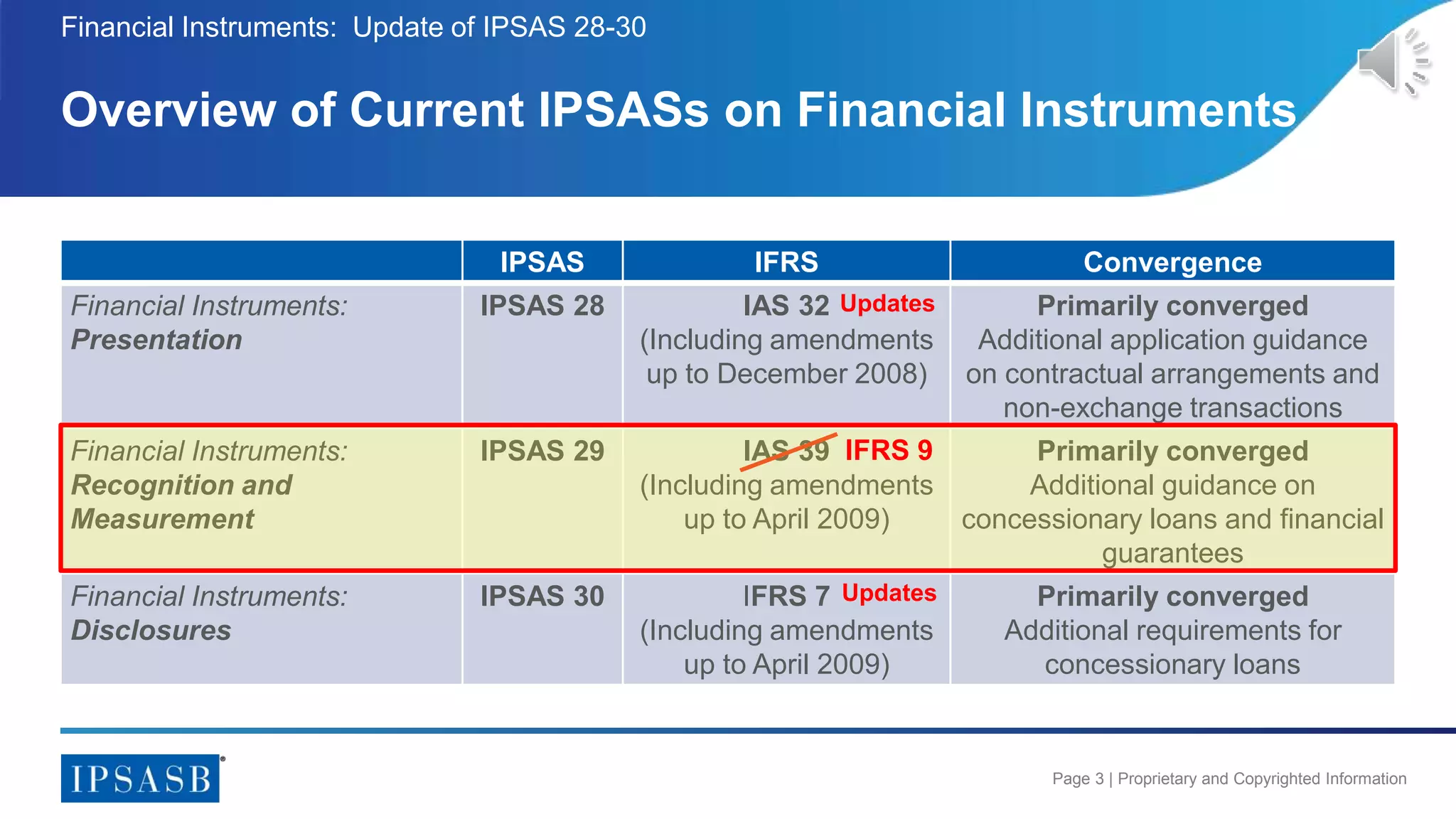

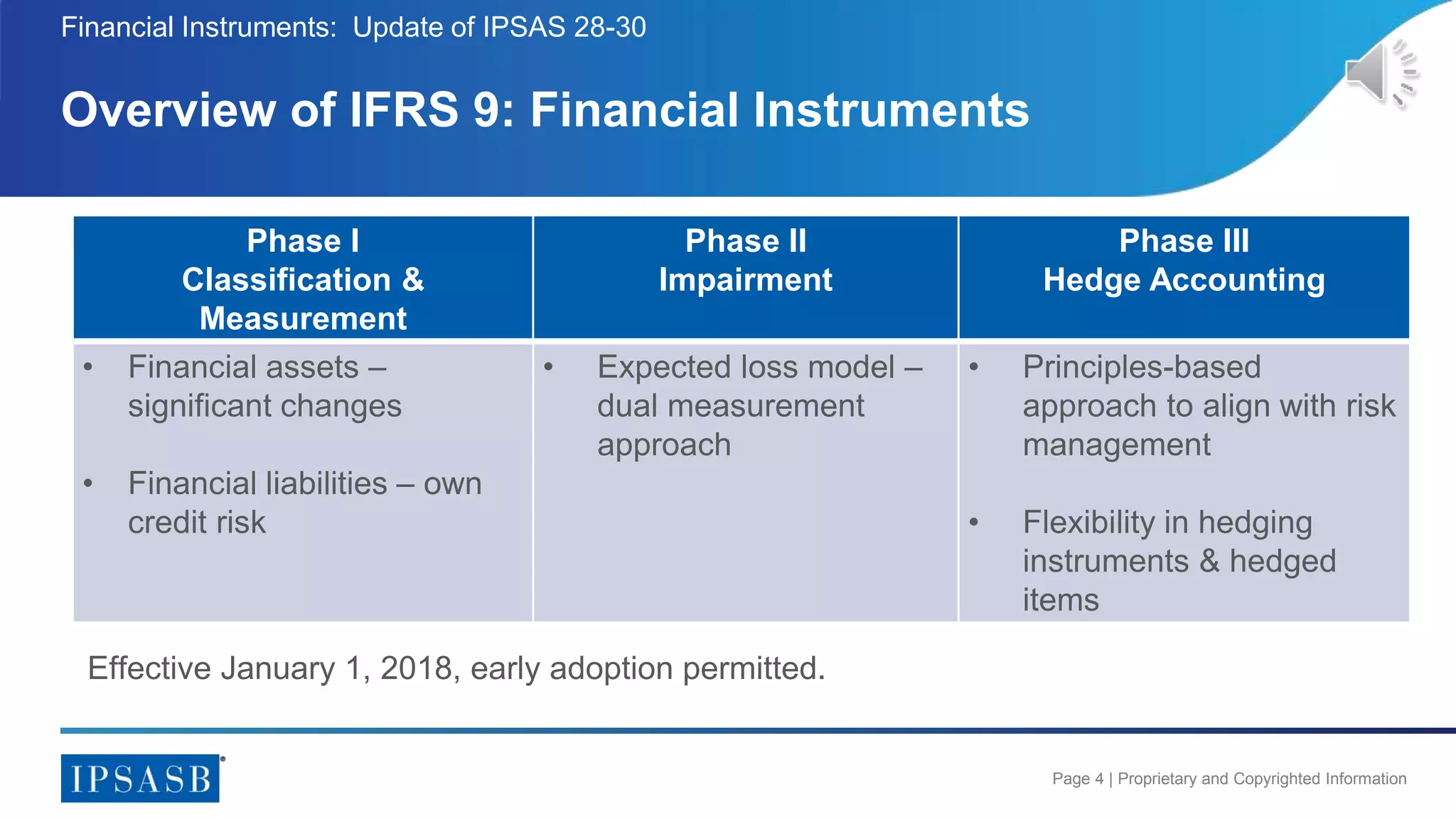

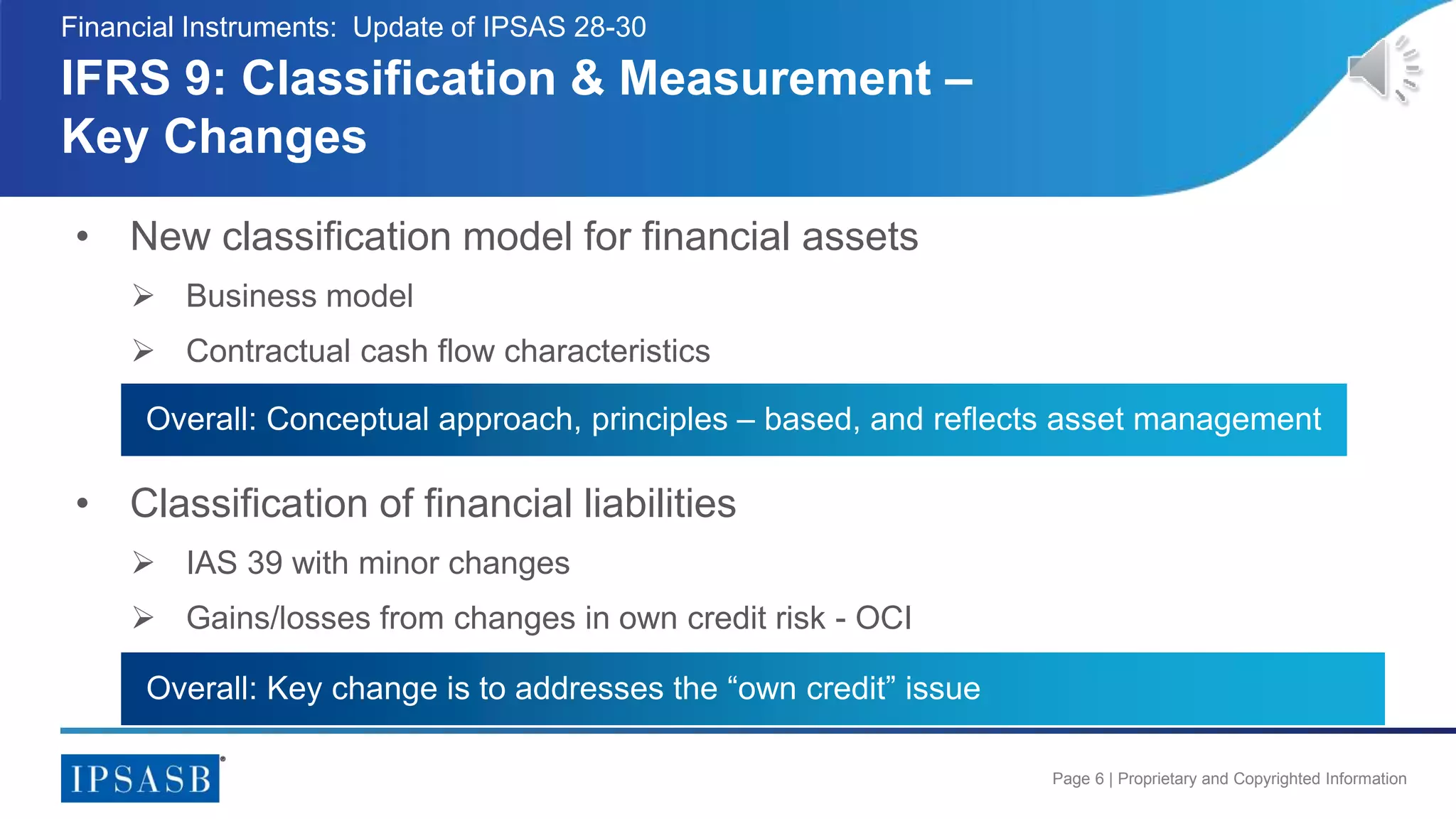

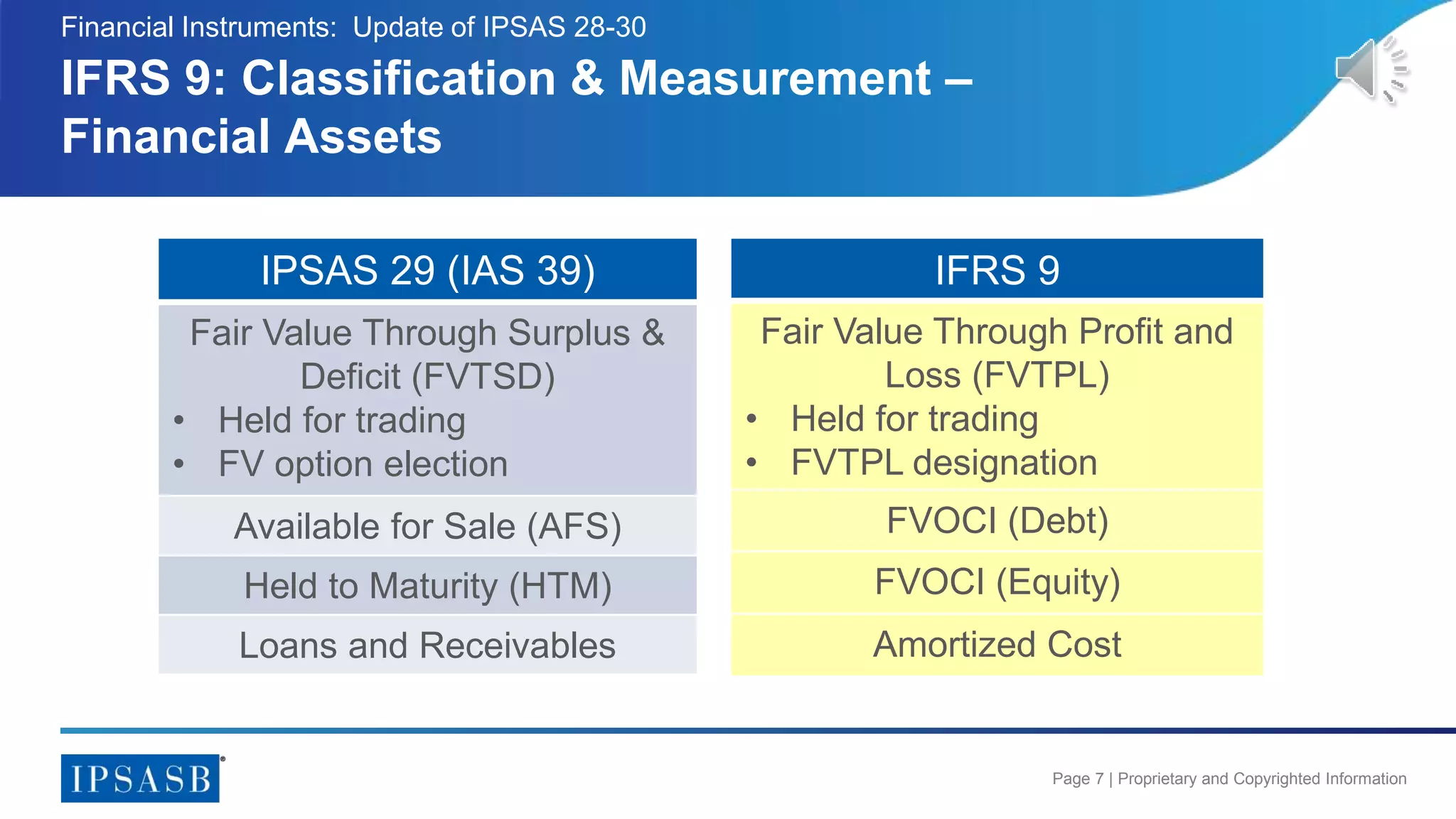

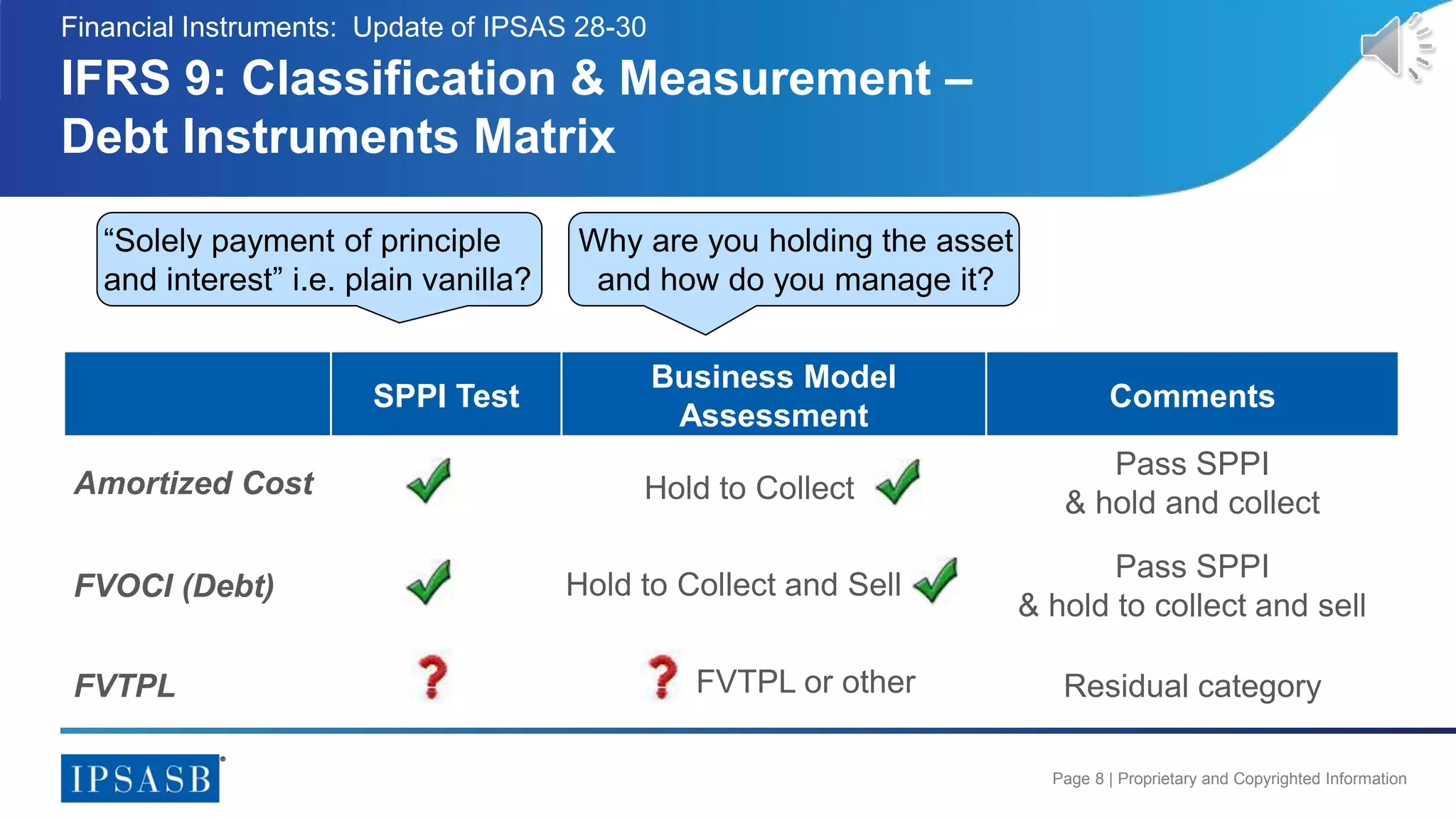

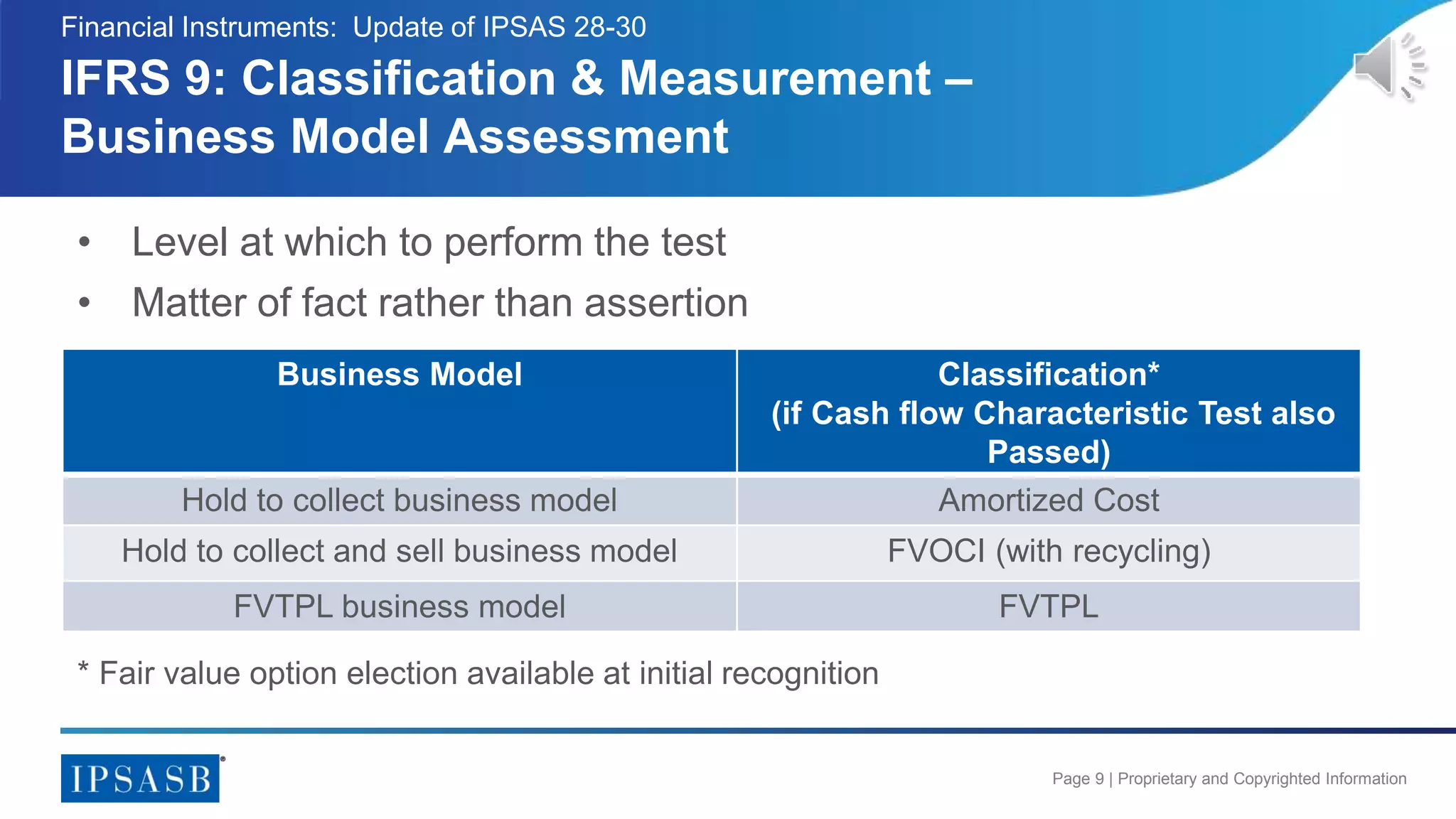

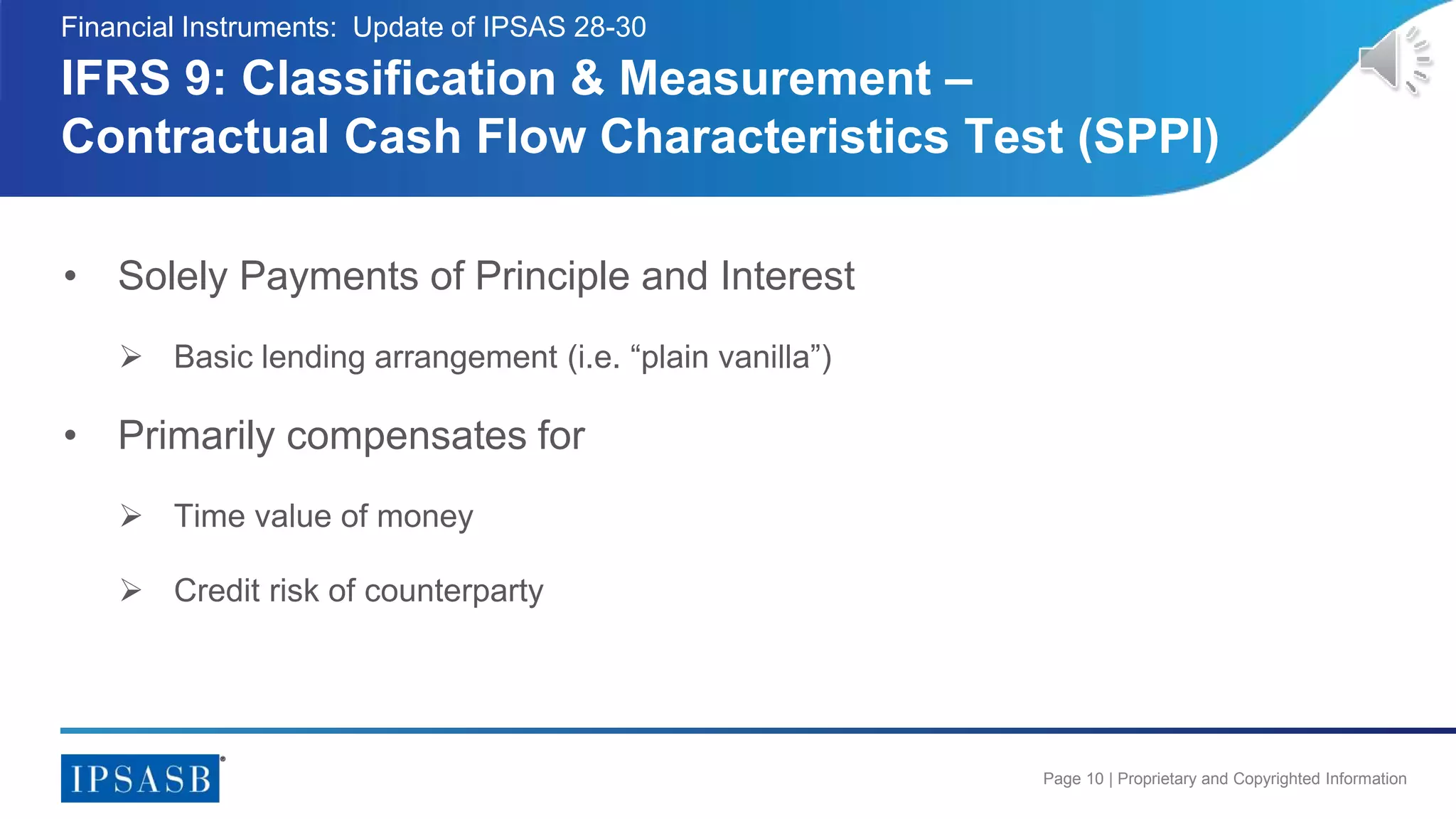

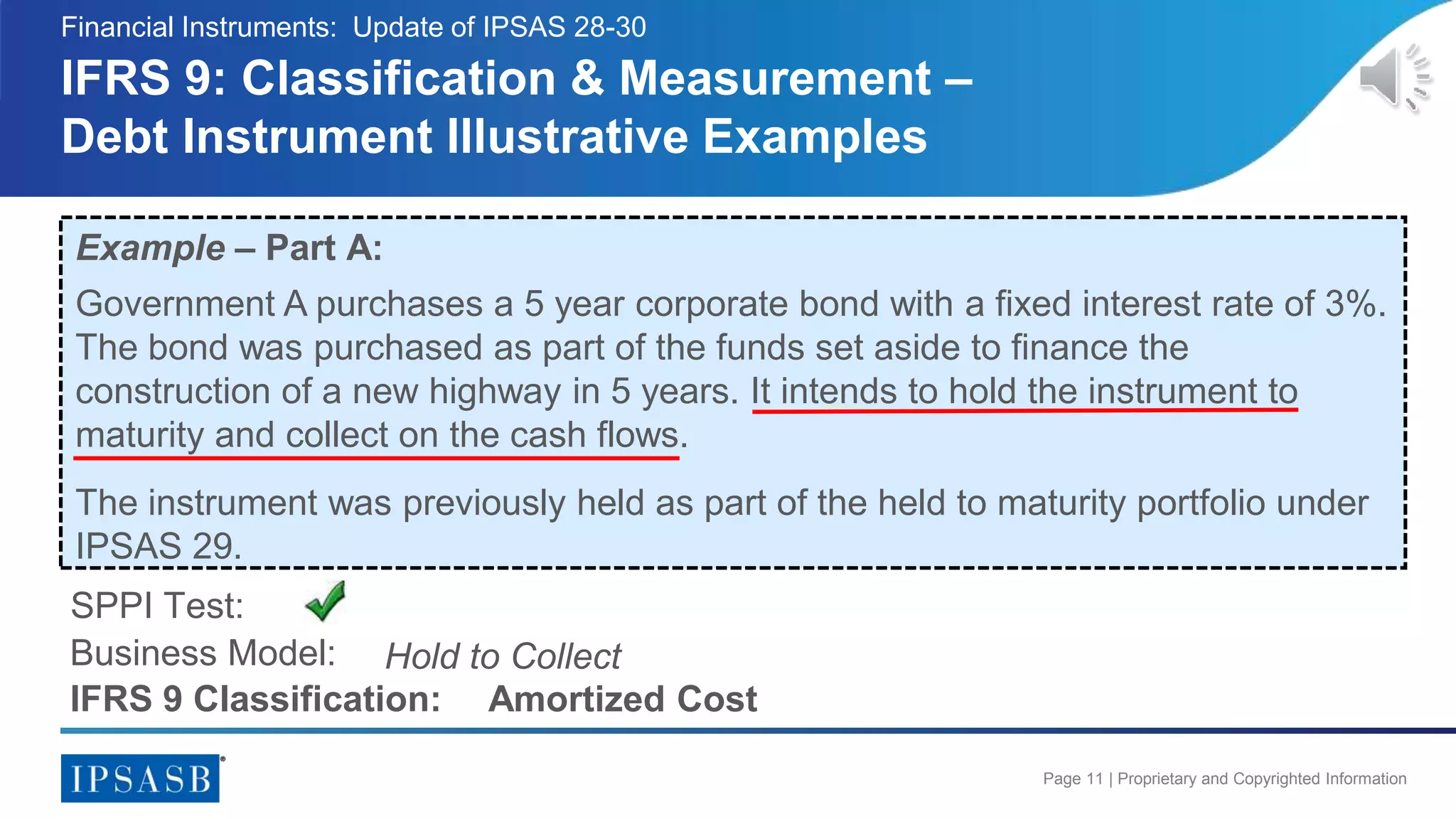

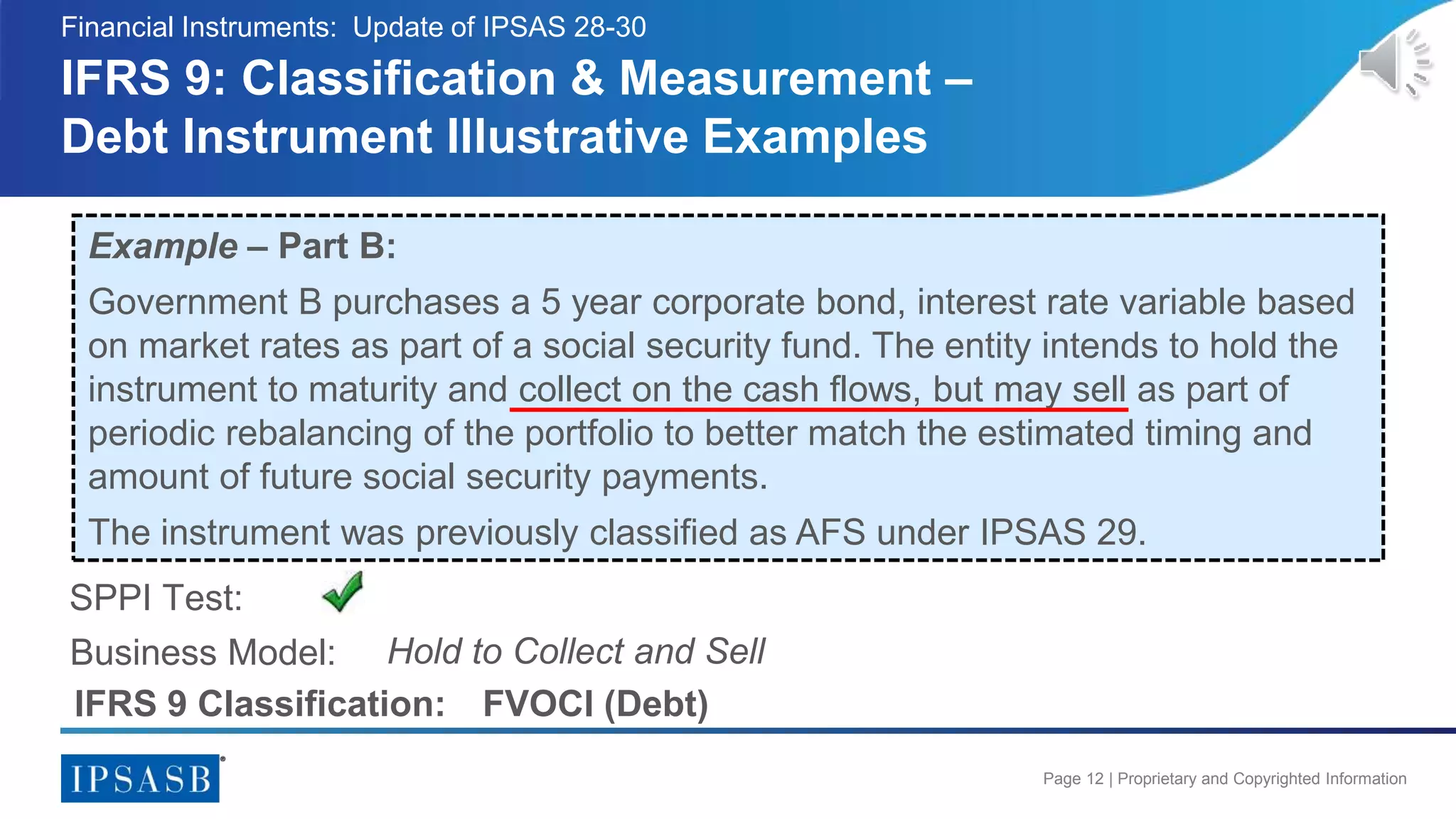

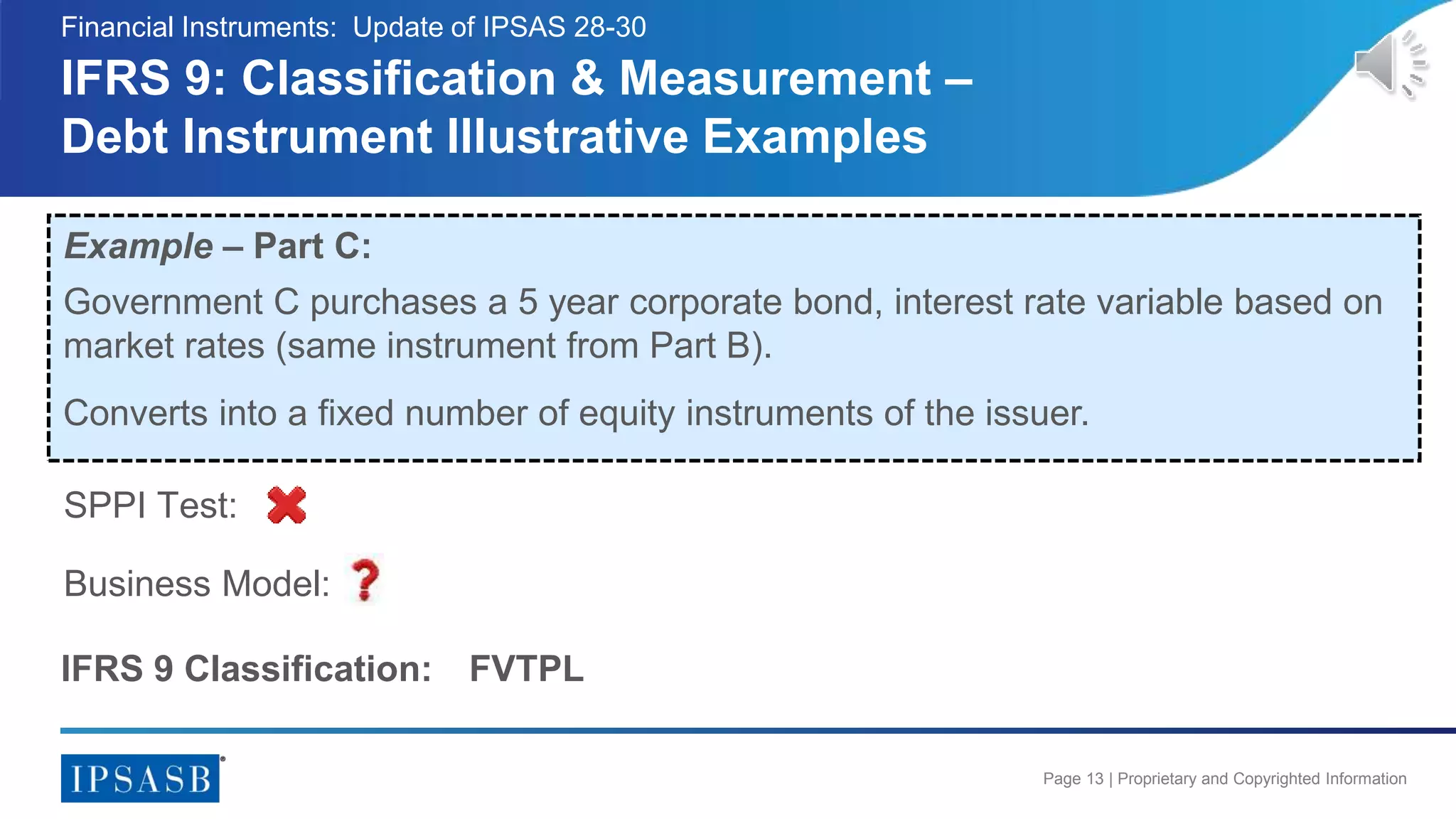

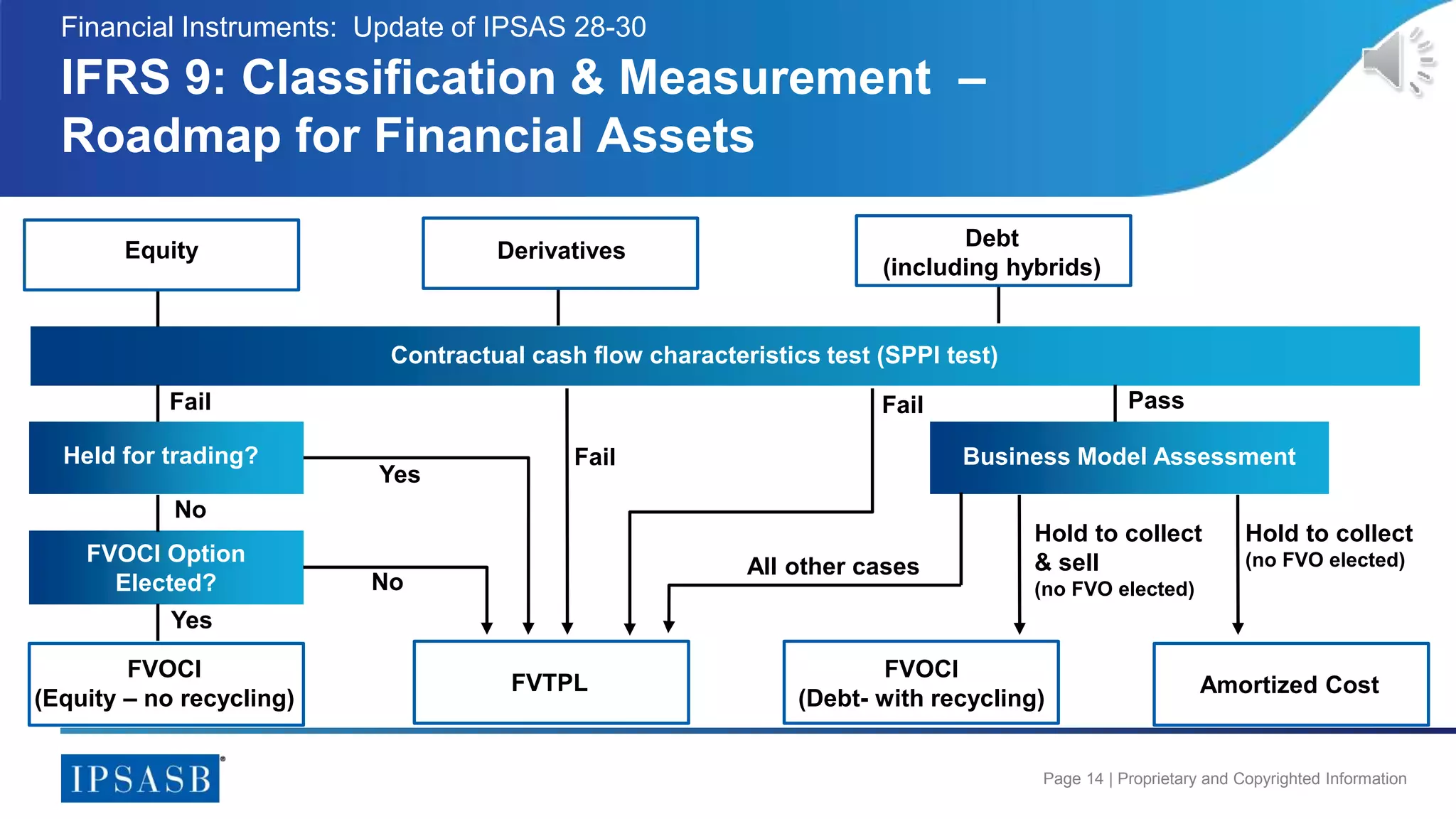

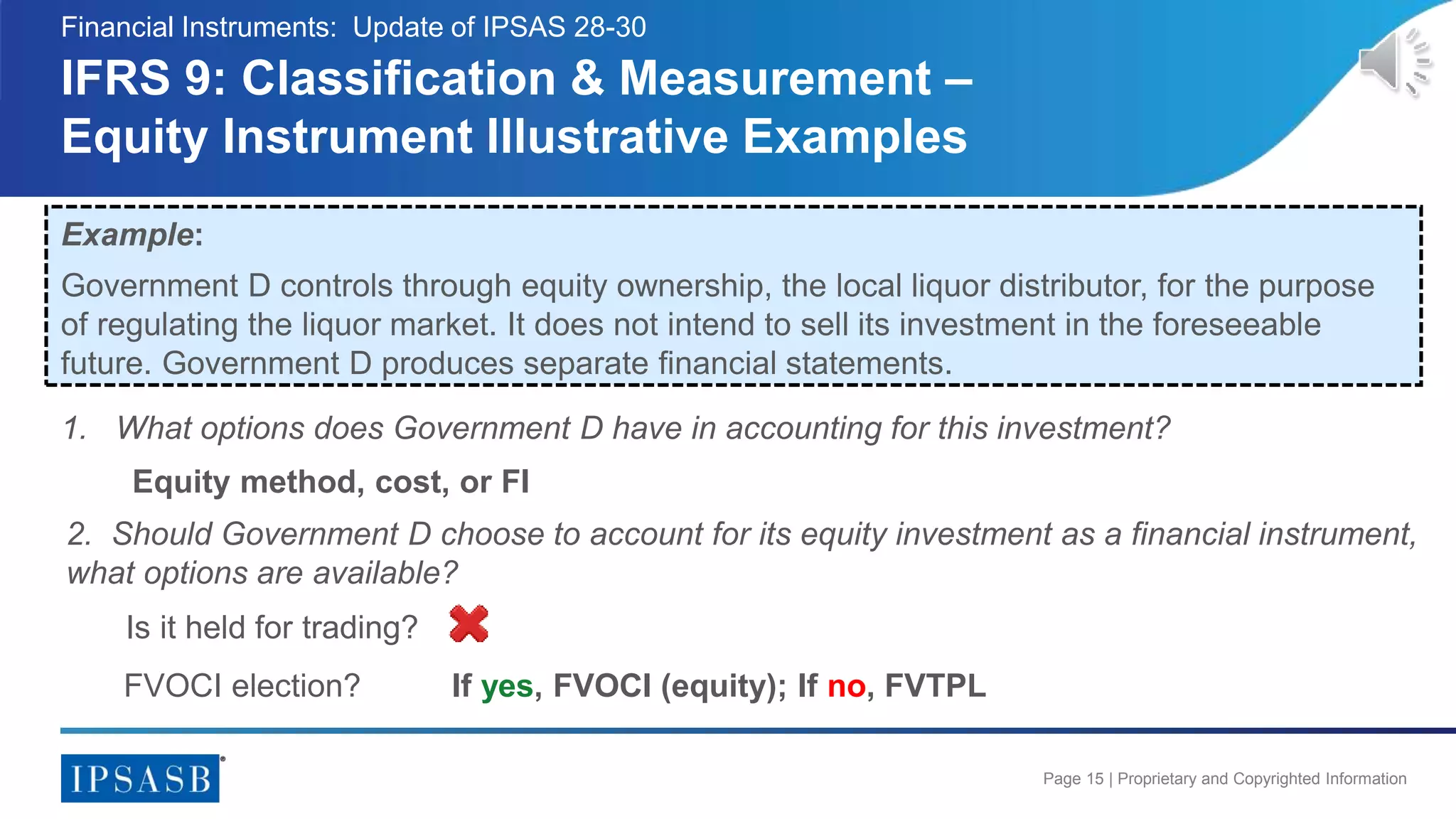

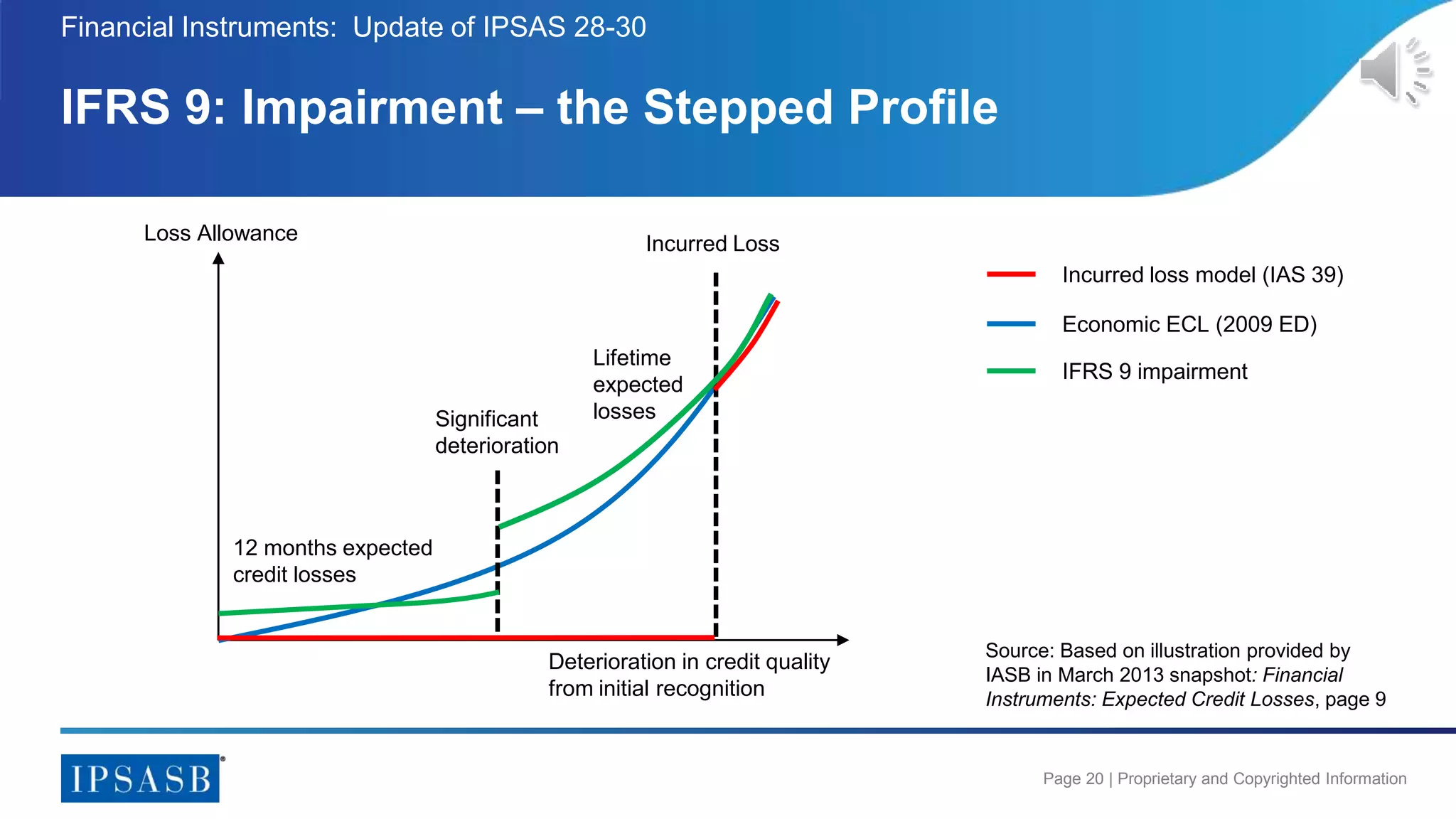

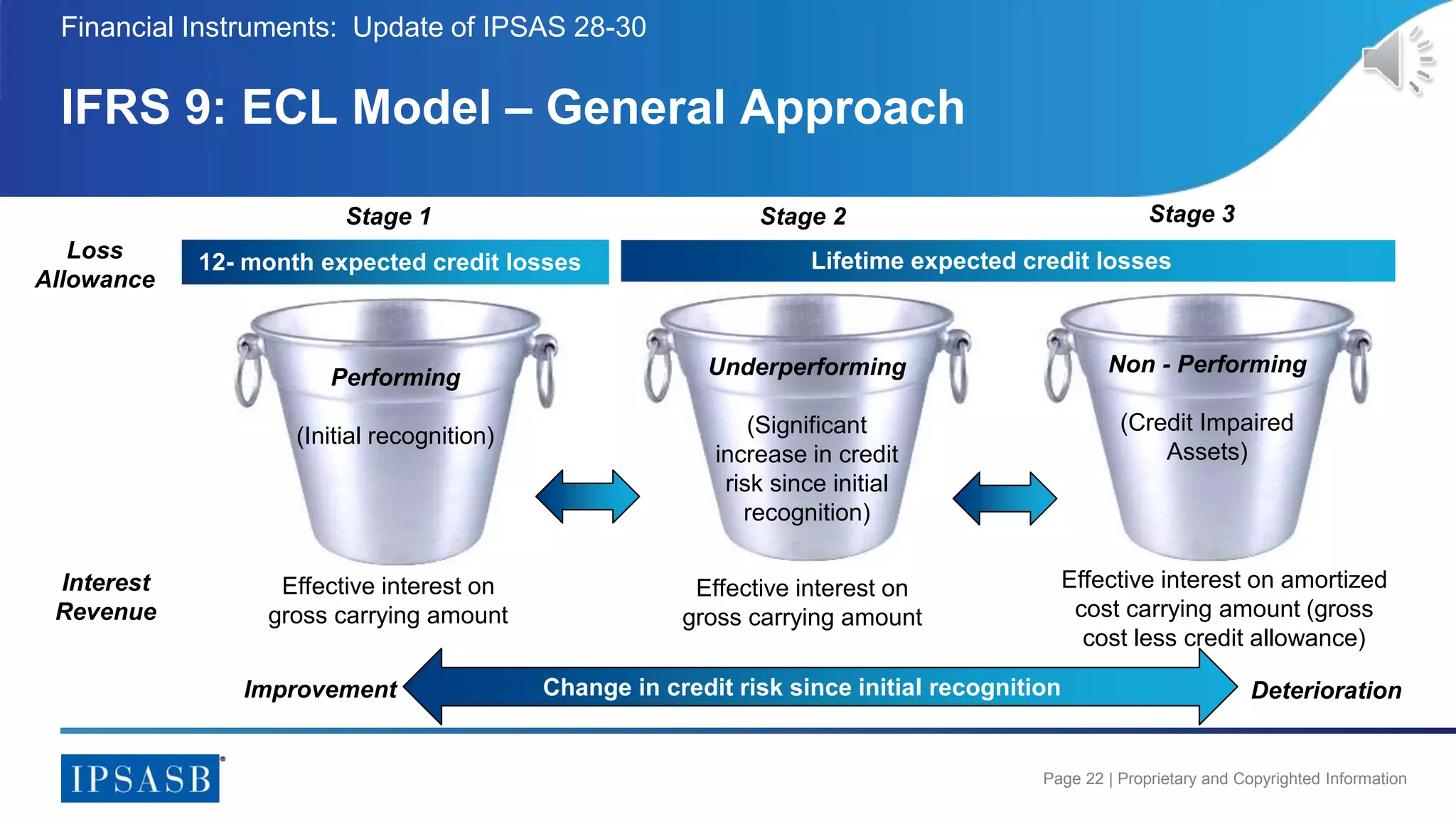

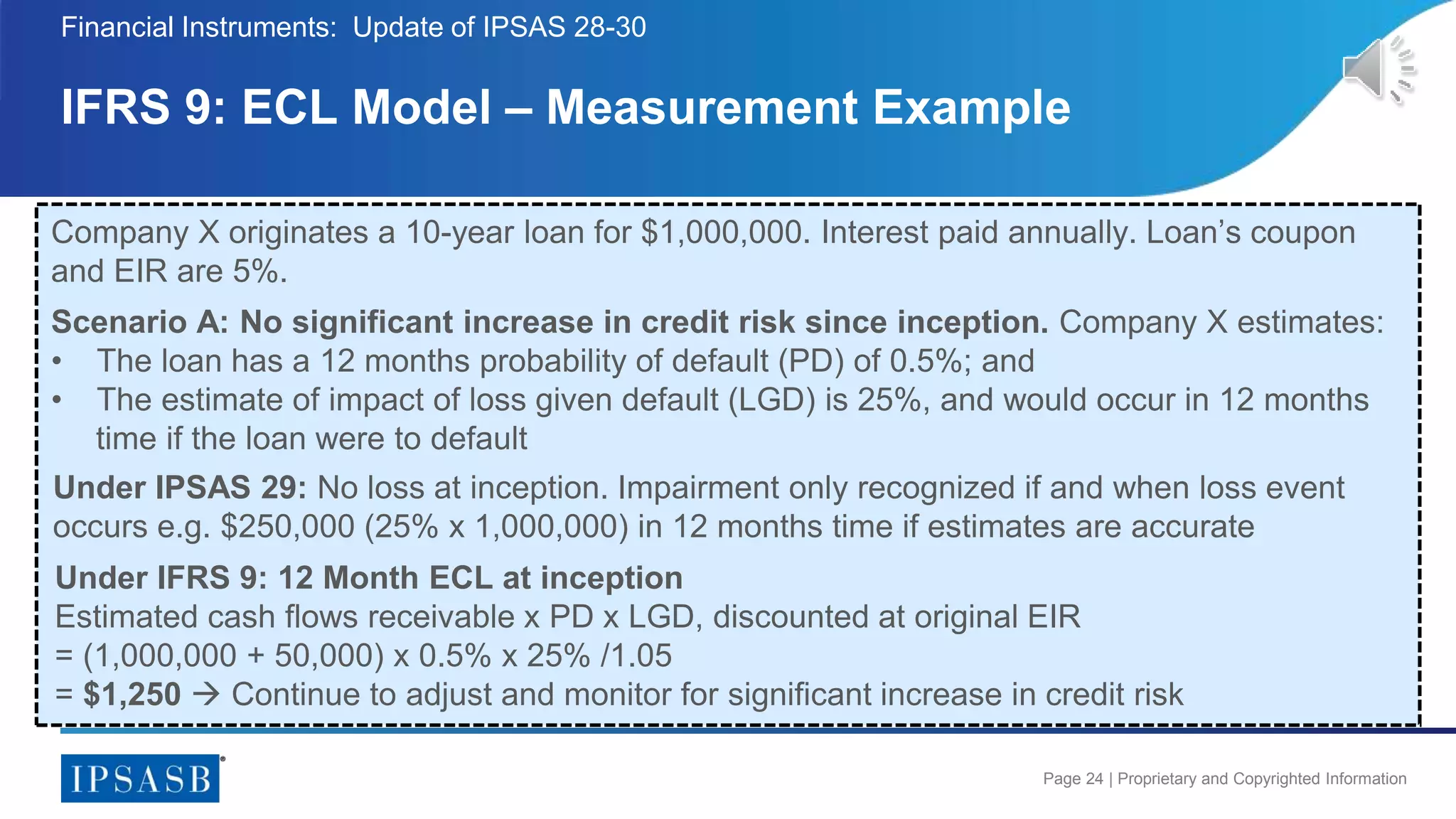

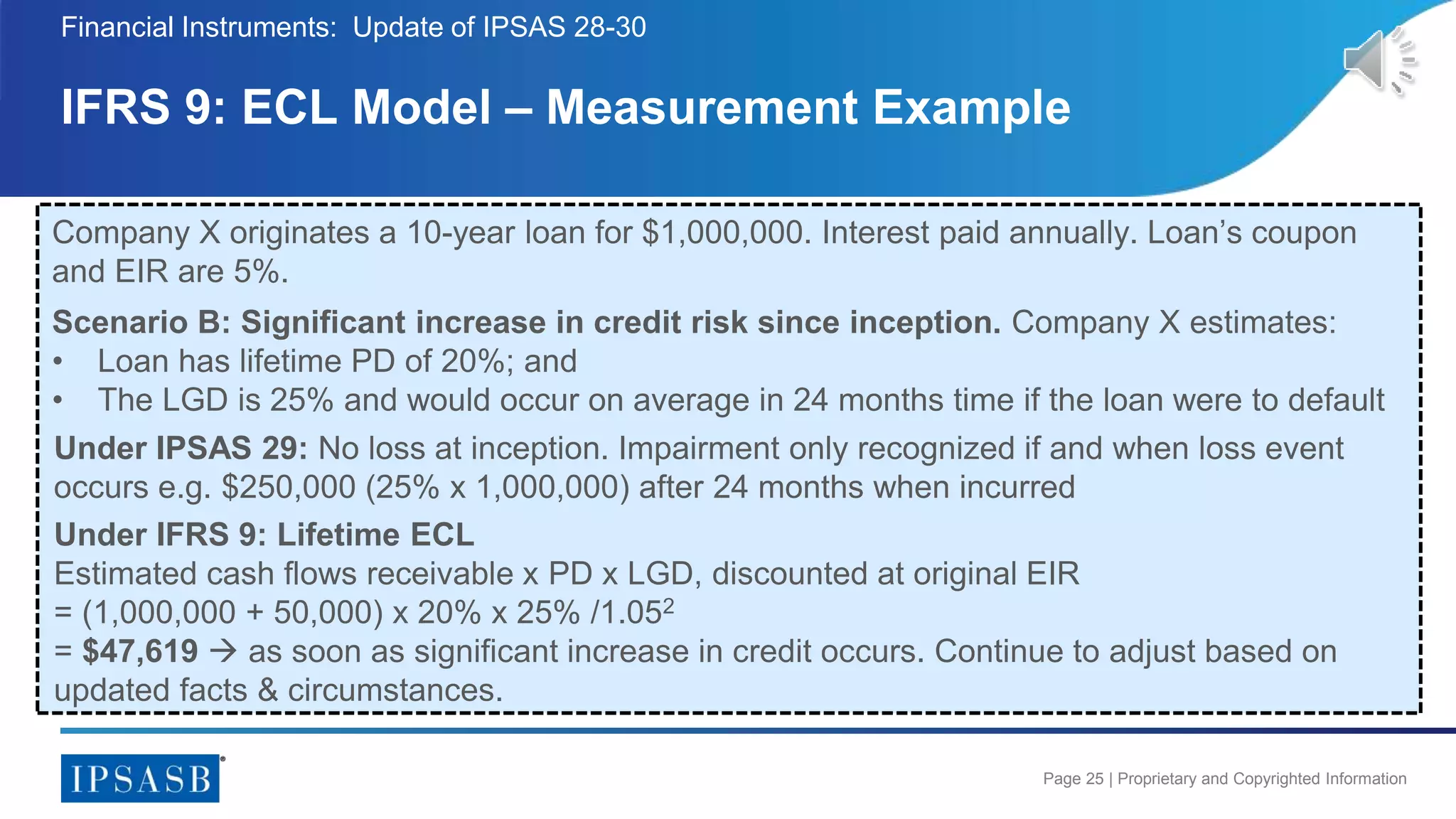

The document provides an update on the International Public Sector Accounting Standards (IPSAS) related to financial instruments, particularly focusing on IPSAS 28-30 and the changes introduced by IFRS 9. Key areas covered include classification and measurement, impairment models shifting from an incurred loss to an expected loss model, and changes in the treatment of financial assets and liabilities. The session aims to align public sector accounting standards with the risk management principles outlined in IFRS 9.