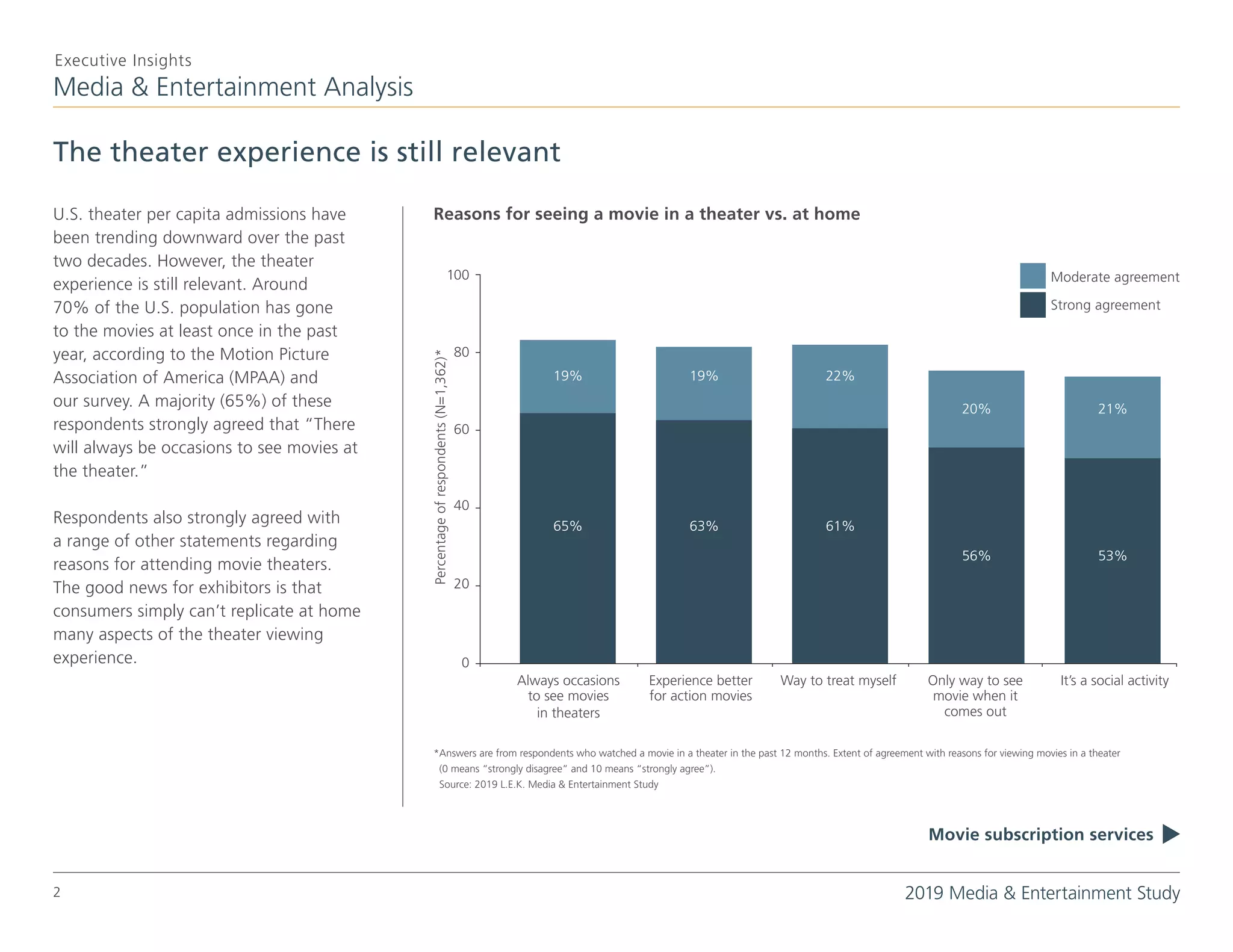

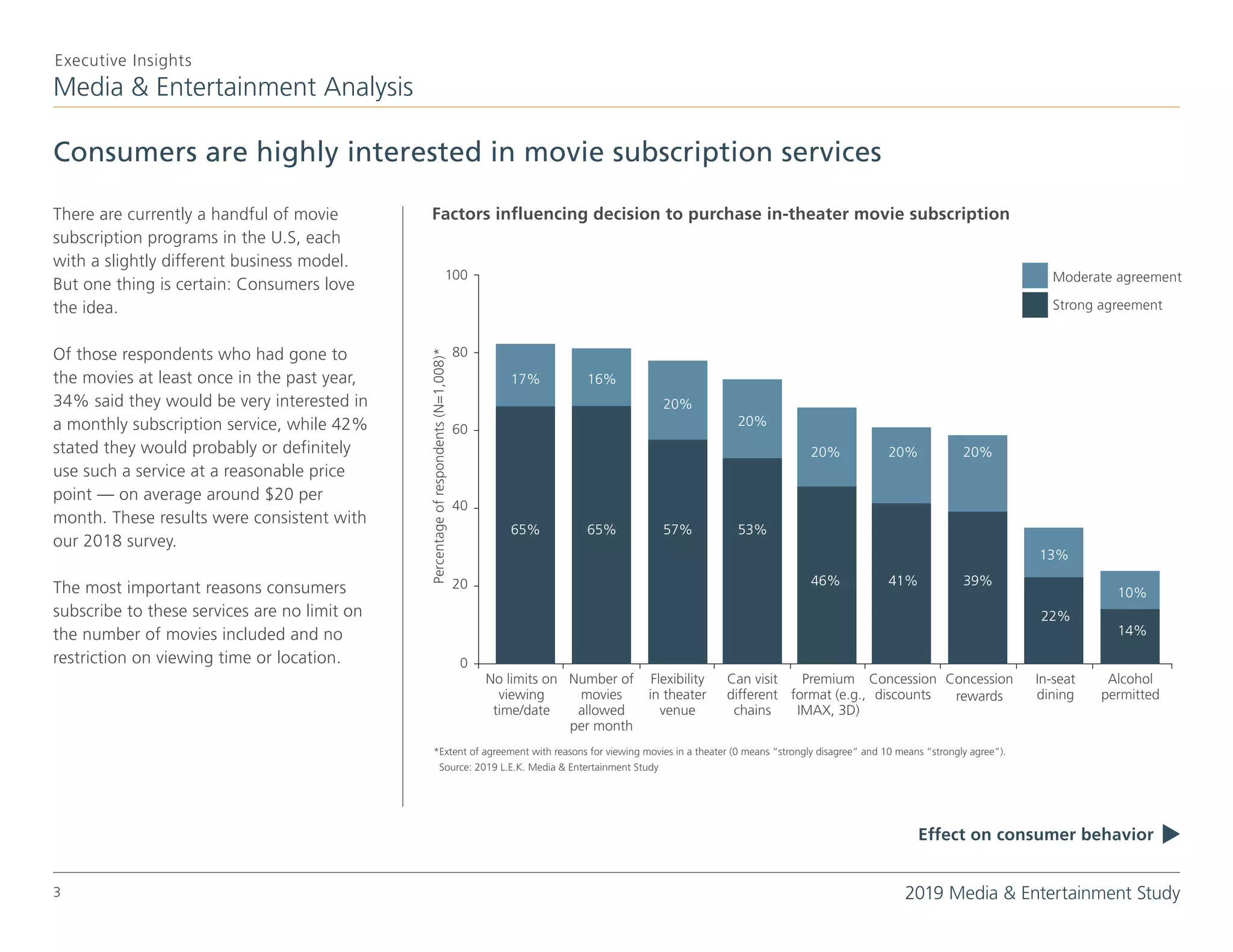

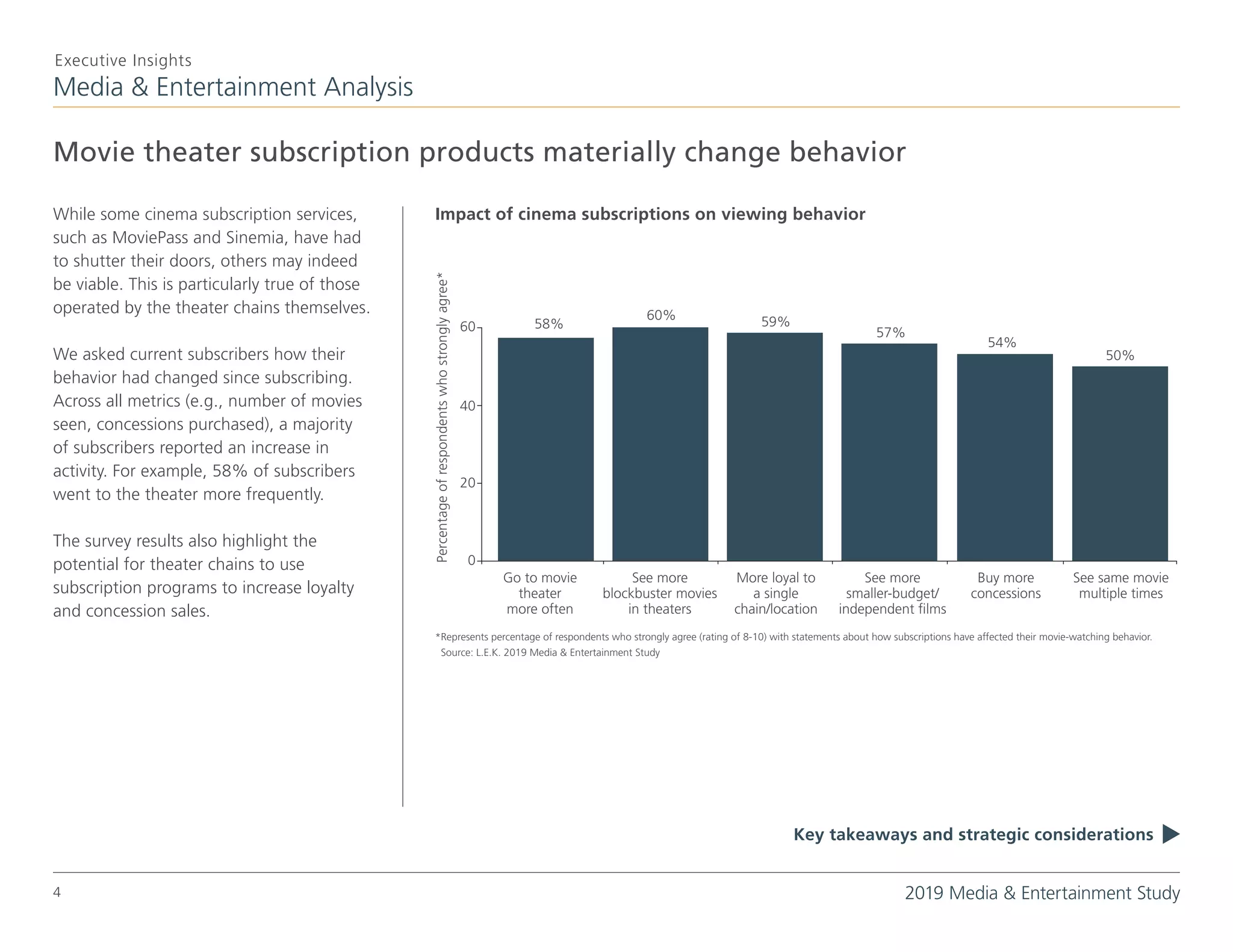

The 2019 L.E.K. Consulting study reveals that despite a decline in theater attendance, 70% of Americans attended a movie last year, highlighting the enduring appeal of the theater experience. Additionally, there is significant consumer interest in subscription services, with 34% expressing strong interest, showing potential for these offerings to impact viewing behavior positively. Current subscribers reported increased frequency of theater visits and concession purchases, emphasizing the importance of subscription models for theater chains.