Investment Limited 23-Apr-18 11 Due BRES Barwa Real Estate Company 24-Apr-18 12 Due QATI Qatar Insurance Company 24-Apr-18 12 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 24-Apr-18 12 Due QGRI Qatar General Insurance & Reinsurance Company 25-Apr-18 13 Due QIMD Qatar Industrial Manufacturing Company 25-Apr-18 13 Due ORDS Ooredoo 25-Apr-18 13 Due ZHCD Zad Holding Company 26-Apr-18 14 Due UDCD United Development Company 29-Apr-18 17 Due MERS Al Meera Consumer Goods Company 29-Apr-18 17 Due QOIS Qatar Oman Investment Company 29-Apr-18 17 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-18 17 Due QFLS Qatar Fuel Company 29-Apr-18 17 Due ERES Ezdan Holding Group 30-Apr-18 18 Due Source: QSE News Qatar Qatar aims to double trade volume with the US – Emir HH Sheikh Tamim Bin Hamad Al Thani said that there are more than 650 US companies operating in Qatar and the volume of trade cooperation between the State of Qatar and the US reached $125bn, and the plan is to double these figures in the near future. HH the Emir pointed out that Qatar is the fastest growing economy in the Middle East region and expressed the hope to work hand in hand with the US. (Peninsula Qatar) Qatar economy more accessible to world post-illegal blockade, says Sheikh Ahmed – The illegal blockade on Qatar since June 2017 has presented the country with an opportunity to make its economy more accessible to the world, and bolster its trade relations, particularly with the US, according to the Minister of Economy and Commerce, HE Sheikh Ahmed Bin Jassim Bin Mohamed Al Thani. “The illegal blockade was with the aim of undermining Qatar’s position as an economically independent and sovereign state, but we have emerged stronger and more independent than ever before,” Sheikh Ahmed said in his address to a reception organized by the US Chamber of Commerce in cooperation with the Qatar-US Business Council and the Embassy of Qatar in Washington. Qatar, he said, has successfully established direct commercial routes with a number of strategic hubs around the world, diverting trade to its major trading partners. Through these agreements, Qatar aims to expand its trade activities by establishing a sea fleet that connects Qatar with its major trading partners in the world, targeting a market of 400mn population in its first stage, Sheikh Ahmed added. (Gulf-Times.com) Qatar-US Forum sees signing of MoUs to boost SMEs – Qatar and the US signed a slew of memoranda of understanding (MoUs) on the sidelines of the ongoing Qatari-US Economic Forum in Washington, DC, in the US. Minister of Economy and Commerce, HE Sheikh Ahmed Bin Jassim Bin Mohammed Al Thani witnessed the signing of two MoUs between Qatar Development Bank (QDB), and SBDC; and the Venture City. The first MoU aims to share best practices and innovative solutions between the two sides to support small and medium enterprises (SMEs) and to introduce unique and diversified initiatives aimed at assisting Qatari entrepreneurs and qualifying them for the labor market as well as increasing the number of joint research on the growing role played by SMEs in stimulating domestic economic growth, besides assisting in the development and promotion of exports to SMEs in both countries, and providing access to investment and incubation centers for further cooperation and development. The second MoU aims to share best practices and innovative solutions between the two parties in the field of investment services to help promote Qatari companies’ exports to the US market, in addition to cooperation in business development and strengthening services for SMEs, and creating a platform for networking between SMEs in Qatar and the US to share ideas and expertise to enhance the joint cooperation. (Peninsula Qatar) ASTAD signs MoU with US firm on Qatar aviation project – Qatar’s project management consultancy ASTAD signed a memorandum of understanding (MoU) with AECOM, an American infrastructure firm, to identify mutual business opportunities and promote collaboration on an aviation project in Qatar. Elaborating on the MoU signing, ASTAD’s CEO, Ali Al Khalifa said, “We look forward to working with American firm AECOM with the aim of forming a strategic joint venture, combining our expertise in engineering consultancy, construction management, design and project management fields to support the development of a landmark airport and aviation facility in Qatar.” (Gulf-Times.com) Qatar-Oman joint investments reach more than QR5.5bn – Joint investments between Qatar and Oman have reached more than

- 4. Page 4 of 7 QR5.5bn and Qatar will soon see the establishment of a water bottling plant in a joint venture. “The joint investments between Qatar and Oman have increased over time, so did trade exchange. In fact, the value of joint investments was estimated at more than QR5.5bn, including Omani investments in Qatar worth QR427mn,” Youssef Al Emadi, Director of the Industrial Zones Department at the Ministry of Energy. These investments included import of food products and construction materials to Qatar. Highlighting that the Qatari investments in Oman were in the fields of telecommunications, electricity, cars assembly, food products and tourism, he projected an increase in trade value between the two countries with the increasing imports from Oman. (Gulf-Times.com) Growing trade links to open opportunities for Omani companies – The strengthened air and maritime links between Qatar and Oman has opened up more business opportunities for Omani companies, especially in the industry, transport and food security, which could aid the growth and development of both the economies, according to Manateq’s CEO, Fahad Rashid Al Kaabi. “Especially after blockade, lots of trading has been happening between Oman and Qatar. We hope to see even bigger cooperation in various areas such as investments in the sectors of industry, transport, food security and more,” Al Kaabi told reporters on the sidelines of the Qatar-Oman Joint Entrepreneurs Meeting, organized by the Gulf Organization for Industrial Consulting. (Gulf-Times.com) Qatar showcases 15 industrial investment opportunities for Oman corporate sector – Qatar showcased 15 industrial investment opportunities before Omani corporate sector as part of efforts to scale up the economic, business and investment relations between the two countries. The investment opportunities, spread across various sectors such as inorganic compounds, pharmaceuticals and medical supplies, plastic and rubber, manufactured products and machinery and equipment, were unveiled by the Gulf Organization for Industrial Consulting (GOIC) at the Qatar-Oman Joint Entrepreneurs Meeting, organized by GOIC in association with Modern Talent, a Omani-based company. Out of the 15 investment prospects; as many as five in the areas of plastic, manufactured metals and inorganic compounds. Remaining investment opportunities are in the field of medical supplies. (Gulf-Times.com) QFC to embark on major Europe roadshow – Qatar Financial Centre (QFC) is set to embark on an extensive Investment roadshow in Europe. The two-phase roadshow will offer exclusive consultation opportunities to the potential investors on how to expand their businesses to Qatar and beyond in the region, according to Sheikha Alanoud Hamad Al Thani, Managing Director, Business Development at Qatar Financial Centre. The first phase of the European roadshow will cover Spain and France. The event will offer unique opportunities for the participants to meet and network with QFC’s leading investment experts. The second phase will start during 4Q2018, she said on the sidelines of a workshop on bilateral investments and investment opportunities in Qatar and Spain. “Our 2022 target was 1000 firms. Recently, we have already met the half mark by bringing 500 companies under the QFC platform. These companies range from financial institutions to professional services,” Sheikha Alanoud said. (Peninsula Qatar) Qatar Petroleum’s investment to generate 45,000 US jobs – Qatar Petroleum’s $10bn investment in a liquefied natural gas (LNG) plant in Texas will contribute to generating 45,000 jobs in the US, according to the Minister of Economy and Commerce, HE Sheikh Ahmed Bin Jassim Bin Mohamed Al Thani. During the last five years, Sheikh Ahmed said the volume of trade between Qatar and the US reached about $24bn, noting that 84% of the trade balance between the two countries, equivalent to $20bn, was in the favor of the US. In 2017, the US topped as the source of imports for Qatar. Last year, the US accounted for 16% of total Qatari imports. (Gulf-Times.com) Local production during blockade reaches 300% – Minister of Municipality and Environment, HE Mohamed Bin Abdullah Al Rumaihi said that the local production during the blockade period increased 300%. He said that the Ministry is seeking to provide all means and forms of support to various owners of productive farms and halal breeders in order to achieve the desired goal. “The Ministry has allocated QR105mn for 2018 of the budget for support to the agricultural, fish and livestock sector with a view to achieving food security, in addition, QR70mn allocated for the next five years,” the Minister added. (Peninsula Qatar) Ezdan Holding Group to disclose its 1Q2018 financial results on April 30 – Ezdan Holding Group announced its intention to disclose its 1Q2018 financial results on April 30, 2018. (QSE) BRES to disclose its 1Q2018 financial results on April 24 – Barwa Real Estate Company (BRES) announced its intention to disclose its 1Q2018 financial results on April 24, 2018. (QSE) Zad Holding Company to disclose its 1Q2018 financial results on April 26 – Zad Holding Company announced its intention to disclose its 1Q2018 financial results on April 26, 2018. (QSE) Aamal Company to disclose its 1Q2018 financial results on April 30 – Aamal Company announced its intention to disclose its 1Q2018 financial results on April 30, 2018. (QSE) Vodafone Qatar to disclose its 1Q2018 financial results on April 30 – Vodafone Qatar announced its intention to disclose its 1Q2018 financial results on April 30, 2018. (QSE) QCFS to disclose its 1Q2018 financial results on April 29 – Qatar Cinema & Film Distribution Company (QCFS) announced its intention to disclose its 1Q2018 financial results on April 29, 2018. (QSE) Notice to shareholders of Zad Holding Company – Zad Holding Company announced dividends for the financial year ending December 31, 2017, will be distributed as follows: 1) Shareholders who have registered their bank account information with Qatar Exchange, direct deposits has been done to their accounts on April 10, 2018. 2) Shareholders who have not registered may collect their dividends directly from Masraf Al Rayan Branches from April 11, 2018. Shareholders, whose shares are not listed on Qatar Stock Exchange or pledge, may collect dividend cheque from the company’s address. (QSE) International US consumer prices drop, but core inflation firming – US consumer prices fell for the first time in ten months in March, weighed down by a decline in the cost of gasoline, but underlying inflation continued to firm amid rising prices for healthcare and rental accommodation. The drop in the headline

- 5. Page 5 of 7 monthly inflation reading reported by the Labor Department is likely temporary as producer prices increased solidly in March. In addition, the tightening labor market is expected to start generating significant wage inflation in the second half of the year. As such, many economists believe the Federal Reserve will raise interest rates three more times this year. The Consumer Price Index slipped 0.1% last month, the first and largest drop since May 2017, after climbing 0.2% in February, the Labor Department stated. In the 12 months through March, the CPI increased 2.4%. That was the largest annual gain in a year and followed February’s 2.2% increase. Annual inflation is rising as the big price declines from last year drop from the calculation. Excluding the volatile food and energy components, the CPI climbed 0.2%, matching February’s increase. The core CPI is now well above the 1.8% annual average increase over the past ten years. Economists polled by Reuters had forecast the CPI unchanged in March and the core CPI rising 0.2% from the prior month. (Reuters) US government posts $209bn deficit in March – The US government ran $209bn budget deficit in March as outlays grew and receipts fell, the Treasury Department stated. That compared with a budget deficit of $176bn in the same month last year, according to Treasury’s monthly budget statement. Economists polled by Reuters had forecast the Treasury recording $194bn shortfall last month. When accounting for calendar adjustments, the deficit last month was $165bn compared with an adjusted deficit of $134bn in the same month in the prior year. The deficit for the fiscal year, which began in October, was $600bn, compared to a deficit of $527bn in the same period of fiscal 2017. Unadjusted receipts last month totaled $211bn, down 3% from March 2017, while unadjusted outlays grew to $420bn, up 7% from the same month a year earlier. (Reuters) US mortgage applications fall to seven-week low – The volume of US mortgage applications fell to a seven-week low even as most home borrowing costs declined last week, the Mortgage Bankers Association (MBA) stated. MBA stated its seasonally adjusted index on mortgage applications fell 1.9% to 380.6 in the week ended April 6. This was the lowest level since 372.9 in week of February 16. (Reuters) Bad weather cut UK’s GDP growth to 0.2% in 1Q2018 – Heavy snow in late February and early March is likely to have caused British economic growth to halve in the first three months of the year to 0.2%, the National Institute of Economic and Social Research (NIESR) stated. Official figures showed the economy grew 0.4% in the last three months of 2017. February factory and construction data released earlier were weak, and first- quarter gross domestic product data is due on April 27. (Reuters) Bank of France trims first quarter’s GDP growth estimate to 0.3% – France’s economy grew less quickly in the first quarter than previously thought, the Bank of France stated, largely due to a slowdown in manufacturing activity. The central bank cut its growth estimate to 0.3% from 0.4%. Bank of France’s business sentiment indicator for the manufacturing industry fell to 103 points in March from 105 in the previous month, with a sharp decline in orders as deliveries slowed. (Reuters) Regional Moody’s: GCC Islamic banks to maintain improved asset quality – The credit fundamentals of Islamic banks operating in the GCC countries converged with those of their conventional peers and they should maintain their improved asset quality and profitability in the coming year, Moody’s Investors Service noted in a report. However, the Islamic banks’ still high loan concentration to real estate-related sector and higher asset growth remain key moderating factors in Moody’s assessment of their standalone profiles, noted the report. Nitish Bhojnagarwala, Senior Analyst and Author of the report said, “Islamic banks operating in the GCC countries have benefited from sustained growth in their franchises in recent years. Their solvency has improved, supported by their efforts to reduce the stock of problem loans, and by their sound profitability.” (Peninsula Qatar) SAICO signs auto insurance agreement with Al Rajhi Bank – Saudi Arabian Cooperative Insurance Company (SAICO) signed insurance agreement with Al Rajhi Bank to provide insurance coverage for vehicles sold by bank under financial leasing program. SAICO is expecting annual premiums from one year contract to exceed 5% of its revenue. (Reuters) Saudi Aramco’s IPO in 2018 or 2019 depends on market – The hotly-awaited stock market debut of Saudi Aramco will be launched in 2018 if market conditions permit, otherwise in 2019, the Kingdom’s Finance Minister, Mohammad Al Jadaan said. “If the market is ready in 2018, we will go in 2018. If not, we will wait until 2019. We are not desperate for listing. We will only list when the market is right,” Al Jadaan said. (GulfBase.com) UAE’s economy returning to growth – The UAE has been resilient to the impact of the prolonged oil price slump. Following the recent rise in oil prices to over $60 per barrel, there is a sense that the worst is behind the UAE’s economy and confidence is gradually returning, according to Institute of International Finance (IIF). IIF MENA’s Chief Economist, Garbis Iradian said, “We expect non-oil growth to pickup to 2.7% in 2018 and 3% in 2019, driven by private consumption and non- oil exports, as fiscal consolidation eases and global trade improves. The deceleration in headline growth last year was due to the oil production decline.” (GulfBase.com) DAMAC Properties launches $400mn five-year Sukuk – Dubai real estate developer, DAMAC Properties launched a $400mn, five-year Sukuk with a 6.625% yield, a document from one of the banks leading the Islamic bond issue showed. The Sukuk was marketed with initial price guidance in the 6% area. Orders rose to about $850mn, including from the banks arranging the transaction, the document showed. (Reuters) Hamdan Centre for the Future of Investment launched – Dubai Investment Development Agency (Dubai FDI) announced the launch of Hamdan Centre for the Future of Investment (HCFI), a global initiative that aims to channel foreign direct investment (FDI) to sustainable development activities to help economies to benefit from. The HCFI’s aim is to present a global partnership model in providing a thriving investment ecosystem that keeps pace with global shifts towards sustainable investment and new forms of investment. (GulfBase.com)

- 6. Page 6 of 7 ADNOC mulls downstream opportunities abroad with Saudi Aramco – Abu Dhabi National Oil Co. (ADNOC) is in talks with several partners, including Saudi Aramco, for possible downstream joint ventures abroad, particularly in Asia, sources said. ADNOC wants to increase its crude refining capacity by 60% and boost petrochemical production. It is planning to spend more than AED400bn in the next five years, which will include boosting gas output and investing in international downstream activities, the company had said in November. ADNOC wants to expand its downstream portfolio in markets where demand for oil is still growing, such as China and India, securing a new outlet for its crude. (Reuters) Sharjah Islamic Bank launches $500mn Sukuk – Sharjah Islamic Bank launched $500mn Sukuk with a spread set at 150 basis points over mid-swaps, a document from one of the banks leading the deal showed. Initial price guidance for the deal was in the area of 160 basis points over mid-swaps. The planned Islamic bonds issue attracted around $950mn in orders, the document showed. Sharjah Islamic Bank has appointed HSBC and Standard Chartered Bank as global coordinators and Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, Noor Bank, and Standard Chartered Bank as joint lead managers and bookrunners for the issue. (Reuters) Seef Properties awards KMC Holding for mixed-use project contract – Seef Properties appointed Kuwaiti Manager Holding Company (KMC Holding) as the main contractor for its BHD50.2mn mixed-use development project ‘Liwan.’ KMC Holding is a fully-owned subsidiary of Kuwaiti Finance House which was established in 1996 to manage real estate projects and contracting. Liwan project, which is expected to be completed by 4Q2019, will elevate the Kingdom’s real estate sector, bringing in a new destination for residents and visitors. (GulfBase.com)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 QSE Index S&P Pan Arab S&P GCC (1.9%) 0.1% 0.0% 0.1% 0.0% (0.5%) 1.4% (2.4%) (1.6%) (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,353.35 1.0 1.5 3.9 MSCI World Index 2,082.57 (0.4) 1.5 (1.0) Silver/Ounce 16.67 0.6 1.7 (1.6) DJ Industrial 24,189.45 (0.9) 1.1 (2.1) Crude Oil (Brent)/Barrel (FM Future) 72.06 1.4 7.4 7.8 S&P 500 2,642.19 (0.6) 1.4 (1.2) Crude Oil (WTI)/Barrel (FM Future) 66.82 2.0 7.7 10.6 NASDAQ 100 7,069.03 (0.4) 2.2 2.4 Natural Gas (Henry Hub)/MMBtu 2.74 1.8 0.4 (22.6) STOXX 600 376.18 (0.3) 1.2 (0.5) LPG Propane (Arab Gulf)/Ton 80.50 2.2 8.1 (18.7) DAX 12,293.97 (0.6) 1.2 (2.0) LPG Butane (Arab Gulf)/Ton 80.50 1.3 5.2 (25.8) FTSE 100 7,257.14 0.1 1.7 (1.1) Euro 1.24 0.1 0.7 3.0 CAC 40 5,277.94 (0.3) 1.2 2.3 Yen 106.79 (0.4) (0.1) (5.2) Nikkei 21,687.10 (0.2) 0.8 0.4 GBP 1.42 0.0 0.6 4.9 MSCI EM 1,175.53 0.0 1.2 1.5 CHF 1.04 (0.1) 0.2 1.8 SHANGHAI SE Composite 3,208.08 1.1 3.3 0.8 AUD 0.78 (0.1) 0.9 (0.7) HANG SENG 30,897.71 0.5 3.5 2.8 USD Index 89.57 (0.0) (0.6) (2.8) BSE SENSEX 33,940.44 (0.2) 0.5 (2.4) RUB 62.60 (0.7) 7.6 8.6 Bovespa 85,245.59 2.0 (0.1) 8.9 BRL 0.30 1.1 (0.1) (1.8) RTS 1,083.53 (0.7) (12.4) (6.1) 85.0 84.4 76.6