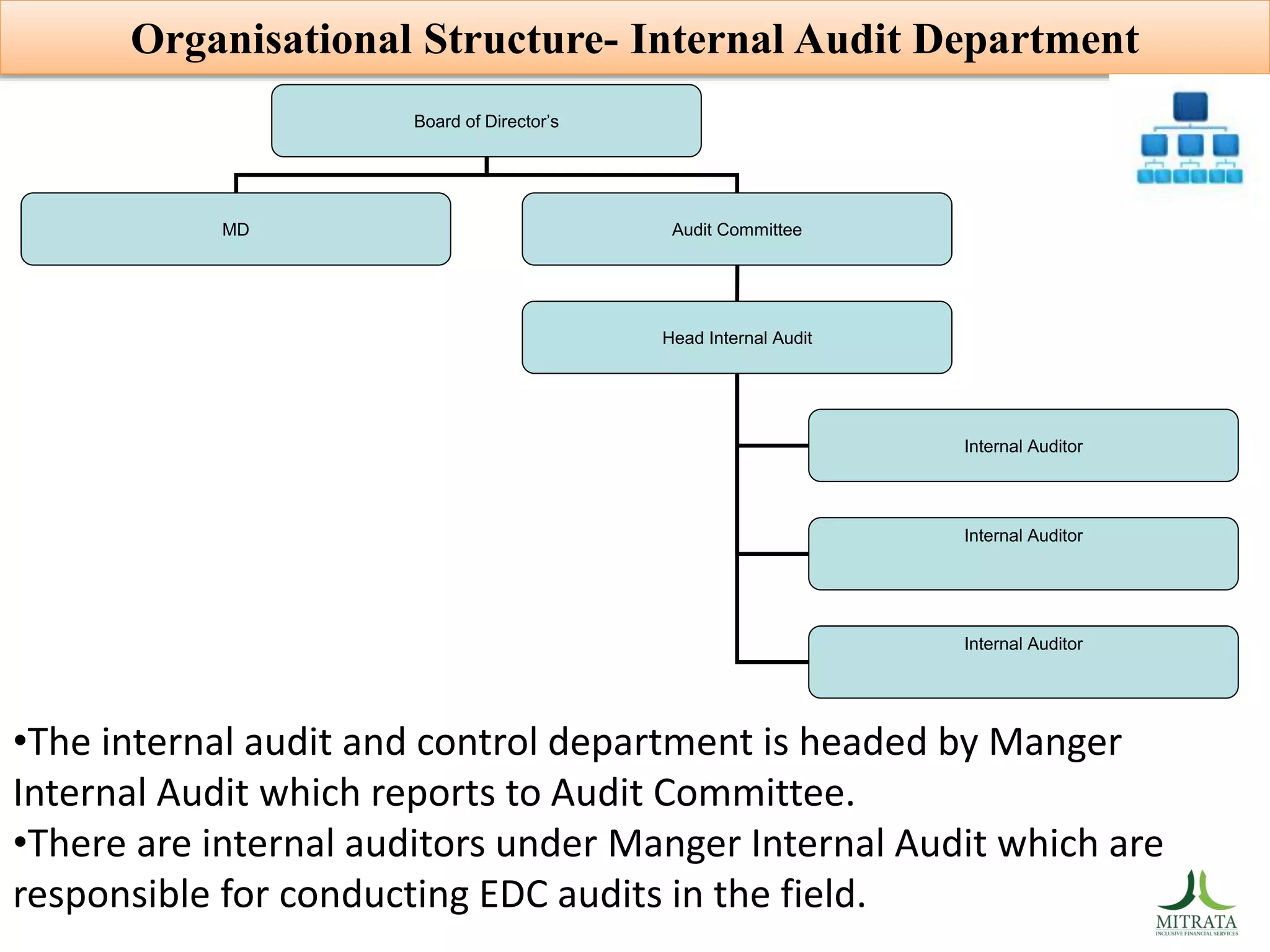

The internal audit department of Mitrata Inclusive Financial Services (MIFS) aims to enhance operations through independent evaluations of risk management, control, and governance processes. Its primary objectives include detecting fraud, ensuring compliance with policies, and assessing staff behavior to uphold organizational integrity. The department collaborates with management to improve practices, maintain effective internal controls, and provides comprehensive audits, particularly focusing on field operations and documentation verification.