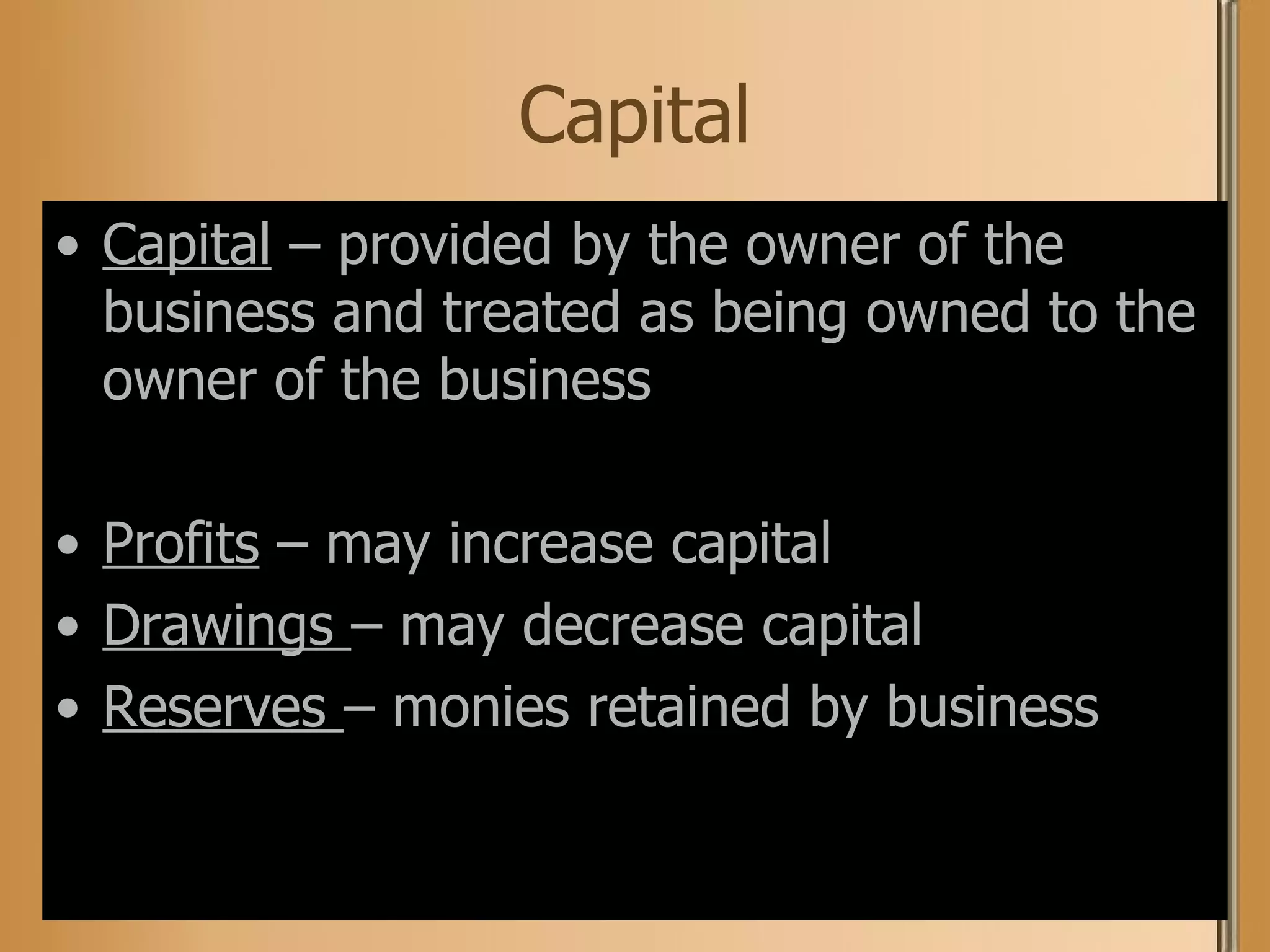

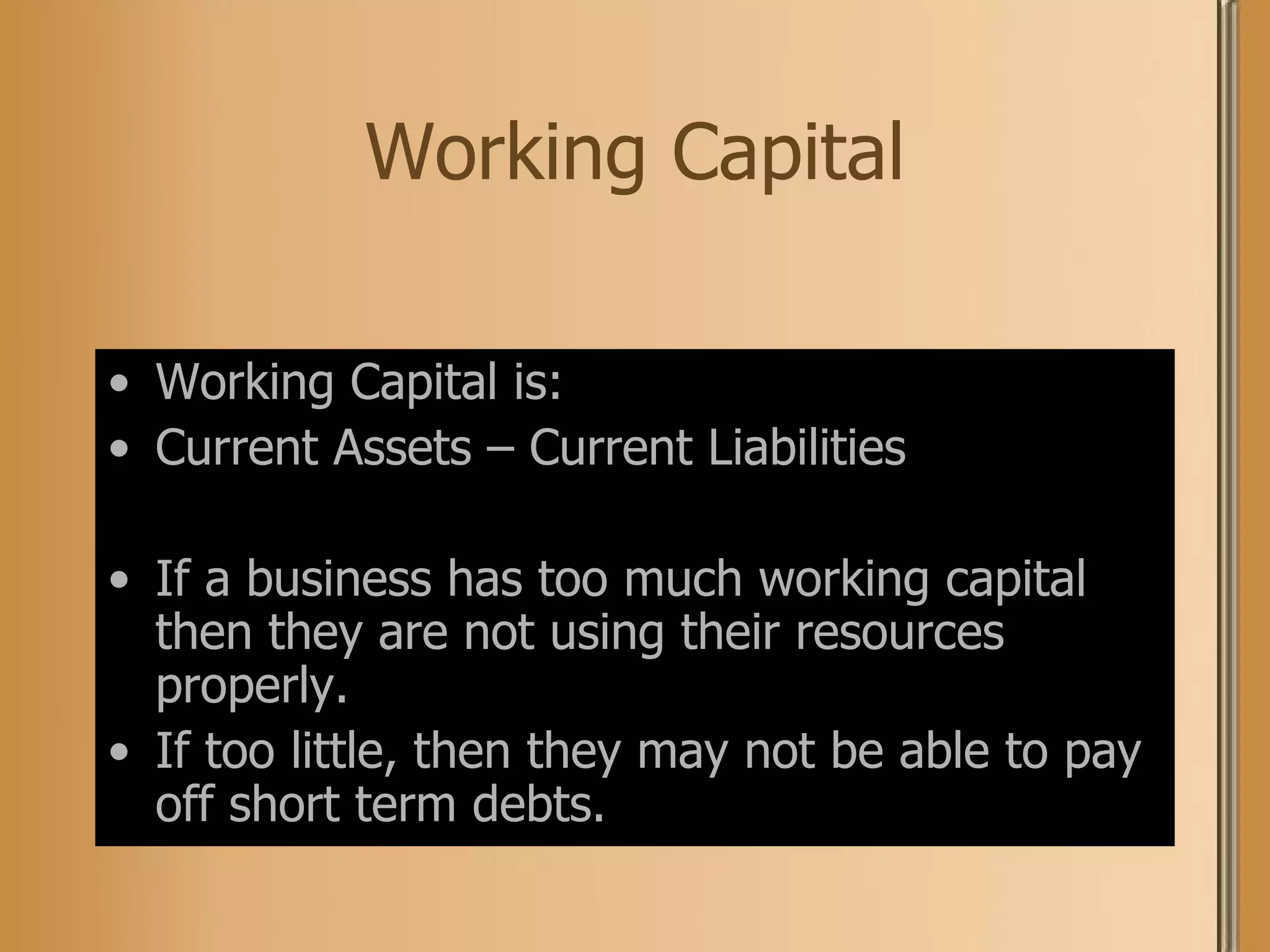

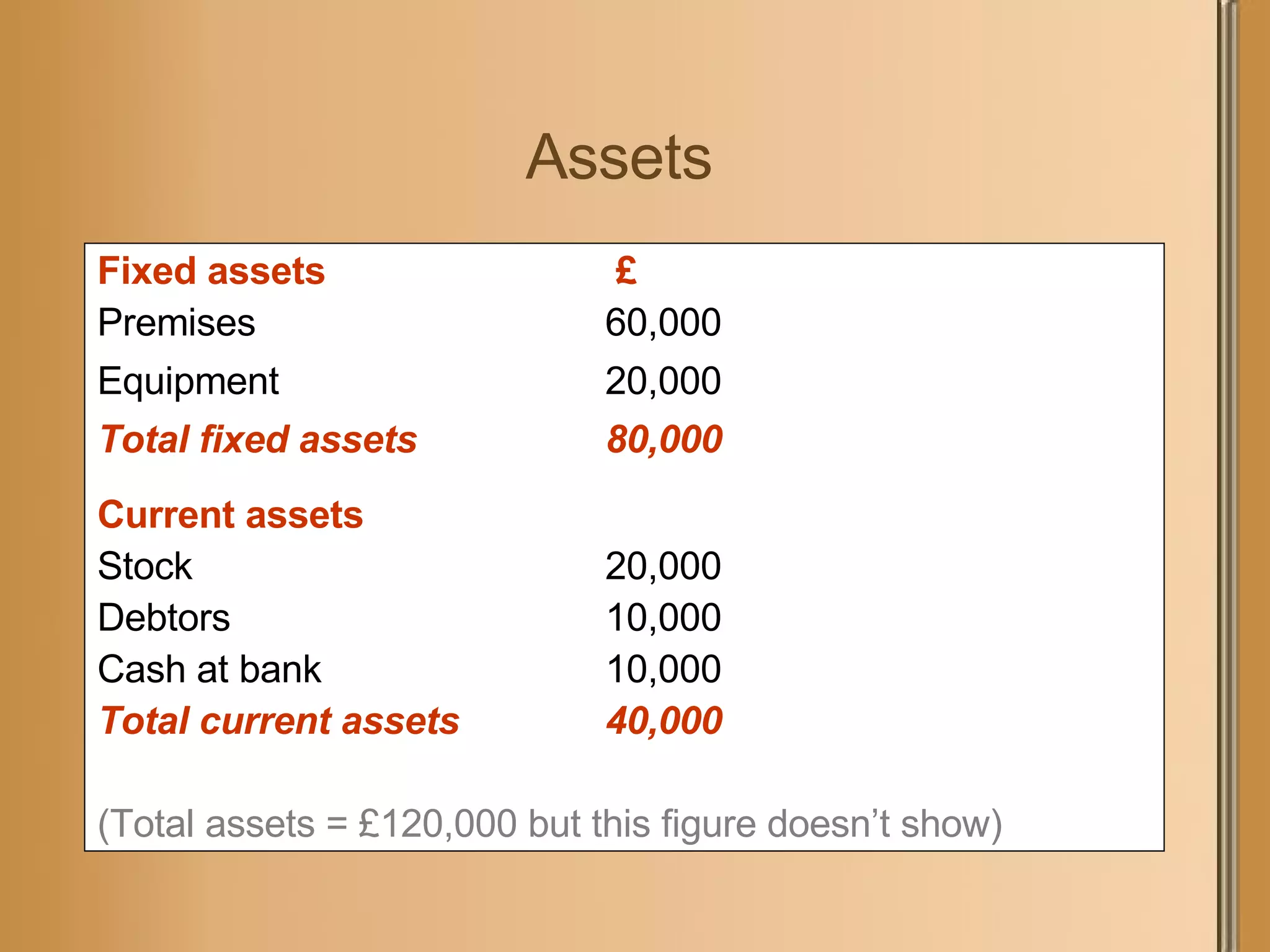

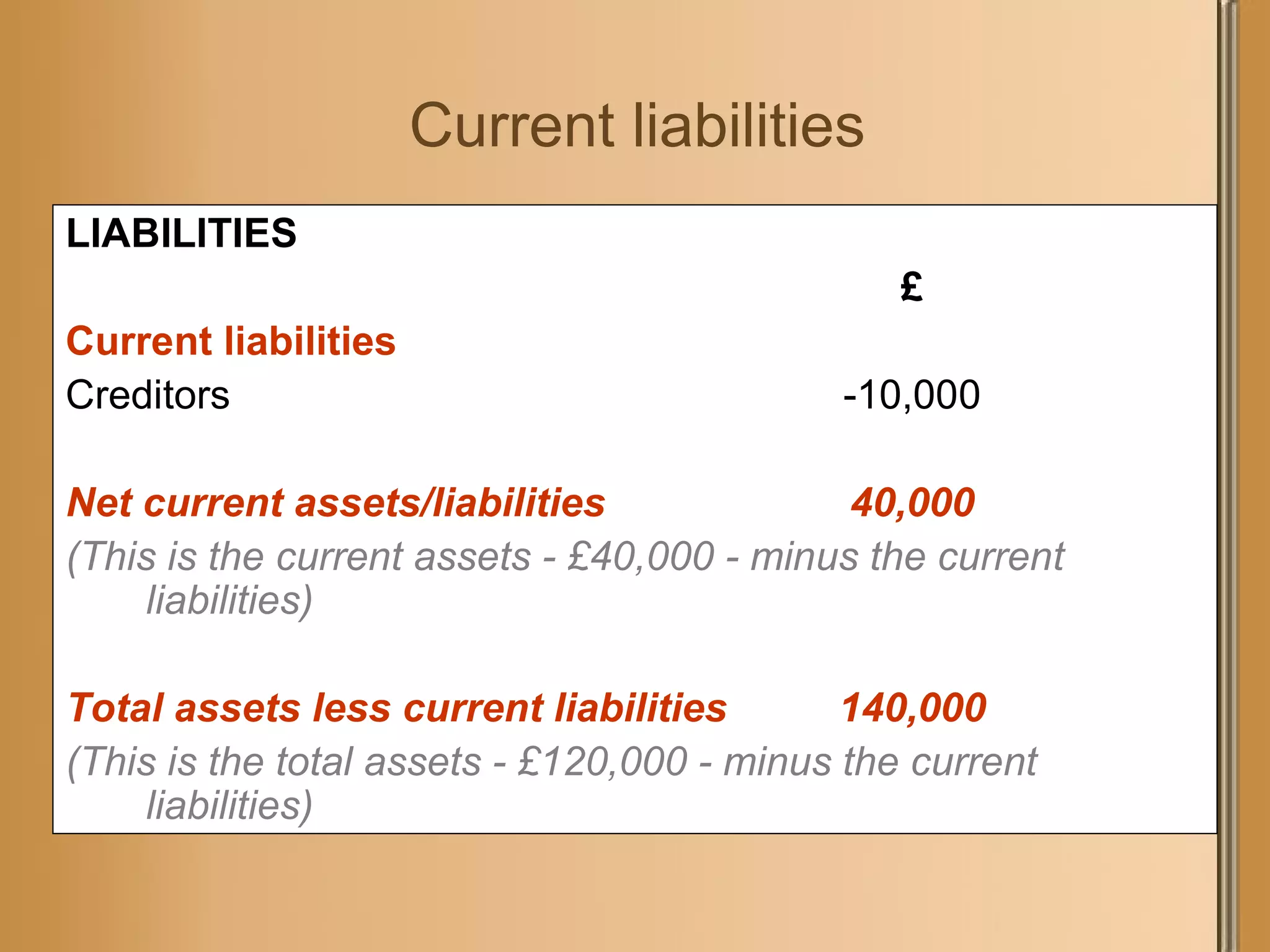

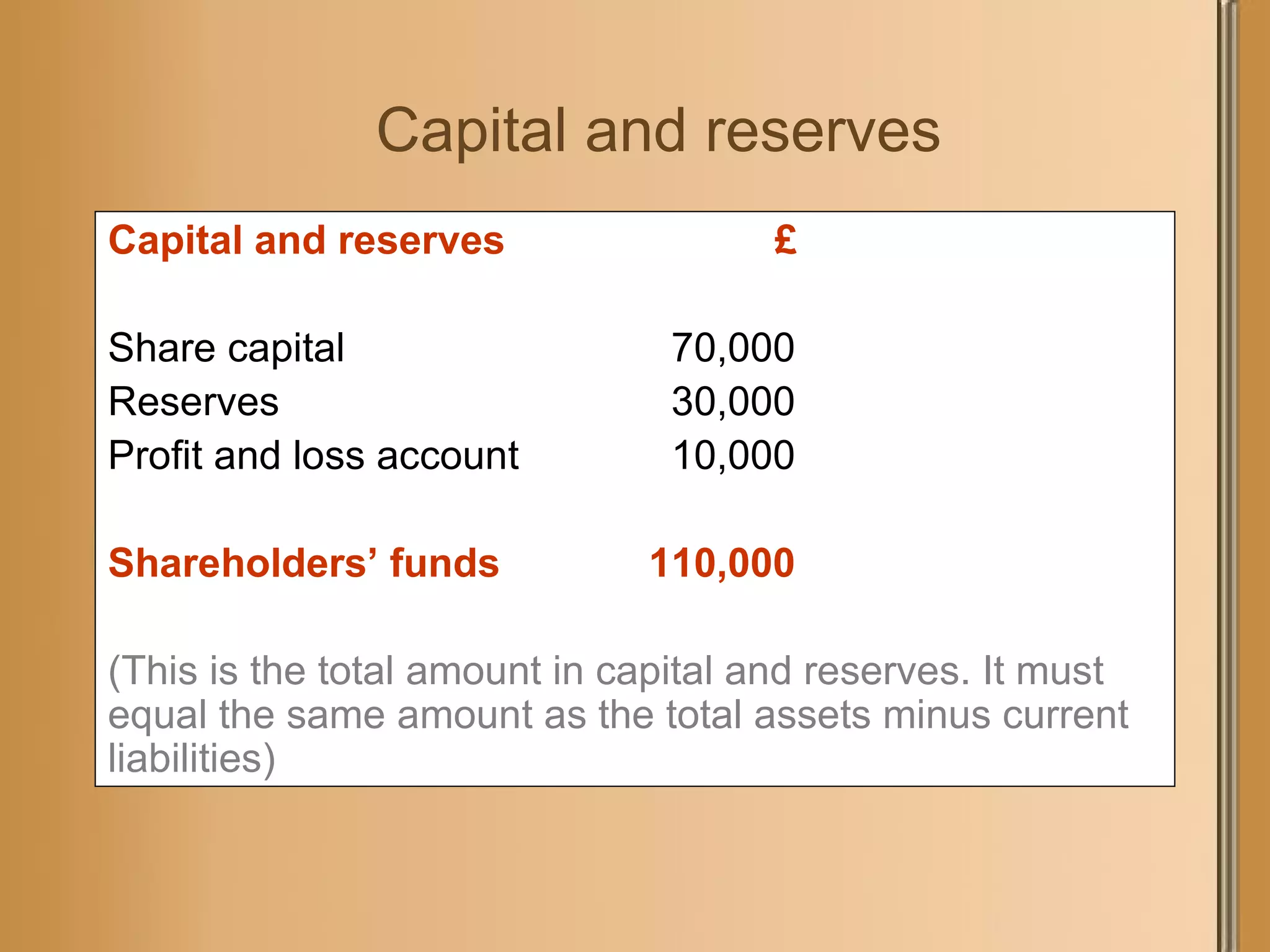

The balance sheet shows a snapshot of a business' financial position at a point in time. It lists the business' assets, liabilities, and capital. Assets are what the business owns, like equipment, inventory, and cash. Liabilities are what the business owes, such as loans and accounts payable. Capital represents the owner's investment in the business. The balance sheet ensures that assets always equal the sum of liabilities and capital.