Motilal oswal coalindia_26june15

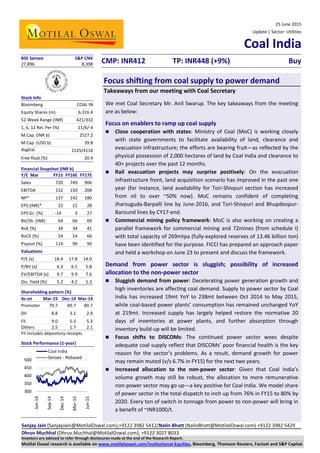

- 1. Sanjay Jain (SanjayJain@MotilalOswal.com);+9122 3982 5412/Nalin Bhatt (NalinBhatt@MotilalOswal.com) +9122 3982 5429 Dhruv Muchhal (Dhruv.Muchhal@MotilalOswal.com); +9122 3027 8033 25 June 2015 Update | Sector: Utilities Coal India CMP: INR412 TP: INR448 (+9%) Buy Investors are advised to refer through disclosures made at the end of the Research Report. Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital. Focus shifting from coal supply to power demand Takeaways from our meeting with Coal Secretary We met Coal Secretary Mr. Anil Swarup. The key takeaways from the meeting are as below: Focus on enablers to ramp up coal supply Close cooperation with states: Ministry of Coal (MoC) is working closely with state governments to facilitate availability of land, clearance and evacuation infrastructure; the efforts are bearing fruit—as reflected by the physical possession of 2,000 hectares of land by Coal India and clearance to 40+ projects over the past 12 months. Rail evacuation projects may surprise positively: On the evacuation infrastructure front, land acquisition scenario has improved in the past one year (for instance, land availability for Tori-Shivpuri section has increased from nil to over ~50% now). MoC remains confident of completing Jharsuguda-Barpalli line by June-2016, and Tori-Shivpuri and Bhupdeopur- Baround lines by CY17-end. Commercial mining policy framework: MoC is also working on creating a parallel framework for commercial mining and 72mines (from schedule I) with total capacity of 269mtpa (fully-explored reserves of 13.46 billion ton) have been identified for the purpose. FICCI has prepared an approach paper and held a workshop on June 23 to present and discuss the framework. Demand from power sector is sluggish; possibility of increased allocation to the non-power sector Sluggish demand from power: Decelerating power generation growth and high inventories are affecting coal demand. Supply to power sector by Coal India has increased 19mt YoY to 238mt between Oct 2014 to May 2015, while coal-based power plants’ consumption has remained unchanged YoY at 219mt. Increased supply has largely helped restore the normative 20 days of inventories at power plants, and further absorption through inventory build-up will be limited. Focus shifts to DISCOMs: The continued power sector woes despite adequate coal supply reflect that DISCOMs’ poor financial health is the key reason for the sector’s problems. As a result, demand growth for power may remain muted (v/s 6.7% in FY15) for the next two years. Increased allocation to the non-power sector: Given that Coal India’s volume growth may still be robust, the allocation to more remunerative non-power sector may go up—a key positive for Coal India. We model share of power sector in the total dispatch to inch up from 76% in FY15 to 80% by 2020. Every ton of switch in tonnage from power to non-power will bring in a benefit of ~INR1000/t. BSE Sensex S&P CNX 27,896 8,398 Stock Info Bloomberg COAL IN Equity Shares (m) 6,316.4 52-Week Range (INR) 421/332 1, 6, 12 Rel. Per (%) 11/6/-4 M.Cap. (INR b) 2527.2 M.Cap. (USD b) 39.8 AvgVal. INR /V l‘000 1525/4116 Free float (%) 20.4 Financial Snapshot (INR b) Y/E Mar FY15 FY16E FY17E Sales 720 749 906 EBITDA 152 150 208 NP* 137 142 180 EPS (INR)* 22 22 28 EPS Gr. (%) -14 3 27 BV/Sh. (INR) 64 66 69 RoE (%) 34 34 41 RoCE (%) 54 54 66 Payout (%) 114 90 90 Valuations P/E (x) 18.4 17.8 14.0 P/BV (x) 6.3 6.1 5.8 EV/EBITDA (x) 9.7 9.9 7.6 Div. Yield (%) 5.2 4.2 5.3 Shareholding pattern (%) As on Mar-15 Dec-14 Mar-14 Promoter 79.7 89.7 89.7 DII 8.8 3.1 2.9 FII 9.0 5.5 5.3 Others 2.5 1.7 2.1 FII Includes depository receipts Stock Performance (1-year) 300 350 400 450 500 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Coal India Sensex - Rebased

- 2. Coal India 25 June 2015 2 Power sector coal supply: new policies to incentivize system efficiencies No respite for insane bidders: In order to be fair to every participant, MoC remains firm on capping fixed capacity charge, thereby not allowing passing of variable cost into fixed cost component even if it results in failure of 3-4 projects. Tapering linkages to end: After the de-allocation of captive coal mines, there is no fundamental reason for extending tapering linkages. In all likelihood, these projects with tapering linkages will have to seek either fresh linkages or captive mines under tariff-based bidding framework. Focus turning to efficiencies: Apparently, low cost coal to DISCOMs is disincentive in reforming its revenue model and operations. The focus is now shifting to capital, transportation and operating efficiencies. Perhaps, this will force DISCOMs to procure low-cost power from the most efficient stations (such as those which are closer to the mines). This will also drive demand for long-distance high-capacity power transmission lines, in our view. Coal India: To benefit from linkage auction and price hike for power sector coal Non-power linkage auction: Final guidelines for coal linkage auction for the non-power sector are expected by the end of June 2015. The benefit will flow in FY17—potential gain of ~INR30b, in our view. Price hike for power to offset cost increase: MoC highlighted that price revision for the power sector may be considered to offset the cost increase on account of 5/10-yearly wage renegotiation; this allays concerns on price hikes. We model 10% increase in FSA price for power sector in FY17. Volume growth at inflection; reiterate Buy: We expect Coal India to register a CAGR of 10% in volume over FY15-20E (v/s 2% during FY10-15). Accelerated volume growth and natural attrition will result in productivity gains and operating leverage. We expect adjusted EBIDTA to double over FY15-20E, while higher FCF and dividend yield will provide comfort. We expect earnings CAGR of 14% over FY15-20E. Reiterate Buy with a DCF- based TP of INR448/sh. The stock trades at P/E of 14.0x and EV/EBITDA of 7.6x on FY17E basis.

- 3. Coal India 25 June 2015 3 Exhibit 1: Coal demand from power sector is sluggish - mt Source: MOSL, Company Exhibit 2: Coal inventory at power plants have increased - mt Source: MOSL, Company Exhibit 3: Power generation growth has moderated in the last few months Source: MOSL, Company 32.6 29.7 32.1 31.7 32.6 34.4 29.1 29.9 30.0 32.5 Jan Feb Mar April May 2015 2014 8.0 10.8 14.0 16.4 20.0 26.1 29.8 29.7 29.8 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 3.4 11.0 7.3 2.0 4.5 7.0 9.5 12.0 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Power generation annualized growth YoY (%)

- 4. Coal India 25 June 2015 4 Story in charts Exhibit 1: Production to grow by 10% CAGR over FY15-20E Source: MOSL, Company Exhibit 2: Power disp. growth 11% CAGR over FY15-20E (mt) Source: MOSL, Company Exhibit 3: FSA price realization - INR/t Source: MOSL, Company Exhibit 4: Non-power price realization - INT/t Source: MOSL, Company Exhibit 5: Contracting % of prod. to inc. to ~71% by FY20E Source: MOSL, Company Exhibit 6: and is ~70% cheaper than in-house (INR/t) Source: MOSL, Company 267 280 291 306 324 342 360 378 403 430 431 436 453 461 494 534 576 646 717 781 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Production (m ton) 299 304 312 342 347 372 413 435 516 568 626 116 120 121 122 124 117 121 140 130 149 155 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Power (FSA) Non-power 884 958 1,233 1,294 1,314 1,327 1,324 1,450 1,450 1,450 1,450 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E FSA realization Wage negotiation impact 1,583 1,846 2,599 2,544 2,182 2,450 1,949 1,958 1,958 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E E-auction Linkage auction Washed coal 34 38 42 46 50 51 53 55 56 60 62 64 67 69 71 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Contracting share of production (%) 782 902 1,276 1,384 1,500 1,754 1,717 172 209 214 233 262 287 309 333 373 401 432 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Employee cost per ton of in-house prod. Contracting per ton of contracted prod.

- 5. Coal India 25 June 2015 5 Story in charts Exhibit 7: Net attrition rate (%) Source: MOSL, Company Exhibit 8: Cost per ton to be flattish - INR/t Source: MOSL, Company Exhibit 9: EBITDA to double by FY20E Source: MOSL, Company Exhibit 10: PAT growth of ~14% over FY15-20E Source: MOSL, Company Exhibit 11: Strong FCF despite higher capex Source: MOSL, Company Exhibit 12: Dividend yield to protect downside Source: MOSL, Company 3.0 3.2 3.7 3.5 3.1 1.8 3.4 3.3 3.5 3.6 3.8 3.9 4.1 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E FY18E FY19E FY20E Net attritionrate (%) 727 913 809 808 1,000 1,014 1,052 1,084 1,054 1,144 1,115 1,091 1,084 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Cost per ton 88 63 148 175 207 228 209 207 204 267 305 359 393 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Adj. EBITDA - INR b 43 56 98 110 162 178 160 137 142 180 202 238 261 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E PAT - INR b 105 97 127 114 224 161 146 118 150 165 223 261 301 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E FY18E FY19E FY20E FCF - INR b 7.6 5.4 4.4 5.6 6.2 7.4 8.1 FY14 FY15 FY16E FY17E FY18E FY19E FY20E Dividend yield (%)

- 6. Coal India 25 June 2015 6 Financials and valuation Income Statement (INR Million) Y/E March FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E Net Sales 466,843 502,336 624,154 683,027 688,100 720,146 748,527 905,604 Change (%) 14.4 7.6 24.3 9.4 0.7 4.7 3.9 21.0 Operating Expenses 362,112 365,872 467,476 502,191 528,469 567,847 598,693 697,374 EBITDA 104,730 136,464 156,679 180,836 159,632 152,300 149,834 208,230 % of Net Sales 22.4 27.2 25.1 26.5 23.2 21.1 20.0 23.0 adj. EBITDA/ton 360 416 482 491 445 423 381 464 Depreciation 13,138 17,654 19,692 18,130 19,964 23,198 22,194 22,889 Interest 1,560 737 540 452 580 73 273 256 Other Income 52,408 49,615 76,150 88,373 89,694 86,761 87,146 83,505 Extra Ordinary 2,786 2,162 -911 -69 -14 -50 0 0 PBT 139,654 165,525 213,508 250,697 228,795 215,839 214,513 268,589 Tax 43,425 55,959 64,845 76,227 77,679 78,573 72,913 88,608 Rate (%) 31.1 33.8 30.4 30.4 34.0 36.4 34.0 33.0 Reported PAT 96,230 109,566 148,664 174,470 151,116 137,266 141,600 179,982 Change (%) 362.7 13.9 35.7 17.4 -13.4 -9.2 3.2 27.1 Adjusted PAT 98,299 110,202 162,386 177,530 159,881 137,316 141,600 179,982 Change (%) 76.7 12.1 47.4 9.3 -9.9 -14.1 3.1 27.1 Balance Sheet (INR Million) Y/E March FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E Share Capital 63,164 63,164 63,164 63,164 63,164 63,164 63,164 63,164 Reserves 194,789 269,978 341,366 421,556 360,881 340,367 354,527 372,525 Net Worth 257,952 333,142 404,530 484,720 424,045 403,531 417,691 435,689 Minority Interest 236 326 536 636 636 658 658 658 Loans 19,631 13,664 13,054 10,778 1,715 4,019 1,515 1,424 Defferd tax Liabiity -9,658 -11,941 -11,941 -22,550 -19,717 -19,596 -19,596 -19,596 Capital Employed 268,161 335,191 406,179 473,584 406,678 388,612 400,268 418,175 Gross Fixed Assets 349,453 376,253 380,964 390,107 408,971 493,788 554,081 620,403 Less: Depreciation 229,144 238,708 246,561 255,449 263,022 272,572 283,333 295,155 Net Fixed Assets 120,309 137,546 134,403 134,658 145,949 221,217 270,748 325,248 Capital Work in Progress 22,107 11,459 29,034 34,960 45,053 40,440 46,234 51,457 Investments 12,819 10,637 19,814 23,950 37,749 28,134 13,406 14,076 Inventory 42,294 55,856 60,713 56,178 55,681 61,838 64,275 77,763 Debtors 21,688 34,189 56,630 104,802 82,410 85,219 88,577 107,165 Other Current Assets 0 0 30,347 42,489 54,375 78,690 81,791 98,955 Loans and Advances 86,762 120,254 145,013 173,760 77,594 88,268 77,490 90,597 Cash 390,778 458,064 582,028 622,360 523,895 530,925 504,899 495,735 Current Liabilities 346,202 338,222 437,266 550,947 588,916 667,382 744,838 840,276 Provisions 82,396 175,737 209,894 145,567 1,912 2,103 2,314 2,545 Net Curr. Assets 112,924 175,549 222,928 280,017 177,927 147,734 69,881 27,394 Misc. Expenses 0 0 0 0 0 0 0 0 Application of Funds 268,160 335,193 406,179 473,584 406,678 437,525 400,268 418,175 E: MOSL Estimates -444,401 -568,974 303,076 -522,181

- 7. Coal India 25 June 2015 7 Financials and valuation Ratios Y/E March FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E Basic (INR) 15.2 17.3 23.5 27.6 23.9 21.7 22.4 28.5 Adjusted EPS 15.6 17.4 25.7 28.1 25.3 21.7 22.4 28.5 Growth (%) 76.7 12.1 47.4 9.3 -9.9 -14.1 3.1 27.1 Cash EPS 22.5 24.4 34.7 36.0 33.7 31.5 31.6 38.3 Book Value 40.8 52.7 64.0 76.7 67.1 63.9 66.1 69.0 DPS 3.5 3.9 10.0 14.0 29.0 20.7 16.8 21.4 Payout (incl. Div. Tax.) 30.4 30.5 46.2 57.3 132.2 114.3 90.0 90.0 Interest Rates (%) 7.6 Valuation (x) P/E 25.7 22.9 15.6 14.2 15.8 18.4 17.8 14.0 Cash P/E 17.8 16.4 11.5 11.1 11.9 12.7 12.7 10.4 EV/Adj. EBITDA 14.6 11.9 9.4 8.4 9.6 9.7 9.9 7.6 EV/Adj. Sales 4.6 4.1 3.1 2.7 2.8 2.7 2.6 2.2 EV /m ton of Reserves 99.2 95.8 90.1 88.1 92.2 92.0 93.1 93.5 Price/Book Value 9.8 7.6 6.2 5.2 6.0 6.3 6.1 5.8 Dividend Yield (%) 0.9 1.0 2.5 3.5 7.2 5.2 4.2 5.3 Profitability Ratios (%) Reported RoE 37.3 32.9 36.7 36.0 35.6 34.0 33.9 41.3 RoCE 60.1 55.1 57.7 57.1 52.1 54.3 54.5 65.7 Adj. RoCE 61.0 55.1 61.5 57.8 54.1 Leverage Ratio Net Debt/Equity (x) -1.4 -1.3 -1.4 -1.3 -1.2 -1.3 -1.2 -1.1 Cash Flow Statement (INR Million) Y/E March FY10 FY11 FY12 FY13 FY14 FY15 FY16E FY17E PBT before EO Items 136,868 163,363 214,420 250,765 228,810 215,889 214,513 268,589 Add : Depreciation 13,138 17,654 19,692 18,130 19,964 23,198 22,194 22,889 Interest 1,560 737 540 452 580 73 273 256 Less : Direct Taxes Paid -43,425 -55,959 -64,845 -76,227 -77,679 -78,573 -72,913 -88,608 (Inc)/Dec in WC 38,606 4,662 76,585 -16,757 3,625 37,223 51,827 33,323 CF from Operations 146,747 130,457 246,392 176,363 175,300 197,810 215,894 236,450 (Inc)/Dec in FA -19,815 -16,153 -22,286 -15,068 -28,958 -80,205 -66,087 -71,545 Free Cash Flow 126,932 114,304 224,106 161,295 146,343 117,606 149,807 164,905 (Pur)/Sale of Investments 2,232 2,183 -9,177 -4,136 -13,799 9,615 14,729 -670 CF from Investments -17,583 -13,970 -31,463 -19,204 -42,757 -70,590 -51,358 -72,216 (Inc)/Dec in Net Worth 1,512 -766 -2,277 7,382 -364 -882 0 0 (Inc)/Dec in Debt -1,854 -5,967 -610 -2,276 -9,063 2,305 -2,504 -91 (Inc)/Dec in Differed Tax Liability -109 -2,283 0 -10,610 2,833 121 0 0 Less : Interest Paid -1,560 -737 -540 -452 -580 -73 -273 -256 Dividend Paid -29,871 -33,611 -74,999 -101,661 -211,427 -156,898 -127,440 -161,983 Others -3,455 -5,836 -12,540 -9,210 -12,406 -12,035 -11,432 -11,068 CF from Fin. Activity -35,337 -49,199 -90,966 -116,827 -231,008 -167,462 -141,650 -173,398 Inc/Dec of Cash 93,828 67,287 123,963 40,332 -98,465 -40,242 22,886 -9,164 Add: Beginning Balance 296,950 390,778 458,064 582,028 622,360 523,895 530,925 504,899 Closing Balance 390,778 458,065 582,028 622,360 523,895 483,654 553,811 495,735

- 8. Coal India 25 June 2015 8 Disclosures This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Motilal Oswal Securities Limited is registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014. SEBI Reg. No. INH000000412 There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues Disclosure of Interest Statement COAL INDIA Analyst ownership of the stock No Served as an officer, director or employee No A graph of daily closing prices of securities is available at www.nseindia.com and http://economictimes.indiatimes.com/markets/stocks/stock-quotes Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com